Final Summer 2012 Survey Report

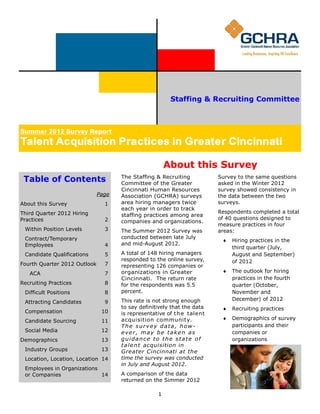

- 1. Staffing & Recruiting Committee C Summer 2012 Survey Report Winter 2012 Survey Report Talent Acquisition Practices Greater Cincinnati Talent Acquisition Practices inin Greater Cincinnati About this Survey Table of Contents The Staffing & Recruiting Committee of the Greater Survey to the same questions asked in the Winter 2012 Page Cincinnati Human Resources survey showed consistency in Page Association (GCHRA) surveys the data between the two About this Survey 1 About this Survey 1 area hiring managers twice surveys. First Quarter 2012 Hiring each year in order to track Third Quarter 2012 Hiring Practices 2 Respondents completed a total staffing practices among area Practices 2 of 40 questions designed to Qualifications Sought in companies and organizations. measure practices in four Within Position Levels Candidates 3 4 The Summer 2012 Survey was areas: Contract/Temporary Employee Turnover 6 conducted between late July Hiring practices in the Employees 4 and mid-August 2012. Recruiting Practices 7 third quarter (July, Candidate Qualifications 5 A total of 148 hiring managers August and September) Some Positions Difficult responded to the online survey, Fourth Quarter 2012 Outlook 7 of 2012 to Fill representing 126 companies or ACA 7 organizations in Greater The outlook for hiring Compensation 9 Cincinnati. The return rate practices in the fourth Recruiting PracticesCandidate Social Media and 8 for the respondents was 5.5 quarter (October, Sourcing Method 10 percent. November and Difficult Positions 8 Demographics 11 This rate is not strong enough December) of 2012 Attracting Candidates 9 Industry Groups 11 to say definitively that the data Recruiting practices Compensation 10 is representative of t h e talent Location, Location, Location 12 acquisition communit y. Demographics of survey Candidate Sourcing 11 Employees in Organizations The survey data, how- participants and their Social Media 12 ever, may be taken as companies or or Companies 12 Demographics 13 guidance to the state of organizations Outlook for Second Quarter t a l e n t acquisition in Industry Groups 2012 13 Greater Cincinnati at the Location, Location, Location 14 time the survey was conducted in July and August 2012. Employees in Organizations or Companies 14 A comparison of the data returned on the Simmer 2012 1

- 2. Third Quarter 2012 Hiring Practices Hiring among Greater reported their organization/ reducing the number of Cincinnati companies company was hiring during the employees. during the third quarter first quarter 2012. Another 23.1 percent of appeared to be up compared Only 12 percent of survey respondents indicated that a to hiring in the first quarter respondents indicated they hiring freeze was in effect at 2012. were not hiring during third their organization/company. Among the 107 survey respondents quarter 2012, down from the Only 15.4 percent of who answered the question, 15.5 percent who reported this respondents indicated their “Thinking about your organi- during the first quarter 2012. company/organization was zation/company as a whole, For those organizations/ downsizing or rightsizing. are you hiring between July companies, 61.5 percent of re- The types of hiring conducted and September 2012?” 87.9 spondents indicated their by organizations/companies percent indicated their organiza- organization was in a holding from the Summer 2012 survey tion/company was hiring during pattern – neither hiring nor are reported in Table A. the third quarter 2012. This compares to 84.4 percent who Table A Types of Hiring Conducted by Organizations/Companies Third First Quarter Quarter 2012 2012 (percentage (percentage of of Hiring Practice respondents) respodents) Hiring both to fill vacancies in existing positions and hiring for new positions 68.2 61.6 Only hiring to fill vacancies in existing positions 29.5 28.3 Adding employees -- Only hiring for new positions 2.3 10.1 2

