HDFC Morning Market Note - HDFC Sec

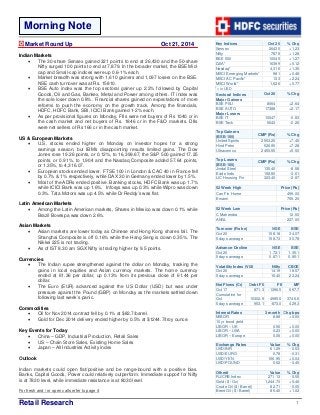

- 1. Morning Note Retail Research Key Indices Oct 20 % Chg Sensex 26430 +1.23 Nifty 7879 +1.28 BSE 500 10045 +1.27 DJIA* 16399 +0.12 Nasdaq* 4,316 +1.35 MSCI Emerging Markets* 981 +0.48 MSCI AC Pacific* 133 +2.24 MSCI World* 1,626 +0.77 *= in USD Sectoral Indices Oct 20 % Chg Major Gainers BSE PSU 8064 +2.64 BSE AUTO 17388 +2.17 Major Losers BSE IT 10047 -0.83 BSE Teck 5643 -0.26 Top Gainers (BSE-100) CMP (Rs) % Chg United Spirits 2553.20 +7.45 Hind Petro 526.95 +7.28 Ultracemco 2450.55 +5.50 Top Losers (BSE-100) CMP (Rs) % Chg Jindal Steel 135.40 -8.58 Exide Inds 158.80 -3.61 LIC Housing Fin 323.40 -2.87 52 Week High Price (Rs) Can Fin Home 499.00 Emami 759.20 52 Week Low Price (Rs) C Mahendra 12.50 ANGL 227.00 Turnover (Rs bn) NSE BSE Oct 20 158.18 34.07 5 days average 158.73 30.78 Advance-Decline NSE BSE Oct 20 1.72:1 1.35:1 5 days average 0.87:1 0.85:1 Volatility Index (ViX) Nifty CBOE Oct 20 14.19 18.57 5 days average 15.40 23.24 Net Flows (Cr) Debt FII FII MF Oct 17 871.3 -1396.5 697.7 Cumulative for Oct 10302.9 -4995.5 3746.6 5 days average 953.1 -873.0 429.3 Interest Rates 3 month Chg bps MIBOR 8.88 +0.00 10 yr bond yield - - LIBOR – UK 0.56 +0.00 LIBOR – USA 0.23 +0.00 LIBOR – Europe 0.06 +0.00 Exchange Rates Value % Chg USD/INR 61.29 -0.53 USD/EURO 0.78 -0.31 USD/YEN 106.95 +0.04 USD/POUND 0.62 -0.45 Other# Value % Chg RJ/CRB Index 271.13 -0.55 Gold ($ / Oz) 1,244.70 +0.46 Crude Oil ($ / Barrel) 82.71 -0.05 Brent Oil ($ / Barrel) 85.40 +1.02 1 Market Round Up Oct 21, 2014 Indian Markets The 30-share Sensex gained 321 points to end at 26,430 and the 50-share Nifty surged 100 points to end at 7,879. In the broader market, the BSE Mid-cap and Small-cap indices were up 0.6-1% each. Market breadth was strong with 1,610 gainers and 1,097 losers on the BSE. NSE cash turnover was at Rs. 15810. BSE Auto index was the top sectoral gainer up 2.2% followed by Capital Goods, Oil and Gas, Bankex, Metal and Power among others. IT index was the sole loser down 0.8%. Financial shares gained on expectations of more reforms to push the economy on the growth track. Among the financials, HDFC, HDFC Bank, SBI, ICICI Bank gained 1-2% each. As per provisional figures on Monday, FIIs were net buyers of Rs 1040 cr in the cash market and net buyers of Rs. 1846 cr in the F&O markets. DIIs were net sellers of Rs 166 cr in the cash market. US & European Markets U.S. stocks ended higher on Monday on investor hopes for a strong earnings season, but IBM's disappointing results limited gains. The Dow Jones rose 19.26 points, or 0.12%, to 16,399.67, the S&P 500 gained 17.25 points, or 0.91%, to 1,904 and the Nasdaq Composite added 57.64 points, or 1.35%, to 4,316.07. European stocks ended lower. FTSE 100 in London & CAC 40 in France fell by 0.7% & 1% respectively, while DAX 30 in Germany ended lower by 1.5%. Most of the ADRs ended positive. Banking stocks, HDFC Bank was up 1.7% while ICICI Bank was up 1.6%. Infosys was up 0.3% while