Randomness of returns_historical_asset_class_ranking_2014 skittles

•

1 j'aime•1,811 vues

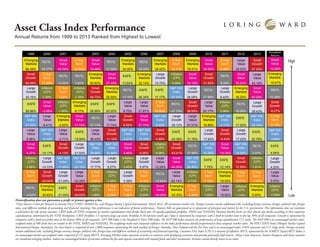

The Need for Diversification (“Skittles Chart”) Asset Class Index Performance The “Skittles Chart” is a great way to show investors the randomness of investment returns from one year to the next, reinforcing the potential benefits of Asset Class Investing as an alternative to active management.

Signaler

Partager

Signaler

Partager

Télécharger pour lire hors ligne

Recommandé

Recommandé

Contenu connexe

Tendances

Tendances (20)

Presentacion gestor BMO Global AM: Funds Experience 2016

Presentacion gestor BMO Global AM: Funds Experience 2016

2020 Investment Outlook: Risks and Opportunities for Investors in Global Markets

2020 Investment Outlook: Risks and Opportunities for Investors in Global Markets

Griffon quarterly report - capital markets update September 2017

Griffon quarterly report - capital markets update September 2017

Netwealth portfolio construction series - Why investing in commercial propert...

Netwealth portfolio construction series - Why investing in commercial propert...

December 13 quarterly: Is this too good to be true?

December 13 quarterly: Is this too good to be true?

Similaire à Randomness of returns_historical_asset_class_ranking_2014 skittles

Similaire à Randomness of returns_historical_asset_class_ranking_2014 skittles (20)

Plus de Better Financial Education

A practical method for advisers to measure exposure to sequence risk is through evaluation of the current probability of failure rate (which I've later renames as iteration failure rate to reflect measurement of the Monte Carlo simulation rather than the plan itself - two different things). This paper lead to a deeper investigation of failure rates thus leading to two subsequent papers discovering the three-dimensional nature of simulations over various time periods and allocations, as well as application of longevity to the simulation modeling.The Dynamic Implications of Sequence Risk on a Distribution Portfolio Journal...

The Dynamic Implications of Sequence Risk on a Distribution Portfolio Journal...Better Financial Education

This first appeared in blog post that describes the graphs in more details

https://blog.betterfinancialeducation.com/sustainable-retirement/what-are-the-three-paradigms-of-retirement-planning/

Prototype software example of aging model incorporating both portfolio and longevity percentile statistics along with consumer spending trend line of “Real People” (which is not based here on spending percentile statistics, but on research averages). Starting balance $500,000 with $36,000 Social Security. Two simple graphs by age answer many retiree questions about potential future spending and balances. Creates a whole different discussion. Also illustrates why age 95 is a poor reference for planning since it doesn’t plan or consider aging into future ages from the beginning of retirement.Prototype software example of aging model incorporating both portfolio and lo...

Prototype software example of aging model incorporating both portfolio and lo...Better Financial Education

Have you ever wondered who is buying if so many people are selling?

The notion that sellers can outnumber buyers on

down days doesn’t make sense. What the newscasters should say, of course, is that prices adjusted lower because would-be buyers weren’t prepared to pay

the former price.

What happens in such a case is either the would-be sellers sit on their shares or prices quickly adjust to the point where supply and demand come into balance and transactions occur at a price that both buyers

and sellers find mutually beneficial. Economists refer

to this as equilibrium. A question of equilibrium - can there be more buyers than sellers? Or more se...

A question of equilibrium - can there be more buyers than sellers? Or more se...Better Financial Education

Plus de Better Financial Education (20)

The Dynamic Implications of Sequence Risk on a Distribution Portfolio Journal...

The Dynamic Implications of Sequence Risk on a Distribution Portfolio Journal...

the-rewarding-distribution-of-us-stock-market-returns.pdf

the-rewarding-distribution-of-us-stock-market-returns.pdf

Prototype software example of aging model incorporating both portfolio and lo...

Prototype software example of aging model incorporating both portfolio and lo...

A question of equilibrium - can there be more buyers than sellers? Or more se...

A question of equilibrium - can there be more buyers than sellers? Or more se...

