Nov 2013 Colliers Vietnam Investment Digest

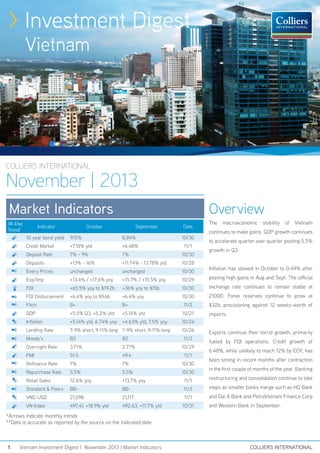

- 1. > Investment Digest Vietnam COLLIERS INTERNATIONAL November | 2013 Market Indicators 30-Day Trend Indicator Overview October September Date The macroeconomic stability of Vietnam continues to make gains. GDP growth continues 10 year bond yield 9.15% 8.84% 10/30 Credit Market +7.18% ytd +6.48% 11/1 Deposit Rate 7% - 9% 7% 10/30 Deposits +13% - 16% +11.74% - 13.78% ytd 10/28 Enery Prices unchanged unchanged 10/30 Exp/Imp +13.4% / +17.6% yoy +15.7% / +15.5% yoy 10/29 posting high gains in Aug and Sept. The official FDI +65.5% yoy to $19.2b +36% yoy to $15b 10/30 exchange rate continues to remain stable at FDI Disbursement +6.4% yoy to $9.6b +6.4% yoy 10/30 21000. Forex reserves continue to grow at Fitch B+ B+ 11/2 $32b, provisioning against 12 weeks-worth of GDP +5.5% Q3, +5.2% ytd +5.14% ytd 10/21 imports. Inflation +5.14% ytd, 6.74% yoy +4.63% ytd, 7.5% yoy 10/24 Lending Rate 7-9% short, 9-11% long 7-9% short, 9-11% long Moody’s B2 B2 Overnight Rate 3.71% 2.77% PMI 51.5 49.4 11/1 Refinance Rate 7% 7% 10/30 Repurchase Rate 5.5% 5.5% 10/30 Retail Sales 12.6% yoy +13.7% yoy 11/1 restructuring and consolidation continue to take Standard & Poors BB- BB- 11/2 steps as smaller banks merge such as HD Bank VND-USD 21,098 21,117 11/1 and Dai A Bank and PetroVietnam Finance Corp VN-Index 497.41, +18.9% ytd 492.63, +17.7% ytd 10/26 11/2 10/29 10/31 to accelerate quarter over quarter posting 5.5% growth in Q3. Inflation has slowed in October to 0.49% after Exports continue their torrid growth, primarily fueled by FDI operations. Credit growth of 6.48%, while unlikely to reach 12% by EOY, has been strong in recent months after contraction in the first couple of months of the year. Banking and Western Bank in September. *Arrows indicate monthly trends **Data is accurate as reported by the source on the indicated date 1 Vietnam Investment Digest | November 2013 | Market Indicators COLLIERS INTERNATIONAL

- 2. Investment Manager’s Letter Early numbers indicate a continued strengthening of the 5.14% GDP growth in the first three quarters over the same investment environment from both a macro and micro view. period in 2012. However, Vietnam’s growth is dwarfed by Key indicators have continued their upward trend from Q2 into neighboring countries such as the Philippines (>7%) and the end of the year as displayed on page 1. There are three China (>7%). As you will see, domestic industrial output, retail things to watch as you consider investing in Vietnam. growth, and credit growth are showing slow gains. To make the most of the current FDI interest, Vietnam must focus on In the banking and finance sector, continue to watch Vietnam areas of talent transfer, support industries, and oversight to Asset Management Company (VAMC) and State Bank of bring domestic industry up to world standard. Vietnam’s (SBV) handling of non-performing loans (NPL). The current mechanism serves only to add near-term liquidity On the whole, 2013 has shown much progress over the to a sector that is already awash with capital and continues year before, but there is much work yet to be done. In this to struggle to lend in a market void of demand. Without a debt environment, “distressed” assets are not yet internationally trading market or other similar market mechanism, these accessible for most. I believe the opportunities lie in investing NPLs will remain out of reach. with an eye on 2016-2020 in the mid-end residential and commercial office space. Once domestic demand kicks in Secondly, keep an eye on the SBV’s handling of the currency. early-to-mid next year, the limited office space in Vietnam According to various industry insiders and others looking will fill quickly and flip the market to a seller’s orientation. In in, the VND is still over-valued and will be a source of the industrial and manufacturing space the government, with additional volatility. While Vietnam’s forex reserves are now support from FDI operations, has been making a strong push approximately $32 billion, a quick devaluation can still wipe to incentivize support industries and increase localization. this out. Additionally, Vietnam is looking to increase its fiscal Many opportunities abound in Vietnam and can be uncovered deficit to pay for an increase in public spending in target with the right focus. sectors and infrastructure to stimulate domestic demand. Finally, pay attention to the lackluster growth of domestic demand. The tremendous growth and health of the FDI sector KYNAM DOAN Investment Manager While Vietnam is by no means struggling, as indicated by a kynam.doan@colliers.com +84 1223 128 032 2 COLLIERS INTERNATIONAL has overshadowed a troubling stagnation of domestic demand. Vietnam Investment Digest | November 2013 | Investment Manager’s Letter

