17th Annual Wealth Creation Study Key Highlights

- 1. www.motilaloswal.com17th Annual Wealth Creation Study Economic Moat By Raamdeo Agrawal 12 December 2012 17th Annual Wealth Creation Study 2007-2012

- 3. www.motilaloswal.com17th Annual Wealth Creation Study 2 Discussion Points • 17th Wealth Creation Study Findings • Theme 2013: Fountainhead of Wealth Creation • Market Outlook • Conclusions

- 4. www.motilaloswal.com17th Annual Wealth Creation Study 3 Wealth Creation 2007-12 Study Findings

- 5. www.motilaloswal.com17th Annual Wealth Creation Study 4 Concept of Wealth Creation The process by which a company enhances market value of the capital entrusted to it by its shareholders Net Wealth Created Change in Market Cap over the study period (2007-12), adjusted for corporate actions like dilutions Study Methodology

- 6. www.motilaloswal.com17th Annual Wealth Creation Study 5 Fastest Wealth Creators The top 100 wealth creators are sorted by fastest rise in their adjusted stock price Most Consistent Wealth Creators Based on no. of times a company appeared in the last 10 studies Study Methodology (contd)

- 7. www.motilaloswal.com17th Annual Wealth Creation Study 6 Biggest Wealth Creators Top 100 Wealth Creators subject to a new condition that stock performance beats the benchmark (Sensex) Who missed the bus because of the market outperformance filter Study Methodology (contd) Company NWC (Rs cr) Price CAGR O N G C 40,863 4.0 Wipro 26,602 5.6 I O C L 15,839 5.6 NTPC 10,678 1.7 Company NWC (Rs cr) Price CAGR Hindalco 8,838 1.8 B H E L 7,557 2.6 Cipla 5,463 5.3 Oracle Finl 4,594 4.7 NOTE: 5-time topper Reliance Industries did not make it on both counts – absolute wealth created and market outperformance

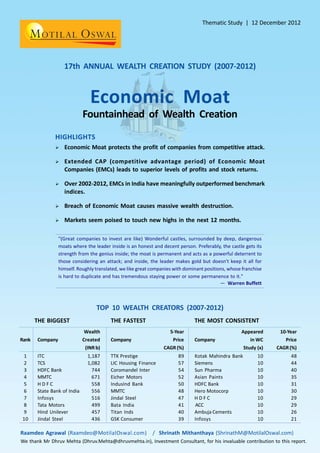

- 8. www.motilaloswal.com17th Annual Wealth Creation Study 7 Rank, Company NWC (Rs cr) Price CAGR 1. ITC 118,681 7 2. TCS 108,186 7 3. HDFC Bank 74,425 5 4. MMTC 67,110 4 5. H D F C 55,793 3 Rank, Company NWC (Rs cr) Price CAGR 6. SBI 55,595 3 7. Infosys 51,573 3 8. Tata Motors 49,946 3 9. Hind Unilever 45,746 3 10. Jindal Steel 43,647 3 Top 10 Biggest Wealth Creators ITC largest wealth creator for the first time ever, beating RIL Total wealth created during 2007-12: Rs16+ lakh crores HUL has made it to the top 10 after a long time

- 9. www.motilaloswal.com17th Annual Wealth Creation Study 8 Rank, Company Mult. (x) Price CAGR 1. TTK Prestige 24 89 2. LIC Housing 10 57 3. Coromandel Inter 9 54 4. Eicher Motors 8 52 5. IndusInd Bank 8 50 Rank, Company Mult. (x) Price CAGR 6. MMTC 7 48 7. Jindal Steel 7 47 8. Bata India 6 41 9. Titan Inds 5 40 10. GSK Consumer 5 39 Top 10 Fastest Wealth Creators TTK Prestige is the Top 10 fastest wealth creator 4 Consumer companies in Top 10 fastest wealth creators; sector hitherto associated with steady growth seems to be enjoying tailwind of India’s NTD era

- 10. www.motilaloswal.com17th Annual Wealth Creation Study 9 Rank, Company WCS (x) Price CAGR 1. Kotak Mahindra 10 48 2. Siemens 10 44 3. Sun Pharma 10 40 4. Asian Paints 10 35 5. HDFC Bank 10 31 Rank, Company WCS (x) Price CAGR 6. Hero Motocorp 10 30 7. H D F C 10 29 8. ACC 10 29 9. Ambuja Cement 10 26 10. Infosys 10 21 Most Consistent Wealth Creators Kotak Mahindra Most Consistent for 2nd year in a row Holcim Group is getting its act together in India – both ACC and Ambuja among Most Consistent Wealth Creators

