Project on lupin pharmaceutical(3) (1)

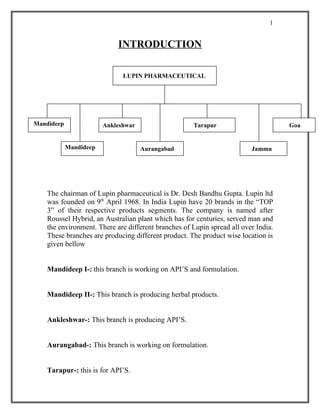

- 1. 1 INTRODUCTION LUPIN PHARMACEUTICAL Mandideep Ankleshwar Tarapur Goa Mandideep Aurangabad Jammu The chairman of Lupin pharmaceutical is Dr. Desh Bandhu Gupta. Lupin ltd was founded on 9th April 1968. In India Lupin have 20 brands in the “TOP 3” of their respective products segments. The company is named after Roussel Hybrid, an Australian plant which has for centuries, served man and the environment. There are different branches of Lupin spread all over India. These branches are producing different product. The product wise location is given bellow Mandideep I-: this branch is working on API’S and formulation. Mandideep II-: This branch is producing herbal products. Ankleshwar-: This branch is producing API’S. Aurangabad-: This branch is working on formulation. Tarapur-: this is for API’S.

- 2. 2 Jammu-: This branch is for formulation. Goa-: This is producing Non Cephalosporin Dosage forms. API’S-: This is the active pharmaceutical ingredient. This is in the form of powder and this is generally using in the formulation of medicine. It is the kind of production. FORMULATION -: This is production of capsules, tablets and syrup with the help of API’S. A branch which is producing API’S will send this for formulation. In India Lupin have 20 brands in the “TOP 3” of their respective products segments. Global leader in anti-tuberculosis products and cephalosporin. Lupin products sold in over 70 countries. When it comes to reliability and quality, Lupin’s name is amongst in the mind of specialists. More and more specialists such as chest physicians, consulting physicians, general surgeons, pediatricians, cardiologists and diabetologists are choosing its products everyday. Despite the fact that the Indian urban prescription market showed stagnation with only 0.1% of growth, Lupin has bucked the trend by recording a strong growth of 8.2% during the year. AAMLA (Asia, Africa, Middle East & Latin America)-: In its pursuit to be an innovation led translation pharmaceutical company, Lupin has ventured penetrated into chosen markets represented by its AAMLA division. The AAMLA geographic provide unique challenge and opportunity. On one hand, there are highly regulated markets such as Japan, Australia, South Korea, Mexico, U.A.E., Saudi Arabia etc. while, on the there, there are less regulated markets such as Myanmar, Nigeria, Kenya and Peru.

- 3. 3 1200 1000 800 600 400 200 0 2002-03 2003-04 2004-05 2005-06 sales (rs. in million) INDIA PHARMACEUTICAL MARKET- Today, the pharmaceutical industry in India is estimated to be over a US $5 billion. 2005 marked the beginning of an era in the Indian pharmaceutical industry with the introduction product patent regime. The bill not only provided the confidence to multinational companies to bring in their research molecule but, it also gave Indian companies reason to focus on developing brands and exploring in-licensing and marketing alliances. The Indian pharmaceutical market continued to grow in size, powered by 9% value and 7%volume growth respectively. FINANCIAL OVERVIEW-: In financial year 2005-06, the net sales of the company increased by 38% from Rs. 11611.3 million to Rs. 16061 million in net profit, a 117% increase over the previous year’s Rs. 843.6 million. Higher sales volume, especially in the high value market of US and in formulations in the domestic markets triggered the higher profitability. These entire factors contributed to the growth in earning before interest, tax, depreciation and amortization (EBITDA) by 106%, from Rs. 1457.9 million. During the year EBITDA constituted 19% of net sales. The company registered strong export sales constituted 46% of gross sales.

- 4. 4 3500 3000 2500 2000 1500 1000 500 0 2004-05 2005-06 --EBITDA (Rs, in million) 1- On the strength of the various ANDA’s filled by the company in the previous year, the company, the company was able to launch 7 new products in the US, from which sales of Rs. 2233 million were added to the company’s top line. In particular, Ceftriaxone has been a major success for the company, for which it now enjoys around 25% market share. The price drop for the product was about 70% in hospital market, being less intense, with fewer competitors participating in this high-end niche generic product. 2- Domestically, the company’s strong performances within the recently entered Anti-Asthma segment and its overall market penetration of its multitude of leading products in other therapeutic areas have generated significant revenues additions. 3- In terms of other product, Lupin has been able to maintain optimal cost positioning and quality maintenance, the keys to success in this industry. Despite price drops in various products, the company has been able to maintain and grow its market share to make strong margins from these products, contributed to the strong financial performance of the company.

- 5. 5 45 40 35 30 25 20 15 10 5 0 2004-05 2005-06 --EPS (Rs. In million) As a result of these factors, the profit after tax recorded was Rs. 1827.2 million, with cash profits amounting to Rs. 2230.7 million. The earning per share was Rs. 44.59. The Board recommended a dividend of 65%, absorbing a sum of Rs. 297.5 million, inclusive of tax on dividend. 8000 7000 6000 5000 4000 3000 2000 1000 0 2000-01 2001-02 2002-03 2003-04 2004-05 2005-06 --API SALES GROWTH

- 6. 6 FINANCIAL OVERVIEW (2004-05)-: In financial year 2004-05, the net sales of the company by 4% from Rs.11192.8 million to Rs.11611.3 million. The net profit after extraordinary items was Rs.843.6 million as against Rs.987.1 million in the previous year. The company made a strategic decision to significantly increase investment in intellectual capital, marketing and R&D. The company witnessed a dip in margin in its Pen G based API product and faced market uncertainty in the last quarter owing to the introduction of VAT. These entire factors contributed to the reduction of the Earning before tax, Depreciation and Amortization (EBITDA) from Rs.2801.7 million in the previous year to Rs.1457.9 million. 2500 2000 1500 1000 500 0 2004-05 2005-06 --PBT (Rs. In million) The company registered strong export sales worth Rs.5619.1 million, thereby constituting 48% of the net sales. The company expanded its product pipe line, R&D Company investing substantially higher amount in R&D (Rs.760.1 million in revenue, Rs.76 million in capex). The R&D expenditure increased to7.2% of net sales in the previous financial year 2004-05 up from 4.11% in the previous year.

- 7. 7 90 80 70 60 50 40 30 20 10 0 2004-05 2005-06 --REGULATED MARKETS -- SEMI REGULATED MARKET Ratio Analysis: Introduction A ratio is a quantity that denotes the proportional amount or magnitude of one quantity relative to another Ratio Analysis is the most commonly used analysis to judge the financial strength of a company. A lot of entities like research houses, investment bankers, financial institutions and investors make use of this analysis to judge the financial strength of any company. Fundamental Analysis has a very broad scope. One aspect looks at the general (qualitative) factors of a company. The other side considers tangible and measurable factors (quantitative). This means crunching and analyzing numbers from the financial statements. If used in conjunction with other methods, quantitative analysis can produce excellent results.

- 8. 8 Ratio analysis isn't just comparing different numbers from the balance sheet, income statement, and cash flow statement. It's comparing the number against previous years, other companies, the industry, or even the economy in general. Ratios look at the relationships between individual values and relate them to how a company has performed in the past, and might perform in the future. Financial ratios are calculated from one or more pieces of information from a company's financial statements. For example, the "gross margin" is the gross profit from operations divided by the total sales or revenues of a company, expressed in percentage terms. In isolation, a financial ratio is a useless piece of information. In context, however, a financial ratio can give a financial analyst an excellent picture of a company's situation and the trends that are developing. A ratio gains utility by comparison to other data and standards. Taking our example, a gross profit margin for a company of 25% is meaningless by itself. If we know that this company's competitors have profit margins of 10%, we know that it is more profitable than its industry peers which is quite favorable. If we also know that the historical trend is upwards, for example has been increasing steadily for the last few years, this would also be a favorable sign that management is implementing effective business policies and strategies. This analysis makes use of certain ratios to achieve the above-mentioned purpose. There are certain benchmarks fixed for each ratio and the actual ones are compared with these benchmarks to judge as to how sound the company is. The ratios are divided into various categories, which are mentioned below: Financial ratio analysis groups the ratios into categories which tell us about different facets of a company's finances and operations. An overview of some of the categories of ratios is given below. • Leverage Ratios which show the extent that debt is used in a company's capital structure. • Liquidity Ratios which give a picture of a company's short term financial situation or solvency.