- 3. VIETNAM INVESTMENT DIGEST | NOVEMBER 2013 Investment News VAMC CURRENCY The VAMC has purchased VND 11.1 trillion of bad debts from 14 banks by the end of October according to VAMC’s VP Mr. Nguyen Quoc Hung. Approximately 67% of these bad debts are secured by real estate and 22% are in manufacturing. The VAMC purchases these debts with special 5-year, zero-coupon bonds and require the Following the 1% devaluation of the VND in June, the SBV plans to further devalue the currency by 2% before the end of the year, seller to provision 20% of the value of the debt annually. according to PM Nguyen Tan Dung. Several forces may be depressing the value of the VND including the strengthening economy of economies that have traditionally invested heavily in Vietnam like Japan, America, Australia, Singapore, and However, as mentioned previously, the current mechanism only serves to buy lenders a little time while further locking up the underlying asset. Currently, there is no clear procedure or legal framework for the VAMC and other lenders to list their bad debts and for investors to find, assess, and bid for these assets. Until a mechanism that can approximate a debt trading market is set up, member-states of Europe. these bad debts will remain out of reach. INDUSTRIAL GROWTH Additionally, while banks can refinance up to 70% of the value of these bonds, no banks have yet done so – indicating healthy liquidity among Vietnam’s lenders. RETAIL Low interest rates coupled with double-digit deposit growth and the imperative to increase credit by 12% in FY13 may lead to higherthan-expected inflation once domestic demand returns, which would then depress the dong further. Industrial production has seen significant progress in the third quarter of this year compared to the two previous quarters. These achievements resulted from the development of the processing and manufacturing sector with high manufacturing and consumption of export products. Industrial Production index year to date has increased 5.4% year over year. Of the ten months’ 5.4% general growth rate, the manufacturing contributed 4.9%. Among the highest growth in manufacturing are textile industry with the year to date increase of 19.9% year over year, leather and related products with the increase of 16.3% year over year, prefabricated metal products and motored vehicles with the rise of 13.7% year over year and 12.9% year over year. Vietnam’s total retail sales and service revenues were estimated to have increased by 12.6% year over year to VND 2,159 trillion ($100.21 billion) in the first 10 months of 2013, the General Statistics Office (GSO) said on its website. The trade sector contributed 76.8% of the country’s total retail sales and service turnovers with VND 1,657.8 trillion, increasing 12.1% year over year. Hotel, restaurant sector accounted for 12.1% of the country's total with VND260.2 trillion, rising 14.9% year over year. Service sector accounted for 10.2% with VND 220.2 trillion, rising 14.8% year over year. Tourism sector contributed 0.9% or VND 20.3 trillion, up 3.1% year over year. However, If price hike is excluded, the retail growth rate would be 5.5% which is lower than the rise by 6.8% (price hike excluded) in the same period last year. This slow recovery is troubling and casts Industrial investment is focused on Ho Chi Minh City, Dong Nai, Ba Ria-Vung Tau, Hanoi, Binh Duong and Bac Ninh. These six localities are making up nearly 70 percent of total industrial production value of the country. WORLD BANK – VIETNAM RANKS 99TH IN EASE OF DOING BUSINES While Vietnam has improved its business environment slightly, it still dropped 1 spot to 99th from 98th. The marginal improvement of 69 basis points to 61.13% in 2014 over 2013 lags behind the region. The subcategory, “Protecting Investors,” gained the most, jumping 12 spots to 157 (out of 189) and “Paying Taxes” lost the most, falling 4 spots to 149. Vietnam has increased employers’ social security contribution rate, contributing to the 4-spot drop in that category. a shadow over much of the other positive growth data. 3 Vietnam Investment Digest | November 2013 | Investment News COLLIERS INTERNATIONAL

