Rodman renshaw report on affy

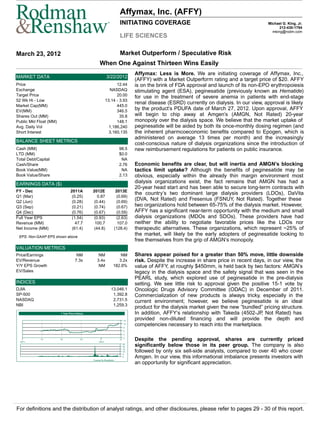

- 1. Affymax, Inc. (AFFY) ® INITIATING COVERAGE Michael G. King, Jr. 212-430-1794 mking@rodm.com LIFE SCIENCES March 23, 2012 Market Outperform / Speculative Risk When One Against Thirteen Wins Easily Affymax: Less is More. We are initiating coverage of Affymax, Inc., MARKET DATA 3/22/2012 (AFFY) with a Market Outperform rating and a target price of $20. AFFY Price 12.44 is on the brink of FDA approval and launch of its non-EPO erythropoiesis Exchange NASDAQ stimulating agent (ESA), peginesatide (previously known as Hematide) Target Price 20.00 for use in the treatment of severe anemia in patients with end-stage 52 Wk Hi - Low 13.14 - 3.93 renal disease (ESRD) currently on dialysis. In our view, approval is likely Market Cap(MM) 445.0 EV(MM) 346.5 by the product’s PDUFA date of March 27, 2012. Upon approval, AFFY Shares Out (MM) 35.8 will begin to chip away at Amgen’s (AMGN, Not Rated) 20-year Public Mkt Float (MM) 148.1 monopoly over the dialysis space. We believe that the market uptake of Avg. Daily Vol 1,186,240 peginesatide will be aided by both its once-monthly dosing regimen (and Short Interest 3,160,135 the inherent pharmcoeconomic benefits compared to Epogen, which is administered on average 13 times per month) and the increasingly BALANCE SHEET METRICS cost-conscious nature of dialysis organizations since the introduction of Cash (MM) 98.5 new reimbursement regulations for patients on public insurance. LTD (MM) $0.0 Total Debt/Capital NA Cash/Share 2.76 Economic benefits are clear, but will inertia and AMGN’s blocking Book Value(MM) NA tactics limit uptake? Although the benefits of peginesatide may be Book Value/Share 2.13 obvious, especially within the already thin margin environment most EARNINGS DATA ($) dialysis organizations exist, the fact remains that AMGN has had a 20-year head start and has been able to secure long-term contracts with FY - Dec 2011A 2012E 2013E the country’s two dominant large dialysis providers (LDOs), DaVita Q1 (Mar) (0.25) 0.87 (0.69) Q2 (Jun) (0.28) (0.44) (0.69) (DVA, Not Rated) and Fresenius (FSNUY, Not Rated). Together these Q3 (Sep) (0.21) (0.74) (0.67) two organizations hold between 65-75% of the dialysis market. However, Q4 (Dec) (0.76) (0.67) (0.59) AFFY has a significant near-term opportunity with the medium and small Full Year EPS (1.54) (0.93) (2.63) dialysis organizations (MDOs and SDOs). These providers have had Revenue (MM) 47.7 100.7 107.0 neither the ability to negotiate favorable prices like the LDOs nor Net Income (MM) (61.4) (44.8) (128.4) therapeutic alternatives. These organizations, which represent ~25% of EPS: Non-GAAP EPS shown above the market, will likely be the early adopters of peginesatide looking to free themselves from the grip of AMGN’s monopoly. VALUATION METRICS Price/Earnings NM NM NM Shares appear poised for a greater than 50% move, little downside EV/Revenue 7.3x 3.4x 3.2x risk. Despite the increase in share price in recent days, in our view, the Y/Y EPS Growth NM 182.8% value of AFFY, at roughly $450mm, is held back by two factors: AMGN’s EV/Sales legacy in the dialysis space and the safety signal that was seen in the PEARL study, which explored use of peginesatide in the pre-dialysis INDICES setting. We see little risk to approval given the positive 15-1 vote by DJIA 13,046.1 Oncologic Drugs Advisory Committee (ODAC) in December of 2011. SP-500 1,392.8 Commercialization of new products is always tricky, especially in the NASDAQ 2,731.5 current environment; however, we believe peginesatide is an ideal NBI 1,259.3 product for the dialysis market given the new “bundled” pricing structure. 1 Year Price History In addition, AFFY’s relationship with Takeda (4502-JP Not Rated) has , 15 provided non-diluted financing and will provide the depth and 12 9 competencies necessary to reach into the marketplace. 6 3 2011 Q1 Q2 Q3 2012 Q1 0 Despite the pending approval, shares are currently priced 25 20 significantly below those in its peer group. The company is also 15 10 5 followed by only six sell-side analysts, compared to over 40 who cover 0 Amgen. In our view, this informational imbalance presents investors with Created by BlueMatrix an opportunity for significant appreciation. For definitions and the distribution of analyst ratings, and other disclosures, please refer to pages 29 - 30 of this report.

- 2. Affymax, Inc. March 23, 2012 Investment Thesis – Breaking Through the Red Fortress Affymax is developing peginesatide, previously known as Hematide, as the first truly novel erythropoiesis stimulating agent (ESA) since the launch of AMGN’s Epogen. While the language of this statement is simple, the task of developing a small peptide drug that mimics the action of recombinant human erythropoietin, a 40,000 dalton protein molecule, cannot be overstated. Also not simple, and perhaps even more complex, will be the market launch of peginesatide. Though the unique once-monthly dosing requirement of peginesatide can save hundreds of dollars per patient per year for a busy dialysis practice versus the multiple-times per week dosing for Epogen, AFFY will have to fight the inertia built up over the past 20 years. This would certainly have applied to the renal dialysis industry of the past; however, a tectonic shift occurred in 2010 when the Centers for Medicare and Medicaid Services (CMS) changed its reimbursement policy towards the drugs that are used in dialysis patients and turned them from a profit center into a cost center. It is on this background that the emergence of peginesatide onto the market comes with a tailwind blowing behind it. The problems that Amgen has experienced with Epogen have been well documented and described by many in the investment community and therefore will only be touched upon minimally in this report. Suffice it to say that the recent label updates from FDA, based on the results of studies such as TREAT and CHOIR, have significantly reduced the use of Epogen in the dialysis patient population. For example, sales of Epogen were $2.040 billion in FY11, vs. $2.569 billion during FY09. While sales of Epogen in the dialysis market are down from a peak of roughly $4 billion in 2008, the US market is still attractive to a small company like AFFY. The rest of world (ROW) market opportunity is likewise significant, though complicated by the presence and competition of biosimilar EPOs. In mid-2006, AFFY entered into a lucrative partnership with Takeda worth over $600MM in upfront ($132MM) and potential milestones. According to the deal terms, the companies will co-commercialize peginesatide in the US and Takeda will have an exclusive license to develop and commercialize the drug in the rest of the world. Takeda showed its dedication to peginesatide with a swift filing of an NDA in Japan; however, Takeda recently announced that it intends to sub-license the rights to peginesatide in Japan. On the competitive front, we do not expect AMGN to block commercialization (as it did against Micera from Roche (RHHBY, Not Rated) given that the peptide sequence of peginesatide is unrelated to recombinant EPO and does not infringe AMGN’s IP estate. RODMAN & RENSHAW EQUITY RESEARCH 2

