Cutomer perception and attitude towards bajaj allianz project report

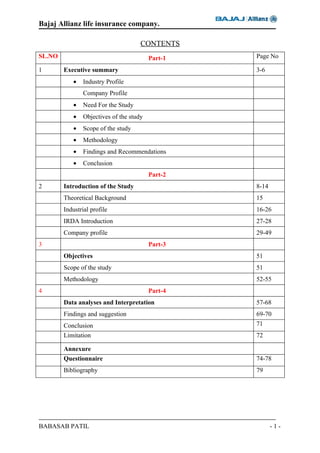

- 1. Bajaj Allianz life insurance company. CONTENTS SL.NO Part-1 Page No 1 Executive summary 3-6 • Industry Profile Company Profile • Need For the Study • Objectives of the study • Scope of the study • Methodology • Findings and Recommendations • Conclusion Part-2 2 Introduction of the Study 8-14 Theoretical Background 15 Industrial profile 16-26 IRDA Introduction 27-28 Company profile 29-49 3 Part-3 Objectives 51 Scope of the study 51 Methodology 52-55 4 Part-4 Data analyses and Interpretation 57-68 Findings and suggestion 69-70 Conclusion 71 Limitation 72 Annexure Questionnaire 74-78 Bibliography 79 BABASAB PATIL -1-

- 2. Bajaj Allianz life insurance company. PART-1 EXECUTIVE SUMMARY BABASAB PATIL -2-

- 3. Bajaj Allianz life insurance company. EXECUTIVE SUMMARY Over the last few decades the role of insurance sector has undergone a paradigm shift. It is widely recognized as an important aspect of the source of security for the policyholder and considered it as a short and long-term investment. After zeroing down on my research area, I have collected information through primary and secondary sources .I had a constant discussion with Mr. Ramesh V, Sales Manager throughout my trading and took valuable suggestions from him. The objective of this report is to study “Customer Awareness, Perception and Attitude towards Bajaj Allianz Life Insurance Company”, at Sindhanur. For this survey was conducted through structured Questionnaire. In today’s competitive business world every customer is significant for the leading insurance sector like Bajaj Allianz Life insurance with competitive strategies, the customer expectations are very high so it should be kept in mind and offer them best possible service. The report deals with the conceptual background of insurance and over view of the company, the next part deals with research design of the study that is problem identification, objectives and how the research was carried out. The outcome of the study shows that the level of customer awareness towards Bajaj Allianz is good with the benefits and service what they are giving and most of the people wants to go for investments where there is above average risk and high return. Company can start some good promotional activities to build its brand and to make recognition by all the peoples in the market .The effective marketing channel with the personal selling is an essential factor in influencing insurance company’s growth INDUSTRY PROFILE: By any yardstick, India with about 200million middle class households presents a huge untapped potential for players in the insurance industry. Saturation of markets in many developed economies has made the Indian market even more attractive for global insurance majors. The low percentage and per capita penetration of insurance in India compared to other developed and developing countries. With the per capita income in India expected to grow at over 6% for the next 10 years and with improvement in awareness levels the demand for insurance is expected to grow at an attractive rate in India .An independent consulting company .The monitor group has estimated that the life insurance market will grow from Rs. 218 billion in 1998 to Rs. 1003 billion by 2008(a compound annual growth of 16.5%). The insurance sector in India has come a full circle from being an open competitive market to BABASAB PATIL -3-

- 4. Bajaj Allianz life insurance company. nationalization and back to liberalized market again. Tracing the development in the Indian insurance sector reveals the 360-degree turn witnessed over a period of almost two centuries. COMPANY PROFILE: Bajaj Allianz Life insurance company limited is a union between Allianz SE, the world’s leading insurer and Bajaj Auto, one of India’s most respected names. Allianz SE is a leading insurance conglomerate globally and one of the largest asset managers in the world, managing assets worth over a Trillion Euros (over RS 55, 00,000 crores). At Bajaj Allianz, we realize that you seek an insurer you can trust your hard earned money with. Allianz SE has more than 110 years in the Indian market, are committed to offering you financial solutions that provide all the security you need for your family and yourself. At Bajaj Allianz, customer delight is our guiding principle. Ensuring world class solutions by offering you customized products with transparent benefit supported by the best technology is our business philosophy. Need for the study: Assets are insured; because they are likely to be destroyed through accidental occurrences such possible occurrences are called perils. Fire floods breakdowns, lighting, and earth quakes etc. If such perils can cause damage to the asset the asset is exposed to that risk. The risk only means that there is a possibility of loss or damage. The damage may or may not happen. Insurance is done against the contingency that it may happen. There has to be an uncertainty about the risk. Insurance is relevant only if there are uncertain. In the case of a person who is terminally ill the time of death is not uncertain though not exactly known. Insurance does not protect the asset. It does not prevent its loss due to the peril .The peril can sometimes be avoided, through better safety and damage control management. Insurance only tries to reduce the impact of the risk on the owner of the asset and those who depend on that asset. It only compensates the looses and that too, not fully. Only economic consequences can be insured. If the loss is not financial insurance may not be possible. BABASAB PATIL -4-

- 5. Bajaj Allianz life insurance company. OBJECTIVES OF THE STUDY To Study the Awareness of Bajaj Allianz Life Insurance Company. To know which source has made aware about Bajaj Allianz Life Insurance. To determine which factors customer look for while investing in Bajaj Allianz Life Insurance. To determine the Customer Perception towards different Private Life Insurance. To Study the Attitude of the Existing customers of Bajaj Allianz Life Insurance. SCOPE: 1. The study is based on the survey & is confined to Sindhanur only 2. The study covers the information about, a) The various investments in Bajaj Allianz life insurance Company available. b) The awareness level of Insurance. c) The perception of the people. And attitude of existing customer Allianz life Insurance Company. METHODOLOGY: TYPES AND SOURCES OF DATA For the purpose of study the data has been collected from two sources mainly: 1) Primary Data. 2) Secondary Data. PRIMARY DATA: Primary Data is the data collected for the first time for the purpose to solve the problem at hand. In this study the primary data is collected through questionnaire & Personal Interview SECONDARY DATA: The major sources of secondary data are as follows, 1. WEBSITES. 2. Broachers BABASAB PATIL -5-

- 6. Bajaj Allianz life insurance company. FINDINGS: o From the market research study it has been observed that 53% of the respondents are Aware of Bajaj Allianz Life Insurance. o 62% of the respondents are Aware of Bajaj Allianz Life Insurance through Agent. o About 91% of the respondents are look for security while investing in Bajaj Allianz Life Insurance. And It was found that 63% of the respondents rate the service of Bajaj Allianz Life Insurance as very good. 90% of the existing Customers are Happy with the Benefits of Bajaj Allianz Life Insurance. Recommendations: The Bajaj Allianz Life Insurance Company should concentrate heavily on attractive Advertisements and various Promotional Strategies like, giving Pamphlets; put the hoardings and banners at important locations of all over Shindanur. o Where the movement of the people is very high, Should be used to bring out the Awareness. o People should be educated by giving seminar in Business Conferences, installing stalls in Business Exhibitions. And Company should conduct seminars in Educational Institutions to provide information about company and its products. Company has to create a sense of security among the customers. Because most of the people fear about security in Private life Insurance. So Company has to explain and highlight about IRDA, which will give support to the Private life Insurance. Conclusion: ♦ Almost, all the population of Sindhanur is Aware Life Insurance.From overall study it can be concluded that Almost, all the people are Aware of It can be concluded that the people Expectations in a Private Life Insurance. Company is Security and Service while purchasing. LIMITATIONS OF THE STUDY The study is confined to Sindhanur only. Any suggestions given by analyzing data Collected may not be accurate for other locations as people requirements and Expectations differ from one place to other. There existed some respondents who refused to respond and these respondents who Did not participate in the survey may not be distinct & might have affected the BABASAB PATIL -6-

- 7. Bajaj Allianz life insurance company. Result of the study. PART-2 BABASAB PATIL -7-

- 8. Bajaj Allianz life insurance company. INTRODUCTION OF THE STUDY INTRODUCTION OF THE STUDY Introduction to Insurance The business is related to the protection of the economic values of the assets. Every asset has a value; the asset would have been created through the efforts of the owner. The asset is valuable to the owner because he expects to get some of the benefits from it. Insurance is a mechanism that helps to reduce the effect of such adverse situation. Purpose And Need of Insurance Assets are insured; because they are likely to be destroyed through accidental occurrences such possible occurrences are called perils. Fire floods breakdowns, lighting, and earth quakes etc. If such perils can cause damage to the asset the asset is exposed to that risk. The risk only means that there is a possibility of loss or damage. The damage may or may not happen. Insurance is done against the contingency that it may happen. There has to be an uncertainty about the risk. Insurance is relevant only if there are uncertain. In the case of a person who is terminally ill the time of death is not uncertain though not exactly known. Insurance does not protect the asset. It does not prevent its loss due to the peril .The peril can sometimes be avoided, through better safety and damage control management. Insurance only tries to reduce the impact of the risk on the owner of the asset and those who depend on that asset. It only compensates the looses and that too, not fully. Only economic consequences can be insured. If the loss is not financial insurance may not be possible. BABASAB PATIL -8-