Dernier

VIP Independent Call Girls in Andheri 🌹 9920725232 ( Call Me ) Mumbai Escorts * Ruhi Singh *

FOR BOOKING ★ A-Level (5-star Escort) (Akanksha): ☎️ +91-9920725232

AVAILABLE FOR COMPLETE ENJOYMENT WITH HIGH PROFILE INDIAN MODEL AVAILABLE HOTEL & HOME

Visit Our Site For More Pleasure in your City 👉 ☎️ +91-9920725232 👈

★ SAFE AND SECURE HIGH-CLASS SERVICE AFFORDABLE RATE

★

SATISFACTION, UNLIMITED ENJOYMENT.

★ All Meetings are confidential and no information is provided to any one at any cost.

★ EXCLUSIVE PROFILes Are Safe and Consensual with Most Limits Respected

★ Service Available In: - HOME & HOTEL Star Hotel Service. In Call & Out call

SeRvIcEs :

★ A-Level (star escort)

★ Strip-tease

★ BBBJ (Bareback Blowjob) Receive advanced sexual techniques in different mode make their life more pleasurable.

★ Spending time in hotel rooms

★ BJ (Blowjob Without a Condom)

★ Completion (Oral to completion)

★ Covered (Covered blowjob Without condom

★ANAL SERVICES.

Contact me

TELEPHONE

WHATSAPP

Looking for Enjoy all Day(Akanksha) : ☎️ +91-9920725232

Mumbai, Andheri, Navi Mumbai, Thane, Mumbai Airport, Mumbai Central, South Mumbai, Juhu, Bandra, Colaba, Nariman point, Malad, Powai, Mira Road, Dahisar, Mira Bhayandar, Worli, Santacruz, Vile Parle, Lower Parel, Chembur, Dadar, Ghatkopar, Kurla, Mulund, Goregaon, Kandivali, Borivali, Jogeshwari, Kalyan, Vashi , Nerul, Panvel, Dombivli, Lokhandwala, Four Bungalows, Versova, NRI Complex, Kharghar, Belapur, Taloja, Marine Drive, Hiranandani Gardens, Churchgate, Marine lines, Oshiwara, DN Nagar, Jb Nagar, Marol Naka, Saki Naka, Andheri East, Andheri West, Bandra West, Bandra East , Thane West, Ghodbundar Road,

There is a lot of talk about it in the media and news, so you might be wondering if this particular service is really worth the effort. A call girl service is exactly what it sounds like – a service where a woman offers sexual services over the phone. This type of service has been around for a long time and has become increasingly popular over the years. In most cases, call girl services are legal and regulated in many countries. There are a few things to keep in mind when considering the choice of whether to use a call girl service. First and foremost, make sure that you are comfortable with the particular person you are using the service from. Second, research accordingly before choosing a call girl. Don't just go with the first provider that comes up in your search; get opinions from others as well. Finally, be sure to have fun while using a call girl service; it's not just about sex. S040524N

★OUR BEST SERVICES: - FOR BOOKING ★ A-Level (5-star escort) ★ Strip-tease ★ BBBJ (Bareback Blowjob) ★ Spending time in my rooms ★ BJ (Blowjob Without a Condom) ★ COF (Come on Face) ★ Completion ★ (Oral to completion) noncovered ★ Special Massage ★ O-Level (Oral) ★ Blow Job; ★ Oral fun uncovered) ★ COB (Come on Body) ★. Extra ball (Have ride many times) ☛ ☛ ☛ ✔✔ secure✔✔ 100% safe WHATSAPP CALL ME +91-9920725232

VIP Independent Call Girls in Andheri 🌹 9920725232 ( Call Me ) Mumbai Escorts...

VIP Independent Call Girls in Andheri 🌹 9920725232 ( Call Me ) Mumbai Escorts...dipikadinghjn ( Why You Choose Us? ) Escorts

VIP Independent Call Girls in Bandra West 🌹 9920725232 ( Call Me ) Mumbai Escorts * Ruhi Singh *

FOR BOOKING ★ A-Level (5-star Escort) (Akanksha): ☎️ +91-9920725232

AVAILABLE FOR COMPLETE ENJOYMENT WITH HIGH PROFILE INDIAN MODEL AVAILABLE HOTEL & HOME

Visit Our Site For More Pleasure in your City 👉 ☎️ +91-9920725232 👈

★ SAFE AND SECURE HIGH-CLASS SERVICE AFFORDABLE RATE

★

SATISFACTION, UNLIMITED ENJOYMENT.

★ All Meetings are confidential and no information is provided to any one at any cost.

