Illinois Complaint Against Financial Advisor Charged With Falsely Advertising Like He Acted As A Fiduciary

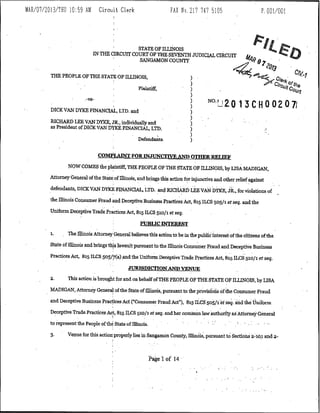

- 1. MAR/07/2013/THU 10:59 AM Circuit Clerk FAX No. 217 747 5105 P. 00 l/00 I STATE OF ILUNOIS IN THE CIRcmT COURT OF UlE SEVENTH JUDICIAL CIRCUIT SANGAMON.COUNTY THE PEOPLE OF THE STATE OF ILLINOlS, ) ) Plaintiff, ) ) tJ 2. 0 13 c. H0 0 2 0 71 .-vs- ) I ) NO. DICK VAN DYKE FINANCIAL, LTD. and ) ) RlCHARD LEE VAN DYKE, JR, individually and ). as President of DICK VAN DYKE FINANCIAL, LTD. ) ) Defend~ts- ) COMPLAINT FORINJUNCfiVE.AND OTHER RELIEF NOW COMES the pl~tiff, THE PEOPLE OF THE S'l'ATE OF ILUNOIS, by LISA MADIGAN, Attorney General of the State of illinois, and bx:ings this action for injunct:i.'9'e and other relief against defendants, DICK vAN om FINAN~ LTD. ~d ru~ LEE VAN nYn:, .rlt, for vi~lations of . . the illinois Consumer Fraud and Deceptive Business Practices Act, 815 ILCS 505/1 et seq. and the Uniform Deceptive Trade Practices Act, 815 ILCS 510/1 et seq. PUBLIC INTEREST 1. The Illinois Attorney: General believes this action to be in the public interest· of the citizens of the State of Ulinois and brings this lawsuit pursuant to the illinois Consumer Fraud and DeceptiVe Business I . . . Practices Act, 815 ILCS 505/j(a) ,and the Dnifonn Deceptive Trade Practices Act, 815 ILCS 510/1 et seq. JURISDICTION AND VENUE 2. This action is brought for and on behalf ofTaE PEOPLE OF THE STATE OF ILUNOIS, by USA MADIGAN, Attorney Genera1 of the State of illinois, pursuant to the proviSions of the Consumer Fraud I • and Deceptive :Susiness Prac~ces Act ("Consumer Fraud Act"), 815 :rr:.c.s·sos/dJtseq. ab.dth~ Uniform Deceptive Trade Pl'actices Act, 8~5 IJ,.CS 510/1 et seq. and her common law authority asAti:orneyCeneral . ! to represent the People of th~ State of Illinois. .. ·' .. : :. 3. Venue for this action; properly lies in Sangamon County, Illin6~; ptirsuant to S~ctiona 2~io.1 and 2- Page 1 of 14 ·

