Jllm pulse apr_2012_all_india

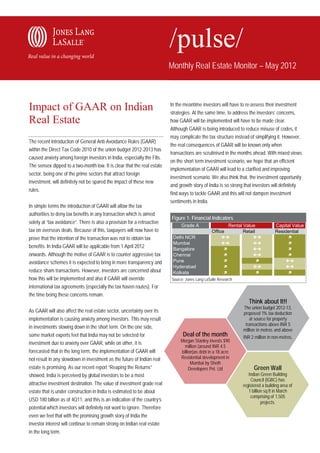

- 1. Monthly Real Estate Monitor – May 2012 In the meantime investors will have to re-assess their investment Impact of GAAR on Indian strategies. At the same time, to address the investors’ concerns, Real Estate how GAAR will be implemented will have to be made clear. Although GAAR is being introduced to reduce misuse of codes, it may complicate the tax structure instead of simplifying it. However, The recent introduction of General Anti-Avoidance Rules (GAAR) the real consequences of GAAR will be known only when within the Direct Tax Code 2010 of the union budget 2012-2013 has transactions are scrutinised in the months ahead. With mixed views caused anxiety among foreign investors in India, especially the FIIs. on the short term investment scenario, we hope that an efficient The sensex dipped to a two-month low. It is clear that the real estate implementation of GAAR will lead to a clarified and improving sector, being one of the prime sectors that attract foreign investment scenario. We also think that, the investment opportunity investment, will definitely not be spared the impact of these new and growth story of India is so strong that investors will definitely rules. find ways to tackle GAAR and this will not dampen investment sentiments in India. In simple terms the introduction of GAAR will allow the tax authorities to deny tax benefits in any transaction which is aimed Figure 1: Financial Indicators solely at “tax avoidance”. There is also a provision for a retroactive Grade A Rental Value Capital Value tax on overseas deals. Because of this, taxpayers will now have to Office Retail Residential prove that the intention of the transaction was not to obtain tax Delhi NCR Mumbai benefits. In India GAAR will be applicable from 1 April 2012 Bangalore onwards. Although the motive of GAAR is to counter aggressive tax Chennai avoidance schemes it is expected to bring in more transparency and Pune Hyderabad reduce sham transactions. However, investors are concerned about Kolkata how this will be implemented and also if GAAR will override Source: Jones Lang LaSalle Research international tax agreements (especially the tax haven routes). For the time being these concerns remain. Think about It!! The union budget 2012-13, As GAAR will also affect the real estate sector, uncertainty over its proposed 1% tax deduction implementation is causing anxiety among investors. This may result at source for property transactions above INR 5 in investments slowing down in the short term. On the one side, million in metros and above some market experts feel that India may not be selected for Deal of the month INR 2 million in non-metros. investment due to anxiety over GAAR, while on other, it is Morgan Stanley invests $90 million (around INR 4.5 forecasted that in the long term, the implementation of GAAR will billion)as debt in a 18 acre not result in any slowdown in investment as the future of Indian real Residential development in Mumbai by Sheth estate is promising. As our recent report “Reaping the Returns” Developers Pvt. Ltd Green Wall showed, India is perceived by global investors to be a most Indian Green Building Council (IGBC) has attractive investment destination. The value of investment grade real registered a building area of estate that is under construction in India is estimated to be about 1 billion sq ft in March comprising of 1,505 USD 180 billion as of 4Q11, and this is an indication of the country’s projects. potential which investors will definitely not want to ignore. Therefore even we feel that with the promising growth story of India the investor interest will continue to remain strong on Indian real estate in the long term.

