HDFC Morning Market Note - HDFC Sec

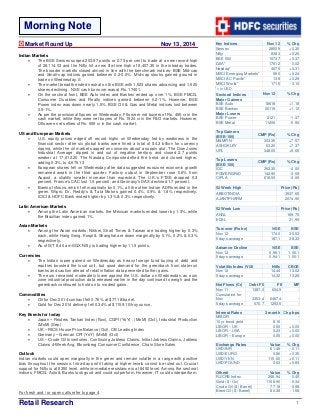

- 1. Morning Note Retail Research Key Indices Nov 12 % Chg Sensex 28009 +0.35 Nifty 8383 +0.25 BSE 500 10737 +0.37 DJIA* 17612 -0.02 Nasdaq* 4675 +0.31 MSCI Emerging Markets* 996 +0.24 MSCI AC Pacific* 138 +0.29 MSCI World* 1715 -0.10 *= in USD Sectoral Indices Nov 12 % Chg Major Gainers BSE Auto 18618 +1.18 BSE Bankex 20118 +1.12 Major Losers BSE Power 2121 -1.37 BSE Metal 11206 -0.90 Top Gainers (BSE-100) CMP (Rs) % Chg M&MFIN 333.35 +7.57 ASHOKLEY 53.20 +7.37 UPL 348.00 +5.65 Top Losers (BSE-100) CMP (Rs) % Chg IOC 362.35 -4.00 POWERGRID 142.90 -3.09 CIPLA 618.50 -3.06 52 Week High Price (Rs) ABBOTINDIA 3537.65 AJANTPHARM 2074.90 52 Week Low Price (Rs) ANGL 189.70 EDSL 21.95 Turnover (Rs bn) NSE BSE Nov 12 174.0 36.53 5 days average 187.1 38.33 Advance-Decline NSE BSE Nov 12 0.96:1 1.00:1 5 days average 0.94:1 1.00:1 Volatility Index (ViX) Nifty CBOE Nov 12 14.44 13.02 5 days average 14.32 13.26 Net Flows (Cr) Debt FII FII MF Nov 11 1387.0 604.9 - Cumulative for Nov 3353.4 6467.4 - 5 days average 670.7 1293.5 - Interest Rates 3 month Chg bps MIBOR - - 10 yr bond yield 8.16 - LIBOR – UK 0.56 +0.00 LIBOR – USA 0.23 +0.00 LIBOR – Europe 0.05 +0.00 Exchange Rates Value % Chg USD/INR 61.48 -0.11 USD/EURO 0.80 +0.35 USD/YEN 115.60 +0.11 USD/POUND 0.63 +0.83 Other# Value % Chg RJ/CRB Index 268.94 -0.45 Gold ($ / Oz) 1158.90 -0.34 Crude Oil ($ / Barrel) 77.18 -0.98 Brent Oil ($ / Barrel) 80.38 -1.58 1 Market Round Up Nov 13, 2014 Indian Markets The BSE Sensex surged 203.97 points or 0.73 per cent to trade at a new record-high of 28,114.03 and the Nifty hit a new life-time high of 8,407.35 in the intraday trades. The broader markets closed almost in line with the benchmark indices- BSE Mid-cap and Small-cap indices gained between 0.2-0.5%. Mid-cap stocks gained ground in trade on Wednesday. S The market breadth ended neutral on the BSE with 1,523 shares advancing and 1,520 shares declining. NSE cash turnover was at Rs. 17401. On the sectoral front, BSE Auto index and Bankex ended up over 1%. BSE FMCG, Consumer Durables and Realty indices gained between 0.2-1%. However, BSE Power index was down nearly 1.5%. BSE Oil & Gas and Metal indices lost between 0.5-1%. As per the provisional figures on Wednesday, FIIs were net buyers of Rs. 459 cr in the cash market, while they were net buyers of Rs. 1924 cr in the F&O markets. However, DIIs were net sellers of Rs. 559 cr in the cash market. US and European Markets U.S. equity prices edged off record highs on Wednesday led by weakness in the financial sector after six global banks were fined a total of $4.3 billion for currency rigging, while the oil market sagged on concerns about a supply glut. The Dow Jones Industrial Average dipped in and out of negative territory and closed 2.7 points weaker at 17,612.20 The Nasdaq Composite defied the trend and closed higher, adding 0.3%, to 4,675.13 European shares fell on Wednesday after data suggested eurozone economic growth remained weak in the third quarter. Factory output in September rose 0.6% from August, a slightly smaller increase than expected. The U.K.’s FTSE dropped 0.3 percent, France’s CAC lost 1.5 percent, and Germany’s DAX declined 1.7 percent. Barring Infosys, which