Tricumen / 'Rescuing' banks from Hedge Fund & Private Equity investments_9-Jan-14

•

0 j'aime•216 vues

‘Rescuing’ banks from Hedge Fund & Private Equity investments Our analysis shows that Top 14 US and European banks generated $35.5bn in net revenue from their HF and PE investments in 5 years to end-2011… … and that revenue is likely to all but disappear as a result of the ‘Volcker Rule’ and similar legislation being discussed in Europe and APAC.

Signaler

Partager

Signaler

Partager

Télécharger pour lire hors ligne

Recommandé

Recommandé

Microfinance investments –

strategies for triple-bottom-line

performance. originally posted by Sebastien JuhenBlueOrchard Finance SA - Microfinance investments – strategies for triple-bot...

BlueOrchard Finance SA - Microfinance investments – strategies for triple-bot...BlueOrchard Finance S.A.

Contenu connexe

Tendances

Microfinance investments –

strategies for triple-bottom-line

performance. originally posted by Sebastien JuhenBlueOrchard Finance SA - Microfinance investments – strategies for triple-bot...

BlueOrchard Finance SA - Microfinance investments – strategies for triple-bot...BlueOrchard Finance S.A.

Tendances (19)

The ‘Holy Grail’ for Micro Cap CEOs & CFOs: Knowing the Financing Terms—Long ...

The ‘Holy Grail’ for Micro Cap CEOs & CFOs: Knowing the Financing Terms—Long ...

European securitisation - Making a comeback (May 2016)

European securitisation - Making a comeback (May 2016)

"Digging Deeper" by Jimmy Gentry and Gary Trennepohl

"Digging Deeper" by Jimmy Gentry and Gary Trennepohl

BlueOrchard Finance SA - Microfinance investments – strategies for triple-bot...

BlueOrchard Finance SA - Microfinance investments – strategies for triple-bot...

Synthetic Roth Solution - wealth planning platform

Synthetic Roth Solution - wealth planning platform

En vedette

En vedette (7)

Tricumen / Credit Suisse: Restructuring EMEA and Americas_290316

Tricumen / Credit Suisse: Restructuring EMEA and Americas_290316

Bazza Design case study - Rear View Mirror with Integrated Lighting for Donne...

Bazza Design case study - Rear View Mirror with Integrated Lighting for Donne...

Tricumen / 1Q16 Capital Markets Results Review_open

Tricumen / 1Q16 Capital Markets Results Review_open

Tricumen / Capital Markets: Regions 1Q16_open 260516

Tricumen / Capital Markets: Regions 1Q16_open 260516

Tricumen 2Q16 Capital Markes Results Review_open 290816

Tricumen 2Q16 Capital Markes Results Review_open 290816

Tricumen 6m16 Capital Markets Results Review_Regions_OPEN 010916

Tricumen 6m16 Capital Markets Results Review_Regions_OPEN 010916

Tricumen / FY15 Capital Markets: Regions_open 080316

Tricumen / FY15 Capital Markets: Regions_open 080316

Similaire à Tricumen / 'Rescuing' banks from Hedge Fund & Private Equity investments_9-Jan-14

On December 14, 2009, the Alliance to Save Energy and the Renewable Energy and Energy Efficiency Partnership (REEEP) held a side event at the COP15 climate conference in Copenhagen, Denmark, entitled, "Paradox to Paradigm: The Role of Energy Efficiency in Creating Low Carbon Economies."Energy Efficiency Investments In A Pension Fund Asset Allocation, Michael Fri...

Energy Efficiency Investments In A Pension Fund Asset Allocation, Michael Fri...Alliance To Save Energy

Similaire à Tricumen / 'Rescuing' banks from Hedge Fund & Private Equity investments_9-Jan-14 (20)

Tricumen / Banks: Credit Suisse Prime Service, IB targets & achievements

Tricumen / Banks: Credit Suisse Prime Service, IB targets & achievements

Energy Efficiency Investments In A Pension Fund Asset Allocation, Michael Fri...

Energy Efficiency Investments In A Pension Fund Asset Allocation, Michael Fri...