- 2. .. 102 of the Illinois Code of Civil Procedure, 735 ILCS 5/2-101 and 2-102, in that Sangamon County is the Defendants' county of residence. PARTIES 4· Plaintiff, THE PEOPLE OF THE STATE OF ILLINOIS, by LISA MADIGAN, the Attorn~y General of the State of Illinois, is authorized to enforce the Consumer Fraud Act and the Uniform Deceptive Trade Practices Act. 5. Defendant, Dick Van Dyke Financial Ltd., is an Illinois corporation with its principal place of business at 1028 S. Walnut Street, Springfield, IL. 62704. 6. For purposes of this Complaint for Injunctive and Other Relief, any references to the acts and practices of Dick Van Dyke Financial, Ltd. shall mean that such acts and practices are by and through the acts of Dick Van Dyke Financial, Ltd.'s officers, owners, members, directors, employees, salespersons, representatives and/or other agents. 7· The defendant, Richard Lee Van Dyke, Jr., is sued individually and in his capacity as President of Dick Van Dyke Financial, Ltd. 8. The defendant, Richard Lee Van Dyke, Jr. formulated, directed, controlled and had knowledge of the acts and practices of the defendant, Dick Van Dyke Financial, Ltd. and, at all times relevant hereto, was President of defendant Dick Van Dyke Financial, Ltd. g. To adhere to the fiction of separate corporate existence between the defendant, Richard Lee Van Dyke, Jr. and Dick Van Dyke Financial, Ltd. would serve to sanction fraud and promote injustice. TRADE AND COMMERCE 10. Subsection 1(f) ofthe Consumer Fraud Act, 815 ILCS 505/l(f), defines "trade" and "commerce" as follows: The terms 'trade' and 'commerce' mean the advertising, offering for sale, · sale, or distribution of any services and any property, tangible or intangible, real, personal, or mixed, and any other article, commodity, or thing of value wherever situated, and shall include any trade or commerce directly or indirectly affecting the people of this State. 11. The Defendants, Dick Van Dyke Financial, Ltd. and Richard Lee Van Dyke, Jr. were at all times relevant hereto engaged in trade and commerce in the State of Illinois by advertising, Page 2 of 14

- 3. .. offering for sale, selling and accepting money for insurance products. SUMMARY Defendant Dick Van Dyke engages in a pattern of conduct whereby he gains the trust of senior citizens by holding himself out as an objective, knowledgeable and unbiased financial services expert for consumers facing retirement, when in fact his undisclosed agenda is to sell deferred annuities as a one-size-fits-all financial solution for senior citizens. Through at least July 31, 2012, Defendants' website www.dickvandykefinancial.com employed multiple marketing strategies and statements to portray Defendant Dick Van Dyke as a financial services provider with specialized expertise in advising elderly consumers facing retirement in a full range of financial, legal, and tax, and related matters. For example, the Mission Statement on Defendants' website states: "Our Mission: Assist our clients in achieving their goals and objectives by integrating all aspects of their financial well being; including estate, investment, insurance, legal, and tax strategies. We assist them in gaining clarity amidst a world of increasing complexity. We serve as our client's Financial Quarterback by assisting them with a successful team approach." Despite representations of providing a full range of financial and other services, since January 2012, Defendants Dick Van Dyke Financial, Ltd. and bick Van Dyke have been licensed only as an insurance agency and producer respectively. DEFENDANTS' UNFAIR AND DECEPTIVE BUSINESS PRACTICES 12. Defendants solicit consumers through two websites, www.dickvandykefinanical.com and www.annuitvratesinstantly.com. 13. Defendant Dick Van Dyke failed to renew his registration as an investment advisor for securities effective December 31, 2011, purportedly to avoid conflicts of interest and the burden of increasing regulatory requirements imposed on the securities industry by the new Dodd-Frank legislation. According to his website, www.dickvandykefinanical.com, this decision allowed him to focus on the relevant financial service needs of his clients. 14. Since July 2005 to the present, Dick Van Dyke has held an Illinois insur~nce producer license, as well as individual non-resident insurance agent licenses in other states. Page 3 of 14

- 4. ., 15. Since November 2005 to the present, Dick Van Dyke Financial, Ltd. has held an Illinois Insurance Agency License. 16. Upon information and belief, there are only two employees of Dick Van Dyke Financial, Ltd., Defendant Dick Van Dyke and his wife, Alma Van Dyke, who serves as office manager. 17. - Between the time period of January 2012 through at least July 31,2012, a virtual spokesman appeared when visitors first visit www.dickvandykefinanical.com. During the relevant time period, the virtual spokesman stated as follows: "If you want a successful financial plan these days, you need a financial advisor you can really trust. You need to know as much as you can about that person's credentials, background, and certification. So on this site, you'll find third party reports about Dick Van Dyke such as the Better Business Bureau, Society of Certified Senior Advisors and the National Ethics Bureau's extensive 7 year background check. Make sure you check out the validation documents, disclosures, and references which is near the middle of this page. He believes in' principles like full disclosure and transparency and he doesn't sell investments on commission which means he's on your side so you get to reach your goals first before he does. When's the last time ~n investment advisor put you first?" 18. The claim that Defendant Dick Van Dyke does not sell investments on commission is deceptive because the vast majority of his business is the sale of deferred annuities that are sold on commission. 19. Over 90% of defendants' business involve commission based annuity sales, which includes sales of replacement annuities. 20. The representation by the virtual spokesman that Defendant Dick Van Dyke is an investment advisor is deceptive because during the relevant time period of January 2012 to at least Jule 31, 20I2, Dick Van Dyke was not a registered investment advisor as required by the Illinois Securities Act. 21. The certification by the Society of Certified Senior Advisors referenced by the virtual . spokesperson is a purported credential intended to convey expertise in senior financial matters. Page 4 of 14