fell marginally by 0.1%, all the other Indian ADRs ended in the green. Wipro, Dr. Reddy’s & Tata Motors gained 0.4%, 0.9% & 1.8% respectively. ICICI & HDFC Bank ended higher by 1.3% & 0.3% respectively. Latin American Markets Among the Latin American markets, the Mexican markets ended lower by 1.3%, while the Brazilian index gained 1%. Asian Markets Among the Asian markets, Nikkei, Strait Times & Taiwan are trading higher by 0.3% each, while Hang Seng, Kospi & Shanghai are down marginally by 0.1%, 0.2% & 0.3% respectively. As of IST 8.40 am SGX Nifty is trading higher by 11.5 points. Currencies The Indian rupee gained on Wednesday as heavy foreign fund buying of debt and equities boosted the local unit, but good demand for the greenback from state-run banks and caution ahead of retail inflation data prevented further gains. The euro remained moderately lower against the U.S. dollar on Wednesday, as euro zone industrial production data released earlier in the day continued to weigh and the greenback continued to hold on to modest gains. Commodities Oil for Dec 2014 contract fell 0.76% at $77.18/barrel. Gold for Dec 2014 delivery fell 0.34% at $1159.10/troy ounce. Key Events for today Japan – Reuters Tankan Index (Nov), CGPI (YoY) , (MoM) (Oct), Industrial Production (MoM) (Sep) UK – RICS House Price Balance (Oct), CB Leading Index Germany – German CPI (YoY) (MoM) (Oct) US – Crude Oil Inventories, Continuing Jobless Claims, Initial Jobless Claims, Jobless Claims 4-Week Avg, Bloomberg Consumer Confidence, Chain Store Sales Outlook Indian markets could open marginally in the green and remain volatile in a range with positive bias throughout the session. Intra-day profit taking at higher levels cannot be ruled out. Crucial support for Nifty is at 8350 level, while immediate resistance is at 8450 level. Among the sectoral indices, FMCG, Auto & Banks look good and could outperform. However, IT could underperform. For fresh and / or open calls refer to page 4

- 2. Retail Research For forthcoming Board Meeting on Nov 13, 2014 click on the following link http://www.bseindia.com/mktlive/board_meeting.asp#1 2 News Flash Nov 13, 2014 Economy News On the plea of domestic steelmakers, government is soon expected to initiate measures to counter cheap and galloping imports from China, the world's largest producer. The government plans to address labour issues, infrastructure deficit and high cost of capital soon to meet the 'uphill tasks' of raising share of manufacturing in GDP from 15 to 25%. India, the world's third-largest buyer of overseas coal, may be able to stop imports of power-generating thermal coal in the next three years as state behemoth Coal India steps up production, Power and Coal Minister Piyush Goyal said on Wednesday. Corporate News Ruchi Soya Industries Ltd has divested its majority stake (50.001%) in a Hyderabad-based subsidiary Gemini Edibles and Fats India (GEFI) to Singapore-based Golden Agri International India Holding Pte Ltd at a total consideration of $17.88 million (Rs 109.92 crore). The first LNG terminal in east coast part of the country, which will be set up by Indian Oil Corporation (IOC) is expected to go onstream by the third quarter of 2017-18. The project cost has been revised to Rs 5,150 crore. Mobile tower