A project report on awareness level of personal banking products of SBI bank

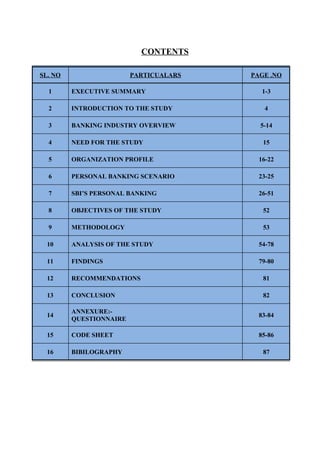

- 1. CONTENTS SL. NO PARTICUALARS PAGE .NO 1 EXECUTIVE SUMMARY 1-3 2 INTRODUCTION TO THE STUDY 4 3 BANKING INDUSTRY OVERVIEW 5-14 4 NEED FOR THE STUDY 15 5 ORGANIZATION PROFILE 16-22 6 PERSONAL BANKING SCENARIO 23-25 7 SBI’S PERSONAL BANKING 26-51 8 OBJECTIVES OF THE STUDY 52 9 METHODOLOGY 53 10 ANALYSIS OF THE STUDY 54-78 11 FINDINGS 79-80 12 RECOMMENDATIONS 81 13 CONCLUSION 82 ANNEXURE:- 14 83-84 QUESTIONNAIRE 15 CODE SHEET 85-86 16 BIBILOGRAPHY 87

- 2. Awareness Level of Personal Banking Products of SBI Bank EXECUTIVE SUMMARY The Banking Industry Profile is- Banking in India has its origin as carry as the Vedic period. It is believed that the transition from money lending to banking must have occurred even before Manu, the great Hindu jurist, who has devoted a section of his work to deposits and advances and laid down rules relating to the interest. During the mogal period, the indigenous bankers played a very important role in lending money and financing foreign trade and commerce. During the days of East India Company, it was to turn of the agency houses top carry on the banking business. The general bank of India was the first joint stock bank to be established in the year 1786.The others that followed were the Bank of Hindustan and the Bengal Bank. The Bank of Hindustan is reported to have continued till 1906, while the other two failed in the meantime. After the second phase of financial sector reforms and liberalization of the sector in the early nineties, the PSB’s found it extremely difficult to complete with the new private sector banks and the foreign banks. The new private sector first made their appearance after the guidelines permitting them were issued in January 1993. The Organization Profile is- Not only many financial institution in the world today can claim the antiquity and majesty of the State Bank Of India founded nearly two centuries ago with primarily intent of imparting stability to the money market, the bank from its inception mobilized funds for supporting both the public credit of the companies governments in the three presidencies of British India and the private credit of the European and India merchants from about 1860s when the Indian economy book a significant leap forward under the impulse of quickened world communications and ingenious method of industrial and agricultural production the Bank became intimately in valued in the financing of practically and mining activity of the Sub- Continent Although large European and Indian merchants and manufacturers were undoubtedly thee principal beneficiaries, the small man never ignored loans as low as Rs.100 were disbursed in agricultural districts against glad ornaments. A highly efficient and experienced management functioning in a well-defined organizational structure did not take long to place the bank an executed pedestal in the areas of business, profitability, internal discipline and above all credibility Babasabpatilfreepptmba.com 2

- 3. Awareness Level of Personal Banking Products of SBI Bank The Objectives are- To Know The Customer Preference Towards Different Products Of SBI. To Know the Perception of Customers towards SBI’s Personal Banking Products. To know the awareness level of customers towards SBI’s facilities. The Need for the Study is- The Indian Banking industry comprises segments that provide comprehensive banking services to individuals, corporate and small business. Industry segments are Public Sector Banks, Private Sector Bank and Foreign Banks. In this Project the report is mainly focused on Awareness Level of Personal Banking Products of SBI. The Data Collection Method is- To fulfill the objectives of my study, I have taken both into considerations viz primary & secondary data. Primary data: Primary data has been collected through personal interview by direct contact method. The method, which was adopted to collect the information, is ‘Personal Interview’ method by using questionnaire. Personal interview and discussion was made with manager and other personnel in the organization for this purpose. Secondary data: The data is collected from the Internet, Textbooks. The various sources that were used for the collection of secondary data are o Websites – www.SBI.com o Www.google.com. Sample size: • Samples of 100 customers of the bank were chosen for the purpose of study. Sampling Method: Random Sampling Method • From the large number of account holder’s of the bank, 100 customers were selected randomly from the bank’s database were considered for the study. Babasabpatilfreepptmba.com 3

- 4. Awareness Level of Personal Banking Products of SBI Bank The Findings are- Among the respondent 99% said they wish to transact or deal with persona ling products of SBI bank and 1% of them said don’t want to open account. The SBI customer Rank the SBI products as shown in the above chart. 26% of them say the PERSONAL products of SBI are good, 50% rank them as Best, and 3% rank it as Moderate and remaining 1% rank them as poor. There are 14% of the customers who are using On-Line Banking weekly and 5% of them are using monthly. The Recommendations are- 1) The costumers are aware of only few products of SBI Personal banking products. So bank should provide the information regarding the availability of the products. 2) Disbursement of loans should be quickly done as and when required. 3) There are many People who don’t know about On-Line Banking, so bank should help to know about the operations and facilities. The Conclusion is- Most of the customers are aware of few SBI personal banking products like Home Loan, Savings Account, Education loan and they are not aware of products like Loan against Shares & Debentures, Loan against Mortgage of Property. So the bank should help the customers to know about such products, which they are less aware. They are satisfied on the interest of Personal banking products. Babasabpatilfreepptmba.com 4

- 5. Awareness Level of Personal Banking Products of SBI Bank INTRODUCTION TO THE STUDY The Indian economic is growing. There are various factors contributing for the development of economy. One of the industries, which have revolutnalise the economy, is banking. Change in the IT & faster growth has changed the banking operations to a great extent. Banking operations have led to a great development of economy & meeting customer’s needs. Among various sectors that bank is involved, Personal Banking is one area that has changed gradually in meeting dynamic needs of customers. TITLE OF THE PROJECT “Awareness Level of Personal Banking Products of SBI Bank” Organization: STATE BANK OF INDIA, RANEBENNUR BACKGROUND OF PROJECT TOPIC I have undertaken my study in area of Personal Banking in order to get the basic understanding of banking operations especially Personal Banking. As Personal Banking activity has been changing & very completive in nature in meeting needs of customers. State bank has been focus on Personal Banking. The idea of undertaking this project is to understand the customer’s present expectation from bank & even to know their perception about Personal Banking in this competitive banking scenario. The project title is Awareness Level of Personal Banking Products of SBI Bank, Ranebennur. Babasabpatilfreepptmba.com 5

- 6. Awareness Level of Personal Banking Products of SBI Bank BANKING INDUSTRY OVERVIEW History: Banking in India has its origin as carry as the Vedic period. It is believed that the transition from money lending to banking must have occurred even before Manu, the great Hindu jurist, who has devoted a section of his work to deposits and advances and laid down rules relating to the interest. During the mogal period, the indigenous bankers played a very important role in lending money and financing foreign trade and commerce. During the days of East India Company, it was to turn of the agency houses top carry on the banking business. The general bank of India was the first joint stock bank to be established in the year 1786.The others, which followed, were the Bank of Hindustan and the Bengal Bank. The Bank of Hindustan is reported to have continued till 1906, while the other two failed in the meantime. In the first half of the 19th Century the East India Company established three banks; The Bank of Bengal in 1809, The Bank of Bombay in 1840 and The Bank of Madras in 1843.These three banks also known as presidency banks and were independent units and functioned well. These three banks were amalgamated in 1920 and The Imperial Bank of India was established on the 27 th Jan 1921, with the passing of the SBI Act in 1955, the undertaking of The Imperial Bank of India was taken over by the newly constituted SBI. The Reserve Bank which is the Central Bank was created in 1935 by passing of RBI Act 1934, in the wake of swadeshi movement, a number of banks with Indian Management were established in the country namely Punjab National Bank Ltd, Bank of India Ltd, Canara Bank Ltd, Indian Bank Ltd, The Bank of Baroda Ltd. The Central Bank of India Ltd .On July 19th 1969, 14 Major Banks of the country were Babasabpatilfreepptmba.com 6