- 5. ·. 22. Defendants' inclusion of this purported credential is deceptive because this designation does not qualify a person to provide investment advice under Illinois law (14 Ill. Admin. Code, Part 130 (Use of Senior Certifications and Professional Designations). 23. In fact, the Certified Senior Advisor designation is obtained by paying a fee to take either a three and a half day live course, or a home study course, followed by a multiple choice examination. Part of the study includes marketing to seniors. This purported credential is obtained primarily for marketing purposes to earn the trust and confidence of seniors. . . 24_. The certification by the National Ethics Bureau referenced by the virtual spokesperson is a purported credential intended to promote trust and gain confidence. 25. Defendants' inclusion of this purported credential is deceptive because National Ethics Bureau is a Colorado based for-profit organization with sponsors, many of which appear to be in · the annuity and insurance industry. Once again, this purported credential was developed primarily for marketing purposes. No education or exam is required, and there are no continuing education requirements. 26. Another purported credential displayed on the Defendants' website under validation do~uments, is that of Certified Annuity Advisor. 27. Defendants' inclusion of this purported credential is deceptive because the issuing entity is no longer in existence, and the original certification did not require any continuing education or provide a complaint process once an individual was certified. Once again, this purported credential was a marketing tool for gaining trust and confidence of older consumers. 28. Defendant Dick Van Dyke also displays an "ARI Code of Ethics and Requirements" on the website www.dickvandykefinancial.com under validation documents. "ARI" stands for Annuity Rates Instantly, the name of another website that Defendant Dick Van Dyke purportedly owns, created, and operates. 29. Defendants' inclusion of the purported credential, ARI Code of Ethics and Requirements, is deceptive because no education or exam is required, no complaint process is in place, and it is a self-conferred credential. This document was created by Defendant Dick Van Dyke to gain the Page 5 of 14

- 6. .. trust and confidence of older consumers. 30. Defendant Dick Van Dyke states in the disclosure section of his website that he "earns commissions as mandated by state law on insurance products." This is deceptive because there is · considerable flexibility under the Illinois Insurance Code as to how producers are paid. Some use salary type arrangements, particularly where the producer is just starting out. 31. Defendants' website section "Our Firm" contains a section titled "Meet Our Financial Team." 32. Here, Defendant Dick Van Dyke makes the unsubstantiated claim that he conducts workshops for individuals and other advisors on the internet or in a classroom setting, available by invitation. 33. Defendant Dick Van Dyke makes an additional claim as follows: "Recognized as an advisor on retirement issues, Dick, utilizing his business and financial experience, assists retirees with their concerns in retirement by helping them preserve assets with growth and an increasing income, while avoiding unnecessary estate and income tax issues." This is deceptive because, despite representations of providing a full range of financial services, since January 2012, Defendant Dick Van Dyke has been licensed only as an insurance producer. 34. In the relevant tiine period, under the section "Meet Our Financial Team," Defendants' website identifies Matt Neuman as Marketing Vice President. This is deceptive because Matt Neuman is not and has never been employed by Defendants. In fact, Matt Neuman is Vice President of Marketing at Advisors Excel, LLC an insurance field marketing organization located in Topeka, Kansas. 35. On Advisors Excel, LLC's website, www.advisorsexcel.com, Mr. Neuman is described as one of the most successful annuity marketers in the country who has been an integral part of developing Advisors Excel into a $2 billion firm ip.just 5 years. In truth and in fact, Mr. Neuman and his organization provide the Defendants with tools and strategies to "keep improving numbers and profits" from the sale of annuities. Moreover, according to its website, Advisors Excel operates exclusively on a commission basis from producers like Mr. Van Dyke, who have Page 6 of 14

