Financial system

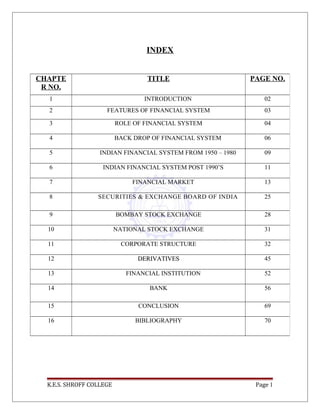

- 1. INDEX K.E.S. SHROFF COLLEGE Page 1 CHAPTE R NO. TITLE PAGE NO. 1 INTRODUCTION 02 2 FEATURES OF FINANCIAL SYSTEM 03 3 ROLE OF FINANCIAL SYSTEM 04 4 BACK DROP OF FINANCIAL SYSTEM 06 5 INDIAN FINANCIAL SYSTEM FROM 1950 – 1980 09 6 INDIAN FINANCIAL SYSTEM POST 1990’S 11 7 FINANCIAL MARKET 13 8 SECURITIES & EXCHANGE BOARD OF INDIA 25 9 BOMBAY STOCK EXCHANGE 28 10 NATIONAL STOCK EXCHANGE 31 11 CORPORATE STRUCTURE 32 12 DERIVATIVESDERIVATIVES 45 13 FINANCIAL INSTITUTION 52 14 BANK 56 15 CONCLUSION 69 16 BIBLIOGRAPHY 70

- 2. CHAPTER-1 INTRODUCTIONINTRODUCTION The financial system or the financial sector of any country consists of:- (a) specialized & non specialized financial institution (b) organized &unorganized financial markets and (c) Financial instruments & services which facilitate transfer of funds. Procedure & practices adopted in the markets, and financial inter relationships are also the parts of the system. These parts are not always mutually exclusive. For example, the financial institution operate in financial market and are, therefore a part of such market. The word system in the term financial system implies a set of complex and closely connected or inters mixed institution, agents practices, markets, transactions, claims, & liabilities in the economy. The financial system is concerned about money, credit, & finance – the terms intimately related yet some what different from each other. Money refers to the current medium of exchange or means of payment. Credit or Loan is a sum of money to be returned normally with Interest it refers to a debt of economic unit. Finance is a monetary resources comprising debt & ownership fund of the state, company or person. K.E.S. SHROFF COLLEGE Page 2

- 3. CHAPTER- 2 FEATURES OF FINANCIAL SYSTEMFEATURES OF FINANCIAL SYSTEM 1. It provides an Ideal linkage between depositors savers and Investors Therefore it encourages savings and investment. 2. Financial system facilitates expansion of financial markets over a period of time. 3. Financial system should promote deficient allocation of financial resources of socially desirable and economically productive purpose. 4. Financial system influence both quality and the pace of economic development. K.E.S. SHROFF COLLEGE Page 3

- 4. CHAPTER- 3 ROLE OF FINANCIAL SYSTEMROLE OF FINANCIAL SYSTEM The role of the financial system is to promote savings & investments in the economy. It has a vital role to play in the productive process and in the mobilization of savings and their distribution among the various productive activities. Savings are the excess of current expenditure over income. The domestic savings has been categorized into three sectors, household, government & private sectors. The savings from household sector dominates the domestic savings component. The savings will be in the form of currency, bank deposits, non bank deposits, life insurance funds, provident funds, pension funds, shares, debentures, bonds, units & trade debts. All of these currency & deposits are voluntary transactions & precautionary measures. The savings in the household sector are mobilized directly in the form of units, premium, provident fund, and pension fund. These are the contractual forms of savings. Financial actively deals with the production, distribution & consumption of goods and services. The financial system will provide inputs to productive activity. Financial sector provides inputs in the form of cash credit & assets in financial for production activities. The function of a financial system is to establish a bridge between the savers and investors. It helps in mobilization of savings to materialize investment ideas into realities. It helps to increase the output towards the existing production frontier. The growth of the banking habit helps to activate saving and undertake fresh saving. The financial system encourages investment activity by reducing the cost of finance risk. It helps to make investment decisions regarding projects by sponsoring, encouraging, export project appraisal, feasibility studies, monitoring & execution of the projects. K.E.S. SHROFF COLLEGE Page 4

- 5. An overview of Financial System and Financial Markets in India K.E.S. SHROFF COLLEGE Page 5 MINISTRY OF FINANCE Financial Institutions RBI SEBI IRDA Insurance company Mutual Fund Venture Capital Fund Capital Market LIC & Other GIC & Other Commercial Banks NBFC Money Market Primary Market Secondary Market Stock Exchange Government Security Market Development Banks Investment Banks Sectoral Banks State Level Financial Institution

- 6. CHAPTER- 4 BACK DROP OF INDIAN FINANCIAL SYSTEM At the time of independence, India had a reasonably diversified financial system in terms of intermediaries but a somewhat narrow focus on terms of intermediation, i.e., a lack of a long term capital market and the relative neglect of agriculture in particular and rural areas in general. As India embarked on a process of industrialization and growth, RBI set up Development Financial Institutions (DFI’s) and State Finance Corporations (SFC’s) as providers of long term capital. Agriculture’s need for credit was met by cooperative banks. UTI was set up to canalize resources from retail investors to the capital market. In essence, the understanding that requirement of financial needs for accelerated growth and development was best met by specialized financial intermediaries who performed specialized functions influenced financial market architecture. To ensure that these specializations were adhered to, financial intermediaries developed and promoted by the Reserve Bank of India had significant restrictions on both the asset and liabilities side of their balance sheets. In the 1950s and 1960s, despite an expansion of the commercial banking system in terms of both reach and mobilization of resources, agriculture still remained under funded and rural areas under banked. Whereas industry’s share in credit disbursed almost doubled between 1951 and 1968, from 34 to 67.5%, agriculture got barely 2% of available. Credit to exports and small scale industries were relatively neglected as well. K.E.S. SHROFF COLLEGE Page 6 1947 1960s Industry’s share in credit doubled, agriculture, rural areas, SSI, exports still neglected Nationalisation of Banks to ensure credit allocation as per plan priorities 1980s 1970s NABARD, EXIM, SIDBI, NHB setup RRBs setup 1990s Credit to Industry / Govt doubled Highly segmented financial market, highly restricted Neglected: long term, agricultural, and rural area credit Need for specialized FIs felt. DFIs, SFCs, UTI, Co-op Banks setup.

- 7. In view of the above, it was decided to nationalize the banking sector so that credit allocation could take place in accordance in plan priorities. Nationalization took place in two phases, with a first round in 1969 followed by another in 1980. By the mid-seventies it was felt that commercialized banks did not have sufficient expertise in rural banking and hence in 1975 Regional Rural Banks (RRBs) were set up to help bring rural India into the ambit of the financial network. This effort was capped in 1980 with the formation of National Bank for Agriculture and Rural Development (NABARD), which was to function as an apex bank for all cooperative banks in the country, helping control and guide their activities. NABARD was also given the remit of regulating rural credit cooperatives. Following with the logic of specialization, the 1980s saw other DFIs with specific remits being set up – e.g. The EXIM Bank for export financing, the Small Industries Development Bank of India (SIDBI) for small scale industries and the National Housing Bank (NHB) for housing finance. Long term finance for the private sector came from DFIs and institutional investors or through the capital market. However both price and quantity of capital issues was regulated by the Controller of Capital Issues. Therefore the deepening of financial intermediation had occurred with an increase in the draft by both the commercial sector and the government on financial resources mobilized. At the end of the 1980s then the Indian financial system was characterized by segmented financial markets with significant restrictions on both the asset and liability side of the balance sheet of financial intermediaries as well as the price at which financial products could be offered. In the Indian context segmentation meant that competition was muted. In a scenario where price was determined from outside the system and targets were set in terms of quantities, there was no pressure for non-price competition as well. As a result the financial system had relatively high transaction costs and political economy factors meant that asset quality was not a prime concern. Therefore even though the Indian financial system at the end of 1980s had achieved substantial expansion in terms of access, this had come at the cost of asset quality. In addition, was the fact that the draft of the government on resources of the financial system had increased significantly. This in itself need necessarily was not a problem but over this period, i.e., the 1980s, the composition of government expenditure was changing as well, with shift towards current rather than capital expenditure. In addition, in the absence of a reasonably liquid market for government securities, an increase in net bank lending to the government meant that the asset side of banks’ balance sheets tended to become increasingly illiquid. The impetus for change came from one expected and one unexpected quarter - first, the importance of prudential capital adequacy ratios was underlined by the announcement of BaselI norms (see Error: Reference source not found Error: Reference source not found) That banks were expected to adhere to; second the macroeconomic crisis of 1990-91. K.E.S. SHROFF COLLEGE Page 7