- 9. 9 • Operational Ratios which use turnover measures to show how efficient a company is in its operations and use of assets. • Profitability Ratios which use margin analysis and show the return on sales and capital employed. • Solvency Ratios which give a picture of a company's ability to generate cash flow and pay it financial obligations. CLASSIFICATION OF RATIOS The use of ratio analysis is not confined to financial manager only. There are different parties interested in the ratio analyses for knowing the financial position of a firm for different purposes. In vies of various users of ratios, there are many types of ratio which can be calculated from the information given in the financial statements. The particular purpose of the user determines the particular ratios that might be used for financial analysis. Similarly the interests of the owners and the management also differ. The shareholders are generally interested in the profitability or dividend position of a firm while management requires information on almost all the financial aspects of the firm to enable it to protect the interests of all parties. RATIOS (A) (B) (C) TRADITIONAL FUNCTIONAL CLASSIFICATION SIGNIFICANCE RATIOS CLASSIFILCATION OR OR OR STATEMENT RATIOS CLASSIFICATION ACCORDING TO RATIOS ACCORDING TO TESTS IMPORTANCE 1. BALANCE SHEET RATIOS 1.LIQUIDITY RAT IOS 1.PRIMARY RATIOS POSI TION STATEMENT 2.LEVERAGE RATIOS 2.SECONDARY RATIOS RATIOS 3.ACTIVITY RATIOS 2. PROFIT AND LOSS A/C 4.PROFITABILITY RATIOS OR REVENUE/INCOME STATEMENT RATIOS 3.COMPOSITE/MIXED RATIOS OR INTER STATEMNT RATIOS

- 10. 10 (A)TRADITIONAL CLASSIFICATION OR STATEMNT RATIOS Traditional classification or classification according to statement, from which these ratios are calculated, is as follows. TRADITIONAL CLASSIFICATION OR STATEMENT RATIOS (A) (B) BALANCE SHEET RATIOS PROFIT AND LOSS A/C RATIOS COMPOSITE/MIXED OR OR OR POSITON STATEMENT RATIOS REVENUE/INCOME STATEMENT RATIOS INTER-STATEMENT RATIOS 1. CURRENT RATIO 1.GROSS PROFIT RATIO 1. STOCK TURNOVER RATIO 2. LIQUID RATIO (ACID TEST 2.OPERATING RATIO 2. DEBTORS TURNOVER OR QUICK RATIO) 3. OPERATING PROFIT RATIO 3. PAYABLE TURNOVER RATI0 3. ABSOLUTE LIQUIDITY RATIO 4.NET PROFIT RATIO 4. FIXED ASSET 4. DEBT EQUITY RATIO 5.EXPENSE RATIO TURNOVER RATIO 5. PROPRIETORY RATIO 6.INTEREST COVERAGE RATIO 5. RETURN ON EQUITY 6. CAPITAL GEARING RATIO 6. RETURN ON 7. ASSETS-PROPRIETORSHIP SHAREHOLDERS FUNDS RATIO 7. RETURN ON CAPITAL 8. CAPITAL INVENTORY TO CAPITAL EMPLOYED WORKING CAPITAL RATIO 8. CAPITAL TURNOVER RATIO 9. RATIO OF CURRENT 9. WORKING CAPITAL ASSETS TO FIXED ASSETS TURNOVER RATIO. 10. RETURN ON TOTAL RESOURCES 11. TOTAL ASSETS TURNOVER EXPLAINATION 1. BALANCE SHEET OR POSITION STATEMENT RATIOS: Balance sheet ratios deal with the relationship between the two balance sheet items. Both its items must however, pertain to the same balance sheet. 2. PROFIT AND LOSS A/C OR REVENUE/INCOME STATEMENT RATIOS: These ratios however deal with the relationship between two profit and loss A/C items. Both the items must however belong to the same profit and loss A/C. 3. COMPOSITE/MIXED RATIOS OR INTER STATEMNT RATIOS: These ratios exhibit the relation between a profit and loss A/C of income statement item and a balance sheet item.

- 11. 11 (B) FUNCTIONAL CLASSIFICATION OR CLASSIFICAITON ACCORDING TO TESTS In view of the financial management or according to the tests satisfied, various ratios have been classified as below: FUNCTIONAL CLASSIFICATION IN VIEW OF FINANCIAL MANAGEMENT OR CLASSIFICATION ACCORDING TO TESTS LIQUIDITY RATIOS LONGTERM SOLVENCY AND ACTIVITY RATIOS PROFITABILITY RATIOS LEVERAGE RATIOS (a)1.CURRENT RATIO FINANCIAL OPERATING 1.INVENTORY TURNOVER (a)IN RELATION TI SALE 2.LIQUID RATIO(ACID COMPOSITE RATIO 1.GROSS PROFIT TEST OR QUICK RATIOS 1.DEBT EQITY RATIO 2.DEBTORS TURNOVER RATIO 3.ABSOLUTE LIQUID 2.DEBT TO TOTAL CAPITAL 3.FIXED ASSET TURNOVER 2.OPERATING RATIO OR CASH RATIO 3.INTEREST COVERAGE 4.TOTAL ASSET TURNOVER 3.OPERATING PROFIT 4. INTERNAL MEASURE 4.CASH FLOW/DEBT RATIO RATIO 5. CAPITAL GEARING 5.WORKING CAPITAL 4.NET PROFIT RATIO (b)1. DEBTORS TURNOVER TURNOVER RATIO 5.EXPENSE RATIO RATIO 6.PAYABLE TURNOVER (b)IN RELATION TO 2. CREDITOR TURNOVER RATIO INVESTMENTS RATIO 7.CAPITAL EMPLOYED 1. RETURN ON 3. INVENTORY TURNOVER TURNOVER INVESTMENTS RATIO 2. RETURN ON CAPITAL 3. RETURN ON EQITY CAPITAL 4. RETURN ON TOTAL RESOURCES 5. EARNING PER SHAR 6. PRICE EARNING RATIO EXPLAINATION 1. LIQUIDITY RATIOS: There are ratios, which measure the short- term solvency or financial position of a firm. These ratios are calculated to comment upon the short term paying capacity of a concern or the firm ability to meet its current obligations. 2. LONG TERM SOLVENCY AND LEVERAGE RATIOS: Long- term solvency ratios convey a firm’s ability to meet the interest cots and repayments schedules of its long term obligations. 3. ACTIVITY RATIOS: Activity ratios are calculated to measure the efficiency with which the resources of a firm have been employed. These ratios are also called turnover ratios because they indicate the speed with which assets are being turned over into sales.

- 12. 12 4. PROFITABILITY RATIOS: These ratio measures the results of business operations or overall performance and effectiveness of the firm. There are two type of profitability ratios 1.in relation to sales 2.in relation to investments. (C) CLASSIFICATION ACCORDING TO SIGNIFICANCE OR IMPORTANCE The ratios have also been classified according to their significance or importance. Some ratios are more important then others and the firm may classify them al primary and secondary ratios. The British Institute of management has recommended the classification of the ratios according to importance for inter firm comparison. For inter-firm comparisons the ratios may be classified as Primary and Secondary ratios. The primary ratios is one of which is of the prime importance to a concern; thus return on the capital is employed is named as primary ratio. The other ratios, which support the other ratios, are called secondary ratios. IMPORTANT FORMULA USED IN RATION ANALYSIS Liquidity Analysis Ratios Current Ratio Current Assets Current Ratio = ------------------------ Current Liabilities Quick Ratio Quick Assets Quick Ratio = ---------------------- Current Liabilities

- 13. 13 Quick Assets = Current Assets - Inventories Net Working Capital Ratio Net Working Capital Net Working Capital Ratio = -------------------------- Total Assets Net Working Capital = Current Assets - Current Liabilities Profitability Analysis Ratios Return on Assets (ROA) Net Income Return on Assets (ROA) = ---------------------------------- Average Total Assets Average Total Assets = (Beginning Total Assets + Ending Total Assets) / 2 Return on Equity (ROE) Net Income Return on Equity (ROE) = -------------------------------------------- Average Stockholders' Equity Average Stockholders' Equity = (Beginning Stockholders' Equity + Ending Stockholders' Equity) / 2 Return on Common Equity (ROCE) Net Income Return on Common Equity (ROCE) -------------------------------------------- = Average Common Stockholders' Equity Average Common Stockholders' Equity = (Beginning Common Stockholders' Equity + Ending Common Stockholders' Equity) / 2 Profit Margin Net Income Profit Margin = ----------------- Sales

- 14. 14 Earnings Per Share (EPS) Net Income Earnings Per Share (EPS) = --------------------------------------------- Number of Common Shares Outstanding Activity Analysis Ratios Assets Turnover Ratio Sales Assets Turnover Ratio = ---------------------------- Average Total Assets Average Total Assets = (Beginning Total Assets + Ending Total Assets) / 2 Accounts Receivable Turnover Ratio Sales Accounts Receivable Turnover Ratio = ----------------------------------- Average Accounts Receivable Average Accounts Receivable = (Beginning Accounts Receivable + Ending Accounts Receivable) / 2 Inventory Turnover Ratio Cost of Goods Sold Inventory Turnover Ratio = --------------------------- Average Inventories Average Inventories = (Beginning Inventories + Ending Inventories) / 2 Capital Structure Analysis Ratios Debt to Equity Ratio Total Liabilities Debt to Equity Ratio = ---------------------------------- Total Stockholders' Equity Interest Coverage Ratio

- 15. 15 Income Before Interest and Income Tax Expenses Interest Coverage Ratio = ------------------------------------------------------- Interest Expense Income Before Interest and Income Tax Expenses = Income Before Income Taxes + Interest Expense Capital Market Analysis Ratios Price Earnings (PE) Ratio Market Price of Common Stock Per Share Price Earnings (PE) Ratio = ------------------------------------------------------ Earnings Per Share Market to Book Ratio Market Price of Common Stock Per Share Market to Book Ratio = ------------------------------------------------------- Book Value of Equity Per Common Share Book Value of Equity Per Common Share = Book Value of Equity for Common Stock / Number of Common Shares Dividend Yield Annual Dividends Per Common Share Dividend Yield ------------------------------------------------ = Market Price of Common Stock Per Share Book Value of Equity Per Common Share = Book Value of Equity for Common Stock / Number of Common Shares Dividend Payout Ratio Cash Dividends Dividend Payout Ratio = -------------------- Net Income

- 16. 16 ROA = Profit Margin X Assets Turnover Ratio ROA = Profit Margin X Assets Turnover Ratio Net Income Net Income Sales ROA = ------------------------ = -------------- X ------------------------ Average Total Assets Sales Average Total Assets Profit Margin = Net Income / Sales Assets Turnover Ratio = Sales / Averages Total Assets INTERPRETATIONS THEORY OF THE RATIOS The interpretations of the ratios are an important factor. Though calculation of the ratios is important but it is only a clerical task whereas interpretation needs skill, intelligence and foresightedness. The inherent limitations of the ratio analysis should be kept in mind while interpreting them. The impact of the factors such as price level changes, change in accounting policies, window dressing etc., should be also be kept in mind when attempting to interpret ratios. The interpretation of the ratios can be made in the following ways. 1. SINGLE ABSOLUTE RATIOS: the single ratios can be studied in relation to certain rules of thumb, which are based upon well-proven conventions. 2. GROUP OF RATIOS: Ratios may be interpreted by calculating a group of related ratios. A single ratios supported by a group of related ratios become more understandable and meaningful. 3. HISTORICAL COMPARISION: one of the earliest and most popular ways of evaluating the performance of the firm is to compare its present ratios with the past ratios called comparision overtime.