- 7. agreements with Advisors Excel. 36. In the relevant time period, under the section "Meet Our Financial Team," Defendants' website identifies Melinda Graham as Sales Coordinator. This is deceptive because Melinda Graham is not now and has never been employed by Defendants. In fact, Ms. Graham is Sales Coordinator at Advisors Excel, LLC, an insurance field marketing organization located in Topeka, Kansas. 37· On Advisors Excel, ~LC's website, www.advisorsexcel.com, Ms. Graham is described as a sales coordinator who partners with Matt Neuman to bring a high service level and deepen the relationships with the producers they work with on a daily basis. 38. Defendants' website during the relevant time period identifies office locations as a main branch at 1028 South Walnut, Springfield, IL, and other branch locations at 700 Commerce Drive, Suite 500, Oak Brook, IL (Chicago Branch) and· at 111 West Port Plaza, 6th Fl., St. Louis, MO 63146 (St. Louis Branch). This is deceptive because Defendant did not maintain branch offices in St. Louis, MOor Chicago, IL as represented. The St. Louis and Chicago addresses were merely locations where space could be rented oh an as needed basis. 39. On Defendants' website, consumers are offered a complimentary social security consult~tion. The consultation involves obtaining detailed information about consumers; income and assets, purportedly for retirement planning purposes. Defendant Dick Van Dyke fails to disclose to seniors that the true purpose of this consultation is to qualify the consumers as a prospect for selling insurance products, particularly deferred annuities. 40. The social security website, www.socialsecurity.gov provides information, calculators, and links to websites that provide essentially the same information that Defendant Dick Van Dyke offers in his free social security consultations. 41. The representations cited above, on which Defendants intend consumers will rely, as well as others on Defendants' website, lead consumers to believe Defendant Dick Van Dyke is an objective, knowledgeable and unbiased financial services expert for consumers facing retirement, when in fact he is an insurance salesman. Page 7 of 14

- 8. 42. Beginning in 2006, Defendant Richard Lee Van Dyke, Jr. also solicited consumers 55 and older through events described as educational seminars offering a free meal or refreshments held at local hotels, restaurants, and other venues 43. As a result of attendance at such events, some consumers purchased deferred indexed annuities, including replacement annuities, from Defendants. 44. An invitation to such an event held in 2009 is attached hereto as Exhibit A. Among other things, the invitation, titled Stealth Tax Bill Hits Millions of Unsuspecting Retirees, states: This Seminar Is: NOT a sales seminar ·NOT an annuity presentation NOT a Free meal come-on to get you to buy something 45· · These statements are deceptive, because the true purpose of the event was to schedule and make individual sales presentations for deferred indexed annuities to attendees. COUNT I-CONSUMER FRAUD AND DECEPTIVE BUSINESS PRACTICES ACT APPLICABLE STATUTE 46. Section 2 of the Consumer Fraud and Deceptive Business Practices Act, 815 ILCS 505/2, provides: Unfair methods of competition and unfair or deceptive acts or practices, . including but not limited to the use or employment of any deception, fraud, false pretense, false promise, misrepresentation or the concealment, suppression or omission of any material fact, with intent that others rely upon the concealment, suppression or omission of such material fact, or the use or employment of any practice described in Section 2 of the 'Uniform Deceptive Trade Practices Act', approved August 5, 1965, in the conduct of any trade or commerce are hereby declared unlawful whether any person has in fact been misled, deceived or damaged thereby. VIOLATIONS Page 8 of 14