- 2. Monthly Real Estate Monitor – May 2012 Office Rents Capital Value Bangalore INR per sq ft Key Precincts per month INR per sq ft Outer Ring Road (North) 48-52 5,000-6,000 Old Airport Road 60-65 6,000-7,000 Office space leasing continued to remain strong in Outer Ring Road (Eastern) 46-48 4,500-5,000 March in Bangalore. Majority of the leasing was Old Madras Road 30-34 3,000-3,500 contributed by the IT/ ITES companies who leased Electronic City 26-28 2,400-2,800 Retail Rents Capital Value large format spaces. The fast declining leasable INR per sq ft space has led to the decrease in vacancy in most of the sub- Key Precincts per month INR per sq ft markets of Bangalore. This has also increased the rents and capital Koramangala 80-150 9,000-16,000 values. The major tenants who leased space in were Time Warner, Indiranagar 90-180 12,000-18,000 New BEL Road 50-80 6,000-10,000 InMobi, Indegene, SmileInteractive, Flipkart and Quintiles. Icon India Commercial Street 175-250 16,000-20,000 located at Whitefield was the only building that commenced Jayanagar 80-120 7,000-15,000 operations in March. This building did not witness any pre-leasing. Residential Rents Capital Value Rents and capital values of office space increased marginally in the INR per month SBD and Whitefield sub-markets, due to limited supply and for a 1,000 sq ft 2BHK increased demand from IT occupiers. Key Precincts apartment INR per sq ft Old Madras Road 10,000-15,000 5,000-6,000 Indiranagar 18,000-20,000 10,000-20,000 Bellary Road 8,000-10,000 3,000-4,000 Hosur Road 10,000-12,000 3,000-4,500 Retail demand continued to be strong as the Whitefield 10,000-15,000 3,000-5,000 retailers expanded their foot print in both high streets Tumkur Road 7,000-10,000 3,000-5,000 and malls. Orion mall located at Rajaji Nagar Kanakapura Road 7,000-10,000 3,000-4,500 became operational in March. The mall commenced Mysore Road 6,000-10,000 2,500-3,500 operations with more than 80% occupancy rate. Star Bazaar, PVR Cinemas and Time zone are amongst the anchor tenants, while Wills Lifestyle, Espirit, Jack& Jones etc are amongst the small INFRASTRUCTURE ONGOING format stores. The 22.12 km long elevated six-lane expressway project is part of the Hyderabad-Bangalore section under Phase VII of the National Highway Development Project. Estimated to be Residential demand also remained upbeat in built at a cost of INR 6.8 billion on a BOT basis, the Bangalore in March. The demand was due to buyer construction is expected to get completed by 2013. sentiment shifting towards purchasing a property rather than paying high rents, as well as the entry of buyers from other Tier I and II cities particularly for investment purpose. The projects that saw good absorption in March included Karle Zenith, Prestige Tranquility, Mantri Alpyne, Prestige Park View, DLF Maiden Heights, Provident Harmony and Prestige Silver Crest. Capital values appreciated marginally across various sub- markets due to an increase in sales volume and new launches that were priced above market average.

- 3. Monthly Real Estate Monitor – May 2012 Office Rents Capital Value Chennai INR per sq ft per Key Precincts month INR per sq ft Mount Road 60-90 9,000-15,000 RK Salai 70-100 10,000-15,000 With relatively bigger deals in the pipeline, the city Pre-toll OMR 35-55 5,000-6,500 witnessed modest leasing during March. Companies Post-toll OMR 25-35 3,500-5,000 Guindy 40-55 6,000-8,500 continue to lease spaces cautiously as IT/ITES Ambattur 25-35 3,250-4,500 players are holding their expansion plans and Retail Rents Capital Value postponing them towards the second half of the year. Manufacturing INR per sq ft per sector continued to lease more space during the quarter. Renault Key Precincts month INR per sq ft T.Nagar 120 - 180 12,000-15,000 Nissan leased space on GST Road in March. Project delays Nungambakkam 130 - 150 13,000-16,000 continued to cap new supplies helping vacancy levels to remain Velachery 80 - 100 10,000-12,000 stable. Pre-toll OMR 50 - 70 8,000-11,000 Anna Nagar 110 - 140 11,000-13,000 LB Road (Adyar) 130 - 150 12,500-14,000 Residential Rents Capital Value INR per month Small format stores in the CBD were in demand for a 1,000 sq ft during March. Canon Image studio, Gem palace, Key Precincts 2BHK apartment INR per sq ft Adyar 16,000 - 25,000 9,500 – 16,500 Lasya, Kryolan, Timex and Eye t world were some Medavakkam 7,000 - 14,000 3,600 – 4,800 of the brands which occupied vacant spaces in Tambaram 6,000 - 15,000 3,500 – 4,500 Ramee Mall at Mount road. High streets continued to witness a Anna Nagar 15,000 - 25,000 9,000 – 14,000 healthy demand amidst lack of new mall space in the city. Low retail Porur 5,000 - 10,000 3,600 – 4,300 activity kept the rental and capital values stable across the Sholinganallur 9,000 - 12,000 4,000 – 5,000 submarkets. INFRASTRUCTURE ONGOING >> State Government announced an INR 5 billion metropolitan development scheme for Chennai and its suburbs, INR 7.50 Residential market in Chennai is witnessing new billion for other corporations and municipalities and trends. Chennai which was predominantly a 2BHK INR 2 billion for improving roads. and 3BHK apartment market is slowly seeing more >> Ascendas and a Japanese consortium will set up a 1,500 villas being launched. With the entry of more pan- acre integrated industrial township at a cost of around India players, demand for luxury and studio apartments is also INR 35 billion near Chennai. catching up. With historic launches and improved absorption, rental and capital values have increased across different sub-markets, especially in the suburbs.