- 9. Bajaj Allianz life insurance company. The Business of Insurance: The business of the insurance is to: • Collect the share or contribution • Pay out compensations (called claims) both those who suffer. • Bring together persons with common insurance interests (sharing the same risks) In India insurance is classified primarily as life and non-life or general. Life insurance includes all risks related to the lives of human beings and general insurance covers the rest. General insurance has three classifications; Fire, Marine, Miscellaneous. Personal accident and sickness insurance, which are related to human beings is classified as ‘non life’ in India, but is classified as’ life’ in many other countries. The business of the insurance is nothing but one of sharing. It spreads loose of an individual over the group of individuals who are exposed to similar risks. People who suffer loss get relief because their loss is made good. People who do not suffer loss are relieved because they were spared the loss. INSURANCE BUSINESS : Nature of insurance business Limitations of insurance Types of insurance Principles of insurance “Insurance is sharing of Risks.” RISKS: BABASAB PATIL -9-

- 10. Bajaj Allianz life insurance company. 1. The term risk may be defined as the possibility of a financial loss flowing from any occurrence 2. In insurance it is essential that the risk should be measurable in financial terms Risk sharing and risk transfer: Insurance is a complex mechanism, it has two fundamental characteristics: 1. Transferring or shifting of a risk from one individual to a group; 2. Sharing losses, on some equitable basis, by all members of the group. Elements of an Insurable Risk: Large numbers of exposure units Definite and measurable loss The loss must be fortuitous The loss must not be catastrophic Randomness-adverse selection Economic feasibility Limitations of Insurance: All risks cannot be insured There must be insurable interest Insurance is limited to the financial value There must be large number of similar risks It must be possible to calculate the risk of loss Losses should not be catastrophic Losses must not be too small Losses must be reasonably unexpected Losses must be accidental It must be consistent with public policy Insurance business is classified into four sections 1) Life Insurance Business BABASAB PATIL - 10 -

- 11. Bajaj Allianz life insurance company. 2) Marine Insurance Business 3) Fire Insurance Business 4) Miscellaneous Insurance Business Life Insurance Business: Life insurance originally conceived to protect a man’s family when his death left them without income has developed into a variety of policy plans. Marine Insurance Business: Marine insurance protects shipping companies against the loss of a ship or its cargo, as well as many other items, and so-called inland marine insurance covers a vast miscellany of items, including tourist baggage, express and parcel post packages, trucks cargoes, goods in transit, and even bridges and tunnels. Fire Insurance Business: Fire Insurance usually includes damage from lightning other insurance against the elements includes hail, tornado, flood, and drought. Miscellaneous Insurance Business: Special casualty forms are issued to cover the hazards of sudden explosions from equipment such as steam boilers, compressors, electric motors, flywheels, air tanks, furnaces and engines. Boilers and machinery insurance has several distinctive features. A substantial portion of the collected is used for inspection services rather than loss protection. The business if insurance started with marine business. Traders, who used to gather in the Lloyd’s coffee house in London, agreed to share the losses to their goods while being carried BABASAB PATIL - 11 -

- 12. Bajaj Allianz life insurance company. by ships .the losses used to occur because of pirates who robbed on the high seas of bad weather spoiling the goods or sinking the skip. The first insurance policy was started in 1583 in England .In India, insurance began in 1870. The business of the insurance is the protection of economic values of the assets. Every asset is expected to last for a certain period of time during which it will perform. Insurance is a mechanism that helps to reduce the effect of such adverse situation. Insurance is relevant only if there are uncertainties. Life Insurers transact life insurance business the rest is transacted by General Insurers. No composites are permitted as per law. The business of insurance essentially means defraying risks attached to any activity over time and sharing the risks between various entities both persons and organizations. Insurance companies are important players in financial markets as they collect and invest large amounts of the premium. Insurance products are multi purpose and offer the following benefits. 1) Protection to the investors 2) Accumulative savings 3) Canalize savings into sectors needing huge long-term investments. Insurance companies receive without much default a steady cash stream of premium or contributions to pensions plans. Various actuary studies and models enable them to predict, relatively accurately, their expected cash outflows. Liabilities of insurance companies being long term or contingent in nature, liquidity is excellent and their investments are also long term in nature. Since they offer more than the return on savings in the shape of life covers to the investors the rate of the return guaranteed in their insurance policies is relatively low. Consequently the need to seek high rates of returns on their investments is also low. The risk return trade off is heavily tilted in favors of risk .As a combined result of all this, investments of insurance companies have been largely in bonds floated by GOI, PSU’s, state governments, local bodies, corporate bodies and mortgages of long term nature. The last place where insurance companies are expected to be over active is bourses. Lately insurance companies have ventured into pension schemes and mutual funds also. However, life insurance constitutes the major the major share of insurance business. Life BABASAB PATIL - 12 -

- 13. Bajaj Allianz life insurance company. insurance depends upon the laws of mortality and there lies the difference between life and general insurance businesses. Life has to extinguish sooner or later and the claim in respect of life is certain. In case of general insurance, however, there may never be a claim and the amount can never be ascertained in advance. Hence, Life insurance includes, besides covering the risk of early happening of an event, an element of savings also for the beneficiaries. Pension business also services from life insurance in as mush as the pension outgo again depends upon the laws of mortality. The forays made by insurance in this area are, therefore, natural corollary of their business Number of Public and Private Life and Non-Life Insurance Companies Type of Business Number of Public Number of Sector Companies Private Sector Total Companies Life Insurance 1 12 13 Non- 6 8 14 Life(General)Insurance Reassurance 1 0 1 Total 8 20 28 Role of Insurance In Economic Development For economic development, investments are necessary. Investments are made out of Savings .A life insurance Company is a major instrument for the mobilization of saving of the people, particularly from the middle and lower income groups. These savings are channeled into investments for economic growth. All good life insurance companies have huge funds, accumulated through the payments of small amount of premium of individuals. These funds are invested in ways that contribute substantially for the economic development of the countries in which they do business. BABASAB PATIL - 13 -

- 14. Bajaj Allianz life insurance company. The private insurers in India are new and had not build up funds in 2002. But, in course of time, they also would be directly and indirectly contributing to the country’s economic development. A life insurance company will have large funds. These amounts are collected by way of premiums. Every premium represents a risk that is covered by that premium .In effect, therefore, these vast amount represent pooling of risks .The funds are collected and held in trust for the benefit of the policyholders .The management of the life insurance companies are required to keep this aspect in mind and make all its decisions in ways that benefit the community. This applies also to its investments. That is why successful insurance companies would not be found investing in speculative ventures. Apart from investments, business and trade benefit through insurance. Without insurance, trade and commerce will find it difficult to face the impact of major perils like fire, earthquake, and floods etc. Financiers, like banks would collapse if the factory, financed by it, were reduced to ashes by a terrible fire. Insurance cover also the loss to financiers, if their debtors default. BABASAB PATIL - 14 -

- 15. Bajaj Allianz life insurance company. Theoretical Back ground: Bhartha commanced operation as importing agents for vespa scooter of paggio in 1948.Entered into technical collaboration agreement with piaggio expired in 1971, was not Renewed.BAL has 3 plant located in maharashtra. The scooter incorporate piaggio Technology as upgraded by BAL’s in house R&D from time to time. It also developedA fully indigenous model of motorcycle in 1981. subsequent to the opening up of The scooter for foreign technology and equity participation in the mid 80’s it entered Into a technical collaboration agreement with Kawasaki Japa. It started production Of Kawasaki 100cc motorcycles in 1986. the company has also entered into technical Collaboration with M/s kabota of japan for manufacture of diesel engines for its three Wheelers and cagiva of italy. BAL has also promoted Maharashtra Scooter Ltd.(MSL) With state government bodies. MSL assembles Bajaj scooter at its satara plant. BABASAB PATIL - 15 -

