Analysis Coversheet Final

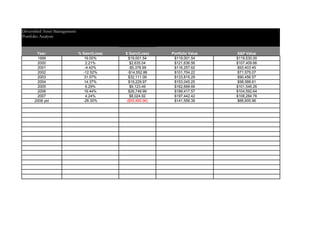

- 1. Diversified Asset Management Portfolio Analysis Year: % Gain/(Loss) $ Gain/(Loss) Portfolio Value S&P Value 1999 19.00% $19,001.54 $119,001.54 $119,530.00 2000 2.21% $2,635.04 $121,636.56 $107,409.66 2001 -4.42% -$5,378.99 $116,257.62 $93,403.45 2002 -12.52% -$14,552.86 $101,704.22 $71,575.07 2003 31.57% $32,111.09 $133,815.29 $90,456.57 2004 14.37% $19,229.97 $153,045.25 $98,588.61 2005 6.29% $9,123.49 $162,668.69 $101,546.26 2006 16.44% $26,748.99 $189,417.57 $104,592.64 2007 4.24% $8,024.92 $197,442.42 $108,284.76 -28.30% ($55,885.96) $141,556.39 $66,605.96 2008 ytd $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00

- 2. Diversified Asset Management Portfolio Analysis % Diff. Portfolio S&P 500 Portfolio vs. 2006 11.06% 8.03% 3.03% Year: % Gain / Loss: % Gain / Loss: S&P 500 Asset Name: Initial Value % Gain/(Loss) $ Gain/(Loss) EOY Value SPY $100.00 8.99% $8.99 $108.99 MUNT $100.00 10.00% $10.00 $110.00 PTM $100.00 -10.00% -$10.00 $90.00 IWN $599.00 20.00% $119.80 $718.80 Q $100.00 2.00% $2.00 $102.00 RECT $100.00 1.00% $1.00 $101.00 MDY $100.00 2.00% $2.00 $102.00 IWO $100.00 10.00% $10.00 $110.00 IFU $100.00 10.00% $10.00 $110.00 KWJ $100.00 12.00% $12.00 $112.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 Totals: $1,499.00 11.06% $165.79 $1,664.79

- 3. Diversified Asset Management Portfolio Analysis % Diff. Portfolio S&P 500 Portfolio vs. 2005 10.82% 8.03% 2.79% Year: % Gain / Loss: % Gain / Loss: S&P 500 Asset Name: Initial Value % Gain/(Loss) $ Gain/(Loss) EOY Value SPY $100.00 8.99% $8.99 $108.99 MUNT $100.00 10.00% $10.00 $110.00 PTM $100.00 -10.00% -$10.00 $90.00 IWN $599.00 20.00% $119.80 $718.80 Q $100.00 2.00% $2.00 $102.00 RECT $100.00 1.00% $1.00 $101.00 MDY $100.00 2.00% $2.00 $102.00 IWO $100.00 4.00% $4.00 $104.00 IFU $100.00 10.00% $10.00 $110.00 KWJ $100.00 12.00% $12.00 $112.00 $200.00 12.00% $24.00 $224.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 Totals: $1,699.00 10.82% $183.79 $1,882.79

- 4. Diversified Asset Management Portfolio Analysis % Diff. Portfolio S&P 500 Portfolio vs. 2004 10.66% 8.03% 2.63% Year: % Gain / Loss: % Gain / Loss: S&P 500 Asset Name: Initial Value % Gain/(Loss) $ Gain/(Loss) EOY Value SPY $100.00 8.99% $8.99 $108.99 MUNT $100.00 10.00% $10.00 $110.00 PTM $100.00 -10.00% -$10.00 $90.00 IWN $599.00 20.00% $119.80 $718.80 Q $100.00 2.00% $2.00 $102.00 RECT $100.00 1.00% $1.00 $101.00 MDY $100.00 2.00% $2.00 $102.00 IWO $100.00 4.00% $4.00 $104.00 IFU $100.00 10.00% $10.00 $110.00 KWJ $100.00 12.00% $12.00 $112.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 Totals: $1,499.00 10.66% $159.79 $1,658.79