- 8. The reform process that followed accelerated the process of liberalization already begun in the 1980s and began a series of measured and deliberate steps to integrate India into the global economy, including the global financial network. Briefly however, given the problems facing the financial system and keeping in mind the institutional changes necessary to help India financially integrate into the global economy, financial reform focused on the following: improving the asset quality on bank balance sheets in particular and operational efficiency in general; increasing competition by removing regulatory barriers to entry; increasing product competition by removing restrictions on asset and liability sides of financial intermediaries; allowing financial intermediaries freedom to set their prices; putting in place a market for government securities; and improving the functioning of the call money market. The government security market was particularly important not only because it was decided the RBI would no longer monetize the fiscal deficit, which would now be financed by directly borrowing from the market, but also monetary policy would be conducted through open market operations and a large liquid bond market would help the RBI sterilise, if necessary, foreign exchange movements. CHAPTER- 5 K.E.S. SHROFF COLLEGE Page 8

- 9. INDIAN FINANCIAL SYSTEM FROM 1950 TO 1980 Indian Financial System During this period evolved in response to the objective of planned economic development. With the adoption of mixed economy as a pattern of industrial development, a complimentary role was conceived for public and private sector. There was a need to align financial system with government economic policies. At that time there was government control over distribution of credit and finance. The main elements of financial organization in planned economic development are as follows:- 1. Public ownership of financial institutions –Public ownership of financial institutions – The nationalization of RBI was in 1948, SBI was set up in 1956, LIC came in to existence in 1956 by merging 245 life insurance companies in 1969, 14 major private banks were brought under the direct control of Government of India. In 1972, GIC was set up and in 1980; six more commercial banks were brought under public ownership. Some institutions were also set up during this period like development banks, term lending institutions, UTI was set up in public sector in 1964, provident fund, pension fund was set up. In this way public sector occupied commanding position in Indian Financial System. 2.2. Fortification Of Institutional structure –Fortification Of Institutional structure – Financial institutions should stimulate / encourage capital formation in the economy. The important feature of well developed financial system is strengthening of institutional structures. Development banks was set up with this objective like industrial finance corporation of India (IFCI) was set up in 1948, state financial corporation (SFCs) were set up in 1951, Industrial credit and Investment corporation of India Ltd (ICICI)was set up in 1955. It was pioneer in many respects like underwriting of issue of capital, channelisation of foreign currency loans from World Bank to private industry. In 1964, Industrial Development of India (IDBI). 3.3. Protection of Investors –Protection of Investors – Lot many acts were passed during this period for protection of investors in financial markets. The various acts Companies Act, 1956 ; Capital Issues Control Act, 1947 ; Securities Contract Regulation Act, 1956 ; Monopolies and Restrictive Trade Practices Act, 1970 ; Foreign Exchange Regulation Act, 1973 ; Securities & Exchange Board of India, 1988. K.E.S. SHROFF COLLEGE Page 9

- 10. 4.4. Participation in Corporate Management –Participation in Corporate Management – As participation were made by large companies and financial instruments it leads to accumulation of voting power in hands of institutional investors in several big companies financial instruments particularly LIC and UTI were able to put considerable pressure on management by virtual of their voting power. The Indian Financial System between 1951 and mid80’s was broad based number of institutions came up. The system was characterized by diversifying organizations which used to perform number of functions. The Financial structure with considerable strength and capability of supplying industrial capital to various enterprises was gradually built up the whole financial system came under the ownership and control of public authorities in this manner public sector occupy a commanding position in the industrial enterprises. Such control was viewed as integral part of the strategy of planned economy development. K.E.S. SHROFF COLLEGE Page 10

- 11. CHAPTER- 6 INDIAN FINANCIAL SYSTEM POST 1990’S The organizations of Indian Financial system witnessed transformation after launching of new economic policy 1991. The development process shifted from controlled economy to free market for these changes were made in the economic policy. The role of government in business was reduced the measure trust of the government should be on development of infrastructure, public welfare and equity. The capital market an important role in allocation of resources. The major development during this phase are:- 1. Privatisation of Financial Institutions1. Privatisation of Financial Institutions –– At this time many institutions were converted in to public company and number of private players were allowed to enter in to various sectors: a) Industrial Finance Corporation on India (IFCI): The pioneer development finance institution was converted in to a public company. b) Industrial Development Bank of India & Industrial Finance Corporation of India (IDBI & IFCI): IDBI & IFCI ltd offers their equity capital to private investors. c) Private Mutual Funds have been set up under the guidelines prescribed by SEBI. d) Number of private banks and foreign banks came up under the RBI guidelines. Private institution companies emerged and work under the guidelines of IRDA, 1999. e) In this manner government monopoly over financial institutions has been dismantled in phased manner. IT was done by converting public financial institutions in joint stock companies and permitting to sell equity capital to the government. 2. Reorganization of Institutional Structure –2. Reorganization of Institutional Structure – The importance of development financial institutions decline with shift to capital market for raising finance commercial banks were give more funds to investment in capital market for this. SLR and CRR were produced; SLR earlier @ 38.5% was reduced to 25% and CRR which used to be 25% is at present 5%. Permission was also given to banks to directly undertake leasing, hire-purchase and factoring business. There was trust on development of primary market, secondary market and money market. K.E.S. SHROFF COLLEGE Page 11

- 12. 3. Investors Protection –3. Investors Protection – SEBI is given power to regulate financial markets and the various intermediaries in the financial markets. K.E.S. SHROFF COLLEGE Page 12

- 13. CHAPTER-7 FINANCIAL MARKET Money Market Call Money Market Commercial Paper Certificate of Deposit Treasury Bill Market Money Market Mutual Fund Capital Market International Capital Market K.E.S. SHROFF COLLEGE Page 13

- 14. MONEY MARKET AND GOVT. SECURITIES MARKET Money market deal with short term monetary assets and claims, which are generally from one day to one year duration. Govt. securities on the other hand are also called dated securities to denote that they are generally long term in nature and are issued by state and central govt. under their borrowing programmes and duration of more than one year, generally of 5 years and above. These securities being long term in nature are also traded in govt. securities market between institution and banks also on the stock exchanges- debt segments. MONEY MARKET One of the important function of a well developed money market is to channelize saving into short term productive investments like working capital. Call money market, treasury bills market and markets for commercial paper and certificate of deposit are some of the example of money market. CALL MONEY MARKET The call money markets form a part of the national money market, where day –to- day surplus funds, mostly of banks are traded . The call money loans are very short term in nature and the maturity period of this vary from 1 to 15 days. The money which is lent for one day in this market is known as “call money”, and if it exceeds one day (but less than 15 days), is referred as “notice money” in this market any amount could be lent or borrowed at a convenient interest rate . Which is acceptable to both borrower and lender .these loans are consider as highly liquid as they are repayable on demand at the option of ether the lender or borrower. PURPOSE Call money is borrowed from the market to meet various requirements of commercial bill market and commercial banks. Commercial bill market borrower call money for short period to discount commercial bills. Banks borrower in call market to: 1:- Fill the temporary gaps, or mismatches that banks normally face. 2:- Meet the cash Reserve Ratio requirement. 3: - Meet sudden demand for fund, which may arise due to large payment and remittance. K.E.S. SHROFF COLLEGE Page 14