- 16. Bajaj Allianz life insurance company. INDUSTRY PROFILE Insurance Market In India By any yardstick, India with about 200million middle class households presents a huge untapped potential for players in the insurance industry. Saturation of markets in many developed economies has made the Indian market even more attractive for global insurance majors. The low percentage and per capita penetration of insurance in India compared to other developed and developing countries. With the per capita income in India expected to grow at over 6% for the next 10 years and with improvement in awareness levels the demand for insurance is expected to grow at an attractive rate in India .An independent consulting company .The monitor group has estimated that the life insurance market will grow from Rs. 218 billion in 1998 to Rs. 1003 billion by 2008(a compound annual growth of 16.5%). The insurance sector in India has come a full circle from being an open competitive market to nationalization and back to liberalized market again. Tracing the development in the Indian insurance sector reveals the 360-degree turn witnessed over a period of almost two centuries. A Brief History of the Insurance Sector The business of life insurance in India in its existing form started in India in the year 1818 with the establishments of the Oriental Life Insurance Company in Calcutta. Some of the important milestone in the life insurance business in India is: BABASAB PATIL - 16 -

- 17. Bajaj Allianz life insurance company. • 1912: The Life Assurance Companies Act enacted as the first statue to regulate the life insurance business. • 1928: The Indian insurance companies act enacted to enable the government to collect statistical information about both life and non life insurance businesses. • 1938: Earlier legislation consolidated and amended to by the insurance act with the objective of protecting the interests of the insuring public. • 1956: 245 Indian and foreign insurers and provident societies taken over by the central government and nationalized .LIC formed by an act of parliament, viz LIC Act, 1956, with a capital contribution of Rs 5 crore from the government of India. The General insurance business in India, on the other hand, can trace its roots to the Triton Insurance Company Ltd the first general insurance company established in the year 1850 in Calcutta by the British. General insurance business in India is • 1907: The Indian Mercantile Insurance Ltd set up the first company to transact all classes of general insurance business. • 1957: General Insurance Council, a wing of the insurance Association pf India, frames a code of the conduct for ensuring fair conduct and sound business practices. • 1968: The Insurance Act amended to regulate investments and set minimum solvency. Margins and the Tariff Advisory Committee set up • 1972: The general insurance Business Act nationalized the general insurance business in India with effect from 1st January 1973.107 insurers amalgamated and grouped into four companies viz the national insurance company Ltd ,the New India Assurance Company Ltd ,the Oriental Insurance Company Ltd and the United India Insurance Company Ltd .GIC incorporated as a company. Insurance Sector Reforms BABASAB PATIL - 17 -

- 18. Bajaj Allianz life insurance company. In 1993 Malhotra committee headed by former finance secretary and RBI governor R. N. Malhotra was formed to evaluate the Indian insurance industry and recommend its future direction. The Malhotra committee was set up with the objective of complementing the reforms initiated in the financial sector. The reforms were aimed at “creating the reforms more efficient and competitive financial system suitable for the requirements of the economy keeping in mind the structural changes currently underway and recognizing that insurance to address the need for similar reforms”. In 1994 the committee submitted the report and some of the key recommendations included. 1. Structure Government stake in the insurance companies to be brought down to50%. Government should take over the holdings of GIC and its subsidiaries so that these subsidiaries can act as independent corporations. All the insurance companies should be given greater freedom to operate. 2. Competition • Private companies with a minimum paid up capital of Rs 1 Bn should be allowed to enter the industry No Company should deal in both Life and General Insurance through a single entity. • Foreign companies may be allowed to enter the industry in collaboration with the domestic companies. • Postal Life Insurance should be allowed to operate in the rural market • Only on state level Life Insurance Company should be allowed to operate in each state. 3. Regulatory Body BABASAB PATIL - 18 -

- 19. Bajaj Allianz life insurance company. • The Insurance Act should be changed. • An Insurance Regulatory body should be set up. • Controller of insurance (currently a part from the finance ministry) should be made independent. 4. Investments • Mandatory Investments of LIC Fund in government securities to be reduced from 75%to50%. • GIC and its subsidiaries are not to hold more than 5 % in any company (there current holdings to be brought down to this level over a period of time). 5. Customer service • LIC should pay interest on delays in payments beyond 30 days. • Computerization of operations and updating of technology to be carried out in the insurance industry. The committee emphasized that in order to improve the customer services and increase the coverage of the insurance industry should be opened up to competition. • But at the same time the committee felt the need to exercise caution as any failure on the part of new players could ruin the public confidence in the industry. Hence, it was decided to allow competition in a limited way by stipulating the minimum capital requirements of Rs 100 crores. • The committee felt the need to provide greater autonomy to insurance companies in order to improve their performance and enable to act as independent companies with economic motives. For this purpose, it had proposed setting up an independent regulatory body. Bank And Insurance Bank assurance symbolizes the convergence of banking and insurance has its origins in France and involves distribution of insurance products through a banks branch network. BABASAB PATIL - 19 -

- 20. Bajaj Allianz life insurance company. While banc assurance has developed into a tremendous success story in Europe, it is a relatively new concept in Australia and Asia. Most new insurers have entered into memoranda of understanding with banks to use their branches as outlets for marketing standard products. State Bank of India, Vysya Bank and J&K Bank already have joint ventures in life insurance. Vijaya Bank and Punjab National Bank are in the midst of finalizing life and non-life ventures. The Insurance Act allows only those companies registered under the companies Act to become corporate agents. This gives the new generation and old private sector banks a head start over public sector banks, which are technically not eligible to sell risk products. IRDA, IBA&RBI are in discussions to iron out the various issues, as public sector banks will play a key role in the distribution of products. Major Markets Players 1) Birla Sun Life Insurance Company: Birla Sun Life Insurance is the coming together of the Aditya Birla group and Sun Life Financial of Canada to enter the Indian insurance sector. The Aditya Birla Group, a multinational conglomerate has over 75 business units in India and overseas with operations in Canada, USA, UK, Thailand, Malaysia, Egypt to name a few. Foreign Partner: Sun Life Assurance, Sun Life Financials primary insurance business, has excellent ratings with the world’s top rating agencies. With assets under management as on September 30,2000 totaling more than CDN billion, it ranks amongst the largest international financial services organizations in the world. Today, the Sun Life Financial Group of companies and partner are represented globally in Canada the united states the Philippines Japan Indonesia India and Bermuda. 2) HDFC- Standard Life: BABASAB PATIL - 20 -

- 21. Bajaj Allianz life insurance company. HDFC Standard Life Insurance Company is a joint venture between India’s largest housing finance provider, HDFC and Europe’s largest mutual life assurance company –The Standard Life Assurance Company. HDFC Standard Life Insurance Company Limited is the First Private Sector Life Insurance Company to be granted license. Aviva is UK’s largest and the world’s sixth largest insurance Group. It is one of the leading providers of life and pensions products to Europe and has substantial businesses elsewhere around the world. With a history dating back to 1696, Aviva has a 30 million-customer base worldwide. It has more than £317 billion of assets under management. Aviva’s Fund management operation is one of its key differentiators. Operating from Mumbai, Aviva has an experienced team of fund managers and the range of fund options includes Unitized With-Profits Fund and four Unit Linked funds: - Protector Fund, Secure Fund, Balanced Fund and Foreign Partner: Standard Life, UK- founded in 1825, has been at the forefront of the UK insurance industry for 175 years by combining sound financial judgment with integrity and reliability. It is the Largest Mutual Life Company in Europe and has total assets of Rs 5, 50,000 crore. It is one of the very few insurance companies in the world to have received ‘AAA’ rating from two of the leading international credit rating agencies. Monody’s and standard & Poor’s standard life was recently voted company of the Decade in UK by the independent Brokers called IFAs. 3) Life Insurance Corporation of India (LIC): The Life Insurance Corporation Of India was established about 44 years ago with a view to provide an insurance cover against various risks in life .A monolith then, the corporation, enjoyed a monopoly status and became synonymous with life insurance .Its main asset is its staff strength of 1.24 lakh employees and 2,048 branches and over 6 lakh agency force .LIC has hundred divisional offices and has established extensive training facilities at all levels. At the apex, is the Management Development Institute, seven Zonal Training Centers and 35 sales Training BABASAB PATIL - 21 -

- 22. Bajaj Allianz life insurance company. Centers .At the industry level, along with the government and the GIC, has helped establish the national insurance academy. It presently transacts individual life insurance businesses, group insurance businesses, social security schemes and pensions, grants housing loans through its subsidiary; and markets savings and investment products through its mutual fund .Its pays off about Rs 6,000 crore annually to5.6million policyholders. 4) Om Kotak Mahindra Life Insurance: Established in 1985 as Kotak Capital Management Finance promoted by Uday Kotak the company has come a long way since its entry into corporate finance .It has dabbled in leasing, autofinance, investment banking, consumer banking, and broking. The company got its name Kotak Mahindra as Industrialists Harish Mahindra and Anand Mahindra pickes a stake in the company. Kotak Mahindra is today one of India’s leading financial institutions. Old Mutual: Old mutual plc is an international financial services group based in London with expanding operations in life assurance, asset management, banking and general insurance .Old mutual is listed on the London stock exchange (where it is included anon the FTSE 100 index) and also on the south African, Namibian Malawi stock exchange .It has 156 years of experience in the life insurance business 5) Max New York Life: Max India:- It is a multi –business corporation that has business interests in telecom services ,bulk pharmaceuticals ,electronic components and specialty products .It is also the service – oriented businesses of health care ,life insurance and information technology. New York Life: New York Life has grown to be a fortune 100 company and an expert in life insurance .It was the first insurance company to offer cash dividends to policy holders .In 1894, BABASAB PATIL - 22 -