- 3. Survey Respondents Report Hiring Within Position Levels For those companies/ 61 percent of respondents re- reporting hiring at that level. organizations where survey ported hiring at that level. At Respondents reported the respondents reported hiring, the same time, positions on the following hiring within levels at positions in the Non-exempt Executive level were the least their companies/organizations hourly-Non-technical level were filled positions, with just nine (Figure 1): the most filled positions. Nearly percent of respondents Figure 1 Hiring Within Position Levels During Third Quarter 2012 Non-exempt hourly – Non-technical – 60.9% Exempt – Technical – 55.2% Supervisor/Manager – 44.8% Non-exempt hourly – Technical – 42.5% Exempt – Non-technical – 41.4% Non exempt salaried – Non-Technical – 25.3% Director Level – 24.1% Non-exempt salaried – Technical – 18.4% Executive Level – 9.2% (Total percentage of all levels is more than 100% because respondents could report hiring in more than one position.) 3

- 4. Hiring Status of Contract/Temporary Employees Chart 1 displays the breakout of how respondents reported contract/temporary employees were hired for their organization/company. Contractors/temporary employees are defined as individuals not on the organization/company payroll and who are not benefits eligible. Chart 1: Hiring Status for Contract/Temporary Employers* 3rd Qtr. 2012 Displayed as Percentage of Yes or No Responses ( * d ef ined as ind ivid uals who ar e N OT o n co mp any/ o r g aniz at io n' s p ayr o ll and N OT b enef it s elig ib le) Yes No 100% 90% 80% 70% 58 .7% 6 1.2 % 6 5.3 % 6 8 .6 % 60% 78 .9 % 50% 40% 30% 20% 4 1.3 % 3 8 .8 % 3 4 .7% 3 1.4 % 10% 2 1.5% 0% H I R I N G c o n t r a c t o r s/ t e m p o r a r y A D D I N G c o n t r a c t o r s/ t e m p o r a r y R EP L A C I N G H I R I N Gc o n t r a c t / t e m p o r a r y C u r r e n t l y N OT H I R I N G e m p l o y e e s t o f i l l wh a t we r e e mpl oy e e s t o f i l l ne w c o n t r a c t o r s/ t e m p o r a r y e mpl oy e e s t o e v e nt ua l l y f i l l a C o n t r a c t / T e m p o r a r y Em p l o y e e s f or me r l y c ont r a c t i ng/ t e mpor a r y j obs e m p l o y e e s t o f i l l e x i st i n g c o m p a n y p o si t i o n or ga ni z a t i ona l / c ompa ny j obs c ont r a c t i ng/ t e mpor a r y j obs Hir ing St at us Chart 2 shows the types of positions for which contract/temporary employees were hired during the third quarter 2012. Chart 2: Positions Filled for Contract/Temporary Employees 3rd Qtr. 2012 by Percent of Total Responses for Each Position ( R esp o nd ent s C o uld Select M o r e t han One Po sit io n Level) 7.8 % 19 .6 % 9 .8 % 11.8 % 3 1.4 % 19 .6 % 58 .8 % 3 5.3 % Director level Supervisor/Manager Exempt – Technical Exempt – Non-technical Non-exempt hourly -Technical Non-exempt hourly – Non-Technical Non-exempt salaried – Technical Non-exempt salaried – Non Technical 4