company Bharti Infratel has approached Vodafone and Idea Cellular to buy their mobile towers in seven out of 22 telecom circles in the country. Aurobindo Pharma's US subsidiary has emerged as the highest bidder for the acquisition of US-based nutritional supplement maker, Natrol Inc, and its other affiliate entities. Under the auction process, Aurobindo USA emerged as the highest bidder, with a bid of $132.5 million (approximately Rs 808 crore). Healthcare major Apollo Hospitals Enterprise reported 5.17 per cent rise in its standalone net profit at Rs 91.50 crore for the quarter ended September. Drug firm Abbott India posted 41 per cent rise in net profit to Rs 63.74 crore for the second quarter ended September 30, 2014-15. Bulk Deals Scrip Name Quantity (in lakhs) Fund Name Price KDDL +0.51 WOODLAND RETAILS PRIVATE LIMITED 199.43 EXCAST -0.41 PAYAL JAYESHBHAI MADIYAR 134.04 Key Corporate Action SCRIP NAME BC/RD BC/RD FROM EX-DATE PURPOSE AARTI INDUS RD 14-11-2014 13-11-2014 45% Interim Dividend APM INDUSTRI RD 14-11-2014 13-11-2014 50% Interim Dividend ATUL AUTO RD 14-11-2014 13-11-2014 50% Interim Dividend EXCEL INDUS RD 14-11-2014 13-11-2014 60% Interim Dividend MRF LTD RD 14-11-2014 13-11-2014 30% Second Interim dividend MARICO LTD RD 14-11-2014 13-11-2014 100% First Interim dividend NITIN FIRE RD 15-11-2014 13-11-2014 1:3 Bonus Issue NMDC LTD RD 14-11-2014 13-11-2014 300% Interim Dividend P I INDUS LTD RD 14-11-2014 13-11-2014 120% Interim Dividend SHRIRAM CITY RD 14-11-2014 13-11-2014 45% Interim Dividend SONATA SOFTWARE RD 14-11-2014 13-11-2014 100% Interim Dividend SUN TV RD 14-11-2014 13-11-2014 45% Interim Dividend WOCHARDT RD 15-11-2014 13-11-2014 400% Interim Dividend ZYLOG SYSTEM BC 17-11-2014 13-11-2014 AGM

- 3. Retail Research 3 Stock Ideas Nov 13, 2014 Update of Index Futures Date B/S Positional Call Entry at Sloss Targets Exit Price / CMP Exit Date % G/L Comments Time Horizon Avg. Entry Abs. Gain/Loss 05-Nov-14 B Nifty Nov Fut 8374.3 8335 8450 8335 07-Nov-14 -0.5 Stop Loss Triggered 3-5 Days 8374.3 -39.3 05-Nov-14 B Nifty Nov Fut 8382 8342 8460 8412.4 05-Nov-14 0.4 Premature Profit Booked 3-5 Days 8382 30.4 Update of Stock and Nifty Options Calls: Date B/S Positional Call Entry at Sloss Targets Exit Price / CMP Exit Date % G/L Comments Time Horizon Avg. Entry Abs. Gain/Loss 12-Nov-14 B ICICI Bank 1650 Put 12.3 7.5 25 13.15 6.9 Hold 2-3 days 12.3 0.9 10-Nov-14 B Bharti Airtel 400 Call Nov 8.50 5.5 16.0 5.5 11-Nov-14 -35.3 Stoploss Trig. 3-5 Days 8.50 -3.0 10-Nov-14 B Axis Bank 460 Put Nov 9.30 5.7 18.0 11.40 10-Nov-14 22.6 Premature Profit Booked 3-5 Days 9.30 2.1 10-Nov-14 B Century Textile 580 Put Nov 15.75 10.3 30.0 15.60 10-Nov-14 -1.0 Premature Exit 3-5 Days 15.75 -0.2 Update of Momentum / Intra Day/Futures Calls: Date B/S Positional Call Entry at Sloss Targets Exit Price / CMP Exit Date % G/L Comments Time Horizon Avg. Entry Abs. Gain/Loss 12-Nov-14 B Mastek 282 274.0 304.0 294.7 12-Nov-14 4.5 Premature Profit Booked 2-3 days 282.00 12.7 12-Nov-14 B Axis ENG 125 120.9 136.0 134.0 12-Nov-14 7.2 Premature Profit Booked 2-3 days 125.00 9.0 12-Nov-14 B J K Tyre 518 499.0 556.0 537.5 12-Nov-14 3.8 Premature Profit Booked 3-5 Days 518.00 19.5 12-Nov-14 B KITEX 546.00 525.0 575.0 560.0 12-Nov-14 2.6 Premature Profit Booked 