Tag Young Professionals - Merrill Lynch Presentation

Tag Young Professionals - Merrill Lynch Presentation

Plus de Tricumen Ltd

Plus de Tricumen Ltd (20)

Tricumen 4Q17/FY17 wholesale Banking results_open 260218

Tricumen 4Q17/FY17 wholesale Banking results_open 260218

Tricumen 3Q17 Wholesale Banking Results Review_OPEN 221117

Tricumen 3Q17 Wholesale Banking Results Review_OPEN 221117

Tricumen 4Q16/FY16 Wholesale Banking results review_open 270217

Tricumen 4Q16/FY16 Wholesale Banking results review_open 270217

Tricumen_3Q16 Wholesale Banking Results Review_OPEN 051216

Tricumen_3Q16 Wholesale Banking Results Review_OPEN 051216

Tricumen / Future Models in Wholesale Banking 100915

Tricumen / Future Models in Wholesale Banking 100915

Tricumen / Capital Markets Regions 6m15_open 230815

Tricumen / Capital Markets Regions 6m15_open 230815

Tricumen / 1Q15 Capital Markets Result Review_open 110515

Tricumen / 1Q15 Capital Markets Result Review_open 110515

Tricumen / FY14 Capital Markets: Regions_open 250315

Tricumen / FY14 Capital Markets: Regions_open 250315

Tricumen / Capital Markets Revenue & Profit rankings FY14_open 230315

Tricumen / Capital Markets Revenue & Profit rankings FY14_open 230315

Tricumen / Goldman Sachs Liberty Harbour (GS BDC Inc.)_310113 updated 050315

Tricumen / Goldman Sachs Liberty Harbour (GS BDC Inc.)_310113 updated 050315

Tricumen / 4Q14 Capital Markets Result Review_open 050315

Tricumen / 4Q14 Capital Markets Result Review_open 050315

Tricumen / Future Strategies for Inter Dealer Brokers_230215

Tricumen / Future Strategies for Inter Dealer Brokers_230215

Dernier

( Jasmin ) Top VIP Escorts Service Dindigul 💧 7737669865 💧 by Dindigul Call Girls All India Service 🔥

Looking for Enjoy all Day(Akanksha) : ☎️ +91-7737669865

Today call girl service available 24X7*▬█⓿▀█▀ 𝐈𝐍𝐃𝐄𝐏𝐄𝐍𝐃𝐄𝐍𝐓 CALL 𝐆𝐈𝐑𝐋 𝐕𝐈𝐏 𝐄𝐒𝐂𝐎𝐑𝐓 SERVICE ✅

⭐➡️HOT & SEXY MODELS // COLLEGE GIRLS

AVAILABLE FOR COMPLETE ENJOYMENT WITH HIGH PROFILE INDIAN MODEL AVAILABLE HOTEL & HOME

★ SAFE AND SECURE HIGH CLASS SERVICE AFFORDABLE RATE

★ 100% SATISFACTION,UNLIMITED ENJOYMENT.

★ All Meetings are confidential and no information is provided to any one at any cost.

★ EXCLUSIVE PROFILes Are Safe and Consensual with Most Limits Respected

★ Service Available In: - HOME & HOTEL 24x7 :: 3 * 5 *7 *Star Hotel Service .In Call & Out call SeRvIcEs :

★ A-Level (5 star escort) S040524N

★ Strip-tease

★ BBBJ (Bareback Blowjob)Receive advanced sexual techniques in different mode make their life more pleasurable.

★ Spending time in hotel rooms

★ BJ (Blowjob Without a Condom)

★ Completion (Oral to completion)