★ EXCLUSIVE PROFILes Are Safe and Consensual with Most Limits Respected

★ Service Available In: - HOME & HOTEL Star Hotel Service. In Call & Out call

SeRvIcEs :

★ A-Level (star escort)

★ Strip-tease

★ BBBJ (Bareback Blowjob) Receive advanced sexual techniques in different mode make their life more pleasurable.

★ Spending time in hotel rooms

★ BJ (Blowjob Without a Condom)

★ Completion (Oral to completion)

★ Covered (Covered blowjob Without condom

★ANAL SERVICES.

Contact me

TELEPHONE

WHATSAPP

Looking for Enjoy all Day(Akanksha) : ☎️ +91-9920725232

Mumbai, Andheri, Navi Mumbai, Thane, Mumbai Airport, Mumbai Central, South Mumbai, Juhu, Bandra, Colaba, Nariman point, Malad, Powai, Mira Road, Dahisar, Mira Bhayandar, Worli, Santacruz, Vile Parle, Lower Parel, Chembur, Dadar, Ghatkopar, Kurla, Mulund, Goregaon, Kandivali, Borivali, Jogeshwari, Kalyan, Vashi , Nerul, Panvel, Dombivli, Lokhandwala, Four Bungalows, Versova, NRI Complex, Kharghar, Belapur, Taloja, Marine Drive, Hiranandani Gardens, Churchgate, Marine lines, Oshiwara, DN Nagar, Jb Nagar, Marol Naka, Saki Naka, Andheri East, Andheri West, Bandra West, Bandra East , Thane West, Ghodbundar Road,

There is a lot of talk about it in the media and news, so you might be wondering if this particular service is really worth the effort. A call girl service is exactly what it sounds like – a service where a woman offers sexual services over the phone. This type of service has been around for a long time and has become increasingly popular over the years. In most cases, call girl services are legal and regulated in many countries. There are a few things to keep in mind when considering the choice of whether to use a call girl service. First and foremost, make sure that you are comfortable with the particular person you are using the service from. Second, research accordingly before choosing a call girl. Don't just go with the first provider that comes up in your search; get opinions from others as well. Finally, be sure to have fun while using a call girl service; it's not just about sex. S040524N

★OUR BEST SERVICES: - FOR BOOKING ★ A-Level (5-star escort) ★ Strip-tease ★ BBBJ (Bareback Blowjob) ★ Spending time in my rooms ★ BJ (Blowjob Without a Condom) ★ COF (Come on Face) ★ Completion ★ (Oral to completion) noncovered ★ Special Massage ★ O-Level (Oral) ★ Blow Job; ★ Oral fun uncovered) ★ COB (Come on Body) ★. Extra ball (Have ride many times) ☛ ☛ ☛ ✔✔ secure✔✔ 100% safe WHATSAPP CALL ME +91-992072523VIP Independent Call Girls in Bandra West 🌹 9920725232 ( Call Me ) Mumbai Esc...

VIP Independent Call Girls in Bandra West 🌹 9920725232 ( Call Me ) Mumbai Esc...dipikadinghjn ( Why You Choose Us? ) Escorts

Call Girl Mumbai Indira Call Now: 8250077686 Mumbai Escorts Booking Contact Details WhatsApp Chat: +91-8250077686 Mumbai Escort Service includes providing maximum physical satisfaction to their clients as well as engaging conversation that keeps your time enjoyable and entertainin. Plus they look fabulously elegant; making an impressionable. Independent Escorts Mumbai understands the value of confidentiality and discretion - they will go the extra mile to meet your needs. Simply contact them via text messaging or through their online profiles; they'd be more than delighted to accommodate any request or arrange a romantic date or fun-filled night together. We provide –(INDIRA) Call Girl Mumbai Call Now 8250077686 Mumbai Escorts 24x7

(INDIRA) Call Girl Mumbai Call Now 8250077686 Mumbai Escorts 24x7Call Girls in Nagpur High Profile Call Girls

Booking open Available Pune Call Girls Shivane 6297143586 Call Hot Indian Girls Waiting For You To Fuck

Booking Contact Details

WhatsApp Chat: +91-6297143586

pune Escort Service includes providing maximum physical satisfaction to their clients as well as engaging conversation that keeps your time enjoyable and entertaining. Plus they look fabulously elegant; making an impressionable.