- 23. Bajaj Allianz life insurance company. New York Life pioneered the then unheard of concept of insuring women at the same rate as men. Thereafter, it continued to introduce a series of firsts a disability clause in 1920.unemployment insurance in 192 and complete customer care on the web in 1998. Today New York Life has over US billion in assets under management and over 30,000 agents and employees worldwide. With over 3 million policyholders, New York Life Insurance is a leading provider of insurance in a host of countries worldwide. 6) Aviva Life Insurance India: It is joint venture between Dabur, one of India ‘s oldest and largest groups of companies and Aviva. Aviva plc is UK’s largest insurer .In accordance with government regulations, Aviva holds a 26% stake in the new venture and Dabur holds a 74%share. Aviva: It is the world’s seventh –largest insurance group (based on gross worldwide premiums) and the biggest in the UK .It is one of the leading providers of life and pensions products to Europe and has substantial businesses elsewhere around the world .Its main activities are long term savings, fund management and general insurance. 7) ING Vysya Life Insurance: ING Group: ING Vysya Life Insurance is a joint venture between three pioneers, ING Insurance, ING Vysya Bank and GMR group. Over the last 150 years .ING group has grown to become one of the largest life insurance organizations in the world. Today is touches the lives of over 50 million people across 65 countries .It offers a ranges of financial services including insurance ,pensions ,banking and asset ,management .In the year markets ,which require substantial investments underlying ING’s long-term BABASAB PATIL - 23 -

- 24. Bajaj Allianz life insurance company. commitment .In the last 20 years ,ING group has established successful life insurance companies in 15 countries contributing to the development of insurance services in these countries . ING Vysya Bank Limited: It is one of the India’s premier private sector banks with a heritage of over 70 years. With 1.5 million customers, 480 outlets and 6000 employees it is known for its innovative banking. Services and for pioneering several products and services. ING Vysya bank has a long-standing relationship with its customers and deep understanding of the Indian market GMR Group: It has a solid track record of over two decades of growth and has wide-ranging interests in field such as power generation, infrastructure, manufacturing, software and banking. GMR group has an excellent reputation of being able to successfully develop ventures from scratch. 8) Met Life Insurance Pvt Company: It was corporate as a joint venture between Met Life International Holdings, Jammu & Kashmir, and other private investors. MetLife is headquartered in bang lore with offices and presence in major Indian cities, and additional 1000 outreach points through its channel partners. Met Life: BABASAB PATIL - 24 -

- 25. Bajaj Allianz life insurance company. It ranked 38 on the fortune 500 list, Met Life, Inc is one of the worlds largest, strongest and most respected financial organizations .Met Life, through its affiliates, is the number 1 life insurer in the US with approximately $2.4 trillion of life insurance in force and has been delivering reliable serve approximately 12 million individuals in the US as well as the employees of 88 of the fortune 100 companies. Headquartered in New York, Met Life operates through its affiliates and subsidiaries in 12 countries across the Americas, Europe and Asia. 9) Allianz Bajaj Life Insurance Company : It is also a joint venture between two leading conglomerates Allianz AG, one of the world’s largest insurance companies, and Bajaj Auto, one of the biggest 2 and 3 wheeler manufacturers in the world. Foreign Partner: I t is one of the world’s leading insurers and financial service providers. Founded in 1890 in Berlin, Allianz is now present in over 70 countries with almost 174,000 employees. At the top of the international group is the holding company, Allianz AG, with its head office in Munich. Allianz group provides its more than 60 million customers worldwide with a comprehensive range of services in the area of • Property and casualty Insurance • Life and Health Insurance • Asset Management and Banking 10). SBI Life Insurance Company Ltd: SBI Life Insurance Company Ltd is a joint venture between India’s largest banks, State Bank Of India & Cardiff S A, a leading life insurance company in France State BABASAB PATIL - 25 -

- 26. Bajaj Allianz life insurance company. Bank of India is a household name, and it stands as the last word for financial strength and security in the country. SBI’s illustrations background dates back to the year 1806 when it started business, as a presidency bank, known as bank of Bengal Over the long journey, it has learnt to combine the best of banking practices handed down from the imperial management with the more dynamic ways of doing banking in the modern India. It has grown as a responsible giant in the banking field over the years. The Market Share of each company Name of the Player Market Share (%) LIC 74.26 ICICI Prudential 7.24 Birla Sun life 1.84 Bajaj Allianz 5.68 SBI Life 1.49 HDFC std 3.11 TATA Aig 1.67 Max New York 1.33 Aviva 1.13 Om Kotak Mahindra 0.73 Ing Vysya 0.60 AMP Sanmar 0.49 MetLife 0.38 BABASAB PATIL - 26 -

- 27. Bajaj Allianz life insurance company. INSURANCE REGULATIORY AND DEVEVLOPMENT AUTHORITY (IRDA) The opening of insurance sector has been long standing and development authority- IRDA bill a significant step has been taken. IRDA is formed as an authority to protect the interest of holders of insurance policies, to regulate, promote and ensure orderly growth of insurance industry and for matters connected there with incidental thereto. Composition of authority under IRDA, Act, 1999 As per the section 4 of IRDA Act ‘1999, insurance Regulatory and development Authority (IRDA, which was constituted by an act of parliament) Specify the composition of authority. The authority is ten-member team consisting of 1) A chairman 2) 5 whole team members 3) 4 part time members Duties, powers and functions of IRDA Section 14 of IRDA Act, 1999 lays down the duties, powers and functions of IRDA. BABASAB PATIL - 27 -

- 28. Bajaj Allianz life insurance company. 1) Subject to the provisions of this act and any other law for the time being in force, the authority shall have the duty to regulate, promote ensure orderly growth of the insurance business and re-insurance business. 2) Without prejudice to the generality of the provisions contained in sub-section (1) the power and functions of the authority shall include a) Issue to the applicant a certificate of registration, renew, modify, withdraw, suspend or cancel such registration. b) Protection of the interests of the policy holders in matters concerning assigning of policy, nomination by policy holders, insurable interests, settlement of insurance claim, surrender value of policy and other terms and conditions of contracts of insurance. c) Specifying requisite qualification, code of conduct and practical training for intermediary or insurance intermediaries and agent. d) Specifying the code of conduct for surveyors and loss assessors. e) Promoting efficiency in the conduct of insurance business f) Promoting and regulating professional organizations connected with the insurance. g) Levying fees and other charges for carrying out the purposes of this Act. h) Calling for information from, undertaking inspection of, conducting enquiries and investigations including audit of the insurers, intermediaries, insurance intermediaries and other organizations connected with the insurance business. i) Control and regulation of the rates, advantages, terms and conditions that may be offered by insurers in respect of general insurance business not so controlled and regulated by the tariff advisory committee under section 64u of the insurance Act, 1938(4 of 1938). h) Specifying the form and manner in which books of account shall be maintained and insurers and other insurance intermediaries shall render statement of accounts. j) Regulating maintenance of margin of solvency. k) Adjudication of disputes between insurers and intermediaries or insurance intermediaries. l) Supervising the functioning of the Tariff Advisory Committee. m) Specifying the percentage of premium income of the insurer to finance schemes for promoting and regulating professional organizations referred to in clause (f). o) Specifying the percentage of life insurance business and general insurance business to be understood by the insurer in the rural or social sector. BABASAB PATIL - 28 -

- 29. Bajaj Allianz life insurance company. COMPANY PROFILE Bajaj Allianz Life Insurance Company Ltd. Bajaj Allianz Life insurance company limited is a union between Allianz SE, the world’s leading insurer and Bajaj Auto, one of India’s most respected names. Allianz SE is a leading insurance conglomerate globally and one of the largest asset managers in the world, managing assets worth over a Trillion Euros (over RS 55, 00,000 crores). At Bajaj Allianz, we realize that you seek an insurer you can trust your hard earned money with. Allianz SE has more than 110 years in the Indian market, are committed to offering you financial solutions that provide all the security you need for your family and yourself. At Bajaj Allianz, customer delight is our guiding principle. Ensuring world class solutions by offering you customized products with transparent benefit supported by the best technology is our business philosophy. OUR VISION To be the best insurance co. in India to buy from, work for and invest in. OUR VALUES Our core values : o Customer delight the guiding principle BABASAB PATIL - 29 -