- 5. Qualifications Sought in Candidates The survey asked Human Resources hiring managers about the educational and work experience that or- ganizations and companies desire in candidates. Survey respondents were asked to provide information about candidates in three categories of positions: exempt employee positions; non-exempt employee positions and hourly employee positions. Exempt Positions Both candidates with bachelor’s degrees and Survey respondents reported the following about desired graduates of technical or qualifications in candidates for exempt positions (percentages may career colleges were sought total more than 100 percent because respondents could select more by nearly 41 percent of than one educational level or work experience level as being sought in candidates): organizations/companies Nearly 87 percent of respondents indicated that college Candidates with certificates graduates with bachelor’s degrees were the most sought from professional programs candidates at accredited institutions were sought by slightly more than Master’s degree candidates were sought by nearly 43 34 percent of organizations/ percent of organizations/companies companies Candidates with technical or career college degrees were Those candidates with post- sought by 31 percent of graduate degrees (i.e. Masters, respondents J.D., Ph.D., M.D.) were the Slightly more than 21 percent of survey respondents least sought, coming in at just indicated candidates with certificates in professional over five percent programs from accredited institutions were desired, while When it comes to work just 20 percent indicated high school graduates or GED experience, candidates with certificates were sought for exempt positions. two to five years of work Nearly 80 percent of respondents indicated that candidates experience were the winners. with two to five years Nearly 87 percent of experience were the most sought candidates respondents listed these candidates as the most Candidates with six to ten years experience were the sought candidates. second most sought candidates as indicated by nearly 67 percent of respondents Nearly 67 percent of respondents listed candidates Respondents indicated a major drop for desired with less than two years candidates outside the two to ten years experience work experience as the range: just 25 percent sought candidates with 11 to 15 second most sought group years experience; slightly more than 21 percent sought of candidates candidates with more than 15 years of experience; and 20 percent sought candidates with less than two years of Respondents indicated a experience. major drop for desired candidates falling outside the two years to five years Non-exempt Positions experience range: slightly Survey respondents reported the following about desired qualifica- more than 33 percent seek tions in candidates for non-exempt positions (percentages may total candidates with six to ten years more than 100 percent because respondents could select more than of experience; just 16 percent one educational level or work experience level as being sought in seek candidates with 11 to 15 candidates): years of experience; and slightly Nearly 78 percent of respondents indicated that high school graduates or more than 13 percent seek GED recipients were the most sought candidates candidates with more than 15 5

- 6. Qualifications Sought in Candidates Hourly Positions Survey respondents reported the following about desired qualifications in candidates for hourly positions (percentages may total more than 100 percent because respondents could select more than one educational level or work experience level as being sought in candidates): The most sought educational level for hourly position candidates is a high school diploma or GED as indicated by nearly 85 percent of survey respondents. Nearly 33 percent of respondents seek candidates with a technical or career college degree and 30 percent of respondents indicate that candidates with certificates in professional programs from an accredited institution are desirable candidates. College graduates with bachelor’s degrees are sought for hourly positions by nearly 22 percent of respondents Just under seven percent of respondents seek candidates with post graduate degrees (i.e., Masters, J.D., Ph.D., M.D.) In terms of work experience, 76 percent of respondents seek those with less than two years of experience for hourly positions, while those with two to five years of experience are sought by 68 percent of respondents. Candidates with more years of work experience are the lesser-sought candidates for hourly positions: nearly 27 percent of respondents seek candidates with six to ten years of experience; candidates with 11 to 15 years experience and those with more than 15 years of experience are sought by slightly more than 13 percent of respondents. Chart 3 shows the percentage of respondents who indicated their organizations/companies seek candidates who fall into four diversity qualifications (percentages total more than 100 percent because respondents could indicate more than one diversity qualification) : Chart 3: Diversity Qualifications Sought in Candidates by Percent of Total Responses for Each Qualification ( R esp o nd ent s C o uld Select M o r e t han One D iver sit y Qualif icat io n) Veterans, 87.0% Ethnicity, 95.7% Disabled, 76.8% Gender, 92.8% 6

- 7. Hiring Practices Outlook for Fourth Quarter 2012 75.3 percent of respondents anticipate hiring in this quarter 58.2 percent of respondents anticipate hiring both to fill vacancies in existing positions and hiring for new positions 32.8 percent of respondents anticipate hiring to replace employees by filling only vacancies in existing positions 62.7 percent of respondents anticipate filling positions for Non-Exempt hourly-Non-technical positions 55.2 percent of respondents anticipate filling positions for Exempt-Technical positions 38.2 percent of respondents anticipate filling Supervisor/Manager positions 35.8 percent of respondents anticipate filling both Exempt-Non-technical and Non-exempt hourly- Technical positions 34.3 percent of respondents anticipate filling Non- Exempt salaried-Technical positions Less than a third of respondents anticipated filling positions for Executive-level, Director-level, and Non-Exempt salaried – Technical positions Survey responses show that more organizations/ companies do not anticipate hiring contract/ temporary employees than companies that do anticipate hiring contract/temporary employees Affordable Health Care Act Just prior to the survey being sent to possible respondents, the U.S. Supreme Court upheld the constitutionality of the Affordable Health Care Act. The survey added a question to gauge possible changes from previous hiring patterns within the next 18 months as a result of the Supreme Court ruling. The results: 58.8 percent of respondents do not anticipate a change from pre- vious normal hiring patterns 2,1 percent of respondents anticipate an increase in normal hir- ing patterns 6.2 percent of respondents anticipate a decrease in normal hiring patterns 33.0 percent of respondents are unsure/do not know when asked about a change from previous normal hiring patterns 7