- 15. Banks usually borrow form the market to avoid the penal interest rate for not meeting CRR requirement and high cost of refinance from RBI. Call money helps the banks to maintain short term liquidity position at comfortable level. LOCATION In India call money markets are mainly located in commercial centers and big industrial centers and industrial center such as Mumbai, Calcutta, Chennai, Delhi and Ahmedabad. As BSE and NSE and head office of RBI and many other banks are situated in Mumbai; the volume of funds involved in call money market in Mumbai is far bigger than other cities. PARTICIPANTS Initially, only few large banks were operating in the bank market. however the market had expanded and now scheduled , non scheduled commercial banks foreign banks ,state , district, and urban cooperative banks , financial institution such as LIC,UTI,GIC, and its subsidiaries , IDBI, NABARD, IRBI, ECGC, EXIM Bank, IFCI, NHB , TFCI, and SIDBI, Mutual fund such as SBI Mutual fund . LIC Mutual funds. And RBI Intermediaries like DFHI and STCI are participants in local call money markets. However RBI has recently introduced restriction on some of the participants to phase them out of call money market in a time bound manner. Participant in call money market are split into two categories 1:- BORROWER AND LENDER:- This comprises entities those who can both borrower and lend in this market, such as RBI, intermediaries like DFHI, and STCI and commercial banks. 2:- ONLY LENDER: - This category comprises of entities those who can act only as lender, like financial institution and mutual funds. K.E.S. SHROFF COLLEGE Page 15

- 16. CALL RATES The interest paid on call loan is known as the call rates. Unlike in the case of other short and long rates. The call rate is expected to freely reflect the day to day availability and long rates. These rates vary highly from day to day. Often from hour to hour. While high rates indicate a tightness of liquidity position in market. The rate is largely subject to be influenced by sources of supply and demand for funds. The call money rate had fluctuated from time to time reflecting the seasonal variation in fund requirements. Call rates climbs high during busy seasons in relation to those in slack season. These seasonal variations were high due to a limited number of lender and many borrowers. The entry of financial institution and money market mutual funds into the call market has reduced the demand supply gap and these fluctuations gradually came down in recent years. Though the seasonal fluctuations were reduced to considerable extent, there are still variations in the call rates due to the following reason: 1:- large borrower by banks to meet the CRR requirements on certain dates cause a gate demand for call money. These rates usually go up during the first week to meet CRR requirements and decline afterwards. 2:- the sanction of loans by banks, in excess of their own resources compel the bank to rely on the call market. Banks use the call market as a source of funds for meeting dis- equilibrium of inflow and out flow of fund s. 3:- the withdrawal of funds to pay advance tax by the corporate sector leads to steep increase in call money rates in the market. COMMERCIAL PAPER Commercial paper are short term, unsecured promissory notes issued at a discount to face value by well- known companies that are financial strong and carry a high credit rating . They are sold directly by the issuers to investor, or else placed by borrowers through agents like merchant banks and security houses the flexible maturity at which they can be issued are one of the main attraction for borrower and investor since issues can be adapted to the needs of both. The CP market has the advantage of giving highly rated corporate borrowers cheaper fund than they could obtain from the banks while still providing institutional investors with higher interest earning than they could obtain form the banking system the issue of CP imparts a degree of financial stability to the systems as the issuing company has an incentive to remain financially strong. K.E.S. SHROFF COLLEGE Page 16

- 17. THE FEATURES OF CP 1. They are negotiable by endorsement and delivery. 2. They are issued in multiple of Rs 5 lakhs. 3. The maturity varies between 15 days to a year. 4. No prior approval of RBI is needed for CP issued. 5. The tangible net worth issuing company should not be less than 4 lakhs 6. The company fund based working capital limit should not less than Rs 10 crore. 7. The issuing company shall have P2 and A2 rating from CRISIL and ICRA. CERTIFICATE OF DEPOSIT Certificate of Deposits,. Instruments such as the Certificates of Deposit (CDs introduced in 1989), Commercial Paper (CP introduced in 1989), inter-bank participation certificates (with and without risk) were introduced to increase the range of instruments. Certificates of Deposit are basically negotiable money market instruments issued by banks and financial institutions during tight liquidity conditions. Smaller banks with relatively smaller branch networks generally mobilise CDs. As CDs are large size deposits, transaction costs on CDs are lower than retail deposits FEATURES OF CD 1. All scheduled bank other than RRB and scheduled cooperative bank are eligible to issue CDs. 2. CDs can be issued to individuals, corporation, companies, trust, funds and associations. NRI can subscribe to CDs but only on a non- repatriation basis. 3. They are issued at a discount rate freely determined by the issuing bank and market. 4. They issued in the multiple of Rs 5 lakh subject to minimum size of each issue of Rs is 10 lakh. 5. The bank can issue CDs ranging from 3 month t 1 year , whereas financial institution can issue CDs ranging from 1 year to 3 years. K.E.S. SHROFF COLLEGE Page 17

- 18. TREASURY BILLS MARKETTREASURY BILLS MARKET:-:- Treasury bills are the main financial instruments of money market. These bills are issued by the government. The borrowings of the government are monitored & controlled by the central bank. The bills are issued by the RBI on behalf of the central government. The RBI is the agent of Union Government. They are issued by tender or tap. The bills were sold to the public by tender method up to 1965. These bills were put at weekly auctions. A treasury bill is a particular kind of finance bill. It is a promissory note issued by the government. Until 1950 these bills were also issued by the state government. After 1950 onwards the central government has the authority to issue such bills. These bills are greater liquidity than any other kind of bills. They are of two kinds: a) ad hoc, b) regular. Ad hoc treasury bills are issued to the state governments, semi government departments & foreign ventral banks. They are not marketable. The ad hoc bills are not sold to the banks & public. The regular treasury bills are sold to the general public & banks. They are freely marketable. These bills are sold by the RBI on behalf of the central government. The treasury bills can be categorized as follows:- 1) 14 days treasury bills:- The 14 day treasury bills has been introduced from 1996-97. These bills are non- transferable. They are issued only in book entry system they would be redeemed at par. Generally the participants in this market are state government, specific bodies & foreign central banks. The discount rate on this bill will be decided at the beginning of the year quarter. 2) 28 days treasury bills:- These bills were introduced in 1998. The treasury bills in India issued on auction basis. The date of issue of these bills will be announced in advance to the market. The information regarding the notified amount is announced before each auction. The notified amount in respect of treasury bills auction is announced in advance for the whole year separately. A uniform calendar of treasury bills issuance is also announced. 3) 91 days treasury bills:- The 91 days treasury bills were issued from July 1965. These were issued tap basis at a discount rate. The discount rates vary between 2.5 to 4.6% P.a. from July 1974 the discount rate of 4.6% remained uncharged the return on these bills were very low. However the RBI provides rediscounting facility freely for this bill. K.E.S. SHROFF COLLEGE Page 18

- 19. 4) 182 days treasury bills:- The 182 days treasury bills was introduced in November 1986. The chakravarthy committee made recommendations regarding 182 day treasury bills instruments. There was a significant development in this market. These bills were sold through monthly auctions. These bills were issued without any specified amount. These bills are tailored to meet the requirements of the holders of short term liquid funds. These bills were issued at a discount. These instruments were eligible as securities for SLR purposes. These bills have rediscounting facilities. 5) 364 days treasury bills:- The 364 treasury bills were introduced by the government in April 1992. These instruments are issued to stabilise the money market. These bills were sold on the basis of auction. The auctions for these instruments will be conducted for every fortnight. There will be no indication when they are putting auction. Therefore the RBI does not provide rediscounting facility to these bills. These instruments have been instrumental in reducing, the net RBI credit to the government. These bills have become very popular in India. Money Market Mutual Funds (MMMFs) The benefits of developments in the various in the money market like cell money loans. Treasury bills, commercial papers and certificate of deposits were available only to the few institutional participants in the market. The main reason for this was that huge amounts were required to be invested in these instruments, the minimum being Rs. 10 lack, which was beyond the means of individual money markets to small investors. MMMFs are mutual funds that invest primarily in money market instruments of very high quality and of very short maturities. MMMFs can be set up by very high quality and of very short maturities. MMMFs can be set up by commercial bank, RBI and public financial institution either directly or through their existing mutual fund subsidiaries. The guidelines with respect to mobilization of funds by MMMFs provide that only individuals are allowed to invest in such funds. Earlier these funds were regulated by the RBI. But RBI withdrew its guidelines, with effect form March 7, 2001 and now they are governed by SEBI. The schemes offered by MMMfs can either by open – ended or close-ended. In case of open- ended schemer, the units are available for purchase on a continuous basis and the MMMFs would be willing to repurchase the units. A close –ended scheme is available for subscription for a limited period and is redeemed at maturity. K.E.S. SHROFF COLLEGE Page 19

