State of the_net_issue_19_[1,780_kb]

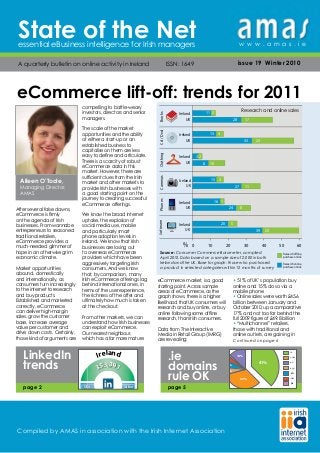

- 1. State of the Netessential eBusiness intelligence for Irish managers A quarterly bulletin on online activity in Ireland ISSN: 1649 Compiled by AMAS in association with the Irish Internet Association w w w . a m a s . i e issue 19 Winter 2010 compelling to battle-weary investors, directors and senior managers. The scale of the market opportunities and the ability of either a start-up or an established business to capitalise on them are less easy to define and articulate. There is a scarcity of robust eCommerce data in this market. However, there are sufficient clues from the Irish market and other markets to provide Irish businesses with a good starting point on the journey to creating successful eCommerce offerings. We know the broad internet uptake, the explosion of social media use, mobile and particularly smart phone adoption levels in Ireland. We know that Irish businesses are losing out to overseas eCommerce providers which have been aggressively targeting Irish consumers. And we know that, by comparison, many Irish eCommerce offerings lag behind international ones, in terms of the user experience, the richness of the offer and ultimately how much is taken at the checkout. From other markets, we can understand how Irish businesses can exploit eCommerce. Our nearest neighbour, which has a far more mature eCommerce market, is a good starting point. Across sample areas of eCommerce, as the graph shows, there is a higher likelihood that UK consumers will research and buy online, or buy online following some offline research, than Irish consumers. Data from The Interactive Media in Retail Group (IMRG) are revealing: • 51% of UK’s population buy online and 15% do so via a mobile phone • Online sales were worth £45.6 billion between January and October 2010, up a comparative 17% and not too far behind the full 2009 figure of £49.8 billion • “Multichannel” retailers, those with traditional and online outlets, are gaining in LinkedIn trends page 2 USA 38.4m SA .4m 353,391 Worldwide 80 million India 7.4m UK 4.8m Other 29m Ireland .ie domains rule OK page 5 .info .com .eu .org .ie .net .biz 41% 30% 14% 3% 1% 6% 5% Aileen O’Toole, Managing Director, AMAS After several false dawns, eCommerce is firmly on the agenda of Irish businesses. From wannabe entrepreneurs to seasoned traditional retailers, eCommerce provides a much-needed glimmer of hope in an otherwise grim economic climate. Market opportunities abound, domestically and internationally, as consumers turn increasingly to the internet to research and buy products. Established and marketed correctly, eCommerce can deliver high-margin sales, grow the customer base, increase average value per customer and drive down costs. Certainly, those kind of arguments are eCommerce lift-off: trends for 2011 Research offline, purchase online Research online, purchase online 0 10 20 30 40 50 60 Ireland UK Ireland UK Ireland UK Ireland UK Ireland UK BooksCd/DvdCamerasPhonesSoftware Ireland UKClothing 11 2 28 17 33 24 13 4 % 8 10 13 3 27 11 16 1 24 8 20 5 39 20 3 2 Source: Consumer Commerce Barometer, compiled April 2010. Data based on a sample size of 2,000 in both Ireland and the UK. Base for graph: those who purchased a product in selected categories within 12 months of survey Research and online sales Continued on page 4

