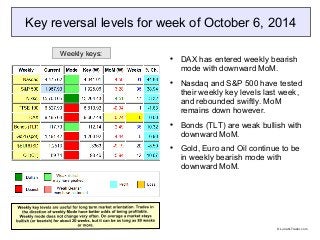

Key reversal levels for week of October 6, 2014

- 1. Key reversal levels for week of October 6, 2014 DAX has entered weekly bearish mode with downward MoM. Nasdaq and S&P 500 have tested their weekly key levels last week, and rebounded swiftly. MoM remains down however. Bonds (TLT) are weak bullish with downward MoM. Gold, Euro and Oil continue to be in weekly bearish mode with downward MoM. Weekly keys: © LunaticTrader.com

- 2. Daily MoM remains down for all major stock indexes, so it is too early to declare an end to recent pullback. Bonds remain in rally mode, making for a possible double top. Gold , EURUSD and crude oil are back to fully bearish, continuing to decline. Comment: A lot of red in our key level tables. Bonds are benefiting from a flight to “safety” reflex, but my impression is that this rally is being faded. Wait for buying opportunities when daily MoM turns up from oversold levels in markets that are still bullish on the weekly level. Daily keys: © LunaticTrader.com

- 3. Weekly keys for World markets and sectors: Weekly sell signal for Canada, France, Hong Kong, Italy, Singapore, South Africa, South Korea and MSCI world index MoM has turned down for Biotech sector, Dow Industrials and Spain Only two markets remain fully bullish: China and Switzerland. Markets to watch, coming very close to weekly key reversal: Brazil, Social Media sector and Spain. Comment: It is quite rare to see so many markets turn bearish in the same week. How long this weakness continues remains to be seen. It never hurts to watch from the sidelines until your favorite market gets back into bullish mode. © LunaticTrader.com

- 4. Weekly keys for the 30 Dow stocks: Sell signals for PFE 21 stocks bullish, down from 22 last week. Above 20 = healthy bull market. See: Keeping an eye on the Dow stocks MoM turning up for CSCO MoM turning down for: GE, MSFT, UNH and UTX Comment: some deterioration, but no reason for panic. Large cap stocks are holding up better than the overall markets. Of course, that could change. © LunaticTrader.com

- 5. Key target zones: New Top targets for Nikkei at 16366 and 17134 A new Bottom2 target for FTSE100 at 6220 A new Bottom1 target for Oil at 88.98 Legend * = new or updated target Note: we use a +/-1% zone around these targets. These key target zones are a by-product of the key level calculations. When a key target is reached the market will typically react and turn back from it. On the second or third attempt the target gets finally broken and then the next target comes into play. So these key target zones can be used as price objectives for taking profits or for entering the market after a significant sell-off. They can be seen as a kind of pivot points. When MoM indicator reverses right near a key target it is very likely that the market has reached a temporary peak (or bottom). For more details about these key targets, see: http://lunatictrader.wordpress.com/2013/08/20/key-target-levels/ © LunaticTrader.com

- 6. More details about the key reversal levels and how to use them in your trading can be found here: http://lunatictrader.wordpress.com/key-reversal-levels/ For daily key levels, regular market commentary or questions you are welcome to follow or contact us here: Blog: http://LunaticTrader.Wordpress.com On Twitter: http://twitter.com/lunatictrader1 On Scutify: http://www.scutify.com/profiles/scutifier.aspx?q=LunaticTrader On Stocktwits: http://stocktwits.com/LunaticTrader © LunaticTrader.com Disclaimer Investing in stocks, forex or commodities is risky. No guarantee can be given that the opinions or predictions given in this presentation will be correct. LunaticTrader cannot in any way be responsible for eventual losses you may incur if you trade based on the given information. Simulated trading programs in general are subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. Trade at your own risk and responsibility.

- 7. More details about the key reversal levels and how to use them in your trading can be found here: http://lunatictrader.wordpress.com/key-reversal-levels/ For daily key levels, regular market commentary or questions you are welcome to follow or contact us here: Blog: http://LunaticTrader.Wordpress.com On Twitter: http://twitter.com/lunatictrader1 On Scutify: http://www.scutify.com/profiles/scutifier.aspx?q=LunaticTrader On Stocktwits: http://stocktwits.com/LunaticTrader © LunaticTrader.com Disclaimer Investing in stocks, forex or commodities is risky. No guarantee can be given that the opinions or predictions given in this presentation will be correct. LunaticTrader cannot in any way be responsible for eventual losses you may incur if you trade based on the given information. Simulated trading programs in general are subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. Trade at your own risk and responsibility.