- 5. Diversified Asset Management Portfolio Analysis % Diff. Portfolio S&P 500 Portfolio vs. 2003 10.66% 8.03% 2.63% Year: % Gain / Loss: % Gain / Loss: S&P 500 Asset Name: Initial Value % Gain/(Loss) $ Gain/(Loss) EOY Value SPY $100.00 8.99% $8.99 $108.99 MUNT $100.00 10.00% $10.00 $110.00 PTM $100.00 -10.00% -$10.00 $90.00 IWN $599.00 20.00% $119.80 $718.80 Q $100.00 2.00% $2.00 $102.00 RECT $100.00 1.00% $1.00 $101.00 MDY $100.00 2.00% $2.00 $102.00 IWO $100.00 4.00% $4.00 $104.00 IFU $100.00 10.00% $10.00 $110.00 KWJ $100.00 12.00% $12.00 $112.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 Totals: $1,499.00 10.66% $159.79 $1,658.79

- 6. Diversified Asset Management Portfolio Analysis % Diff. Portfolio S&P 500 Portfolio vs. 2002 10.66% 8.03% 2.63% Year: % Gain / Loss: % Gain / Loss: S&P 500 Asset Name: Initial Value % Gain/(Loss) $ Gain/(Loss) EOY Value SPY $100.00 8.99% $8.99 $108.99 MUNT $100.00 10.00% $10.00 $110.00 PTM $100.00 -10.00% -$10.00 $90.00 IWN $599.00 20.00% $119.80 $718.80 Q $100.00 2.00% $2.00 $102.00 RECT $100.00 1.00% $1.00 $101.00 MDY $100.00 2.00% $2.00 $102.00 IWO $100.00 4.00% $4.00 $104.00 IFU $100.00 10.00% $10.00 $110.00 KWJ $100.00 12.00% $12.00 $112.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 Totals: $1,499.00 10.66% $159.79 $1,658.79

- 7. Diversified Asset Management Portfolio Analysis % Diff. Portfolio S&P 500 Portfolio vs. 2001 10.66% 8.03% 2.63% Year: % Gain / Loss: % Gain / Loss: S&P 500 Asset Name: Initial Value % Gain/(Loss) $ Gain/(Loss) EOY Value SPY $100.00 8.99% $8.99 $108.99 MUNT $100.00 10.00% $10.00 $110.00 PTM $100.00 -10.00% -$10.00 $90.00 IWN $599.00 20.00% $119.80 $718.80 Q $100.00 2.00% $2.00 $102.00 RECT $100.00 1.00% $1.00 $101.00 MDY $100.00 2.00% $2.00 $102.00 IWO $100.00 4.00% $4.00 $104.00 IFU $100.00 10.00% $10.00 $110.00 KWJ $100.00 12.00% $12.00 $112.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 Totals: $1,499.00 10.66% $159.79 $1,658.79

- 8. Diversified Asset Management Portfolio Analysis % Diff. Portfolio S&P 500 Portfolio vs. 2000 10.66% 8.03% 2.63% Year: % Gain / Loss: % Gain / Loss: S&P 500 Asset Name: Initial Value % Gain/(Loss) $ Gain/(Loss) EOY Value SPY $100.00 8.99% $8.99 $108.99 MUNT $100.00 10.00% $10.00 $110.00 PTM $100.00 -10.00% -$10.00 $90.00 IWN $599.00 20.00% $119.80 $718.80 Q $100.00 2.00% $2.00 $102.00 RECT $100.00 1.00% $1.00 $101.00 MDY $100.00 2.00% $2.00 $102.00 IWO $100.00 4.00% $4.00 $104.00 IFU $100.00 10.00% $10.00 $110.00 KWJ $100.00 12.00% $12.00 $112.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 Totals: $1,499.00 10.66% $159.79 $1,658.79