Wipro was down 0.3%. Tata Motors was up 4.5% while Dr Reddy’s was flat. Latin American Markets Among the Latin American markets, Shares in Mexico was down 0.1% while Brazil Bovespa was down 2.6%. Asian Markets Asian markets are lower today as Chinese and Hong Kong shares fall. The Shanghai Composite is off 0.16% while the Hang Seng is down 0.35%. The Nikkei 225 is not trading. As of IST 8.30 am SGX Nifty is trading higher by 9.5 points. Currencies The Indian rupee strengthened against the dollar on Monday, tracking the gains in local equities and Asian currency markets. The home currency ended at 61.36 per dollar, up 0.13% from its previous close of 61.44 per dollar. The Euro (EUR) advanced against the US Dollar (USD) but was under pressure against the Pound (GBP) on Monday as the markets settled down following last week’s panic. Commodities Oil for Nov 2014 contract fell by 0.1% at $82.7/barrel. Gold for Dec 2014 delivery ended higher by 0.5% at $1244.7/troy ounce. Key Events for Today China – GDP, Industrial Production, Retail Sales US – Chain Store Sales, Existing Home Sales Japan – All Industries Activity index Outlook Indian markets could open flat/positive and be range-bound with a positive bias. Banks, Capital Goods, Power could relatively outperform. Immediate support for Nifty is at 7820 level, while immediate resistance is at 8030 level. For fresh and / or open calls refer to page 4

- 2. Technical Analysis – Market Pulse Oct 21, 2014 After showing smart recovery from the lower levels of 7725 on Friday, Nifty continued its relief rally yesterday and witnessed smart gains of around 100 points. Nifty opened yesterday with an upside gap of around 116 points and later shifted into sideways consolidation for better part of the session. It slipped into intraday correction within an opening upside gap area of around 7820-7896 levels and recovered during afternoon session. Hence the opening upside gap has been filled partially. The formation of opening upside gap (green minor parallel horizontal lines) after a decent decline/from near the support could be considered as a bullish breakaway gap (bullish breakaway gaps normally formed inline with bottom reversal patterns) and this gap should not get filled completely with in 3-4 day’s of its formation to continue with positive bias. The immediate resistance of down sloping minor trend line (brown line, which is connected from the swing high of 8160 levels-23rd Sept) has been broken on the upside, which is indicating that bulls are gradually gaining strength. Daily momentum oscillator like 34 period stochastic oscillators has turned up from near the oversold region of 10 levels by showing positive crossover signal (previously, such turnarounds of stochastic from the oversold regions have resulted in a decent bottom reversal patterns in Nifty). Nifty continuing its upmove yesterday, after the lower levels recovery from 7725 of Friday is indicating an emergence of buying interest from the support area of 7725-7700 levels. This could be confirmed only when Nifty holds around the immediate support of 7820 levels without showing any further declines. If Nifty manages to sustain around these supports for the next 2-3 sessions, then there is a possibility of Nifty reaching the upside region of around 8030/8160 levels for near term. Retail Research 2