- 4. VIETNAM INVESTMENT DIGEST | NOVEMBER 2013 Investment News RESIDENTIAL REAL ESTATE INVENTORY AT $4.85 BILLION, DOWN 20% FROM APRIL According to the Ministry of Construction, the value of real estate inventory fell $200 million to $4.85 billion in September from Aug (a 4% drop) and $1.23 billion from April (a 20% drop) with low-income housing leading the way. Inventories in the two largest markets, Ho Chi Minh City and Hanoi, have dropped by 16.1% and 15% to $1.05 billion and $0.69 billion respectively in September compared to August. Four major factors are thawing the residential sector: 1. Real demand is returning and home buyer sentiment has improved. It is consensus that residential prices are near or at the bottom with certain products returning to the level of seven years ago. 2. The government has additionally helped push the affordable market with preferential 6% loans to both home buyers and developers. 3. Developers have reduced prices sufficiently to meet market demand. Prices have fallen 10%-30% across the industry and even as much as 50% in the case of Novaland’s Sunrise City. 4. Developers have also added flexibility and other incentives, such as Osaka Garden’s offer of free foundations for land lot purchases, Estella’s extended payment terms of 50% down and zerointerest payments over two years, and Vingroup’s offer of free management service in Royal City, Times City, and Vincom Village. OCTOBER’S PMI OF 51.5 POINTS MEETS EXPECTATION HSBC’s Vietnam Manufacturing Purchasing Managers’ Index (PMI) has risen two months in a row to 51.5 after four months of decline earlier this year and is the best reading since April 2011, the first month PMI was recorded. According to HSBC, this is a strong indication that demand has returned and the manufacturing sector has returned to output growth. Payrolls have continued to expand and companies are anticipating further production growth. New work has increased for the second month in a row and has led to a rise in production. Additionally, faced with increasing average input costs, manufacturers have increased their charges for the first time since March. M&A »» Seafood companies Hung Vuong Corp and Minh Phu – Hau Giang Seafood Processing Company have sold $42.3 million and $12.5 million in shares to foreign partners. »» Viettel purchased 70% of Cam Pha Cement, worth approximately $6.7 million. »» REE Corp increased their investment in Pha Lai Heat and Thu Duc Water of $1.9 million and $1.2 million. »» Thien Minh Group acquired 89% of Hai Au Airline for approximately $2.5 million OTHER NOTES »» Metro line 1 is being further delayed because nearly 100 households in Thu Duc and Di An have yet to hand over their sites. This will cost the city up to USD$119,000 (VND 2.5b) per day. Line No. 1 was initially estimated to cost USD$1.09 billion, but has now ballooned to USD$2.07 billion. »» In the January-September period, tax collection from the State sector was 2% lower year on year, while tax payments from the foreign direct investment sector rose 30%, and that from the local, non-State sector increased 18%. »» PM Dung signed Decision 61/2003/QD-TTg on October 25 approving the release of 6 types of national data needed to rate the country’s credit. »» Vietnam’s Ho Chi Minh City Stock Exchange (HOSE) became an official member of the World Federation of Exchanges on October 29. »» China’s Manufacturing PMI (CPMINDX) climbs to 51.4, NonReceive this and other reports by joining our group: http://bit.ly/investVN Manufacturing PMI (CPMINMAN) jumps to 56.3 and continues its steep climb from Aug (53.9) and Oct (55.4). South Korea’s PMI Increased to 50.2 in Oct from a local min of 47.2 in July. Taiwan’s PMI increased to 53 in Oct from 52 and Japan’s PMI Increased to 54.2 in Oct from 52.5. 4 Vietnam Investment Digest | November 2013 | Investment News COLLIERS INTERNATIONAL