- 17. 17 4. PROJECT RATIOS: Ratios can be also calculated for future standards based upon the projected or perform financial statements. These future ratios may be taken as standard for comparison and the ratios calculated on actual financial statements can be compared with the standard ratios to find out variances. 5. INTER FIRM COMPARISION: Ratios of one firm can also be calculated with the ratios of the other selected firm in the same industry at the same point of time. This kind of comparison helps in evaluating relative financial position and performance of the firm. GUIDELINES OR PRECUATIONS FOR THE USE OF RATIOS The calculation of the ratios may not be a difficult task but their use is not easy. The information on which these are based, the constraints of the financial statements, objective for using them, the caliber of the analyst, etc. are the important factors which influence the use of ratios. Following are the guidelines for interpreting ratios. 1. ACCURACY OF THE FINANCIAL STATEMENTS: The reliability of the ratios are linked with the data available in the financial statements. Before calculating the ratios one should see whether the proper conventions have been used for preparing financial statements or not. 2. OBJECTIVE OF THE PURPOSE OF ANALYSIS: The type of ratios to be calculated will depend upon the purpose for which these are required. If the purpose is to study the financial position then the ratios of current assets and liabilities will be studied. The purpose of “user” is important for the analysis of ratios. 3. SELECTION OF RATIOS: another precaution in ratio analysis is the proper selection of appropriate ratios. The ratios should match the purpose for which these are required.

- 18. 18 4. USE OF STANDARDS: The ratios will give an indication of financial position only when discussed with the reference to certain standards. Unless otherwise these ratios are compared with certain standards one will not be able to reach at conclusions. 5. CALIBER OF THE ANALYST: The ratios are only the tools of the analysis and their interpretation will depend upon the caliber and competence of the analyst. He should be familiar with the various financial statements and significant changes etc. 6. RATIOS PROVIDE ONSY A BASE: The ratios are only guidelines for there analyst, he should not base his decisions entirely on them. He should study any other relevant information, situation in concern, other economic environment. USE AND SIGNIFICANCE OF RATIO ANALYSIS The ratio analysis is one of the most powerful tools of financial analysis. It is used as a device to analyze and interpret the financial health of enterprise. Just like the doctor examines the patient by recording his body temperature, blood pressure, and etc. before making his conclusion regarding the illness and before giving his treatment. The use of ratios is not confined to financial managers only but there are different parties also which are interested in the ratio analysis for knowing the financial position of a firm for different purposes like supplier of goods on credit, financial institutions, invertors, shareholders etc. With the use of ratio analysis one can measure the financial condition of a firm and can point our whether the condition is strong, good, poor etc. Applications of the ratio analysis are: MANAGERIAL USES OF RATIO ANALYSIS 1. HELPS IN DECISION MAKING: Financial statements are prepared primarily for decision-making. Ratio analysis helps in

- 19. 19 making decisions from the information provided in these financial statements. 2. HELPS IN FINANCIAL FORECASTING AND PLANNING: Ration analysis is of much help in financial forecasting and planning. Planning is looking ahead and the ratios calculated for a number of years work as a guide for the future. Meaningful conclusions can be drawn from these ratios. 3. HELPS IN COMMUNICATING: The financial strengths and weakness of the firm are communicated in a more easy and understandable manner by the use of these ratios. The ratios help in communication and enhance the value of the financial statements. 4. HELPS IN COORDINATION: Ratios even help in coordination, which is of utmost importance in effective business management. Better communication of efficiency and weakness of an enterprise results on better coordination in the enterprise. 5. HELPS IN CONTROL: Ratio analysis even helps in making effective control of the business. Standard ratios can be based upon Performa of financial statements and variance or deviations, if any, helps in comparing the actual with the standards so as to take a corrective action at the right time. 6. OTHER USES: There are so many other uses of the ratio analysis. It is an essential part of the budgetary control and standard costing. Ratios are of immense importance in the analyses and interpretation of financial statements as they bring the strength or weakness of the firm UTILITY TO SHARE HOLDERS AND INVESTORS The investor in the company will like to assess the financial position of the concern where he is going to invest. Firstly the investor

- 20. 20 will try to ass3ess the value of fixed assets and the loans raised against them. The investor will feel satisfied only if the concern has sufficient amount of assets. Long-term solvency ratios will help him in assessing the financial position of the concern. Profitability ratios, on the other hand, will be useful to determine profitability position. Ratio analysis will be useful to the investor in making up his mind whether present financial position of the concern warrants further investment or not. UTILITY TO THE CREDITORS The creditors or the suppliers extend short-term credit to the concern. They are interested to know whether financial position of the concern warrants their payments at a specified time or not. The concern pays short-term creditors out of its current assets. If the current assets are quiet sufficient to meet current liabilities then the creditor will not hesitate in extending credit facilities. Current and acid test ratios will give an idea about their current financial position of the concern. UTILITY TO THE EMPLOYEES The employees are also interested in the financial position of the concern especially profitability. Their wage increase and amount of fringe benefits are related to the volume of profits earned by the concern. The employees make use of information available in the financial statements. Various profitability ratios relating to gross profit, operating, net profit, etc., enable the employees to put forward their viewpoint for the increase of wages and other benefits. UTILITY TO GOVERNMENT Government is interested to know the overall strength of the industry. Various financial statements published by industrial units are

- 21. 21 used to calculate ratios for determining short-term. Long-term and overall financial position of concerns. Profitability indexes can also be prepared with the help of ratios. Government may base its future policies on the bases of industrial information available from various units. The ratios may be used as indicators of overall financial strength of public as well as private sector. In the absence of the reliable economic information, government plans and policies may not prove successful. TAX AUDIT REQUIREMENTS The Finance Act, 1984, inserted section 44 AB in the Income Tax Act. Under this section every assessed engaged in any business and having turnover or gross receipts exceeding Rs. 40 lakh is required to get the accounts audited by a charted accountant and submit the tax audit report before the due date for filing the return of income under section 139(1). In case of a professional, a similar report is required if the gross receipts exceeds Rs. 10 lacks. Clause 32 of the income Tax Act trequires that the following accounting ratios should be given: 1. Gross Profit/turnover 2. Net Profit/turnover 3. Stock-in-trade/turnover 4. Materials consumed/Finished Goods Produced

- 22. 22 LIMITATIONS OF THE RATIO ANALYSIS LIMITED USE OF A SINGLE RATIO: A single ratio, usually, does not convey much of a sense. To make a better interpretation a number of ratios have to be calculated which is likely to confuse the analyst than help him in making any meaningful conclusion. LACK OF ADEQUATE STANDARDS: There are no well-accepted standards or rules of thumb for all ratios, which can accept as norms. It renders interpretation of the ratios difficult. INHERENT LIMITATIONS OF ACCOUNTING: like financial statements, ratios also suffer from the inherent weakness of accounting records such as their historical nature. CHANGES OF ACCOUNTING PROCEDRURE: Changes in accounting procedure by a firm often makes ratio analysis misleading e.g. Changes in the valuation of inventories. WINDOW DRESSING: Financial statements can easily be window dressed to present a better picture of its financial and profitability position to outsiders. Hence one has to be very careful from making a decisions from ratios calculated from such financial statements. PERSONAL BIAS: Ratios are only a means to financial analysis and not an end in itself. Ratios have to be interpreted and different people may interpret the same ratios in different ways. UNCOMPARABLE: Not only industries differ in their nature but also the firms of the similar business widely differ in their size and accounting procedures etc., It makes the comparison of ratios difficult and misleading. Moreover, comparisons are made difficult due to differences in definitions of various financial terms used in the ratio analysis. ABSOLUTE FIGURES DISTORTIVE: Ratios devoid of absolute figures may prove distractive as ratio analysis is primarily a quantitative analysis and not qualitative analysis.

