Financial Asset Classes Session For Iipm On 2 2 11

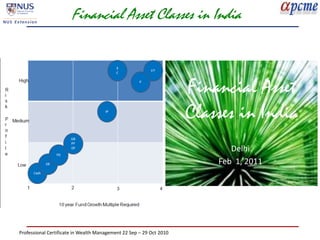

- 1. Financial Asset Classes in India Financial Asset Classes in India Delhi Feb 1, 2011 Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 2. Objective • Understand –What different classes of financial assets are available in India? –What are the differences in these asset classes –What are their risks and returns? Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 3. Agenda • Overview of Financial Asset Classes available in India • Fixed Income Assets • Commodities • Gold • Real Estate • Equity • Unit Linked Insurance Plans • Venture Funds Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 4. Overview of Financial Asset Classes in India Equity Gold/ Commodities Real Estate Insurance Plans- Unit Linked Fixed Income Assets Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 5. Overview of Financial Asset Classes in India Equity Gold/ Commodities Real Estate Insurance Plans- Unit Linked Fixed Income Assets Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 6. Fixed Income Assets • Cash • Current Accounts • Savings Accounts • Fixed Deposits • PF/ PPF • Government Bonds • Corporate Bonds • Fixed Income Mutual Funds Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 7. Fixed Income Assets • Rational for Investment – Protects against dilution or financial accidents – Provides relatively predictable return – Generate better returns in long term vs. short term – May also increase return and reduce risk in short term on opportunistic basis – Reduces volatility of overall portfolio due to lower standard deviation of the retunes (10 vs. 30% for equity) Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 8. J P Morgan ex-US Bond Index vs. MSCI EM Free Gross Index Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 9. Fixed Income Assets • Risks & Concerns – Increasing level of credit or default risk along with higher return from Cash to Debt Funds – Lower trading liquidity – Cost of prepayment – Higher Income Taxes vs. others even in long term Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 10. Fixed Income Assets Type Lock in Period Annual Return I T Benefits Funds invested Cash - Own Use Current - - Bank Account Savings - 3.5% Bank Account Fixed Deposits 30 days -10 7-9% Interest Tax Loan and years Exempt up to Credits Rs 1 L under Govt Bonds 5 Years 8% 80C RBI Corporate 3-5 Years 8-11% Corporate Bonds PF Till last job 8% Fully Tax RPF PPF 8% exempt Govt Bonds Fixed Income 6 months -1 7-8% Money Mutual Funds Years Markets and Equity (max20%) Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 11. FDs & Bonds Illustration Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 12. Bank FDs – Interesting Interest Information 1. It is wrong to assume that greater the FD tenure, higher will be the rate of interest. It is not so. Sometimes short duration interest rates are higher than long duration rates (due to tighter liquidity conditions). 2. Even a single day difference in the FD period can make a huge difference in your interest income due to wide variation in the FD interest rates. For instance, let’s say you are planning to invest in two FDs, one for 2 months and another for 3 months and your bank is offering, say, 6% on FDs for the duration of 31-60 days, 6.5% on 61-90 days deposits and 7% for 91-180 days deposits. In this case it would be outright foolish to invest in FDs for 60days and 90 days. It makes greater sense to go for 61 days and 91 days fixed deposits and earn extra interest of 0.5%. Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 13. Bank FDs – Interesting Interest Information 3. Many banks offer special deposit rates for a particular tenure which are quite higher than deposit rates for other durations (both higher as well as lower tenures). For instance, HDFC bank was as on August 17, 2009)offering following interest rates (p.a.) on FDs: 91 days to less than 6 months 1 day------> 4.50% 6 months 2 days to 6 months 15 days ----> 5.50% 6 months 16 days-----------------------------> 6.00% 6 months 17 days to 9 months 15 days---> 5.50% • Supposing that you’re planning to invest in an FD for 6 months, if you are not careful and fill the FD form for either 6 months or 180 days, you can straightforwardly lose 1.5% p.a. The right choice is to invest in FD for 6 months 16 days. But why do banks so much juggle with interest rates on fixed deposits? ‘Cost of funds’ simply can’t be the reason. Perhaps, like other financial companies they also practice confusopoly. So you need to be extra careful. It is always better to check the latest deposit rates online (as the rates are also changed frequently in addition to variation in interest rates for different tenures of FDs) instead of relying on the bank branch officials, who might not guide you properly or in fact misguide you. • Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 14. Bank FDs – Interesting Interest Information 4. The interest rates offered on fixed deposits are annual rates (% p.a.). So, if a bank is offering you 7% rate of interest for 90 days deposit, it means that 7% for 365 days to be paid for 90 days i.e., you get 1.726% (7/365*90) for 90 days. 5. The rate applicable for a ‘monthly interest payment’ option is discounted rate over the standard FD rate. For example, if you invest in a FD for one year offering interest @ 12% p.a. (assuming no quarterly compounding) and choose the maturity option, you’ll get interest @ 12%. However, if choose monthly payment option you won’t receive interest @ 1% (i.e., 12/12) per month. Because, if you receive interest @1% per month, the effective annual rate on the FD becomes 12.68 per cent. Therefore, in case of monthly interest payouts, the bank discounts the annual interest rate; in the above example, the discounted rate of interest per month works out to be 0.9488% approximately. If you’ve a fixed deposit of Rs 1 lakh, you will receive monthly interest of Rs 949 and not Rs 1,000. So the total interest to be received by you at the end of one year will be Rs 12,000 for maturity option and Rs 11,388 for monthly payment option. However, this discounting rule is not applicable if the maturity period itself is of shorter duration. For instance, if the bank is offering, say, 12% p.a. on one month fixed deposit, then you’ll receive interest @ one per cent (12/12) for the one month deposit (i.e., effective rate of interest earned by you is 12.68%). It follows from the above that, in case of shorter term deposits (i.e., less than one year), your effective rate of interest is more than the stated rate of interest). Let me explain it in another way. Continuing the above example, when your monthly deposit will mature, you’ll receive Rs 1,01,000. If you again reinvest it for another month, your interest for next month will be Rs 1,010 and if you continue reinvesting at the end of every month (assuming there is no change in interest rates), you’ll finally end up with Rs 1,12,680 in your pocket at the end of one year earning annualized yield of 12.68%. However, it is not practically feasible even if you keep on reinvesting because of too frequent changes in interest rates. In the above example, the actual returns earned by you at the end of the year will be either greater or lesser than 12.68%. Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 15. Bank FDs – Interesting Interest Information 6. The interest rate offered doesn’t truly reflect your return. The true measure to reflect the returns from FDs is the yield. For instance, even if the interest rates on two FDs are similar, yield may differ because of frequency of compounding. A 10% rate of interest per annum payable quarterly is better than a same interest rate payable either half-yearly or annually. In India, most banks offer you quarterly compounding for FDs of greater than 6 months duration and calculate interest at maturity as simple interest for FDs up to 6 months tenure. The effective yield in case of quarterly compounding (assuming 10% rate of interest) comes to be 10.38%, for half yearly compounding it works out to be 10.25% and for annual compounding it remains unchanged at 10%. Similarly, if the interest rate of 5.8% p.a. is compounded quarterly then effective yield / annualized yield works out to be 5.927%. Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 16. How to Invest in PPF PPF Account Opening 1. First, you should open a PPF account even if it’s not on your investment radar. Furthermore, leave aside section 80C tax-break/tax-planning, otherwise also PPF is among the best debt option available to you – particularly self-employed persons who don’t contribute to EPF – for retirement planning because it offers tax-free returns (current interest rate is 8% which translates into pre-tax yield of 12.12% for someone in the 33.99% tax bracket), exemption from wealth tax and the protection from attachment by any order or decree of court. 