3 - 7 Days 546.00 14.0 12-Nov-14 B Fin Cables 253 - 247 241.0 267.0 259.2 12-Nov-14 2.5 Premature Profit Booked 3 - 7 Days 253.00 6.2 12-Nov-14 B TNPL 148 142.7 160.0 147.0 -0.7 Hold 2-3 days 148.00 -1.0 12-Nov-14 B Enginers India 237.5 229.0 255.0 231.5 -2.5 Hold 3-5 Days 237.50 -6.0 12-Nov-14 B ALSTOM T&D 382.85-379 367.0 415.0 382.1 0.3 Hold 3-5 Days 380.93 1.1 11-Nov-14 B Syndicate Bank 127-129.1 124.0 139.0 131.7 12-Nov-14 2.0 Premature Profit Booked 1-5 days 129.10 2.6 11-Nov-14 B IIFL 176.10-173 170.5 188.0 180.5 12-Nov-14 2.5 Premature Profit Booked 3-5 Days 176.10 4.4 11-Nov-14 B MAX 407-402 392.0 440.0 433.8 12-Nov-14 6.6 Premature Profit Booked 3-5 Days 407.00 26.8 11-Nov-14 B Autoline 97.70 94.0 105.0 102.6 11-Nov-14 5.0 Premature Profit Booked 2-3 days 97.70 4.9 11-Nov-14 B GPPL 179.30 174.0 190.0 178.3 -0.6 Hold 2-3 days 179.30 -1.0 10-Nov-14 B Dishman 162.05 156.00 174.40 156.0 12-Nov-14 -3.7 Stop loss Triggered 2-3 days 162.05 -6.1 10-Nov-14 B Tata Power 92-93.1 90.00 100.00 92.2 12-Nov-14 -1.0 Exit 1-5 days 93.10 -0.9 07-Nov-14 B NRB Bearings 133, 138.3 129.50 150.00 142.0 12-Nov-14 2.7 Premature Profit Booked 2-3 days 138.30 3.7 07-Nov-14 B Graves Cotton 144.50 139.00 155.00 147.9 10-Nov-14 2.4 Premature Profit Booked 2-3 days 144.50 3.4 07-Nov-14 B Bajaj Ele 291.00 284.85 302.00 295.5 10-Nov-14 1.5 Premature Profit Booked 2-3 days 291.00 4.5 07-Nov-14 B TV Today 245.80 234.00 265.00 252.3 07-Nov-14 2.6 Premature Profit Booked 2-3 days 245.80 6.4 07-Nov-14 B ALHUCONS 158.20 152.50 173.00 153.5 07-Nov-14 -3.0 Exit 2-3 days 158.20 -4.7 07-Nov-14 B Geometric 137.00 132.0 144.0 133.4 -2.6 Hold 3 - 7 Days 137.00 -3.6 05-Nov-14 B Megh 28, 29.80 26.90 34.00 26.9 07-Nov-14 -6.9 Stop loss Triggered 2-3 days 28.90 -2.0 05-Nov-14 B Nocil 44, 47 43.00 53.00 48.5 07-Nov-14 3.2 Premature Profit Booked 47.00 1.5 05-Nov-14 B Arvind 304-306.8 298.0 325.0 312.0 07-Nov-14 2.1 Premature Profit Booked 1-5 days 305.40 6.6 05-Nov-14 B Walchandnagar Ind 146.00 141.0 160.0 154.0 07-Nov-14 5.5 Premature Profit Booked 3 - 7 Days 146.00 8.0 05-Nov-14 B Niit Ltd 51.75 49.00 58.00 53.8 05-Nov-14 4.0 Premature Profit Booked 2-3 days 51.75 2.1 05-Nov-14 B Nectar Life 38.85 37.25 44.00 41.8 05-Nov-14 7.6 Premature Profit Booked 2-3 days 38.85 3.0 05-Nov-14 B Dhampur Sugar 48.95 46.00 55.00 50.7 05-Nov-14 3.6 Premature Profit Booked 2-3 days 48.95 1.8 05-Nov-14 B HCL Infosys. 75.55 72.9 81.0 77.5 05-Nov-14 2.6 Premature Profit Booked 3-5 Days 75.55 2.0 03-Nov-14 B Ahmed Forge 408, 417.4 404.00 440.00 420.7 05-Nov-14 1.9 Premature Profit Booked 2-3 days 412.70 8.0 03-Nov-14 B Venus Rem 270.80 264.00 290.00 282.4 05-Nov-14 4.3 Premature Profit Booked 2-3 days 270.80 11.6 03-Nov-14 B PARSVNATH 21.00-20.70 20.0 23.0 21.9 05-Nov-14 4.0 Premature Profit Booked 3-5 Days 21.00 0.9 03-Nov-14 B Federal Mogul 325 - 315 308.0 360.0 344.0 05-Nov-14 5.8 Premature Profit Booked 3 - 7 Days 325.00 19.0 03-Nov-14 B NHPC 20.5-21.3 20.1 25.0 20.8 -2.3 Hold 1-5 days 21.30 -0.5 31-Oct-14 B MAGMA 121.8 115.0 132.0 115.0 10-Nov-14 -5.6 Stoploss Trig. 3-5 Days 121.80 -6.8 31-Oct-14 B Siemens 874 850.0 920.0 887.9 07-Nov-14 1.6 Premature Profit Booked 1-5 days 874.00 13.9 31-Oct-14 B Kotak Bank 1110 - 1094 1070.0 1200.0 1131.8 05-Nov-14 2.0 Premature Profit Booked 3 - 7 Days 