- 3. Affymax, Inc. March 23, 2012 Investment Risks Regulatory. Like any pharmaceutical or biotechnology company, marketing and commercialization is dependent on the ability to obtain approval from FDA and/or foreign regulatory authorities such as EMEA. Regulatory agencies may not approve peginesatide or may request that additional studies be performed th before approval can be obtained. Peginesatide has a near-term PDUFA date (March 27 , 2012) at which time it may be rejected or its approval may be delayed, in which case AFFY and Takeda may have to re- run certain studies. Even if approved, AFFY may be required to conduct additional studies. Additionally, there is no guarantee that peginesatide will be approved in regions outside of the US. In addition, the regulatory environment for ESAs has recently been acutely focused in safety. Given that a cardiovascular safety signal emerged in the PEARL 1 and 2 trials, the FDA may choose to proceed slowly on the approval of peginesatide despite the 15-1 vote in favor of a recommendation for approval from the ODAC. Commercial. AFFY is currently developing its first product, peginesatide, which is awaiting an approval decision by the FDA. AFFY has no other drugs in clinical or pre-clinical development. As a result, any setback that may occur with respect to whether peginesatide can be made commercially successful will likely have a negative material impact on the stock . Competitive. As the only peptide-based therapy for the treatment of anemia, AFFY has a clear competitive advantage in our view. However, AFFY faces multiple competitive pressures. Should peginesatide obtain approval in the US, AFFY will face significant competitive pressure from AMGN. AMGN is significantly larger than AFFY and can deploy more resources. Further, AMGN has more than 20 years of experience and relationships with dialysis organizations. Specifically in the US, AMGN has already signed long-term contracts with the two largest dialysis organizations: DaVita (exclusive) and Fresenius (non-exclusive). This may restrict AFFY’s ability to secure business from these organizations. However, changes in the competitive landscape, such as new entrants or the launch of new drugs ahead of peginesatide, could materially alter the market potential of the drug. Additionally, AFFY will face competition from multiple biosimilar versions of EPO, as well as from Mircera. These additional competitors may have a negative effect on the competitive positioning of peginesatide. Financial: Like most non-profitable biotechnology companies, AFFY may need to raise additional capital either through an equity offering or another transaction in the interim, which could result in a dilution of existing shareholder value. AFFY ended 4Q11 with a cash balance of just under $100 million. The company expects 2012 operating expenses, net of Takeda reimbursements, to be approximately $135- $145 million. Table 1. Upcoming Milestones Milestones Timing Peginesatide PDUFA March 27, 2012 Communication of price of peginesatide from AFFY and Takeda 2Q 2012 Formal launch of peginesatide 2Q 2012 Publication of Phase III results 2012 Formal J-code for reimbursement Late 2012/Early 2013 Decision from EMA on European submission Mid 2013 RODMAN & RENSHAW EQUITY RESEARCH 3

- 4. Affymax, Inc. March 23, 2012 Valuation Our price target of $20 was derived from the synthesis of four valuation methodologies: discounted cash flow (DCF), our standard CAGR-driven model, and public company comparable valuation analysis (See Table 2). Additionally, we recognized that the company’s valuation could be limited by its revenue share from the peginesatide collaboration. As such, we also valued what those revenues would equate to on a per share basis ($22.62) based on our projected year-end 2012 share count). Table 2. Synthesis of Valuation Methodologies Synthesis of Valuation Approaches DCF $ 19.48 CAGR $ 21.51 Analysis of Comparables $ 18.65 2020 Revenue $ 22.62 Price Target $ 20.00 DCF Methodology In order to arrive a discount cash flow valuation, we first modeled revenues through 2021 for peginesatide in the US and ROW. For the US, we began by looking at the most recent CMS Renal data, detailing that 380,000 patients are on dialysis in 2011. We then split the US market into 3 segments: patients-treated at Fresenius centers, patients treated at DaVita centers, and those treated at other centers”. We modeled in unique market penetration curves for each segment leading us to specific cash flows after expenses for each year. Our assumptions are described in greater detail in the Peginesatide – Market Projections section. We assumed a discount rate of 17.5% to arrive at an equity valuation of $817MM. To this, we added the current cash on hand to arrive at an enterprise valuation (AFFY has essentially zero debt) of $910MM. Divided by our projected outstanding shares figures for year-end 2012 of $46.6MM (diluted shares plus outstanding options and warrants), we arrived at a valuation per share of $19.48. Our model is detailed below in Table 3. Table 3. Discount Cash Flow Model and Assumptions Discount Cash Flow Model 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022-2026 Total Revenues 105.9 108.3 203.1 326.7 446.3 571.3 665.2 795.4 936.9 1,062.6 Cost of product sales - - - - - - - - - - R&D expenses 50.0 63.5 90.0 103.5 119.0 136.9 150.6 165.6 182.2 200.4 R&D as % of sales 58.6% 44.3% 31.7% 26.7% 24.0% 22.6% 20.8% 19.4% 18.9% SG&A expenses 97.5 173.0 195.0 210.0 225.8 237.0 248.9 253.9 258.9 264.1 SG&A as % of sales 159.8% 96.0% 64.3% 50.6% 41.5% 37.4% 31.9% 27.6% 24.9% Royalties and Payments to Jannsen 2.5 - 3.0 2.1 4.4 6.9 9.0 10.9 12.3 13.4 Operating Incom e (EBIT) (44.1) (128.2) (84.9) 11.1 97.1 190.5 256.8 365.1 483.5 584.6 % Margin 3.4% 21.8% 33.3% 38.6% 45.9% 51.6% 55.0% Taxes - 14.4 66.1 89.2 127.0 168.2 203.5 Tax Rate 15% 35% 35% 35% 35% 35% After-Tax Operating Incom e (44.1) (128.2) (84.9) 11.1 82.7 124.4 167.6 238.1 315.3 381.1 Discounting Year 1 2 3 4 5 6 7 8 9 Discount Factor 1.18 1.38 1.62 1.91 2.24 2.63 3.09 3.63 4.27 PV (109.1) (61.5) 6.8 43.4 55.5 63.7 77.0 86.8 89.3 282.4 Residual Value of CF $ 817 + Cash and Cash Equivalents $ 99 Value of Com pany $ 915 - LT Debt $ - Value of Equity $ 915 Price/share= $ 19.48 Source: Rodman & Renshaw LLC estimates. RODMAN & RENSHAW EQUITY RESEARCH 4

- 5. Affymax, Inc. March 23, 2012 Standardized CAGR Approach We also attempted to value AFFY by our standardized CAGR valuation model by multiplying the comparable group mean forward (FY12) P/E of 14.5 by a ratio of our estimated FY16-21 Non-GAAP EPS CAGR for AFFY of 33.1% to the group’s median FY12-13 CAGR of 13.9% then by our FY16E Non-GAAP EPS of $1.40. To this multiple, we then discounted back by in our view an appropriate cost of equity of 17.5% for AFFY. This methodology led to an implied valuation of $21.60 per share. Please see Table 4 and Table 5 for our assumptions and the associated sensitivity analysis. Table 4. CAGR Model Assumptions CAGR Valuation Comparables Biotech Group P/E (2012) 14.5 Biotech Group Forward CAGR ('12- '13) 13.9% Valued Company Year used for discounting Price Target Year 2016 3-year EPS CAGR 33.3% EPS in the discounting year $ 1.39 Discount Rate 17.5% # Years for Discounting 5 Target Price $21.51 Source: Rodman & Renshaw LLC estimates. Table 5. CAGR Model Sensitivity Chart Sensitivity Analysis Discount Rate CAGR 14.5% 16.0% 17.5% 19.0% 20.5% 18.3% $13.45 $12.61 $11.82 $11.10 $10.42 23.3% $17.13 $16.05 $15.05 $14.13 $13.27 28.3% $20.80 $19.49 $18.28 $17.16 $16.11 33.3% $24.48 $22.94 $21.51 $20.19 $18.96 38.3% $28.15 $26.38 $24.74 $23.22 $21.81 43.3% $31.83 $29.82 $27.97 $26.25 $24.65 48.3% $35.50 $33.26 $31.19 $29.28 $27.50 Source: Rodman & Renshaw LLC estimates. Valuation of Comparable Public Companies We also analyzed the valuation of AFFY relative to a group comprising its peers. We selected approximately 20 companies that are at or near-commercial stage (see Table 6. We then calculated the average market cap ($619MM) and enterprise value ($523MM) for this group. By these metrics, the average for the group was valued 60% - 90% higher than AFFY, indicating that it remains potentially significantly undervalue on a comparable basis. Using this approach, we arrived at a valuation of $18.65 RODMAN & RENSHAW EQUITY RESEARCH 5