2. Public Provident Fund (PPF) account rules allow you to open an account in the name of your spouse or children. Children can be major or minor, son or daughter, bachelor or married, dependent or otherwise. As per PPF rules, the aggregate limit of Rs 70,000 is only for the account of an individual and minor combined together. Contribution to other PPF accounts (spouse and major children) is excluded from this limit. The mistake is regretted. It came to light when a reader pointed it out. See comment section. If you decide to open a PPF account in the name of your spouse or minor child, what are the tax implications? The contribution will be deemed as gift and clubbing provisions under section 64 should apply. But as the interest on PPF is exempt, there’s no income to be clubbed; therefore, nothing to worry about. On maturity of PPF account, if you reinvest the amount somewhere else, the clubbing provisions becomes applicable in both the cases: spouse and minor child. However, if by the time of maturity of PPF, child has become major, the clubbing provision under section 64 (1A) becomes inoperative (i.e., there won’t be any clubbing of income). So, if you want to make investment in the name of your minor child, PPF is a preferred instrument to avoid the clubbing provisions of IT Act. 3. While opening a PPF account, please don’t forget to appoint a nominee. In fact this is a very important part of making any investment or buying life insurance. You’re also allowed to change the nomination at any time thereafter. Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 17. How to Invest in PPF Making Contributions to PPF Account 4. One of the attractive features of Public Provident Fund (PPF) is the flexibility offered to you for making contributions. Unlike NSC, you need not invest a lump sum amount at one go. PPF gives you full discretion to invest in instalments within the range of minimum amount of Rs 500 and maximum amount of Rs 70,000. Besides, unlike recurring deposits or mutual fund SIPs each PPF instalment need not be the same. You can vary the amount of PPF deposit as per your convenience. Also, you can deposit more than one instalment in a month. The only limitation is that the total number of instalments in a year should not exceed twelve. Thus, rather than waiting for the end of the year to deposit the one lump sum amount, keep on investing small sums on regular basis in your PPF account. 5. Make sure that you invest by the 5th of every month. Why? Because, in case of PPF accounts, interest is calculated on the lowest balance between the close of the fifth day and end of the month (though credited to your PPF account on annual basis). 6. Keep on investing in your PPF account. Never think of making premature withdrawals. Nevertheless, if ever you face a financial crunch, you can avail the facility of loan (from 3rd year to 6th year) and partial withdrawal (from 7th year onwards). However, both the facilities are subject to certain ceiling limits. Furthermore, there’s another possibility that you’re not able to make tax-saving investments for availing the deduction under section 80C due to some temporary cash flow problem (although your financial position is ok). In such a case also you just need to rotate the funds by making a partial withdrawal from your PPF account and redepositing the amount in your PPF account. 7. Ensure that you continue to make a minimum deposit of Rs. 500 every year to keep the PPF account active. Otherwise, it becomes ‘inactive’ account and you become ineligible for loan as well as partial withdrawal. However, you can regularize or revive the discontinued PPF account after paying the prescribed default fee along with subscription arrears (i.e. a minimum of Rs 500 for each such year). 8. Though the term of PPF account is 15 years, the contribution made in 16th year (even on the last day) also qualifies for section 80C tax benefit. How? Because the PPF account can be closed only after the 15 years from the end of the financial year in which it is opened. Put another way, PPF account runs for full 15 financial years subsequent to opening and matures on 1st April of the 17th year. In other words, if you make a contribution to your PPF account on 31st March of the 16th year, and withdraw it on the next day (i.e., 1st April of the 17th year), you’ll be allowed a deduction under section 80C. Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 18. How to Invest in PPF PPF Account Maturity 9. On maturity, you can still continue with your Public Provident Fund (PPF) account, if you so desire. PPF gives you option to extend the account beyond maturity, each time for another block of 5 years. Put another way, you have three options available to you: a) Close the PPF account and withdraw the entire amount. b) Continue the PPF account without making any further contribution and earn the same rate of interest as before the maturity. If you choose this option, you can withdraw the entire PPF amount either in a lump sum or in instalments. However, you’re not allowed more than one withdrawal in a financial year. c) Continue the PPF account with fresh subscription. Please remember that for exercising this option, you’ve to submit form H within a period of one year of maturity. Besides, also note that if you choose this option, (i.e., extending the PPF account while continuing with fresh deposits), then you’ve access to only 60% of the account balance (at the beginning of the extended period) during the next five years (i.e., 40% gets permanently blocked for another 5 years and you can’t withdraw it even in an emergency). In other words, though you’ll continue to be eligible for section 80C deduction on fresh contributions, it will adversely affect the liquidity. How to decide whether to close the PPF account or continue with it? The decision depends upon the facts and circumstances prevailing at the time of maturity such as your need for funds (immediate or in the near future), interest rate and availability of other investment opportunities. 10. When closing the PPF account and withdrawing the amount, make sure you do it at the beginning of a month because you are not allowed any interest for the month of withdrawal. Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 19. PPF Pitfalls to Avoid 1. Don’t open two PPF accounts in the name of one individual. Even if your current account is inactive, you’re not allowed to open a new PPF a/c. 2. Don’t deposit more than the maximum allowed. You won’t get the interest on excess deposit in your PPF account. 3. Don’t forget to deposit a minimum amount of Rs 500 every year to avoid the PPF account become inoperative. You will be denied loans / partial withdrawal before maturity. 4. At the time of extension of PPF account, submit Form H, otherwise the continuation will be deemed as “extension without subscription” or “irregular” and you will be denied interest on additional deposits and also become ineligible to claim section 80C deduction. 5. Don’t forget to nominate, otherwise your family will have to obtain a succession certificate to receive the PPF proceeds in case of your death. 6. Avoid premature withdrawals and loans unless there is an emergency because PPF is one of the best long term saving instrument available to you. 7. Understand that post-maturity of PPF if you choose 'extension without further deposits', you can’t change it to 'continuation with further deposits' after the expiry of one year. So make an informed choice. Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 20. PPF Pitfalls to Avoid 8. Don’t recycle the PPF account because it defeats the very purpose of opening a Public Provident Fund account. 9. After the subscriber’s death, nominee should consider closing the PPF account at the earliest instead of continuing it because a nominee can’t appoint a further nominee. 10. While making deposits in your PPF account at the end of the financial year for tax savings purpose ensure that you deposit the cheque / demand draft well in time…remember that date of realization is treated as date of deposit. If the cheque/draft is not encashed by 31st March, the amount will be treated as deposit for the next financial year and you will lose tax benefit for the current financial year. This is as per the amendment made by the Government of India in February 2010 in the Public Provident Fund Scheme. Earlier in case of PPF (unlike other small savings), date of presentation/tender of cheque was treated as date of deposit. 11. Don’t open a PPF account in the name of your HUF because vide an amendment made in the year 2005, PPF account can’t be opened in the name of HUFs although existing accounts are allowed to earn interest till their maturity. Besides, even the existing PPF Account in the name of HUF is not allowed any further extension after the initial maturity period of 16 years. Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 21. GOI Savings Bonds, 2003 What are different kinds of bonds available? What is the maturity period? Currently 8% Savings (Taxable) Bonds are available. The maturity period of 8% Saving Bonds is 6 years without any early redemption option. · Who issues Savings bonds? Is payment guaranteed on maturity? Saving Bonds are issued by the Government of India. As these bonds are sovereign in nature, payment is guaranteed on maturity. · Who can invest in Saving Bonds? All Individuals and Hindu Undivided Families (HUFs), who are customers of ICICIdirect can invest in these Bonds · What is the minimum and maximum permissible investment? The minimum permissible investment for 8% Savings Bonds is Rs.1000/- and in multiples of Rs. 1000/- thereof. There is however is no maximum limit of investment. Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 22. GOI Savings Bonds, 2003 • When is Interest Payable? Interest is payable at half-yearly intervals from the date of issue or compounded with half-yearly rests, payable on maturity along with the principal, as the investor may choose. The interest payment dates are 1st July and 1st January every year. • How would I receive the Interest? The interest on your Saving Bonds would be directly credited to your Bond Account. • What is the value date? How is the same determined? Value date is the date from which the bond starts earning interest. • Can I place more than one order for Saving Bonds? Yes, you can place more than one order for Saving Bonds However after you have placed the first order for any particular bond, you would not be permitted to place another order in that particular bond scheme till the Bond Ledger Account Number (BLA) is received. Normally the BLA Number would be allotted within 4 business days. • For e.g.: If you make an investment in 8% Saving Bonds you would not be permitted to place another order in 8% Saving Bonds till the BLA No. is allotted to you. • ·When will I receive my Bond Ledger Account number? As soon as the bonds are credited to your Bond Ledger Account, an intimation will be sent to you specifying the Bond ledger Account number and the number of bonds held. Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 23. GOI Savings Bonds, 2003 · How can I appoint a nominee for my Bonds? In case you wish to make any nomination for your Bonds, you shall have to download the nomination form put up on the website, and send the duly filled form.. · How can I redeem the bonds? On maturity of bonds you would need to discharge your Certificate of Holding and submit the same to the nearest branch of RBI. · In case I do not encash the bonds on expiry will I continue to earn interest? No interest would be payable after maturity in case the bonds are not encashed. · Can I transfer the bonds prior to maturity? 8% Saving Bonds are non–transferable except by way of gift to a relative as defined in Section 6 of the Indian Companies Act, 1956. · What are the tax benefits available? Interest on 8% Saving Bonds will be taxable under the Income-Tax Act, 1961 as applicable according to the relevant tax status of the bondholder. However these bonds will be exempt from Wealth-tax under the Wealth-tax Act. Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 24. GOI Savings Bonds, 2003 • Is Tax deductible at source on the interest payment in case of 8% Saving Bonds? In case of 8% Saving Bonds tax will be deducted at source while making payment of interest on the non- cumulative bonds from time to time and credited to Government Account. Tax on interest portion of the maturity value will be deducted at source at the time of payment of the maturity proceeds on the cumulative bonds and credited to Government Account. • Can I use these bonds as collateral for obtaining loans? No, the Bonds are not tradable in the secondary market and are not eligible as collateral for loans from banks, financial Institutions and Non Banking Financial Companies, (NBFC) etc. Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 25. Fixed Income Mutual Funds What is a Mutual Fund? A Mutual Fund is a body corporate that pools the savings of a number of investors and invests the same in a variety of different financial instruments, or securities. The income earned through these investments and the capital appreciation realised by the scheme are shared by its unit holders in proportion to the number of units owned by them. Mutual funds can thus be considered as financial intermediaries in the investment business who collect funds from the public and invest on behalf of the investors. The losses and gains accrue to the investors only. The Investment objectives outlined by a Mutual Fund in its prospectus are binding on the Mutual Fund scheme. The investment objectives specify the class of securities a Mutual Fund can invest in. Mutual Funds invest in various asset classes like equity, bonds, debentures, commercial paper and government securities. What is an Asset Management Company? An Asset Management Company (AMC) is a highly regulated organisation that pools money from investors and invests the same in a portfolio. They charge a small management fee, which is normally 1.5 per cent of the total funds managed. Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 26. Fixed Income Mutual Funds What are the benefits of investing in Mutual Funds? 1. Qualified and experienced professionals manage Mutual Funds. Generally, investors, by themselves, may have reasonable capability, but to assess a financial instrument a professional analytical approach is required in addition to access to research and information and time and methodology to make sound investment decisions and keep monitoring them. 2. Since Mutual Funds make investments in a number of stocks, the resultant diversification reduces risk. They provide the small investors with an opportunity to invest in a larger basket of securities. 3. The investor is spared the time and effort of tracking investments, collecting income, etc. from various issuers, etc. 4. It is possible to invest in small amounts as and when the investor has surplus funds to invest. 5. Mutual Funds are registered with SEBI. SEBI monitors the activities of Mutual Funds. 6. In case of open-ended funds, the investment is very liquid as it can be redeemed at any time with the fund unlike direct investment in stocks/bonds. Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 27. Fixed Income Mutual Funds Are there any risks involved in investing in Mutual Funds? 1. Mutual Funds do not provide assured returns. 2. Their returns are linked to their performance. 3. They invest in shares, debentures and deposits. 4. All these investments involve an element of risk. 5. The unit value may vary depending upon the performance of the company and companies may default in payment of interest/principal on their debentures/bonds/deposits. 6. Besides this, the government may come up with new regulation which may affect a particular industry or class of industries. All these factors influence the performance of Mutual Funds. Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 28. Fixed Income Mutual Funds Who are the issuers of Mutual funds in India? Unit Trust of India was the first mutual fund which began operations in 1964. Other issuers of Mutual funds are Public sector banks like SBI, Canara Bank, Bank of India, Institutions like IDBI, ICICI, GIC, LIC, Foreign Institutions like Alliance, Morgan Stanley, Templeton and Private financial companies like Kothari Pioneer, DSP Merrill Lynch, Sundaram, Kotak Mahindra, Cholamandalam etc. What are the factors that influence the performance of Mutual Funds? The performances of Mutual funds are influenced by the performance of the stock market as well as the economy as a whole. Equity Funds are influenced to a large extent by the stock market. The stock market in turn is influenced by the performance of the companies as well as the economy as a whole. The performance of the sector funds depends to a large extent on the companies within that sector. Bond-funds are influenced by interest rates and credit quality. As interest rates rise, bond prices fall, and vice versa. Similarly, bond funds with higher credit ratings are less influenced by changes in the economy Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 29. Fixed Income Mutual Funds Debt / Income Funds These Funds invest predominantly in high-rated fixed-income-bearing instruments like bonds, debentures, government securities, commercial paper and other money market instruments. They are best suited for the medium to long-term investors who are averse to risk and seek capital preservation. They provide regular income and safety to the investor. Liquid Funds / Money Market Funds These funds invest in highly liquid money market instruments. The period of investment could be as short as a day. They provide easy liquidity. They have emerged as an alternative for savings and short-term fixed deposit accounts with comparatively higher returns. These funds are ideal for Corporates, institutional investors and business houses who invest their funds for very short periods. Gilt Funds These funds invest in Central and State Government securities. Since they are Government backed bonds they give a secured return and also ensure safety of the principal amount. They are best suited for the medium to long-term investors who are averse to risk Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 30. Fixed Income Mutual Funds Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 31. Fixed Income Mutual Funds Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 32. Overview of Financial Asset Classes in India Equity Gold/ Commodities Real Estate Insurance Plans- Unit Linked Fixed Income Assets Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 33. Gold • Recently minted legal tender and commemorative coins • Previously issued coins & medals • bars and bullion • Shares of mining companies • Futures & Options • Bonds • Jewellery Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 34. How to Invest in Gold Gold Jewellery The largest source of demand for the precious metal is for the purpose of gold jewellery. However, the high prices curtail the spending on jewellery and increase the investment demand for the yellow metal. If you want to buy gold for consumption (i.e., jewellery for wearing purposes) rather than investment purposes, you can go for it. But considering jewellery as an investment is not prudent as its buying and selling involves labour and design charges and is usually made of 22-carat (and not 24 carats, the purest form). Besides, in case you want to sell, most jewellers only allow gold exchange and do not pay cash against your gold Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 35. How to Invest in Gold Gold bars and coins The best way to invest in physical gold is to buy gold bars and coins. You can buy them from local jewellers but the doubt about the purity remains. The best way is to buy from RBI authorised banks although it cost you a little bit more(Gold bars/coins sold by banks are marked up by 5-15% above the market prices) and banks usually do not buy it back from you. However, you can be assured about the quality. The other alternative is to buy from a trusted jeweller Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 36. How to Invest in Gold Gold Futures You can also take exposure in yellow metal through commodity exchanges (MCX and NCDEX), where you can buy (or sell) gold futures. Since October 2003, futures trading in gold and silver is allowed. For catering to the needs of small investor, the Multi Commodity Exchange (MCX) has specially launched gold mini contracts (with a minimum unit size of 8 grams) in May’08. But, commodity futures are basically meant for hedgers and speculators and not for small investors because futures are highly leveraged investments and therefore carry high risks. In the words of Warren Buffet, the greatest investor in the world, derivatives (which include futures) are financial weapons of mass destruction. Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 37. How to Invest in Gold Stocks of gold mining companies Another indirect way of profiting from the gold rush is by investing in the stocks of gold mining companies. While the price of gold is driven by simple demand and supply economics, the price of stocks of gold mining companies depends upon many other factors besides company fundamentals and also gives you leverage on the gold price (multiplier effect on profitability with the rise/fall in gold prices) and are therefore more risky. Since no gold mining company is listed on Indian stock exchanges, you have to route your investments through gold mutual funds which invests in equity and equity related securities of gold mining companies. Right now, there are two gold funds available in India: AIG World Gold Fund and DSP ML World Gold Fund. As there is no Indian gold mining company, the gold funds invest in world gold funds that further invest in gold mining companies across the world Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 38. How to Invest in Gold/ Commodities Gold ETFs Traditionally, gold jewellery has been the preferred mode of investing in the gold but of late gold ETFs (Exchange-Traded Funds) are gaining in popularity. Like other ETFs, these also follow passive investment strategy i.e., the fund simply buys and holds gold on behalf of the investor without actively managing it. While the returns from gold mining stocks depend upon the financial performance of the company, the aim of ETFs is to provide returns as close as possible to that given by the physical gold. In India, currently five Gold ETFs are available via Benchmark Gold BeES, Kotak Gold ETF, UTI Gold ETF, Reliance Gold ETF and Quantum Gold ETF. Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 39. Gold /Commodities • Rational for Investment – Durability, portability, divisibility and anonymity – Slowly changing and relatively inelastic supply – Provides financial protection at the times of financial turmoil – Has retained is purchasing power over long term vs. cost of fundamental human needs like food, shelter and clothing – Uncorrelated to other asset classes Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 40. Handy & Harman Spot Gold Price Index Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 41. Gold As An Alternative Asset Class: 5 Reasons to Invest # 1: Effective Portfolio Diversifier Investment in gold is considered as best way to mitigate the risk and insure the portfolio. Small allocation (5 - 15%) of gold improves the consistency of portfolio performance. The purpose of diversification is not to increase the returns, but to reduce the risk. The aim is to protect the value of portfolio against the fluctuations in any class of asset and this purpose is achieved when the different asset classes in a portfolio have either low or negative correlation with each other. Gold serves this purpose well. The need for an uncorrelated asset classes to manage risk makes gold an ideal asset class for diversified portfolio. It can diversify and stabilize your portfolio and protect it against stock market fluctuations because there is low to negative correlation between returns on gold and those on stock and bonds. # 2: Thrives under worst conditions As an asset of last resort, gold is considered as a perfect hedge against uncertainties and financial crises. It never requires any economic or political stability to survive; rather in a crisis situation like this gold is considered as the best investment option. During unstable times, most traditional asset moves together in the same direction which can lead to wild fluctuations in the portfolio. In such times, gold can prove to be an invaluable asset as it lends stability to the portfolio. # 3: Hedge against inflation Gold is considered as a perfect hedge against inflation. It has strong correlation with inflation. The purchasing power of gold (the real goods and services it can buy) remains same over long periods of time. According to one study done a few years back by World Gold Council (WGC), a body that promotes the yellow metal, one ounce of gold would consistently purchase the same amount of goods and services as it would have done 400 years ago. Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 42. Gold As An Alternative Asset Class: 5 Reasons to Invest # 4: Linkage with oil and US Dollar Gold prices are closely linked with two important factors: the USD and crude oil prices. While gold has an inverse relationship – strong negative correlation – with the USD (the prices of gold rallies as the dollar falls and vice versa), it has direct link with the oil prices. Historically, gold has shown a higher correlation to oil prices. In general, higher oil prices tend to push up the inflation numbers and gold is considered as the best hedge against inflation. Thus, when oil prices shoot up, so does the price of gold. Furthermore, in a global environment, with the weakening of the dollar, gold is likely to become more attractive to central banks (traditionally, the largest holder of gold), thereby further fuelling its demand and consequently its price. # 5: Widening demand and supply Gap There is ever widening gap between gold demand and supply due to ever increasing demand on the one hand and constraints on the other. In a nutshell, gold must be made a part of your asset allocation because it is a great risk diversifier and considered as a safe haven during times of economic uncertainty, political strife, high inflation and wars Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 43. Gold /Commodities • Risks & Concerns – Trades in low volumes – Subject to Governmental confiscation in difficult times – Prices move within a narrow band in the years of stability – Some segment of Trade is driven by very subjective and powerful participants – Shares of mining shares are expensively priced and difficult to assesses objectively Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 44. Gold ETFs: The Best Way to Invest in Gold 1. Better than physical gold holdings Investing in Gold ETF’s is more secure than holding physical gold as the ETF can be held in demat form. Furthermore, it eliminates drawbacks of physical gold – cost of storage, liquidity and purity. 2. Wealth tax exemption For high net worth individuals (HNI’s), Gold ETFs also provide tax benefits in the form of exemption from wealth tax (as gold held in paper form is not liable for wealth tax) which is otherwise payable on holding physical gold. 3. Income tax benefit In case of Gold ETF’s long term capital gains (LTCGs) benefit is available just after holding period of one year as against 3 years in case of physical gold holdings. 4. Investment in small denominations ETF’s allows for investment in gold in smaller amounts which makes it easier for retail investors to participate. With ETF’s you can take small exposure and hold for long periods. It enables you to accumulate the units over time and reap the benefits of rupee cost averaging. 5. Hedging If you are likely to buy gold in future (e.g. for a marriage) then Gold ETFs allow you to start building your gold kitty in a systematic manner. Like in stocks, predicting prices with any accuracy is a fool’s game. Smart way of dealing with money is to eliminate or reduce uncertainty by choosing a pricing strategy which is price neutral. You can achieve it by making systematic & regular investments in Gold ETF’s. 6. Convenience Since ETFs units are traded like shares, it gives you the ability to buy and sell quickly at market prices making them highly liquid. The only requirement is to have a DMAT account. World over investors looking to put money in gold are increasing routing it through ETF’s. In India, currently five Gold ETF’s are available viz Benchmark Gold BeES, Kotak Gold ETF, UTI Gold ETF, Reliance Gold ETF and Quantum Gold ETF Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 45. Investing in Gold ETFs - FAQs 1. What are gold ETFs? Also known as paper gold, Gold ETFs are mutual fund schemes that invest in standard gold bullion (99.5% purity). They are special types of exchange traded funds (ETFs) which tracks the prices of gold (i.e. whose value is based on price of gold) and are convenient and inexpensive alternative to owning physical gold. 2. What is the origin of Gold ETFs? The World’s first Gold ETF (exchange-traded fund) was launched in Australia in March 2003. In United States, first Gold ETF was launched in 2004. But the idea was originated in India way back in 2002 when Benchmark filed a proposal with SEBI in May 2002. However, it could not be launched at that time due to not getting the required regulatory approval. Finally, in Feb’2007 Benchmark launched India’s first gold ETF. 3. How do Gold ETFs differ from physical gold? Unlike physical gold, Gold ETFs are held in demat / electronic form and can be traded on a stock exchange just like buying and selling stocks. 