- 30. Bajaj Allianz life insurance company. o Ensuring world class solution and services o Offering customized product o Transparent benefits ALLIANZ SE World’s Largest Insurance Co. by revenue – Rs 5,20,353 Cr (Euro 96,9 billion) Worldwide 2nd by gross written premiums – Rs 4,77,930 Cr (Euro 89 billion) 3rd largest assets under management (AUM) and largest amongst insurance cos. – AUM of Rs 95,94,200 Cr (Euro 1078 billion) 11th largest corporation in the world 50% of global business form life insurance, close to 60 million lives insured globally Established in 1890, 110 yrs of insurance expertise More than 70 countries, 173,750 employees worldwide Insurance to almost half of the fortune 500 cos. BAJAJ AUTO One of the largest 2 and 3 wheeler manufacturer in the world 21 million+ vehicles on the roads across the globe Managing funds of over s 5,329 cr. Bajaj Auto finances one of the largest auto finance cos. In India Rs. 6,340 Cr. Turnover and Profits after tax of 767 Cr. in 2004-05 About Bajaj The Bajaj Group is amongst the top 10 business houses in India. Its footprint stretches over a wide range of industries, spanning automobiles (two-wheelers and three-wheelers), home appliances, lighting, iron and steel, insurance, travel and finance. The group’s flagship company, Bajaj Auto, is ranked as the world’s fourth largest two- and three- wheeler manufacturer and the Bajaj brand is well-known in over a dozen countries in Europe, Latin America, the US and Asia. Founded in 1926, at the height of India's movement for independence from the British, the group has an illustrious history. The integrity, dedication, resourcefulness and determination to succeed which are characteristic of the group today, are often traced back to its birth during those days of relentless devotion to a common cause. Jamnalal Bajaj, founder of the BABASAB PATIL - 30 -

- 31. Bajaj Allianz life insurance company. group, was a close confidant and disciple of Mahatma Gandhi. In fact, Gandhiji had adopted him as his son. This close relationship and his deep involvement in the independence movement did not leave Jamnalal Bajaj with much time to spend on his newly launched business venture. His son, Kamalnayan Bajaj, then 27, took over the reins of business in 1942. He too was close to Gandhiji and it was only after Independence in 1947, that he was able to give his full attention to the business. Kamalnayan Bajaj not only consolidated the group, but also diversified into various manufacturing activities.The present Chairman and Managing Director of the group, Rahul Bajaj, took charge of the business in 1965. Under his leadership, the turnover of the Bajaj Auto the flagship company has gone up from Rs.72 million to Rs.46.16 billion (USD 936 million), its product portfolio has expanded from one to and the brand has found a global market. He is one of India’s most distinguished business leaders and internationally respected for his business acumen and entrepreneurial spirit. GROUP COMPANIES Bajaj Auto is the flagship of the Bajaj group of companies. The group comprises of 27 companies and was founded in the year 1926. The companies in the group are:- BABASAB PATIL - 31 -

- 32. Bajaj Allianz life insurance company. Bajaj Allianz Life Insurance Most Profitable Pvt. Life insurance Co Rs.63cr (US $ 15.3 mn.) profit for FY 06-07 Over 2 million (20,79,217) policies in this year – highest amongst all pvt. Sector Bajaj Auto Ltd. Mukand International Ltd. Mukand Ltd. Mukand Engineers Ltd. Bajaj Electricals Ltd. Mukand Global Finance Ltd. Bajaj Hindustan Ltd. Bachhraj Factories Pvt. Ltd. Maharashtra Scooters Ltd. Bajaj Consumer Care Ltd. Bajaj Auto Finance Ltd. Bajaj Auto Holdings Ltd. Hercules Hoists Ltd. Jamnalal Sons Pvt. Ltd. Bajaj Sevashram Pvt Ltd. Bachhraj & Company Pvt. Ltd. Hind Lamps Ltd. Jeevan Ltd. Bajaj Ventures Ltd. The Hindustan Housing Co Ltd. Bajaj International Pvt Ltd. Baroda Industries Pvt Ltd. Hind Musafir Agency Pvt Ltd. Stainless India Ltd. Bajaj Allianz General Insurance Company Ltd. Bombay Forgings Ltd. Have sold over 3.4 million policies (34,72,875) issued till date Largest distribution network to reach the customer across the country with 2,13,000 agents, 900 offices in 840 towns, 200 corporate agents and Banc assurance partners Accelerated Growth Fiscal Year No of policies sold in FY New Business in FY 2001-02(6 mths) 21,376 Rs 7 cr 2002-03 1,15,965 Rs 69 cr 2003-04 1,86,443 Rs 180cr 2004-05 2,88,189 Rs 857cr 2005-06 7,81,685 Rs 2717cr BABASAB PATIL - 32 -

- 33. Bajaj Allianz life insurance company. 2006-07 20,,79,217 Rs 4270cr Assets under management Rs 5,500 cr Shareholder capital base of Rs 700 cr. Product tailored to suit your needs Decentralized organization structure for faster response Wide reach to serve you better – a nationwide network of 900 + branches Specialized departments for Bancessurance, corporate Agency and Group Business and strong dedicated product teams for pension, health, women and child. Well networked customer care centres (CCCs) with state of art IT systems. Highest standard of customer service & simplified claims process in the industry. Website to provide all Assistance and information on products and services, online buying and online renewals. Toll-free number to answer all your queries, accessible from anywhere in the country- call Now 1800 23 7272 and a strong tele-marketing and direct marketing team. Swift and easy claim settlement process. BABASAB PATIL - 33 -

- 34. Bajaj Allianz life insurance company. Networked for reach BAJAJ ALLIANZ LIFE INSURANCE – DISTRIBUTION NETWORK Agency channel Bancassurance Group & Alternate channel Standard chartered Bank Employee Benefit Branches (257) Syndicate Bank Corporate Agents Satllites (643) GE Money Franchisees Over 2, 00,000 strong Tied Agency Force And growing BABASAB PATIL - 34 Rapidly everyday -

- 35. Bajaj Allianz life insurance company. Urban Co-Op Banks Direct Marketing Dist. Co-Op Banks Regional Rural Banks Catering to mass & Rural markets Brokers BABASAB PATIL - 35 -

- 36. Bajaj Allianz life insurance company. Sales Structure BABASAB PATIL - 36 -

- 37. Bajaj Allianz life insurance company. MANAGEMENT STRUCTURE: BABASAB PATIL - 37 -

- 38. Bajaj Allianz life insurance company. Trainee Program We have the following Trainee Program : BABASAB PATIL - 38 -

- 39. Bajaj Allianz life insurance company. IT Trainee: • This trainee is taken in the IT Dept for a training period of. • Performance Appraisal happens every after 6 month and does on the overall performance and delivery, they are being absorbed. Operations Trainee : • This Trainee are taken in the Operations Dept for a training 1 year. • Performance Appraisal happens after completion of 1 year a depending on the overall performance and delivery; they are been absorbed in Grade. NETWORKED FOR REACH Strong Branch Network of 900+ Branches and growing…… Over 10000+Sales Team Managers 200,000+ Insurance Care Consultants 170+ Bancassurance partner across the country Strong alternate channel with 2200 Franchisees, 200 corporate agents, 74 brokers and 28 direct marketing branches. Growing reach through tie-ups Bancassurance BABASAB PATIL - 39 -

- 40. Bajaj Allianz life insurance company. Pioneered the phenomenon in India – 170 bancassurance partners One of our core focus areas – tie-ups with large national and pvt. Sector banks : o Standard Chartered Bank o Syndicate Bank o GE money o Tie-up with Co-Op Bank and Regional Rural Banks (Catering to mass and Rural markets) Expanding reach also through tie-ups with large regional banks Exclusive life insurance products- MRTA and Credit Shield. Products customized to suit specific need of Banks. Allianz Group- Global Bancassurance Experience BABASAB PATIL - 40 -

- 41. Bajaj Allianz life insurance company. Asia Europe Korea Hana bank Germany Dresdner Bank Hypo Vereinsbank Raiffeisenbanken Taiwan Grand Commercial France Credit Lyonnais Ta Chong Bank Italy Unicredito Italiano Taipei Bank Rolo Banca Malaysia Union Bank Casa di Risparmio Banco di Scicilia Banco Antoniana Popolare Banco Regionale Europea South America Brasil Spain Banco Popular Chile Portugal BPI-SGPS Maxico Bradesco Austria Bawag Banco Bice Greece Ergo Bank, Bank of Piraeus BanCrecer Europe Czechlslovakia Croatia Zagrebacka Bank Hungary Zivnobanka Bulgaria Bulbank Hypobank Poland Pekao S.A. BPH Takarekbank BABASAB PATIL - 41 -