- 6. Affymax, Inc. March 23, 2012 Table 6. Analysis of Comparable Public Companies Valuation of Comparable Companies Comparable Ticker Rating Price Market Cap Cash Debt EV AMAG Pharm aceuticals Inc. AMAG Not Rated $15.78 $337 $212 $0 $125 Arena Pharm aceuticals Inc. ARNA Not Rated $2.04 $368 $58 $90 $401 ArQule Inc. ARQL Not Rated $7.21 $389 $68 $2 $322 AVEO Pharm aceuticals Inc. AVEO Not Rated $12.19 $527 $221 $24 $291 BioCryst Pharm aceuticals Inc. BCRX Not Rated $5.28 $239 $58 $30 $224 Chem oCentryx Inc CCXI Not Rated $10.46 $369 $126 $2 $244 Curis Inc. CRIS Market Outperform $4.57 $354 $38 $0 $326 Dynavax Technologies Corp. DVAX Not Rated $4.69 $731 $114 $13 $630 Exelixis Inc. EXEL Not Rated $5.49 $815 $194 $182 $802 Halozym e Therapeutics Inc. HALO Not Rated $11.94 $1,338 $53 $0 $1,285 Im m unogen Inc. IMGN Not Rated $13.99 $1,074 $169 $0 $905 Ironw ood Pharm aceuticals Inc. Cl A IRWD Not Rated $12.90 $1,380 $164 $1 $1,216 Neurocrine Biosciences Inc. NBIX Not Rated $8.83 $585 $129 $0 $456 Nektar Therapeutics NKTR Not Rated $7.60 $870 $241 $232 $861 Om eros Corp. OMER Market Outperform $9.66 $217 $25 $19 $212 Orexigen Therapeutics Inc. OREX Not Rated $4.89 $331 $148 $0 $184 Protalix BioTherapeutics Inc. PLX Not Rated $5.93 $539 $27 $0 $511 Ardea Biosciences Inc. RDEA Not Rated $22.57 $829 $96 $0 $734 Rigel Pharm aceuticals Inc. RIGL Not Rated $8.24 $589 $248 $0 $341 Averages $625 $530 Affym ax Inc. AFFY Market Outperform $12.44 $445 $99 $0 $347 Source: FactSet (as of close 3/22/2012) RODMAN & RENSHAW EQUITY RESEARCH 6

- 7. Affymax, Inc. March 23, 2012 Company Overview Affymax Research Institute was founded in 1988 and acquired by GlaxoSmithKline (GSK, Not Rated) in 1995. In 2001, Affymax, Inc. was formed with a strategic goal to develop peptide-based therapeutics for patients with renal disease. The company currently has approximately 170 employees and is located in Palo Alto, California. Since the peginesatide IND in 2003, Affymax has made significant progress moving the compound towards commercial development. In 2005, just two years after the IND, Affymax reported preliminary positive results in a Phase II study with Peginesatide. The following year Affymax entered into a partnership with the largest Japanese pharmaceutical company, Takeda, in an attractive deal worth approximately $637MM for peginesatide. The global deal involved $132MM in an upfront payment, $345MM in developmental milestones and $150MM in commercial milestones. In addition, there is a 50/50 profit in the US and royalties on net sales ex-US. The commercial opportunity for peginesatide in renal indications is significant at more than $2.0 billion in the US alone. According to the National Kidney Foundation, there were over 26 million Americans with chronic kidney disease (CKD). Renal indications alone represent more than 50% of the existing $12 billion global ESA marketplace. In addition, new Medicare legislation was recently signed into law that may have a significant impact on how ESAs are utilized in the dialysis setting may drive utilization of peginesatide. We estimate that peginesatide will be approved in on the March 27, 2012 PDUFA date and reach sales of ~$860MM (US: $687MM; ROW: $176MM) in 2016. By way of background, peginesatide entered clinical development in 2004, and was subsequently partnered with Takeda in a worldwide collaboration agreement. AFFY came public in late 2006, and shortly thereafter Phase III trials were initiated in CKD. Data from the four Phase III trials, EMERALD 1 and 2 in dialysis patients, and PEARL 1 and 2, in non-dialysis patients) read out in 2010. AFFY filed for FDA and EMA approval in 2011 and early 2012, respectively. After a cardiovascular safety signal was seen in the relatively small PEARL 1 and 2 studies, the companies decided to pursue only the CKD indication for peginesatide. Peginesatide Overview Peginesatide is a synthetic dimeric peptide mimetic erythropoietin stimulating agent (ESA) (illustrated in Figure 1). Peginesatide binds directly to and dimerizes the erythropoietin receptor on red blood cells (RBC), stimulating red blood cell formation with potency similar to that seen with that of Epogen (epoetin alfa) and Aranesp (darbopoetin alfa) despite having no structural homology to either agent. Figure 1. Illustration of peginesatide structure Source: Am J Kidney Dis 2012 RODMAN & RENSHAW EQUITY RESEARCH 7

- 8. Affymax, Inc. March 23, 2012 Early development of peginesatide, the result of a joint collaboration between JNJ and AFFY, focused on screening a large peptide library for potential ligands to EpoR. From this effort, erythropoietin-mimetic peptide 1 (EMP-1) was selected and characterized further through in vitro and in vivo studies. Though EMP-1 had low affinity for the EpoR, investigators found that it was able to stimulate cellular proliferation of erythroid cell in dose-dependent manner in cultures. Further, it had no structural homology to either Epogen or Aranesp. Scientists then sought to expand upon the biologic potency of a peptide-based agonist by modifying the peptide with polethylene glycol (PEG) to slow clearance from the blood. In preclinical studies, peginesatide showed an extended half-life (21.5 – 73.7 hours) which lent it to prolonged dosing intervals (~one month) versus those seen with epoetin (approximately 13 doses per month). Additionally, the extended dose-dependent erythropoietic activity of peginesatide was unaccompanied by the presence of anti-peginesatide antibodies. The potential advantages of peginesatide include increased stability at room temperature, easier manufacturing, decreased risk of immunogenic reactions and a favorable pharmacokinetic profile. Role of Erythropoietin Stimulating Agents in Treating Anemia The glycoprotein hormone and cytokine erythropoietin (Epo) is the key regulator in the growth, survival, and maturation of erythroid progenitors into red blood cells (see Figure 2). Figure 2. Stages of Erythropoiesis Source: Benjamin Cummings, imprint of Addison Wesley Longman 2001 Produced predominantly in the kidneys, Epo binds to Erythropoietin receptor (EpoR) initiating an intra- cellular signal cascade that is thought to rescue erythroid progenitors from cell death by suppressing the expression of certain death receptors (e.g., Fas and TRAIL) and by activating Jak2/STAT5-dependent transcription factors in order to accelerate erythrocyte maturation (see Figure 3). Based on this understanding of erythropoietin biology, recombinant Epo was developed in order to treat severe anemia, as defined by lowered levels of circulating red blood cells or deficiency for hemoglobin production. Epogen (epoietin alpha) was the first recombinant human erythropoietin therapeutic indicated for anemia associated with CKD in patients undergoing dialysis. Originally discovered by AMGN, Epogen was developed in collaboration with Kirin Breweries in Japan. AMGN subsequently sold exclusive marketing rights in the US for cancer-related anemia, and all ex-US and ex-Japan anemia indication rights to Johnson & Johnson; JNJ branded the molecule Procrit and Eprex, respectively. Epogen reached sales of $2.65 billion in 2005. In the past six years, label, guideline, and reimbursement changes have all had a significant impact decreasing 2011 Epogen sales to ~$2 billion. Within the recombinant epoietin-alpha class, Epogen has a short half-life (ranging from 4 to 13 hours), relative to Aranesp and requires a three-times per week IV dosing regimen. RODMAN & RENSHAW EQUITY RESEARCH 8

- 9. Affymax, Inc. March 23, 2012 Figure 3. Epo / EpoR Signalling Cascade Leading to Activation of Jak2 / STAT Axis Source: Klipp and Liebermeister BMC Neuroscience 2006 7(Suppl 1):S10 Table 7. Normal Hemoglobin Levels Patient Population Normal Hemoglobin Levels Men 13.5 to 16.5 g/dL Women 12.1 to 15.1 g/dL Children 11 to 16 g/dL Pregnant Women 11 to 12 g/dL Aranesp (darbepoetin alpha) is structurally similar to Epogen, with a single glycosylation change that confers a longer half-life and offers a key dosing advantage over other available recombinant erythropoietins. A correlation was discovered between the number of sialic acid groups on the carbohydrate part of recombinant epoietin and both its serum half-life and biological activity. As a result, Aranesp was created, and contains up to 22 sialic acids as compared to epoietin alpha, which has a maximum of 14 sialic acids. Sialation lengthens the time Aranesp can circulate and act on the bone marrow where, in concert with other growth factors, it commits progenitor cells to the erythroid (red blood cell) pathway. Administration of Aranesp once a week can achieve similar clinical responses to the administration of epoietin alpha three times weekly. Aranesp is approved in the US and EU for anemia associated with CKD and chemotherapy-induced anemia (CIT). Excluding Japan, Amgen has retained global rights and has positioned Aranesp strongly in the oncology market to draw market share away from Procrit, but minimize cannibalization of sales from Epogen in the US CKD market. Today, the majority of sales of Aranesp result from the oncology indication. Compared to the estimated 90% market share that Epogen currently holds in the dialysis setting, Aranesp holds only ~5-8% market share. Unmet Need in the ESA Class Approximately 26.3 million Americans have chronic kidney disease, with ~1.4%, or 380,000 patients, diagnosed with end-stage renal disease (ESRD) requiring chronic hemodialysis. The prevalence and severity of anemia associated with CKD increases with the progression of disease. Today, the majority of patients receive their ESA dose (typically Epogen or Procrit) alongside their hemodialysis, requiring parenteral administration of 3 times per week, translating to ~13 per month. RODMAN & RENSHAW EQUITY RESEARCH 9