4. How are Gold ETFs better than physical gold? Gold ETFs definitely score over physical gold, because they eliminate the hassles and drawbacks of physical gold (e.g. impurity risk), are more tax-efficient and allow you to invest in small amounts. 5. How are Gold ETFs better than Gold Funds? Gold ETFs are better than Gold Funds because in comparison to Gold funds, Gold ETFs are less volatile. While gold ETFs invest in physical gold, Gold Funds invest in equities of gold mining companies; and gold stocks are more leveraged to the gold prices than the gold itself. 6. What are the returns of Gold ETFs? Returns of all Gold ETFs schemes are almost same and more or less similar to physical gold because they are passively managed fund and closely track the performance and yield of gold in the spot market. Put simply, they just hold physical gold on behalf of investors and no active fund management (to take advantage of price fluctuation in gold) is involved. Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 46. Investing in Gold ETFs - FAQs 1. 7. How are Gold ETFs taxed under Income Tax Act, 1961? Gold ETFs schemes are treated like non-equity mutual funds for the purpose of taxation. So, the gains attract short term capital gains (STCG) tax if held for less than one year and long term capital gains (LTCG) tax if the period of holding is more than a year. As far as dividend distribution tax (DDT) is concerned, the question doesn’t arise as none of the Gold ETFs in India have declared any dividend so far. 8. Which are the currently available Gold ETFs in India? As of now, there are five gold ETFs available in India; one each by Reliance, UTI, Benchmark, Quantum and Kotak fund house. The NSE symbols of Gold ETFs are (GOLDBEES, GOLDSHARE, KOTAKGOLD, RELGOLD, QGOLDHALF) Gold Benchmark Exchange Traded Fund --> GOLDBEES UTI Gold Exchange Traded Fund --> GOLDSHARE Kotak Gold Exchange Traded Fund --> KOTAKGOLD Reliance Gold Exchange Traded Fund --> RELGOLD Quantum Gold Exchange Traded Fund --> QGOLDHALF 9. How to invest in Gold ETFs? Gold ETFs are listed and traded on national stock exchange (NSE). They are held in demat form just like the stocks. You require a DMAT account to invest in them (and for that you also require a PAN). Besides, you also require a trading account with a broker (who is a member of NSE). Typically, each unit in Gold ETF represents one-tenth of an ounce of gold. In other words, small sum is required to gain exposure to the gold price. For example, while in case of Gold Benchmark Exchange Traded Fund (GOLDBEES), each unit corresponds to one gram of gold, Quantum Gold Exchange Traded Fund (QGOLDHALF) is available in 0.5 grams of gold. Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 47. Overview of Financial Asset Classes in India Equity Gold/ Commodities Real Estate Insurance Plans- Unit Linked Fixed Income Assets Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 48. Commodities Type • Crude Oil • Base Metals – Copper, Aluminum, Lead, Nickel, Zinc & Tin • Precious Metals – Gold, Silver, Platinum, Palladium & Rhodium • Grains – Corn, Soybean and Wheat • Softs – Coffee, Sugar, Cocoa, Cotton • Basic Materials – Scrap metals, textiles, fibers, fats, oils, foodstuff & raw industrials Trading Options • Physical Commodities • Futures • Bonds Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 49. Commodities • Rational for Investment – Lowe the overall volatility of the portfolio by acting as diversifying counter cyclical asset – Offers intrinsic utility to fulfill basic human needs – Serve as a effective hedge against inflation due to their value independent of the monetary units they are denominated Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 50. Commodities Research Bureau Total Return Index Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 51. Commodities • Risks & Concerns – Tend to be tax inefficient as their trading involves futures, commission based turnover – Commodities price trends magnifies the upwards or down wards movement in the economy – May exacerbate demand and supply imbalances and thus may exaggerate the price movements – Producer prices, consumer prices and future do not necessarily move in the same direction at the time of deflation – Somewhat illiquid and volatile asset that exhibits intense and transient price movements Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 52. Overview of Financial Asset Classes in India Equity Gold/ Commodities Real Estate Insurance Plans- Unit Linked Fixed Income Assets Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 53. Real Estate • Land, Buildings, Oil and Mineral rights • Direct investment or through mutual funds in – Real Estate Investment Trusts – Real Estate Operating Companies – Companies with significant real estate – Real Estate related companies like homebuilders & construction firms Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 54. Real Estate • Rational for Investment – REIT return exceeds bond returns and tend to catch up equity – Acts as effective diversifies as their price movements are dependent of asset specific supply and demand – Acts as a hedge against inflation due to the supply being fixed or not readily expandable – Has lower standard deviation that equity – Offers opportunity to skilled participants to identify and capture value through understand and potential of specific properties Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 55. Real Estate Investment Trusts Index Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 56. Real Estate • Risks & Concerns – Not a good investment in deflationary period as the tenants with cut back on costs or default – May at times be subjected to feast-or-famine prices and returns due to demand supply imbalances in real estate and capital markets – Many assets are not divisible, exhibit illiquidity, lengthy transaction times and significant discounting in stressed conditions – Expensive and complicated to deal – Affected by environmental laws, legal rights, Acts of God, Terrorism Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 57. Overview of Financial Asset Classes in India Equity Gold/ Commodities Real Estate Insurance Plans- Unit Linked Fixed Income Assets Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 58. Equities • Shares – Cash – Margin • Futures – Index – Company Specific • Options – Index • Mutual Funds Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 59. Equities • Rational for Investment – Offers earnings growth of significant magnitude due to faster economic growth in India – Offers significant opportunity to get higher return through bottoms up company analysis and security selection – Highly Liquid Asset in part of full – Generates 4% tax free dividend yields in general – Allows you to participate in capital appreciate through Bonus issues – Offers opportunity to trade short term as well invest long term Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 60. Nifty 10 Year Trend -2001-2010 Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 61. Nifty 10 Year Trend- 1990-2000 Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 62. Nifty 10 Year Trend Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 63. Equities • Risks & Concerns – High variability in the return due to cycles of excessive buoyancy and massive disenchantment – Outflow or stoppage of FII investments can lead to prolonged periods of price stagnation of decline – Lack of adequate controls on insider trading leads to unexplainable changes in prices – Invested capital can we wiped out in the leveraged format like Futures Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 64. Margin Trading Normally to buy and sell shares, you need to have the money to pay for your purchase and shares in your demat account to deliver for your sale. However as you do not have the full amount to make good for your purchases or shares to deliver for your sale you have to cover (square) your purchase/sale transaction by a sale/purchase transaction before the close of the settlement cycle. In case the price during the course of the settlement cycle moves in your favour (risen in case of purchase done earlier and fallen in case of a sale done earlier) you will make a profit and you receive the payment from the exchange. In case the price movement is adverse, you will make a loss and you will have to make the payment to the exchange. Margins are thus collected to safeguard against any adverse price movement. Margins are quoted as a percentage of the value of the transaction Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 65. Margin Trading Normally to buy and sell shares, you need to have the money to pay for your purchase and shares in your demat account to deliver for your sale. However as you do not have the full amount to make good for your purchases or shares to deliver for your sale you have to cover (square) your