- 23. 23 PRICE LEVEL CHANGES: While making ratio analysis, no consideration is made to the changes in price levels and this makes the interpretation of the ratios invalid. RATIOS NO SUBSTITUTE: Ratio analysis is merely a tool of financial statements. Hence, ratios become useless if separated from the statements from which they are computed. CURRENT RATIO Current ratio may be defined as the relationship between current assets and current liabilities. This ratio is also known as working capital ratio, is a measure of general liquidity and is most widely used to make the analysis of the short-term position or liquidity of a firm. It is calculated by dividing the total of current assets by total of the current liabilities. CURRENT RATIO = __CURRENT ASSETS__ CURRENT LIABILITIES Two basic components of this ratio are: current assets and current liabilities. Current assets include cash and those assets, which can be easily converted into cash within a short period of time generally, one year, such as marketable securities, bills receivable, sundry debtors etc. Current liabilities are those obligations which are payable within a short period of generally one year and include outstanding expenses, bills payable, sundry creditors, accrued expenses, dividend payable etc.

- 24. 24 SIGNIFICANCE AND LIMITATIONS OF CURRENT RATIO Current ratio is a general and a quick measure of liquidity of a firm. It represents the ‘margin of safety’ or ‘cushion’ available t the creditors and current liabilities. It is most widely used for making short-term analyses of the financial position or short-term solvency of the firm. But one has to be careful while using current ratio as a measure of liquidity because it suffers from the following limitations: CRUDE RATIO: It is the crude ratio because it measures only the quantity but not the quality if the current assets. WINDOW DRESSING: Valuation of current assets and window dressing is another problem of the current ratio. Current assets and liabilities are manipulated in such a way that current ratio loses its significance. IMPORTANT FACTORS FOR REACHING A CONCLUSION A number of factors should be taken into consideration before reaching a conclusion about short-term financial position. Sone of these factors is.

- 25. 25 I. TYPE OF BUSINESS II. TYPE OF PRODUCTS III. REPUTATION OF THE CONCERN IV. SEASONAL INFLUENCE V. TYPE OF ASSETS AVAILABLE PRACTILCAL CALCULATION OF CURRENT RATIO CURRENT RATIO = CURRENT ASSETS : CURRENT LIABILITIES TABLE YEAR 2004 2005 2006 CONTENTS ASSETS 4461.7 5102.5 11144.8 LIABILITIES 1967.3 2396.4 2995.4 CURRENT RATIO 2.267:1 2.111:1 3.720:1 WORKING NOTES-: CURRENT ASSETS= INVENTORIES+SAUNDRY DEBTORS+CASH AND BANK BALANCES

- 26. 26 2004 = 2153+2158.3+150.4 =4461.7 2005 = 2480.8+2353.9+177.8 = 5102.5 2006 = 3102.0+3483.9+4558.0 = 111444.8 CURRENT LIBILITIES 2004= 1967.3 2005 = 2396.4 2007 = 2995.4 GRAPH 4 3.702 3.5 3 2.5 2.267 2.111 2 CURRENT 1.5 RATIO 1 0.5 0 2004 2005 2006 INTERPRETATION OF CURRERENT RATIO In the year 2004 the current ratio of LUPIN LABORATORIES PVT (LTD) was satisfactory as the ratio was 2.26:1 which was more than the standard ratio 2:1 for the current ratio. This means that the firm

- 27. 27 was liquid and has the ability to pay its current obligations in time as and when they become due. In the year 2005 the current ratio of the company was 2.11:1, which was also satisfactory as was more than the standard ratio of 2:1. Thus the company at that time also was in the position to pay the current obligations as and when they become due. In the year 2006 the current ratio of the company was 3.72:1, which was, much more than the standard figure of the current ratio i.e. 2:1. This means that the firm was liquid but the cash and the bank balance was high which showed that the cash and the bank balance is lying idle due to many reasons. The current ratio in the year 2005 was less than the year 2004, which indicates that the liquidity of the company was reduced and that the liabilities were more than the paying capacity. The main reason of the reduction of the ratio was reduction in the bank balances. The current ratio in the year 2006 was more than the year 2005, which indicates that the liquidity of the company was increased and the capacity to pay the liabilities was more. The main reason of this was the increase in the bank balances, which increased drastically nearly 20% in the year 2006. WEIGHTED CURRENT RATIO (PART OF CURRENT RATIO)

- 28. 28 The two basic determinants pf current ratio as measure of liquidity are current assets and current liabilities. However all types of current assets are not equally liquid and all current liabilities are not repayable with the same degree of quickness. So the discrimination can be made among the different components of current assets and current liabilities, the former on the basis of relative quickness with which each individual item of current liabilities mature for payment. The discrimination can be expressed by assigning by assigning proper weight among each component of current assets and current liabilities. Weights to be assigned on each individual components of current assets and current liabilities, will depend upon the degree of their relative liquidity in case of current assets and relative urgency payments in case of current liabilities having due regard, however in each case the nature and types of business. For e.g. cash and bank balance being most liquid asset may be assigned a weightage of 100% followed by short-term securities 90% receivables 80% inventories 70%and so on. In the same manner, advances received from the customers, tax payable and proposed dividend may be assigned an weighted of 100% followed by trade creditors and accounts payable 90%, bank overdraft 80%. Formula of weighted current ratio:

- 29. 29 WEIGTED CURRENT RATIO= TOTAL PRODUCT OF CURRENT RATIO TOTAL PRODUCT OF CURRENT LIABILITY PRACTICAL CALCULATLION OF WEIGHTED CURRENT RATIO WIGHTED CURRENT RATIO=TOTAL PRODUCT OS CURRENT ASSETS : TOTAL PRODUCT OF CURRENT LIABILITIES TABLE YEAR 2004 2005 2006 CONTENTS PRODUCT OF 309684 354940 920686 CURRENT ASSETS PRODUCT OF 157384 189944 204752 CURRENT LIABILITIES WEIGHTED 1.96 1.86 4.49 CURRENT RATIO WORKING NOTES TOTAL PRODUCT OF CURRENT ASSETS=(AMOUNT OF A PERTICULAR CURRENT ASSET) X (PERCENTAGE WEIGHT)

- 30. 30 2004= CASH AND BANK BALANCES X 100% =150.4 X 100% = 15040 DEBTORS X 80% = 2158.3 X 80% = 172664 INVENTORIES X 60% = 2153.0 X 60% = 129180 TOTAL = 309684 SIMILARLY FOR YEARS 2005 AND 2006 AND ALSO CURRENT LIABILITIES TOTAL PRODUCT OF CURRENT LIABILITIES=(AMOUNT OF A PETICULAR CURRENT LIABILITY) X (PERCENTAGE WEIGHT) GRAPH 4.5 4.49 4 3.5 3 2.5 weighted current 2 1.96 ratio 1.86 1.5 1 0.5 0 2004 2005 2006 ANALYSIS OF THE WEIGHTED CURRENT RATIO The weighted current ratio is measured on the basis of the weightage given to the current assets and current liabilities so it is more reliable than the current ratio.

- 31. 31 In the year 2004 the weighted current ratio of Lupin Ltd. was 1.96:1 which indicates the satisfactory ratio and the liquidity of the company is more and that the company is at the capacity to pay the liabilities due as the current assets are more than the current liabilities. In the year 2005 the ratio was 1.86:1 which indicates that the company is in a good position as the current assets are more than the current liabilities and the company is in the position to pay all the current liabilities due to the company. In the year 2006 the ratio was 4.49:1 which was almost double than the standard ratio, which is 2:1. This is basically because of the increase in the bank balance and the cash in hand which increased almost 20 times to that of the 2005. But this is not a very good sign for the company as the cash in bank is so much that it is remaining idles after paying dues to the creditors and there are not many opportunities to invest that money. In the year 2005 the ratio was decreased as compared to the 2004 ratio basically because the more increase in the current liabilities less increase in the current assets (bank balance, inventories). In the year 2006 the ratio had increased drastically mainly due to the great increase in the bank balance in the current assets. QUICK OR ACID TEST OR LIQUID RATIO Quick Ratio, also known as acid test or Liquid Ratio is more rigorous test of liquidity than the current ratio. The term ‘liquidity’ refers t o the ability of a firm to pay its short-term obligations as and when they become due. The two determinants of current ratio, as a measure of liquidity are current assets and current liabilities. Current assets include inventories and prepaid expenses, which are not easily convertible into cash within a short period. Current assets include inventories and prepaid expenses, which are not easily

- 32. 32 convertible into cash within a short period. Quick ratio may be defined as the relationship between quick/liquid assets and current or liquid liabilities. An asset is said to be liquid if it can be converted into cash within a short period without loss of value. In that sense, cash in hand and cash art bank are most liquid assets. The other assets, which can be included in the liquid assets and sundry debtors, marketable securities and short-term or temporary investments. Inventories cannot be termed to be liquid asset because they cannot be converted into cash immediately without a sufficient loss of value. In the same manner, prepaid expense is also excluded from the list of quick/liquid assets because they are not expected to be converted into cash. The quick ratio can be calculated by dividing the total of the quick assets by total current liabilities. Thus: QUICK/LIQUID OR ACID TEST RATIO=QUICK OR LIQUID ASSETS QUICK/LIQUID LIABILITIES PRACTICAL CALCULATION OF THE LIQUID, ACID TEST OR QUICK RATIO QUICK/LIQUID OR ACID TEST RATIO = QUICK OR LIQUID ASSETS______ LIQUID/CURRENT LIABILITIES TABLE YEAR CONTENTS 2004 2005 2006 2308.7 2531.7 8041.9 LIQUID ASSETS LIQUID 1967.3 2374.3 2995.4 LIABILITIES 1.17:1 1.06:1 2.68:1 LIQUID RATIO

- 33. 33 WORKING NOTES LIQUID ASSETS=CURRENT ASSETS-INVENTORIES 2004 = 4461.7 – 2153.0 = 2308.7 2005 = 5102.5 – 2480.8 = 2531.7 2006 = 11144.8 – 3102.9 = 8041.9 CURRENT LIABILITIES = REFER FROM ABOVE CALCULATION GRAPH (REFERRING THE ABOVE TABLE) 3 2.68 2.5 2 1.5 LIQUID RATIO 1.17 1 1.06 0.5 0 2004 2005 2006 ANALYSIS OF QUICK, ACID TEST OR LIQUID RATIO In the year 2004 the current ratio was 1.17:1 which indicates the high liquidity of the company and good ratio for paying the liabilities for lupin laboratories. The ratio is good as there are funds left after paying the liabilities to put in some more new emerging opportunities.