- 10. Affymax, Inc. March 23, 2012 Beyond the treatment of patients’ anemia, dialysis patients have a myriad of co-morbidities including bone disease, cardiovascular disease, diabetes complication, and vascular access-related isseus, all of which must be managed concurrently. These factors complicate the management of anemia, a labor intensive affair requiring frequent monitoring, review, documentation, and personalization of dosing. Less frequent dosing of ESAs represents an opportunity to introduce new efficiency to the management of anemia for CKD. Additionally, a small number of patients develop a rare, life-threatening complication to protein-based ESAs called anti-EPO antibody-mediated pure red cell aplasia (PRCA). These patients have minimal options available, as they do not respond to existing ESAs. A novel ESA that could reduce the risks to dialysis patients, including those with PRCA, would be a welcome addition to the armamentarium for severe anemia associated with CKD. Perhaps most important of all is the issue of erythropoietin “hyporesponders”, that is, patients whose hemoglobin does not respond normally to incrementally larger doses of EPO. It has been estimated that up to 60% of all erythropoietin use is in such patients (Figure 4). Peginesatide has shown a remarkably linear dose response throughout the dose range, a competitive advantage that may encourage the drug’s uptake in the marketplace. Figure 4. Distribution of EPO Use by Patient Cohort (Based on Weekly EPO Dosing) Source: Besarab, A. Kidney International (2011) 79, 488 – 490. Based on 2005 Data from a sample of 7400 patients. RODMAN & RENSHAW EQUITY RESEARCH 10

- 11. Affymax, Inc. March 23, 2012 Clinical Development of Peginesatide Based on pre-clinical studies showing that antibodies against erythropoietin do not crossreact with peginesatide, or vice-versa, peginesatide was first tested as a potential rescue therapy for patients that had developed antibody-mediated pure red cell aplasia (PRCA) caused by one or more of the commercially available erythropoietic proteins. These patients could not be treated by the approved erythropoietic agents and, as a result, had become become transfusion dependent. Preliminary findings for the first 14 patients treated with peginesatide demonstrated that 13 achieved a hemoglobin concentration >11 g/dL without the need for further red blood cell transfusions. After dose-finding Phase II studies, a comprehensive Phase III program was initiated in two settings: pre- dialysis and dialysis. Two studies (EMERALD 1 and EMERALD 2) were run in the dialysis setting and two (PEARL 1 and PEARL 2) in the pre-dialysis setting (see Table 8). Each trial was randomized 2:1 versus placebo and had a primary efficacy analysis focused on anemia correction or hemoglobin level maintenance. The key takeaways from these studies are threefold: Peginesatide met the proposed efficacy endpoint of non-inferiority to epoetin across all four trials Based on a composite safety score, peginesatide did not meet the proposed endpoint of noninferiority in the pre-dialysis population. In the dialysis population, the drug did met the proposed non-inferiority safety endpoint Table 8. Phase III Studies with Peginesatide Population Study Description Size (n=) Region EMERALD 1 Maintenance Study: 524 vs. 269 US (AFX01-12) Peginesatide vs. epoetin alfa (IV) Dialysis EMERALD 2 Maintenance Study: 542 vs. 273 US and EU (AFX01-14) peginesatide vs. epoetin alfa OR beta (IV/SC) PEARL 1 Correction study: 326 vs. 164 US (AFX01-11) Peginesatide vs. darbepoetin alfa (SC) Non-dialysis PEARL 2 Correction study: 330 vs. 163 US and EU (AFX01-13) Peginesatide vs. darbepoetin alfa (SC) Source: Adapted from ODAC Briefing Documents for Peginesatide Non-inferior efficacy across all four Phase III trials. All of the EMERALD and PEARL trials demonstrated mean changes in hemoglobin that were similar to the epoietin comparator arms (see Tables 9 and 10.) The EMERALD trials also showed relatively similar effect on the number of patients receiving blood transfusion (Table 9). The PEARL trials also showed similar effect on the number of patients achieving a target hemoglobin range (Table 10). The EMERALD trials also demonstrated that peginesatide was similar to commercially available epoetins in terms of hemoglobin excursions, which is a measure of hemoglobin fluctuations that have been linked to complications. These excursions are defined as events in which hemoglobin levels were recorded within the targeted range for two consecutive readings (see Table 11). RODMAN & RENSHAW EQUITY RESEARCH 11

- 12. Affymax, Inc. March 23, 2012 Table 9. Primary efficacy analysis for EMERALD1 (AFX01-12) and EMERALD2 (AFX01-14) Source: ODAC Briefing Documents for Peginesatide Table 10. Primary efficacy analysis for PEARL1 and PEARL2 Source: ODAC Briefing Documents for Peginesatide Table 11. Analysis of Hemoglobin Excursions in the EMERALD 1 and EMERALD 2 Trials Source: AFFY Analyst Day Presentation RODMAN & RENSHAW EQUITY RESEARCH 12

- 13. Affymax, Inc. March 23, 2012 Trials in the Pre-dialysis setting did not meet their safety endpoints. The safety of peginesatide was assessed by a composite cardiovascular safety end point in each of the four studies. Results were assessed relative to epoetin and were expected to meet the non-inferiority standard. Results from the two PEARL studies (see Tables 12 to 14) were pooled together, as were those in the EMERALD studies (see Tables 15 to 17). In a subanalysis of the PEARL studies, an increased risk of developing the cardiovascular composite was seen in patients receiving peginesatide versus the comparator ESA (with an overall hazard ratio of 1.32 (95% CI: 1.02 – 1.72). Table 12. Primary efficacy analysis for PEARL1 and PEARL2 Source: ODAC Briefing Documents for Peginesatide Table 13. Adverse Events for PEARL 1 and PEARL 2 Source: ODAC Briefing Documents for Peginesatide Table 14. Composite Safety Endpoint PEARL 1 and PEARL 2 Source: ODAC Briefing Documents for Peginesatide No safety signal in the dialysis setting. Safety results from the EMERALD studies demonstrated that peginesatide was non-inferior to that seen with epoetin. Based on this outcome, AFFY has decided to only pursue an indication in the dialysis setting. Across other endpoints, including an analysis of Major Adverse Cardiovascular Events (MACE), there was no difference between peginesatide and epoetin, supporting the drug’s overall safety (Table 18). RODMAN & RENSHAW EQUITY RESEARCH 13

- 14. Affymax, Inc. March 23, 2012 Table 15. Secondary efficacy analysis for EMERALD1 and EMERALD2 Source: ODAC Briefing Documents for Peginesatide Table 16. Adverse Events for EMERALD 1 and EMERALD 2 Source: ODAC Briefing Documents for Peginesatide Table 17. Adverse Events for EMERALD1 and EMERALD2 Source: ODAC Briefing Documents for Peginesatide Table 18. Time to First Event Analysis – MACE events Source: ODAC Briefing Documents for Peginesatide RODMAN & RENSHAW EQUITY RESEARCH 14