- 11. www.motilaloswal.com17th Annual Wealth Creation Study 10 Wealth Creators v/s Sensex Wealth-creating companies’ financial and stock market performance is above benchmark. Mar-07 Mar-12 5-yr CAGR BSE Sensex 13,072 17,404 6 Wealthex – re-based 13,072 32,884 20 Sensex EPS (Rs) 718 1,125 9 Sensex PE (x) 18 15 Wealthex EPS (Rs) 809 2,102 21 Wealthex PE (x) 16 16

- 12. www.motilaloswal.com17th Annual Wealth Creation Study 11 Wealth Creation by Industry Financials the biggest wealth creating sector for 2nd year in a row. Absence of new banks has led to widespread profitability and stock performance. Consumer sector a very close second. Industry (No of cos.) WC (Rs cr) 2012 (%) 2007 (%) Financials (21) 367,223 22 13 Consumer (21) 335,845 21 5 Metals / Mining (8) 209,492 13 9 Technology (3) 173,419 11 10 Auto (11) 163,007 10 6 Healthcare (11) 121,480 7 4 Industry (No of cos.) WC (Rs cr) 2012 (%) 2007 (%) Oil & Gas (7) 99,634 6 24 Cement (5) 66,842 4 3 Cap Goods(6) 60,902 4 10 Ultility (3) 23,549 1 2 Others (4) 16,629 1 15 Total 1,638,021 100 100

- 13. www.motilaloswal.com17th Annual Wealth Creation Study 12 Wealth Creation by PAT growth Markets can neither price hyper-growth or high quality growth, resulting in huge wealth creation at a rapid pace. Price CAGR (%) 2007-12 PAT growth range (%)

- 14. www.motilaloswal.com17th Annual Wealth Creation Study 13 Wealth Creation by base RoE High RoE alone does not guarantee superior Wealth Creation. Profit growth is equally important. Economic Moat (or compe- titive advantage) protects profits and ensures Wealth Creation. Avg Price CAGR: 20%

- 15. www.motilaloswal.com17th Annual Wealth Creation Study 14 Wealth Creation & Valuation Metrics Unlike most past studies, low P/E alone did not ensure high speed of wealth creation during 2007-12. PAT CAGR was a key determinant of Price CAGR. P/E (x) No. of Cos. % Wealth Created Price CAGR % PAT CAGR % <10 18 17 20 18 10-15 21 18 22 24 15-20 19 10 21 20 20-25 13 18 25 24 25-30 13 28 16 21 >30 16 10 25 24 Total 100 100 20 21

- 16. www.motilaloswal.com17th Annual Wealth Creation Study 15 Wealth Creation & Valuation Metrics P/B below 1x did deliver high returns, but returns from higher P/B stocks were also comparable (except when P/B > 6) P/B (x) No. of Cos. % Wealth Created Price CAGR % PAT CAGR % <1 6 6 25 28 1-2 20 12 20 19 2-3 10 7 24 21 3-4 11 13 20 20 4-5 13 14 22 24 5-6 11 14 26 21 >6 29 34 17 19 Total 100 100 20 21

- 17. www.motilaloswal.com17th Annual Wealth Creation Study 16 Wealth Creation & Valuation Metrics Payback ratio (Mkt Cap / 5-years forward PAT) of less than 1x in 2007 did ensure superior wealth creation. Also, again here, correlation of PAT and Price CAGR is high. Economic Moats help sustain PAT and PAT growth. Payback Ratio (x) No. of Cos. % Wealth Created Price CAGR % PAT CAGR % <1 19 14 26 25 1-2 37 33 23 24 2-3 26 29 20 15 >3 18 23 15 16 Total 100 100 20 21

- 18. www.motilaloswal.com17th Annual Wealth Creation Study 17 Wealth Destruction 4 of top 10 wealth destroyers are telecoms. Breach of Economic Moat causes massive wealth destruction. Company Wealth Destroyed Price Rs crores % Share CAGR (%) Rel. Comm. 67,698 12 -28 Unitech 29,399 5 -32 Suzlon Energy 27,558 5 -34 Satyam Computer 24,948 4 -30 Bharti Airtel 16,918 3 -2 Bajaj Holdings 15,943 3 -20 S A I L 8,280 1 -4 Tech Mahindra 8,161 1 -13 M T N L 7,519 1 -29 Himachal Futuristic 7,367 1 -12 Total of Above 206,425 36 Total Wealth Destroyed 570,246 100