- 2. 1. Social media LinkedIn’s Irish user base has reached over 353,000 with an increasing number of professionals realising its value as a B2B networking tool. There is a slight gender bias, with males accounting for 54% of the Irish users. Globally, LinkedIn’s user base has grown from 65 million to 80 million in just six months, with almost half of those users based in the US. The social media site is gaining in momentum, not just in terms of sign- ups but in how it is being used to connect or reconnect with business contacts, promote businesses and secure new recruits. Anecdotes abound about how LinkedIn has helped generate or convert leads, raise awareness and market companies’ products and services. There are also some scare stories – spurious contacts, exaggerated or incorrect claims, headhunters mining the CVs to poach people – proving, perhaps, that virtual networks are no different to behaviours experienced in the physical world. What do Irish LinkedIn members do? An Amárach survey found that it’s the routine tasks – looking up and staying in touch with contacts – that are the most popular activities, with job hunting in third place. Source: LinkedIn, November 2010 USA 38.4m SA .4m 353,391 Worldwide 80 million India 7.4m UK 4.8m Other 29m Ireland © AMAS graphic (www.amas.ie) 0 10 20 30 40 50 60 % 59 50 49 45 33 10 Look up new contacts Stay in touch with contacts Browse for possible jobs Update my work/projects status Browse contacts’status updates Browse for possible people to hire © AMAS graphic (www.amas.ie) LinkedIn tasks Source: Amárach, Social Networking in Ireland report, published August 2010. Data based on 850 online interviews LinkedIn 2004 2006 2008 2010 2012 2014 40% Read the newspapers each week Use the internet once a week 60% 70 64 70% 80% 50% Newspaper readership and internet use 2. Newspapers vs online For newspapers, the internet continues to have a profound impact. Readers are turning increasingly to the internet for their news, but for many it is not a case of ‘either or’. More than half of European consumers read a newspaper or magazine and also use the internet at least weekly. In 2010, more consumers are reading a newspaper than use the internet but by 2014 this is expected to be reversed. Quality does not seem to be a factor with online news, with fewer than one in ten internet users who also read newspapers saying that news in print is “any more reliable” than what they read on the internet. Source: IAA Mediascope 2004-2010, 10-market average. 2012 and 2014 figures estimated on best-fit trend line

- 3. Top Trends the opportunity to win online Nov 09 Dec 09 Jan 10 Feb 10 Mar 10 Apr 10 May 10 Jun 10 Jul 10 Aug 10 Sep 10 Oct 10 0.2 0 0.4 0.6 0.8 1.0 1.2 1.4 1.6 1.8 2.0 2.2 RTÉ TV3 TG4 Millions A further tranche of data confirms what everyone involved in digital advertising in Ireland is saying – that digital continues to grow and is set to become a leading category. Research for the first half of 2010 from IAB Ireland/PricewaterhouseCoopers shows that, despite a bruising advertising market, digital advertising spend increased by just over 12% to €53.9 million. Google continues to be the primary beneficiary, with paid search accounting for 45% of digital spend. The broad display category was also a strong performer accounting for 29% of share, with advertising networks (including Google’s) and social media campaigns on sites like Facebook becoming a more common feature on advertising schedules. Online classifieds constit- ute the balance of the digital spend. This IAB/PwC research will be repeated every six months and within a few months of its launch has become the industry benchmark, just as its equivalent research has become in other more mature markets. Separately, PwC has conducted some forecasting about media and entertainment trends globally. For the Irish market, it describes the advertising market as “fragile”, and expects an overall decline of 5.1% this year. Digital will buck the overall ad market trend this year and in the years ahead, with PwC forecasting compound growth in Irish internet revenues of 16.3% over the next five years. 3. Online TV More indicators of how the internet is changing consumers’ media habits. Online TV has become an established medium in Ireland, with consumers playing catch up on their favourite TV programmes through the websites of Irish television stations. The number of streams varies according to the broadcasting schedules, with peaks being recorded for major sport occasions and hit TV shows. RTÉ Player was at its busiest in June with 2.3 million streams, thanks in no small measure to the World Cup. TV3’s highpoint was in October at 1.2 million streams, with X Factor and The Apprentice being online crowd pullers. October was also the best month for TG4 at 343,000 streams, with the Aussie Rules series and Oireachtas Festival helping to boost the numbers. Millions of streams per month Source: Data supplied by RTÉ, TV3 and TG4. Note: TG4 Beo Player streams Irish language programmes only 4. Digital advertising Jan - June 2009 Jan - June 2010 40% 60% 80% 20% 0% 100% 27.6% 25.7% 46.6% 26% 29% 45% €48m €53.9m Search Display Classifieds Source: IAB PwC Online Adspend Study for first half of 2010, and PWC Global entertainment and media outlook 2010– 2014, both published in November 2010 Forecast Irish advertising market 2010 5.1 12.2% % Total market Digital Irish digital advertising market