- 3. Retail Research For forthcoming Board Meeting on Oct 21, 2014 click on the following link http://www.bseindia.com/mktlive/board_meeting.asp#1 3 News Flash Oct 21, 2014 Economy News The Finance Ministry has written to the RBI to consider reemploying some restrictions on gold imports after inbound shipments surged in the last few months, widening the trade deficit. India will float a company to develop Iran's Chabahar Port, a government statement said as New Delhi aims to take advantage of a thaw in Tehran's relations with world powers. Corporate News United Spirits reported a standalone net loss of Rs 55.58 crore for the three months ended June 30. The company had posted a net profit of Rs 118.13 crore during the same period of previous fiscal. Kalyani Steels reported nearly doubling of its net profitin the July-September quarter to Rs 22.77 crore. The company had reported a net profit of Rs 11.83 crore in the corresponding quarter last fiscal Oberoi Realty Ltd reported 10 per cent increase in consolidated net profit at Rs 70.54 crore for the second quarter ended September, 2014-15, on lower expenses. Alembic Pharmaceuticals reported 25.35% rise in consolidated net profit after tax and share of profit of associates to Rs 77.27 crore for the second quarter ended September 30, 2014-15 mainly on account of robust sales.. Hero MotoCorp plans to invest over Rs 5,000 crore across the globe, including manufacturing plants at Colombia and Bangladesh and new facilities at Gujarat and Andhra Pradesh.. Exide Industries has posted 6.01% rise in its net profit to Rs 125.76 crore in the second quarter ended September 30, 2014 as compared to the same quarter previous fiscal. Bulk Deals Scrip Name Quantity (in lakhs) Fund Name Price HATHWAY +15.80 CLSA GLOBAL MARKETS PTE LTD 302.5 REPCOHOME -3.25 CREADOR I LLC 470.05 Key Corporate Action SCRIP NAME BC/RD BC/RD FROM EX-DATE PURPOSE HCL Tech RD 23/10/2014 21/10/2014 300% Interim Dividend Essar India RD 22/10/2014 21/10/2014 03:02 Bonus issue Fedders Llyo BC 27/10/2014 21/10/2014 AGM 10% Dividend Midinfra RD 23/10/2014 21/10/2014 Stock Split from Rs. 10 to Rs.1

- 4. Stock Ideas Oct 21, 2014 Retail Research 4 Update of Index Futures Date B/S Positional Call Entry at Sloss Targets Exit Price / CMP Exit Date % G/L Comments Time Horizon Avg. Entry Abs. Gain/Loss 16-Oct-14 B Nifty Future 7813.15 7769 7897 7769 16-Oct-14 -0.6 Stop loss Triggered 2-3 days 7813.15 -44.1 Update of Stock and Nifty Options Calls: Date B/S Positional Call Entry at Sloss Targets Exit Price / CMP Exit Date % G/L Comments Time Horizon Avg. Entry Abs. Gain/Loss 17-Oct-14 B Zeel 310 Put 4 1.85 12 1.85 20-Oct-14 -53.8 Stop Loss Triggered 2-3 days 4 -2.2 17-Oct-14 B Maruti 