- 4. Monthly Real Estate Monitor – May 2012 launched in Noida. Residential project prices kept showing an Delhi upward trend while demand also remained healthy. Capital values in the residential sector grew at a faster pace. Rents showed an increase in Gurgaon, Delhi and Faridabad sub-markets while Commercial absorption was moderate in March as remaining stagnant in Noida and Ghaziabad. leasing decisions were postponed due to closure of financial year in India. Tenants were focused on Office Rents Capital Value INR per sq ft per consolidation or cautionary expansion in to Key Precincts month INR per sq ft affordable sub-markets. Some firms vacated spaces, which led to an Barakhamba Road 140-350 23,000-32,000 increase in vacancy across select precincts. Notable leases - UHG Jasola 110-170 16,000-21,000 DLF Cybercity 65-70 NA leased space in Oxygen SEZ tower D on the Noida-Greater Noida MG Road 110-125 14,000-17,000 Expressway while Hewitt pre-committed space in 3C’s Commercial Golf Course Road 80-90 10,000-12,000 project in Sector 127 in the same precinct. Sohna Road 45-55 6,500-8,000 Retail Rents Capital Value INR per sq ft per A Fresh supply of office space was mostly seen in Gurgaon and Key Precincts month INR per sq ft Noida sub-markets. A few completions in March were Sun Ramfield South Delhi 180-240 21,000-27,000 West and North Delhi 140-220 14,000-21,000 Solution at Noida City and Boston Tower on Noida-Greater Noida Gurgaon-MG Road 140-230 15,000-20,000 Expressway in Noida, ASF Insignia Phase 1 Block C on Golf Course Rest of Gurgaon 60-100 8,000-12,000 Road and DLF Building 5 Tower C on NH-8 in Gurgaon. The Noida 130-220 14,000-24,000 Ghaziabad 90-150 10,500-16,000 occupancy levels in these newly completed buildings were good as Residential Rents Capital Value ASF Insignia is entirely leased out to TCS, DLF Building 5 Tower C INR per month for a is 35% leased out. Rents remained stagnant, except specific 1,000 sq ft 2BHK precinct level increases in the Gurgaon sub-market. Capital values Key Precincts apartment INR per sq ft also remained stable, with increments seen only for leased property Golf Course Road 13,000-15,000 9,500-15,000 Sohna Road 9,000-10,000 4,800-6,800 sale options. Golf Course Extension Road 10,000-12,000 6,200-7,700 Noida-Greater Noida Expressway 11,000-12,000 4,000-5,500 Noida City 10,000-12,000 4,200-6,000 Retail absorption was moderate as supply in Indirapuram 10,000-11,000 3,300-4,000 prominent malls was down to single digits with retailers looking only at select projects for INFRASTRUCTURE ONGOING expansion. Savoy Outlet mall in Gurgaon & Eros >> The upcoming Dwarka-Gurgaon Expressway seems to Metro mall at Dwarka in Delhi commenced operations in March. finally be taking off from ground as all pending litigations are Savoy Outlet Mall saw prominent retailers like McDonalds, Sisley resolved and construction contract has been awarded to among others. Rents and capital values remained stable in March. Indiabulls >> Planned Monorail project to connect parts of East Delhi to ease congestion. Another monorail project under construction Residential saw many project launches in March, in Gurgaon connecting DLF Cyber City with the Metro network. marking the hectic activity being witnessed in this sector. The major project launches were DLF The Primus & DLF Regal Gardens both part of the DLF Gardencity project, Green Parc-II Petioles by SARE in Gurgaon. Wave Amore & WCC studio apartments by Wave Infratech were

- 5. Monthly Real Estate Monitor – May 2012 Hyderabad Office Rents Capital Value INR per sq ft per Key Precincts month INR per sq ft Begumpet 45-55 4,500-6,500 Demand for office space was moderate in March. Banjara Hills 50-60 4,500-7,500 Hitec City and Gachibowli, the prime IT hubs of the Hitec City 34-42 4,000-5,200 city, are facing a supply crunch. Therefore tenants Gachibowli 34-38 4,000-5,000 have started leasing spaces in the emerging Uppal 25-35 3,000-4,000 suburban locations such as Uppal and Pocharam. Genpact leased Shamshabad 20-25 3,000-4,000 Retail Rents Capital Value space in K R C Mindspace East, located at Pocharam in the eastern INR per sq ft per part of Hyderabad. However, pre-leasing in buildings that are under Key Precincts month INR per