★ Covered (Covered blowjob Without condom

100% SAFE AND SECURE 24 HOURS SERVICE AVAILABLE HOME AND HOTEL SERVICES

Visit Our Site For More Pleasure in your City 👉 ☎️ +91-7737669865 👈

Our Best Areas:-

( Rohtak, Korba, Berhampur, Muzaffarpur, Mathura, Kollam, Avadi, Kadapa, Kamarhati, Sambalpur, Bilaspur, Shahjahanpur, Bijapur, Rampur, Shivamogga, Thrissur, Bardhaman, Kulti, Nizamabad, Tumkur, Khammam, Ozhukarai, Bihar Sharif, Panipat, Darbhanga, Bally, Karnal, Kirari Suleman Nagar, Barasat, Purnia, Satna, Mau, Sonipat, Farrukhabad, Sagar, Durg, Ratlam, Hapur, Arrah, Etawah, North Dumdum, Begusarai, Gandhidham, Baranagar, Tiruvottiyur, Puducherry, Thoothukudi, Rewa, Mirzapur, Raichur, Ramagundam, Katihar, Thanjavur, Bulandshahr, Uluberia, Murwara, Sambhal, Singrauli, Nadiad, Secunderabad, Naihati, Yamunanagar, Bidhan Nagar, Pallavaram, Munger, Panchkula, Burhanpur, Kharagpur, Dindigul, Hospet, Malda, Ongole, Deoghar, Chhapra, Haldia, Nandyal, Morena, Amroha, Madhyamgram, Bhiwani, Baharampur, Ambala, Morvi, Fatehpur, kutch, machilipatnam, mahisagar, malwa, manali, mansa, margao, mehsana, mizoram, modasa, moga, mohali, morbi, Mount Abu, muktsar, nainital, narmada, narsinghpur, Navsari, nawanshahr, neemuch, ooty, palanpur, panna, patan, pathankot, porbandar, prakasam, pushkar, raisen, rajpura, rishikesh, roorkee, sabarkantha, sangrur, sehore, seoni, shahdol, shajapur, sheopur, shivpuri, surendranagar, valsad, vapi, veraval, vidisha, Edappally, Ernakulam, Kottayam, Alappuzha, Chalakudy, Changanassery, Cherthala, Chittur Thathamangalam, Guruvayoor, Kanhangad, Kannur, Kasaragod, Kodungallur, Koyilandy, Malappuram, Nedumangad, Neyyattinkara, Palakkad, Paravur, Pathanamthitta, Peringathur, Perumbavoor, Taliparamba, Thiruvalla, Vaikom, Varkala, Chengannur, Munnar, Guruvayur, Kovalam, Thalassery, Ponnani, Punalur, Angamaly, Shornur, Ottapalam, Kalpetta, Kumarakom, Irinjalakuda, Muvattupuzha, Thekkady, Wayanad, Erattupetta, Kottakkal, Mananthavady, Ma( Jasmin ) Top VIP Escorts Service Dindigul 💧 7737669865 💧 by Dindigul Call G...

( Jasmin ) Top VIP Escorts Service Dindigul 💧 7737669865 💧 by Dindigul Call G...dipikadinghjn ( Why You Choose Us? ) Escorts

Call Girl Mumbai Indira Call Now: 8250077686 Mumbai Escorts Booking Contact Details WhatsApp Chat: +91-8250077686 Mumbai Escort Service includes providing maximum physical satisfaction to their clients as well as engaging conversation that keeps your time enjoyable and entertainin. Plus they look fabulously elegant; making an impressionable. Independent Escorts Mumbai understands the value of confidentiality and discretion - they will go the extra mile to meet your needs. Simply contact them via text messaging or through their online profiles; they'd be more than delighted to accommodate any request or arrange a romantic date or fun-filled night together. We provide –(INDIRA) Call Girl Mumbai Call Now 8250077686 Mumbai Escorts 24x7

(INDIRA) Call Girl Mumbai Call Now 8250077686 Mumbai Escorts 24x7Call Girls in Nagpur High Profile Call Girls

Low Rate Call Girls Pune Vedika Call Now: 8250077686 Pune Escorts Booking Contact Details WhatsApp Chat: +91-8250077686 Pune Escort Service includes providing maximum physical satisfaction to their clients as well as engaging conversation that keeps your time enjoyable and entertainin. Plus they look fabulously elegant; making an impressionable. Independent Escorts Pune understands the value of confidentiality and discretion - they will go the extra mile to meet your needs. Simply contact them via text messaging or through their online profiles; they'd be more than delighted to accommodate any request or arrange a romantic date or fun-filled night together. We provide –(Vedika) Low Rate Call Girls in Pune Call Now 8250077686 Pune Escorts 24x7

(Vedika) Low Rate Call Girls in Pune Call Now 8250077686 Pune Escorts 24x7Call Girls in Nagpur High Profile Call Girls

VIP Call Girl Service Andheri West ⚡ 9920725232 What It Takes To Be The Best * Mumbai Escorts *

FOR BOOKING ★ A-Level (5-star Escort) (Akanksha): ☎️ +91-9920725232

AVAILABLE FOR COMPLETE ENJOYMENT WITH HIGH PROFILE INDIAN MODEL AVAILABLE HOTEL & HOME

Visit Our Site For More Pleasure in your City 👉 ☎️ +91-9920725232 👈

★ SAFE AND SECURE HIGH-CLASS SERVICE AFFORDABLE RATE

★

SATISFACTION, UNLIMITED ENJOYMENT.