Independent Escorts pune understands the value of confidentiality and discretion - they will go the extra mile to meet your needs. Simply contact them via text messaging or through their online profiles; they'd be more than delighted to accommodate any request or arrange a romantic date or fun-filled night together.

We provide -

01-may-2024(v.n)

Booking open Available Pune Call Girls Shivane 6297143586 Call Hot Indian Gi...

Booking open Available Pune Call Girls Shivane 6297143586 Call Hot Indian Gi...Call Girls in Nagpur High Profile

Model Call Girl Services in Delhi reach out to us at 🔝 9953056974 🔝✔️✔️

Our agency presents a selection of young, charming call girls available for bookings at Oyo Hotels. Experience high-class escort services at pocket-friendly rates, with our female escorts exuding both beauty and a delightful personality, ready to meet your desires. Whether it's Housewives, College girls, Russian girls, Muslim girls, or any other preference, we offer a diverse range of options to cater to your tastes.

We provide both in-call and out-call services for your convenience. Our in-call location in Delhi ensures cleanliness, hygiene, and 100% safety, while our out-call services offer doorstep delivery for added ease.

We value your time and money, hence we kindly request pic collectors, time-passers, and bargain hunters to refrain from contacting us.

Our services feature various packages at competitive rates:

One shot: ₹2000/in-call, ₹5000/out-call

Two shots with one girl: ₹3500/in-call, ₹6000/out-call

Body to body massage with sex: ₹3000/in-call

Full night for one person: ₹7000/in-call, ₹10000/out-call

Full night for more than 1 person: Contact us at 🔝 9953056974 🔝. for details

Operating 24/7, we serve various locations in Delhi, including Green Park, Lajpat Nagar, Saket, and Hauz Khas near metro stations.

For premium call girl services in Delhi 🔝 9953056974 🔝. Thank you for considering us!Call Girls in New Ashok Nagar, (delhi) call me [9953056974] escort service 24X7![Call Girls in New Ashok Nagar, (delhi) call me [9953056974] escort service 24X7](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![Call Girls in New Ashok Nagar, (delhi) call me [9953056974] escort service 24X7](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

Call Girls in New Ashok Nagar, (delhi) call me [9953056974] escort service 24X79953056974 Low Rate Call Girls In Saket, Delhi NCR

VIP Call Girl Service Andheri West ⚡ 9920725232 What It Takes To Be The Best * Mumbai Escorts *

FOR BOOKING ★ A-Level (5-star Escort) (Akanksha): ☎️ +91-9920725232

AVAILABLE FOR COMPLETE ENJOYMENT WITH HIGH PROFILE INDIAN MODEL AVAILABLE HOTEL & HOME

Visit Our Site For More Pleasure in your City 👉 ☎️ +91-9920725232 👈

★ SAFE AND SECURE HIGH-CLASS SERVICE AFFORDABLE RATE

★

SATISFACTION, UNLIMITED ENJOYMENT.

★ All Meetings are confidential and no information is provided to any one at any cost.

★ EXCLUSIVE PROFILes Are Safe and Consensual with Most Limits Respected

★ Service Available In: - HOME & HOTEL Star Hotel Service. In Call & Out call

SeRvIcEs :

★ A-Level (star escort)

★ Strip-tease

★ BBBJ (Bareback Blowjob) Receive advanced sexual techniques in different mode make their life more pleasurable.

★ Spending time in hotel rooms

★ BJ (Blowjob Without a Condom)

★ Completion (Oral to completion)

★ Covered (Covered blowjob Without condom

★ANAL SERVICES.

Contact me

TELEPHONE

WHATSAPP

Looking for Enjoy all Day(Akanksha) : ☎️ +91-9920725232

Mumbai, Andheri, Navi Mumbai, Thane, Mumbai Airport, Mumbai Central, South Mumbai, Juhu, Bandra, Colaba, Nariman point, Malad, Powai, Mira Road, Dahisar, Mira Bhayandar, Worli, Santacruz, Vile Parle, Lower Parel, Chembur, Dadar, Ghatkopar, Kurla, Mulund, Goregaon, Kandivali, Borivali, Jogeshwari, Kalyan, Vashi , Nerul, Panvel, Dombivli, Lokhandwala, Four Bungalows, Versova, NRI Complex, Kharghar, Belapur, Taloja, Marine Drive, Hiranandani Gardens, Churchgate, Marine lines, Oshiwara, DN Nagar, Jb Nagar, Marol Naka, Saki Naka, Andheri East, Andheri West, Bandra West, Bandra East , Thane West, Ghodbundar Road,