sq ft construction remained strong; DuPont pre-leased space in TSI Banjara Hills 100-120 10,000-12,000 Waverock’s Phase 2. The supply crunch in Hitec City and Jubilee Hills 110-140 11,000-14,000 Gachibowli has pushed up the rents and capital values marginally Secunderabad 80-100 8,000-10,000 Hitec City 100-120 10,000-12,000 over the month. Kukatpally 80-100 8,000-10,000 Dilshuknagar 60-80 6,000-8,000 Residential Rents Capital Value Retailers continued to focus on leasing in high INR per month for a streets. There was no new supply of malls in the 1,000 sq ft 2BHK Key Precincts apartment INR per sq ft month of March. Malls that were expected to begin Banjara Hills 13,000-20,000 5,500-10,000 operations in March postponed their plans for a few Begumpet 10,000-15,000 3,500-4,000 more months. The rents and capital values continued to remain Kondapur 10,000-15,000 2,800-4,500 stable in March. Tellapur 8,000-12,000 2,200-2,800 Kukatpally 7,000-10,000 3,300-3,500 Miyapur 5,000-6,000 1,800-3,300 Residential demand remained moderate in March. INFRASTRUCTURE ONGOING Aparna Cyberzon, located at Tellapur close to >> Hyderabad Metropolitan Development Authority (HMDA) Aparna Developer’s two other projects Aparna approved an inter-city bus terminal at Miyapur. Sarovar and Aparna Cyber Commune, was soft >> 71.6-km-long Hyderabad metro rail project is almost ready launched. As this is situated in the western part of the city it is for implementation. The phase I of the project will cover two expected to witness good sales. However, the plans of the project tracks- 8 kms between Nagole and Mettuguda and 12 kms are awaiting approvals. Overall, rents and capital values remained between Miyapur and Ameerpet, which are expected to be stable over the month of March. Few projects that are in the final complete by end of 2014. stages of completion continued to increase prices. .

- 6. Monthly Real Estate Monitor – May 2012 Kolkata Office Rents Capital Value INR per sq ft per Kolkata’s office market remained buoyant in March. Key Precincts month INR per sq ft Most of the leasing activity was focused in the Park Street 90-120 9,000-11,000 Topsia 55-65 5,000-7,000 suburban sub-markets of Salt Lake and Rajarhat. Salt Lake 40-50 4,000-5,000 Rents and capital values witnessed a nominal Rajarhat 25-35 3,000-3,500 upsurge during March on the back of reviving sentiments amongst Retail Rents Capital Value INR per sq ft per occupiers, coupled with increased cost of inputs. Over the course of Key Precincts month INR per sq ft the month, Digicable leased space at Assyst Park in Salt Lake Elgin Road 120 - 180 12,000-15,000 Sector V and Learning Mate leased space at Ecospace in Rajarhat. Park street (high street) 130 - 150 13,000-16,000 Prince Anwar Shah Road 80 - 100 10,000-12,000 Salt Lake 50 - 70 8,000-11,000 Demand from retailers was mostly focused on malls Residential Rents Capital Value INR per month in the suburban locations due to lack of leasable for a 1,000 sq ft space in prime city areas. There were no new Key Precincts 2BHK apartment INR per sq ft Alipore 35,000 - 40,000 10,000 - 15,000 completions in the month of March. Rents and PA Shah Road 18,000 - 20,000 3,500 - 4,500 capital values (for retail space) witnessed a rise across sub-markets, EM Bypass 14,000 - 16,000 3,000 - 3,500 boosted by robust demand from retailers. Kolkata has gradually Lake Town 10,000 - 12,000 2,000 - 3,000 made its way onto the radar of international premium brands and Behala 9,000 - 12,000 2,500 - 4,000 Howrah 5,000 - 7,000 1,700 - 1,900 international retailers continued to expand their footprint in the city. INFRASTRUCTURE ONGOING The number of residential project launches remained A new metro line is proposed on the East-West Metro Corridor. stable in Kolkata. Residential sales remained This new metro line is expected to enhance the connectivity of moderate in March. Capital values continued to the city manifold. This stretch covers 13.77 kms of show marginal upward trend across most of the sub- underground and elevated tracks from Salt Lake to Howrah, markets despite nominal absorption rates in the submarket. In with an investment of INR 46.8 billion. addition, rents continued to rise on the back of a high demand for rental housing.