★ All Meetings are confidential and no information is provided to any one at any cost.

★ EXCLUSIVE PROFILes Are Safe and Consensual with Most Limits Respected

★ Service Available In: - HOME & HOTEL Star Hotel Service. In Call & Out call

SeRvIcEs :

★ A-Level (star escort)

★ Strip-tease

★ BBBJ (Bareback Blowjob) Receive advanced sexual techniques in different mode make their life more pleasurable.

★ Spending time in hotel rooms

★ BJ (Blowjob Without a Condom)

★ Completion (Oral to completion)

★ Covered (Covered blowjob Without condom

★ANAL SERVICES.

Contact me

TELEPHONE

WHATSAPP

Looking for Enjoy all Day(Akanksha) : ☎️ +91-9920725232

Mumbai, Andheri, Navi Mumbai, Thane, Mumbai Airport, Mumbai Central, South Mumbai, Juhu, Bandra, Colaba, Nariman point, Malad, Powai, Mira Road, Dahisar, Mira Bhayandar, Worli, Santacruz, Vile Parle, Lower Parel, Chembur, Dadar, Ghatkopar, Kurla, Mulund, Goregaon, Kandivali, Borivali, Jogeshwari, Kalyan, Vashi , Nerul, Panvel, Dombivli, Lokhandwala, Four Bungalows, Versova, NRI Complex, Kharghar, Belapur, Taloja, Marine Drive, Hiranandani Gardens, Churchgate, Marine lines, Oshiwara, DN Nagar, Jb Nagar, Marol Naka, Saki Naka, Andheri East, Andheri West, Bandra West, Bandra East , Thane West, Ghodbundar Road,

There is a lot of talk about it in the media and news, so you might be wondering if this particular service is really worth the effort. A call girl service is exactly what it sounds like – a service where a woman offers sexual services over the phone. This type of service has been around for a long time and has become increasingly popular over the years. In most cases, call girl services are legal and regulated in many countries. S040524N

★OUR BEST SERVICES: - FOR BOOKING ★ A-Level (5-star escort) ★ Strip-tease ★ BBBJ (Bareback Blowjob) ★ Spending time in my rooms ★ BJ (Blowjob Without a Condom) ★ COF (Come on Face) ★ Completion ★ (Oral to completion) noncovered ★ Special Massage ★ O-Level (Oral) ★ Blow Job; ★ Oral fun uncovered) ★ COB (Come on Body) ★. Extra ball (Have ride many times) ☛ ☛ ☛ ✔✔ secure✔✔ 100% safe WHATSAPP CALL ME +91-9920725232

VIP Call Girl Service Andheri West ⚡ 9920725232 What It Takes To Be The Best ...

VIP Call Girl Service Andheri West ⚡ 9920725232 What It Takes To Be The Best ...dipikadinghjn ( Why You Choose Us? ) Escorts

Top Rated Pune Call Girls Dighi ⟟ 6297143586 ⟟ Call Me For Genuine Sex Service At Affordable Rate

Booking Contact Details

WhatsApp Chat: +91-6297143586

pune Escort Service includes providing maximum physical satisfaction to their clients as well as engaging conversation that keeps your time enjoyable and entertaining. Plus they look fabulously elegant; making an impressionable.

Independent Escorts pune understands the value of confidentiality and discretion - they will go the extra mile to meet your needs. Simply contact them via text messaging or through their online profiles; they'd be more than delighted to accommodate any request or arrange a romantic date or fun-filled night together.

We provide -

01-may-2024(v.n)

Top Rated Pune Call Girls Dighi ⟟ 6297143586 ⟟ Call Me For Genuine Sex Servi...

Top Rated Pune Call Girls Dighi ⟟ 6297143586 ⟟ Call Me For Genuine Sex Servi...Call Girls in Nagpur High Profile

VVIP Pune Call Girls Katraj (7001035870) Pune Escorts Nearby with Complete Satisfaction and Quality Time

Booking Contact Details

WhatsApp Chat: +91-7001035870

pune Escort Service includes providing maximum physical satisfaction to their clients as well as engaging conversation that keeps your time enjoyable and entertaining. Plus they look fabulously elegant; making an impressionable.