- 34. 34 In the year 2005 the liquid ratio of Lupin was 1.06:1 which indicates the satisfactory liquidity position of the company because during the payment of the dues of the creditors there will be hardly any funds left to use in any other opportunity as the funds left will be reserved for the next years liability. In the year 2006 the ratio was 2.68:1 which was more than double if the satisfactory ratio i.e. the company is in an a high liquidity position. But such high ratio is also not good for the company as the funds are left idle as they are not fully in the further opportunities due to many reasons The ratio was decreased in the year 2005 mainly because of the high increase in the liquid liabilities and less increase in the liquid assets. The ratio was increased in the year 2006 mainly because of the very high increase in the cash and bank balance and less increase in the liquid liabilities. ABSOLUTE LIQUID RATIO OR CASH RATIO Although receivables, debtors and bills receivables are generally more liquid than inventories, yet there may be doubts regarding their realization into cash immediately or in time. Hence, some authorities are of the opinion that the absolute liquid ratio should also be calculated together with current ratio and acid test ratio so as to exclude even receivables from the current assets and find our the absolute liquid assets. Absolute liquid assets include cash in

- 35. 35 hand and at bank and marketable securities or temporary investments. The acceptable norm for this ratio is 50% or .5:1 or 1:2 i.e. Re. 1 worth absolute liquid assets are considered are considered adequate to pay Rs. 2 worth current liabilities in time as ass the creditors are not expected to demand cash at the same time and then cash may also be realized from debtors and inventories. Thus ABSOLUTE LIQUID RATIO=ABSOLUTE LIQUID ASSETS CURRENT LIABILITIES CASH RATIO= CASH AND BANK+SHORT-TERM SECURITIES CURRENT LIABILITIES PRACTICAL CALCULATION OF ABSOLUTE LIQUID RATIO OR CASH RATIO CASH RATIO = CASH & BANK+SHORT TERM SECURITIES CURRENT LIABILITIES TABLE YEAR 2004 2005 2006 CONTENTS CASH & BANK + 604.7 631.3 5070 SHORT TERM SECURETIES

- 36. 36 CURRENT 1967.3 2396.4 2995.4 LIABILITIES CASH RATIO 0.30 : 1 0.26 : 1 1.62 : 1 WORKING NOTES: CASH AND BANK + SHORT TERM SECURITIES 2004 = 150.4 + 454.3 = 604.7 2005 = 177.8 + 453.5 = 631.3 2006 = 4558 + 512 = 5070 CURRENT LIABILITIES= REFER FROM ABOVE CALCULATION GRAPH (REFERRING THE ABOVE TABLE) 1.8 1.6 1.62 1.4 1.2 1 0.8 CASH RATIO 0.6 0.4 0.3 0.26 0.2 0 2004 2005 2006 ANALYSIS OF THE CASH RATIO OR ABSOLUTE LIQUIDITY RATIO 1. The absolute liquid ratio in 2004 was .30:1 which is less than the accepted norm i.e. .5:1. the ratio less than the standard ratio denotes that the liabilities for LUPIN is more and that its liquid assets are less

- 37. 37 but all the creditors do not ask for the cash at the same time so the situation can be handled. 2. The absolute liquid ratio in 2005 was .26:1 which is very less than the accepted norm and thus the asset liquidity condition of LUPIN is not good and thus the creditors are more. 3. The absolute liquid ratio in 2006 is 1.62:1 which is very favorable for LUPIN but it is advisable that the company should try to collect funds from public more to use its ideal liquid assets on other big projects. 4. The absolute liquid ratio in 2006 is more favorable than 2004 and 2005 mainly because of the increase in the liquidity of the assets and decrease in the creditors for LUPIN. CURRENT ASSETS MOVEMENT OR EFFICIENCY/ACTIVITY RATIOS Funds are invested in various assets in business to make sales and earn profits. The efficiency with which asserts are managed directly affect the volume of sales. The better the management of assets, the larger is the amount of sales and the profits. Activity ratios measure the efficiency or effectiveness with which a firm manages its resources or assets. These ratios are also called turnover ratios because they indicate the speed rate at which the funds invested in inventories are converted into sale. Depending upon the purpose a number of turnover ratios can be calculated as debtors turnover capital turnover, etc. There are 4 types of current assets movement or efficiency ratios: I. INVENTORY OR STOCK TURNOVER RATIO. II. CREDITORS/PAYABLES TURNOVER RATIO. III. WORKING CAPITAL TURNOVER RATIO. IV. DEBTORS/RECEIVIBLES TURNOVER RATIO. EXPLAINATION

- 38. 38 CREDITORS/PAYABLES TURNOVER RATIO In the course of business operations, a firm has to make credit purchases and incur short-term liabilities. A supplier of goods i.e. creditor is naturally interested in finding out how much time the firm is likely to take in repaying its trade creditors. The analysis for creditor’s turnover is basically the same as of debtor’s turnover ratio except that in place of average daily sales, average daily purchases are taken as the other component of the ratio and in place of average daily sales; creditor’s turnover ratio can be calculated as: CREDITORS/PAYABLE TURNOVER RATIO=NET CREDIT ANNUAL PURCHASES AVERAGE TRADE CREDITORS If the information about the credit purchases is not available, the figure of total purchases may be taken as the numerator and the trade creditors include sundry creditors and bills payable. If opening and closing balances of the creditors are not known, the creditors are turned over in relation to purchase. Generally, higher the creditor’s velocity better it is or otherwise lower the creditor’s velocity less favorable are the results. PRACTICAL CALCULATLION ON CREDITORS/PAYABLES TURNOVER RATIO CREDITORS TURNOVER RATIO=NET CREDIT ANNUAL PURCHASES AVERAGE TRADE CREDITORS TABLE YEAR 2004 2005 2006 CONTENTS NET CREDIT 846.2 1192.2 1861

- 39. 39 ANNUAL PURCHASES AVERAGE TRADE 1479.75 2238.2 2714.5 CREDITORS CREDITORS 5.7times 5.3times 6.8times TURNOVER RATIO WORKING NOTES TRADE CREDITORS=SUNDRY CREDITORS+BILLS PAYABLE+A/C PAYABLE 2004 = 2036.2+248.5=22847 2005 = 184.2+417.2=601.4 2006 = 1447.1+647.8=2094.9 AVERAGE TRADE CREDITORS= OPENING TRADE CREDITORS+CLOSING TRADE CREDITORS 2 2004 = 674.8+284.7 /2 = 1479.75 2005 = 2284.7+601.4 / 2 = 2238.2 2006 = 601.4+2094.9 / 2 = 2714.5 NET CREDIT ANNUAL PURCHASES = REFER FROM EXCEL SHEET GRAPH (REFERRING THE ABOVE TABLE)

- 40. 40 7 6.8 6 5.7 5.3 5 4 CREDITORS TURNOVER 3 RATIO 2 1 0 2004 2005 2006 ANALYSIS OF CREDITORS/PAYABLE TURNOVER RATIOS The creditor’s turnover ratio in the year 2004 was 5.7 times which indicates that velocity with which the creditors are turned over in relation to purchases is in a satisfactory position. The creditors turnover ratio in the year 2005 was 5.3 times which indicate the velocity with which the creditors are turned over in relation to purchases is in a satisfactory position. Basically the ratio should be more than 5 times.

- 41. 41 The creditors turnover ratio in the year 2006 was 6.8 times which indicates that the velocity with which the creditors are turned over in relation to purchases is high which indicates a good sign for LUPIN. The creditor’s turnover ratio in the year 2004 was more that 2005 which indicates that the turn over of creditor’s rate had decreased which is not a good sign. This is mainly due to the increase in the net credit annual purchases. The creditor’s turnover ratio in the year 2006 had increased from 2005, which is a good sign for the liquidity position of LUPIN. This is mainly due to the increase in the net credit purchases. WORKING CAPITAL TURNOVER RATIO Working capital of a concern is directly related to sales, the current assets like debtors, bills receivables, cash, and stock, etc. change with the increase or decrease in sales. The working capital is taken as: WORKING CAPITAL = CURRENT ASSETS-CURRENT LIABILITIES Working capital turnover ratio indicates the velocity of the utilization of net working capital. This ratio indicates the number of times the working capital is turned over in the course of a year. The ratio measures the efficiency with