- 7. Monthly Real Estate Monitor – May 2012 Office Rents Capital Value Mumbai Key Precincts INR per sq ft per month INR per sq ft Lower Parel 150-180 19,000 -23,000 BKC 250 - 350 25,000 -35,000 Andheri 100 - 150 9,000 – 15,000 Overall Mumbai office market witnessed subdued Goregaon-Malad 80 - 100 8,000 -10,000 transaction activity in March. Secondary and Wagle Estate 45 - 60 5,000 – 6,000 suburban sub-markets contributed equally well to Thane-Belapur Road 40 - 55 5,000 – 6,000 the leasing activity. Rents and capital values Retail Rents Capital Value INR per sq ft per remained stable during the month. Pfizer leased space at Key Precincts month INR per sq ft Jogeshwari which is in the SBD North sub market. Few buildings Lower Parel 500 - 700 22,000 – 32,000 which became operational in March included – Phoenix Market City Malad 400 - 500 18,000 – 28,000 at Kurla, I think Thane Phase 2 at Thane, Mindspace Building 5&6 Ghatkopar 250 - 350 15,000 - 20,000 at Airoli and Godrej IT Park Wing C at Vikhroli. Occupancy levels Mulund 500 - 600 15,000 – 25,000 were good in Godrej IT Park Wing C and Mindspace Building 5&6. Thane 300 - 400 12,000 – 18,000 Navi Mumbai 200 - 300 10,000 – 15,000 Residential Rents Capital Value INR per month for a Demand from retailers was mostly concentrated in 1,000 sq ft 2BHK malls of the suburban locations because of its good Key Precincts apartment INR per sq ft infrastructure and residential catchment. No new Lower Parel 70,000 - 85,000 20,000 – 26,000 malls got operational in March. However, the Wadala 35,000 - 50,000 13,500 – 15,000 Magnet mall at Bhandup commenced operations in February and Andheri 30,000 – 45,000 22,000 – 16,000 the mall has seen a moderate occupancy. Retailers such as Easy Ghatkopar 30,000 – 40,000 9,500 – 11,000 day, Archies, Fila, Only, Biba and Bata have opened stores in Ghodbunder Road 10,000-20,000 5,000 – 6,500 Magnet mall. Retail space rents and capital values remained stable Kharghar 10,000-15,000 4500 – 6,000 in most of the locations in Mumbai except Prime South. International retailers primarily in the luxury segment continued to expand their INFRASTRUCTURE ONGOING footprint in prime locations of Mumbai. >> Santacruz – Chembur Link Road (SCLR): This arterial road (6.45 km) will connect the Western Express Highway and Eastern Express Highway. This project is expected to be The number of residential project launches remained completed by end of 2012. stable in Thane, Navi Mumbai and extended >> Mumbai Metro Rail: The 12 km stretch of Phase 1 from suburbs of Mumbai. Residential sales remained Versova to Ghatkopar is expected to become operational by moderate in March. The capital values continued to early 2013, improving east-west connectivity and providing show marginal upward trend across most sub markets (barring impetus to Andheri. South Mumbai) despite nominal absorption rates. Rents continued to rise as the demand for rental housing remained high. The fact that potential buyers continued to defer their decision to buy drives growth of the rental market in MMR. Major launches in March were Omkar Wing A and B at Worli, Godrej Platinum Tower 2 at Vikhroli, Lodha Dawn at Ghodbunder Road, KUL Tulip at Ghatkopar.