- 42. Bajaj Allianz life insurance company. Growing reach through tie-ups Alternate channels The Strategic Alliances group at Bajaj Allianz focus ‘Group insurance’ and ‘Corporate Agency’ network. Corporate Agents, Brokers and Franchisees o A constantly growing nationwide network of Corporate Agents, Brokers and Franchisees. o A decentralized, dedicated team of professionals to recruit, develop and support Corporate Agents, Brokers and Franchisees. Group Business o A growing product range to meet generic and specific needs of various groups. Some of them are Group Team Life, Group Gratuity, Group Superannuation, Group MRTA, GTL in lieu of EDLI, among many others. o A dedicated team to ensure nothing but the best in service delivery. On line Selling and renewals o Unit Gain plus SP and Unit Gain Easy Pension. Financial Services Consultants o A set of expect financial advisors to address comprehensive financial planning needs of high net worth clients. o Products designed to suit your needs. BABASAB PATIL - 42 -

- 43. Bajaj Allianz life insurance company. Decentralized Operations • Insure in minutes • Service any where Insure in minutes at any CCC CCCs fully empowered to o Issue policy end to end (from collection to issue and prepare policy bond) o IT enabled process geared to insures in few minutes from starts to finish o Only pvt. Insurance co. to do so Black box – Decentralized underwriting o Proprietary IT software for underwriting o Enables us to also decentralize underwriting o Maintains quality with standardization across the country o Eliminates human intervention and subjectiveness o Only pvt. Insurance co. to do so. Customers from any CCC offered all services at all CCC Policy holder from any CCC o Can get basic policy servicing at any of our CCCs – No Ho interface o Can pay renewal premium : Online – renewal At any of XXX offices Through Bill – Junction Cheque drop boxes across the country Credit cards or direct debit for standard chartered customers BABASAB PATIL - 43 -

- 44. Bajaj Allianz life insurance company. Efficient systems, process’ and speed of response has ensured lowest number of complaints from customers to IRDA Products to suit your needs Individual Plans Group Life Plans Individual Plans In our constant endeavor to secure a bright and happy future for you and your family, we offer a range of insurance products that is just perfect for your investment needs. Unit linked insurance plans Traditional insurance plans Pension plans Team plans Unit Liked Insurance Plans Offering insurance plans with flexibility and tax benefits • Capital Unit Gain : Big Boss of ULIPs o This plan offers the highest allocations of 97% for Regular Premium insurance plans in the market. With a lifetime of protection to match insurance and investment needs, this Unit linked endowment plan has an option of unlimited top up to park your windfall gains. Choice of 5 active investment funds, flexi BABASAB PATIL - 44 -

- 45. Bajaj Allianz life insurance company. plan to increase / decrease Regular Premium and 4 additional rider benefits for total protection make this plan one of the best products to invest in. • New UnitGain plus SP : Single Premium plan with maxx allocation o New UnitGain Plus SP plan is a Single Premium plan with maxx allocation and gives you a Guaranteed death benefit, it offers you choice of 5 active investment funds with 3 free switches allowed every year. Flexi plan allows you to make partial and full withdrawals after 3 years. • New UnitGain Premier : Gives 100 and get 105 Now – “umeed se Zyaaada” o A simple single premium unit linked investments plan which give to upfront 105 % allocation of the single premium on day 1. • New Family Gain: Policy as pure as your love for family. With Bajaj Allianz Family Assure, you can invest in one life insurance plan that can take care of all your changing requirements. This plan has been designed to provide you with maximum flexibility, so that you do not have to worry about your changing needs. • New Unit Gain Super: Insure fully get MAX Allocation. o This is a unique combination of protection with the attractive prospects of investing in securities. With higher allocation up to 93 % and choice of 5 investment funds with flexible investment management. Plus, you have the options of switching between the funds at any time this works a wonderful investment cum insurance plan. You also benefit from attractive tax advantages and unmatched flexibility to match your changing needs. In addition, you benefit from the advantages of low charges. BABASAB PATIL - 45 -

- 46. Bajaj Allianz life insurance company. • New UnitGain Plus : A Unit Linked Plan o Bajaj Allianz UnitGain Plus offers the unique option of combining the protection of life insurance with the attractive prospects of investing in securities. You have the choice of 5 investment funds with flexible investment management; you can change funds at any time. You also benefit from attractive tax advantages and unmatched flexibility – to match your changing needs. And the advantage of low fund management and fund management and fund administration costs. Some of the key features of the plan are : Guaranteed death benefit Choice of 5 investment alternative to fixed interest securities. Attractive investment alternative to fixed interest securities. Provision for full/partial withdrawals any time after three years from commencement of the policy provided three full years premium are paid. Unmatched flexibility to match your changing needs. Maturity Benefit equal to the Fund Value payable on date of maturity. • UnitGain Guarantee SP : o This is a unique Single Premium plan, which gives guaranteed maturity benefit regardless of market performance. This plan is specifically designed keeping in mind the uncertainly in the stock market and comes with a unique 3–in-1 capital Gurantee Fund, which gives guaranteed maturity benefit of upto 112% of allocated premium less charges. BABASAB PATIL - 46 -

- 47. Bajaj Allianz life insurance company. Traditional Insurance Plans That helps you save tax and earn more interest • InvestGain : An Endowment Plan o This savings plan combines high protection (up to quadruple cover) with a unique family income benefit. • ChildGain : Children’s Policy o Ever wondered why you need an insurance policy for your child? As a parent, you always dream the best for your child including marriage, higher education, or that hand holding for a start in life. Whether you are there to see your child grow up and settled or not, your child feels your love in the financial support arranged by you through our wide range of Children's insurance policies taking him from one milestone to another. • CashGain : Momey Back Plan o This is the only money back plan that offers quadruple protection, going up to 4 times the basic sum assured, and a family income benefit. • Protector : A Mortgage Reducing Team Insurance plan o This is the perfect plan to protect the family the repayment liability of outstanding loans, in the unfortunate case of death of the loanee. There is also BABASAB PATIL - 47 -

- 48. Bajaj Allianz life insurance company. an option to cover the co-applicant of the loan at a very nominal cost under this plan. • Save care economy SP : Single Premium Endowment Plan A single premium investment plan for 10 years, which provides life cover along with growth in savings. Bajaj Allianz Super Saver is a regular premium endowment plan, which helps you save regular amounts for a safer tomorrow. It also provides you with extra benefits of Guaranteed Additions to your sum assured, at the end of each policy year. BABASAB PATIL - 48 -

- 49. Bajaj Allianz life insurance company. • Health care The 6-in-1 health care plan at just Rs 100/- per month is a wonderful way to secure health for 3 years term. BABASAB PATIL - 49 -

- 50. Bajaj Allianz life insurance company. A 6- in-1 health insurance plan that offers: A Life Cover A Hospital Cash benefit A Surgical benefit A Post Hospitalization Benefit A Critical Illness Cover A Accidental Permanent Total / Partial Disability (APT/PD) along with a cash less card facility makes it an excellent product as the benefits under this plan can be taken in addition to any other health insurance plan. • New unit Gain Easy Pension Plus : Unit Linked Retirement Plan without life cover Bajaj Allianz Unit Gain Easy Pension is a plan that helps you take control of your future and ensure a retirement you can look forward to. This is a regular premium investment linked deferred annuity policy. There are two packages to choose from: New unit Gain Easy Pension BABASAB PATIL - 50 -

- 51. Bajaj Allianz life insurance company. Plan Single Premium. Gives you the flexibility to purchase units in any/all of the 6 funds available with us Term Plans Pure Insurance Plans to protect family • TermCare : Term Plan With Return-of-Premium o An economic way to providing life cover, this plan also ensures the return of all premiums at the time of maturity. • RiskCare : Pure Term Plan o The “Bajaj Allianz Risk Care” Plan in a pure term insurance plan & offers one of the most economical means to provide financial security to your loved ones. The only pure term plan in the market to provide Hospital Cash Benefit. • Lifetime Care : Whole Life Plan o This whole life plan provides survival benefits at the age of 80 thereby making sure you are financially secure at a time when you need it the most. Group Life Plans Bajaj Allianz provides an exciting range of group products which enable organization to provide protection and care to their members / employees. o Group Credit Shield BABASAB PATIL - 51 -