- 15. Affymax, Inc. March 23, 2012 Reimbursement and Dialysis Operator Dynamics The operation of dialysis facilities is a relatively low margin business with intense competition. The vast majority (~90%) of patients are insured by public payors, namely Medicare, with reimbursement rates legislated and dictated by the government. The average margin for hemodialysis across all Medicare patients was only 2.3% in 2010 (Figure 4), according to the Medicare Payment Advisory Commission (MedPac). That same analysis showed that larger operators (those with more than 10,000 treatments) had significantly higher margins (7.7% vs. -2.3%) versus smaller operators. These results explain the key trend seen in among dialysis operators in the past two decades: gain scale, often through consolidation. Because of these trends, the market is now heavily concentrated among two large operators (LDO): DaVita and Fresenius. Combined, DaVita and Fresneius control approximately 75% of the market. Further, the top 10 dialysis providers control 90% of the market. The dominance of DaVita and Frensenius has provided leverage in negotiating discounts and rebates with AMGN. Those centers associated with DaVita and Fresenius have significantly higher margins per patient (3.4% vs. 0.1%; see Figure 5). The smaller operators have, in turn, been shut out and reduced to razor thin or negative margins. Figure 5. Margins of Hemodialysis Patients with Medicare Coverage Table 19. Ten Largest US Renal Providers in 2011 Source: Nephrology News & Issues, July 2011 RODMAN & RENSHAW EQUITY RESEARCH 15

- 16. Affymax, Inc. March 23, 2012 Margins will face additional pressure as the reimbursement mechanism for Medicare patients has changed significantly since the beginning of 2011. Previously, dialysis operators or hospital were reimbursed for the services they provided under a fixed rate and the drugs were reimbursed separately at ASP (average selling price) + 6% rate. This encouraged higher utilization rates of rEPO as the incentives between AMGN and the dialysis operator were aligned. CMS has, however, now shifted towards a “bundle reimbursement” (Figure 6). This factor, in conjunction with lower hemoglobin level guidelines has resulted in significant declines in ESA utilization. Figure 6. Changes to Medicare Reimbursement of Hemodialysis Source:AFFY Analyst Day Presentation With this backdrop, we believe that AFFY’s product can quickly garner significant uptake in those centers under more cost pressure, namely the small to medium sized dialysis operators. AFFY will face more difficulty in garnering use in both DaVita and Fresenius centers. AMGN recently signed contracts with both of the large operators. Though the Fresenius contract is non-exclusive and the DaVita contract allots up to 10% of its ESA spend to potential competitors, it is clear that it will be more difficult to garner use in these center. Table 20. Recent Amgen Contracts with Large Dialysis Operators Company Terms Length Exclusive; DaVita Through end of 2018 10% of ESA spend potentially available to competitors Fresenius Non-Exclusive Not disclosed Partnership with Takeda Takeda and AFFY initially entered into a collaboration agreement in early 2006 to develop and commercialize peginesatide in Japan. That agreement was expanded later that year to include worldwide development and commercialization with AFFY assuming primary responsibility for commercialization of renal indications in the US and Takeda assuming responsibility for all oncology indications and ex-US renal opportunities. As per the agreement, AFFY received upfront license fees of $122MM from Takeda. Takeda also made an equity investment of $10MM. Takeda also committed up to $355MM in clinical and development milestones payments. Takeda also pays 70% of all third-party peginesatide development expenses in the US and 100% outside the US. Each company is responsible for their own overhead and personnel related expenses. Once the product is on the market, the companies will share RODMAN & RENSHAW EQUITY RESEARCH 16

- 17. Affymax, Inc. March 23, 2012 profits equally in the United States and Takeda will pay Affymax royalties based on net sales of peginesatide outside the United States. In 2008, both parties suspended the development of peginesatide for the treatment of chemotherapy-induced anemia. Further details on the profit equalization payments are provided in Figure 7. Figure 7. Description of Profit Share between AFFY and Takeda Source:AFFY Analyst Day Presentation Revenue Models and Income Statement In order to assess the market potential for peginesatide, we first identified meaningful segments of the US on-dialysis ESRD patient population. Given the dominance of the LDOs in the market place, we felt it appropriate to segment patients by treatment location. We divided the 380,000 patients on dialysis into three-sub groups patients treated at Fresenius centers (40%), those treated at DaVita centers (35%), and those treated at “other” centers or at home (25%). We grew the overall addressable market at a conservative 1.5% annual growth rate. Market Share Next, we modeled in market penetration rates for each of the three segments we identified (Table 21 and 22) in order to arrive at the total number of patients on pegensatide. In the “other” segment, which we believe will offer the most significant revenues in the near-to-mid term, we grew market penetration from 2% in the 4Q12 to ~6% in 2013, growing to more than 60% by 2020. We assume faster growth in penetration of the Fresenius segment than the DaVita segment due to the difference between the LDO contracts with AMGN. Likewise, we cap DaVita market share at 10% until the end of the DaVita – Amgen contract. RODMAN & RENSHAW EQUITY RESEARCH 17

- 18. Affymax, Inc. March 23, 2012 Table 21. Projected Market Share by Center Market Share by Setting 1Q12E 2Q12E 3Q12E 4Q12E 2013E 2014E 2015E 2016E 2017E 2018E 2019E 2020E Fresenius 0.3% 0.8% 2.0% 4.0% 8.0% 14.0% 20.0% 25.0% 29.0% 32.5% DaVita 0.0% 0.2% 0.7% 2.0% 4.5% 7.5% 10.0% 10.0% 17.5% 27.0% Other 1.0% 2.0% 5.8% 20.0% 32.5% 40.0% 47.0% 53.0% 58.0% 62.0% Pricing and Compliance We conservatively assume 90% compliance despite the heavily compliant patient population given the serious nature of the anemia. Our model also assumes a monthly cost of $825 per month at launch, with 1.25% annual growth in pricing. Our revenue model for ROW is detailed in Table 23. Revenues and Net Income Based on the assumptions and analysis outline above, we arrived at peginesatide sales of $1.56 billion in the US by 2020 with another $490MM coming from rest-of-world sales. Profit sharing and royalties on these sales would translate to $907MM in revenue to AFFY (excludes R&D reimbursement and sales of drug product). We model in GAAP operating expenses of $150MM, relatively in-line with AFFY’s non-GAAP guidance. We assume operating expenses will increase substantially between 2012 and 2015 in order to market the product and compete with AMGN. We also model in two discrete milestone payments and the royalty AFFY owes Janssen on ex-US revenues. We assume a 2.5% royalty to Janssen on ex-US sales, though the only guidance AFFY has provided is “low single-digits”. In reaching our net income projections, we assume a gradual increase in the company’s effective tax rate from 2016 to 2017, before leveling off at 35%. The company has guided that it has enough cash to reach 2013. For our model, we assume a raise of $80MM (~5.2 million shares) in the latter half of FY12. This results in our projection of 42 million shares outstanding by year-end 2012 with an additional ~5 million shares in options and warrants. Summary and Conclusion We view the coming approval of peginesatide as the dawn of a new era for the treatment of anemia of chronic kidney disease and for the business of dialysis in the United States. Peginesatide has the same mechanism of action as endogenous and recombinant erythropoietin (rEPO), although it is structurally unrelated. The drug’s once-a-month dosing, as well as its stability at room temperature will prove, in conjunction with the new CMS bundling provisions, will provide a powerful collection of forces we believe will drive adoption. Based on our strong conviction that peginesatide will convert many small and medium size dialysis operators to prescribers of peginesatide in the short-term, and that even the larger LDO’s will eventually shift as the economics become clear and their agreements with AMGN expire, we believe peginesatide will reach sales of $1.5billion in the US and $490mm outside the US by 2015. Based on the synthesis of our DCF valuation and standard-CAGR valuation, assuming a discount rate of 17.5%, as well as the analysis of comparable company valuations, we establish a year-end 2012 price target of $20 per share. RODMAN & RENSHAW EQUITY RESEARCH 18