- 8. Monthly Real Estate Monitor – May 2012 Office Rents Capital Value Pune INR per sq ft per Key Precincts month INR per sq ft Hinjewadi 32-35 3,000-3,500 Hadapsar 45-50 4,000-5,000 Leasing activity in the commercial asset class Bund Garden Road 55-60 5,500-6,000 remained strong in the month of March, similar to Viman Nagar 50-55 5,000-5,500 previous two months. Transactions were dominated S.B Road 55-60 5,000-5,500 Koregaon Park 60-65 6,000-7,000 by IT/ITES firms. Majority of the transactions in Retail Rents Capital Value March were concluded in STPI projects located in SBD. Matrix INR per sq ft per edge, a non IT project located in the eastern part of Pune Key Precincts month INR per sq ft commenced operations in March. Rents and capital values showed MG Road 100-150 10,000-15,000 Bund Garden Road 90-130 9,000-13,000 nominal improvement during the month. Imagination Technologies FC Road 100-150 10,000-15,000 leased space in Rainbow IT Park located at Shivaji Nagar. JM Road 100-150 10,000-15,000 DP Road 90-110 9,000-11,000 SB Road 80-120 8,000-11,000 Demand from retailers was mostly focused on the Residential Rents Capital Value central part of the city. Majority of the transactions INR per month for a 1,000 sq ft 2BHK were concluded in Plaza Centre and Centre port Key Precincts apartment INR per sq ft mall. The Plaza Centre mall commenced operations Wakad 10,000-12,000 3,200-3,500 in March. Many national and international brands, such as Star India Kharadi 11,000-15,000 4,200-4,500 Bazaar and Hamleys, have set up stores for the first time in Pune in Hadapsar 12,000-16,000 4,000-4,500 Hinjewadi 9,000-11,000 3,200-3,500 the aforementioned malls. The rent and capital values remained Kondhwa 9,000-12,000 3,700-4,000 stable across all the sub-markets. Pimpri-Chinchwad 8,000-12,000 3,200-3,700 Pune's residential market continued to witness a INFRASTRUCTURE ONGOING decent number of launches in the month of March as >> To mitigate traffic congestion in the city, local municipal well. The major launches were Casa 7, GAIA and authorities in city have planned an outer ring road for Pune. Down Town. Sales velocity remained stable. Capital The work is in progress. values continued to show marginal upward trend across most of the >> The outer ring road is a considerable length of 169 kms, sub-markets. with the project being divided into 4 parts. Part I of 39.89 kms to cover Theurphata NH-9, Kesnand, Wagholi, Bhavdi, Tulapur, Alandi, Kelgaon, Chimbli and NH-50. .

- 9. About Jones Lang LaSalle Jones Lang LaSalle (NYSE:JLL) is a financial and professional services firm specializing in real estate. The firm offers integrated services delivered by expert teams worldwide to clients seeking increased value by owning, occupying or investing in real estate. With 2011 global revenue of more than USD 3.6 billion, Jones Lang LaSalle serves clients in 70 countries from more than 1,000 locations worldwide, including 200 corporate offices. The firm is an industry leader in property and corporate facility management services, with a portfolio of approximately 1.8 billion square feet worldwide. LaSalle Investment Management, the company’s investment management business, is one of the world’s largest and most diverse in real estate with USD 47.9 billion of assets under management. Jones Lang LaSalle has over 50 years of experience in Asia Pacific, with over 20,800 employees operating in 77 offices in 13 countries across the region. The firm was named the Best Property Consultancy in Asia Pacific at ‘The Asia Pacific Property Awards 2011 in association with Bloomberg Television’. For further information, please visit our website, www.ap.joneslanglasalle.com About Jones Lang LaSalle India Jones Lang LaSalle is India’s premier and largest professional services firm specializing in real estate. With an extensive geographic footprint across eleven cities (Ahmedabad, Delhi, Mumbai, Bangalore, Pune, Chennai, Hyderabad, Kolkata, Kochi, Chandigarh and Coimbatore) and a staff strength of over 4800, the firm provides investors, developers, local corporate and multinational companies with a comprehensive range of services including research, analytics, consultancy, transactions, project and development services, integrated facility management, property and asset management, sustainability, Industrial, capital markets, residential, hotels, health care, senior living, education and retail advisory. For further information, please visit www.joneslanglasalle.co.in For more information about our research Ashutosh Limaye Head, Research and REIS ashutosh.limaye@ap.jll.com +91 98211 07054 Trivita Roy Manager, Research trivita.roy@ap.jll.com +91 40 4040 9100 Research Dynamics April 2012 Pulse reports from Jones Lang LaSalle are frequent updates on real estate market dynamics. COPYRIGHT © JONES LANG LASALLE IP, INC. 2012. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means without prior written consent of Jones Lang LaSalle. It is based on material that we believe to be reliable. Whilst every effort has been made to ensure its accuracy, we cannot offer any warranty that it contains no factual errors. We would like to be told of any such errors in order to correct them.