- 5. VIETNAM INVESTMENT DIGEST | NOVEMBER 2013 Major Economic Indicators FDI TRADE FDI has been accelerating quickly over Q3 and into Q4. Total FDI stands at $19.2 billion, a rise of 65.5%, while disbursed FDI stands at $9.6 billion, a rise of 6.4%. This total far outstrips the government’s target of $13-$14 billion. Exports have reached $107.97 billion and imports, $108.16 billion. Both represent an increase of 15.2% over the same period last year. While overall exports continue to grow strongly, domestic-based exports increased only 3% to $35.9 billion – underperforming inflation. Korea and Singapore lead all other countries with pledged investments of $3.6 billion and $2.7 billion respectively. Manufacturing and processing lead all categories with $14.9 billion, or 78% of the total pledged. In October, there were two major investments of $2 billion by China Southern Power Grid Company and China Power International Holdings in a 1,200MW thermal power plant and $1.2 billion by Samsung. INFLATION Industrial production has seen significant progress in the third Inflation in October slowed to an estimated 0.49% month-overmonth after increasing sharply in September by 1.06% and August by 0.83% according to the GSO. In the first 10 months of the year, inflation is 5.14%, well within range of the target of 7.05%. Topping gains were food by 0.91%, education by 0.53% and housing and construction materials by 0.50%. VN-INDEX October ended the month at 497.41, up slightly from September’s close of 492.63. Foreigners continued to be net buyers two months in a row propping the index near 500 due to indications that the US will continue its quantitative easing due to lackluster employment data. GDP 10M/2013 GDP stands at 5.14%, higher than last year’s 5.1%. GDP grew 5.54% in Q3, 5% in Q2, and 4.76% in Q1. Analysts expect a GDP growth of approximately 5.6%-5.7% in Q4, increasing 2013’s growth to 5.2%-5.3%. The manufacturing sector is leading the way, improving 8.6% yoy in Q3. CREDIT GROWTH TARGET OF 12% OUT OF REACH Lenders are awash in capital, but are struggling to maintain lending standards while attempting to attain year-end credit growth goals. Because of the lack of credit demand by domestic business, banks would have to significantly lower their risk standards to reach 12% by year end. BUDGET DEFICIT CAP TO 5.3% The National Assembly is also preparing to vote on raising the budget deficit cap to 5.3% by issuing $8.1 billion in bonds. They are hoping to raise capital to further invest in infrastructure. FOREX RESERVES Vietnam’s foreign exchange reserves are estimated at $32 billion, or 12 weeks of imports. This figure is 60% higher than the $20 billion in reserves at the end of December 2012. SBVs focus on shoring up the forex reserves will help mitigate inflationary pressures and foreign withdrawal when the US begins to slow its quantitative easing of $85 billion per month. The Fed has indicated that they would continue with this level of QE given recent lackluster employment numbers and GDP growth. 5 Vietnam Investment Digest | November 2013 | Investment News COLLIERS INTERNATIONAL

- 6. VIETNAM INVESTMENT DIGEST | NOVEMBER 2013 Legal Brief CIRCULAR NO. 141/2013/TT-BTC A new circular by the Minister of Finance guiding Decree No. 92/2013/ND-CP, which guided the Law on Corporate Income Tax and Law on Value-added Tax amendments, was issued on 16 October 2013 and will take effect from 30 November 2013. Accordingly, from 1 July 2013, the VAT rate applied for the sale, lease, hire or purchase of social houses will only be 5%. Notably, from 1 July 2013 until 30 June 2014, the sale, lease or lease for purchase of commercial houses with a floor area of under 70m2 and a sale price of less than VND 15 million/m2 will attract a 50% reduced rate of VAT to 10%. DECREE NO. 121/2013/ND-CP From 30 November 2013, Decree No. 121/2013/ND-CP will take effect and replace Decree No. 23/2009/ND-CP on administrative sanctions in the activities of construction, real estate business, exploiting, manufacturing and trading of building materials, infrastructure management, development and management of houses and offices. In these fields, the maximum level of fines is VND 300,000,000. Furthermore, the statute of limitations for handling administrative violations on real estate business, manufacturing and trading of building materials and infrastructure management is 1 year. FOREIGN INVESTORS MAY HAVE THE RIGHT TO SUB-LEASE REAL ESTATE The abovementioned is referred to in the draft amendments to the Law on Real Estate Business, which will be submitted to the Government. The proposed law, if passed, will expand the rights of foreign investors to sub-lease real estate. This will be a significant improvement from the current law, which permits foreign investors to only invest in new projects for sale or leasing. COLLIERS INTERNATIONAL VN General Director Peter.Dinning@colliers.com Investment Manager | HCMC KyNam.Doan@colliers.com Investment Manager | Hanoi Tung.Nguyen@colliers.com + + Reach out to the Vietnamese investment community. To contribute to Colliers’ Investment Digest, contact kynam.doan@colliers.com MONTHLY INVESTMENT DIGEST This brief is published monthly by Colliers Vietnam Investment Services, led by Peter Dinning and KyNam Doan, with the assistance of our legal partner, LNTPartners. We advise an asset portfolio that focuses on appropriate returns to match diverse risk-return profiles. Our portfolio tracks a wide range of assets including land, developments, and income-producing properties across all market sectors - commercial, hotel, industrial, residential, and retail. Contact us to learn more. LNT & PARTNERS LNT & PARTNERS is a leading full-service independently ranked local law firm in Partner Binh.Tran@LNT-Partners.com The firm is among Vietnam’s most prominent, representing a wide range of Vietnam with offices in Ho Chi Minh City, Hanoi, Hong Kong, and San Francisco. multinational and domestic clients, including Fortune Global 500 companies as well as well-known Vietnamese listed companies on a variety of business and investment matters. 6 Vietnam Investment Digest | November 2013 | Legal Brief

