CV-KRS Apr15

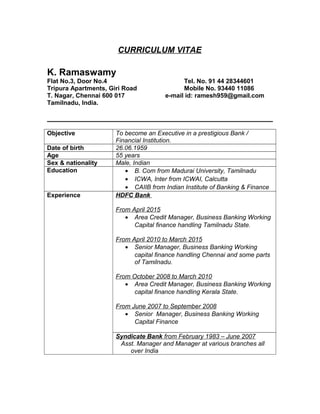

- 1. CURRICULUM VITAE K. Ramaswamy Flat No.3, Door No.4 Tel. No. 91 44 28344601 Tripura Apartments, Giri Road Mobile No. 93440 11086 T. Nagar, Chennai 600 017 e-mail id: ramesh959@gmail.com Tamilnadu, India. Objective To become an Executive in a prestigious Bank / Financial Institution. Date of birth 26.06.1959 Age 55 years Sex & nationality Male, Indian Education • B. Com from Madurai University, Tamilnadu • ICWA, Inter from ICWAI, Calcutta • CAIIB from Indian Institute of Banking & Finance Experience HDFC Bank From April 2015 • Area Credit Manager, Business Banking Working Capital finance handling Tamilnadu State. From April 2010 to March 2015 • Senior Manager, Business Banking Working capital finance handling Chennai and some parts of Tamilnadu. From October 2008 to March 2010 • Area Credit Manager, Business Banking Working capital finance handling Kerala State. From June 2007 to September 2008 • Senior Manager, Business Banking Working Capital Finance Syndicate Bank from February 1983 – June 2007 Asst. Manager and Manager at various branches all over India

- 2. BHEL, Hyderabad from November 1982 to February 1983 Accounts Trainee Present CTC Rs. 12 lakhs per annum Work Knowledge As per Annexure Computer literacy Proficient in using MS Word and MS Excel. Languages known Tamil, English and Hindi. Other Interests Yoga, Philately, Numismatics and Cricket. Joining time required 3 months (K. Ramaswamy) A N N E X U R E WORK KNOWLEDGE AND EXPERIENCE Present Employer : HDFC BANK LTD Position Held : AREA CREDIT MANAGER (Business Banking) From : 1st April 2015 Present Job Profile: As supervisor with 5 reportees under me, am handling the entire Business banking (working capital) portfolio upto exposure of Rs. 5 crores all over Tamilnadu. Includes interaction with various business verticals such as Branch banking, Operations, Sales team, Audit team, HR and other verticals required for regulatory purposes. Responsible for growth of credit portfolio – quantity as well as quality-wise across Tamilnadu. Keeping abreast of all industry trends to ensure stability and feasibility of credit portfolio. Undertaking extensive tour all over Tamilnadu by meeting high value clients and keeping the interaction with Branch Managers and Credit Managers in order to maintain faster decision making and ensure quality of credit proposals. Monitoring TAT of various vendors like CPAs, panel lawyers and valuers and ensuring seamless delivery of decisions on credit proposals. I joined Centurion Bank of Punjab in June 2007 as Credit Manager and was handling SME (Small and Medium Enterprises) advances. Centurion Bank was 2

- 3. merged with HDFC Bank in April 2008 and I was posted as Area Credit Manager at Cochin. There I was in charge of the entire Kerala working capital portfolio with 5 reportees under me. Job Profile of Credit Manager: As Credit Manager, I appraised credit proposals of SME clients whose annual turnover is from Rs. 1 crore to Rs. 200 crores. I also have delegated approval powers for sanctioning loans upto Rs. 2.00 crores. • Includes analysis of financials, assessment of working capital / term loan / mortgage loan needs and recommending to higher authorities for approvals. • Have processed more than 500 proposals of various exposures ranging from Rs. 5 lacs to Rs. 5 crores with a TAT of 0 to 7 days. • Have exposure in various types of industries such as textiles, foundries, iron & steel, chemicals, machinery manufacturers, wholesale and retail merchants, leather, contractors, FMCG, Software industries etc. • Post-sanction monitoring of credit disbursed. • Ensuring timely stock audits and following up any discrepancies and getting them rectified. • Conversant with LC and Bank Guarantee issues, LC Bill discounting etc. SYNDICATE BANK – FROM FEBRUARY 1983 TO JUNE 2007 From June 2002 to June 2007 - Regional Office, Coimbatore Worked as Group Head (Credit) for 28 branches of the Region spanning from Coimbatore District to Kanyakumari District. Have taken up and processed many high value projects of textile mills, knit wear companies, windmill installations etc pertaining to branches at Tirupur, Dindigul, Salem and Rajapalayam. Appraising high value credit - fund based and non-fund based - is my forte. Job profile included processing and recommending of credit proposals of more than Rs.3.00 crores to our Corporate Office for sanction. Apart from processing of credit proposals beyond Branch sanctioning powers, my responsibilities include taking note of credit sanctions of Rs.2.00 lacs and above made by Branch Managers. This is done after thorough verification of the processing done by the Branch Managers and confirming whether it is in compliance to the credit policies of the Bank. The job also involves taking part in fixing of credit targets to branches, preparation of statistical data pertaining to credit, follow up of stressed assets and clarifying matters regarding credit to all the branches. Follow up of credit 3