2800 Put 20.3 13.7 45 26 17-Oct-14 28.1 Premature Profit Booked 2-3 days 20.3 5.7 17-Oct-14 B ONGC Oct 400 Puts 13.2 8.8 24 8.8 17-Oct-14 -33.3 Stopped Out/Exit 1-5 days 13.2 -4.4 16-Oct-14 B HPCL 520 Call 14.15 9 25 19 16-Oct-14 34.3 Premature Profit Booked 2-3 days 14.15 4.9 16-Oct-14 B M & M 1300 Call 13.55 8.9 25 8.9 16-Oct-14 -34.3 Stoploss Trig. 2-3 days 13.55 -4.7 16-Oct-14 B Hindalco 150 Call 3.85 1.85 6.5 1.85 -51.9 Stop Loss Triggered 2-3 days 3.85 -2.0 14 Oct 14 B Bank Baroda 900 Call 17.90 11.5 30.0 14.6 17-Oct-14 -18.4 Premature Exit 1-5 Days 17.90 -3.3 14 Oct 14 B Hindalco Oct 150 Calls 8.70 6.1 15.0 7.0 14-Oct-14 -20.1 Exit Called 1-5 days 8.70 -1.8 13-Oct-14 B Axis Bank 400 Call Oct 5.80 3.5 12.0 8.10 14-Oct-14 39.7 Premature Profit Booked 3-5 Days 5.80 2.3 13-Oct-14 B PNB OCT 900 Calls 32.50 22.8 52.0 38.00 13-Oct-14 16.9 Premature Profit Booked 1-5 days 32.50 5.5 10 Oct 14 B Sun Pharma Oct 830 Call 23.50 14.0 45.0 14.0 13-Oct-14 -40.4 Stoploss Trig. 1-5 Days 23.50 -9.5 Update of Momentum / Intra Day/Futures Calls: Date B/S Positional Call Entry at Sloss Targets Exit Price / CMP Exit Date % G/L Comments Time Horizon Avg. Entry Abs. Gain/Loss 20-Oct-14 B TVS Motors 235.8 227.0 255.0 242.6 20-Oct-14 2.9 Premature Profit Booked 3-5 Days 235.80 6.8 20-Oct-14 B PNB 946.15 910.0 1050.0 970.0 2.5 hold 1-5 days 946.15 23.9 20-Oct-14 B Auro Pharma 931.7 899.5 995.0 937.0 0.6 Hold 3-5 Days 931.70 5.3 17-Oct-14 S SAIL 75.75 77.0 71.0 77.0 20-Oct-14 -1.6 Stoploss Trig. 3-7 Days 75.75 -1.3 17-Oct-14 S Century Textile Oct Fut 508.45 530.0 465.0 523.4 -2.9 Hold 3-5 Days 508.45 -15.0 17-Oct-14 B ABG Shipyard 223.65 215.0 239.0 222.8 -0.4 Hold 3-5 Days 223.65 -0.8 16-Oct-14 B Wondrela 314.70 305.00 340.00 322.9 16-Oct-14 2.6 Premature Profit Booked 2-3 days 314.70 8.2 16-Oct-14 B Thomas Cook 150.8 145.0 165.0 147.6 16-Oct-14 -2.1 Exit Called 2-7 days 150.80 -3.2 16-Oct-14 B Pidilite Ind 387.95 375.0 415.0 391.9 16-Oct-14 1.0 Premature Profit Booked 3-5 Days 387.95 3.9 16-Oct-14 S Bharat Forge Oct Fut 768.65 801.0 703.0 738.8 16-Oct-14 4.0 Premature Profit Booked 3-5 Days 768.65 29.9 14-Oct-14 B McDowell 2455.00 2350.0 2660.0 2350.0 17-Oct-14 -4.3 Stoploss Trig. 3-5 Days 2455.00 -105.0 14-Oct-14 B Raymond 467.00 450.0 490.0 468.0 17-Oct-14 0.2 Hold 3 - 7 Days 467.00 1.0 14-Oct-14 B Monsanto 3045.00 2925.0 3400.0 2925.0 16-Oct-14 -3.9 Stop loss Triggered 2-7 days 3045.00 -120.0 14-Oct-14 B Engineers India 239.30 232.0 255.0 233.8 16-Oct-14 -2.3 Exit Called 1-5 days 239.30 -5.6 14-Oct-14 B B F Utilities 670.00 643.0 720.0 720.0 14-Oct-14 7.5 Target Achieved 3-5 Days 670.00 50.0 14-Oct-14 B ABG Shipyard 226.40 217.0 245.0 240.7 14-Oct-14 6.3 Premature Profit Booked 3-5 Days 226.40 14.3 14-Oct-14 B CEAT 783.5,763 749.0 830.0 808.0 14-Oct-14 3.1 Premature Profit Booked 3 - 7 Days 783.50 24.5 13-Oct-14 B Indus Ind Bank 632.00 615.0 670.0 644.0 14-Oct-14 1.9 Premature Profit Booked 1-5 days 632.00 12.0 10-Oct-14 B VIP Industries 122.85 117.5 135.0 120.9 16-Oct-14 -1.6 Premature Exit 3-5 Days 