Independent Escorts pune understands the value of confidentiality and discretion - they will go the extra mile to meet your needs. Simply contact them via text messaging or through their online profiles; they'd be more than delighted to accommodate any request or arrange a romantic date or fun-filled night together.

We provide -

29-april-2024(v.n)

VVIP Pune Call Girls Katraj (7001035870) Pune Escorts Nearby with Complete Sa...

VVIP Pune Call Girls Katraj (7001035870) Pune Escorts Nearby with Complete Sa...Call Girls in Nagpur High Profile

VIP Independent Call Girls in Mumbai 🌹 9920725232 ( Call Me ) Mumbai Escorts * Ruhi Singh *

FOR BOOKING ★ A-Level (5-star Escort) (Akanksha): ☎️ +91-9920725232

AVAILABLE FOR COMPLETE ENJOYMENT WITH HIGH PROFILE INDIAN MODEL AVAILABLE HOTEL & HOME

Visit Our Site For More Pleasure in your City 👉 ☎️ +91-9920725232 👈

★ SAFE AND SECURE HIGH-CLASS SERVICE AFFORDABLE RATE

★

SATISFACTION, UNLIMITED ENJOYMENT.

★ All Meetings are confidential and no information is provided to any one at any cost.

★ EXCLUSIVE PROFILes Are Safe and Consensual with Most Limits Respected

★ Service Available In: - HOME & HOTEL Star Hotel Service. In Call & Out call

SeRvIcEs :

★ A-Level (star escort)

★ Strip-tease

★ BBBJ (Bareback Blowjob) Receive advanced sexual techniques in different mode make their life more pleasurable.

★ Spending time in hotel rooms

★ BJ (Blowjob Without a Condom)

★ Completion (Oral to completion)

★ Covered (Covered blowjob Without condom

★ANAL SERVICES.

Contact me

TELEPHONE

WHATSAPP

Looking for Enjoy all Day(Akanksha) : ☎️ +91-9920725232

Mumbai, Andheri, Navi Mumbai, Thane, Mumbai Airport, Mumbai Central, South Mumbai, Juhu, Bandra, Colaba, Nariman point, Malad, Powai, Mira Road, Dahisar, Mira Bhayandar, Worli, Santacruz, Vile Parle, Lower Parel, Chembur, Dadar, Ghatkopar, Kurla, Mulund, Goregaon, Kandivali, Borivali, Jogeshwari, Kalyan, Vashi , Nerul, Panvel, Dombivli, Lokhandwala, Four Bungalows, Versova, NRI Complex, Kharghar, Belapur, Taloja, Marine Drive, Hiranandani Gardens, Churchgate, Marine lines, Oshiwara, DN Nagar, Jb Nagar, Marol Naka, Saki Naka, Andheri East, Andheri West, Bandra West, Bandra East , Thane West, Ghodbundar Road,

There is a lot of talk about it in the media and news, so you might be wondering if this particular service is really worth the effort. A call girl service is exactly what it sounds like – a service where a woman offers sexual services over the phone. This type of service has been around for a long time and has become increasingly popular over the years. In most cases, call girl services are legal and regulated in many countries. There are a few things to keep in mind when considering the choice of whether to use a call girl service. First and foremost, make sure that you are comfortable with the particular person you are using the service from. Second, research accordingly before choosing a call girl. Don't just go with the first provider that comes up in your search; get opinions from others as well. Finally, be sure to have fun while using a call girl service; it's not just about sex. S030524N

★OUR BEST SERVICES: - FOR BOOKING ★ A-Level (5-star escort) ★ Strip-tease ★ BBBJ (Bareback Blowjob) ★ Spending time in my rooms ★ BJ (Blowjob Without a Condom) ★ COF (Come on Face) ★ Completion ★ (Oral to completion) noncovered ★ Special Massage ★ O-Level (Oral) ★ Blow Job; ★ Oral fun uncovered) ★ COB (Come on Body) ★. Extra ball (Have ride many times) ☛ ☛ ☛ ✔✔ secure✔✔ 100% safe WHATSAPP CALL ME +91-9920725232

VIP Independent Call Girls in Mumbai 🌹 9920725232 ( Call Me ) Mumbai Escorts ...

VIP Independent Call Girls in Mumbai 🌹 9920725232 ( Call Me ) Mumbai Escorts ...dipikadinghjn ( Why You Choose Us? ) Escorts

Dernier (20)

( Jasmin ) Top VIP Escorts Service Dindigul 💧 7737669865 💧 by Dindigul Call G...