- 4. includes verification of stock statements, maintenance of insurance register, QIS statements etc. From 1997 to 2002 – Ahmedabad, Gujarat Worked as Manager (Credit) in two branches, Paldi and Navrangpura. Was in charge of entire Credit Department functions in both the above branches. Have processed and handled high value proposals of several major manufacturing and trading concerns. Was thoroughly exposed to various credit matters regarding pre-sanction appraisal and post-sanction follow up. From 1994 to 1997 – Madurai, Tamilnadu As Asst. Manager, I was looking after the operations side of banking which includes opening of all types of Deposit Accounts, precautions to be taken while issuing receipts, KYC norms, TDS formalities, NRE/FCNR accounts etc. Worked for a brief period in credit and recovery department. Was in charge of all internal control matters of the branch. From 1987 to 1994 – Tiruchirapalli, Tamilnadu Was in charge of Credit Department in Tiruchirapalli Main branch apart from working in the operations side like deposits, daybook, Accounts too. Had a thorough exposure to lending under various Government sponsored schemes. Completed my rural posting at Amoor branch (Trichy Dist.) where I was the lone Officer handling the entire operations, credit and internal control. From 1983 to 1987 – Meerut, Uttar Pradesh Joined as a direct recruit of 1983 batch as a Probationary Officer in the Bank. Worked as Asst. Manager looking after the whole of deposits section and the other routine operations of the branch. AREAS OF EXPOSURE Credit Analyzing the proposals by applying various parameters to ascertain the quality of proposals, Balance Sheet Analysis, Financial Ratio analysis, Sensitivity Analysis, Pre-sanction appraisal, Post-sanction follow-up, preparing CMA data, arriving at the Term Loan/Working Capital components based on different 4

- 5. methods of lending, issue of Bank Guarantees and LCs, formalities to be complied with for different type of loans are my key areas of functioning. Quite conversant with Consortium lending, Syndication, verification of stock in respect of stocks hypothecated to us, fixing D.P, matters to be taken up with Registrar of Companies with regard to charge creation etc., Operations Quite conversant with the formalities relating to operational side of the banking operations which includes opening of all types of Deposit Accounts, precautions to be taken while issuing receipts, KYC norms, TDS formalities, NRE/FCNR accounts etc. Foreign Exchange In the field of Foreign Exchange, I have a good exposure in the following departments: a) Remittances both inward and outward b) Sending the bills for export and import bills for collection. c) Opening of Import LC d) Negotiation / Discounting of bills. IMPORTANT TRAINING PROGRAMMES ATTENDED: • Training on Trade Finance and Foreign Exchange regulations. • Workshop on Risk Management – Basel II norms • Risk Assessment Model of CRISIL • Training for Core Credit Officers handling high value proposals. • External training on Foreign Exchange conducted by Reserve Bank of India. • On-the-job FX training at Surat Main branch of Syndicate Bank. * * * * * * * * * * 5

- 6. methods of lending, issue of Bank Guarantees and LCs, formalities to be complied with for different type of loans are my key areas of functioning. Quite conversant with Consortium lending, Syndication, verification of stock in respect of stocks hypothecated to us, fixing D.P, matters to be taken up with Registrar of Companies with regard to charge creation etc., Operations Quite conversant with the formalities relating to operational side of the banking operations which includes opening of all types of Deposit Accounts, precautions to be taken while issuing receipts, KYC norms, TDS formalities, NRE/FCNR accounts etc. Foreign Exchange In the field of Foreign Exchange, I have a good exposure in the following departments: a) Remittances both inward and outward b) Sending the bills for export and import bills for collection. c) Opening of Import LC d) Negotiation / Discounting of bills. IMPORTANT TRAINING PROGRAMMES ATTENDED: • Training on Trade Finance and Foreign Exchange regulations. • Workshop on Risk Management – Basel II norms • Risk Assessment Model of CRISIL • Training for Core Credit Officers handling high value proposals. • External training on Foreign Exchange conducted by Reserve Bank of India. • On-the-job FX training at Surat Main branch of Syndicate Bank. * * * * * * * * * * 5