- 4. Economic mayhem does not seem to have dampened demand for top-notch mobile phones among Irish consumers. Smart phones which allow users to access emails, Facebook accounts and multimedia content are “must haves” and not just for the Christmas stockings. Ireland is slightly ahead of the European average when it comes to the mobile internet: with 35% of Irish mobile phone users reporting that their mobiles are internet-enabled. But, as with many trends online, there is a big gap with our nearest neighbours – UK mobile internet adoption is the second highest in Europe at 49%. On the European leader- board, it’s a typical north v. south divide. In Romania and Bulgaria, only one in seven has an internet-enabled mobile phone, compared with almost three out of every five people in Sweden. Source: Eurobarometer, eCommunications Household Survey, published October 2010; Irish sample size 1,014 out of total EU27 sample of 26,761 ©AMASgraphic(www.amas.ie) 5. Mobile Internet Sweden 58% United Kingdom 49% Slovenia 47% Czech Republic 45% Poland 44% Latvia 43% Estonia 42% Denmark 38% Austria 38% Slovakia 38% Finland 36% Ireland 35% France 35% Luxembourg 34% EU27 33% Netherlands 32% Spain 30% Germany 30% Hungary 28% Lithuania 23% Portugal 21% Belgium 20% Greece 20% Italy 20% Cyprus 18% Malta 18% Bulgaria 15% RO 12% 50% - 100% 40% - 49% 21% - 39% 0% - 20% Non EU 50% - 100% 40% - 49% 21% - 39% 0% - 20% Non EU 50% - 100% 40% - 49% 21% - 39% 0% - 20% Non EU 50% - 100% 40% - 49% 21% - 39% 0% - 20% Non EU 50% - 100% 40% - 49% 21% - 39% 0% - 20% Non EU market share against the internet “pureplays” • Sophisticated online consumers are driving innovation and using tools and market knowledge to secure the best deals across both online and traditional channels Casting the net further, the global trends are also worth considering • Women spend 20% more time on retail sites than men (comScore) • Average sales value per customer are higher for multichannel retailers - $900 a year, compared with $160 for online-only and $200 for store-only (JC Penney channel value analysis) • Only a third of UK retailers perform shopping cart analysis although such analysis improves conversions (eConsultancy) • Consumers take their time to make online purchase, with 65% waiting a day or more to complete a purchase (McAfee) • Mobile commerce is becoming serious business, with 10 million using their iPhones to buy from eBay in 2009 • Social commerce will become big business, particularly with younger audiences, with 28% of US retailers reporting that sales through social media sites are already significant (Shop.org) Irish businesses are waking up to eCommerce. The opportunities are definitely there but so too are risks. Upfront investment in strategy and planning pays considerable dividends. Continued from page 1 www.amas.ie

- 5. Top Trends Mobile, location technologies and social media for the retail sector are set to be key themes in the Irish Internet Association’s next “8Ways” eCommerce conference in 2011. It builds on the phenomenal response to the IIA’s initial “8Ways” conf- erence earlier this autumn, which had 120 delegates and reflects a significant increase in interest in eCommerce during the past year. The first “8 Ways to Sell More Stuff” conference was designed specifically for eCommerce traders and focused on the basics of sales conversion and loyalty techniques for members’ websites. The conference found that while Irish consumers out-shop their European counterparts online, Irish retailers are under- selling online compared with their international counterparts. Irish consumers are clearly shopping online for value and/or product range that cannot be found easily in the Irish market. Broadband is still prohibitively slow in many areas, and is not only a disincentive for retailers to developing their eCommerce offerings but is also a barrier to consumers. The final challenge is cost- effective product fulfilment: unless the product is truly unique or exceptionally less expensive, customers overseas or indeed on the other side of Ireland are unlikely to be willing to absorb the cost of shipping. Within the grocery sector, some of Ireland’s largest domestic brands are still not trading online. Smaller independents have been more aggressive and creative in adopting online strategies to boost sales. For these organisations, eCommerce presents an opportunity to expand the business without the need for capital expenditure. SMEs and sole traders operate lean and nimble operations that allow them to respond quickly to customer requests. This was again evidenced by the delegate profile at the “8Ways” conference. Such was the level of interest in the conference and the positive feedback from delegates, the IIA will be heading into 2011 with a continued focus on this sector and future “8Ways” events. eCommerce conference puts spotlight on mobile and social media Joan Mulvihill CEO, Irish Internet Association 6. Domains What’s in a name and more particularly a domain name? An awful, awful lot if you want to launch a new brand, protect an existing one and target different audiences and markets. Increasingly, businesses realise how essential domains are to their brand armoury. Decisions about what type of domain .com or .ie for instance – often rest with the aspirations of the business or the brand and particularly the market focus. Companies with global ambitions often opt for .com or .net but then try to mop up the relevant market- specific domains .co.uk for the UK or .fr for France – to allow for more market-specific focus. As the IEDR celebrates its tenth birthday, new statistics shows that .ie is performing strongly. The Irish domain market accounts for approximately 355,000 of the world’s total of 196 million domains. .ie accounts for around 41% of the Irish market, compared with 29.5% for .com. Benchmarked against other similar countries, the Irish share is ahead of the global average of 39% for other equivalent country code top-level domain (ccTLDs). Source: IEDR, Domain Industry Report 2010; comparisons based on data from Directi (webhosting.info), Eurid and IEDR .info .com .eu .org .ie .net .biz 41% 30% 14% 3% 1% 6% 5% The IEDR is on a mission to promote the value of the .ie domain to Irish businesses and has launched a new site – and of course a catchy domain, Why.ie. It has also launched a publication, the Domain Industry Report, which provides a wealth of statistics on domains and the Irish internet “ecosystem”. AMAS Managing Director Aileen O’Toole has written a piece for this publication on how Ireland’s digital economy has matured over the past ten years. It is available for download on www.iedr.ie .ie on a mission Ireland’s domain name registrations