- 52. Bajaj Allianz life insurance company. o Group Term Life o Group Term Life Scheme in Lieu of EDLI o Group Gratuity Care o Group Superannuation Care o Small Group Term Life BABASAB PATIL - 52 -

- 53. Bajaj Allianz life insurance company. PART-3 OBJECTIVES RESEARCH PROBLEM The research problem is to study the “Customer Awareness, Perception and Attitude towards Bajaj Allianz Life Insurance Company, Shindanur .” OBJECTIVES: To Study the Awareness of Bajaj Allianz Life Insurance Company. To know which source has made aware about Bajaj Allianz Life Insurance. To determine which factors customer look for while investing in Bajaj Allianz Life Insurance. To determine the Customer Perception towards different Private Life Insurance. To Study the Attitude of the Existing customers of Bajaj Allianz Life Insurance. Scope of the study : 1. The study has based on the survey to be conducted in Sindhanur & will focus on the Sindhanur people. 2. The study covers the information about, a) The various investments in life insurance available. b) The awareness level of Insurance. c) The perception and attitude of the people. 3. The study is confined to Sindhanur only. BABASAB PATIL - 53 -

- 54. Bajaj Allianz life insurance company. METHODOLOGY Methodology explains the methods used in collecting information to the steps touch are as follows. DESCRIPTION OF RESEARCH Marketing Research design specify the procedure for conducting a research project. The survey is conducted with the objective to know the Customer Awareness, Perception and Attitude towards Bajaj Allianz Life Insurance Company. In this, two types of research methods are used. 1) DESCRIPTIVE RESEARCH. Descriptive Research is used to collect various information from customer to study the Awareness, Perception and Attitude, Opinion With the Life Insurance. 2) EXPLORATORY RESEARCH. Exploratory Research is concerned with discovering the general nature of the problem and the variables that are related to research study. TYPES AND SOURCES OF DATA For the purpose of research study the data from two sources has been collected mainly, 5) Primary Data. 6) Secondary Data. PRIMARY DATA BABASAB PATIL - 54 -

- 55. Bajaj Allianz life insurance company. Primary Data is the data collected for the first time for the purpose to solve the problem at hand. In this study the primary data is collected by survey research. i.e. collection of information directly from the respondents by personal interview, a questionnaire method is used to collect the information from the respondent. SECONDARY DATA The major sources of secondary data are as follows, 3. WEBSITES. 4. Broachers SURVEY RESEARCH The method used to collect data for the study was through survey research. Survey Research is the systematic gathering of information from respondents for the purpose of understanding and predicting some aspect of the behavior of the population of interest. MEASUREMENT TECHNIQUES Measurement may be defined as the assignment of numbers to characteristics of objects, persons, states or events, according to rules. Some of the measurement techniques used are, QUESTIONNAIRE It represents the most common form of measurement for eliciting information. As much, its function is measurement. The Questionnaire designed included Open-ended questions, Multiple-Choice questions, and Dichotomous questions. OPEN-ENDED QUESTION BABASAB PATIL - 55 -

- 56. Bajaj Allianz life insurance company. These questions leave the respondents free to offer, any replies that seem appropriate in light of the question. Questionnaire administered included Open-Ended question to find out respondents Expectations in Life Insurance. MULTIPLE-CHOICE QUESTION Multiple-Choice are immediately followed by a list of possible answers from which the respondents must choose. Questionnaire included multiple-choice questions to find out the which sources has made aware about Bajaj Allianz Life Insurance Company. DICHOTOMOUS QUESTION. Dichotomous Question represent an extreme form of the multiple-choice question, allow only two responses such as “Yes or No” This type of questions were used to find out whether respondents aware of Bajaj Allianz Life Insurance Company and whether respondents happy with the Benefits of Bajaj Allianz Life Insurance. RATING SCALES The use of Rating Scale requires the rater to place an attribute of the object being rated at some point along a numerically ordered series of categories. Rating Scale focus on, Overall attribute towards an object. The degree to which an object contains a particular attribute. BABASAB PATIL - 56 -

- 57. Bajaj Allianz life insurance company. Ones feeling towards an attribute. SAMPLING SAMPLING PROCEDURE Descriptive field studies require collection of first hand information or data pertaining to the units of study from the field. The units of study may include the area covered under the Sindhanur . “The process of drawing a sample from large population is called Sampling”. SAMPLING PROCESS POPULATION: The Aggregate of all units pertaining to the study is called Population. The population of this project is a survey of Walking Customers and Existing Customer. SAMPLING FRAME: A Sampling Frame is a means of representing the elements of the population. SAMPLING UNIT: The Sampling Unit is basic unit containing the elements of the population to be sampled. SAMPLING EXTENT: It is the scope of study Sampling Extent is Sindhanur . TIME PERIODS: The Period of study was also limited to 60 days. SAMPLE SIZE: The total Sample Size is 100 from different locations of Sindhanur . BABASAB PATIL - 57 -

- 58. Bajaj Allianz life insurance company. BABASAB PATIL - 58 -

- 59. Bajaj Allianz life insurance company. PART-4 DATA ANALYSIS AND INTERPRETATION BABASAB PATIL - 59 -

- 60. Bajaj Allianz life insurance company. DATA ANALYSIS AND INTERPRETATION Data collected is useful only after analysis. Data Analysis involves converting a series of recorded observations into descriptive statements and inferences about relationships. The types of analysis that can be conducted depend on the nature of the measurement instrument and the data collected method. If the researcher selects the analytical techniques prior to collecting data, the researcher should generate fictional responses to the measurement instrument, these dummy data are then analyzed the results of this analysis will provide the information required by the problem at hand. The results obtained by analyzing such data may not be accurate due to present of dummy data, so it is preferable to select analytical technique after collection of data, depending on data collected. BABASAB PATIL - 60 -

- 61. Bajaj Allianz life insurance company. TABLE.1.Graph Showing the Qualification of Respondents. QUALIFICATION NO.OF RESPONDENTS PERCENTAGE UNDER GRADUATE 15 25.0% GRADUATE 28 46.6% POST GRADUATE 11 18.3% OTHER 06 10.0% QUALIFICATION OF RESPONDENTS 46.60% 50% 45% UNDER GRADUATE 40% 35% GRADUATE 30% 25% POST GRADUATE 25% 18.30% OTHER 20% 15% 10% 10% 5% 0% 1 Interpretation: From the above table , it is clear that out of 60 respondents, 15 respondents are belong to Under Graduate, 28 respondents are belong to Graduate, 11 respondents are belong to Post Graduate and 06 respondents belong to other categories, like PUC, SSLC. So that majority of the respondents are belonging to Graduate. BABASAB PATIL - 61 -

- 62. Bajaj Allianz life insurance company. TABLE.2.Graph Showing the Occupation of Respondents. OCCUPATION NO.OF RESPONDENTS PERCENTAGE BUSSINESSMEN 28 46.6% PRIVA.EMPLOYEE 06 10.0% GOVT. EMPLOYEE 05 8.3% PROFESSIONALS 07 11.6% STUDENTS 11 18.3% OTHERS 03 05% OCCUPATION OF RESPONDENTS 46.60% 50.00% BUSSINESSMEN 40.00% PRIVA.EMPLOYEE GOVT. EMPLOYEE 30.00% PROFESSIONALS 18.30% 20.00% STUDENTS 10.00% 8.30%11.6 0% OTHERS 10.00% 5% 0.00% 1 Interpretation: From the graph it has been observed that, 28 out of 60 respondents are belong to Businessmen, 06 respondents are belong to Private Employee, O5 respondents are belong to Government Employee, 07 respondents belong to Professionals, 11 respondents are belong to students and 03 respondents are belong to other categories. So that major respondents are belongs to Businessmen. TABLE.3.Graph Showing the Age Group of Respondents. BABASAB PATIL - 62 -

- 63. Bajaj Allianz life insurance company. AGE GROUP NO.OF RESPONDENTS PERCENTAGE 18 TO 25 20 33.3% 26 TO 35 22 36.6% 36 TO 45 13 21.6% 46 & ABOVE 5 8.3% AGE GROUP OF RESPONDENTS 8% 33% 22% 18 TO 25 37% 26 TO 35 36 TO 45 46 & ABOVE Interpretation: From the graph it is clear that, out of 60 respondents, 20 respondents are falls in the Age group of (18 to 25), 22 respondents are falls in the Age Group of (26 to 35), 13 respondents are falls in the Age Group of (36 to 45), And 05 respondents fall in the Age Group of (46 & above). TABLE.4. Graph Showing the Family Size of Respondents BABASAB PATIL - 63 -