There is a lot of talk about it in the media and news, so you might be wondering if this particular service is really worth the effort. A call girl service is exactly what it sounds like – a service where a woman offers sexual services over the phone. This type of service has been around for a long time and has become increasingly popular over the years. In most cases, call girl services are legal and regulated in many countries. S040524N

★OUR BEST SERVICES: - FOR BOOKING ★ A-Level (5-star escort) ★ Strip-tease ★ BBBJ (Bareback Blowjob) ★ Spending time in my rooms ★ BJ (Blowjob Without a Condom) ★ COF (Come on Face) ★ Completion ★ (Oral to completion) noncovered ★ Special Massage ★ O-Level (Oral) ★ Blow Job; ★ Oral fun uncovered) ★ COB (Come on Body) ★. Extra ball (Have ride many times) ☛ ☛ ☛ ✔✔ secure✔✔ 100% safe WHATSAPP CALL ME +91-9920725232

VIP Call Girl Service Andheri West ⚡ 9920725232 What It Takes To Be The Best ...

VIP Call Girl Service Andheri West ⚡ 9920725232 What It Takes To Be The Best ...dipikadinghjn ( Why You Choose Us? ) Escorts

VIP Call Girl in Mumbai 💧 9920725232 ( Call Me ) Get A New Crush Everyday With Jareena * Mumbai Escorts *

FOR BOOKING ★ A-Level (5-star Escort) (Akanksha): ☎️ +91-9920725232

AVAILABLE FOR COMPLETE ENJOYMENT WITH HIGH PROFILE INDIAN MODEL AVAILABLE HOTEL & HOME

Visit Our Site For More Pleasure in your City 👉 ☎️ +91-9920725232 👈

★ SAFE AND SECURE HIGH-CLASS SERVICE AFFORDABLE RATE

★

SATISFACTION, UNLIMITED ENJOYMENT.

★ All Meetings are confidential and no information is provided to any one at any cost.

★ EXCLUSIVE PROFILes Are Safe and Consensual with Most Limits Respected

★ Service Available In: - HOME & HOTEL Star Hotel Service. In Call & Out call

SeRvIcEs :

★ A-Level (star escort)

★ Strip-tease

★ BBBJ (Bareback Blowjob) Receive advanced sexual techniques in different mode make their life more pleasurable.

★ Spending time in hotel rooms

★ BJ (Blowjob Without a Condom)

★ Completion (Oral to completion)

★ Covered (Covered blowjob Without condom

★ANAL SERVICES.

Contact me

TELEPHONE

WHATSAPP

Looking for Enjoy all Day(Akanksha) : ☎️ +91-9920725232

Mumbai, Andheri, Navi Mumbai, Thane, Mumbai Airport, Mumbai Central, South Mumbai, Juhu, Bandra, Colaba, Nariman point, Malad, Powai, Mira Road, Dahisar, Mira Bhayandar, Worli, Santacruz, Vile Parle, Lower Parel, Chembur, Dadar, Ghatkopar, Kurla, Mulund, Goregaon, Kandivali, Borivali, Jogeshwari, Kalyan, Vashi , Nerul, Panvel, Dombivli, Lokhandwala, Four Bungalows, Versova, NRI Complex, Kharghar, Belapur, Taloja, Marine Drive, Hiranandani Gardens, Churchgate, Marine lines, Oshiwara, DN Nagar, Jb Nagar, Marol Naka, Saki Naka, Andheri East, Andheri West, Bandra West, Bandra East , Thane West, Ghodbundar Road,

There is a lot of talk about it in the media and news, so you might be wondering if this particular service is really worth the effort. A call girl service is exactly what it sounds like – a service where a woman offers sexual services over the phone. This type of service has been around for a long time and has become increasingly popular over the years. In most cases, call girl services are legal and regulated in many countries. There are a few things to keep in mind when considering the choice of whether to use a call girl service. First and foremost, make sure that you are comfortable with the particular person you are using the service from. Second, research accordingly before choosing a call girl. Don't just go with the first provider that comes up in your search; get opinions from others as well. Finally, be sure to have fun while using a call girl service; it's not just about sex. S040524N

★OUR BEST SERVICES: - FOR BOOKING ★ A-Level (5-star escort) ★ Strip-tease ★ BBBJ (Bareback Blowjob) ★ Spending time in my rooms ★ BJ (Blowjob Without a Condom) ★ COF (Come on Face) ★ Completion ★ (Oral to completion) noncovered ★ Special Massage ★ O-Level (Oral) ★ Blow Job; ★ Oral fun uncovered) ★ COB (Come on Body) ★. Extra ball (Have ride many times) ☛ ☛ ☛ ✔✔ secure✔✔ 100% safe WHATSAPP CALL ME +91-VIP Call Girl in Mumbai 💧 9920725232 ( Call Me ) Get A New Crush Everyday Wit...