- 6. © AMAS Ltd. Published by AMAS Ltd., 38 Lr. Leeson Street, Dublin 2, Ireland. Tel: +353 1 6610499 Email: info@amas.ie Web: www.amas.ie Think Irish SMEs are behind the curve in terms of online adoption? And that they fear the effects of the internet on traditional business models. Then think again. There is growing evidence that the digital divide is narrowing and that SMEs are deriving much business value from using the internet. AMAS had a role in producing such evidence in tourism, which more than any other economic sector has been transformed by the internet. Three years ago, AMAS research for the Irish Tourist Industry Confederation (ITIC) concluded that there was a digital divide in tourism, with many businesses missing out on bookings because of slow internet adoption. This year, AMAS was in the field again for ITIC. In collaboration with CHL Consulting, we canvassed the views of more than 600 Irish tourism businesses as part of a broad study on travel distribution. This time, the tourism industry had a different story to tell: • Over 90% of Irish tourism businesses say that the internet has been very positive or positive for their businesses • 88% of business say it has increased sales • 71% say it has led to improved yields • 60% believe it has improved capacity utilisation Challenges remain. Word of mouth reputation has gone online, and gone viral. The authoritative view of tourism destinations and facilities has moved to sites like TripAdvisor, which serves up over five million pages about Ireland each month. Also the pace of change is breathtaking. Mobile technology, for instance, is becoming increasingly important in tourism distribution and will be the platform of choice for many visitors to Ireland within a short few years. And, in these battered economic times, it is difficult for many SMEs to secure capital investment for complex internet integration projects. Our experience, in tourism and in other economic sectors, is that many SMEs are meeting those challenges head on. Many are hungry for knowledge and, in some cases, have become self- taught, highly motivated online marketers. Many are becoming more informed buyers of web design, tec- hnology and online marketing services. And many, have set their sights on full-scale integration between their websites and back-end systems. Digital divide is narrowing for SMEs AMAS: what we do AMAS is an internet consultancy with a simple goal – help our clients to exploit the internet. Large corporates, government bodies and, increasingly, high- potential businesses retain us to develop and help implement internet strategies. We cut through the clutter and the complexity to allow our clients to capitalise on the unlimited opportunities offered by the internet. Services: • Strategy • Research • User experience • Content • Training • Marketing • Project management Fiachra Ó Marcaigh Director, AMAS 1% % 100 90 80 70 60 50 40 30 20 10 0 90.5% 8.6% Positive / Very Positive Neutral Negative Tourism industry perceptions of the internet’s impact on business Tourism and Travel Distribution in a Changed World is a largescale study on the impact of the internet on Ireland’s tourism industry and on traditional distribution channels. It involved extensive Irish and international research by CHL Consulting and AMAS on behalf of ITIC. The study’s recommen- dations will be used by industry bodies, state agencies, policy makers and tourism businesses to ensure that the Irish tourism product is well distributed across existing and new channels globally. For tourism SMEs, the study includes a series of practical resources on repu- tation mana- gement, online marketing and maximising their own websites. The research study can be downloaded in the research areas of either the ITIC website (www.itic.ie) or the AMAS website (www.amas.ie) Follow us: For digital research and insights, follow AMAS on Twitter@AMASinternet Contact Us: Aileen O’Toole, Managing Director on +353 1 6610499 or info@amas.ie