SAMPLE - Origination Manual

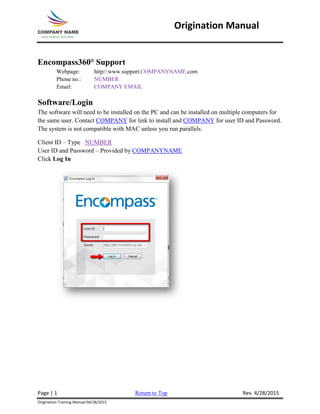

- 1. Origination Manual Encompass360° Support Webpage: http//:www.support.COMPANYNAME.com Phone no.: NUMBER Email: COMPANY EMAIL Software/Login The software will need to be installed on the PC and can be installed on multiple computers for the same user. Contact COMPANY for link to install and COMPANY for user ID and Password. The system is not compatible with MAC unless you run parallels. Client ID – Type NUMBER User ID and Password – Provided by COMPANYNAME Click Log In Page | 1 Return to Top Rev. 4/28/2015 Origination Training Manual 04/28/2015

- 2. Origination Manual Home Tab The home tab is the Central location for viewing important information. The first two column can be customized to personal preferences. These modules can be added, removed, change location and/or color with the exception of the Admin Whiteboard, which still can be moved and changed color but not removed. The third column cannot be altered in anyway, these modules are directly from Ellie Mae, the makers of Encompass360. Any messages Ellie Mae wants to broadcast to ALL users, not just COMPANY, can be found third column along with the Resource Center, which is a great source of all trainings for Encompass360°. The user can also add different modules is up to 12, by using the Add Modules icon. Page | 2 Return to Top Rev. 4/28/2015 Origination Training Manual 04/28/2015

- 3. Origination Manual Pipeline Tab The pipeline tab is the starting point for originating, viewing, and managing loans. The user can view loan summary, detail information, search, and sort, manage alerts and open loan files. Loans in the summary area display with the following colors: White - a loan with a status of Active Loan, Loan Originated, or Loan purchased by your institution. Gray - a loan with a status of Active Loan, Loan Originated, or Loan purchased by your institution. Pink - a loan with an Adverse status: Application approved but not accepted, Application denied, Application withdrawn, File closed for incompleteness, Preapproval request denied by financial institution, or Preapproval request approved but not accepted. Dark Gray - the logged-in user has read-only access to the loan. Light Blue - a loan that is open on the Loan tab. Page | 3 Return to Top Rev. 4/28/2015 Origination Training Manual 04/28/2015

- 4. Origination Manual Loan Folders Depending on the status of a loan will determine which loan folder it will be in. <(All Folders)> – contains all loans no matter the status <(Archive)> - contains loans after a period of time being completed Adverse Loans - contains loans that have been withdrawn or denied Closed Loans – contains loans that have closed and funded Completed Loans – contains loans that have gone through all the milestones My Pipeline – contains loans that are active and have been disclosed Prospects – contains loans that are not a full application. A full application contains the following; o Name o Income o Social Security Number o Subject Property Address o Estimated Value of Subject Property o Mortgage Loan Amount Sought *Note – Refinances are an automatic application since all the above information is received and/or can be obtained with due diligence. A refinance needs to be disclosed by the third day to stay in compliance.* Page | 4 Return to Top Rev. 4/28/2015 Origination Training Manual 04/28/2015

- 5. Origination Manual Views Users will have one or more default view from which to choose. The administrator determines the views that are available to the user based on their assigned personas. Create Views: After changing the columns, sorting the data, applying search criteria, and/or selecting All Loan of My Pipeline, the user can save the new configuration as a new custom view. Once the view is saved, the user can select it at any time to apply the criteria to your loan summary list. Right click the column header and select Custom Columns… Check or uncheck column header titles then click OK Click the save icon Page | 5 Return to Top Rev. 4/28/2015 Origination Training Manual 04/28/2015

- 6. Origination Manual Type the name for the new view and then click Save. The new view will be saved along with the default views set by the administrator and both can be accessed at any time. Page | 6 Return to Top Rev. 4/28/2015 Origination Training Manual 04/28/2015

- 7. Origination Manual Pipeline Icons Pipeline Icons can be clicked once to view more detailed information without opening the file completely. Example click the Borrower icon to view home, cell and work phone numbers. Page | 7 Return to Top Rev. 4/28/2015 Origination Training Manual 04/28/2015