- 7. Awareness Level of Personal Banking Products of SBI Bank nationalized and in 15th April 1980 six more commercial private sector banks were also taken over by the government. The Indian Banking industry, which is governed by the Banking Regulation Act of India 1949, can be broadly classified into two major categories, non- scheduled banks and scheduled banks. Scheduled Banks comprise commercial banks and the co-operative banks. The first phase of financial reforms resulted in the nationalization of 14 major banks in 1969 and resulted in a shift from class banking to mass banking. This in turn resulted in the significant growth in the geographical coverage of banks. Every bank had to earmark a min Percentage of their loan portfolio to sectors identified as “priority sectors” the manufacturing sector also grew during the 1970’s in protected environments and the banking sector was a critical source. The next wave of reforms saw the nationalization of 6 more commercial banks in 1980 since then the number of scheduled commercial banks increased four- fold and the number of bank branches increased to eight fold. After the second phase of financial sector reforms and liberalization of the sector in the early nineties, the PSB’s found it extremely difficult to complete with the new private sector banks and the foreign banks. The new private sector first made their appearance after the guidelines permitting them were issued in January 1993. The Indian Banking System: Banking in our country is already witnessing the sea changes as the banking sector seeks new technology and its applications. The best port is that the benefits are beginning to reach the masses. Earlier this domain was the preserve of very few organizations. Foreign banks with heavy investments in technology started giving some “Out of the world” customer services. But, such services were available only to selected few- the very large account holders. Then came the liberalization and with it a multitude of private banks, a large segment of the urban population now requires minimal time and space for its banking needs. Automated teller machines or popularly known as ATM are the three alphabets that have changed the concept of banking like nothing before. Instead of tellers handling your own cash, today there are efficient machines that don’t talk but just dispense cash. Under the Reserve Bank of India Act 1934, banks are classified as scheduled banks and non-scheduled banks. The scheduled banks are those, which are entered in the Second Schedule of RBI Act, 1934. Babasabpatilfreepptmba.com 7

- 8. Awareness Level of Personal Banking Products of SBI Bank Such banks are those, which have paid- up capital and reserves of an aggregate value of not less then Rs.5 lacks and which satisfy RBI that their affairs are carried out in the interest of their depositors. All commercial banks Indian and Foreign, regional rural banks and state co- operative banks are Scheduled banks. Non Scheduled banks are those, which have not been included in the Second Schedule of the RBI Act, 1934.The organized banking system in India can be broadly classified into three categories: (i) Commercial Banks (ii) Regional Rural Banks and (iii) Co-operative banks. The Reserve Bank of India is the supreme monetary and banking authority in the country and has the responsibility to control the banking system in the country. It keeps the reserves of all commercial banks and hence is known as the “Reserve Bank”. Current scenario: Currently (2009), the overall banking in India is considered as fairly mature in terms of supply, product range and reach - even though reach in rural India still remains a challenge for the private sector and foreign banks. Even in terms of quality of assets and Capital adequacy, Indian banks are considered to have clean, strong and transparent balance sheets - as compared to other banks in comparable economies in its region. The Reserve Bank of India is an autonomous body, with minimal pressure from the Government With the growth in the Indian economy expected to be strong for quite some time especially in its services sector, the demand for banking services especially personal banking, mortgages and investment services are expected to be strong. Mergers & Acquisitions., takeovers, are much more in action in India. One of the classical economic functions of the banking industry that has remained virtually unchanged over the centuries is lending. On the one hand, competition has had considerable adverse impact on the margins, which lenders have enjoyed, but on the other hand technology has to some extent reduced the cost of delivery of various products and services. Bank is a financial institution that borrows money from the public and lends money to the public for productive purposes. The Indian Banking Regulation Act of 1949 defines the term Banking Company as "Any company which transacts banking business in India" and the term banking as "Accepting for the purpose of lending all investment of deposits, of money from the public, repayable on demand or otherwise and withdrawal by cheque, draft or otherwise". Banks play important role in economic development of a country, like: Babasabpatilfreepptmba.com 8

- 9. Awareness Level of Personal Banking Products of SBI Bank • Banks mobilise the small savings of the people and make them available for productive purposes. • Promotes the habit of savings among the people thereby offering attractive rates of interests on their deposits. • Provides safety and security to the surplus money of the depositors and as well provides a convenient and economical method of payment. • Banks provide convenient means of transfer of fund from one place to another. • Helps the movement of capital from regions where it is not very useful to regions where it can be more useful. • Banks advances exposure in trade and commerce, industry and agriculture by knowing their financial requirements and prospects. • Bank acts as an intermediary between the depositors and the investors. Bank also acts as mediator between exporter and importer who does foreign trades. Thus Indian banking has come from a long way from being a sleepy business institution to a highly pro-active and dynamic entity. This transformation has been largely brought about by the large dose of liberalization and economic reforms that allowed banks to explore new business opportunities rather than generating revenues from conventional streams (i.e. borrowing and lending). The banking in India is highly fragmented with 30 banking units contributing to almost 100% of deposits and 60% of advances. Babasabpatilfreepptmba.com 9

- 10. Awareness Level of Personal Banking Products of SBI Bank The Structure of Indian Banking: The Indian banking industry has Reserve Bank of India as its Regulatory Authority. This is a mix of the Public sector, Private sector, Co-operative banks and foreign banks. The private sector banks are again split into old banks and new banks. Reserve Bank of India [Central Bank] Scheduled Banks Scheduled Scheduled Co-operative Banks Commercial Banks Public Sector Private Sector Foreign Regional Banks Banks Banks Rural Banks Nationalized SBI & its Scheduled Urban Scheduled State Banks Associates Co-Operative Co-Operative Banks Banks Old Private New Private Sector Banks Sector Banks Babasabpatilfreepptmba.com 10

- 11. Awareness Level of Personal Banking Products of SBI Bank Chart Showing Three Different Sectors of Banks: i) Public Sector Banks ii) Private Sector Banks Public Sector Banks SBI and Nationalized Regional Rural SUBSIDIARIES Banks Banks SBI and Subsidiaries: This group comprises of the State Bank of India and its seven subsidiaries viz., State Bank of Patiala, State Bank of Hyderabad, State Bank of Travancore, and State Bank of Bikaner and Jaipur, State Bank of Mysore, State Bank of Saurashtra, State Bank of India State Bank of India (SBI) is the largest bank in India. If one measures by the number of branch offices and employees, SBI is the largest bank in the world. Established in 1806as Bank of Bengal it is the oldest commercial bank in the Indian subcontinent. SBI provides various domestic, international and NRI products and services, through its vast network in India and overseas. With an asset base of $126 billion and its reach, it is a regional banking behemoth. The government nationalized the bank in1955, with the Reserve bank of India taking a 60% ownership stake. In recent years the bank has focused on two priorities, 1), reducing its huge staff through Golden handshake schemes known as the Voluntary Retirement Scheme, which saw many of its best and brightest defects to the private sector, and 2), computerizing its operations. The State Bank of India traces its roots to the first decade of19th century, when the Bank of Calcutta, later renamed the Bank of Bengal, was established on 2 jun 1806. The government amalgamated Bank of Bengal and two other Presidency banks, namely, the Bank of Bombay and the bank of Madras, and named the reorganized banking entity the Imperial Bank of India. All these Presidency banks were incorporated as companies, and were the result of the royal charters. The Imperial Bank of India continued to remain a joint stock company. Until the establishment of a central bank in India the Imperial Bank and its early predecessors served as the nation's central bank printing currency. The State Bank of India Babasabpatilfreepptmba.com 11

- 12. Awareness Level of Personal Banking Products of SBI Bank Act 1955, enacted by the parliament of India, authorized the Reserve Bank of India, which is the central Banking Organizational India, to acquire a controlling interest in the Imperial Bank of India, which was renamed the State Bank of India on30th April 1955.In recent years, the bank has sought to expand its overseas operations by buying foreign banks. It is the only Indian bank to feature in the top 100 world banks in the Fortune Global 1000 rating and various other rankings. According to the Forbes 2000 listing it tops all Indian companies. Nationalized banks: This group consists of private sector banks that were nationalized. The Government of India nationalized 14 private banks in 1969 and another 6 in the year 1980. In early 1993, there were 28 nationalized banks i.e., SBI and its 7 subsidiaries plus 20 nationalized banks. In 1993, the loss making new bank of India was merged with profit making Punjab National Bank. Hence, now only 27 nationalized banks exist in India. Regional Rural banks: The RBI established these in the year 1975 of banking commission. It was established to operate exclusively in rural areas to provide credit and other facilities to small and marginal farmers, agricultural laborers, artisans and small entrepreneurs. Private Sector Banks Private Sector Banks Old private new private Sector Banks Sector Banks Old Private Sector Banks: This group consists of the banks that were establishes by the privy sectors, committee organizations or by group of professionals for the cause of economic betterment in their Babasabpatilfreepptmba.com 12

