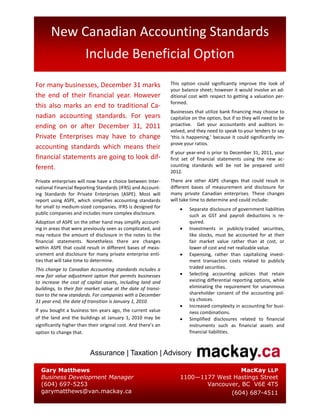

New Accounting Standards

- 1. New Canadian Accounting Standards Include Beneficial Option For many businesses, December 31 marks This option could significantly improve the look of your balance sheet; however it would involve an ad- the end of their financial year. However ditional cost with respect to getting a valuation per- formed. this also marks an end to traditional Ca- Businesses that utilize bank financing may choose to nadian accounting standards. For years capitalize on the option, but if so they will need to be ending on or after December 31, 2011 proactive. Get your accountants and auditors in- volved, and they need to speak to your lenders to say Private Enterprises may have to change ‘this is happening,’ because it could significantly im- prove your ratios. accounting standards which means their If your year-end is prior to December 31, 2011, your financial statements are going to look dif- first set of financial statements using the new ac- ferent. counting standards will be not be prepared until 2012. Private enterprises will now have a choice between Inter- There are other ASPE changes that could result in national Financial Reporting Standards (IFRS) and Account- different bases of measurement and disclosure for ing Standards for Private Enterprises (ASPE). Most will many private Canadian enterprises. These changes report using ASPE, which simplifies accounting standards will take time to determine and could include: for small to medium-sized companies. IFRS is designed for Separate disclosure of government liabilities public companies and includes more complex disclosure. such as GST and payroll deductions is re- Adoption of ASPE on the other hand may simplify account- quired. ing in areas that were previously seen as complicated, and Investments in publicly-traded securities, may reduce the amount of disclosure in the notes to the like stocks, must be accounted for at their financial statements. Nonetheless there are changes fair market value rather than at cost, or within ASPE that could result in different bases of meas- lower of cost and net realizable value. urement and disclosure for many private enterprise enti- Expensing, rather than capitalizing invest- ties that will take time to determine. ment transaction costs related to publicly This change to Canadian Accounting standards includes a traded securities. new fair value adjustment option that permits businesses Selecting accounting policies that retain to increase the cost of capital assets, including land and existing differential reporting options, while buildings, to their fair market value at the date of transi- eliminating the requirement for unanimous tion to the new standards. For companies with a December shareholder consent of the accounting pol- 31 year end, the date of transition is January 1, 2010. icy choices. Increased complexity in accounting for busi- If you bought a business ten years ago, the current value ness combinations. of the land and the buildings at January 1, 2010 may be Simplified disclosures related to financial significantly higher than their original cost. And there’s an instruments such as financial assets and option to change that. financial liabilities. Assurance | Taxation | Advisory Gary Matthews MacKay LLP Business Development Manager 1100—1177 West Hastings Street (604) 697-5253 Vancouver, BC V6E 4T5 garymatthews@van.mackay.ca (604) 687-4511