1,110.0 21.8 29-Oct-14 S COLPAL Nov Fut 1701.3 1752.0 1610.0 1752.0 05-Nov-14 -2.9 Stoploss Triggered 5-7 Days 1701.30 -50.7 Update of Positional Calls: Date B/S Positional Call Entry at Sloss Targets Exit Price / CMP Exit Date % G/L Comments Time Horizon Avg. Entry Abs. Gain/Loss 12-Nov-14 B Cox & Kings 306-314.5 301.0 350.0 309.9 -1.5 Hold 5-10 days 314.50 -4.6 11-Nov-14 B Electrosteel Cast 20.55 19.5 23.0 22.0 12-Nov-14 7.1 Premature Profit Booked 3-14 days 20.55 1.5 11-Nov-14 B Astec 104, 109.4 101.5 124.0 110.9 1.4 Hold 5-7 days 109.40 1.5 10-Nov-14 B BEML 670-707 660.0 850.0 745.0 10-Nov-14 5.4 Premature Profit Booked 5-10 days 707.00 38.0 10-Nov-14 B Zuari Global 98, 103 94.9 114.0 98.4 -4.5 Hold 5-7 days 103.00 -4.6 07-Nov-14 B Crisil 1850-1890 1800.0 2200.0 1941.4 12-Nov-14 2.7 Premature Profit Booked 5-10 days 1,890.0 51.4 07-Nov-14 B KSK 77.5 - 74.5 72.5 85.0 75.0 -1.3 Hold 3-14 days 76.00 -1.0 05-Nov-14 B Vijaya Bank 49.30-48.25 47.5 54.0 51.40 12-Nov-14 4.5 Premature Profit Booked 5-7 Days 49.2 2.2 05-Nov-14 B Fin Pipe 334-338 318.0 380.0 327.70 11-Nov-14 -2.5 Premature Exit 5-10 days 336.0 -8.3

- 4. 05-Nov-14 B Zee Learn 35, 36.3 34.5 42.0 34.5 10-Nov-14 -3.2 Hold 5-7 days 35.65 -1.2 05-Nov-14 B Amtek Auto 176 - 171 163.0 190.0 166.5 07-Nov-14 -4.0 Premature Exit 3-14 days 173.50 -7.0 03-Nov-14 B SPIC 25.90 24.5 28.0 27.2 05-Nov-14 4.8 Premature Profit Booked 3-14 days 25.90 1.3 31-Oct-14 B Graphite 90, 94.7 87.9 105.0 87.9 10-Nov-14 -4.8 Stop loss Triggered 5-7 days 92.35 -4.4 31-Oct-14 B BGR Energy 161-166.9 155.0 200.0 166.90 0.0 Hold 5-10 days 166.9 0.0 29-Oct-14 B PFC 285.15-282 274.0 305.0 274.0 10-Nov-14 -3.4 Stoploss Trig. 3-5 Days 283.6 -9.6 27-Oct-14 B Fortis 120.60 116.0 135.0 121.4 07-Nov-14 0.6 Premature Profit Booked 5-10 days 120.60 0.8 22-Oct-14 B ABIRLANUVO 1685.00 1609.0 1810.0 1755.0 10-Nov-14 4.2 Premature Profit Booked 3-5 Days 1685.00 70.0 Retail Research 4 HDFC securities Limited, I Think Techno Campus, Building –B, ”Alpha”, Office Floor 8, Near Kanjurmarg Station, Opp. Crompton Greaves, Kanjurmarg (East), Mumbai 400 042 Fax: (022) 30753435 Disclaimer: This document has been prepared by HDFC securities Limited and is meant for sole use by the recipient and not for circulation. This document is not to be reported or copied or made available to others. It should not be considered to be taken as an offer to sell or a solicitation to buy any security. The information contained herein is from sources believed reliable. We do not represent that it is accurate or complete and it should not be relied upon as such. We may have from time to time positions or options on, and buy and sell securities referred to herein. We may from time to time solicit from, or perform investment banking, or other services for, any company mentioned in this document. This report is intended for Retail Clients only and not for any other category of clients, including, but not limited to, Institutional Clients This report has been prepared by the Retail Research team of HDFC Securities Ltd. The views, opinions, estimates, ratings, target price, entry prices and/or other parameters mentioned in this document may or may not match or may be contrary with those of the other Research teams (Institutional, PCG) of HDFC Securities Ltd.