- 20. The guidelines on the on MMMfs specify a minimum lock – in period of 15 days during which the investor cannot redeem his investment. The guidelines also stipulate the minimum size of the MMMF to be Rs. 50 crore and this should not exceed 2% of the aggregate deposits of the latest accounting year in the case of banks and 2% of the long-term domestic borrowings in the case of public financial institutions. Structure of capital market CAPITAL MARKETCAPITAL MARKET K.E.S. SHROFF COLLEGE Page 20 Private Placement CAPITAL MARKET Secondary Market Listing Trading Practices of Settlements & Clearing Primary Market Costs of Issue Method of Issue Public Issue Quantum of Issue Bonus Issue Operation Right Issue Players Companies (Issuer) Intermediaries (Merchant Banks FIIs & Broker) Investor (Public) Instruments Interest Rates Procedures

- 21. Capital market is market for long term securities. It contains financial instruments of maturity period exceeding one year. It involves in long term nature of transactions. It is a growing element of the financial system in the India economy. It differs from the money market in terms of maturity period & liquidity. It is the financial pillar of industrialized economy. The development of a nation depends upon the functions & capabilities of the capital market. Capital market is the market for long term sources of finance. It refers to meet the long term requirements of the industry. Generally the business concerns need two kinds of finance:- 1. Short term funds for working capital requirements. 2. Long term funds for purchasing fixed assets. Therefore the requirements of working capital of the industry are met by the money market. The long term requirements of the funds to the corporate sector are supplied by the capital market. It refers to the institutional arrangements which facilitate the lending & borrowing of long term funds. IMPORTANCE OF CAPITAL MARKETIMPORTANCE OF CAPITAL MARKET Capital market deals with long term funds. These funds are subject to uncertainty & risk. Its supplies long term funds & medium term funds to the corporate sector. It provides the mechanism for facilitating capital fund transactions. It deals I ordinary shares, bond debentures & stocks & securities of the governments. In this market the funds flow will come from savers. It converts financial assets in to productive physical assets. It provides incentives to savers in the form of interest or dividend to the investors. It leads to the capital formation. The following factors play an important role in the growth of the capital market:- • A strong & powerful central government. • Financial dynamics • Speedy industrialization • Attracting foreign investment • Investments from NRI’s • Speedy implementation of policies • Regulatory changes • Globalization • The level of savings & investments pattern of the household sectors • Development of financial theories • Sophisticated technological advances. K.E.S. SHROFF COLLEGE Page 21

- 22. PLAYERS IN THE CAPITAL MARKETPLAYERS IN THE CAPITAL MARKET Capital market is a market for long term funds. It requires a well structured market to enhance the financial capability of the country. The market consist a number of players. They are categorized as:- 1. Companies 2. Financial intermediaries 3. Investors. I. COMPANIES: Generally every company which is a public limited company can access the capital market. The companies which are in need of finance for their project can approach the market. The capital market provides funds from the savers of the community. The companies can mobilize the resources for their long term needs such as project cost, expansion & diversification of projects & other expenditure of India to raise the capital from the market. The SEBI is the most powerful organization to monitor, control & guidance the capital market. It classifies the companies for the issue of share capital as new companies, existing unlisted companies& existing listed companies. According to its guidelines a company is a new company if it satisfies all the following:- a) The company shall not complete 12 months of commercial operations. b) Its audited operative results are not available. c) The company may set up by entrepreneurs with or without track record. A company which can be treated as existing listed company, if its shares are listed in any recognized stock exchange in India. A company is said to be an existing unlisted company if it is a closely held or private company. II. FINANCIAL INTERMEDIARIES: Financial intermediaries are those who assist in the process of converting savings into capital formation in the country. A strong capital formation process is the oxygen to the corporate sector. Therefore the intermediaries occupy a dominant role in the capital formation which ultimately leads to the growth of prosperous to the community. Their role in this situation cannot be. The government should encourage these intermediaries to build a strong financial empire for the country. They are also being called as financial architectures of the India digital economy. Their financial capability cannot be measured. They take active role in the capital market. K.E.S. SHROFF COLLEGE Page 22

- 23. The major intermediaries in the capital market are:- a) Brokers. b) Stock brokers & sub brokers c) Merchant bankers d) Underwriters e) Registrars f) Mutual funds g) Collecting agents h) Depositories i) Agents j) Advertising agencies III. INVESTORS: The capital market consists many numbers of investors. All types of investor’s basic objective is to get good returns on their investment. Investment means, just parking one’s idle fund in a right parking place for a stipulated period of time. Every parked vehicle shall be taken away by its owners from parking place after a specific period. The same process may be applicable to the investment. Every fund owner may desire to take away the fund after a specific period. Therefore safety is the most important factor while considering the investment proposal. The investors comprise the financial investment companies & the general public companies. Usually the individual savers are also treated as investors. Return is the reward to the investors. Risk is the punishment to the investors for being wrong selection of their investment decision. Return is always chased by the risk. An intelligent investor must always try to escape the risk & attract the return. All rational investors prefer return, but most investors are risk average. They attempt to get maximum capital gain. The return can be available to the investors in two types they are in the form of revenue or capital appreciation. Some investors will prefer for revenue receipt & others prefer capital appreciation. It depends upon their economic status & the effect of tax implications. K.E.S. SHROFF COLLEGE Page 23

- 24. STRUCTURE OF THE CAPITAL MARKET IN INDIA The structure of the capital market has undergone vast changes in recent years. The Indian capital market has transformed into a new appearance over the last four & a half decades. Now it comprises an impressive network of financial institutions & financial instruments. The market for already issued securities has become more sophisticated in response to the different needs of the investors. The specialized financial institutions were involved in providing long term credit to the corporate sector. Therefore the premier financial institutions such as ICICI, IDBI, UTI, and LIC & GIC constitute the largest segment. A number of new financial instruments & financial intermediaries have emerged in the capital market. Usually the capital markets are classified in two ways:- A. On the basis of issuer B. On the basis of instruments On the basis of issuer the capital market can be classified again two types:- a) Corporate securities market b) Governments securities market On the basis of financial instruments the capital markets are classifieds into two kinds:- a) Equity market b) Debt market Recently there has been a substantial development of the India capital market. It comprises various submarkets. Equity market is more popular in India. It refers to the market for equity shares of existing & new companies. Every company shall approach the market for raising of funds. The equity market can be divided into two categories (a) primary market (b) secondary market. Debt market represents the market for long term financial instruments such as debentures, bonds, etc. PRIMARY MARKET To meet the financial requirement of their project company raise their capital through issue of securities in the company market. Capital issue of the companies were controlled by the capital issue control act 1947. Pricing of issue was determined by the controller of capital issue the main purpose of control on capital issue was to prevent the diversion of investible resources to non- essential projects. Through the necessity of retaining some sort of control on issue of capital to meet the above purpose still exist . The CCI was abolished in 1992 as the practice of government K.E.S. SHROFF COLLEGE Page 24