- 64. Bajaj Allianz life insurance company. FAMILY SIZE NO.OF RESPONDENTS PERCENTAGE 0 TO 3 10 16.6% 3 TO 5 22 36.6% 5 TO 7 15 25.5% 7 & ABOVE 13 21.6% s FAMILY SIZE OF RESPONDENTS 36.6 0% 40.00% 25.50% 30.00% 0 TO 3 21.60% 16.60% 3 TO 5 20.00% 5 TO 7 10.00% 7 & ABOVE 0.00% 1 Interpretation: From the graph it has been observed that, out of 60 respondents 10have the Family size between (0 to3), 22 respondents have the family size between (3 to 5), 15 respondents have the family size between (5 to 7). 13 respondents have the family size between (7 & above), So that major respondents belong to size of family between (3to 5). TABLE.5. Graph Showing the Income Group of respondents INCOME GROUP NO.OF RESPONDENTS PERCENTAGE 3000 TO 5000 /month 06 10.0% 5000 TO 10000/month 17 28.3% 10000 TO5000/month 14 23.3% BABASAB PATIL - 64 -

- 65. Bajaj Allianz life insurance company. 15000 TO ABOVE 11 18.3% INCOME GROUP OF RSPONDENTS 10.00% 3000 TO 5000 /month 18.30% 5000 TO 10000/month 10000 TO15000/month 28.30% 23.30% 15000 TO ABOVE Interpretation: From the graph it has been observed that, out of 60 respondents, O6 respondents have the Income between (3000 to 5000), 17 respondents have the income between (5000 to 10000), 14 respondents have the income between (10000 to 15000) and 11 respondents have the income between (15000 & above). TABLE.6. Graph Showing respondents Awareness about Life Insurance. YES 56 93.3% NO 04 6.6% BABASAB PATIL - 65 -

- 66. Bajaj Allianz life insurance company. AWARENESS OF RESPONDENTS YES 7% NO 93% Interpretation: From the graph, it is observed that, out of 60 respondents, 56 respondents are Aware about Life Insurance, and 06 respondents are not Aware about Life Insurance. So that majority of the respondents are Aware of Life Insurance. TABLE.7. Graph showing respondents Awareness about Bajaj Allianz Life Insurance Company. YES 32 53.3% NO 28 46.6% BABASAB PATIL - 66 -

- 67. Bajaj Allianz life insurance company. AWAREESS ABOUT Bajaj Allianz YES NO 47% 53% Interpretation: From the graph, it is observed that, out of 60 respondents 32 respondents are Aware about Bajaj Allianz Life Insurance Company, and 28 respondents are not Aware about Bajaj Allianz Life Insurance Company. So that most of the respondents are not Aware of Bajaj Allianz Life Insurance. TABLE.8.Graph Showing respondents Sources of Awareness. SOURCES NO.OF RESPONDENTS PERCENTAGE MEDIA 06 18.7% AGENT 18 56.2% BABASAB PATIL - 67 -

- 68. Bajaj Allianz life insurance company. FRIENDS 07 21.8% NEWS PAPER 02 6.25% SOURCES OF AWARENESS 6% MEDIA 18% 21% AGENT FRIENDS 55 % NEWS PAPER Interpretation: From the graph, it is observed that, out of 32 respondents O6 respondents are Aware about Bajaj Allianz Life Insurance through Media, 18 respondents are Aware through Agent, 07 respondents are Aware through Friends, and 02 respondents are Aware through News Paper. So that major source of Awareness of respondents is Agent. TABLE.9.Graph Showing respondents Influence Factors BABASAB PATIL - 68 -

- 69. Bajaj Allianz life insurance company. FACTORS NO.OF RESPONDENTS PERCENTAGE SECURITY 55 91.0% HIGHRETURNS 34 53.1% RIS COVERAGE 16 26.6% SERVICE 18 30.0% OTHERS 01 1.6% INFLUENCE FACTORS 91% 100% SECURITY 80% HIGHRETURNS 53.10% RIS COVERAGE 60% SERVICE 40% 26.60% 30.00% OTHERS 20% 1.60% 0% 1 Interpretation: From the above graph, 91% of the respondents are look for security while investing in Bajaj Allianz, 53% of the respondents look for high returns, 26.6% of the respondents look for risk coverage, 30% of the respondents look for service and 1.6% of the respondents look for others. So that most of the respondents look for security while investing in Bajaj Allianz Life Insurance. BABASAB PATIL - 69 -

- 70. Bajaj Allianz life insurance company. TABLE.10.Graph Showing respondents Happy with the Benefits of Bajaj Allianz Life Insurance. YES 36 90% NO 04 10% 10% YES NO 90% Interpretation: From the graph it has been observed that, out of 40 respondents, 36 respondents are happy with the Benefits of Bajaj Allianz Life Insurance, And 04 respondents are not happy with the Benefits of Bajaj Allianz Life Insurance. So the major respondents are happy with the Benefits of Bajaj Allianz Life Insurance. BABASAB PATIL - 70 -

- 71. Bajaj Allianz life insurance company. TABLE.11. Graph Showing respondents Rating with the Benefits of Bajaj Allianz Life Insurance. RATING NO.OF RESPONDENTS PERCENTAGE VERY GOOD 28 70.0% GOOD 8 20.0% OK 3 7.5% NOT GOOD 1 2.5% RATING OF RESPONDENTS 70.00% VERY GOOD 80.00% GOOD 60.00% OK 40.00% NOT GOOD 20.00% 20.00% 7.50% 2.50% 0.00% 1 Interpretation: From the graph it has been observed that, out of 40 respondents, 28 respondents have given rate as Very Good, 08 respondents have given Good, 03 respondents have given Ok and 01 respondent has given Not Good, So the Majority of respondents have satisfied with the Benefits of Bajaj Allianz Life Insurance. FINDINGS BABASAB PATIL - 71 -

- 72. Bajaj Allianz life insurance company. ♦ From the market research study it has been observed that 90% of the respondents are Aware of Life Insurance. ♦ From the market research study it has been observed that 53% of the respondents are Aware of Bajaj Allianz Life Insurance ♦ 62% of the respondents are Aware of Bajaj Allianz Life Insurance through Agent. ♦ About 91% of the respondents are look for security while investing in a Bajaj Allianz Life Insurance. ♦ It was founded that 63% of the respondents are rate the service of Bajaj Allianz Life Insurance as very good. ♦ 90% of the Existing Customers are Happy with the Benefits of Bajaj Allianz Life Insurance. ♦ 80% of the respondents are Rate the Benefits of Bajaj Allianz Life Insurance as Very good. BABASAB PATIL - 72 -

- 73. Bajaj Allianz life insurance company. SUGGESTIONS The Bajaj Allianz Life Insurance Company should concentrate heavily on attractive Advertisements and various Promotional Strategies like, giving Pamphlets, put the hoardings and banners at important locations of the Sindhanur where the movement of the people is very high, Should be used to bring out the Awareness. People should be educated by giving seminar in Business Conferences, installing stalls in Business Exhibitions. And Company should conduct seminars in Educational Institutions to provide information about company and its products. Company has to create a sense of security among the customers. Because most of the people fear about security in Private life Insurance. So Company has to explain and highlight about IRDA, which will give support to the Private life Insurance. Whenever company launches a new products company can conduct some functions for existing policyholders, which ensures direct interaction with exiting costumers. And create the policyholder clubs that gives sense of belongingness. BABASAB PATIL - 73 -

- 74. Bajaj Allianz life insurance company. CONCLUSIONS Following are the Conclusions drawn after analysis of the data collected from the survey research. ♦ Almost, all the population of Sindhanur is Aware Life Insurance. ♦ Most of the people are not Aware of Bajaj Allianz Life Insurance Company. ♦From overall study it can be concluded that Almost, all the people are Aware of Bajaj Allianz Life Insurance through Agent. ♦ It can be concluded that the people Expectations in a Private Life Insurance Company is Security and Service while purchasing. ♦ From overall study it can be concluded that, almost all Existing Customers are Happy with the Benefits of Bajaj Allianz Life Insurance. BABASAB PATIL - 74 -

- 75. Bajaj Allianz life insurance company. LIMITATIONS OF THE STUDY Despite of all possible efforts to make the market research mare comprehensive and scientific, study has certain following Limitations. The study is confined to Sindhanur only. Any suggestions given by analyzing data Collected may not be accurate for other locations as people requirements and Expectations differ from one place to other. There existed some respondents who refused to respond and these respondents who Did not participate in the survey may not be distinct & might have affected the Result of the study. The sample size was chosen randomly which might not be appropriate which lead to few errors in the study. Many of respondents did not furnish true information, they provided Information Just to complete the interview, which has affected the study? Some of the respondents did not furnish all the information required for the study. BABASAB PATIL - 75 -

- 76. Bajaj Allianz life insurance company. BABASAB PATIL - 76 -