- 9. CONSUMJE~ lFJRAUD AND ])JECJElPTJME BUSJINJESS lP'lRAC'f][CJES ACT 47·. The People re-allege and incorporate by reference the allegations in Paragraphs 1 to 45. 48. While engaged in trade or commerce, the Defendants have committed unfair and deceptive acts or practices declared unlawful under Section 2 of the Consumer Fraud Act, 815 ILCS 505/2, by: A. representing, expressly or by implication, after January 1, 2012, that Defendants do not sell investments on commission, when in fact the vast majority of the investment products sold by Defendants are sold on commission; B. representing, expressly or by implication, that Defendant Dick Van Dyke is a registered investment advisor, when in fact he was not registered as such during the time period relevant to this complaint; C. representing, expressly or by implication, that the Certified Senior Advisor credential qualifies Defendant Dick Van Dyke to provide investment advice to seniors, when in fact it does not and instead is primarily a marketing tool; D. representing, expressly or by implication, that the National Ethics Bureau credential qualifies Defendant Dick Van Dyke as a professional seniors can trust, when in fact it is primarily a marketing tool created by the insurance industry; E. representing, expressly or by implication, that the Certified Annuity Advisor credential qualifies Defendant Dick Van Dyke to provide investment advice about annuities to seniors, when in fact it does not and the issuing entity is no longer in existence; F. representing, expressly or by implication, that the "ARI Code of Ethics and. Requirements" credential qualifies Defendant Dick Van Dyke as a professional seniors can trust, when in fact it is primarily a marketing tool created by the Defendant Dick Van Dyke himself; G. representing, expressly or by implication, that Defendant Dick Van Dyke conducts workshops for individuals and other advisors on the internet or in a classroom setting, without any basis for such representation; Page 9 of 14

- 10. H. representing , expressly or by implication, that state law mandates that Defendant Dick Van Dyke be paid commissions for selling insurance products, when in fact such is not the case; I. representing, expressly or by implication, after January 1, 2012, that . Defendant Dick Van Dyke provides a full range of investment, tax and estate assistance to seniors, when in fact Defendant Dick Van Dyke was only licensed to sell insurance products in the time period relevant to this complaint; J. representing, expressly or by implication, that Matt Neuman is Vice President of Marketing for Defendant Dick Van Dyke Financial, when in fact Matt Neuman is not now and has never been employed by Defendants. K. repres~nting , expressly or by implication, that Melinda Graham is Sales Coordinator for Defendant Dick Van Dyke Financial, when in fact Melinda Graham is not now and has never been employed by Defendants; and L. failing to disclose clearly aild conspicuously to consumers the materi~l fact that the purpose ofthe offer for a free social security consultation is to qualify the consumer as a prospect to sell insurance products. M. failing to disclose clearly and conspicuously to consumers the material fact that attendance at an educational seminar may result in a sales presentation for annuities and other insurance products. REMEDIES 49. Section 7 of the Consumer Fraud and Deceptive Business Practices Act, 815 ILCS 505/7, provides: (a) Whenever the Attorney General has reason to believe that any person is using, has used, or is about to use any method, act or practice declared by the Act to be unlawful, and that proceedings would be in the public interest, he may bring an action in the name of the State against such person to restrain by preliminary or permanent injunction the use of such method, act or practice. The Court, in its discretion, may exercise all powers necessary, including but not limited to: injunction, revocation, Page 10 of 14