- 8. Origination Manual Loan Workspace The loan workspace will look the same on every loan with the exception of the data within the loan. 1. Header: Contains summary of key information such as subject address, LTV, DTI, the eFolder, save icon, print icon, loan exit, etc. 2. Left Panel Upper Section: Contains all messages and alerts and the Log tab has all the milestones 3. Left Panel Lower Section: Contains Forms, Tools and Services 4. Work Area/Viewing Section: Displays items selected in the Left Panel Upper and Lower sections Page | 8 Return to Top Rev. 4/28/2015 Origination Training Manual 04/28/2015

- 9. Origination Manual Help The Help Tab is always available as you maneuver through Encompass360. The Help function is intuitive and will populate help information as it relates to the page that you are on. A detailed table of contents is available with hyperlinks to written material, videos and graphics. Accessing help topics can be done by clicking the word Help on the main screen then click Encompass360 Help or by pressing the F1 key on the keyboard. Page | 9 Return to Top Rev. 4/28/2015 Origination Training Manual 04/28/2015

- 10. Origination Manual Keyboard Shortcuts Help – F1 Current Date – Ctrl+D Go-To Field – Ctrl+G The Go-To Field option locates a field based on its field ID: Step 1. With a loan open, press Ctrl+G Step 2. Type a field ID and click Find The system will automatically go to the form the field is found. The field ID can also be found by hovering over the field a quick popup will show the field ID number and description. See HelpPad for descriptions too long to read in the quick popup. Field IDs can also be found on the bottom right side of the computer screen. The HelpPad allows you to capture field-level help in a separate help window: Press the Ctrl key and then click a field on a form (repeat to add more field information), the HelpPad opens with the selected field-level help displayed. Page | 10 Return to Top Rev. 4/28/2015 Origination Training Manual 04/28/2015

- 11. Origination Manual Custom Links Adding Custom Links is a faster way to access websites frequently used i.e. 411.com, FHA connector, VA portal, NMLS consumer access, etc. Step 1. Click Services Step 2. Click My Custom Links Step 3. Click New Link Step 4. Type in the information for the website Step 5. Click Add Custom Link Page | 11 Return to Top Rev. 4/28/2015 Origination Training Manual 04/28/2015

- 12. Origination Manual Step 6. Access the website by clicking the name Step 7. Click Continue Page | 12 Return to Top Rev. 4/28/2015 Origination Training Manual 04/28/2015

- 13. Origination Manual Page Left Intentionally Blank Page | 13 Return to Top Rev. 4/28/2015 Origination Training Manual 04/28/2015

- 14. Origination Manual Creating a New Loan Creating a new loan can only be done in the Prospect Loan Folder. If you are in any other folder the “New” icon will not be illuminated. Step 1. Click the New Icon Step 2. There are two (2) options of selecting a template a. Double click PURCHASE Loans or REFINANCE Loans b. Select PURCHASE Loans or REFINANCE Loans then click Select Template Page | 14 Return to Top Rev. 4/28/2015 Origination Training Manual 04/28/2015

- 15. Origination Manual Forms to Complete For All Loans Purchase If a prospect is a purchase and the Borrower is looking to see if they qualify, the following forms need to be filled out; 1. Borrower Summary 2. 1003 Page 1 3. 1003 Page 2 - Pull credit 4. 1003 Page 3 5. 2010 Itemization – Manually enter fees Once the Borrower has an Accepted Offer or signed a Sales Contract (Purchase and Sales) the prospect becomes a full application and will need to be disclosed within three (3) business days, follow Full Application Workflow. Refinance If a prospect is a refinance all of the six (6) pieces of information are available and/or obtainable with due diligence. A full application contains the following and needs to follow the Full Application Workflow; *Note – a refinance CANNOT be a TBD* o Name o Income o Social Security Number o Subject Property Address o Estimated Value of Subject Property o Mortgage Loan Amount Sought Page | 15 Return to Top Rev. 4/28/2015 Origination Training Manual 04/28/2015

- 16. Origination Manual Full Application Workflow All forms need to be filled out, see below. When originating a loan it is crucial to follow the workflow from top to bottom in the forms tab as well as when inputting data. Fields will automatically populate on other forms for less data entry. If the file is FHA, VA or USDA additional forms will need to be filled out, as well as below, use the Show All and Show in Alpha Order to view all available forms. 1. Borrower Summary 2. 1003 Page 1 3. 1003 Page 2 (Pull credit) 4. 1003 Page 3 5. 2010 Itemization – (SmartGFE) 6. 2010 GFE 7. REGZ-TIL 8. Home Counseling Providers 9. Request for Transcript of Tax 10. State-Specific Disclosure Information Page | 16 Return to Top Rev. 4/28/2015 Origination Training Manual 04/28/2015