purchase/sale transaction by a sale/purchase transaction before the close of the settlement cycle. In case the price during the course of the settlement cycle moves in your favour (risen in case of purchase done earlier and fallen in case of a sale done earlier) you will make a profit and you receive the payment from the exchange. In case the price movement is adverse, you will make a loss and you will have to make the payment to the exchange. Margins are thus collected to safeguard against any adverse price movement. Margins are quoted as a percentage of the value of the transaction Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 66. Going Short If you do not have shares and you sell them it is known as going short on a stock. Generally a trader will go short if he expects the price to decline. In a rolling settlement cycle you will have to cover by end of the day on which you had gone short Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 67. Futures • Futures -A forward contract- is the simplest mode of a derivative transaction. • It is an agreement to buy or sell an asset (of a specified quantity) at a certain future time for a certain price. • No cash is exchanged when the contract is entered into • The difference between a share and derivative is that shares/securities is an asset while derivative instrument is a contract Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 68. Index Futures • Index futures are all futures contracts where the underlying is the stock index (Nifty or Sensex) and helps a trader to take a view on the market as a whole. • Index futures permits speculation and if a trader anticipates a major rally in the market he can simply buy a futures contract and hope for a price rise on the futures contract when the rally occurs. • In India we have index futures contracts based on S&P CNX Nifty and the BSE Sensex and near 3 months duration contracts are available at all times. Each contract expires on the last Thursday of the expiry month and simultaneously a new contract is introduced for trading after expiry of a contract. Example: • Futures contract in September 2010 Contract month Expiry/settlement September 2010 September 30 October 2010 October 28 November 2010 November 25 The index futures symbols are represented as follows: BSE NSE BSXSEP2010 (September contract) FUTDXNIFTY30-Sep2010 BSXOCT2010 (October contract) FUTDXNIFTY28-OCT2010 BSXNOV2010 (November contract) FUTDXNIFTY25-NOV2010 Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 69. Futures Trading Strategies • Hedging Hedging involves protecting an existing asset position from future adverse price movements. In order to hedge a position, a market player needs to take an equal and opposite position in the futures market to the one held in the cash market. Every portfolio has a hidden exposure to the index, which is denoted by the beta. Assuming you have a portfolio of Rs 1 million, which has a beta of 1.2, you can factor a complete hedge by selling Rs 1.2 mn of S&P CNX Nifty futures • Speculation Speculators are those who do not have any position on which they enter in futures and options market. They only have a particular view on the market, stock, commodity etc. In short, speculators put their money at risk in the hope of profiting from an anticipated price change. They consider various factors such as demand supply, market positions, open interests, economic fundamentals and other data to take their positions • Arbitrage An arbitrageur is basically risk averse. He enters into those contracts were he can earn riskless profits. When markets are imperfect, buying in one market and simultaneously selling in other market gives riskless profit. Arbitrageurs are always in the look out for such imperfections. In the futures market one can take advantages of arbitrage opportunities by buying from lower priced market and selling at the higher priced market. In index futures arbitrage is possible between the spot market and the futures market (NSE has provided a special software for buying all 50 Nifty stocks in the spot market Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 70. How to read Futures Data • The first step is start tracking the end of day prices. Closing prices, Trading Volumes and Open Interest are the three primary data we carry with Index option quotes. The most important parameter are the actual prices, the high, low, open, close, last traded prices and the intra-day prices and to track them one has to have access to real time prices • The most useful measure of market activity is Open interest, which is also published by exchanges and used for technical analysis. Open interest indicates the liquidity of a market and is the total number of contracts, which are still outstanding in a futures market for a specified futures contract. • A futures contract is formed when a buyer and a seller take opposite positions in a transaction. This means that the buyer goes long and the seller goes short. Open interest is calculated by looking at either the total number of outstanding long or short positions - not both. • Open interest is therefore a measure of contracts that have not been matched and closed out. The number of open long contracts must equal exactly the number of open short contracts. Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 71. How to read Futures Data Action Resulting open interest New buyer (long) and new seller Rise (short) Trade to form a new contract. Existing buyer sells and existing seller buys -The old contract is Fall closed. New buyer buys from existing buyer. No change - there is no increase in The Existing buyer closes his position long contracts being held by selling to new buyer. Existing seller buys from new seller. No change - there is no increase in The Existing seller closes his position short contracts being held by buying from new seller. Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 72. How to read Futures Data • Open interest is also used in conjunction with other technical analysis chart patterns and indicators to gauge market signals Price Open interest Market ↑ ↑ Strong ↑ ↓ Warning signal ↓ ↑ Weak ↓ ↓ Warning signal • The warning sign indicates that the Open interest is not supporting the price direction Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 73. What are Options? • An option is a contract, which gives the buyer the right, but not the obligation to buy or sell shares of the underlying security at a specific price on or before a specific date. • 'Option', as the word suggests, is a choice given to the investor to either honour the contract; or if he chooses not to walk away from the contract. • Technically, an option is a contract between two parties. The buyer receives a privilege for which he pays a premium. The seller accepts an obligation for which he receives a fee • To begin, there are two kinds of options: Call Options and Put Options Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 74. Call Options • A Call Option is an option to buy a stock at a specific price on or before a certain date. In this way, Call options are like security deposits. If, for example, you wanted to rent a certain property, and left a security deposit for it, the money would be used to insure that you could, in fact, rent that property at the price agreed upon when you returned. If you never returned, you would give up your security deposit, but you would have no other liability. Call options usually increase in value as the value of the underlying instrument rises. • When you buy a Call option, the price you pay for it, called the option premium, secures your right to buy that certain stock at a specified price called the strike price. If you decide not to use the option to buy the stock, and you are not obligated to, your only cost is the option premium Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 75. Put Options • Put Options are options to sell a stock at a specific price on or before a certain date. In this way, Put options are like insurance policies • If you buy a new car, and then buy auto insurance on the car, you pay a premium and are, hence, protected if the asset is damaged in an accident. If this happens, you can use your policy to regain the insured value of the car. In this way, the put option gains in value as the value of the underlying instrument decreases. If all goes well and the insurance is not needed, the insurance company keeps your premium in return for taking on the risk. • With a Put Option, you can "insure" a stock by fixing a selling price. If something happens which causes the stock price to fall, and thus, "damages" your asset, you can exercise your option and sell it at its "insured" price level. If the price of your stock goes up, and there is no "damage," then you do not need to use the insurance, and, once again, your only cost is the premium. This is the primary function of listed options, to allow investors ways to manage risk. Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 76. Bull Market Strategies Calls in a Bullish Strategy • An investor with a bullish market outlook should buy call options. If you expect the market price of the underlying asset to rise, then you would rather have the right to purchase at a specified price and sell later at a higher price than have the obligation to deliver later at a higher price. • The investor's profit potential buying a call option is unlimited. The investor's profit is the market price less the exercise price less the premium. The greater the increase in price of the underlying, the greater the investor's profit. • The investor's potential loss is limited. Even if the market takes a drastic decline in price levels, the holder of a call is under no obligation to exercise the option. He may let the option expire worthless. • The investor breaks even when the market price equals the exercise price plus the premium. • An increase in volatility will increase the value of your call and increase your return. Because of the increased likelihood that the option will become in- the- money, an increase in the underlying volatility (before expiration), will increase the value of a long options position. As an option holder, your return will also increase. Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 77. Bull Market Strategies Puts in a Bullish Strategy • An investor with a bullish market outlook can also go short on a Put option. Basically, an investor anticipating a bull market could write Put options. If the market price increases and puts become out-of-the-money, investors with long put positions will let their options expire worthless. • By writing Puts, profit potential is limited. A Put writer profits when the price of the underlying asset increases and the option expires worthless. The maximum profit is limited to the premium received. • However, the potential loss is unlimited. Because a short put position holder has an obligation to purchase if exercised. He will be exposed to potentially large losses if the market moves against his position and declines. • The break-even point occurs when the market price equals the exercise price: minus the premium. At any price less than the exercise price minus the premium, the investor loses money on the transaction. At higher prices, his option is profitable. • An increase in volatility will increase the value of your put and decrease your return. As an option writer, the higher price you will be forced to pay in order to buy back the option at a later date , lower is the return. Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 78. Bull Market Strategies Bullish Call Spread Strategies • A vertical call spread is the simultaneous purchase and sale of identical call options but with different exercise prices. • To "buy a call spread" is to purchase a call with a lower exercise price and to write a call with a higher exercise price. The trader pays a net premium for the position. • To "sell a call spread" is the opposite, here the trader buys a call with a higher exercise price and writes a call with a lower exercise price, receiving a net premium for the position. • An investor with a bullish market outlook should buy a call spread. The "Bull Call Spread" allows the investor to participate to a limited extent in a bull market, while at the same time limiting risk exposure. • To put on a bull spread, the trader needs to buy the lower strike call and sell the higher strike call. The combination of these two options will result in a bought spread. The cost of Putting on this position will be the difference between the premium paid for the low strike call and the premium received for the high strike call. • The investor's profit potential is limited. When both calls are in-the-money, both will be exercised and the maximum profit will be realised. The investor delivers on his short call and receives a higher price than he is paid for receiving delivery on his long call. • The investors' potential loss is limited. At the most, the investor can lose is the net premium. He pays a higher premium for the lower exercise price call than he receives for writing the higher exercise price call. • The investor breaks even when the market price equals the lower exercise price plus the net premium. At the most, an investor can lose is the net premium paid. To recover the premium, the market price must be as great as the lower exercise price plus the net premium. Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 79. Bull Market Strategies Bullish Put Spread Strategies • A vertical Put spread is the simultaneous purchase and sale of identical Put options but with different exercise prices. • To "buy a put spread" is to purchase a Put with a higher exercise price and to write a Put with a lower exercise price. The trader pays a net premium for the position. • To "sell a put spread" is the opposite: the trader buys a Put with a lower exercise price and writes a put with a higher exercise price, receiving a net premium for the position. • An investor with a bullish market outlook should sell a Put spread. The "vertical bull put spread" allows the investor to participate to a limited extent in a bull market, while at the same time limiting risk exposure. • To put on a bull spread, a trader sells the higher strike put and buys the lower strike put. The bull spread can be created by buying the lower strike and selling the higher strike of either calls or put. The difference between the premiums paid and received makes up one leg of the spread. • The investor's profit potential is limited. When the market price reaches or exceeds the higher exercise price, both options will be out-of-the-money and will expire worthless. The trader will realize his maximum profit, the net premium • The investor's potential loss is also limited. If the market falls, the options will be in-the-money. The puts will offset one another, but at different exercise prices. • The investor breaks-even when the market price equals the lower exercise price less the net premium. The investor achieves maximum profit i.e. the premium received, when the market price moves up beyond the higher exercise price (both puts are then worthless). Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 80. Bear Market Strategies Puts in a Bearish Strategy • When you purchase a put you are long and want the market to fall. A put option is a bearish position. It will increase in value if the market falls. An investor with a bearish market outlook shall buy put options. By purchasing put options, the trader has the right to choose whether to sell the underlying asset at the exercise price. In a falling market, this choice is preferable to being obligated to buy the underlying at a price higher. • An investor's profit potential is practically unlimited. The higher the fall in price of the underlying asset, higher the profits. • The investor's potential loss is limited. If the price of the underlying asset rises instead of falling as the investor has anticipated, he may let the option expire worthless. At the most, he may lose the premium for the option. • The trader's breakeven point is the exercise price minus the premium. To profit, the market price must be below the exercise price. Since the trader has paid a premium he must recover the premium he paid for the option. • An increase in volatility will increase the value of your put and increase your return. An increase in volatility will make it more likely that the price of the underlying instrument will move. This increases the value of the option. • The investor's profit potential is limited because the trader's maximum profit is limited to the premium received for writing the option. • Here the loss potential is unlimited because a short call position holder has an obligation to sell if exercised, he will be exposed to potentially large losses if the market rises against his position. • The investor breaks even when the market price equals the exercise price: plus the premium. At any price greater than the exercise price plus the premium, the trader is losing money. When the market price equals the exercise price plus the premium, the trader breaks even. • An increase in volatility will increase the value of your call and decrease your return. When the option writer has to buy back the option in order to cancel out his position, he will be forced to pay a higher price due to the increased value of the calls. Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 81. Bear Market Strategies Calls in a Bearish Strategy • Another option for a bearish investor is to go short on a call with the intent to purchase it back in the future. By selling a call, you have a net short position and needs to be bought back before expiration and cancel out your position. • For this an investor needs to write a call option. If the market price falls, long call holders will let their out-of- the-money options expire worthless, because they could purchase the underlying asset at the lower market price. Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 82. Bear Market Strategies Bearish Put Spread Strategies • A vertical put spread is the simultaneous purchase and sale of identical put options but with different exercise prices. • To "buy a put spread" is to purchase a put with a higher exercise price and to write a put with a lower exercise price. The trader pays a net premium for the position. • To "sell a put spread" is the opposite. The trader buys a put with a lower exercise price and writes a put with a higher exercise price, receiving a net premium for the position. • To put on a bear put spread you buy the higher strike put and sell the lower strike put. You sell the lower strike and buy the higher strike of either calls or puts to set up a bear spread. • An investor with a bearish market outlook should: buy a put spread. The "Bear Put Spread" allows the investor to participate to a limited extent in a bear market, while at the same time limiting risk exposure. • The investor's profit potential is limited. When the market price falls to or below the lower exercise price, both options will be in-the-money and the trader will realize his maximum profit when he recovers the net premium paid for the options. • The investor's potential loss is limited. The trader has offsetting positions at different exercise prices. If the market rises rather than falls, the options will be out-of-the-money and expire worthless. Since the trader has paid a net premium • The investor breaks even when the market price equals the higher exercise price less the net premium. For the strategy to be profitable, the market price must fall. When the market price falls to the high exercise price less the net premium, the trader breaks even. When the market falls beyond this point, the trader profits Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 83. Bear Market Strategies Bearish Call Spread Strategies • A vertical call spread is the simultaneous purchase and sale of identical call options but with different exercise prices. • To "buy a call spread" is to purchase a call with a lower exercise price and to write a call with a higher exercise price. The trader pays a net premium for the position. • To "sell a call spread" is the opposite: the trader buys a call with a higher exercise price and writes a call with a lower exercise price, receiving a net premium for the position. • To put on a bear call spread you sell the lower strike call and buy the higher strike call. An investor sells the lower strike and buys the higher strike of either calls or puts to put on a bear spread. • An investor with a bearish market outlook should: sell a call spread. The "Bear Call Spread" allows the investor to participate to a limited extent in a bear market, while at the same time limiting risk exposure. • The investor's profit potential is limited. When the market price falls to the lower exercise price, both out-of-the-money options will expire worthless. The maximum profit that the trader can realize is the net premium: The premium he receives for the call at the higher exercise price. • Here the investor's potential loss is limited. If the market rises, the options will offset one another. At any price greater than the high exercise price, the maximum loss will equal high exercise price minus low exercise price minus net premium. • The investor breaks even when the market price equals the lower exercise price plus the net premium. The strategy becomes profitable as the market price declines. Since the trader is receiving a net premium, the market price does not have to fall as low as the lower exercise price to breakeven. Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 84. Direct Equity Vs Mutual Funds PROS of mutual fund investing: 1. Professionally-managed portfolio Mutual funds are managed by professionals who take investment decisions based on thorough economy, industry and company research rather than ad-hoc decisions based on market tips and broker’s advice. Besides, they keep a regular watch even after investing. Thus, mutual funds are an easy way to take advantage of professional expertise at an affordable price. 2. In-built Diversification Top-most benefit of investing in mutual funds is built-in diversification. Mutual funds offer convenient and effective way to achieve instant diversification. Although you can achieve the objective of diversification through direct investing also but for that you require quite huge amount of money. On the other hand, you can do the same through mutual funds by making a single investment of just a few bucks. In short, mutual funds allow you the benefit of diversification without investing large sums of money that would be required to create an individual portfolio. Why do you need to diversify? Because, diversification reduces risk by spreading your investments among various companies belonging to different industries. A downturn of a company/sector gets offset by the better performance of other companies/sectors. 3. Transparency Mutual fund industry is regulated by SEBI & AMFI. Gradually, over a period of time, the investment practices have more become more transparent due to stringent regulations regarding manner of investments, maximum exposure limits, expense ratio’s, entry & exit loads, manner of calculating and disclosing NAVs. Thus, it is safer to invest in mutual funds. Chances of getting duped are minimal. Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 85. Direct Equity Vs Mutual Funds CONS of Mutual Fund Investing But there is other side of the coin too. You should also know that there are certain demerits associated with mutual fund investing: 1. Too Bulky Portfolios Holding too many stocks in a portfolio can lead to unnecessary duplication and sub-optimal performance. This is particularly relevant to over-sized funds investing in small and mid-caps. Due to high illiquidity in small and mid- cap segments, a mutual fund can not take large exposures. The problem with too big portfolio’s (over-diversification) is that rather than out performing the market, portfolio simply mimics the market returns which in turns defeats the very purpose of active investing. 2. Too much churning of portfolios In the over-enthusiasm to outperform their index counterparts, a lot many fund managers indulge in frequent churning of portfolios which amounts to timing the markets and shows a lack of long term approach. Also, it doesn’t ordinarily result in higher returns due to high brokerage and other costs. 3. Rampant mis-selling While investing in mutual funds, you rely on the advice of so-called advisors who are just agents/ distributors of financial products with half-baked knowledge and more interested in earning their commissions rather than keeping the investor’s interest in mind. Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 86. Direct Equity Vs Mutual Funds CONS of Mutual Fund Investing 4. Herd Mentality Portfolio of most funds in the same category (funds with similar objective) is more or less the same? In the words of Peter Lynch, (Excerpts from his book “LEARN to EARN: A Beginner’s Guide to the Basics of Investing and Business”) “…herd of fund managers tend to graze in the same pasture of stocks. They feel comfortable buying the same stocks the other managers are buying and they avoid wandering off into unfamiliar territory. So they miss the exciting prospects that can be found outside the boundaries of the herd”. But why? There are two basic reasons behind it. First is called herd instinct (the comfort of going with the crowds is powerfully attractive because to humans a group offers security) and second is that underperformance of fund managers can be treated quite harshly. Because mandate given to fund managers is to beat the benchmark index, fear of underperformance drives them towards mediocre performance by conforming to the peers and invest mostly in benchmark index securities rather than taking risks by surfing in unchartered waters. If a fund manager holds the same ICICI, ACC or DLF’s and they drop, the economy can be blamed. However, if they show more creativity with stock picking, the onus will fall directly on them. If you invest directly you are in a privileged position as compared to fund managers because unlike them you are not answerable to anybody and therefore need not chase returns. Furthermore, what’s more important to you is real absolute returns and not the relative outperformance. Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010

- 87. Direct Equity Vs Mutual Funds CONS of Mutual Fund Investing 5. Paradox of Choice One argument against direct investing is that retail investor has neither the time nor the expertise required to research and pick individual stocks. But this multitude of choice also exists in mutual fund space. There are thousands of mutual fund schemes available in the market. At present, around 30 fund houses with more than 2000 schemes are present in India. If you want to invest in mutual funds, say, equity diversified schemes; you’ll have to research over 200 schemes. Even if you leave aside the recently launched funds and concentrate only on funds with a long term performance, there are more than 100 diversified equity schemes with a track record of more than 5 years. However, unlike direct stock picking, there is a way out – to remove the clutter – as rating of mutual fund schemes is periodically done and published by VALUE RESEARCH, Economic Times and Outlook Money. To sum up, invest directly if you have the requisite time and skill to do proper & thorough research and also keep a regular vigil on your investments. On the other hand, if you are too busy in your work and can’t spare time or don’t have the inclination towards stock markets, it is better to hand over your money to mutual funds. It’s an easy and convenient way to invest. Anyhow, whether you want to rely on your own wisdom or on the wisdom of so-called specialist, the choice is yours. However, if you decide in favor of mutual fund investing, please keep in mind the following Smart principles of mutual fund investing. And if you decide to take a direct plunge into the markets which requires a lot of patience and discipline, remember to start small, learn some basic investment principles, be wary of human irrationality and flaws in our decision making and don’t forget to do regular portfolio rebalancing. I’ll be covering the direct stock investing principles and decisions flaws in my future posts. In the meantime, you can put your own views in the comment box Professional Certificate in Wealth Management 22 Sep – 29 Oct 2010