- 11. forfeiture or suspension of any license, charter, franchise, certificate or other evidence of authority of any person to do business ·in this State; appointment of a receiver; dissolution of domestic corporations or association suspension or termination of the right of foreign corporations or associations to do business in this State; and restitution. (b) In addition to the remedies provided herein, the Attorney General may request and this Court may impose a civil penalty in a sum not to exceed $so,ooo against any person found by the Court to have engaged in any method, act or practice declared unlawful under this Act. In the event the court finds the method, act or practice to have been entered into with intent to defraud, the court has the authority to impose a civil penalty in a sum not to exceed $so,ooo per violation. (c) In addition to any other civil penalty provided in this Section, if a person is found by the court to have engaged in any method, act, or practice declared unlawful under this Act, and the violation was committed against a person 65 years of age or older, the court may impose an additional civil penalty not to exceed $10,000 for each violation. so. Section 10 of the Consumer Fraud Act, 815 ILCS 505/10, provides that "in any action brought under the provisions of this Act, the Attorney General is entitled to recover costs for the use of this State." PRAYER FOR RELIEF-COUNT I WHEREFORE, the plaintiff prays that this honorable Court enter an Order: A. Finding that the defendant has violated Section 2 of the Consumer Fraud and Deceptive Business Practices Act, 815 ILCS 505/2, by but not limited to, the unlawful acts and practices alleged herein; B. Preliminarily and permanently enjoining the defendant from'engaging in the deceptive and unfair practices alleged herein; C. Disgorging from the defendants all commissions earned from replacement annuity sales; D. Assessing a civil penalty in the amount of Fifty Thousand Dollars ($so,ooo) if the Court Page 11 of 14

- 12. finds the Defendant has engaged in methods, acts, or practices declared unlawful by the Act without the . intent to defraud, if the Court finds Defendant has engaged in methods, acts or practices declared unlawful by the Act with the intent to defraud, then assessing a statutory civil penalty of $50,000, all as provided in Section 7 of the Coi_lsumer Fraud Act, 815 ILCS 505/7; E. Assessing an additional civil penalty in the amount ofTen Thousand Dollars ($10,000) per violation of the Consumer Fraud Act found by the Court to have been committed by the Defendant against a person 65 years of age and older as provided in Section 7(c) of the Consumer Fraud Act, 815 ILCS 505/?(c); F. Requiring the defendant to pay all costs for the prosecution and investigation of this action, as provided by Section 10 of the Consumer Fraud Act, 815 ILCS 505/10; and · G. Providing such other and further equitable relief as justice and equity may require. COUNT II- UNIFORM DECEPTIVE TRADE PRACTICES ACT 51. Plaintiff re-alleges the allegations contained in paragraphs 1 through 45 above. APPLICABLE STATUTE 52. Section 2 of the Deceptive Trade Practices Act provides in relevant part: . (a) . A person engages in a deceptive trade practice when, in the course of his or her business, vocation, or occupation, the person: *** (5) represents that goods or services have sponsorship, approval . ·.. that they do not have or that a person has a sponsorship, approval, status, affiliation, or connection that he or she does not have; (b) In order to prevail in an action under this Act, a plaintiff need not prove competition between the parties or actual confusion or misunderstanding. VIOJLATIONS 53. Defendants, in connection With the advertising, offering for sale, and selling of financial services, have represented that their financial services have a status or affiliation which they do not have violation of section 2(a)(5 ) of the Deceptive Trade Practices Act by representing, expressly or by · Page 12 of 14

- 13. implication: a. that Defendant Dick Van Dyke is a registered investment advisor, when in fact such is not the case; and b. that Defendant Dick Van Dyke is an objective, knowledgeable and unbiased financial services expert for consumers facing retirement, when in fact Defendant is simply an insurance salesman whose primary business is to sell deferred annuities as a one-size-fits-all financial solution for senior citizens. REMEDIES 54· Section 2 of the Deceptive Trade Practices Act is recognized as a prohibited practice to be treated similarly to prohibited practices under section 2 of the Consumer Fraud Act: Unfair methods of competition and unfair or deceptive acts or practices ... or the use or employment of any practice described in section 2 of the 'Uniform Deceptive Trade Practices Act,' [815 ILCS 510/2 et seq... .in the conduct of any trade or commerce are Hereby declared unlawful whether any person has in fact been misled, deceived or damaged thereby ... Sis ILCS 505/2. 55· Since section 2 of the Deceptive Trade Practices Act is treated the same as a violation of section 2 of the Consumer Fraud Act, the rights and remedies available to the Attorney General under the Consumer Fraud Act, are similarly available to the court to remedyviolations of the Uniform Trade Practices Act. PlRAYER FOR RELIEF-COUNT II 56. WHEREFORE, the plaintiff prays that this honorable Court enter an Order: A. Finding that the defendants have violated sections 2(a)(5) of the Deceptive Trade Practices Act, as described herein; B. Enjoining the defendants from engaging in the business of advertising, offering for sale, selling and accepting money for insurance products, in violation of the Deceptive Trade Practices Act; C. Disgorging from the defendants all commissions earned from replacement annuity sales; Page 13 of 14