VIP Call Girl in Mumbai 💧 9920725232 ( Call Me ) Get A New Crush Everyday Wit...dipikadinghjn ( Why You Choose Us? ) Escorts

Dernier (20)

Mira Road Awesome 100% Independent Call Girls NUmber-9833754194-Dahisar Inter...

Mira Road Awesome 100% Independent Call Girls NUmber-9833754194-Dahisar Inter...

Solution Manual for Principles of Corporate Finance 14th Edition by Richard B...

Solution Manual for Principles of Corporate Finance 14th Edition by Richard B...

WhatsApp 📞 Call : 9892124323 ✅Call Girls In Chembur ( Mumbai ) secure service

WhatsApp 📞 Call : 9892124323 ✅Call Girls In Chembur ( Mumbai ) secure service

VIP Independent Call Girls in Andheri 🌹 9920725232 ( Call Me ) Mumbai Escorts...

VIP Independent Call Girls in Andheri 🌹 9920725232 ( Call Me ) Mumbai Escorts...

Mira Road Memorable Call Grls Number-9833754194-Bhayandar Speciallty Call Gir...

Mira Road Memorable Call Grls Number-9833754194-Bhayandar Speciallty Call Gir...

VIP Independent Call Girls in Bandra West 🌹 9920725232 ( Call Me ) Mumbai Esc...

VIP Independent Call Girls in Bandra West 🌹 9920725232 ( Call Me ) Mumbai Esc...

02_Fabio Colombo_Accenture_MeetupDora&Cybersecurity.pptx

02_Fabio Colombo_Accenture_MeetupDora&Cybersecurity.pptx

Vasai-Virar Fantastic Call Girls-9833754194-Call Girls MUmbai

Vasai-Virar Fantastic Call Girls-9833754194-Call Girls MUmbai

(INDIRA) Call Girl Mumbai Call Now 8250077686 Mumbai Escorts 24x7

(INDIRA) Call Girl Mumbai Call Now 8250077686 Mumbai Escorts 24x7

Booking open Available Pune Call Girls Shivane 6297143586 Call Hot Indian Gi...

Booking open Available Pune Call Girls Shivane 6297143586 Call Hot Indian Gi...

Call Girls in New Ashok Nagar, (delhi) call me [9953056974] escort service 24X7![Call Girls in New Ashok Nagar, (delhi) call me [9953056974] escort service 24X7](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![Call Girls in New Ashok Nagar, (delhi) call me [9953056974] escort service 24X7](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

Call Girls in New Ashok Nagar, (delhi) call me [9953056974] escort service 24X7

Vip Call US 📞 7738631006 ✅Call Girls In Sakinaka ( Mumbai )

Vip Call US 📞 7738631006 ✅Call Girls In Sakinaka ( Mumbai )

VIP Call Girl Service Andheri West ⚡ 9920725232 What It Takes To Be The Best ...

VIP Call Girl Service Andheri West ⚡ 9920725232 What It Takes To Be The Best ...

Call Girls Koregaon Park Call Me 7737669865 Budget Friendly No Advance Booking

Call Girls Koregaon Park Call Me 7737669865 Budget Friendly No Advance Booking

VIP Call Girl in Mumbai 💧 9920725232 ( Call Me ) Get A New Crush Everyday Wit...

VIP Call Girl in Mumbai 💧 9920725232 ( Call Me ) Get A New Crush Everyday Wit...

Call Girls in New Friends Colony Delhi 💯 Call Us 🔝9205541914 🔝( Delhi) Escort...

Call Girls in New Friends Colony Delhi 💯 Call Us 🔝9205541914 🔝( Delhi) Escort...