- 25. control over the capital issue as well as the overlapping of issuing has lost its relevance in the changed circumstances. CHAPTER-8 SECURITIES & EXCHANGE BOARD OF INDIA INTRODUCTION:INTRODUCTION: It was set up in 1988 through administrative order it became statutory body in 1992. SEBI is under the control of Ministry of Finance. Head office is at Mumbai and regional offices are at Delhi, Calcutta and Chennai. The creation of SEBI is with the objective to replace multiple regulatory structures. It is governed by six member board of governors appointed by government of India and RBI. OBJECTIVES OF SEBI:OBJECTIVES OF SEBI: 1. To protect the interest of investors in securities. 2. To regulate securities market and the various intermediaries in the market. 3. To develop securities market over a period of time. POWERS AND FUNCTIONS OF SEBI:POWERS AND FUNCTIONS OF SEBI: (1) ISSUE GUIDELINES TO COMPANIES:- SEBI issues guidelines to the companies for disclosing information and to protect the interest of investor. The guidelines relates to issue of new shares, issue of convertible debentures, issue by new companies, etc. After abolition of capital issues control act, SEBI was given powers to control and regulate new issue market as well as stock exchanges. (2) REGULATION OF PORTFOLIO MANAGEMENT SERVICES:- Portfolio Management services were brought under SEBI regulations in January 1993. SEBI framed regulations for portfolio management keeping securities scams in mind. SEBI has been entrusted with a job to regulate the working of portfolio managers in order to give protections to investors. (3) REGULATION OF MUTUAL FUNDS:- The mutual funds were placed under the control of SEBI on January 1993. Mutual funds have been restricted from short selling or carrying forward transactions in securities. Permission has been granted to invest only in transferable securities in money market and capital market. K.E.S. SHROFF COLLEGE Page 25

- 26. (4) CONTROL ON MERCHANT BANKING:- Merchant bankers are to be authorized by SEBI, they have to follow code of conduct which makes them responsible towards the investors in respect of pricing, disclosure of/ in the prospectus and issue of securities, merchant bankers have high degree of accountability in relation to offer documents and issue of shares. (5) ACTION FOR DELAY IN TRANSFER AND REFUNDS:- SEBI has prosecuted many companies for delay in transfer of shares and refund of money to the applicants to whom the shares are not allotted. These also gives protection to investors and ensures timely payment in case of refunds. (6) ISSUE GUIDELINES TO INTERMEDIARIES:- SEBI controls unfair practices of intermediaries operating in capital market, such control helps in winning investors confidence and also gives protection to investors. (7) GUIDELINES FOR TAKEOVERS AND MERGERS:- SEBI makes guidelines for takeover and merger to ensure transparency in acquisitions of shares, fair disclosure through public announcement and also to avoid unfair practices in takeover and mergers. (8) REGULATION OF STOCK EXCHANGES FUNCTIONING:- SEBI is working for expanding the membership of stock exchanges to improve transparency, to shorten settlement period and to promote professionalism among brokers. All these steps are for the healthy growth of stock exchanges and to improve their functioning. (9) REGULATION OF FOREIGN INSTITUTIONAL INVESTMENT (FIIS):- SEBI has started registration of foreign institutional investment. It is for effective control on such investors who invest on a large scale in securities. TYPES OF ISSUE A company can raise its capital through issue of share and debenture by means of :- PUBLIC ISSUE :- K.E.S. SHROFF COLLEGE Page 26

- 27. Public issue is the most popular method of raising capital and involves raising capital and involve raising of fund direct from the public . RIGHT ISSUE :- Right issue is the method of raising additional finance from existing members by offering securities to them on pro rata basis. A company proposing to issue securities on right basis should send a letter of offer to the shareholders giving adequate discloser as to how the additional amount received by the issue is used by the company. BONUS ISSUE:- Some companies distribute profits to existing shareholders by way of fully paid up bonus share in lieu of dividend. Bonus share are issued in the ratio of existing share held. The shareholder do not have to nay additional payment for these share . PRIVATE PLACEMENT :- private placement market financing is the direct sale by a public limited company or private limited company of private as well as public sector of its securities to a limited number of sophisticated investors like UTI , LIC , GIC state finance corporation and pension and insurance funds the intermediaries are credit rating agencies and trustees and financial advisors such as merchant bankers. And the maximum time – frame required for private placement market is only 2 to 3 months. Private placement can be made out of promoter quota but it cannot be made with unrelated investors. SECONDRY MARKET The secondary market is that segment of the capital market where the outstanding securities are traded from the investors point of view the secondary market imparts liquidity to the long – term securities held by them by providing an auction market for these securities. The secondary market operates through the medium of stock exchange which regulates the trading activity in this market and ensures a measure of safety and fair dealing to the investors. India has a long tradition of trading in securities going back to nearly 200 years. The first India stock exchange established at Mumbai in 1875 is the oldest exchange in Asia. The main objective was to protect the character status and interest of the native share and stock broker. K.E.S. SHROFF COLLEGE Page 27

- 28. CHAPTER-9 BOMBAY STOCK EXCHANGE Bombay Stock Exchange is the oldest stock exchange in Asia with a rich heritage, now spanning three centuries in its 133 years of existence. What is now popularly known as BSE was established as "The Native Share & Stock Brokers' Association" in 1875. BSE is the first stock exchange in the country which obtained permanent recognition (in 1956) from the Government of India under the Securities Contracts (Regulation) Act 1956. BSE's pivotal and pre-eminent role in the development of the Indian capital market is widely recognized. It migrated from the open outcry system to an online screen-based order driven trading system in 1995. Earlier an Association of Persons (AOP), BSE is now a corporatised and demutualised entity incorporated under the provisions of the Companies Act, 1956, pursuant to the BSE (Corporatisation and Demutualisation) Scheme, 2005 notified by the Securities and Exchange Board of India (SEBI). With demutualisation, BSE has two of world's best exchanges, Deutsche Börse and Singapore Exchange, as its strategic partners. Over the past 133 years, BSE has facilitated the growth of the Indian corporate sector by providing it with an efficient access to resources. There is perhaps no major corporate in India which has not sourced BSE's services in raising resources from the capital market. Today, BSE is the world's number 1 exchange in terms of the number of listed companies and the world's 5th in transaction numbers. The market capitalization as on December 31, 2007 stood at USD 1.79 trillion . An investor can choose from more than 4,700 listed companies, which for easy reference, are classified into A, B, S, T and Z groups. The BSE Index, SENSEX, is India's first stock market index that enjoys an iconic stature , and is tracked worldwide. It is an index of 30 stocks representing 12 major sectors. The SENSEX is constructed on a 'free-float' methodology, and is sensitive to market sentiments and market realities. Apart from the SENSEX, BSE offers 21 indices, including 12 sectoral indices. BSE has entered into an index cooperation agreement with Deutsche Börse. This agreement has made SENSEX and other BSE indices available to investors in Europe and America. Moreover, Barclays Global Investors (BGI), the global leader in ETFs through its iShares® brand, has created the 'iShares® BSE SENSEX India Tracker' which tracks the SENSEX. The ETF enables investors in Hong Kong to take an exposure to the Indian equity market. K.E.S. SHROFF COLLEGE Page 28

- 29. BSE has tied up with U.S. Futures Exchange (USFE) for U.S. dollar-denominated futures trading of SENSEX in the U.S. The tie-up enables eligible U.S. investors to directly participate in India's equity markets for the first time, without requiring American Depository Receipt (ADR) authorization. The first Exchange Traded Fund (ETF) on SENSEX, called "SPIcE" is listed on BSE. It brings to the investors a trading tool that can be easily used for the purposes of investment, trading, hedging and arbitrage. SPIcE allows small investors to take a long-term view of the market. BSE provides an efficient and transparent market for trading in equity, debt instruments and derivatives. It has a nation-wide reach with a presence in more than 450 cities and towns of India. BSE has always been at par with the international standards. The systems and processes are designed to safeguard market integrity and enhance transparency in operations. BSE is the first exchange in India and the second in the world to obtain an ISO 9001:2000 certification. It is also the first exchange in the country and second in the world to receive Information Security Management System Standard BS 7799-2-2002 certification for its BSE On-line Trading System (BOLT). BSE continues to innovate. In recent times, it has become the first national level stock exchange to launch its website in Gujarati and Hindi to reach out to a larger number of investors. It has successfully launched a reporting platform for corporate bonds in India christened the ICDM or Indian Corporate Debt Market and a unique ticker-cum-screen aptly named 'BSE Broadcast' which enables information dissemination to the common man on the street. In 2006, BSE launched the Directors Database and ICERS (Indian Corporate Electronic Reporting System) to facilitate information flow and increase transparency in the Indian capital market. While the Directors Database provides a single-point access to information on the boards of directors of listed companies, the ICERS facilitates the corporates in sharing with BSE their corporate announcements. BSE also has a wide range of services to empower investors and facilitate smooth transactions: Investor Services: The Department of Investor Services redresses grievances of investors. BSE was the first exchange in the country to provide an amount of Rs.1 million towards the investor protection fund; it is an amount higher than that of any exchange in the country. BSE launched a nationwide investor awareness programme- 'Safe Investing in the Stock Market' under which 264 programmes were held in more than 200 cities. The BSE On-line Trading (BOLT): BSE On-line Trading (BOLT) facilitates on-line K.E.S. SHROFF COLLEGE Page 29