- 19. Affymax, Inc. March 23, 2012 Table 22. CKD Market Analysis – US Affymax 2012 2012A 2013 2013E 2014 2015 2016 2017 2018 2019 2020 2021 CKD Market Analysis - US $ in millions 1Q12E 2Q12E 3Q12E 4Q12E 2012E 1Q13E 2Q13A 3Q13E 4Q13E 2013E 2014E 2015E 2016E 2017E 2018E 2019E 2020E 2021E Epidemiology Prevalence of CKD (millions) 24.7 24.7 24.7 24.7 24.7 24.9 24.9 24.9 24.9 24.9 25.2 25.4 25.7 25.9 26.2 26.4 26.7 27.0 % growth 1.00% 1.00% 1.00% 1.00% 1.00% 1.00% 1.00% 1.00% 1.00% 1.00% % on dialysis 1.54% 1.54% 1.54% 1.54% 1.54% 1.3% 1.3% 1.3% 1.3% 1.5% 1.5% 1.5% 1.5% 1.5% 1.5% 1.5% 1.5% 1.5% Dialysis Addressable Population 380,000 380,000 380,000 380,000 380,000 323,748 323,748 323,748 323,748 383,800 387,638 391,514 395,430 399,384 403,378 407,411 411,486 415,600 Segment Analysis 1Q12E 2Q12E 3Q12E 4Q12E 2012E 1Q13E 2Q13A 3Q13E 4Q13E 2013E 2014E 2015E 2016E 2017E 2018E 2019E 2020E 2021E Fresenius Fresenius Dialysis Patients 152,000 152,000 152,000 152,000 152,000 153,520 153,520 153,520 153,520 153,520 155,055 156,605 158,171 159,753 161,351 162,964 164,594 166,240 Fresenius Patients as % of overall market 40.0% 40.0% 40.0% 40.0% 40.0% 40.0% 40.0% 40.0% 40.0% 40.0% 40.0% 40.0% 40.0% 40.0% 40.0% 40.0% 40.0% 40.0% AFFY Penetration of Fresenius 0.3% 0.8% 1.3% 1.8% 2.3% 2.8% 2.0% 4.0% 8.0% 14.0% 20.0% 25.0% 29.0% 32.5% 36.0% # of Fresenius patients on Peginesetide 380 1,140 760.0 1,919 2,687 3,454 4,222 3,070 6,202 12,528 22,144 31,951 40,338 47,260 53,493 59,846 DaVita DaVita Dialysis Patients 133,000 133,000 133,000 133,000 133,000 134,330 134,330 134,330 134,330 134,330 135,673 137,030 138,400 139,784 141,182 142,594 144,019 145,460 DaVita Patients as % of overall market 35.0% 35.0% 35.0% 35.0% 35.0% 35.0% 35.0% 35.0% 35.0% 35.0% 35.0% 35.0% 35.0% 35.0% 35.0% 35.0% 35.0% 35.0% AFFY Penetration of DaVita 0.0% 0.2% 0.4% 0.6% 0.8% 1.0% 0.7% 2.0% 4.5% 7.5% 10.0% 10.0% 17.5% 27.0% 35.0% # of DaVita patients on Peginesetide 0 266 133.0 537 806 1,075 1,343 940 2,713 6,166 10,380 13,978 14,118 24,954 38,885 50,911 Other Other Dialysis Patients 95,000 95,000 95,000 95,000 95,000 95,950 95,950 95,950 95,950 95,950 96,909 97,878 98,857 99,845 100,844 101,852 102,871 103,900 Other Patients as % of overall market 25.0% 25.0% 25.0% 25.0% 25.0% 25.0% 25.0% 25.0% 25.0% 25.0% 25.0% 25.0% 25.0% 25.0% 25.0% 25.0% 25.0% 25.0% Market Penetration 1.0% 2.0% 3.0% 4.5% 6.5% 9.0% 5.8% 20.0% 32.5% 40.0% 47.0% 53.0% 58.0% 62.0% 65.0% # of Other patients on Peginesetide 950 1,900 1,425.0 2,879 4,318 6,237 8,636 5,517.1 19,382 31,810 39,543 46,927 53,447 59,074 63,780 67,535 Total Patients on Peginesetide 0 0 1,330 3,306 2,318 5,335 7,810 10,766 14,201 9,528 28,297 50,505 72,067 92,856 107,903 131,288 156,158 178,292 Sales Calculations 1Q12E 2Q12E 3Q12E 4Q12E 2012E 1Q13E 2Q13A 3Q13E 4Q13E 2013E 2014E 2015E 2016E 2017E 2018E 2019E 2020E 2021E Effective Market Penetration 0.4% 0.9% 0.6% 1.6% 2.4% 3.3% 4.4% 2.9% 7.3% 12.9% 18.2% 23.2% 26.7% 32.2% 37.9% 42.9% Duration of therapy 2.75 2.75 11.00 2.75 2.75 2.75 2.75 11.0 11.0 11.0 11.0 11.0 11.0 11.0 11.0 11.0 Patients months on Peginesetide 3,657 9,091 12,748.0 14,670 21,478 29,605 39,051 104,804.0 311,272 555,556 792,734 1,021,417 1,186,935 1,444,164 1,717,740 1,961,216 Cost per month of therapy $ 825 $ 825 $ 825 $ 835 $ 835 $ 835 $ 835 $ 835 $ 846 $ 856 $ 867 $ 878 $ 889 $ 900 $ 911 $ 923 Annual cost of therapy $ 9,900 $ 9,900 $ 9,900 $ 10,024 $ 10,024 $ 10,024 $ 10,024 $ 10,024 $ 10,149 $ 10,276 $ 10,404 $ 10,534 $ 10,666 $ 10,799 $ 10,934 $ 11,071 Annual price increase 1.25% 1.25% 1.25% 1.25% 1.25% 1.25% 1.25% 1.25% 1.25% Sales of Peginesetide - US $ 3.0 $ 7.5 $ 10.5 $ 12.3 $ 17.9 $ 24.7 $ 32.6 $ 87.5 $ 263.3 $ 475.7 $ 687.3 $ 896.7 $ 1,055.0 $ 1,299.7 $ 1,565.2 $ 1,809.4 RODMAN & RENSHAW EQUITY RESEARCH 19

- 20. Affymax, Inc. March 23, 2012 Table 23. CKD Market Analysis - ROW Affymax 2012 2012A 2013E 2014 2015 2016 2017 2018 2019 2020 2021 CKD Market Analysis - ROW $ in millions 1Q12E 2Q12E 3Q12E 4Q12E 2012E 2013E 2014E 2015E 2016E 2017E 2018E 2019E 2020E 2021E Epidemiology Prevalence of CKD (millions) 6.1 6.1 6.1 6.1 6.1 6.1 6.2 6.2 6.3 6.4 6.4 6.5 6.6 6.6 % growth 1.00% 1.00% 1.00% 1.00% 1.00% 1.00% 1.00% 1.00% 1.00% 1.00% % on dialysis 6.0% 6.0% 6.0% 6.0% 6.0% 6.0% 6.0% 6.0% 6.0% 6.0% 6.0% 6.0% 6.0% 6.0% Dialysis Addressable Population 363,600 363,600 363,600 363,600 363,600 367,236 370,908 374,617 378,364 382,147 385,969 389,828 393,727 397,664 Sales Calculations Market Penetration 2.0% 4.0% 8.0% 12.0% 15.0% 17.5% 19.0% 20.0% Total Patients on Peginesetide 7,418 14,985 30,269 45,858 57,895 68,220 74,808 79,533 Duration of therapy 11.0 11.0 11.0 11.0 11.0 11.0 11.0 11.0 Patients months on Peginesetide 81,599 164,831 332,959 504,434 636,848 750,419 822,888 874,860 Cost per month of therapy $ 500 $ 515 $ 530 $ 546 $ 563 $ 580 $ 597 $ 615 Annual cost of therapy $ 6,000 $ 6,180 $ 6,365 $ 6,556 $ 6,753 $ 6,956 $ 7,164 $ 7,379 Annual price increase 3.00% 3.00% 3.00% 3.00% 3.00% 3.00% 3.00% 3.00% Sales of Peginesetide - ROW $ - $ - $ - $ - $ 40.8 $ 84.9 $ 176.6 $ 275.6 $ 358.4 $ 435.0 $ 491.3 $ 538.0 RODMAN & RENSHAW EQUITY RESEARCH 20

- 21. Affymax, Inc. March 23, 2012 Table 24. Peginesatide P&L Affymax 2012E 2013 2014 2015 2016 2017 2018 2019 2020 2021 Peginesatide Collaboration P&L $ in millions 2012E 2013E 2013E 2014E 2015E 2016E 2017E 2018E 2019E 2020E Revenue Sales (booked by Takeda) 10.5 87.5 263.3 475.7 687.3 896.7 1,055.0 1,299.7 1,565.2 1,809.4 COGS (booked by Takeda) 0.9 7.9 23.7 42.8 61.9 80.7 94.9 117.0 140.9 162.8 % of Revenue 9.0% 9.0% 9.0% 9.0% 9.0% 9.0% 9.0% 9.0% 9.0% 9.0% Gross Profit 9.6 79.7 239.6 432.9 625.5 816.0 960.0 1,182.7 1,424.3 1,646.6 Commercial Expenses AFFY Commercial Expenses 66.8 146.5 167.2 210.0 225.8 237.0 248.9 253.9 258.9 264.1 Takeda Commercial Expenses 13.4 29.3 33.4 42.0 45.2 47.4 49.8 50.8 51.8 52.8 Total Commercial Expenses 80.2 175.8 200.6 252.0 270.9 284.4 298.7 304.6 310.7 316.9 Product Income (70.6) (96.1) 39.0 180.9 354.6 531.5 661.4 878.1 1,113.6 1,329.6 Calculation of Profit Equalization Payment AFFY % of Product Income 50% 50% 50% 50% 50% 50% 50% 50% 50% 50% AFFY Share of Income (35.3) (48.1) 19.5 90.5 177.3 265.8 330.7 439.0 556.8 664.8 Plus: AFFY Commercial Expenses 66.8 146.5 167.2 210.0 225.8 237.0 248.9 253.9 258.9 264.1 Profit Equalization Payment 31.5 98.4 186.7 300.5 403.0 502.8 579.6 692.9 815.7 928.9 RODMAN & RENSHAW EQUITY RESEARCH 21