- 13. Awareness Level of Personal Banking Products of SBI Bank operations. Initially, their operations were concentrated in a few regional areas. However, their branches slowly spread throughout the nation as they grow. New private Sector Banks: These banks were started as profit orient companies after the RBI opened the banking sector to the private sector. These banks are mostly technology driven and better managed than other banks. IMPORTANCE OF BANKING SECTOR IN A GROWING ECONOMY In the recent times when the service industry is attaining greater importance compared to manufacturing industry, banking has evolved as a prime sector providing financial services to growing needs of the economy. Banking industry has undergone a paradigm shift from providing ordinary banking services in the past to providing such complicated and crucial services like, merchant banking, housing finance, bill discounting etc. This sector has become more active with the entry of new players like private and foreign banks. It has also evolved as a prime builder of the economy by understanding the needs of the same and encouraging the development by way of giving loans, providing infrastructure facilities and financing activities for the promotion of entrepreneurs and other business establishments. For a fast developing economy like ours, presence of a sound financial system to mobilize and allocate savings of the public towards productive activities is necessary. Commercial banks play a crucial role in this regard. The Banking sector in recent years has incorporated new products in their businesses, which are helpful for growth. The banks have started to provide fee-based services like, treasury operations, managing derivatives, options and futures, acting as bankers to the industry during the public offering, providing consultancy services, acting as an intermediary between two-business entities etc. At the same time, the banks are reaching out to other end of customer requirements like, insurance premium payment, tax payment etc. It has changed itself from transaction type of banking into relationship banking, where you find friendly and quick service suited to your Babasabpatilfreepptmba.com 13

- 14. Awareness Level of Personal Banking Products of SBI Bank needs. This is possible with understanding the customer needs, their value to the bank, etc. This is possible with the help of well-organized staff, computer based network for speedy transactions, products like credit card, debit card, health card, ATM etc. These are the present trend of services. SBI Group The Bank of Bengal, which later became the State Bank of India. State Bank of India with its seven associate banks commands the largest banking resources in India. Nationalization The next significant milestone in Indian Banking happened in late 1960s when the then Indira Gandhi government nationalized on 19th July 1949, 14 major commercial Indian banks followed by nationalization of 6 more commercial Indian banks in 1980. The stated reason for the nationalization was more control of credit delivery. After this, until 1990s, the nationalized banks grew at a leisurely pace of around 4% also called as the Hindu growth of the Indian economy. After the amalgamation of New Bank of India with Punjab National Bank, currently there are 19 nationalized banks in India. Liberalization In the early 1990’s the then Narasimha rao government embarked a policy of liberalization and gave licenses to a small number of private banks, which came to be known as New generation tech-savvy banks, which included banks like ICICI and HDFC. This move along with the rapid growth of the economy of India, kick started the banking sector in India, which has seen rapid growth with strong contribution from all the sectors of banks, namely Government banks, Private Banks and Foreign banks. However there had been a few hiccups for these new banks with many either being taken over like Global Trust Bank while others like Centurion Bank have found the going tough. The next stage for the Indian Banking has been set up with the proposed relaxation in the norms for Foreign Direct Investment, where all Foreign Investors in Banks may be given voting rights which could exceed the present cap of 10%, at present it has gone up to 49% with some restrictions. Babasabpatilfreepptmba.com 14

- 15. Awareness Level of Personal Banking Products of SBI Bank The new policy shook the Banking sector in India completely. Bankers, till this time, were used to the 4-6-4 method (Borrow at 4%; Lend at 6%; Go home at 4) of functioning. The new Wave ushered in a modern outlook and tech-savvy methods of working for traditional banks. All this led to the PERSONAL boom in India. People not just demanded more from their banks but also received more. NEED FOR THE STUDY Babasabpatilfreepptmba.com 15

- 16. Awareness Level of Personal Banking Products of SBI Bank The Indian Banking industry comprises segments that provide comprehensive banking services to individuals, corporate and small business. Industry segments are Public Sector Banks, Private Sector Bank and Foreign Banks. In this Project the report is mainly focused on Awareness Level of Personal Banking Products of SBI. The Current Trends - Studying the personal banking products. The SBI customers are satisfied for using the SBI personal products of SBI Bank. Understanding the perception of customers about personal banking. To know the benefits to customers from SBI personal banking products. ORGANIZATION PROFILE Babasabpatilfreepptmba.com 16

- 17. Awareness Level of Personal Banking Products of SBI Bank STATE BANK OF INDIA Not only many financial institution in the world today can claim the antiquity and majesty of the State Bank Of India founded nearly two centuries ago with primarily intent of imparting stability to the money market, the bank from its inception mobilized funds for supporting both the public credit of the companies governments in the three presidencies of British India and the private credit of the European and India merchants from about 1860s when the Indian economy book a significant leap forward under the impulse of quickened world communications and ingenious method of industrial and agricultural production the Bank became intimately in valued in the financing of practically and mining activity of the Sub- Continent Although large European and Indian merchants and manufacturers were undoubtedly thee principal beneficiaries, the small man never ignored loans as low as Rs.100 were disbursed in agricultural districts against glad ornaments, added to these the bank till the creation of the Reserve Bank in 1935 carried out numerous Central – Banking functions. Adaptation world and the needs of the hour has been one of the strengths of the Bank, in the post depression exe. For instance – when business opportunities become extremely restricted, rules laid down in the book of instructions were relined to ensure that good business did not go post. Yet seldom did the bank contravene its value as depart from sound banking principles to retain as expand its business. An innovative array of office, unknown to the world then, was devised in the form of branches, sub branches, treasury pay office, pay office, sub pay office and out students to exploit the opportunities of an expanding economy. New business strategy was also evaded way back in 1937 to render the best banking service through prompt and courteous attention to customers. A highly efficient and experienced management functioning in a well defined organizational structure did not take long to place the bank an executed pedestal in the areas of business, Babasabpatilfreepptmba.com 17

- 18. Awareness Level of Personal Banking Products of SBI Bank profitability, internal discipline and above all credibility A impeccable financial status consistent maintenance of the lofty traditions if banking an observation of a high Standard of integrity in its operations helped the bank gain a pre- eminent status. No wonders the administration for the bank was universal as key functionaries of India successive finance minister of independent India Resource Bank of governors and representatives of chamber of commercial showered economics on it. Modern day management techniques were also very much evident in the good old day’s years before corporate governance had become a puzzled the banks bound functioned with a high degree of responsibility and concerns for the shareholders. An unbroken record of profits and a fairly high rate of profit and fairly high rate of dividend all through ensured satisfaction; prudential management and asset liability management not only protected the interests of the Bank but also ensured that the obligations to customers were not met. The traditions of the past continued to be upheld even to this day as the State Bank years it to meet the emerging challenges of the millennium ABOUT LOGO THE PLACE TO SHARE THE NEWS ...…… SHARE THE VIEWS …… Togetherness is the theme of this corporate loge of SBI where the world of banking services meets the ever-changing customer’s needs and establishes a link that is like a circle, it indicates complete services towards customers. The logo also denotes a bank that it has prepared to do anything to go to any lengths, for customers. The blue pointer represent the philosophy of the bank that is always looking for the growth and newer, more challenging, more promising direction. The keyhole indicates safety and security. LOGO Babasabpatilfreepptmba.com 18

- 19. Awareness Level of Personal Banking Products of SBI Bank THE PLACE TO SHARE THE NEWS ...…… SHARE THE VIEWS …… MISSION, VISION AND VALUES MISSION STATEMENT: To retain the Bank’s position as premiere Indian Financial Service Group, with world class standards and significant global committed to excellence in customer, shareholder and employee satisfaction and to play a leading role in expanding and diversifying financial service sectors while containing emphasis on its development banking rule. VISION STATEMENT: Babasabpatilfreepptmba.com 19

- 20. Awareness Level of Personal Banking Products of SBI Bank ♦ Premier Indian financial service group with prospective world-class standards of efficiency ♦ Retain its position in the country as pioneers in Development banking. ♦ Maximize the shareholders value through high-sustained earnings per Share. VALUES: ♦ Excellence in customer service ♦ Profit orientation ♦ Belonging commitment to Bank ♦ Fairness in all dealings and relations ♦ Risk taking and innovative ♦ Team playing ORGANIZATION: Basically an organization is a group of people intentionally organized to accomplish an overall, common goal or set of goals. Business organizations can range in size from two people to tens of thousands. There are several important aspects to consider about the goal of the business organization. These features are explicit (deliberate and recognized) or implicit (operating unrecognized, "behind the scenes"). Ideally, these features are carefully considered and established, usually during the strategic planning process. (Later, we'll consider dimensions and concepts that are common to organizations.) Types of organization a. Formal organization. b. Informal organization. a. Formal organization: The formal organization or group exists in all organization. It is a group of the people working together in all co-operations under the authority towards common goal, objectives for the mutual benefit of the participants. The formal groups are created to carry out some specific work to meet some goals of the organization b. Informal Organization: Babasabpatilfreepptmba.com 20