- 42. 42 which the working capital is being used by the firm. The higher ratio indicated the efficient utilization of the working capital and low ration indicated otherwise. But a very high working capital turnover ratio is not good situation for any firm and hence care must be taken while interpreting the ratio. Making of comparative and trend analysis can use the ratio for different firms in the same industry and for various periods. The ratio can be calculated as: Working capital turnover ratio = Cost of Sales_____ Average working capital Average working capital = Opening working capital + closing working capital 2 If the figure of the cost of sale is not given then the figure of sales can be used instead. On the other hand if opening working capital is not disclosed, then working capital at the year-end will be used, In that case the ratios will be: WORKING CAPITAL TURNOVER RATIO= _________SALES________ NET WORKING CAPITAL PRACTICAL CALCULATION ON WORKING CAPITAL TURNOVER RATIO WORKING CAPITAL TURNOVER RATIO= COST OF SALES AVERAGE WORKING CAPITAL

- 43. 43 TABLE YEAR 2004 2005 2006 CONTENTS COST OF SALES 11192.8 11611.3 16061 AVERAGE 2638.2 2627.15 5517.75 WORKING CAPITAL WORKING 2.91 times 4.41 times 4.20 times CAPITAL TURNOVER RATIO WORKING NOTES WORKING CAPITAL=CURRENT ASSETS-CURRENT LIABILITIES 2004 = 4461.7 - 1967.3 = 2494.4 2005 = 5102.5 - 2374.3 = 2728.2 2006 = 11144.8 - 2995.4 = 8149.4 AVERAGE WORKING CAPITAL= OPENING WOKING CAPITAL+CLOSING WORKING CAPITAL 2 2004 = 2242+2494.4 / 2 = 2638.2 2005 = 2494.4+2728.2 / 2 = 2627.15

- 44. 44 2006 = 2728.2+8149.4 / 2 = 5517.75 NET CREDIT ANNUAL SALES = REFER FROM THE EXCEL SHEET GRAPH 4.5 4.41 4.2 4 3.5 3 2.91 2.5 W.C 2 TURNOVER RATIO 1.5 1 0.5 0 2004 2005 2006 ANALYSIS OF WORKING CAPITAL TURNOVER RATIO The working capital turnover ratio in the year 2004 was 2.91 times, which is not a satisfactory ratio, and the company does not use which indicates that LUPIN is not in a good position and the working capital efficiently. The working capital turnover ratio in the year 2005 was 4.41 times which a satisfactory ratio for the company and which indicates that LUPIN is using efficiently the working capital and that the resources are efficiently being utilized.

- 45. 45 The working capital turnover ratio in the year 2006 was 4.20 times which indicates the satisfactory position of LUPIN and the working capital is being reutilized efficiently more and more times by the company. The working capital turnover ratio in the year 2004 was less than 2005 mainly because of the decrease in the cost of sales and the average working capital of LUPIN. The working capital turnover ratio in the year 2005 was more than the year 2006 mainly because of the increase in the working capital and the decrease in the cost of sales of the company. I. INVENTORY/STOCK TURNOVER RATIO Every firm has to maintain a certain level on inventory for finished goods so as to be able to meet the requirements of the business. But the level of inventory should neither to be too high or too low. But the level of inventory should neither be too high nor too low. It is harmful to hold more inventories for the following reasons. a) It unnecessarily blocks capital which can otherwise be profitability used somewhere else. b) Over stocking will require more godown space, so more rent will be paid.

- 46. 46 c) There are chances of obsolescence of stocks. Consumers will prefer goods of latest design, etc. d) Slow disposal of stocks means slow delivery of cash also which will adverselu affect liquidity. e) There are chances of deterioration in quality if the stock are held for more periods. Inventory turnover ratio also known as stock velocity is normally calculated as sales/average inventory. It would indicate whether inventory has been efficiently used or not. The purpose is to see whether only the required minimum funds have been locked up in inventory. Inventory turnover ratio (I.T.R.) indicates the number of times the stock has been turn over during the period and evaluates the efficiency with which a firm is able to manage the inventory. Inventory turnover ratio = _cost of goods sold______ Average inventory at cost PRACTICAL CALCUALTION ON INVENTORY/STOCK TURNOVER RATIO INVENTORY TURNOVER RATIO = NET SALES__ AVERAGE INVENTORY AT COST TABLE

- 47. 47 YEAR 2004 2005 2006 CONTENTS NET SALES 11192.8 11611.3 16061.0 AVERAGE 1785.8 2316.9 2791.85 INVENTORY AT COST INVENTORT 6.26 : 1 5.01 : 1 5.75 : 1 TURNOVER RATIO WORKING NOTES NET SALES = 2004 = 11192.8 2005 = 11611.3 2006= 16061.0 AVERAGE INVENTORY AT COST=OPENING STOCK+CLOSING STOCK 2 2004 = 1418.6+2153.0 = 1785.8 2 2005 = 2153.0+2480.8 = 2316.9 2 2006 = 2480.8+3102 = 2791.85 2 GRAPH (REFERRING THE ABOVE TABLE)

- 48. 48 7 6.26 6 5.75 5.01 5 4 Inventory 3 turnover ratio 2 1 0 2004 2005 2006 ANALYSIS OF THE INVENTORY/STOCK TURNOVER RATIO The inventory turnover ratio of the LUPIN in the year 2004 was 6.26:1, which is more than the standard ratio i.e. 5:1. The increased amount of ratio indicates that the sales are high but the stock is not sufficient in the company so as to meet the high demand which in turn decreases the market share. The inventory turnover ratio in the year 2005 was 5.01:1, which was very accurate, and up to the mark of the standard ratio. This ratio indicates that there was a perfect balance in LUPIN of the sales and there the market demands were timely fulfilled and there was no shortage of goods. The inventory turnover ratio in the year2006 was 5.75:1, which indicates that the sales of LUPIN were good but the stock of sales was some less than required.

- 49. 49 The inventory turnover ratio decreased from 2004 to 2005 from 6.26:1 to 5.01:1, which indicates that the net sales were less and that the balance was gained between the sales and the stock in LUPIN. The inventory turnover ratio was increased from 2005 to 2006 from 5.01:1 to 5.75:1, which indicates that the the sales of the product has increased but the balance of the stocks in LUPIN has decreased. DEBTORS OR RECEIVIBLES TURNOVER RATIO A concern may sell goods on cash as well credit. Credit is one of the most important elements of sales promotion. The volume of sales can be increased but following a liberal credit policy. But the effect of a liberal credit policy may result in tying up substantial funds of a firm in the form of trade debtors (or receivables i.e. debtors plus bills receivables). Trade debtors are expected

- 50. 50 to be converted into cash within a short period and are included in current assets. Hence the liquidity position of a concern to pay its short-term obligations in time depends upon the quality of its trade debtors. Debtor’s turnover ratio indicates the velocity of debt collection of firm. In simple words, it indicates the number of times average debtors (receivables) are turned over during a year, thus: DEBTORS(RECEIVIBLES)TURNOVER/VELOCITY=NET CREDIT ANNUAL SALE AVERAGE TRADE DEBTORS TRADE DEBTORS=SUNDRY DEBTORS+BILLS RECEIVIBLES AND ACCOUNTS RECEIVIBLES AVERAGE TRADE DEBTORS=OPENING TRADE DEBTORS+CLOSING TRADE DEBTOR 2 PRACTICAL CALCULATION ON DEBTORS/RECEIVIBLES TURNOVER RATIO DEBTORS/RECEIVIBLES TURNOVER RATIO= NET CREDIT ANNUAL SALES AVERAGE TRADE DEBTORS TABLE YEAR 2004 2005 2006 CONTENTS NET CREDIT 11192.8 12611.4 16954.0 ANNUAL SALES

- 51. 51 AVERAGE 6593 7564.8 9364.8 TRADE DEBTORS DEBTORS 1.69 1.66 1.81 TURNOVER RATIO WORKING NOTES TRADE DEBTORS = SUNDRY DEBTORS + BILLS REVEIVIBLES & A/C RECEIVIBLES 2004 = 2158.3 + 2036.2 = 4194.5 2005 = 2353.9 + 184.2 = 2538.1 2006 = 3483.9 + 1447.1 = 4931 AVERAGE TRADE DEBTORS = OPENING TRADE DEBTORS+CLOSING TRADE DEBTORS 2 2004 = 8991.5+4194.5 / 2 = 6593 2005 = 4194.5+2538.1 / 2 = 7564.8 2006 = 4931+2538.1/2= 9364.8 NET CREDIT ANNUAL SALES= REFER FROM EXCEL SHEET GRAPH REFERRING THE ABOVE TABLE

- 52. 52 1.85 1.81 1.8 1.75 1.7 debtor turnover 1.69 ratio 1.66 1.65 1.6 1.55 2004 2005 2006 ANALYSIS OF THE DEBTORS TURNOVER RATIO The ratios in the year 2004 indicate that the ratio turned over 1.69 times in a year which is satisfactory for LUPIN. The more times the ratio turnovers in a year the more efficient are it for the company. The ratio in the year 2005 indicates that the ratio turned over for 1.66 times in a year which is satisfactory for a company. The ratio in the year 2006 indicates that the ratio is turned over for 1.81 times in a year which is approximately equal to 2 times which is good for LUPIN which denotes that the management of the debtors is good as well as more liquid are the debtors. ANALYSIS OF LONG TERM FINANCIAL POSITION OR LONG TERM SOLVENCY