- 7. Colliers International Investment Services Colliers International is a world leader in connecting capital with real estate investment opportunities. We provide breadth and depth of services to both international and local investors, developers, and landowners. We manage a portfolio of opportunities that offer strong returns along a spectrum of well-understood levels of risk. This portfolio includes bare land, distressed developments, and incomeproducing properties across all market sectors - commercial, hotel, industrial, Colliers Vietnam is committed to residential, and retail. helping our clients make informed decisions - whether it's through Backed by an outstanding track record, investing, divesting, or holding - to wealth of knowledge and strong increase the value of their porfolios regional presence, our team is able to and achieve target liquidity, risk, and deliver the following services: returns. Acquisitions >> Identify & secure opportunities to help you achieve your porfolio targets >> Assist/Conduct negotiation of letter of intent through to settlement of contract >> Conduct Market and Financial Due Diligence as well as advise on best use of land Dispositions >> Execute marketing of asset through our strong network of relationships with institutional investors, banks, developers and high net worth individuals in Vietnam and throughout the Asia Pacific >> Conduct initial due diligence of interested parties prior to negotiation >> Assist/Conduct negotiation through to completion of divestment

- 8. About Colliers International Colliers International is a leader in global real estate services, defined by our spirit of enterprise. Through a culture of service excellence and a shared sense of initiative, we integrate the resources of real estate specialists worldwide to accelerate the success of our partners. We connect through a shared set of values that shape a collaborative environment throughout our organization that is unsurpassed in the industry. With more than 100 professionals in 2 offices in Vietnam, the team is market driven and has proven and successful track record with both international and local experience. From Hanoi to Ho Chi Minh City, we provide a full range of real estate services • Research >> Market research across all sectors 482 offices in : 140 : 42 62 countries on : 20 : 195 6 continents United States : 85 $2 billion in annual revenue >> Market analysis, advisory, and strategy • Valuation & Advisory Services 13,500 professionals and staff 2.5 >> Valuation for land, existing property or development sites >> Feasibility studies to determine NPV, IRR and highest & best use billion square feet under management • Office Services >> Tenant Representation >> Landlord Representation COLLIERS INTERNATIONAL • Residential Sales & Leasing HO CHI MINH CITY Bitexco Office Building, 7th Floor 19-25 Nguyen Hue Street District 1, HCM City, Vietnam Tel: + 84 8 3827 5665 • Retail Services • Investment Services • Real Estate Management Services • Corporate Services • Industrial Leasing The foundation of our services is the strength and depth of our experience. HANOI Capital Tower, 10th Floor 109 Tran Hung Dao Street, Hoan Kiem District, Hanoi, Vietnam Tel: +84 4 3941 3277 Please contact, If you would like to recieve our other research reports Publication Coverage Frequency Content Availability Research & Forecast Report Vietnam Cities Quarterly All market sectors Publicly available CBD Report HCMC CBD Monthly Office, Retail, Hotel and Publicly available Serviced Apartment Asia Pacific Office Report Asia Pacific including Vietnam Quarterly Office market Publicly available Vietnam Property Market Report Vietnam cities Quarterly All market sectors On subscription Development Recommendation Vietnam cities At request All market sectors On subscription www.colliers.com/vietnam PETER DINNING General Director peter.dinning@colliers.com +84 903 322 344 KYNAM DOAN Investment Manager kynam.doan@colliers.com +84 1223 128 032 This document/email has been prepared by Colliers International for advertising Accelerating success Accelerating success