- 21. Awareness Level of Personal Banking Products of SBI Bank The informal organization refers to relationship between peoples in the organization based not on procedure and regulation laid down in the organization but on the personal attitude friendship or some common interest which may or may not be work related informal organization. Departmentation: Departmentation is the process of dividing and grouping the activities of an enterprise in the various units for the purpose of administration. The units for the purpose of administration .the units are designated as departments’ division sector or branches. Departmentation facilitates the benefits of specialization. It aims at achieving units of directing, co-operation, co-ordination, control and effective communication. It leads to effective performance of activities of the enterprise ORGANISATION STRUCTURE MANAGING DIRECTOR CHIEF GENERAL MANAGER G. M G.M G. M G. M G. M (Operations) (C&B) (F&S) (I) & CVO (P&D) Zonal officers Functional Heads Regional officers OUR BUREAU Babasabpatilfreepptmba.com 21

- 22. Awareness Level of Personal Banking Products of SBI Bank MR O.P. BHATT SBI Chairman Mumbai, June 30 Mr. O.P. Bhatt, Managing Director, State Bank of India has been appointed Chairman of the bank. The five-year term of Mr. Bhatt will expire in March 2011. His will be the longest tenure as SBI chairman in the recent past. Mr. Bhatt took charge as the Managing Director, in-charge of national banking at SBI in April. Prior to this he was the MD, State Bank of Travancore. Mr. T.S. Bhattacharya, the other SBI MD, was appointed as acting chairman, following the retirement of Mr. A.K. Purwar as chairman in May. However, Mr. Bhattacharya did not have a two-year residual service, necessary for the post of chairman. The announcement of Mr. Bhatt's appointment came on Friday at the SBI annual general meeting in Mumbai. It was during his tenure as MD of SBI that the bank had implemented core-banking solution in all its branches. Starting his career as a probationary officer in SBI in 1972, Mr. Bhatt held several key assignments in the bank. He served as Managing Director of State Bank of Travancore from January 2005 to April 2006. LIST OF DIRECTORS Babasabpatilfreepptmba.com 22

- 23. Awareness Level of Personal Banking Products of SBI Bank Sl.no Name of Directors Sec. of SBI Act, 1955 1 Shri O.P. Bhatt 19(a) Chairman 2 Shri T.S. Bhattacharya 19 (b) MD & GE (CB) 3 Shri S.K. Bhattacharyya 19(b) MD & CC&RO 4 Shri Suman Kumar Bery 19(c) 5 Dr. Ashok Jhunjhunwala 19(c) 6 Shri Ananta Chandra Kalita 19(ca) 7 Shri Amar Pal 19(cb) 8 Shri Piyush Goyal 19(d) 9 Dr. DevaNand Balodhi 19(d) 10 19(d) Prof. Mohd. Salahuddin An sari 11 Shri Vinod Rai 19(e) 12 19(f) Smt. Shyamala Gopinath PERSONAL BANKING SCENARIO Babasabpatilfreepptmba.com 23

- 24. Awareness Level of Personal Banking Products of SBI Bank Personal banking includes a comprehensive range of financial products viz. deposit products, residential mortgage loans, credit cards, auto finance, personal loans, consumer durable loans, loans against equity shares, loans for subscribing to initial public offers (IPO’s), debit cards, bill payment services, mutual funds, investment advisory services. These products provide an opportunity for banks to diversify the asset portfolio with high profitability and relatively low NPAs. The categorization of Personal banking segment and have identified it as a principal growth driver. They are slowly gaining market share in the PERSONAL space. For several years, banks viewed consumer loans with skepticism. Commercial loans dominated the banks portfolio as they generate high net yields with low credit risk. Consumer loans in contrast involved smaller amounts, large staff to handle accounts and high default rates. The banks considered them substandard. Even the regulators across the globe have not encouraged consumer finance till very recently. However, over the past few years, fierce competition among the banks lowered the spreads and profitability on commercial loans. With deregulation and increase in consumer loan rates, the risk-adjusted returns in PERSONAL sector have exceeded the returns on commercial loans. The enormous competition has led to innovative Personal banking products that are extremely customer-friendly and plug the loopholes in the existing similar products. The growth in Personal banking has been facilitated by the growth in banking technology and automation of banking processes that enable extension of reach and rationalization of costs. ATM’s have emerged as an alternative banking channel, which facilitate low cost transaction vis-à-vis traditional branches. It also has the advantage of reducing the branch traffic and enable banks with small networks to upset the traditional disadvantages by increasing their reach and spread. The Personal banking industry is diverse and competitive. In addition, to checking and savings account services, banks offer brokerage and insurance capabilities to manage all Babasabpatilfreepptmba.com 24

- 25. Awareness Level of Personal Banking Products of SBI Bank aspects of a customer’s financial portfolio. Attracting profitable customers from competitors is essential for long-term success. Personal banking has both pros and cons. In the present situation, the bankers have very little option, but to chant ‘PERSONAL mantra’. Banks today face complex challenges on multiple fronts. Customer expectations are higher then ever, with growing demand for more rapid service delivery and more flexible, personalized interaction. PERSONAL BANKING IN INDIA The stagnation in Indian economy has resulted in poor credit absorption both for long term funding to big-ticket projects as well as working capital. The slow down could be attributed to lack of credit off-take by the industrial sector even as food credit continued to search. This has resulted in limited lending opportunities to banks. Major portion of the loans raised by corporate were to replace the existing high cost funding and is more in the nature of arbitraging on the interest rates with various banks. The loan products to corporate with Strong financial are now almost linked to prices of government securities- or mark up over government paper, more over, big corporate are bypassing banks and rising money through the debt market and commercial papers, which are cheaper than bank credit. Therefore banks are being forced to look at the mid corporate. The tough macro economic environment, increasing risk profile and low yield indicate that corporate banking has entered the maturity face. To survive and prosper amid the rapid changes that continue to redefine financial services market place, banks hitherto concentrating on corporate borrowers are embarking now on a strategy driven by Personal banking and fee based income in order to maintain asset growth and profitability. The ratio of non-interest income to total funds has already increased for some banks. Babasabpatilfreepptmba.com 25

- 26. Awareness Level of Personal Banking Products of SBI Bank The critical success factors of banks, which are aggressively moving in the Personal banking segment are wider distribution network, low cost of funding, low intermediation (operating) costs, marketing capability, large product portfolio, cross-selling, proper credit appraisal mechanism/risk assessment procedures, high service levels in terms of faster loan processing and disbursement, flexible technology across banking platforms, multi-distribution channels, strong brand presence and good recovery mechanism. These success factors would ultimately transform into how well banks understand their customers and how effective they are in meeting their new definition of access, convenience and value. GROWTH OF PERSONAL INDUSTRY The income levels and employment opportunities for young persons have risen in the IT, ITES and BPO fields where salaries are generally higher by about 20 to 30%. According to the officials of Standard Chartered Bank, the number of young people in the age of 20 to 24 who join the workforce is around three million. With a large amount of disposable income and no financial commitments towards the family, they form a major chunk of customers for consumer durables and FMCG. PERSONAL industry is the fastest growing industry in India, whose growth is attributed to ideal breeding ground in the form of huge market, rising income levels, surplus disposable income, increasing awareness due to growth of advertisement and cable television channels and the entry of multinational brands. It is estimated that the PERSONAL market is about Rs 9, 00,000 cr and growing at a rate of 8.5% per annum. Based on market figures, it is estimated that the PERSONALING industry will grow from 2 to 10% in the next five years added to this is the fact that growth in PERSONAL industry has increased employment opportunities in this field which in turn raises the demand for PERSONAL and consumer goods. SBI’S PERSONAL BANKING Babasabpatilfreepptmba.com 26

- 27. Awareness Level of Personal Banking Products of SBI Bank State Bank of India offers a wide range of services in the Personal Banking Segment, which are indexed here. Our products are designed with flexibility to suit your personal requirements. Enjoy 24-hour facility through our ATMs - growing speedily it has crossed the 10000 mark Watch this space for more details. SBI Term Deposits SBI Loan For Pensioners SBI Recurring Deposits Loan Against Mortgage Of Property SBI Housing Loan Loan Against Shares & Debentures SBI Car Loan SBI Educational Loan SBI Personal Loan Medic-Plus Scheme Babasabpatilfreepptmba.com 27