- 19. www.motilaloswal.com17th Annual Wealth Creation Study 18 Theme Study

- 20. www.motilaloswal.com17th Annual Wealth Creation Study 19 "(Great companies to invest are like) wonderful castles, surrounded by deep, dangerous moats where the leader inside is an honest and decent person. Preferably, the castle gets its strength from the genius inside; the moat is permanent and acts as a powerful deterrent to those considering an attack; and inside, the leader makes gold but doesn't keep it all for himself. Roughly translated, we like great companies with dominant positions, whose franchise is hard to duplicate and has tremendous staying power or some permanence to it.” – Warren Buffett Moat Quote

- 21. www.motilaloswal.com17th Annual Wealth Creation Study 20 The concept of 'Economic Moat' has its roots in the idea of a traditional moat A moat is a deep, wide trench filled with water, that surrounds the rampart of a castle or fortified place. An Economic Moat protects a company's profits from being attacked by business forces Traditional management theory terms: "Sustainable Competitive Advantage" or "Entry Barriers" What is an Economic Moat?

- 22. www.motilaloswal.com17th Annual Wealth Creation Study 21 Without Economic Moat, competition from rivals will ensure that high returns of a company are lowered to the level of economic cost of capital … or even below What is happening in the Indian Telecom sector is a classic example of this Moat Quote The dynamics of capitalism guarantee that competitors will repeatedly assault any business "castle" that is earning high returns … Business history is filled with "Roman Candles," companies whose moats proved illusory and were soon crossed.” – Warren Buffett Why Economic Moat?

- 23. www.motilaloswal.com17th Annual Wealth Creation Study 22 Economic Moat helps sustain superior profitability multiple pulls and pressures Companies do not compete only with rivals for profit, but also with customers, suppliers, potential entrants and substitute products Why Economic Moat? Porter's Five Forces of Industry Economic Moat protects profits being eroded by such forces

- 24. www.motilaloswal.com17th Annual Wealth Creation Study 23 Much like companies, equity investors too chase high returns on their investments In the long run, equity investors can only make as much money and return as the company itself makes Investing in companies with Economic Moats is the only way to enjoy a share of their high profits and create wealth Moat Quote “A truly great business must have an enduring moat that protects excellent returns on invested capital.” – Buffett Economic Moat & investing

- 25. www.motilaloswal.com17th Annual Wealth Creation Study 24 Companies with "deep, dangerous moats“ outperform those without, both in terms of financial performance and stock returns. Markets worldwide are replete with examples similar to cross-sector cases given below in India 1. Hero MotoCorp v/s TVS Motors 2. Bharti Airtel v/s Tata Teleservices 3. L&T v/s HCC 4. HDFC Bank v/s Central Bank Economic Moat & investing

- 26. www.motilaloswal.com17th Annual Wealth Creation Study 25 Hero MotoCorp v/s TVS Motors The facts … Both started business around the same time in the 1980s Both were Indo-Japanese JVs – Hero Group with Honda and TVS Group with Suzuki MOAT IMPACT: Hero MotoCorp: World’s largest two-wheeler company TVS Motor: Struggling to retain its hitherto No 3 spot in India

- 27. www.motilaloswal.com17th Annual Wealth Creation Study 26 Bharti Airtel v/s Tata Teleservices The facts … Both incorporated in 1995 on the eve of India’s telecom boom. In fact, Tata Tele had the rich Tata legacy Both journeyed India’s wireless explosion – massive value migration from wired telephony. MOAT IMPACT: Bharti: India’s No1 telecom co with global aspirations Tata Tele: Yet to report a single quarter of profit

- 28. www.motilaloswal.com17th Annual Wealth Creation Study 27 L&T v/s HCC The facts … Both long standing construction players in India. In fact, HCC was incorporated in 1926, earlier than L&T (1946) Both have benefited from India’s exponential growth in infra, construction, real estate MOAT IMPACT: L&T: Arguably India’s answer to General Electric HCC: Struggling to make profit plus issues like BOTs, Lavasa

- 29. www.motilaloswal.com17th Annual Wealth Creation Study 28 HDFC Bank v/s Central Bank The facts … Central Bank has recently completed 100 years. HDFC Bank, in contrast, is less than 20 years old. Central Bank’s has 60% more branches than HDFC Bank (4,000+ v/s 2,500) MOAT IMPACT: HDFC Bank: FY12 PAT 10x of Central Bank, Mkt Cap 24x Central Bank: Lagging on most metrics – NPA, RoE, RoTA, etc