- 22. Affymax, Inc. March 23, 2012 Table 25. Income Statement Affymax 2011A 2012 2012E 2013 2014 2015 2016 2017 2018 2019 2020 2021 Income Statement $ in millions 2011A 1Q12E 2Q12E 3Q12E 4Q12E 2012E 2013E 2014E 2015E 2016E 2017E 2018E 2019E 2020E 2021E Revenue Collaboration revenue Milestone - FDA Approval 50.0 0.0 0.0 0.0 50.0 0.0 Milestone - MAA Submission 5.0 5.0 0.0 Amounts due from Takeda under Janssen agreement 5.3 5.3 1.3 R&D Reimbursement 3.8 2.4 2.2 2.1 10.5 7.8 8.0 9.2 10.6 12.2 13.4 14.7 16.2 17.8 API Purchases 2.4 1.2 0.0 0.1 3.7 0.8 2.4 4.3 6.2 8.1 9.5 11.7 14.1 16.3 Profit Equalization Payments from Takeda for US 0.0 6.9 9.8 14.8 31.5 98.4 186.7 300.5 403.0 502.8 579.6 692.9 815.7 928.9 Total Collaboration Revenue (excludes ex-US royalties) 47.7 61.1 15.8 12.0 17.0 105.9 108.3 197.0 313.9 419.8 523.0 602.5 719.3 846.0 963.0 License and royalty revenue Royalties from ex-US sales of peginesatide 0.0 0.0 0.0 0.0 0.0 0.0 0.0 6.1 12.7 26.5 48.2 62.7 76.1 90.9 99.5 Other Total License and royalty revenue 0.0 0.0 0.0 0.0 0.0 0.0 0.0 6.1 12.7 26.5 48.2 62.7 76.1 90.9 99.5 Total Revenue 47.7 61.1 15.8 12.0 17.0 105.9 108.3 203.1 326.7 446.3 571.3 665.2 795.4 936.9 1,062.6 COGS 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 % of Revenue Gross Profit 47.7 61.1 15.8 12.0 17.0 105.9 108.3 203.1 326.7 446.3 571.3 665.2 795.4 936.9 1,062.6 Operating expenses R&D 76.3 15.0 11.0 11.5 12.5 50.0 63.5 90.0 103.5 119.0 136.9 150.6 165.6 182.2 200.4 G&A 32.8 13.0 23.0 27.0 34.5 97.5 173.0 195.0 210.0 225.8 237.0 248.9 253.9 258.9 264.1 Cost of PEG from Nektar 0.5 0.2 0.0 0.0 0.7 0.2 0.5 0.9 1.2 1.6 1.9 2.3 2.8 3.3 Royalties and Payments to Jannsen 0.0 2.5 2.5 0.0 3.0 2.1 4.4 6.9 9.0 10.9 12.3 13.4 Total Operating Expenses 109.2 28.5 34.2 41.0 47.0 150.7 236.7 288.5 316.5 350.4 382.4 410.3 432.7 456.2 481.2 Operating Income (Loss) (61.4) 32.7 (18.5) (29.0) (30.0) (44.8) (128.4) (85.4) 10.2 95.9 188.8 254.9 362.7 480.7 581.3 Non-operating income (expense) Interest income 0.2 0.0 Interest expenses (0.1) 0.0 Other income (expense), net 0.0 0.0 Non-operating income 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 EBIT (61.4) 32.7 (18.5) (29.0) (30.0) (44.8) (128.4) (85.4) 10.2 95.9 188.8 254.9 362.7 480.7 581.3 Tax Rate(%) 15% 35% 35% 35% 35% 35% Provision for income taxes (benefit) 0.0 0.0 14.4 66.1 89.2 127.0 168.2 203.5 Net Income (Loss) (61.4) 32.7 (18.5) (29.0) (30.0) (44.8) (128.4) (85.4) 10.2 81.5 122.8 165.7 235.8 312.4 377.9 Share Count Basic shares outstanding 33.288 35.912 36.091 36.272 41.787 37.515 44.278 51.506 52.279 53.063 54.124 55.207 56.311 57.437 58.586 % of Options Exercised 0.5% 0.5% 0.5% 0.5% 12.7% 18.0% 1.5% 1.5% 1.5% 2.0% 2.0% 2.0% 2.0% 2.0% Diluted shares 33.288 41.028 36.091 36.272 41.787 37.515 44.278 51.506 57.905 58.774 59.921 61.090 62.283 63.498 64.738 GAAP EPS Figures Basic $ (1.84) $ 0.91 $ (0.51) $ (0.80) $ (0.72) $ (1.19) $ (2.90) $ (1.66) $ 0.20 $ 1.54 $ 2.27 $ 3.00 $ 4.19 $ 5.44 $ 6.45 Diluted $ (1.84) $ 0.80 $ (0.51) $ (0.80) $ (0.72) $ (1.19) $ (2.90) $ (1.66) $ 0.18 $ 1.39 $ 2.05 $ 2.71 $ 3.79 $ 4.92 $ 5.84 Non-GAAP Adjustments and EPS Non-GAAP EPS Basic $ (1.54) $ 0.99 $ (0.44) $ (0.74) $ (0.67) $ (0.93) $ (2.63) $ (1.38) $ 0.50 $ 1.87 $ 2.62 $ 3.37 $ 4.57 $ 5.84 $ 6.86 Diluted $ (1.54) $ 0.87 $ (0.44) $ (0.74) $ (0.67) $ (0.93) $ (2.63) $ (1.38) $ 0.45 $ 1.68 $ 2.37 $ 3.05 $ 4.13 $ 5.28 $ 6.21 RODMAN & RENSHAW EQUITY RESEARCH 22

- 23. Affymax, Inc. March 23, 2012 APPENDIX Management Team John A. Orwin, Chief Executive Officer Mr. Orwin has served as chief executive officer and a member of Affymax’s board of directors since February 2011. From April 2010 to January 2011, he served as president and chief operating officer of Affymax. From 2005 to 2010, Mr. Orwin served as vice president and then senior vice president, BioOncology Business Unit, at Genentech, where he was responsible for all marketing, sales, business unit operations and pipeline brand management for Genentech's oncology portfolio in the United States. From 2001 to 2005, Mr. Orwin served in various executive level positions at Johnson & Johnson overseeing oncology therapeutic commercial and portfolio expansion efforts in the US. He has also held senior marketing and sales positions at Alza Pharmaceuticals, Sangstat Medical Corporation, Rhone- Poulenc Rorer Pharmaceuticals (now Sanofi; SNY, Not Rated) and Schering-Plough Corporation (now Merck; MRK, Not Rated). Mr. Orwin holds a M.B.A. from New York University and a B.A. from Rutgers University. Herb Cross, Chief Financial Officer Mr. Cross has served as chief financial officer for Affymax since March 2011. From November 2010 to March 2011, he served as chief accounting officer and vice president, Finance for Affymax. From 2008 to 2010, Mr. Cross held multiple positions including vice president, Finance for Facet Biotech Corporation (since acquired by Abbott; ABT, Not Rated). a public clinical-stage biotech company. In that position he was responsible for the controllership, financial planning and analysis, stock administration, treasury and risk management, corporate governance, tax functions and was a key member on a broad array of strategic transactions. From 2006 to 2008, he served as corporate controller at PDL BioPharma (PDLI, Not Rated), a public bio-pharmaceutical company with more than $400 million in annual revenues. While at PDL BioPharma he acted as the finance lead in multiple strategic partnerships, participated in corporate governance activities and implemented process changes that improved the quality, accuracy and timeliness of financial reporting and increased efficiency in resource utilization. Before that, he held positions of increasing responsibility, including vice president, Finance at Neoforma, Inc. Mr. Cross also served as a manager, Assurance and Business Advisory Services at Arthur Andersen, LLP, an independent registered public accounting firm. Mr. Cross earned a B.S. from the Haas School of Business at the University of California, Berkeley. Anne-Marie Duliege, M.D., M.S., Chief Medical Officer Dr. Duliege has served as chief medical officer for Affymax since July 2007. From 2004 until 2007, she served as vice president, Clinical, Medical and Regulatory Affairs for Affymax. Since 1998, Dr. Duliege has also practiced at the Lucille Packard Children’s Hospital at Stanford University Medical Center. From 1992 to 2004, she served in various positions at Chiron Corporation, a biotechnology company, most recently as senior medical director. Dr. Duliege holds an M.D. and M.S. from Paris Medical School and an M.S. from Harvard School of Public Health. Jeffery H. Knapp, Chief Commercial Officer Mr. Knapp has served as chief commercial officer for Affymax since July 2006. From November 2005 to April 2006, he served as senior vice president, Sales and Marketing at Abgenix, Inc. (since acquired by Amgen; AMGN, Not Rated), a biopharmaceutical company. From October 2004 to July 2005, Mr. Knapp RODMAN & RENSHAW EQUITY RESEARCH 23