Randomness of returns_historical_asset_class_ranking_2014 skittles

- 1. Asset Class Index Performance Annual Returns from 1999 to 2013 Ranked from Highest to Lowest* Diversification does not guarantee a profit or protect against a loss *Data Sources: Center for Research in Security Prices (CRSP), BARRA Inc. and Morgan Stanley Capital International, March 2014. All investments involve risk. Foreign securities involve additional risks, including foreign currency changes, political risks, foreign taxes, and different methods of accounting and financial reporting. Past performance is not indicative of future performance. Treasury bills are guaranteed as to repayment of principal and interest by the U.S. government. This information does not constitute a solicitation for sale of any securities. CRSP ranks all NYSE companies by market capitalization and divides them into 10 equally-populated portfolios. AMEX and NASDAQ National Market stocks are then placed into deciles according to their respective capitalizations, determined by the NYSE breakpoints. CRSP Portfolios 1-5 represent large-cap stocks; Portfolios 6-10 represent small caps; Value is represented by companies with a book-to-market ratio in the top 30% of all companies. Growth is represented by companies with a book-to-market ratio in the bottom 30% of all companies. S&P 500 Index is the Standard & Poor’s 500 Index. The S&P 500 Index measures the performance of large-capitalization U.S. stocks. The S&P 500 is an unmanaged market value- weighted index of 500 stocks that are traded on the NYSE, AMEX and NASDAQ. The weightings make each company’s influence on the index performance directly proportional to that company’s market value. The MSCI EAFE Index (Morgan Stanley Capital International Europe, Australasia, Far East Index) is comprised of over 1,000 companies representing the stock markets of Europe, Australia, New Zealand and the Far East, and is an unmanaged index. EAFE represents non-U.S. large stocks. Foreign securities involve additional risks, including foreign currency changes, political risks, foreign taxes and different methods of accounting and financial reporting. Consumer Price Index (CPI) is a measure of inflation. REITs, represented by the NAREIT Equity REIT Index, is an unmanaged market cap-weighted index comprised of 151 equity REITS. Emerging Markets index represents securities in countries with developing economies and provide potentially high returns. Many Latin American, Eastern European and Asian countries are considered emerging markets. Indexes are unmanaged baskets of securities without the fees and expenses associated with mutual funds and other investments. Investors cannot directly invest in an index. Asset Class Performance *DataSources:CenterforResearchinSecurityPrices(CRSP),BARRAInc.andMorganStanleyCapitalInternational,March2014.Allinvestmentsinvolverisk.Foreignsecuritiesinvolveadditionalrisks,includingforeign currencychanges,politicalrisks,foreigntaxes,anddifferentmethodsofaccountingandfinancialreporting.Pastperformanceisnotindicativeoffutureperformance.Treasurybillsareguaranteedastorepaymentofprincipal and interest by the U.S. government.This information does not constitute a solicitation for sale of any securities. CRSPranks all NYSE companies by market capitalization and divides them into 10 equally-populated portfolios.AMEX and NASDAQ National Market stocks are then placed into deciles according to their respective capitalizations, determined by the NYSE breakpoints. CRSPPortfolios 1-5 represent large-cap stocks; Portfolios6-10representsmallcaps;Valueisrepresentedbycompanieswithabook-to-marketratiointhetop30%ofallcompanies.Growthisrepresentedbycompanieswithabook-to-marketratiointhebottom30%of allcompanies.S&P500IndexistheStandard&Poor’s500Index.TheS&P500Indexmeasurestheperformanceoflarge-capitalizationU.S.stocks.TheS&P500isanunmanagedmarketvalue-weightedindexof500 