122.85 -2.0 10-Oct-14 B Balaji Tele 78, 80.5 76.5 87.0 76.5 14-Oct-14 -3.5 Stop loss Triggered 2-3 days 79.25 -2.8 10-Oct-14 B Bajaj Electricals 282.70 269.0 307.0 287.4 13-Oct-14 1.7 Premature Profit Booked 3-5 Days 282.70 4.7 10-Oct-14 S Bharti Airtel Fut 392.85 410.0 358.0 383.1 13-Oct-14 2.6 Premature Profit Booked 1-5 days 392.85 9.8 9-Oct-14 B Aptech 82.45 79.9 88.0 79.9 16-Oct-14 -3.1 Stop loss Triggered 2-3 days 82.45 -2.6 9-Oct-14 B SBBJ 563.00 542.0 600.0 542.0 16-Oct-14 -3.7 Stop loss Triggered 3 - 7 Days 563.00 -21.0 9-Oct-14 B JB Che Pharma 230.75 220.0 250.0 233.2 14-Oct-14 1.1 Premature Profit Booked 1-5 days 230.75 2.4 9-Oct-14 B India Glycol 123, 127.3 121.0 138.5 121.0 13-Oct-14 -3.3 Stop loss Triggered 2-3 days 125.15 -4.2 7-Oct-14 B Sundram Fastner 158, 166.25 156.0 179.0 173.0 15-Oct-14 4.1 Exit 2-3 days 166.25 6.8 Update of Positional Calls: Date B/S Positional Call Entry at Sloss Targets Exit Price / CMP Exit Date % G/L Comments Time Horizon Avg. Entry Abs. Gain/Loss 20-Oct-14 B SKS Micro Finance 288, 297.65 282.0 320.0 313.7 20-Oct-14 5.4 Premature Profit Booked 5-7 days 297.65 16.0 17-Oct-14 S Allahabad Bank Fut. 101.00 105.0 93.0 105.0 20-Oct-14 -3.8 Stop loss Triggered 2 Weeks 101.00 -4.0 14-Oct-14 B BHEL 223.80 213.5 244.0 222.0 17-Oct-14 -0.8 Premature Exit 5-7 Days 223.80 -1.8 13-Oct-14 S Ambuja Cements Oct Fut 208.10 216.5 192.0 213.0 20-Oct-14 -2.3 Premature Exit 5-7 Days 208.10 -4.8 13-Oct-14 B NDTV 131, 135 127.5 155.0 127.5 14-Oct-14 -5.6 Stop loss Triggered 5-7 days 135.00 -7.5 7-Oct-14 S SR Trans Fin Fut. 887.00 940.0 790.0 887.0 14-Oct-14 0.0 Premature Exit 3-14 days 887.00 0.0 7-Oct-14 S LIC Housing Fin. Oct Fut 314.50 329.0 286.0 313.6 13-Oct-14 0.3 Premature Exit 5-7 Days 314.50 0.9 32,080. 30-Sep-14 B MRF 32,080.00 30500.0 36000.0 31194.6 14-Oct-14 -2.8 Premature Exit 5-10 days 00 -885.5 25-Sep-14 S ONGC Oct Fut. 402 - 410 420.0 360.0 420.0 20-Oct-14 -3.3 Stop loss Triggered 2 Weeks 406.00 -14.0

- 5. Retail Research 5 HDFC securities Limited, I Think Techno Campus, Building –B, ”Alpha”, Office Floor 8, Near Kanjurmarg Station, Opp. Crompton Greaves, Kanjurmarg (East), Mumbai 400 042 Fax: (022) 30753435 Disclaimer: This document has been prepared by HDFC securities Limited and is meant for sole use by the recipient and not for circulation. This document is not to be reported or copied or made available to others. It should not be considered to be taken as an offer to sell or a solicitation to buy any security. The information contained herein is from sources believed reliable. We do not represent that it is accurate or complete and it should not be relied upon as such. We may have from time to time positions or options on, and buy and sell securities referred to herein. We may from time to time solicit from, or perform investment banking, or other services for, any company mentioned in this document. This report is intended for Retail Clients only and not for any other category of clients, including, but not limited to, Institutional Clients