- 53. 53 The term solvency refers to the ability of a concern to meet its long-term obligations. The long-term in debt ness of a firm includes debentures holders, financial institutions providing medium and long-term loans and other creditors selling goods on installment bases. The long-term creditors of a firm are primarily interested in knowing the firms ability to pay regularly interested on long term borrowings, repayment of the principal amount at the maturity and the security of their loans. Accordingly, long-term solvency ratios indicate a firm’s ability to meet the fixed interest and costs and repayments schedules associated with its long-term borrowings. The following ratios serve the purpose of determining the solvency of the concern. DEBT-EQUITY RATIO. FUNDED DEBT TO TOTAL CAPIT ALISATION RATIO. PROPRIETORY RATIO OR EQUITY RATIO. SOLVENCY RATIO OR RATIO OF TOTAL LIABILITIES TO TOTAL ASSETS. FIXED ASSETS TO NET WORTH OR PROPRIETORS FUNDS RATIO. FIXED ASSETS TO LONG-TERM FUNDS OR FIXED ASSETS RATIO. RATIO OF CURRENT ASSETS TO PROPRIETOR’S FUNDS. DEBT SERVICE RATIO OR INTEREST COVERAGE RATIO. CASH TO DEBT SERVICE RATIO. (I) DEBT EQUITY RATIO

- 54. 54 Debt equity ratio is also known as External internal equity ratio is calculated to measure the relative claims of outsiders and the owners against the firm’s assets. These ratios indicates the relationship between the external equities or the outsider’s funds and the internal equities or the share holders funds, thus: DEBT-EQUITY RATIO = OUTSIDERS FUNDS SHARE HOLDERS FUNDS The two basic components of the ratio are outsider’s funds, i.e.., external equities and shareholders funds, i.e. internal equities. The outsiders funds include all debts/liabilities to outsiders, whether long-term or short term or whether in the form of debentures bonds, mortgage or bills. The shareholders funds consist of equity share capital, preference share capital, capital reserves, revenue for contingencies, sinking funds etc. the accumulated losses and differed expenses, if any, should be deducted from the total to find out shareholders funds. When the accumulated losses or differed expenses are deducted from the shareholders funds, it is called net worth and the ratio may be termed as the ratio ma be termed as debt to net worth ratio. (II) FUNDED DEBT TO TOTAL CAPITALISATION RATIO

- 55. 55 The ratio establishes a link between the long-term funds raised from ortsiders and total long-term funds available in the business. The two words used in this ratio are 1. Funded debt 2. Total capitalization Funded debt or total capitalization ratio = Funded debt_____ Total capitalization Funded debt is a part of total capitalization, which is financed by outsiders. Though there is no ‘rule of thumb’ but still the lesser the reliance on outsiders the better it will be. If this ratio is smaller, better it will be, up to 50% or 55% this ratio may be to tolerable and not beyond. PRACTICAL CALCULATION OF FUNDED DEBT TO TOTAL CAPITALISATION RATIO FUNDED DEBT OR TOTAL CAPITALISATION RATIO=FUNDED DEBT TOTAL CAPITALISATION FUNDED DEBT=DEBENTURE+MORTGAGE LOANS+BONDS+OTHER LONG TERM LOANS TOTAL CAPITALISATION=EQUITY SHARE CAPITAL+PREFERENCE SHARE CAPITAL+RESERVES AND SURPLUS+OTHER UNDISTRIBUTED RESERVES+DEBENTURES+FUNDED DEBT

- 56. 56 TABLE 2004 2005 2006 YEAR CONTENTS FUNDED DEBT 3777.3 4421 9128.5 TOTAL 11160.4 12720.1 19517 CAPITALISATION FUNDED DEBT .33 : 1 .34 : 1 .46 : 1 RATIO GRAPH (REFERRING THE TABLE OF FUNDED DEBT RATIO) 0.5 0.45 0.46 0.4 0.35 0.34 0.33 0.3 0.25 FUNDED DEBT 0.2 RATIO 0.15 0.1 0.05 0 2004 2005 2006

- 57. 57 ANALYSIS OF FUNDED DEBT TO TOTAL CAPITALISATION RATIO The ratios in the year 2004-.33:1, 2005-.34:1, 2006-.46:1 indicate that LUPIN has not much relied on the outsiders for taking long-term funds and tried to raise all the finance from its own working capital. The ratio has constantly increased from 2004 to 2006 mainly due to increase in the long-term borrowings from the outsiders but in a small amount.

- 58. 58 (III) PROPRIETORY RATIO OR EQUITY RATIO The variant to the debt-equity ratio is the proprietary, which is also known as Equity Ratio or shareholders to total equities ratio or net worth to total assets ratio. The ratio establishes the relationship between shareholders funds to total assets of the firm. The ratio of proprietor’s funds to total funds is an important ratio for determining long-term solvency of a firm. The components of this ratio are shareholders funds or proprietor’s funds and total assets. The shareholders funds are equity share capital, preference share capital, undistributed profits, reserves and surpluses. Ort of this amount, accumulated losses should be deducted. The total assets on t he other hand denote total resources of the concern. The ratio can be calculated as under: PROPRIETORY RATIO OR EQUITY RATIO=SHAREHOLDERS FUNDS TOTAL ASSETS PRACTICAL CALCULATION OF EQUITY OR PROPRIETORY RATIO EQUITY RATIO = SHAREHOLDERS FUNDS TOTAL ASSETS TABLE

- 59. 59 YEAR 2005 2006 2004 CONTENTS SHAREHOLDE 5005 4480.3 6439.5 RS FUNDS TOTAL ASSETS 11300 9805.5 17820.9 EQUITY .44:1 .46:1 .36:1 RATIO WORKING NOTES TOTAL ASSETS=CURRENT ASSETS+FIXED ASSETS 2004 = 4461.7 + 5343.8 = 6439.5 2005 = 5102.5 + 6287.5 = 5005 2006 = 11144.8 + 6676.1 = 4480.3 SHARE HOLDERS FUNDS=SHARE CAPITAL+RESERVE AND SURPLUS 2004 = 401.4+4078.9=4480.3 2005 = 401.4+4603.6 = 5005.0 2006 = 401.4+6038.1 = 6439.5 GRAPH

- 60. 60 (REFERRING THE EQUITY RATIO TABLE) 0.5 0.45 0.46 0.44 0.4 0.35 0.36 0.3 0.25 EQUITY RATIO 0.2 0.15 0.1 0.05 0 2004 2005 2006 ANALYSIS OF THE PROPRIETORY RATIO OR EQUITY RATIO The long-term financial position of LUPIN the company in the year 2004 was not so good but it gradually increased in the year 2005 due to the decrease of the total assets. The ratio in the year 2006 was more than the year 2005 because of the more decreasing in the assets. The more is the equity ratio the more is the liquidity position of the company.

- 61. 61 (IV) SOLVENCY RATIO OR THE RATIO OF TOTAL LIABILITIES TO TOTAL ASSETS This ratio is a small variant of equity ratio and can be simply calculated as 100-equity ratio i.e., continuing the example taken for the equity ratio, solvency ratio = 100-66.7% or say 33.33%. The ratio indicates the relationship between the total liabilities to outsiders to total assets of a firm and can be calculated as follows: SOLVENCY RATIO=TOTAL LIABILITIES TO OUTSIDERS TOTAL ASSETS Generally, lower the ratio of total liabilities to total assets, more satisfactory or stale is the long-term solvency position of a firm.

- 62. 62 PRACTICAL CALCULATION FOR SOLVENCY RATIO OR THE RATIO IF TOTAL LIABILITIES TOTOTAL ASSETS SOLVENCY RAITO= TOTAL LAIBILITIES TO OUTSIDERS / TOTAL ASSETS TABLE YEAR 2004 2005 2006 CONTENTS TOTAL 11404.8 6328 6275.5 LIABILITIES TO OUTSIDERS TOTOAL ASSETS 17820 11300 9805.5 SOLVENCY .54 .44 .42 RATIO GRAPH (REFERRING THE SOLVENCY RATIO TABLE)

- 63. 63 0.6 0.54 0.5 0.44 0.42 0.4 0.3 SOLVENCY RATIO 0.2 0.1 0 2004 2005 2006 ANALYSIS OF SOLVENCY RATIO OR THE RATIO OF TOTAL LIABILITIES TO TOTAL ASSETS The solvency ratio in the year 2004 was .54 which is not sufficient for LUPIN to for the long-term solvency position of the firm. The solvency ratio in the year 2005 was less than the year 2004 mainly due to the decrease in the assets. Thus the ratio .44 in the year 2005 is satisfactory. The solvency ratio in the year 2006 was less than 2005 which indicates the great financial position of LUPIN. (V) FIXED ASSETS TO NET WORTH RATIO OR FIXED ASSETS TO PROPRIETORS FUNDS

- 64. 64 The ratio establishes the relationship between fixed assets and shareholders funds, i.e., share capital plus reserves, surpluses and retained earnings. The ratio fcan be calculated as follows: FIXED ASSET TO NET WORTH RATIO=FIXED ASSETS SHAREHOLDERS FUNDS The ratio of the fixed assets to net worth indicates the extent to which shareholders funds are sunk into the fixed assets. Generally the purchase of fixed assets should be financed by shareholders equity including reserves, surpluses and retained earnings. PRACTICAL CALCULATIO ON FIXED ASSET TO NET WORTH RATIO FIXED ASSET TO NET WORTH RATIO=FIXED ASSET SHAREHOLDERS FUNDS TABLE YEAR 2004 2005 2006 CONTENTS FIXED ASSET 5343.8 6287.5 6676.1 SHAREHOLDERS 6439.5 5005 4480.3 FUNDS FIXED ASSET TO .82 1.25 1.49 NET WORTH RATIO GRAPH OF THE FIXED ASSET TO NET WORTH RATIO

- 65. 65 1.6 1.49 1.4 1.25 1.2 1 0.8 0.82 fixed assets to net worth ratio 0.6 0.4 0.2 0 2004 2005 2006 INTERPRETATION The ratio in the year 2004, 2005 and 2006 indicates that the net worth ratio of the company is good and that the company has sufficient fixed assets and that the share holders are less than the fixed assets in the organization. The ratio in 2004 is .82:1 indicates that the there are sufficient fixed assets with the company. The ratio in 2005 is 1.25:1 indicates that the company does not have the sufficient fixed assets and the company has to depend more on the public funds for sufficient working capital. The ratio in 2006 is 1.45:1 which is not at all satisfactory and thus the company has to depend totally on the shareholders for sufficient working capital.