- 30. screen based trading in securities. BOLT is currently operating in 25,000 Trader Workstations located across over 450 cities in India. BSEWEBX.com: In February 2001, BSE introduced the world's first centralized exchange-based Internet trading system, BSEWEBX.com. This initiative enables investors anywhere in the world to trade on the BSE platform. Surveillance: BSE's On-Line Surveillance System (BOSS) monitors on a real-time basis the price movements, volume positions and members' positions and real-time measurement of default risk, market reconstruction and generation of cross market alerts. BSE Training Institute: BTI imparts capital market training and certification, in collaboration with reputed management institutes and universities. It offers over 40 courses on various aspects of the capital market and financial sector. More than 20,000 people have attended the BTI programmes Awards • The World Council of Corporate Governance has awarded the Golden Peacock Global CSR Award for BSE's initiatives in Corporate Social Responsibility (CSR). • The Annual Reports and Accounts of BSE for the year ended March 31, 2006 and March 31 2007 have been awarded the ICAI awards for excellence in financial reporting. • The Human Resource Management at BSE has won the Asia - Pacific HRM awards for its efforts in employer branding through talent management at work, health management at work and excellence in HR through technology Drawing from its rich past and its equally robust performance in the recent times, BSE will continue to remain an icon in the Indian capital market. K.E.S. SHROFF COLLEGE Page 30

- 31. CHAPTER-10 NATIONAL STOCK EXCHANGE The National Stock Exchange of India Limited has genesis in the report of the High Powered Study Group on Establishment of New Stock Exchanges, which recommended promotion of a National Stock Exchange by financial institutions (FIs) to provide access to investors from all across the country on an equal footing. Based on the recommendations, NSE was promoted by leading Financial Institutions at the behest of the Government of India and was incorporated in November 1992 as a tax-paying company unlike other stock exchanges in the country. On its recognition as a stock exchange under the Securities Contracts (Regulation) Act, 1956 in April 1993, NSE commenced operations in the Wholesale Debt Market (WDM) segment in June 1994. The Capital Market (Equities) segment commenced operations in November 1994 and operations in Derivatives segment commenced in June 2000. NSE's mission is setting the agenda for change in the securities markets in India. The NSE was set-up with the main objectives of: • establishing a nation-wide trading facility for equities, debt instruments and hybrids, • ensuring equal access to investors all over the country through an appropriate communication network, • providing a fair, efficient and transparent securities market to investors using electronic trading systems, • enabling shorter settlement cycles and book entry settlements systems, and • Meeting the current international standards of securities markets. The standards set by NSE in terms of market practices and technology have become industry benchmarks and are being emulated by other market participants. NSE is more than a mere market facilitator. It's that force which is guiding the industry towards new horizons and greater opportunities. K.E.S. SHROFF COLLEGE Page 31

- 32. CHAPTER-11 CORPORATE STRUCTURE NSE is one of the first de-mutualised stock exchanges in the country, where the ownership and management of the Exchange is completely divorced from the right to trade on it. Though the impetus for its establishment came from policy makers in the country, it has been set up as a public limited company, owned by the leading institutional investors in the country. From day one, NSE has adopted the form of a demutualised exchange - the ownership, management and trading is in the hands of three different sets of people. NSE is owned by a set of leading financial institutions, banks, insurance companies and other financial intermediaries and is managed by professionals, who do not directly or indirectly trade on the Exchange. This has completely eliminated any conflict of interest and helped NSE in aggressively pursuing policies and practices within a public interest framework. The NSE model however, does not preclude, but in fact accommodates involvement, support and contribution of trading members in a variety of ways. Its Board comprises of senior executives from promoter institutions, eminent professionals in the fields of law, economics, accountancy, finance, taxation, and etc, public representatives, nominees of SEBI and one full time executive of the Exchange. While the Board deals with broad policy issues, decisions relating to market operations are delegated by the Board to various committees constituted by it. Such committees includes representatives from trading members, professionals, the public and the management. The day-to-day management of the Exchange is delegated to the Managing Director who is supported by a team of professional staff. K.E.S. SHROFF COLLEGE Page 32

- 33. STRUCTURE OF INTERNATIONAL CAPITAL MARKET K.E.S. SHROFF COLLEGE Page 33 INTERNATIONAL CAPITAL MARKETS INTERNATIONAL BOND MARKET INTERNATIONAL EQUITY MARKET FOREIGN BONDS YANKEE BONDS SAMURAI BONDS BULLDOG BONDS FOREIGN EQUITY EURO BOND EURO/ DOLLAR EURO/ YEN EURO/ POUNDS EURO EQUITY GLOBAL DEPOSITORY RECIEPTS AMERICAN DEPOSITORY RECIEPTS IDR/ EDR

- 34. INTERNATIONAL CAPITAL MARKETS ORIGIN The genesis of the present international markets can be teased to 1960s, when there was a real demand for high quality dollar-denominated bonds form wealthy Europeans (and others) who wished to hold their assets their home countries or in currencies other then their own. These investors were driven by the twin concerns of avoiding taxes in their home country and protecting themselves against the falling value of domestic currencies. The bonds which were then available for investment were subjected to withholding tax. Further it is was also necessary to register to address these concerns. These were issued in bearer forms and so, there was no of ownership and tax was withheld. Also, until 1970, the International Capital Market focused on debt financing and the equity finances were raised by the corporate entities primarily in the domestic markets. This was due to the restrictions on cross-border equity investments prevailing unit then in many countries. Investors too preferred to invest in domestic equity issued due to perceived risks implied in foreign equity issues either related to foreign currency exposure or related to apprehensions of restrictions on such investments by the regulator. Major changes have occurred since the ‘70s which have witnessed expanding and fluctuating trade volumes and patterns with various blocks experiencing extremes in fortunes in their exports/imports. This was the was the period which saw the removal of exchange controls by countries like the UK, franc and Japan which gave a further technology of markets have played an important role in channelizing the funds from surplus unit to deficit units across the globe. The international capital markets also become a major source of external finance for nations with low internal saving. The markets were classified into euro markets, American Markets and Other Foreign Markets. THE PLAYERS Borrowers/Issuers, Lenders/ Investors and Intermediaries are the major players of the international market. The role of these players is discussed below. BORROWERS/ISSUERS These primarily are corporates, banks, financial institutions, government and quasi government bodies and supranational organizations, which need forex funds for various reasons. The important reasons for corporate borrowings are, need for foreign currencies for operation in markets abroad, dull/saturated domestic market and expansion of operations into other countries. Governments borrow in the global financial market to adjust the balance of payments mismatches, to gain net capital investments abroad and to keep a sufficient inventory of K.E.S. SHROFF COLLEGE Page 34

- 35. foreign currency reserves for contingencies like supporting the domestic currency against speculative pressures. LENDERS/INVESTORS In case of Euro-loans, the lenders are mainly banks who possess inherent confidence in the credibility of the borrowing corporate or any other entity mention above in case of GDR it is the institutional investor and high net worth individuals (referred as Belgian Dentists) who subscribe to the equity of the corporates. For an ADR it is the institutional investor or the individual investor through the Qualified Intuitional Buyer who put in the money in the instrument depending on the statutory status attributed to the ADR as per statutory requirements of the land. INTERMEDIARIES LEAD MANGERS They undertake due diligence and preparation of offer circular, marketing the issues and arranger for road shows. UNDERWRITERS Underwriters of the issue bear interest rate/market risks moving against them before they place bonds or Depository Receipts. Usually, the lend managers and co-managers act as underwriters for the issue. CUSTODIAN On behalf of DRs, the custodian holds the underlying shares, and collects rupee dividends on the underlying shares and repatriates the same to the depository in US dollars/foreign equity. Apart from the above, Agents and Trustees, Listing Agents and Depository Banks also play a role in issuing the securities. THE INSTRUMENTS The early eighties witnessed liberalization of many domestic economies and globalization of the same. Issuers form developing countries, where issue of dollar/foreign currency denominated equity shares were not permitted, could access international equity markets through the issue of an intermediate instrument called ‘Depository Receipt’. A Depository Receipt (DR) is a negotiable certificate issued by a depository bank which represents the beneficial interest in shares issued by a company. These shares are deposited with the local ‘custodian’ appointed by the depository, which issues receipts against the deposit of shares. K.E.S. SHROFF COLLEGE Page 35