- 28. Awareness Level of Personal Banking Products of SBI Bank TERM DEPOSITS Now you can earn a higher income on your surplus funds by investing those with us. We provide security, trust and competitive rate of interest. Flexibility in period of term deposit from 7 days to 10 years. Affordable Low Minimum Deposit Amount: You can open a term deposit with SBI for a nominal amount of Rs.1000/- only. Please check our Interest Rates online or simply email through our Helpline. Flexibility in choosing the amount you wish to invest and the maturity period. HIGHLIGHTS Safety - We understand the value of your hard earned money and continue to deliver on our promise of safety and security over 200 years. Liquidity Loan /overdraft facility: You can avail a loan/overdraft against your deposits provides you loan / overdraft up to 90% of your deposit amount at nominal cost. So you continue to earn interest in your deposit and still can meet your urgent financial requirements. Premature Withdrawal Interest to be charged on premature withdrawal of term deposits at 0.5% below the rate applicable for the period deposit has remained with the Bank. Transferability- Transfer of Term Deposits between our wide networks of branches without any charge. Compounding / Flexible / Timely Payment of Interest - Under our Special Term Deposit Scheme, interest accrues in your account and gets compounded quarterly. Besides, we assure timely delivery of the proceeds of your deposit with interest, on maturity. Flexibility of payment on maturity through Cash (subject to prevalent Income Tax Act), Banker's Cheque, Credit in Savings Bank/Current account. Term Deposits are available at all SBI Branches Nomination Facility - Available. Automatic Renewals Babasabpatilfreepptmba.com 28

- 29. Awareness Level of Personal Banking Products of SBI Bank There is no need for you to keep track of the maturity of your deposits. Your deposits with us will be renewed automatically, post maturity. And you continue to earn interest for same period as that of your matured deposit, at the interest rate prevailing at the time of maturity. Automatic renewals take place where there are no standing instructions for renewal. Flexibility to convert your Special Term Deposit to Term Deposit and vice versa You can convert your special Term Deposit to a Term Deposit to receive monthly/quarterly interest payments to match your financial requirements. You can also convert your Term Deposit to a Special Term Deposit, which provides compounded rate of interest to multiply your money faster. RECURRING DEPOSIT Want to create a fund for your children's education or marriage or to buy a car or for a dream holiday? Whatever may be your financial goals, through our Recurring Deposit Scheme you can save a little every month so that at the time of need you have sufficient funds to achieve your financial goals. Recurring Deposit provides you the element of compulsion to save at high rates of interest applicable to Term Deposits along with liquidity to access that savings any time. So set aside a small amount every month and earn at compounded rates of interest. Wide Choice in Period of Deposit • Flexibility in period of deposit with maturity ranging from 12 months to 120 months. • Low minimum monthly deposit amount. • You can start a Recurring Deposit with SBI for a monthly instalment of Rs.100/- only. SBI Term Deposit Rates Apply • Check out our Interest Rates Online or simply email through our Helpline • Choose the amount you wish to invest and the maturity period. HIGHLIGHTS • Safety We understand the value of your hard earned money and continue to deliver on our promise of safety and security over two centuries. Babasabpatilfreepptmba.com 29

- 30. Awareness Level of Personal Banking Products of SBI Bank • Liquidity Loan /overdraft facility: You can avail a loan/overdraft against your deposits provides you loan / overdraft up to 90% of your deposit amount at nominal cost. So you continue to earn interest in your deposit and still can meet your urgent financial requirements. • Transferability Transfer of Recurring Deposit accounts between our wide networks of branches without any charge. • Regular Instalments to your Account Now you have motivation/compulsion to save a chosen amount every month and create a fund, which helps you to meet your future financial needs. • Recurring Deposits are available at all SBI Branches • Easy and convenient access of information at SBI Internet Banking Other Benefits Nomination Facility – Available Regular Instalments to your Account –Save in your account through Fixed Monthly Instalments. –Monthly Instalments can be deposited on any working day of the month. –Delayed monthly instalments attract penalty. –Instalments payable in multiples of Rs.10/- Free Fund Transfer & Regular Updates Free transfer of your funds through standing instructions from your Current or Savings Bank Account to your Recurring Deposit Account every month for the payment of your instalments, so that you do not have to worry about regular payments. You can monitor your deposit through SBI Internet Banking or through a passbook issued to you. Babasabpatilfreepptmba.com 30

- 31. Awareness Level of Personal Banking Products of SBI Bank SBI HOME LOANS "THE MOST PREFERRED HOME LOAN PROVIDER" voted in AWAAZ Consumer Awards along with the MOST PREFERRED BANK AWARD in a survey conducted by TV 18 in association with AC Nielsen-ORG Marg in 21 cities across India. SBI Home Loans come to you on the solid foundation of trust and transparency built in the tradition of State Bank of India. Best Practices followed in SBI mentioned below will tell why it makes sense to do business with State Bank of India Best practices followed in SBI People dealing End to End service by Permanent employees of SBI who are with you accountable to you. SBI branch of your choice will service your loan account. You can Place always meet our employees face to face. Complete transparency. Price Interest charged on the daily reducing balance. Babasabpatilfreepptmba.com 31

- 32. Awareness Level of Personal Banking Products of SBI Bank No penalty for prepayments made, out of bonafide savings or Prepayment charges windfall gains for which evidence is produced. Costs hidden in fine No hidden costs print Complete transparency. All the features of our product, including Transparency interest rates, are in the public domain. UNIQUE FEATURES: Provision for on the spot "In principle" approval. Loan sanctioned within 6 days of submission of required documents. Provision to finance cost of furnishing and consumer durables as part of project cost Repayment permitted up to 70 years of age Free personal accident insurance cover up to Rs.40 Lac. Optional Group Insurance from SBI Life at Concessional premium (Upfront premium financed as part of project cost) Interest calculated on daily reducing balance basis, and starts from the date of disbursement. Babasabpatilfreepptmba.com 32

- 33. Awareness Level of Personal Banking Products of SBI Bank ‘Plus’ schemes, which offer attractive packages with Concessional, interest rates to Govt. Employees, Teachers, and Employees in Public Sector Oil Companies. Special scheme to grant loans to finance Earnest Money Deposits to be paid to Urban Development Authority/ Housing Board, etc. in respect of allotment of sites/ house/ flat Option to avail loan at the place of employment or at the place of construction Package of exclusive benefits: • Complimentary international ATM-Debit card • Complimentary SBI Classic/ International Credit Card. • Option for internet-banking • Concessional package under ‘Credit Khazana’ for prospective Auto Loan, Student Loan, Personal Loan borrowers whose accounts are conducted satisfactorily • 100% concession in charges in respect of all personal remittances/ collection of outstation cheques. Personal loan at attractive rates under SBI Home Plus scheme tailored exclusively for SBI Home Loan customers. Purpose Purchase/ Construction of House/ Flat Purchase of a plot of land for construction of House Extension/ repair/ renovation/ alteration of an existing House/ Flat Purchase of Furnishings and Consumer Durables as a part of the project cost. Take over of an existing loan from other Banks/ Housing Finance Companies. Eligibility Minimum age: 18 years as on the date of sanction. Maximum age limit for a Home Loan borrower is fixed at 70 years, i.e. the age by which the Babasabpatilfreepptmba.com 33

- 34. Awareness Level of Personal Banking Products of SBI Bank loan should be fully repaid, availability of sufficient, regular and continuous source of income for servicing the loan repayment. Loan Amount 40 to 60 times of NMI, depending on repayment capacity as % of NMI as under – Net Annual Income EMI/NMI Ratio Up to Rs.2 lacks 40% Above Rs.2 lacks to Rs. 5 lacks 50% Above Rs. 5 lacks 55% To enhance loan eligibility you have option to add: 1. Income of your spouse/ your son/ daughter living with you, provided they have a steady income and his/ her salary account is maintained with SBI. 2. Expected rent accruals (less taxes, etc.) if the house/ flat being purchased are proposed to be rented out. 3. Depreciation, subject to some conditions and Regular income from all sources. Margin (Special Festival Season Offer) Purchase/ Construction of a new House/ Flat/ Plot of land: 15% for loans up to Rs. 1 cr., 20% for loans above Rs. 1 cr. Repairs/ Renovation of an existing House/ Flat: 15% Interest Processing Fee (Special Festival Season Offer) 0.25% of Loan amount with a cap of Rs.5, 000/-(including Service Tax) Pre-closure Penalty No penalty if the loan is pre closed from own savings/windfall gains for which documentary evidence is produced by the customer. In case, the borrower does not produce such proof, penalty @2% on the amount prepaid in Babasabpatilfreepptmba.com 34