stocksthataretradedontheNYSE,AMEXandNASDAQ.Theweightingsmakeeachcompany’sinfluenceontheindexperformancedirectlyproportionaltothatcompany’smarketvalue.TheMSCIEAFEIndex(Morgan StanleyCapitalInternationalEurope,Australasia,FarEastIndex)iscomprisedofover1,000companiesrepresentingthestockmarketsofEurope,Australia,NewZealandandtheFarEast,andisanunmanagedindex. EAFErepresentsnon-U.S.largestocks.Foreignsecuritiesinvolveadditionalrisks,includingforeigncurrencychanges,politicalrisks,foreigntaxesanddifferentmethodsofaccountingandfinancialreporting.Consumer Price Index (CPI) is a measure of inflation. REITs, represented by the NAREIT Equity REIT Index, is an unmanaged market cap-weighted index comprised of 151 equity REITS. Emerging Markets index represents 20131999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Annualized Returns Emerging Markets Small Value REITs 5 Year Gov't Small Value Emerging Markets REITs Emerging Markets REITs 5 Year Gov't Emerging Markets Small Value 5 Year Gov't Large Value 66.49% 26.37% 40.59% 12.93% 74.48% 31.58% 34.00% 35.06% 39.42% 13.11% 78.51% 34.59% 9.46% 28.03% Emerging Markets 10.91% Small Growth 5 Year Gov't REITs REITs Emerging Markets Small Value Emerging Markets EAFE Large Growth Inflation (CPI) Small Value Small Growth Small Value REITs 54.06% 12.59% 13.93% 3.82% 55.82% 27.33% 13.54% 32.14% 15.70% 0.09% 70.19% 31.83% 8.29% 20.32% Small Value 12.09% Large Growth Inflation (CPI) 5 Year Gov't Inflation (CPI) Small Growth Emerging Markets REITs EAFE EAFE S&P 500 Index Large Growth Large Growth REITs Emerging Markets 30.16% 3.39% 7.62% 2.38% 54.72% 25.55% 12.16% 26.34% 11.17% -37.00% 38.09% 27.96% 6.42% 18.22% REITs 10.36% Small Value EAFE Inflation (CPI) Emerging Markets Large Value EAFE EAFE Large Value 5 Year Gov't Small Growth REITs Large Value Inflation (CPI) REITs 26.96% -3.08% 1.55% -6.17% 38.59% 20.25% 9.70% 21.87% 10.05% -37.73% 38.09% 20.17% 2.96% 18.06% 5 Year Gov't 5.13% S&P 500 Index Large Value Emerging Markets Small Value Large Value REITs Small Growth Small Value S&P 500 Index Large Growth Large Value Emerging Markets S&P 500 Index EAFE 21.04% -6.41% -2.62% -11.72% 37.13% 17.74% 6.02% 21.70% 5.49% -39.12% 37.51% 18.88% 2.11% 17.32% S&P 500 Index 4.68% Large Value S&P 500 Index Large Value Large Value EAFE Small Growth S&P 500 Index S&P 500 Index Small Growth Large Growth EAFE EAFE Small Growth Large Growth 6.99% -9.10% -2.71% -15.94% 36.43% 11.16% 4.91% 15.79% 4.99% -43.38% 31.78% 17.64% -4.43% 17.22% EAFE 4.54% Small Value Small Growth EAFE Large Growth S&P 500 Index S&P 500 Index Small Value Small Growth Inflation (CPI) Small Growth S&P 500 Index REITs Small Value S&P 500 Index 4.37% -14.17% -4.13% -21.93% 28.68% 10.88% 4.46% 9.26% 4.08% -43.41% 27.99% 15.06% -10.78% 16.00% Large Growth 4.22% Inflation (CPI) Large Growth S&P 500 Index S&P 500 Index Large Growth Large Growth Inflation (CPI) Large Growth Large Value Small Value S&P 500 Index EAFE EAFE Small Growth 2.68% -14.33% -11.89% -22.10% 17.77% 5.27% 3.42% 5.97% -12.24% -44.50% 26.46% 7.75% -12.14% 12.59% Small Growth 6.27% 5 Year Gov't Small Growth Large Growth Large Value 5 Year Gov't Inflation (CPI) Large Growth 5 Year Gov't Large Value REITs Inflation (CPI) 5 Year Gov't Emerging Markets Inflation (CPI) -1.77% -24.50% -21.05% -30.28% 2.40% 3.26% 3.39% 3.14% -15.69% -53.14% 2.72% 7.12% -18.42% 1.74% Inflation (CPI) 2.38% Emerging Markets REITs Small Growth EAFE Inflation (CPI) 5 Year Gov't 5 Year Gov't Inflation (CPI) Small Value Emerging Markets 5 Year Gov't Inflation (CPI) Large Value -4.62% -30.83% -21.44% -34.63% 1.88% 2.25% 1.36% 2.54% -18.38% -53.33% -2.40% 1.50% -19.90% 5 Year Gov't 2.07% Large Value 2.53% Small Growth 47.34% Large Value 43.19% Small Value 40.29% Large Growth 39.43% S&P 500 Index 32.39% EAFE 22.78% REITs 2.47% Inflation (CPI) 1.51% 5 Year Gov't -1.07% Emerging Markets -2.60% High Low