( Jasmin ) Top VIP Escorts Service Dindigul 💧 7737669865 💧 by Dindigul Call G...

Call Girls in New Friends Colony Delhi 💯 Call Us 🔝9205541914 🔝( Delhi) Escort...

Call Girls in New Friends Colony Delhi 💯 Call Us 🔝9205541914 🔝( Delhi) Escort...

02_Fabio Colombo_Accenture_MeetupDora&Cybersecurity.pptx

02_Fabio Colombo_Accenture_MeetupDora&Cybersecurity.pptx

(INDIRA) Call Girl Mumbai Call Now 8250077686 Mumbai Escorts 24x7

(INDIRA) Call Girl Mumbai Call Now 8250077686 Mumbai Escorts 24x7

Mira Road Awesome 100% Independent Call Girls NUmber-9833754194-Dahisar Inter...

Mira Road Awesome 100% Independent Call Girls NUmber-9833754194-Dahisar Inter...

(Vedika) Low Rate Call Girls in Pune Call Now 8250077686 Pune Escorts 24x7

(Vedika) Low Rate Call Girls in Pune Call Now 8250077686 Pune Escorts 24x7

VIP Call Girl Service Andheri West ⚡ 9920725232 What It Takes To Be The Best ...

VIP Call Girl Service Andheri West ⚡ 9920725232 What It Takes To Be The Best ...

Top Rated Pune Call Girls Dighi ⟟ 6297143586 ⟟ Call Me For Genuine Sex Servi...

Top Rated Pune Call Girls Dighi ⟟ 6297143586 ⟟ Call Me For Genuine Sex Servi...

05_Annelore Lenoir_Docbyte_MeetupDora&Cybersecurity.pptx

05_Annelore Lenoir_Docbyte_MeetupDora&Cybersecurity.pptx

VVIP Pune Call Girls Katraj (7001035870) Pune Escorts Nearby with Complete Sa...

VVIP Pune Call Girls Katraj (7001035870) Pune Escorts Nearby with Complete Sa...

VIP Independent Call Girls in Mumbai 🌹 9920725232 ( Call Me ) Mumbai Escorts ...

VIP Independent Call Girls in Mumbai 🌹 9920725232 ( Call Me ) Mumbai Escorts ...

20240429 Calibre April 2024 Investor Presentation.pdf

20240429 Calibre April 2024 Investor Presentation.pdf

TEST BANK For Corporate Finance, 13th Edition By Stephen Ross, Randolph Weste...

TEST BANK For Corporate Finance, 13th Edition By Stephen Ross, Randolph Weste...

Vasai-Virar Fantastic Call Girls-9833754194-Call Girls MUmbai

Vasai-Virar Fantastic Call Girls-9833754194-Call Girls MUmbai

Tricumen / 'Rescuing' banks from Hedge Fund & Private Equity investments_9-Jan-14