- 35. Awareness Level of Personal Banking Products of SBI Bank excess of normal EMI dues shall be levied if the loan is pre closed within 3 years from the date of commencement of repayment. Security Equitable mortgage of the property Other tangible security of adequate value like NSCs, Life Insurance policies etc., if the property cannot be mortgaged Maximum Repayment Period For applicants up to 70 years of age: 20 years For applicants over 70 years of age: 15 years Moratorium Up to 18 months from the date of disbursement of first installment or 2 months after final disbursement in respect of loans for construction of new house/ flat (moratorium period will be included in the maximum repayment period) Disbursement In lump sum direct in favor of the builder/ seller in respect of outright purchase In stages depending upon the actual progress of work in respect of construction of house/ flat etc. Documents Completed application form Passport size photograph Proof of Identity – PAN Card/ Voters ID/ Passport/ Driving License Proof of Residence – Recent Telephone Bill/ Electricity Bill/ Property tax receipt/ Passport/ Voters ID Proof of business address in respect of businessmen/ industrialists Babasabpatilfreepptmba.com 35

- 36. Awareness Level of Personal Banking Products of SBI Bank Sale Deed, Agreement of Sale, Letter of Allotment, Non encumbrance certificate, Land/ Building Tax paid receipt etc. (as applicable and subject to satisfaction report from our empanelled lawyer) SBI-FLEXI’ HOME LOANS A customized product designed to enable borrowers to hedge their Home Loan against unfavorable movement in interest rates. The product gives you a one time irrevocable option to choose one of the three customized combinations of fixed and floating interest rates and also to choose the order in which the fixed and floating rate will be availed. Minimum Loan Amount: Rs.5 lacks (Other terms and conditions – as applicable to regular Home Loans) SBI-MAXGAIN’ HOME LOANS An innovative and customer-friendly product to enable you to earn optimal yield on your savings and minimize interest burden on Home Loans, with no extra cost. The loan is granted as an Overdraft facility with the added flexibility for you to operate your Home Loan Account like your SB or Current Account. The product serves to minimize your interest cost by enabling you to park your surplus funds in ‘SBI-Max gain’ (with the benefit to withdraw the surplus funds whenever you require), specially in the wake of low yields from other deposit/ investment avenues. Minimum Loan Amount: Rs.5 lacks (Other terms and conditions – as applicable to regular Home Loans) SBI-REALTY’ HOME LOANS A unique product if you are on the look out for a loan to purchase a plot of land for house construction. The loan is available for a maximum amount of Rs.20 lacks and with a comfortable repayment period of up to 15 years. You are also eligible to avail another Housing Loan for construction of house on the plot financed above with the benefit of running both the loans concurrently. (House construction should commence within 2 years from the date of a ailment of ‘SBI- Realty’ Housing Loan) (Other terms and conditions – as applicable to regular Home Loans) Babasabpatilfreepptmba.com 36

- 37. Awareness Level of Personal Banking Products of SBI Bank SBI FREEDOM’ HOME LOANS A revolutionary product designed for customers who are on the look out for a source of finance for a property they want to invest in without mortgaging the same. All you have to do is pledge any financial security that you have and you will get a Home Loan for your dream home, a must-take for those who do not want to pay stamp duty for mortgage of their property or go through the hassles of creation of mortgage. You also have an option to take the loan by way of mortgage of the property and pledge financial securities in lieu of margin money. Repayment is highly customized, giving you the option to repay through regular EMIs or through maturity proceeds of the securities pledged. (Other terms and conditions – as applicable to regular Home Loans) SBI-OPTIMA ADDITIONAL HOME LOANS SBI-HOMELINE SPECIAL PERSONAL LOANS Innovative and value added products extended to existing Home loan borrowers with a satisfactory repayment record of 3 years and whose loan is Standard Asset, with a view to reinforce the customer loyalty and to maintain long term relationship with the borrowers. In case of take-over of Home Loans from other Banks/HFCs, the borrower should have fulfilled the above conditions with the present Bank/HFC. Purpose ‘SBI-Optima’ Additional Home Loans to meet expenditure towards major repair, renovation, addition to their house/flat, purchase of furniture, fixtures and consumer durables ‘SBI-Homeline’ Special Personal General purpose loan to meet expenditure to Loans meet foreseen/unforeseen contingencies Babasabpatilfreepptmba.com 37

- 38. Awareness Level of Personal Banking Products of SBI Bank Eligibility ‘SBI-Optima’ Additional Home Loans 18 times NMI (for salaried borrowers)/ 1 ½ times NAI ( for others) or (i)25% of the original project cost of house/flat (ii) 85% of the cost of repairs etc. or (iii) gap between 85% of the current market price of flat/house and actual outstanding loan dues , Whichever is lower (EMI/NMI ratio of all loans should not exceed 60%) ‘SBI-Homeline’ Special Personal Loans 18 times NMI (for salaried borrowers)/ 1 ½ times NAI (for others) Interest Rates/processing fee ‘SBI-Optima’ Additional Home Loans As applicable to Home Loans ‘SBI-Homeline’ Special Personal Loans Interest rates 50bps above rates applicable to the repayment tenure (floating rates only) Processing fee : 0.50% of the loan amount (including service tax) Other Salient Features Inbuilt provision for a ailment of the loans on the expiry of each bloc of 5 years, the first bloc commencing on the expiry of 5 years from the date of sanction of original Home Loan. Original Home Loan and all ‘SBI-Optima’ Home Loans/’SBI-Home line’ Personal Loans can run concurrently Comfortable repayment obligations – Tenure of the loans equal to the residual maturity of the original Home Loans – Babasabpatilfreepptmba.com 38

- 39. Awareness Level of Personal Banking Products of SBI Bank CAR LOAN Move ahead in life with SBI Car Loans! If you have been putting off purchasing that Car, we invite you to go through our Car Loan Scheme. Low interest rates, easy repayment options, total transparency, finance to include vehicle registration charges, insurance, one-time road tax and accessories (subject to conditions).Well, what are you waiting for? Just contact any of our branches (more than 6000) that offer Car Loans or our Personal Banking Branches and give wheels to your desire! You can apply for an SBI Car Loan to purchase: • A new car, jeep, Multi Utility Vehicle (MUV) or SUV (any make or model) • A used car / jeep / MUV /SUV (not more than 5 years old). (any make or model) Enjoy the SBI Advantage: Excellent service and lower costs. A quick survey of similar schemes available elsewhere and you will find that SBI Car Loans for new and old vehicles offer you: • Lowest interest rates • Longer repayment period of unto 84 months. • No hidden costs or administrative charges. • Finance for one-time road tax, registration fee, insurance premium and accessories Babasabpatilfreepptmba.com 39

- 40. Awareness Level of Personal Banking Products of SBI Bank • No advance EMIs. (Some Banks/companies ask you to pay one or more EMIs at the time of disbursement of loan, thereby effectively reducing your loan amount.) • Complete transparency: We levy interest on daily reducing balance method. When you pay one installment, the interest is automatically calculated on the reduced balance thereafter. When you pay interest on an annual reducing balance, as charged by many other companies/banks, the interest amount for the coming year is determined on the amount outstanding at the beginning of the year. You continue to pay interest even on the amounts you repay during the year. The Scheme Purpose You can take finance for: A new car, jeep or Multi Utility Vehicles (MUVs) A used car / jeep (not more than 5 years old). (Any make or model). Take over of existing loan from other Bank/Financial institution (Conditions apply) Eligibility: To avail an SBI Car Loan, you should be: • Individual between the ages of 21-65 years of age. • A Permanent employee of State / Central Government, Public Sector Undertaking, Private company or a reputed establishment or • A Professionals or self-employed individual who is an income tax assesses or • A Person engaged in agriculture and allied activities. • Net Annual Income RS. 100,000/- and above. SALIENT FEATURES Loan Amount There is no upper limit for the amount of a car loan. A maximum loan amount of 2.5 times the net annual income can be sanctioned. If married, your spouse's income could also be considered provided the spouse becomes a co-borrower in the loan. The loan amount includes finance for one-time road tax, registration and insurance. No ceiling on the loan amount for new cars. Loan amount for used car is subject to a maximum limit of RS. 15 lacks. Babasabpatilfreepptmba.com 40

