Ifm forex markets-01[1].03.07

•Télécharger en tant que PPT, PDF•

1 j'aime•1,365 vues

Signaler

Partager

Signaler

Partager

Contenu connexe

Tendances

Tendances (17)

Interest Rate Swaps, Currency Swaps & Equity Swaps

Interest Rate Swaps, Currency Swaps & Equity Swaps

IBUS2301 - Tutorial #7 - Chapters 10 and 11 - Foreign Exchange (FX) Market

IBUS2301 - Tutorial #7 - Chapters 10 and 11 - Foreign Exchange (FX) Market

Ter beke financial statistics (Euronext company) ppt

Ter beke financial statistics (Euronext company) ppt

Chevron Corp_Stock Information_Dividend Information

Chevron Corp_Stock Information_Dividend Information

Similaire à Ifm forex markets-01[1].03.07

Similaire à Ifm forex markets-01[1].03.07 (20)

Econ315 Money and Banking: Learning Unit #09: Interest Rate

Econ315 Money and Banking: Learning Unit #09: Interest Rate

Plus de Kapil Chhabra

Plus de Kapil Chhabra (20)

Ifm forex markets-01[1].03.07

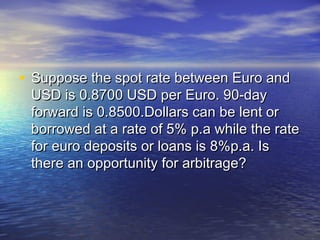

- 1. • Suppose the spot rate between Euro and USD is 0.8700 USD per Euro. 90-day forward is 0.8500.Dollars can be lent or borrowed at a rate of 5% p.a while the rate for euro deposits or loans is 8%p.a. Is there an opportunity for arbitrage?

- 2. Covered Interest Arbitrage • Borrow 100 Euros @ 8%p.a • Convert into USD spot 100x0.87 =$87 • Deposit $87 for 90 days @ 5%p.a = $88.0875 • Convert it to Euro forward =88.0875/.85=103.63 • Repay Euro loan = 102.00 • Arbitrage profit = 1.63

- 3. • Consider the following data: • Gbp/usd: 1.7500/10 • 3 month forward: 1.7380/1.7400 • 3-month eurodollar:8.00/8.20% p.a • 3-month euro sterling: 10.50/11.005 p.a • Check whether there is a covered interest arbitrage.

- 4. • Borrow $1for 3 months at 8.20% p.a., convert to • GBP(1/1.7510) = GBP 0.5711, invest GBP at 10.50% p.a. for three months; maturity value GBP 0.5711[1+(0.1050/4)] = GBP 0.5861, which sold forward at 1.7380 yields $1.0186. Repayment of dollar loan requires $1.0205 = 1+(0.0820/4). Net loss. • Borrow GBP 1 at 11%; convert spot to $1.7500; invest at 8.0% p.a.; maturity value of deposit 1.75(1.02) = $1.7850; sold forward at $1.7400 per GBP yield GBP(1.7850/1.7400) = GBP 1.0259; repayment of GBP loan requires GBP [1+(0.11/4)] = GBP 1.0275. Again net loss. • Hence no covered interest arbitrage opportunity.