- 17. Origination Manual Borrower Summary The Borrower Summary is the first form that needs to be filled out. When a file is started there will be BLUE fields throughout all the forms, these fields are mandatory and must contain data in order to finish the qualification milestone and generate disclosures to eSign or WetSign. Start at the top of the form and work down filling in required data fields, such as Name, SSN, DOB, Phone numbers, etc. Some fields may not be BLUE but still might be applicable to the transactions and should be filled in such as Middle initial, E-mail address, Title held, etc. Note – DO NOT use any COMPANY’s, realtor’s or settlement agent’s email address, otherwise it will look like they eSigned instead of the borrower. Page | 17 Return to Top Rev. 4/28/2015 Origination Training Manual 04/28/2015

- 18. Origination Manual Credit Information – Pulling New Credit In order to pull credit an authorization is needed, usually the Borrower gives a verbal authorization when asked if credit can be pulled. When a Borrower gives their name, present address, SSN and date of birth this is considered a verbal authorization to pull the credit report without having a written authorization. Step 1. Click the calendar Step 2. Select the date the borrower authorized a credit report pull Step 3. Click Order Credit Step 4. Select either ACRAnet or Credit Plus depending on what the branch uses Step 5. Click Submit Page | 18 Return to Top Rev. 4/28/2015 Origination Training Manual 04/28/2015

- 19. Origination Manual Step 6. Fill in the required information Step 7. Click Finish Step 8. The Services View tab will open, review report and click Loan to go back to the File Step 9. Click Import Liabilities Page | 19 Return to Top Rev. 4/28/2015 Origination Training Manual 04/28/2015

- 20. Origination Manual Step 10. Make sure Delete existing liabilities before importing and Import FACTA are checked. Import Credit Fee to HUD and GFE can be checked if desired Step 11. Click Import Step 12. Click OK Page | 20 Return to Top Rev. 4/28/2015 Origination Training Manual 04/28/2015

- 21. Origination Manual Importing Existing Credit Report To import a credit report that has already been pulled and has not yet expired, can be done by the following; Step 1. Click the calendar Step 2. Select the date the borrower authorized a credit report pull Step 3. Click Order Credit Step 4. Select either ACRAnet or Credit Plus depending on what the branch uses Step 5. Click Submit Page | 21 Return to Top Rev. 4/28/2015 Origination Training Manual 04/28/2015

- 22. Origination Manual Step 6. Select Import from website from the dropdown menu Step 7. Type in the Reference/File Number Step 8. Click Finish Step 9. The Services View tab will open, review report and click Loan to go back to the file Step 10. Click Import Liabilities Page | 22 Return to Top Rev. 4/28/2015 Origination Training Manual 04/28/2015

- 23. Origination Manual Step 11. Make sure Delete existing liabilities before importing and Import FACTA are checked. Import Credit Fee to HUD and GFE can be checked if desired Step 12. Click Import Step 13. Click OK Step 14. Click the Save icon in the top right corner of the screen Page | 23 Return to Top Rev. 4/28/2015 Origination Training Manual 04/28/2015

- 24. Origination Manual Step 15. Fill in the Subject Property Info. For purchases, only, leaving the street address as TBD will not trigger any alerts for RESPA or Disclosures until the address is known. Step 16. Click the Magnified glass to select the Loan Program then click Select Step 17. Click the Magnified glass to select COMPANY Fee then click Select Step 18. Fill in all required fields. Comments / Special Instructions from Sales is a location that is used for any information the Originator wants to say about the file to the Processor and/or Underwriter and anyone else that opens the loan file. Page | 24 Return to Top Rev. 4/28/2015 Origination Training Manual 04/28/2015

- 25. Origination Manual Page Left Intentionally Blank Page | 25 Return to Top Rev. 4/28/2015 Origination Training Manual 04/28/2015

- 26. Origination Manual 1003 Page 1 Entering data on the Borrower Summary form will autocomplete some fields on 1003 Page 1. Continue filling out data, use the Show All (VOR) and Show All (VOE) to add additional records of housing and/or employment see next page for instructions. Page | 26 Return to Top Rev. 4/28/2015 Origination Training Manual 04/28/2015