- 30. www.motilaloswal.com17th Annual Wealth Creation Study 29 1. INDUSTRY STRUCTURE Interplay of Buyer power, Supplier Power, Threat of new entrants/substitutes, etc 2. COMPANY STRATEGY 5 elements – (1) Distinct value proposition (2) Tailored value chain (3) Trade-offs (4) Fit (5) Continuity over time Economic Moat: Two factors Moat Quote “Why are some companies more profitable than others? … First, companies benefit from (or are hurt by) the structure of their industry. Second, a company’s relative position within its industry can account for even more of the difference.” – Joan Magretta, in her book Understanding Porter

- 31. www.motilaloswal.com17th Annual Wealth Creation Study 30 1. The Economic Moat hypothesis Investing in a portfolio of EMCs (Economic Moat Companies) should lead to sustained outperformance over benchmark indices across years, irrespective of market conditions. 2. Backtesting the hypothesis Step 1: The backtesting framework 1. Arrive at a list of EMCs as on March 2002 and invest in them 2. Monitor price performance from March 2002 to March 2012 Economic Moat: Applying in equity investing

- 32. www.motilaloswal.com17th Annual Wealth Creation Study 31 Backtesting the Economic Moat hypothesis (contd) Step 2: Deciding Economic Moat criteria 2A. The principles: 1. Economic Moat ultimately reflects in financials, with RoI significantly superior to peers 2. Competitive advantage is relevant only within sectors 2B. The practice: 1. For each of the last 8 years, calculate for all sectors RoE of companies and sector average RoE 2. A company is an EMC if for at least 6 years, its RoE exceeds industry average 3. Discretionary adjustment to the final list based on then known facts and figures Economic Moat: Applying in equity investing

- 33. www.motilaloswal.com17th Annual Wealth Creation Study 32 Backtesting the Economic Moat hypothesis (contd) Step 3: The findings #1 – EMCs handsomely outperform #2 – EMCs’ outperformance is earnings and valuations agnostic #3 – EMCs’ outperformance is sector agnostic #4 – Future not too meaningful for EMCs, but critical for non-EMCs Economic Moat: Applying in equity investing

- 34. www.motilaloswal.com17th Annual Wealth Creation Study 33 Backtesting the Economic Moat hypothesis (contd) Finding #1: EMCs handsomely outperform Over 2003-12, overall return of 177 companies was 18% EMCs returned 25% whereas non-EMCs returned 12% Sensex return was 18%, implying 7% Alpha for EMCs and negative 6% Alpha for non-EMCs Economic Moat: Applying in equity investing EMCs Non-EMCs Overall Return 25% 12% 18% Sensex 18% 18% 18% Alpha +7% -6% 0% 2003-12 Avg Price CAGR (%)

- 35. www.motilaloswal.com17th Annual Wealth Creation Study 34 Backtesting the Economic Moat hypothesis (contd) Finding #1: EMCs handsomely outperform (contd) Besides point-to-point outperformance, EMCs outperformed the Sensex in every year over the 10 years Also, after 3 years, EMCs outperformed even non-EMCs Economic Moat: Applying in equity investing Payoff profile

- 36. www.motilaloswal.com17th Annual Wealth Creation Study 35 Backtesting the Economic Moat hypothesis (contd) Finding #2: EMCs’ outperformance is earnings and valuations agnostic The most plausible explanation for this: Earnings agnosticism EMCs’ strong competitive advantage which ensures that they enjoy a more-than-fair share of the growth inherent in most sectors in India Valuation agnosticism Continuous rollover of EMCs’ competitive advantage period (CAP) Economic Moat: Applying in equity investing

- 37. www.motilaloswal.com17th Annual Wealth Creation Study 36 Backtesting the Economic Moat hypothesis (contd) Explaining EMCs’ valuation agnosticism: CAP Competitive advantage period (CAP) is the time during which a company is expected to generate returns on incremental investment that exceed its cost of capital. Markets do assign premium valuations to EMCs, given their reasonably accurate assessment that such companies enjoy a very long CAP. Where the markets fail is in recognizing that barring a low mortality rate of less than 15%, EMCs leverage their moat and sustain high return even with passage of time. The CAP of EMCs simply rolls over with each passing year, creating incremental excess return for investors. Economic Moat: Applying in equity investing

- 38. www.motilaloswal.com17th Annual Wealth Creation Study 37 Backtesting the Economic Moat hypothesis (contd) CAP rollover plausibly explains EMCs’ valuation agnosticism Economic Moat: Applying in equity investing Return=WACC CAP in Year 0 CAP rolls over by 1 year