- 9. Diversified Asset Management Portfolio Analysis % Diff. Portfolio S&P 500 Portfolio vs. 1999 10.66% 8.03% 2.63% Year: % Gain / Loss: % Gain / Loss: S&P 500 Asset Name: Initial Value % Gain/(Loss) $ Gain/(Loss) EOY Value SPY $100.00 8.99% $8.99 $108.99 MUNT $100.00 10.00% $10.00 $110.00 PTM $100.00 -10.00% -$10.00 $90.00 IWN $599.00 20.00% $119.80 $718.80 Q $100.00 2.00% $2.00 $102.00 RECT $100.00 1.00% $1.00 $101.00 MDY $100.00 2.00% $2.00 $102.00 IWO $100.00 4.00% $4.00 $104.00 IFU $100.00 10.00% $10.00 $110.00 KWJ $100.00 12.00% $12.00 $112.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 Totals: $1,499.00 10.66% $159.79 $1,658.79

- 10. Diversified Asset Management Portfolio Analysis % Diff. Portfolio S&P 500 Portfolio vs. 1998 10.66% 8.03% 2.63% Year: % Gain / Loss: % Gain / Loss: S&P 500 Asset Name: Initial Value % Gain/(Loss) $ Gain/(Loss) EOY Value SPY $100.00 8.99% $8.99 $108.99 MUNT $100.00 10.00% $10.00 $110.00 PTM $100.00 -10.00% -$10.00 $90.00 IWN $599.00 20.00% $119.80 $718.80 Q $100.00 2.00% $2.00 $102.00 RECT $100.00 1.00% $1.00 $101.00 MDY $100.00 2.00% $2.00 $102.00 IWO $100.00 4.00% $4.00 $104.00 IFU $100.00 10.00% $10.00 $110.00 KWJ $100.00 12.00% $12.00 $112.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 Totals: $1,499.00 10.66% $159.79 $1,658.79

- 11. Diversified Asset Management Portfolio Analysis % Diff. Portfolio S&P 500 Portfolio vs. 1997 10.66% 8.00% 2.66% Year: % Gain / Loss: % Gain / Loss: S&P 500 Asset Name: Initial Value % Gain/(Loss) $ Gain/(Loss) EOY Value SPY $100.00 8.99% $8.99 $108.99 MUNT $100.00 10.00% $10.00 $110.00 PTM $100.00 -10.00% -$10.00 $90.00 IWN $599.00 20.00% $119.80 $718.80 Q $100.00 2.00% $2.00 $102.00 RECT $100.00 1.00% $1.00 $101.00 MDY $100.00 2.00% $2.00 $102.00 IWO $100.00 4.00% $4.00 $104.00 IFU $100.00 10.00% $10.00 $110.00 KWJ $100.00 12.00% $12.00 $112.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 Totals: $1,499.00 10.66% $159.79 $1,658.79

- 12. Diversified Asset Management Portfolio Analysis % Diff. Portfolio S&P 500 Portfolio vs. 1996 10.66% 8.03% 2.63% Year: % Gain / Loss: % Gain / Loss: S&P 500 Asset Name: Initial Value % Gain/(Loss) $ Gain/(Loss) EOY Value SPY $100.00 8.99% $8.99 $108.99 MUNT $100.00 10.00% $10.00 $110.00 PTM $100.00 -10.00% -$10.00 $90.00 IWN $599.00 20.00% $119.80 $718.80 Q $100.00 2.00% $2.00 $102.00 RECT $100.00 1.00% $1.00 $101.00 MDY $100.00 2.00% $2.00 $102.00 IWO $100.00 4.00% $4.00 $104.00 IFU $100.00 10.00% $10.00 $110.00 KWJ $100.00 12.00% $12.00 $112.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 0.00% $0.00 $0.00 Totals: $1,499.00 10.66% $159.79 $1,658.79