- 14. .. D. Assessing a civil penalty in the amount of Fifty Thousand Dollars ($50,000) per violation · of the Deceptive Trade Practices Act found by the Court to have been committed by the defendants with the intent to defraud; if the Court finds the defendants have engaged in methods, acts or practices declared unlawful by the Act, without the intent to defraud, then assessing a statutory civil penalty of Fifty Thousand Dollars ($50,000), all as provided in section 7 ofthe Consumer Fraud and Deceptive Business Practices Act (815 ILCS 505/7); E. Assessing an additional civil penalty in the amount of Ten Thousand Dollars ($10,000) per violation of the Deceptive Trade Practices Act found by the Court to have been committed by the defendants against a person 65 years of age and older as provided in section 7(c) of the Consumer Fraud and Deceptive Business Practices Act, 815 ILCS 505/?(c); F. Requiring the defendants to pay all costs for the prosecution and investigation of this action, as provided by section 10 of the Consumer Fraud and Deceptive Business Practices Act ( 815 ILCS 505/10); and E. Providing such other and further equitable relief as justice and equity may require. Respectfully submitted, THE PEOPLE OF THE STATE OF ILLINOIS, by LISA MADIGAN, ATTORNEY GENERAL OF ILLINOIS c tlv~ ~kJ~ -)~~A~~ 1 Elizabeth Blackston ~~r Fraud Bureau, Chief. Clf.J.-et?.Gt{;)jwxlt · R'ebecca Pruitt (ARDC #6209774) Assistant Attorney General Consumer Fraud Bureau 500 South Second Street Springfield, IL 62706 Telephone: (217) 782-4436 Page 14 of 14

- 15. @ . t .. ., "' -:-; :.. " g r OJ/ou am flo~ .Yn/Ottedto~ . AN INFORMATIVE AND ENTERTAINING EVENT FoRADULTs 55 AND OVER {~',....-----.. " PLANTIFF'S EXHIBIT A Page 1 of 2 - -- ·-·---·-----------------------------

- 16. .. Stealth Tax Bill Hits Millions of Unsuspecting Retirees~ .. You are cordially invited to a FREE EDUCATIONAL SEMINAR that highlights the strategies you can use to potentially extract hundreds of thousands, if not millions of dollars out of your IRA or other qualified retirement plan such as a 401k, 403b, 457 & all others with little to NO Tax. This Seminar: • Is an educational event only • Is designed for those with "Retirement Plans valued at over $200,000 • Is the easiest way for you to learn all about the inner secrets used by the "Rich" to eliminate significant taxes during your retirement . This Seminar Is: • NOT a sales seminar • NOT an annuity presentation • NOT a Free meal come-on to get you to buy something Benefits to You: • Learn about the enormous tax impact of your future IRA withdrawals, potentially leading to a 100% "effective" tax rate! o Learn five different strategies that can potentially allow you to pull Lar~e sums of money out of your IRA while experiencing Uttle or No TaX! • Find out why the IRS views your IRA or Retirement Plan as a big revenue target and how you can potentially protect it from their grasp. Reservations are required! You must call our reservation line to confirm your seating (limit of 4). Bonus Topic: Learn how the "Rich" structure their portfolios to enjoy 6% or_ better inflation protected income, while protecting their principal AND in many cases having their income be primarily tax-free! Date, Time & Location Tuesday, September 9th 6:00 - 7:30 p.m. Illinois Education Association 3440 Liberty Drive • Springfield, IL (In Park Way Point, behind Wal-Mart & Targeton the West Side of Springfield) 'Light refreshments will be served ____ :...._ .._.,. -:. -.:: L..~- _ _ ,_,...:.~:-· ~-.:;::- :-;-:-..:....:-: ;-_,· ,·.: ... ~ ·-·. 1-800-882~51 06 & reserve your seats today! '.:..· PLANTIFF'S EXHIBIT A Page 2 of 2