- 36. The various instruments used to raise funds abroad include: equity, straight debt or hybrid instruments. The following figure shows the classification of international capital markets based on instruments used and market(s) accessed. EURO EQUITY GLOBAL DEPOSITORY RECEIPTS (GDR): A GDR is a negotiable instrument which represents publicly traded local-currency equity share. GDR is any instrument in the from of a depository receipt or certificate created by the Overseas Depository Bank outside India and issued to non-resident investors against the issue of ordinary shares or foreign currency convertible bonds of the issuing company. Usually, a typical GDR is denominated in US dollars whereas the underlying shares would be denominated in the local currency of the Issuer. GDRs may be – at the request of the investor – converted into equity shares by cancellation of GDRs through the intermediation of the depository and the sale of underlying shares in the domestic market through the local custodian. GDRs, per se, are considered as common equity of the issuing company and are entitled to dividends and voting rights since the date of its issuance. The company transactions. The voting rights of the shares are exercised by the Depository as per the understanding between the issuing Company and the GDR holders. FOREIGN EQUTIY AMERICAN DEPOSITORY RECEIPTS (ADR): ADR is a dollar denominated negotiable certificate, it represents a non-US company’s publicly traded equity. It was devised in the last 1920s to help Americans invest in overseas securities and assist non-US companies wishing to have their stock traded in the American Markets. ADRs are divided into 3 levels based on the regulation and privilege of each company’s issue. I. ADR LEVEL – I: It is often step of an issuer into the US public equity market. The issuer can enlarge the market for existing shares and thus diversify to the investor base. In this instrument only minimum disclosure is required to the sec and issuer need not comply with the US GAAP (Generally Accepted Accounting Principles). This type of instrument is traded in the US OTC Market. K.E.S. SHROFF COLLEGE Page 36

- 37. The issuer is not allowed to raise fresh capital or list on any one of the national stock exchanges. II. ADR LEVEL – II: Through this level of ADR, the company can enlarge the investor base for existing shares to a greater extent. However, significant disclosures have to be made to the SEC. The company is allowed to List on the American Stock Exchange (AMEX) or New York Stock Exchange (NYSE) which implies that company must meet the listing requirements of the particular exchange. III. ADR LEVEL – III: This level of ADR is used for raising fresh capital through Public offering in the US Capital with the EC and comply with the listing requirements of AMEX/NYSE while following the US-GAAP. DEBT INSTRUMENTS EUROBONDS The process of lending money by investing in bonds originated during the 19th century when the merchant bankers began their operations in the international markets. Issuance of Eurobonds became easier with no exchange controls and no government restrictions on the transfer of funds in international markets. THE INSTRUMENTS EUROBONDS All Eurobonds, through their features can appeal to any class of issuer or investor. The characteristics which make them unique and flexible are: a) No withholding of taxes of any kind on interests payments b) They are in bearer form with interest coupon attached c) They are listed on one or more stock exchanges but issues are generally traded in the over the counter market. Typically, a Eurobond is issued outside the country of the currency in which it is denominated. It is like any other Euro instrument and through international syndication and underwriting, the paper is sold without any limit of geographical boundaries. Eurobonds are generally listed on the world's stock exchanges, usually on the Luxembourg Stock Exchange. K.E.S. SHROFF COLLEGE Page 37

- 38. a) FIXED-RATE BONDS/STRAIGHT DEBT BONDS: Straight debt bonds are fixed interest bearing securities which are redeemable at face value. The bonds issued in the Euro-market referred to as Euro-bonds, have interest rates fixed with reference to the creditworthiness of the issuer. The interest rates on dollar denominated bonds are set at a margin over the US treasury yields. The redemption of straights is done by bullet payment, where the repayment of debt will be in one lump sum at the end of the maturity period, and annual servicing. b) FLOATING RATE NOTES (FRNs): FRNs can be described as a bond issue with a maturity period varying from 5- 7 years having varying coupon rates - either pegged to another security or re- fixed at periodic intervals. Conventionally, the paper is referred to as notes and not as bonds. The spreads or margin on these notes will be above 6 months USOR for Eurodollar deposits. FOREIGN BONDS These are relatively lesser known bonds issued by foreign entities for raising medium to long-term financing from domestic money centers in their domestic currencies. A brief note on the various instruments in this category is given below: a) YANKEE BONDS: These are US dollar denominated issues by foreign borrowers (usually foreign governments or entities, supranational and highly rated corporate borrowers) in the US bond markets. A bond denominated in U.S. dollars and is publicly issued in the U.S. by foreign banks and corporations. According to the Securities Act of 1933, these bonds must first be registered with the Securities and Exchange Commission (SEC) before they can be sold. Yankee bonds are often issued in trenches and each offering can be as large as $1 billion. Due to the high level of stringent regulations and standards that must be adhered to, it may take up to 14 weeks (or 3.5 months) for a Yankee bond to be offered to the public. Part of the process involves having debt-rating agencies evaluate the creditworthiness of the Yankee bond's underlying issuer. K.E.S. SHROFF COLLEGE Page 38

- 39. Foreign issuers tend to prefer issuing Yankee bonds during times when the U.S. interest rates are low, because this enables the foreign issuer to pay out less money in interest payments. b) SAMURAI BONDS: A yen-denominated bond issued in Tokyo by a non-Japanese company and subject to Japanese regulations. Other types of yen-denominated bonds are Euro/yens issued in countries other than Japan. Samurai bonds give issuers the ability to access investment capital available in Japan. The proceeds from the issuance of samurai bonds can be used by non- Japanese companies to break into the Japanese market, or it can be converted into the issuing company's local currency to be used on existing operations. Samurai bonds can also be used to hedge foreign exchange rate risks. These are bonds issued by non-Japanese borrowers in the domestic Japanese markets. c) BULLDOG BONDS: These are sterling denominated foreign bond which are raised in the UK domestic securities market. A sterling denominated bond that is issued in London by a company that is not British. These sterling bonds are referred to as bulldog bonds as the bulldog is a national symbol of England. d) SHIBOSAI BONDS: These are the privately placed bonds issued in the Japanese markets. EURONOTES Euronotes as a concept is different from syndicated bank credit and is different from Eurobonds in terms of its structure and maturity period. Euronotes command the price of a short-term instrument usually a few basic points over LIBOR and in many instances at sub – LIBOR levels. The documentation formalities are minimal (unlike in the case of syndicated credits or bond issues) and cost savings can be achieved on that score too. The funding instruments in the form of Euronotes possess flexibility and can be tailored to suit the specific requirements of different types of borrowers. There are numerous applications of basic concepts of Euronotes. K.E.S. SHROFF COLLEGE Page 39