- 41. Awareness Level of Personal Banking Products of SBI Bank Types of Loan: 1. Term Loan 2. Overdraft - a) For New vehicles only b) Minimum loan amount: RS. 3 lacks. Documents required you would need to submit the following documents along with the completed application form if you are an existing SBI account holder: 1. Statement of Bank account of the borrower for last 12 months. 2. 2 passport size photographs of borrower(s). 3. Signature identification from bankers of borrower(s). 4. A copy of passport /voters ID card/PAN card. 5. Proof of residence. 6. Latest salary-slip showing all deductions 7. I.T. Returns/Form 16: 2 years for salaried employees and 3 years for professional/self- employed/businessmen duly accepted by the ITO wherever applicable to be submitted. 8. Proof of official address for non-salaried individuals. If you were not an account holder with SBI you would also need to furnish documents that establish your identity and give proof of residence. EDUCATION LOAN A term loan granted to Indian Nationals for pursuing higher education in India or abroad where admission has been secured. Babasabpatilfreepptmba.com 41

- 42. Awareness Level of Personal Banking Products of SBI Bank Eligible Courses All courses having employment prospects are eligible. • Graduation courses/ Post graduation courses/ Professional courses • Other courses approved by UGC/Government/AICTE etc. Expenses considered for loan • Fees payable to college/school/hostel • Examination/Library/Laboratory fees • Purchase of Books/Equipment/Instruments/Uniforms • Caution Deposit/Building Fund/Refundable Deposit • Travel Expenses/Passage money for studies abroad • Purchase of computers considered necessary for completion of course • Cost of a Two-wheeler up to RS. 100,000/- Any other expenses required to complete the course like study tours, project work etc. Amount of Loan • For studies in India, maximum RS. 10 lacks • Studies abroad, maximum RS. 20 lacks Interest Rate For loans up to RS.4 lacks - 12.75% p.a. Floating For loans above RS.4 lacks - 13.75% p.a. Floating Processing Fees • No processing fee/ upfront charges • Deposit of RS. 10000/- for education loan for studies abroad which will be adjusted in the margin money Repayment Tenure Repayment will commence one year after completion of course or 6 months after securing a job, whichever is earlier. Babasabpatilfreepptmba.com 42

- 43. Awareness Level of Personal Banking Products of SBI Bank Place of Study Loan Amount Repayment Period in Years Up to RS. 7.5 lacks 5-7 In India Above RS. 7.5 lacks 5-10 Up to RS. 15 lacks 5-7 Abroad Above RS. 15 lacks 5-10 Margin • For loans up to RS.4.0 lacks: No Margin • For loans above RS.4.0 lacks: o Studies in India: 5% o Studies Abroad: 15% Security Amount Studies In India Studies Abroad Up to RS. 4 lacks No Security No Security Above RS. 4 lacks to RS. 7.100 Suitable third Party Suitable third Party Guarantee lacks Guarantee Above RS. 7.100 lacks to RS. 10 Tangible Collateral Tangible Collateral security of suitable lack (India)/ RS. 15 lacks(Abroad) security for full value of value of loan or suitable third party loan guarantee. Tangible Collateral security for full RS 15 lacks to RS. 20 lacks ___ value of loan Documentation Required • Completed Education Loan Application Form. • Mark sheets of last qualifying examination • Proof of admission scholarship, studentship etc • Schedule of expenses for the specified course • 2 passport size photographs • Borrower's Bank account statement for the last six months LOAN TO PENSIONERS Babasabpatilfreepptmba.com 43

- 44. Awareness Level of Personal Banking Products of SBI Bank If you are a Central or State Government pensioner drawing your pension through one of our branches and are not more than 72 years of age, you can avail of a loan from your branch to meet your personal expenses. We understand you may have an urgent or unexpected need for funds or a family obligation to be fulfilled and appreciate your association with us. You can avail a loan of up to a maximum of 12 months pension, subject to a ceiling of Rs.1, 00,000. The documentation is easy. The loan may be repaid over 5 years and will carry a low interest rate of 13.25% p.a.There are no processing fees, no hidden costs and no prepayment penalties. Whenever you have some surplus funds, you can credit your loan account, thereby reducing your loan liability and interest burden. SALIENT FEATURES OF THE SCHEME Eligibility: All Central and State Government pensioners, whose pension accounts are maintained by our branches, the pensioner should not be more than 72 years of age. Purpose: & Loan Amount: To meet personal expenses. A maximum of 12 months pension with a ceiling of Rs.1, 00,000/- Margin and Security: Margin is NIL and the spouse eligible for family pension should guarantee the loan or any other family member or a third party worth the loan amount. Repayment: 60 Equated Monthly Installments (EMIs) – if age of Pensioner at the time of loan sanction is up to 70 years Babasabpatilfreepptmba.com 44

- 45. Awareness Level of Personal Banking Products of SBI Bank Rate of Interest: 0.100% above SBAR floating i.e. 13.25% p.a. Authorized Branches: All branches maintaining pension accounts. The facility is available only from the branch, which is maintaining pension account of the applicant. PROPERTY LOAN A dream comes true! An ALL PURPOSE LOAN for anything that life throws up at Customer! Do you need funds for a Marriage ceremony, want to take your family to a well- deserved holiday or for a sudden medical emergency? Customers have some property, but would rather not sell it? Then why not avail of this ALL PURPOSE LOAN from SBI? SBI now makes it very much possible for you to only keep your property but also have liquid funds. Enjoy the SBI Advantage Complete transparency in operations Access this loan from our wide network of branches Interest rates are levied on a monthly/daily reducing balance method Lowest processing charges. Long repayment period of 60 months, up to 120 months for salaried individuals with check-off facility No Hidden costs or administrative charges. No prepayment penalties. You can have surplus funds at any time thereby conveniently reducing your loan liability and interest burden. Property Loan Scheme Avail of an All-Purpose loan against mortgage of any of your property. We offer you these loans at all our Personal Banking Branches and those branches having Personal Banking Babasabpatilfreepptmba.com 45

- 46. Awareness Level of Personal Banking Products of SBI Bank Divisions amongst others. Purpose This is an all-purpose loan, i.e., the loan can be obtained for any purpose whatsoever. If amount of loan is Rs.25.00 lacks and above then purpose of loan will have to be specified along with an undertaking that loan will not be used for any speculative purpose whatever including speculation on real estate and equity shares. Eligibility: A. An individual who is; a. an Employee or b. a Professional, self-employed or an income tax assesseeor. c. Engaged in agricultural and allied activities. B. Your Net Monthly Income (salaried) is in excess of Rs.12, 000/- or Net Annual Income (others) is in excess of Rs.1, 100,000/-. The income of the spouse may be added if he/she is a co-borrower or a guarantor. C. Maximum age limit: 60 years. SALIENT FEATURES Loan Amount Minimum: Rs.25, 000/- Maximum: Rs.1 crores. The amount is decided by the following calculation: 24 times the net monthly income of salaried persons (Net of all deductions including TDS) OR 2 times the net annual income of others (income as per latest IT return less taxes payable) Margin SBI will finance up to 75% of the market value of your property. Interest: Term Loan 0.75% above SBAR. i.e.13.100% p.a. Floating Repayment Maximum of 60 equated monthly installments, up to 120 months for salaried individuals with Babasabpatilfreepptmba.com 46

- 47. Awareness Level of Personal Banking Products of SBI Bank check-off facility. You could opt to divert any surplus funds towards prepayment of the loan without attracting any penalty and Security, as per banks extant instructions. LOAN AGAINST SHARES DEBENTURES. Do you need urgent cash but you don't wish to sell or liquidate your holding of shares? Leverage your investments in shares, debentures, public sector bonds and Government securities for loans to meet unforeseen expenses!! You need not miss out on the next stock market boom!! Avail of loans up to Rs.20.00 lacks against your shares/debentures to enable you to meet contingencies, personal needs or even for subscribing to rights or new issue of shares. Note: Loan will not be sanctioned for 1. Speculative purposes 2. Inter-corporate investments or 3. Acquiring controlling interest in company/companies. Enjoy the SBI advantage • Low interest rates. Further, we charge interest on a daily reducing balance!! • Low processing charges; only 1% of loan amount - compare with 1-3% of others. • No hidden costs or administrative charges.. • No prepayment penalties. Reduce your interest burden and optimally utilize your surplus funds by prepaying the loan. The Scheme Eligibility This facility is available to our existing individual customers enjoying a strong relationship Babasabpatilfreepptmba.com 47