- 17. STATE OF ILLINOIS IN THE CIRCUIT COURT OF THE SEVENTH JUDICIAL CIRCUIT SANGAMON.COUNTY THE PEOPLE OF THE STATE OF ILLINOIS, ) ) Plaintiff, ) ) -vs- ) NO. ) DICK VAN DYKE FINANCIAL, LTD. and ) RICHARD LEE VAN DYKE, JR., individually and j I 20 1 3 cH0 0 2' 0 7J as President of DICK VAN DYKE FINANCIAL, LTD. ) ) Defendants. ) To each defendant: Dick Van Dyke Financial, LTD. YOU ARE SUMMONED and required to~le an answer .to the complaint in this case, a copy of which is hereto attached, or otherwise file yo'tir appearance, in the office of the clerk of this court, 200 South 91h Street, Room 405, Springfield, Illinois 62701, Within 30 days after service of this summons, not counting the day of service. IF YOU FAIL TO DO SO, A JUDGMENT BY DEFAULT MAY BE ENTERED AGAINST YOU FOR THE RELIEF ASKED IN THE COMPLAINT. To the officer: please serve the Defendant's business agent Richard Lee Van Dyke at 1028 South Walnut, Springfield, Illinois. (i i. Clerk of the CoUrt Associate.Circuit Clerk- Int. Deputy Name Rebecca Pruitt Attorney for Plaintiff Addre.ss 500 South Second Street City Springfield, IL 62706 Telephone (217) 782-4436 Date of service: , 2013. (To be inserted by officer on copy left with defendant or other person)

- 18. STATE OF ILLINOIS IN THE CIRCUIT COURT OF THE SEVENTH JUDICIAL CIRCUIT SANGAMON COUNTY THE PEOPLE OF THE STATE OF ILLINOIS, ) ) Plaintiff, ) ) -vs- ) NO. ) DICK VAN DYKE FINANCIAL, LTD. and ) ) RICHARD LEE VAN DYKE, JR, individually and · ) ~·20 13CH00207J as President of DICK VAN DYKE FINANCIAL, LTD. ) ) Defendants. ) SUMMONS To each defendant:· Richard Lee Van Dyke, Jr.,_ individually and as President of Dick Van Dyke Financial, LTD. YOU ARE SUMMONED and required to file an answer to the complaint in this case~ a copy of which is hereto attached, or otherwise file your appearance, in the office of the clerk of this court, 200 South 9th Street, Room 405, Springfield, Illinois 62701, within 30. days after service· of this summons, not counting the day of serrice. IF YOU FAIL TO DO SO, A .Jl!DGMENT BY .DEFAULT MAY BE. ENTERED AGAINST YOU FOR THE RELIEF . ASKED IN THE COMPLAINT. To the officer: please serve the Defendant at i028 South Walnut, Springfield, Illinois. This summons must be returned by the officer or other person to whom it was given for service, with endorsement of service and fees,ifaby, immediately after service. If service cannot be made, this summons shall be returned so endorsed. This summons may not be served later than 30 d ays after Its date. · l,umnu,,,, MAR 07 2013 ~'''''''lUDic/''''"·:-. WITNESS, ' ~~ .... C 2013. 4-,;/';~t..~ ,.. l: ~~ ,~.-· ~~ ~. ~~~ . J Clerk of the Court ,c;,~ -,')/,, .> ~':c~"~~.., couN'f .. - . o"''"'"""""'"" ~ ',J]'''rnrnu ;~~· ~~..,.,t~ Associate Circuit Clerk - Int. Deputy Name Rebecca Pruitt Attorney for Plaintiff Address 500 South Second Street City Springfield, IL 62706 Telephone (217) 782-4436 Date of service: , 20 13 .. (To be inserted by officer on copy left with defendant or otm~r person)· ·