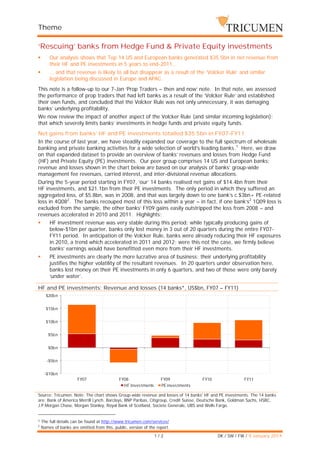

- 1. Theme ‘Rescuing’ banks from Hedge Fund & Private Equity investments Our analysis shows that Top 14 US and European banks generated $35.5bn in net revenue from their HF and PE investments in 5 years to end-2011… … and that revenue is likely to all but disappear as a result of the ‘Volcker Rule’ and similar legislation being discussed in Europe and APAC. This note is a follow-up to our 7-Jan ‘Prop Traders – then and now’ note. In that note, we assessed the performance of prop traders that had left banks as a result of the ‘Volcker Rule’ and established their own funds, and concluded that the Volcker Rule was not only unnecessary, it was damaging banks’ underlying profitability. We now review the impact of another aspect of the Volcker Rule (and similar incoming legislation): that which severely limits banks’ investments in hedge funds and private equity funds. Net gains from banks’ HF and PE investments totalled $35.5bn in FY07-FY11 In the course of last year, we have steadily expanded our coverage to the full spectrum of wholesale banking and private banking activities for a wide selection of world’s leading banks.1 Here, we draw on that expanded dataset to provide an overview of banks’ revenues and losses from Hedge Fund (HF) and Private Equity (PE) investments. Our peer group comprises 14 US and European banks; revenue and losses shown in the chart below are based on our analysis of banks’ group-wide management fee revenues, carried interest, and inter-divisional revenue allocations. During the 5-year period starting in FY07, ‘our’ 14 banks realised net gains of $14.4bn from their HF investments, and $21.1bn from their PE investments. The only period in which they suffered an aggregated loss, of $5.8bn, was in 2008, and that was largely down to one bank’s c.$3bn+ PE-related loss in 4Q082. The banks recouped most of this loss within a year – in fact, if one bank’s2 1Q09 loss is excluded from the sample, the other banks’ FY09 gains easily outstripped the loss from 2008 – and revenues accelerated in 2010 and 2011. Highlights: HF investment revenue was very stable during this period: while typically producing gains of below-$1bn per quarter, banks only lost money in 3 out of 20 quarters during the entire FY07FY11 period. In anticipation of the Volcker Rule, banks were already reducing their HF exposures in 2010, a trend which accelerated in 2011 and 2012; were this not the case, we firmly believe banks’ earnings would have benefitted even more from their HF investments. PE investments are clearly the more lucrative area of business; their underlying profitability justifies the higher volatility of the resultant revenues. In 20 quarters under observation here, banks lost money on their PE investments in only 6 quarters, and two of those were only barely ‘under water’. HF and PE investments: Revenue and losses (14 banks*, US$bn, FY07 – FY11) $20bn $15bn $10bn $5bn $0bn -$5bn -$10bn FY07 FY08 HF Investments FY09 PE investments FY10 FY11 Source: Tricumen. Note: The chart shows Group-wide revenue and losses of 14 banks' HF and PE investments. The 14 banks are: Bank of America Merrill Lynch, Barclays, BNP Paribas, Citigroup, Credit Suisse, Deutsche Bank, Goldman Sachs, HSBC, J.P.Morgan Chase, Morgan Stanley, Royal Bank of Scotland, Societe Generale, UBS and Wells Fargo. 1 2 The full details can be found at http://www.tricumen.com/services/ Names of banks are omitted from this, public, version of the report. 1/2 DK / SW / FW / 9 January 2014

- 2. Theme About Tricumen Tricumen was founded in 2008. It quickly become a strong provider of diversified market intelligence across the capital markets and has since expanded into transaction and corporate banking coverage. Tricumen’s data has been used by many of the world’s leading investment banks as well as strategy consulting firms, investment managers and ‘blue chip’ corporations. Situated near Cambridge in the UK, Tricumen is almost exclusively staffed with senior individuals with an extensive track record of either working for or analysing banks; and boasts what we believe is the largest capital markets-focused research network of its peer group. Caveats This report and the information contained herein may not be reproduced or distributed in the whole or in part without the prior written consent of Tricumen Limited. Such consent is often given, provided that the information released is sourced to Tricumen and that it does not prejudice Tricumen Limited’s business or compromise the company’s ability to analyse the financial markets. Tricumen Limited has used all reasonable care in writing, editing and presenting the information found in this report. All reasonable effort has been made to ensure the information supplied is accurate and not misleading. For the purposes of cross- market comparison, all numerical data is normalised in accordance to Tricumen Limited’s proprietary product classification. Fully-researched dataset may contain margin of error of +/-10%; for modelled datasets, this margin may be wider. The information and commentary provided in this report has been compiled for informational purposes only. We recommend that independent advice and enquiries should be sought before acting upon it. Readers should not rely on this information for legal, accounting, investment, or similar purposes. No part of this report constitutes investment advice, any form of recommendation, or a solicitation to buy or sell any instrument or to engage in any trading or investment activity or strategy. Tricumen Limited does not provide investment advice or personal recommendation nor will it be deemed to have done so. Tricumen Limited makes no representation, guarantee or warranty as to the suitability, accuracy or completeness of the report or the information therein. Tricumen Limited assumes no responsibility for information contained in this report and disclaims all liability arising from negligence or otherwise in respect of such information. Tricumen Limited is not liable for any damages arising in contract, tort or otherwise from the use of or inability to use this report or any material contained in it, or from any action or decision taken as a result of using the report. 2/2 DK / SW / FW / 9 January 2014