- 66. 66 RATIO OF CURRENT ASSETS TO PROPRIETORY’S FUNDS The ratio is calculated by dividing the total of current assets by the amount of shareholders funds. RATIO OF CURRENT ASSETS TO PROPRIETORY’S FUNDS = CURRENT ASSETS SHAREHOLDERS FUNDS The ratio indicates the extent to which proprietor’s funds are invested in current assets. There is no ‘rule of thumb’ for this ratio and depending upon the nature of the business there may be different ratios for different firms. PRACTICAL CALCULATLION ON RATIO OF CURRENT ASSETS TO PROPRIETORY FUNDS RATIO OF CURRENT ASSETS TO PROPRIETORY’S FUNDS=CURRENT ASSET SHAREHOLDERS FUNDS TABLE YEAR 2004 2005 2006 CONTENTS CURRENT 4461.7 5102.5 11144.8 ASSETS SHAREHOLDERS 6439.5 5005 4480.3 FUNDS NET WORTH .69 : 1 1.01 : 1 2.48:1 RAITO

- 67. 67 GRAPH (REFERRING THE ABOVE TABLE OF CURRENT ASSETS TO PROPRIETORY FUNDS) 2.5 2.48 2 1.5 NET WORTH 1 1.01 RATIO 0.69 0.5 0 2004 2005 2006 INTERPRETATION The ratio in the year 2004 and 2005 is satisfactory as the main part of the proprietor’s funds are invested in the current asserts through which the production increases and thus the profit also increases. The ratio in 2006 indicates that the funds are invested in the current assets also but a large part of the assets are remaining idle and LUPIN has to use its own capital more as due to the less amount of public funds as compared to the current assets.

- 68. 68 (VII) DEBT SERVICE RATIO OR INTEREST COVERAGE RATIO Net income to debt service ratio or simple debt service ratio is used to test the debt servicing capacity of a firm. The ratio is also known as interest coverage ratio or coverage ratio or fixed charges cover or times interest earned. This ratio is calculated by dividing the net profit before interest and taxes by fixed interest charges: DEBT SERVICE RATIO/INTEREST COVERAGE= __NET PROFIT________ FIXED INTEREST CHARGES PRACTICAL CALCULATION OF DEBT SERVICE RATIO/INTEREST COVERAGE DEBT SERVICE RATIO/INTEREST COVERAGE= __NET PROFIT________ FIXED INTEREST CHARGES TABLE YEAR 2004 2005 2006 CONTENTS NET PEOFIT 1481.1 578.9 2299 FIXED 515.1 273.1 303 INTEREST CHARGES DEBT SERVICE 2.87 2.11 7.58 RATIO VALUES ARE FROM THE BALANCE SHEET

- 69. 69 GRAPH (REFERRING THE DEBT SERVICE TABLE) 8 7.58 7 6 5 4 DEBT SERVICE RATIO 3 2.67 2 2.11 1 0 2004 2005 2006 INTERPRETATION In the year 2004 and 2005 the ratio is satisfactory for the company as well as for the long-term creditors because even if the earnings of the firm’s earnings fall then also LUPIN will be in the position to pay the interest. In the year 2006 the ratio is not satisfactory for the company as well for the shareholders as it implies that LUPIN is not using debt as a source of finance so as to increase the earnings per share.

- 70. 70 ANALYSIS OF PROFITABILITY OR PROFITABILITY RATIOS The primary objective of the business undertaking is to earn profit. Profit earning is considered essential for the survival of the business. In the works of Lord Kenyes, “Profit is the engine that drives the business enterprise”. A business needs profits not only for its existence but also for expansion and diversification. The investors want an adequate return on their investments, workers want higher wages, creditors want higher security for their interest and loan and so on. A business enterprise can discharge its obligations to the various segments of the society only through earning of profits. Profits are thus a useful measure of overall efficiency of a business. Profits to the management are the test of efficiency and a measurement of control; to owners, a measure of worth of their investment to the creditors etc. Generally, the profitability ratios are calculated either in the relation of their sales or in relation to investment. The various profitability ratios are discussed. GENERAL PROFITABILITY RATIO 1. GROSS PROFIT RATIO 2. OPERATING RATIO 3. OPERATING PROFIT RATIO 4. EXPENSES RATIO 5. NET PROFIT RATIO OVERALL PROFITABLITY RATIOS 1. RETURN ON SHAREHOLDERS INVESTMENT OR NET WORTH RATIO 2. RETURN ON EQUITY CAPITAL RATIO 3. EARNING PER SHARE RATIO 4. RETURN ON CAPITAL EMPLOYED RATIO 5. CAPITAL TURNOVER RATIO 6. DIVIDEND YIELD RATIO 7. DIVIDEND PAYOUT RATIO 8. PRICE EARNING RATIO

- 71. 71 GROSS PROFIT RATIO Gross profit ratio measures the relationship of gross profit to net sales and is usually represented as percentage. Thus it is calculated by dividing the gross profit by sales GROSS PROFIT RATIO =GROSS PROFIT X 100 NET SALES PRACTICAL CALCULATION ON GROSS PROFIT RATIO GROSS PROFIT RATIO =GROSS PROFIT X 100 NET SALES GROSS PROFIT= SALES – COST OF GOODS SOLD NET SALES=SALES – EXISE DUTY TABLE 2004 2005 2006 YEAR CONTENTS 1996.2 852 2302 GROSS PROFIT NET SALES 11192.8 11611.3 16061 GROSS PROFIT 17.83% 7.33% 14.33% RATIO(%)

- 72. 72 GRAPH (REFERRING THEGROSS PROFIT TABLE) 18 17.83 16 14 14.33 12 10 GROSS 8 PROFIT 7.33 RATIO(% ) 6 4 2 0 2004 2005 2006 INTERPRETATION The ratio in 2004 and 2006 are satisfactory as the company is in the position to sell its product at a low price without resulting in losses on operations of a firm. But the ratio in 2005 is not at all satisfactory for LUPIN and a low ratio indicates that the high cost of goods sold due to unfavorable purchasing policies, lesser sales, lower selling prices, excessive competition, over-investment in plant and machinery, etc. OPERATING RATIO

- 73. 73 Operating ratio establishes the relationship between cost of goods sold and other operating expenses on the one hand and the sales on the other. In other words, it measures the cost of the operating per rupee of sales. The ratio is calculated by dividing operating costs with the net sales and its generally represented as a percentage. OPERATING RATIO= OPERATING COST X 100 NET SALES The two basic elements of this ratio are operating cost and net sales. Operating cost can be founded by adding operating expenses to the cost of goods. PRACTICAL CALCULATION ON OPERATING RATIO OPERATING RATIO= OPERATING COST X 100 NET SALES OPERATING COST= OPERATING EXPENSES+COST OF GOODS SOLD NET SALES=GROSS SALES-EXISE DUTY TABLE YEAR 2004 2005 2006 CONTENTS OPERATING 10196.4 10522.6 14263.1 COST NET SALES 11648.3 11799 16061.0 OPERATING 87.53% 89.18% 88.80%

- 74. 74 RATIO(%) GRAPH (PREFERRING THE TABLE OF OPERATING RATIO) 89.5 89.18 89 88.8 88.5 88 OPERATING RATIO (% ) 87.5 87.53 87 86.5 2004 2005 2006 INTERPRETATION The ratios in 2004, 2005 and 2006 are satisfactory as the favorable rations are considered between 80 to 90%. This shows that the operating efficiency of LUPIN in these three years is good and that it has the margin to cover the interest, income tax, dividend and reserves. The ratio in 2004 is the most favorable operating ratio in all the three years.

- 75. 75 OPERATING PROFIT RATIO This ratio is calculated by dividing the operating profit by sales. Operating profit is calculated as: OPERATING PROFIT=NET SALES-OPERATING COST OPERATING PROFIT RATIO=OPERATING PROFIT X 100 NET SALES PRACTICAL CALCULATION ON OPERATING PROFIT RATIO OPERATING PROFIT RATIO=OPERATING PROFIT X 100 NET SALES TABLE YEAR 2004 2005 2006 CONTENTS OPERATING 987.1 843.6 1827.2 PROFIT SALES 11192.8 11611.3 16061.0

- 76. 76 OPERATING 8.81% 7.26% 11.37% PROFIT RATIO(%) GRAPH (REFERRING TO THE TABLE OF OPERATING RATIO) 12 11.37 10 8.81 8 7.26 OPERATING 6 PROFIT RATIO (% ) 4 2 0 2004 2005 2006 INTERPRETATION The operating profit ratio is considered as a yardstick for measuring profits. The more the ratio the more favorable it is for LUPIN. In the year 2004 and 2005 the ratios are satisfactory but in 2006 the ratio is good and indicates that LUPIN is in a profitable position and can face adverse economic conditions.