- 40. These may be categorized under the following heads: a) COMMERCIAL PAPER: These are short-term unsecured promissory notes which repay a fixed amount on a certain future date. These are normally issued at a discount to face value. b) NOTE ISSUANCE FACILITIES (NIFs): The currency involved is mostly US dollars. A NIF is a medium-term legally binding commitment under which a borrower can issue short-term paper, of up to one year. The underlying currency is mostly US dollar. Underwriting banks are committed either to purchase any notes which the borrower b unable to sell or to provide standing credit. These can be re-issued periodically. c) MEDIUM-TERM NOTES (MTNs): MTNs are defined as sequentially issued fixed interest securities which have a maturity of over one year. A typical MTN program enables an issuer to issue Euronotes for different maturities. From over one year up to the desired level of maturity. These are essentially fixed rate funding arrangements as the price of each preferred maturity is determined and fixed up front at the time of launching. These are conceived as non-underwritten facilities, even though international markets have started offering underwriting support in specific instances. A Global MTN (G-MTN) is issued worldwide by tapping Euro as well as the- US markets under the same program. Under G-MTN programs, issuers of different credit ratings are able to raise finance by accessing retail as well as institutional investors. In view of flexible access, speed and efficiency, and enhanced investor base G-MTN programs afford numerous benefits to the issuers. Spreads paid on MTNs depend on credit ratings, treasury yield curve and the familiarity of the issuers among investors. Investors include Private Banks, Pension Funds, Mutual Funds and Insurance Companies. K.E.S. SHROFF COLLEGE Page 40

- 41. FOREIGN EXCHANGE AND FOREIGN EXCHANGE MARKETS – OVERVIEW In today’s world no country is self sufficient, so there is a need for exchange of goods and services amongst the different countries. However, unlike in the primitive age the exchange of goods and services is no longer carried out on barter basis. Every sovereign country in the world has a currency which is a legal tender in its territory and this currency does not act as money outside its boundaries. So whenever a country buys or sells goods and services from or to another country, the residents of two countries have to exchange currencies. So we can imagine that if all countries have the same currency then there is no need for foreign exchange. FOREIGN EXCHANGE IN INDIA In India, foreign exchange has been given a statutory definition. Section 2 (b) of Foreign Exchange Regulation Act, 1973 states: ‘Foreign exchange’ means foreign currency and includes: • All deposits, credits and balances payable in any foreign currency and any drafts, traveler’s cheques, letters of credit and bills of exchange , expressed or drawn in Indian currency but payable in any foreign currency, • Any instrument payable, at the option of drawee or holder thereof or any other party thereto, either in Indian currency or in foreign currency or partly in one and partly in the other. For India we can conclude that foreign exchange refers to foreign money, which includes notes, cheques, bills of exchange, bank balances and deposits in foreign currencies. ABOUT FOREIGN EXCHANGE MARKET Particularly for foreign exchange market there is no market place called the foreign exchange market. It is mechanism through which one country’s currency can be exchange i.e. bought or sold for the currency of another country. The foreign exchange market does not have any geographic location. The market comprises of all foreign exchange traders who are connected to each other through out the world. They deal with each other through telephones, telexes and electronic systems. With the help of Reuters Money 2000-2, it is possible to access any trader in any corner of the world within a few seconds. K.E.S. SHROFF COLLEGE Page 41

- 42. WHO ARE THE PARTICIPANTS IN FOREIGN EXCHANGE MARKETS? The main players in foreign exchange markets are as follows: 1. CUSTOMERS The customers who are engaged in foreign trade participate in foreign exchange markets by availing of the services of banks. Exporters require converting the dollars in to rupee and importers require converting rupee in to the dollars as they have to pay in dollars for the goods/services they have imported. 2. COMMERCIAL BANKS They are most active players in the forex market. Commercial banks dealing with international transactions offer services for conversion of one currency in to another. They have wide network of branches. Typically banks buy foreign exchange from exporters and sells foreign exchange to the importers of the goods. As every time the foreign exchange bought and sold may not be equal banks are left with the overbought or oversold position. The balance amount is sold or bought from the market. Nowadays, in international foreign exchange markets, the international trade turnover accounts for a fraction of huge amounts dealt, i.e. bought and sold. The balance amount is accounted for either by financial transactions or speculation. Banks have enough financial strength and wide experience to speculate the market and banks does so. Which is popularly known as the trading in the forex market. Commercial banks have following objectives for being active in the foreign exchange markets. • They render better service by offering competitive rates to their customers engaged in international trade; • They are in a better position to manage risks arising out of exchange rate fluctuations; • Foreign exchange business is a profitable activity and thus such banks are in a position to generate more profits for themselves; • They can manage their integrated treasury in a more efficient manner. • In India Reserve Bank of India has given license to the commercial banks to deal in foreign exchange under section 6 Foreign Exchange Regulation Act, 1973, which are called the Authorized Dealers (ADs). K.E.S. SHROFF COLLEGE Page 42

- 43. 3. CENTRAL BANK In all countries central banks have been charged with the responsibility of maintaining the external value of the domestic currency. Generally this is achieved by the intervention of the bank. Apart from this central banks deal in the foreign exchange market for the following purposes: 1) Exchange rate management: It is achieved by the intervention though sometimes banks have to maintain external rate of the domestic currency at a level or in a band so fixed. 2) Reserve management: Central bank of the country is mainly concerned with the investment of countries foreign exchange reserve in a stable proportions in range of currencies and in a range of assets in each currency. For this bank has to involve certain amount of switching between currencies. 4. EXCHANGE BROKERS Forex brokers play a very important role in the foreign exchange markets. However the extent to which services of forex brokers are utilized depends on the tradition and practice prevailing at a particular forex market center. In India as per FEDAI guidelines the A Ds are free to deal directly among themselves without going through brokers. The forex brokers are not allowed to deal on their own account all over the world and also in India. 5. OVERSEAS FOREX MARKETS Today the daily global turnover is guestimated to be more than US $ 1.5 trillion a day. The international trade however constitutes hardly 5 to 7 % of this total turnover. The rest of trading in world forex markets is constituted of financial transactions and speculation. As we know that the forex market is 24-hour market, the day begins with Tokyo and thereafter Singapore opens, thereafter India, followed by Bahrain, Frankfurt, Paris, London, New York, Sydney, and back to Tokyo. FORWARD EXCHANGE CONTRACT WHAT IS THE NEED FOR FORWARD EXCHANGE CONTRACT? The risk on account of exchange rate fluctuations, in international trade transactions increases if the time period needed for completion of transaction is longer. It is not uncommon in international trade, on account of logistics, the time frame can not be foretold with clock precision. Exporters and importers alike, can not be precise as to the time when the shipment will be made as sometimes space on the ship is not available, while at the other, there are delays on account of congestion of port etc. K.E.S. SHROFF COLLEGE Page 43

- 44. In international trade there is considerable time lag between entering in to a sales/purchase contract, shipment of goods, and payment. In the meantime, if exchange rate moves against the party who has to exchange his home currency in to foreign currency, he may end up in loss. Consequently, buyers and sellers want to protect them against exchange rate risk. One of the methods by which they can protect themselves is entering in to a foreign exchange forward contract. We can see from the daily report of the Vadilal Industries Limited (Forex division) that the rupee fell down nearly 25 paise in a day. The date of this fluctuation is 25th May 2000. Now let suppose that the exporter has dealt FORWARD EXCHANGE FORWARD CONTRACT Forward exchange forward contract is a contract wherein two parties agree to deliver certain amount of foreign exchange at an agreed rate either at a fixed future date or during a fixed future period. If the merchants are sure about the remittance or the payment of the foreign exchange then they can choose the fix date forward exchange contract, in which they are bound by the date on which they have to meet their part of liability in the agreement. If the customers are not sure about the date of remittance or the payment of the foreign exchange they can enter in to the option period forward exchange contract. Both the types are explained below. 1. FIXED DATE FOREIGN EXCHANGE FORWARD CONTRACT If under the foreign exchange forward contract, foreign exchange is to be delivered at fixed date, the contract is known as fixed date foreign exchange forward contract. 2. OPTION FOREIGN EXCHANGE FORWARD CONTRACT If under the foreign exchange forward contract, foreign exchange is to be delivered in future, during a specified period, the contract is known as option foreign exchange forward contract. In this type of contract there is no option for taking/ delivery of foreign exchange. Such contracts provide for option as far as date of delivery of foreign exchange is concerned. While entering in to a option forward contract first date and the last date for exercising option for giving /taking delivery of foreign exchange is always fixed. In India, like developed countries, there are not many instruments available for hedging foreign exchange risk. As a result the merchants have to hedge their foreign exchange exposures through forward contracts only. For merchants this is the only tool available to minimize the risk due to adverse foreign exchange fluctuation. K.E.S. SHROFF COLLEGE Page 44