- 39. www.motilaloswal.com17th Annual Wealth Creation Study 38 Backtesting the Economic Moat hypothesis (contd) Finding #3: EMCs’ outperformance is sector agnostic EMCs are likely to outperform benchmarks across sectors, even if the sector itself is out of market favor. Thus, out of our 22 homogenous sector groupings, EMCs underperformed the Sensex in only two sectors – Oil Refining and Textiles. Economic Moat: Applying in equity investing

- 40. www.motilaloswal.com17th Annual Wealth Creation Study 39 Backtesting the Economic Moat hypothesis (contd) Economic Moat: Applying in equity investing Finding #4: Future not too meaningful for EMCs, critical for non-EMCs Mortality rate of EMCs is likely to be low. By 2012 only 11 of 74 turned into non-EMCs (mortality<15%). But even these companies beat the Sensex EMCs which remained so did not do much better than initial performance Non-EMCs who upgraded into EMCs delivered the highest return at 27%, albeit with a mortality rate of 75% Worse of all, non-EMCs which remained so delivered only 8% return. Payoff Matrix 2003-12 Yes 27% 26% EMCs No 8% 20% No Yes 1995-02 EMCs2003-12 Sensex return was 18%

- 41. www.motilaloswal.com17th Annual Wealth Creation Study 40 Backtesting the Economic Moat hypothesis (contd) Economic Moat: Applying in equity investing Applying the methodology to Nifty constituents in year 2002 We applied our backtesting methodology to 38 constituents of Nifty in 2002. The results were similar to that of the broader universe – EMCs outperform both non-EMCs and overall Nifty Non-EMCs underperform Nifty EMCs which maintain status quo do not report materially high returns But non-EMCs which upgrade to EMCs deliver high returns Non-EMCs which stay so perform the worst Stock returns on 2002 Nifty Price CAGR No. of cos. EMC 22% 29 Non-EMC 16% 9 Nifty payoff matrix 2003-12 Yes 21% 22% EMCs No 4% 14% No Yes 1995-02 EMCs 38 stocks return: 20% Nifty return: 16%

- 42. www.motilaloswal.com17th Annual Wealth Creation Study 41 Applying the methodology to current Nifty We have bifurcated current Nifty stocks into EMCs and non- EMCs using the backtesting methodology – 1. Company and sector average RoE data 2005 to 2012, and 2. In some cases, discretion based on currently known information and subjective opinion Prognosis based on past experience 1. In our view, there are 27 EMCs and 23 non-EMCs in the current Nifty 2. Expect EMC basket to outperform non-EMCs and Nifty itself 3. Expect about 6 non-EMCs (25% of 23) to upgrade to EMCs and deliver handsome returns 4. Non-EMCs which maintain status quo will eventually be replaced in the Nifty Economic Moat: Applying in equity investing

- 43. www.motilaloswal.com17th Annual Wealth Creation Study 42 Nifty: The Economic Moat classification Economic Moat: Applying in equity investing

- 44. www.motilaloswal.com17th Annual Wealth Creation Study 43 Market Outlook Seems poised for new highs

- 45. www.motilaloswal.com17th Annual Wealth Creation Study 44 Corporate Profit to GDP should be around 5% for 2013 Market Outlook

- 46. www.motilaloswal.com17th Annual Wealth Creation Study 45 Interest rates have softened to 8.2%; expect further fall Market Outlook

- 47. www.motilaloswal.com17th Annual Wealth Creation Study 46 Earnings Yield to Bond Yield at 0.9x is just below parity Market Outlook

- 48. www.motilaloswal.com17th Annual Wealth Creation Study 47 Sensex forward P/E is currently at 14.4x around LPA Market Outlook

- 49. www.motilaloswal.com17th Annual Wealth Creation Study 48 Sensex EPS is expected to grow 11% over FY12-14 Market Outlook

- 50. www.motilaloswal.com17th Annual Wealth Creation Study 49 Consumer sector has bounced back into wealth creation ITC is the largest wealth creator, TTK Prestige the fastest, HUL back in top 10. Financials has emerged the largest wealth creating sector for the second time in a row. Absence of new entrants is leading to widespread profitability and stock performance. Economic Moat protects the profit and profitability of companies from competitive attack. Extended CAP of EMCs drives superior profits and stock returns. Over 2002-2012, EMCs in India have meaningfully outperformed benchmarks. Breach of Economic Moat causes massive wealth destruction. The Telecom sector is a classis case. Markets seem poised to touch new highs in the next 12 months. On the back of earnings growth of 10-11%, imminent moderation in interest rate, and reasonable current valuation. In Conclusion

- 51. Thank You ! & Happy Investing In Economic Moats

- 52. Motilal Oswal Wealth Creation Gallery