- 48. Awareness Level of Personal Banking Products of SBI Bank with SBI. This loan could be availed either singly or as a joint account with spouse in 'either or Survivor'/ 'Former or Survivor' mode. It is offered as an Overdraft or Demand Loan. The facility is available at 100 select centers. Salient Features Purpose For meeting contingencies and needs of personal nature, loan will be permitted for subscribing to rights or new issue of shares / debentures against the security of existing shares / debentures. Loan will not be sanctioned for (i) speculative purposes (ii) inter-corporate investments or (iii) acquiring controlling interest in company / companies. Loan Amount You can avail of loans up to Rs 20.00 lacks against your shares/debentures. Documents Required You will be required to submit a declaration indicating: • Details of loans availed from other banks/ branches for acquiring shares/ debentures. • Details of loans availed from other banks/ branches against security of shares/ debentures Margin & Interest You will need to provide a margin amount of 100% of the prevailing market prices of the shares/ non-convertible debentures being offered as security. (The market prices refer to the prices in the Stock Exchanges as reported in the Economic Times.) Repayment Schedule To be liquidated in maximum period of 30 months through a suitable reducing DP programmed. In case of a default or if the outstanding is over Rs.20.00 lacks, the shares/debentures will be transferred in the name of the Bank. Security: Pledge of the demat shares/debentures against which overdraft is granted. List of Identified Centers 1 Ahmedabad Baroda Surat Gandhinagar Rajkot Babasabpatilfreepptmba.com 48

- 49. Awareness Level of Personal Banking Products of SBI Bank 2 Bangalore Mysore 3 Bhopal Indore Jabalpur Raipur Gwalior 4 Bhubaneswar Cuttack Sambalpur 5 Chandigarh Jallandhar Ludhiana Amritsar 6 Chennai Coimbatore Tirupur 7 Guwahati Shillong 8 Hyderabad Visakhapatnam Karimnagar Tirupati 9 Kolkatta Siliguri Asansol (Bardhamon) 10 Lucknow Varanasi Kanpur Allahabad 11 Mumbai Pune Panjim Aurangabad Nagpur 12 New Delhi Jaipur Agra Udaipur 13 Patna Ranchi Bhagalpur 14 Thiruvananthapuram Cochin Coverage Scheme is available at select branches at 100 centers. MEDI-PLUS SCHEME Babasabpatilfreepptmba.com 49

- 50. Awareness Level of Personal Banking Products of SBI Bank For spreading smiles and cheers on the faces of our customers, we've launched a new loan scheme keeping specialized medical treatments in mind - a scheme that we call Medic Plus! Enjoy the SBI advantage: • Concessions in margin amounts, interest rates and processing charges!! • Lowest interest rates. Further, we charge interest on a daily reducing balance!! • Lowest processing charges; only 1% of loan amount -(compare with 1-3% of others.) • No hidden costs or administrative charges. • No prepayment penalties. Reduce your interest burden and optimally utilize your surplus funds by prepaying the loan. • Flexible repayment period. The Scheme The Specialized Medical Treatments, not only do the cost implications run into several lacks of rupees, but more often than not, these liquid funds also need to be generated at a very short notice, in order to be able to make prompt hospital bill payments… With this in mind, Medic Plus is specially designed to make life simpler for you under what could well be trying circumstances. You may avail of loans under the Medic plus Scheme to cover the cost of treatments such as: • Corneal Implant • Orthodontic Treatment (fixed tooth implant) • Ilazirav Technique of lengthening a limb Babasabpatilfreepptmba.com 50

- 51. Awareness Level of Personal Banking Products of SBI Bank • Congenital heart surgery • Angioplasty • Heart Valve Replacement Surgery • GIFT (in-vitro technique for child bearing) • Serious Accidents and Multiple Injuries Surgery • Hip and Knee Replacement Surgery Purpose: Loan for individuals to avail specialized expensive medical treatment e.g. coronary by-pass, Hip and Knee replacement surgery, cochlear implants (surgical) for the hearing impaired etc. Eligibility: You qualify to avail of loans under this scheme, if you are: • An employee of the Government/ a reputed PSU/ a profit making public limited company, and if you have a minimum, 10 years of service • A self-employed professional • A pensioner, who has taken voluntary retirement and is not yet 60 years old • An agent of Insurance/ KVP/ Mutual Funds etc. with a minimum annual income of Rs.3 lack • An employee/ a pensioner with a minimum income of Rs.10, 000 per month or if you are a neither, a minimum income of RS. 3 lacks per annum. Note: If the person being treated is a minor, the loan may be granted to a parent. The loan amounts range from a minimum of Rs.100, 000/- to a maximum of 12 months NMI (when it concerns salaried individuals and pensioners) or a 1-year net annual income (when it comes to persons other than salaried individuals and pensioners), subject, to the following ceilings: • For Employees and Professionals: Rs.2.0 lacks • For Pensioners and Agents: Rs.1.0 lack Once sanctioned, the loan is disbursed by the issuance of a draft/ banker's cheque, favoring the hospital, where the treatment is being undertaken or where it's proposed to be undertaken. Babasabpatilfreepptmba.com 51

- 52. Awareness Level of Personal Banking Products of SBI Bank Margin, Interest and Security 20% of the total cost of treatment and 0.75% above SBAR i.e.13.100% p.a. As per bank's extant instructions. Repayment Period and Processing Fee (One time): You may comfortably repay your loan over a maximum - 60 Equated Monthly Installments 0.100% of the loan amount. Authorized branches are pleased to inform customers that currently, The Medic plus Scheme is being offered at: • All computerized SBI branches in identified cities • All SBI branches, in metro/ urban centers, having "P" divisions • All SBI Personal Banking Branches Processing Fee: 0.100% of the entire loan amount, If the applicant already maintain a regular Housing Loan Account with us the processing fee is waived. List of Diseases • Corneal implant • Orthodontic treatment - fixed tooth implant • Ilazirav technique of lengthening a limb • Angioplasty • Congenital heart surgery • Heart Valve replacement surgery Babasabpatilfreepptmba.com 52

- 53. Awareness Level of Personal Banking Products of SBI Bank OBJECTIVES OF THE STUDY To Know The Customer Preference Towards Different Products Of SBI. To Know the Perception of Customers towards SBI’s Personal Banking Products. To know the awareness level of customers towards SBI’s facilities. Babasabpatilfreepptmba.com 53

- 54. Awareness Level of Personal Banking Products of SBI Bank METHODOLOGY Sample Unit: • Govt.Employees, Lawyers, Doctors, Engineers, Business People. Sample size: • Samples of 100 customers of the bank were chosen for the purpose of study. Sampling method: Random Sampling Method • From the large number of account holder’s of the bank, 100 customers were selected randomly from the bank’s database were considered for the study. Data Collection Method To fulfill the objectives of my study, I have taken both into considerations viz primary & secondary data. Primary data: Primary data has been collected through personal interview by direct contact method. The method, which was adopted to collect the information, is ‘Personal Interview’ method. Personal interview and discussion was made with manager and other personnel in the organization for this purpose. Secondary data: The data is collected from the Internet, Textbooks. The various sources that were used for the collection of secondary data are o Websites – www.SBI.com o www.google.com Measuring tools • For this purpose measurement technique used for survey is questionnaire to collect information from the respondents. Having collected the information, the information was represented by using statistical tools like bar charts. Babasabpatilfreepptmba.com 54

- 55. Awareness Level of Personal Banking Products of SBI Bank ANALYSIS OF THE STUDY 1. Do you have an account with SBI bank? PARTICULARS FREQUENCY PERCENTAGE A.YES 80 80 B. NO 20 20 TOTAL 100 100 80 70 60 50 PERCENTAGE 40 80 30 20 10 20 0 A.YES B. NO PARTICULARS INTERPRETATION: Among 100 respondents 80 are SBI Customers and have different accounts and have transactions in SBI Bank. Babasabpatilfreepptmba.com 55

- 56. Awareness Level of Personal Banking Products of SBI Bank 2. (I), which are the Personal Banking products you deal with SBI (Savings Account). PARTICULARS FREQUENCY PERCENTAGE A.YES 80 80 B.NO 20 20 TOTAL 100 100 80 70 60 50 PERCENTAGE 40 80 30 20 10 20 0 A.YES B. NO PARTICULARS INTERPRETATION: 80% of the customers have got savings account in SBI Bank and remaining 20% of them use other accounts. 2. (II), which are the Personal Banking products you deal with SBI (Fixed Deposit Account). Babasabpatilfreepptmba.com 56

- 57. Awareness Level of Personal Banking Products of SBI Bank PARTICULARS FREQUENCY PERCENTAGE A.YES 23 23 B.NO 77 77 TOTAL 100 100 80 70 PERCENTAGE 60 50 40 77 30 20 23 10 0 A.YES B. NO PARTICULARS INTERPRETATION: 23% of the respondents have deposits in Fixed Deposits. There are fewer respondents in case of fixed deposit because it is kept for long time, which will be fixed. 2. (III), which are the Personal Banking products you deal with SBI (Home Loan). Babasabpatilfreepptmba.com 57