- 24. Affymax, Inc. March 23, 2012 served as vice president, Sales and Marketing, North America at Pharmion Corporation (since acquired by Celgene; CELG, Not Rated), a pharmaceutical company. From November 2001 to October 2004, he served as vice president, U.S. sales and marketing at EMD Pharmaceuticals, a division of Merck KGaA (MRK-DE, Not Rated), a pharmaceutical company. He has also held sales, marketing and business development positions at Eli Lilly and Company (LLY, Not Rated) and Schering-Plough Corporation. Mr. Knapp holds a B.A. from Wittenberg University. Kay Slocum, Senior Vice President, Human Resources Ms. Slocum has served as senior vice president, Human Resources for Affymax since June 2006. From 2003 to 2006, she served as a human resources consultant to Affymax. From 2001 to 2003, Ms. Slocum served as vice president, Human Resources of Deltagen, Inc., a biotechnology company. She also served as a vice president of Human Resources at Corixa Corporation (formerly Coulter Pharmaceutical), a biotechnology company. Earlier in her career, Ms. Slocum served as manager of Corporate Employee Development for Varian Associates and management consultant for Coulter Corporation. Ms. Slocum holds an M.S. from Loyola University of Chicago and a B.A. from Southern Illinois University. Robert F. Venteicher, Ph.D., Senior Vice President, Technical Operations Dr. Venteicher has served as vice president, Technical Operations for Affymax since August 2007. From 1995 to 2007, he held several positions at Elan Pharmaceuticals, Inc. (ELN, Not Rated), most recently as vice president, R&D Quality and Compliance. From 1992 to 1995, he held several positions at Univax Biologics, Inc. including vice president, Quality Assurance/Quality Control. From 1988 to 1992, he was head, R&D Pharmaceutical Quality Control and associate director of Bioprocess and Analytical Development at Centocor Inc.. He also held scientific and management positions with increasing responsibilities during his 10-year tenure at Hoffmann LaRoche, Inc. Dr. Venteicher received his Ph.D. in chemistry from Pennsylvania State University and his B.S. in chemistry from Iowa State University. He completed postdoctoral training in biochemistry and biophysics at Johnson Research Foundation, University of Pennsylvania. Andrew Blair, M.D., Vice President, Medical Affairs Dr. Blair has served as vice president, Medical Affairs, for Affymax since April 2011. Prior to joining Affymax, Dr. Blair was vice president of Clinical Research for Proteon Therapeutics. In that position he served as the clinical lead in the planning, design, implementation, and ongoing management of a development program for the treatment of vascular access in patients with chronic kidney disease and of peripheral arterial disease. Previously, Dr. Blair was vice president of Clinical Research at Genzyme Corporation (since acquired by Sanofi). While at Genzyme he led critical clinical initiatives for the Renal business unit, including: clinical trial activity for Renagel®, Renvela® and Hectorol®; the successful filing for the approval of the Renvela® NDA; and the largest interventional outcome study in hemodialysis patients. He also led the US/Europe biomedical regulatory affairs and US Renal Medical Affairs group. Before that, Dr. Blair served as medical director for the end-stage Renal Disease Program at the University of Texas Medical Branch. Dr. Blair earned his medical degree at Rush Medical School in Chicago, IL. Christine Conroy, Pharm.D., Vice President, Regulatory Affairs and Clinical Quality Assurance Dr. Conroy has served as vice president, Regulatory Affairs and Clinical Quality Assurance for Affymax since July 2007. From 2004 to 2006, she served as senior director, Regulatory Affairs, and from 2006 to RODMAN & RENSHAW EQUITY RESEARCH 24

- 25. Affymax, Inc. March 23, 2012 2007 as executive director, Regulatory Affairs. From 2002 to 2004, Dr. Conroy served as senior director, Regulatory Affairs, for Genitope Corporation. From 1995 to 2001, she held several positions at Roche Global Development, including regulatory program director with global responsibilities. From 1989 to 1994, she held several positions at Syntex Laboratories, including manager of Medical Services Department, Drug Information Service. From 1982 to 1989, Dr. Conroy was a staff pharmacist in Colorado. She earned her Pharm.D. from the University of Kansas, School of Pharmacy, and her B.S. in pharmacy from the University of Colorado, School of Pharmacy. Tracy J. Dunn, Ph.D., J.D., Vice President, Intellectual Property and Legal Affairs Dr. Dunn has served as vice president, Intellectual Property and Legal Affairs for Affymax since 2002. From 1996 to 2002, he served as director of Intellectual Property at Aviron, a biotechnology company, and subsequently at Medimmune Vaccines, Inc. (since acquired by Astra Zeneca; AZN, Not Rated), a biotechnology company. From 1991 to 1996, Dr. Dunn was a patent attorney at Townsend and Townsend and Crew in Palo Alto, Calif. Dr. Dunn holds Ph.D., J.D. and B.S. degrees from the University of Wisconsin, where he also completed a National Cancer Institute post-doctoral research fellowship. Carol Francisco, Ph.D., Vice President, Biostatistics and Data Management Dr. Francisco has served as vice president, Biostatistics and Data Management for Affymax since April 2008. From 2000 to 2007, she served as vice president, Biostatistics at ICON Clinical Research Inc., an international clinical research organization. From 1995 to 1999, she was vice president, Biostatistics and Data Management at Pacific Research Associates, Inc. From 1986 to 1994, she headed biostatistics departments at Hoffmann-La Roche, Inc. and Syntex Laboratories, Inc. Dr. Francisco holds a Ph.D. in statistics from Iowa State University, an M.S. in psychology from Western Washington University and a B.A. in mathematics and psychology from W. Washington State College. Krishna Polu, M.D., Vice President, Clinical Development Dr. Polu, a nephrologist, has served as vice president, Clinical Development, for Affymax since August 2011. From 2009 to 2011, he served as executive director, Clinical Development, for Affymax. Prior to joining Affymax, Dr. Polu was executive director, Global Development at Amgen where he was responsible for clinical programs in nephrology, diabetes and heart failure. Specifically, he led the global clinical development programs for both EPOGEN and Aranesp while at Amgen. Before joining Amgen, he was a clinical and research fellow at Harvard Medical School in the Renal Division at Brigham and Women’s Hospital and Massachusetts General Hospital. He earned a B.A. in Human Biology from Stanford University and a M.D. from University of Texas Health Science Center, San Antonio. He completed his residency training in Internal Medicine at the University of Colorado. Grace U. Shin, J.D., General Counsel Ms. Shin has served as vice president, Legal Affairs and Corporate Counsel for Affymax since October 2006. From May 1997 to April 2006, Ms. Shin served as corporate counsel to FibroGen, Inc., a biotechnology company, and since 2000 held the position of vice president of Legal Affairs and Corporate Counsel. From 1992 to 1997, Ms. Shin was a corporate attorney at Pacific Gas & Electric Company in San Francisco. From 1989 to 1992, Ms. Shin was a business associate at Cooley Godward in San Francisco. She holds a J.D. from the University of Michigan Law School and a B.A. from the University of Michigan School of Business Administration RODMAN & RENSHAW EQUITY RESEARCH 25