Conta minjangos

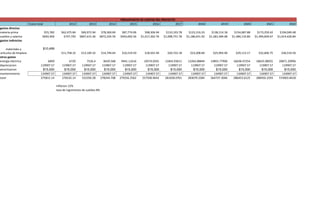

- 1. PRESUPUESTO DE COSTOS DEL PROYECTO Costo total 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 gastos directos materia prima $55,782 $62,475.84 $69,972.94 $78,369.69 $87,774.06 $98,306.94 $110,103.78 $123,316.23 $138,114.18 $154,687.88 $173,250.42 $194,040.48 sueldos y salarios $692,400 $747,792 $807,615.36 $872,224.59 $942,002.56 $1,017,362.76 $1,098,751.78 $1,186,651.92 $1,281,584.08 $1,384,110.80 $1,494,839.67 $1,614,426.84 gastos indirectos materiales y $10,499 articulos de limpieza $11,758.32 $13,169.32 $14,749.64 $16,519.59 $18,501.94 $20,722.18 $23,208.84 $25,993.90 $29,113.17 $32,606.75 $36,519.56 otros gastos energia electrica 6000 6720 7526.4 8429.568 9441.11616 10574.0501 11842.93611 13264.08844 14855.77906 16638.47254 18635.08925 20871.29996 depreciacion 119907.57 119907.57 119907.57 119907.57 119907.57 119907.57 119907.57 119907.57 119907.57 119907.57 119907.57 119907.57 amortizacion $15,000 $15,000 $15,000 $15,000 $15,000 $15,000 $15,000 $15,000 $15,000 $15,000 $15,000 $15,000 mantenimiento 134907.57 134907.57 134907.57 134907.57 134907.57 134907.57 134907.57 134907.57 134907.57 134907.57 134907.57 134907.57 total 275815.14 276535.14 552350.28 278244.708 279256.2562 557500.9642 281658.0761 283079.2284 564737.3046 286453.6125 288450.2293 574903.8418 inflacion 12% tasa de ingremento de sueldos 8%

- 2. PRESUPUESTO DE GASTOS DE ADMINISTRACIÓN 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 Sueldos y salarios 302400 338688 343042.56 384207.667 430312.587 481950.098 539784.109 604558.203 677105.187 758357.809 849360.746 telefono 12000 13440 15052.8 16859.136 18882.2323 21148.1002 23685.8722 26528.1769 29711.5581 33276.9451 37270.1785 Depreciación $2,611.15 $2,611.15 $2,611.15 $2,611.15 $2,611.15 $2,611.15 $2,611.15 $2,611.15 $2,611.15 $2,611.15 $2,611.15 Amortización $1,800 $1,800 $1,800 $1,800 $1,800 $1,800 $1,800 $1,800 $1,800 $1,800 $1,800 Mantenimiento $10,000 $11,200 $12,544.00 $14,049.28 $15,735.19 $17,623.42 $19,738.23 $22,106.81 $24,759.63 $27,730.79 $31,058.48 Gastos de oficina $1,302.00 $1,458.24 $1,633.23 $1,829.22 $2,048.72 $2,294.57 $2,569.92 $2,878.31 $3,223.70 $3,610.55 $4,043.81 Otros gastos 29546.5 33092.08 37063.1296 41510.7052 46491.9898 52071.0285 58319.552 65317.8982 73156.046 81934.7715 91766.9441 Totales 359659.65 402289.47 413746.868 462867.155 517881.875 579498.362 648508.828 725800.549 812367.277 909322.012 1017911.32 inflacion 12% incremento del sueldo y salario 8%

- 3. gastos de venta y de distribucion 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 Sueldos y salarios 372000 401760 433900.8 468613 506101.9 546590 590317.25 637542.63 688546.038 743629.7213 803120.099 Teléfono 12000 13440 15052.8 16859.1 18882.23 21148.1 23685.872 26528.177 29711.5581 33276.94509 37270.1785 Depreciación $7,200 $7,200 $7,200 $7,200 $7,200 $7,200 $7,200 $7,200 $7,200 $7,200 $7,200 Impuestos Mantenimiento 6000 6720 7526.4 8429.57 9441.116 10574.05 11842.936 13264.088 14855.7791 16638.47254 18635.08925 Combustibles y gastos de vehículos 31200 34944 39137.28 43833.8 49093.8 54985.06 61583.268 68973.26 77250.0511 86520.05723 96902.4641 Totales 428400 464064 502817.3 544935 590719 640497.3 694629.32 753508.15 817563.426 887265.1961 963127.8308 inflacion 12% incremento del sueldo y salario 8%

- 4. ESTADO DE RESULTADOS año 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 ventas $2,160,000 $ 2,661,120.00 3273534 4032131.4 4965055.92 6113818.06 7528799.94 9270826.73 11415324.26 14057140.95 18360867.08 (-) costos de produccion 874164 979063.68 1096551.322 1228137.48 1375513.978 1540575.655 1725444.734 1932498.102 2164397.874 2424125.619 2715020.693 utilidad bruta $1,285,836 $ 1,682,056.32 2176982.678 2803993.92 3589541.942 4573242.405 5803355.206 7338328.628 9250926.386 11633015.33 15645846.39 (-) gastos de administracion 359659.65 402289.47 413746.87 462867.15 517881.88 579498.36 648508.83 725800.55 812367.28 909322.01 1017911.3 (-) gastos de venta 428400 464064 502817.28 544935.32 590719.05 640497.26 694629.32 753508.15 817563.43 887265.2 963127.83 utilidad de $ operación $497,776 815,702.85 1260418.528 1796191.45 2581739.472 3353246.785 4460217.056 5859019.928 7620995.676 9836428.121 9836428.121 gastos financieros utilidad antes ISR y PTU $487,776 815702.85 1260418.528 1796191.45 2581739.472 3353246.785 4460217.056 5859019.928 7620995.676 9836428.121 9836428.121 (-) ISR y PTU (35% +10%) $219,499.20 367066.2825 567188.3376 808286.1525 1161782.762 1508961.053 2007097.675 2636558.968 3429448.054 4426392.654 4426392.654 utilidad neta $268,276.80 448636.5675 693230.1904 987905.2975 1419956.71 1844285.732 2453119.381 3222460.96 4191547.622 5410035.467 5410035.467 (+) depresiacion y amortizacion $14,388.91 $14,388.91 $14,388.91 $14,388.91 $14,388.91 $14,388.91 $14,388.91 $14,388.91 $14,388.91 $14,388.91 $14,388.91 flujos de caja $282,665.71 $463,025.48 $707,619.10 $1,002,294.21 $1,434,345.62 $1,858,674.64 $2,467,508.29 $3,236,849.87 $4,205,936.53 $5,424,424.38 $5,424,424.38 inflacion 12%

- 5. BALANCE GENERAL ACTIVOS PASIVO Circulante cajas y bancos 1 $185,863 Total $185,863 credito a banmujer $150,000 Fijos CAPITAL CONTABLE Maquinaria equipo 23,148.00 Aportaciones de los socios $98,011 Equipo de oficina 21759.57 Equipo de venta y dist. 60,000 Total 83,148.00 Diferidos Licencias y permisos 15,000 Total 15,000 Sumas del activo $284,011 Suma pasivo mas capital $248,011 Se considero el equivalente a dos meses de costos de producción y gastos de operación y ventas. Costos de venta anual 275815.14 Gastos de administración 359659.65 Gastos de venta 428400 Total $ 1,063,877.79 Mensual 88,656.48 Importe de dos meses 177,312.97 Imprevistos 8550 Total 185,862.97