- 8. Recruiting Practices This section discusses the findings from survey questions that asked about three specific recruiting practices: compensation, social media usage and candidate sourcing methods. Why Positions Are Some Positions Are Difficult to Fill Difficult to Fill Two-thirds of survey respondents indicated that their or- ganizations/companies experience more difficulty than ex- Among the reasons survey pected in filling certain positions. Table B displays the results respondents reported for more when respondents were asked about difficulty in filling positions in difficulty than expected in six labor sectors: hiring qualified candidates: Table B Candidates don’t possess the right work experience Yes or No Responses to: (58.8 percent) “Does your organization/company experience more difficulty Candidates don’t possess than expected in hiring qualified candidates?” the right skills (43.5 percent) Candidates don’t possess Percentage Percentage the right educational/ of of training background (35.5 YES NO percent) Labor Sector Responses Responses Can’t find candidates in IT/Computer 60.4 39.6 the salary range (33.9 percent) Engineering 50.0 50.0 Mismatch between the Scientific/Technical 41.0 59.0 position qualifications and Business 39.2 60.8 the candidate’s salary/ wage expectations (16.1 Healthcare 35.7 64.3 percent) Manufacturing 34.1 65.9 Can’t find candidates in the hourly rate range (14.5 percent) Difficulty time in attracting candidates to Greater Cincinnati (11.3 percent) Lack of appro- priate educa- tional/training opportunities in the Greater Cincinnati area (4.8 percent) 8

- 9. Companies and Organizations Use Multiple Actions to Attract Candidates According to the survey data, organizations and companies in the Greater Cincinnati area are taking a variety of actions/incentives to attract qualified candidates to the area. Many respondents reported multiple actions/incentives (percentages total more than 100 percent because respondents could indicate more than one action/incentive) : Relocation assistance (e.g., realty firms, visitors financial, moving, tempo- bureaus, museums (29.7 rary housing, real estate, percent) spousal/partner job-hunting Company perks (e.g., assistance) (47.3 percent) company car, Metro Tuition assistance for em- passes, tax assistance, ployee and/or employee’s increased insurance spouse and/or children coverage, bonuses, stock (41.9 percent) options, financial planning, tickets to sport Highly attractive benefits or cultural events, packages that exceed company cafeteria, average benefits company after-work gath- offerings for the Greater erings, company holiday Cincinnati area (37.8 party/summer picnic) percent) (28.4 percent) Literature, maps, guides, Personal integration into websites, social media sites community (e.g., for Greater Cincinnati introductions to prepared by your company/ members of civic/ organization (35.1 percent) community groups, Career growth incentives company volunteer such as professional activities in the association community) for new hires memberships, meeting or (8.1 percent) conference registration Respondents also reported fees, seminar registration that their organization or fees (35.1 percent) company was using methods Provide face-to-face other than those listed above. interaction with potential Among those methods: workplace peers, Initiated a escorted tours or military attendance at cultural/ recruiting civic events to selected can- program to didates during enhance recruiting phase (33.8 per- candidate pool cent) across the U.S. Literature, maps, guides, Use a websites, social media sites temporary for Greater agency and Cincinnati prepared by outside other groups (e.g. relationships Chambers of Commerce, 9

- 10. Compensation Survey responses showed that in all position categories, companies continueed to hold the line on compensation by reporting no change from 2011 to 2012. At the Manager, Director and Executive Levels for new hires: 49.4 percent of respondents indicated no change from 2011 43.8 percent of respondents indicated higher compensation than in 2011 Just 6.7 percent of respondents indicated lower compensation than in 2011 At the Exempt levels for new hires: 60.5 percent of respondents indicated no change from 2011 34.9 percent of respondents indicated higher compensation than in 2011 4.7 percent of respondents indicated lower compensation than in 2011 At the Hourly Technical and Hourly Non-Technical levels for new hires: 65.5 percent of respondents indicated no change from 2011 31.0 percent of respondents indicated higher compensation than in 2011 3.67 percent of respondents indicated lower compensation than in 2011 The survey asked respondents to report the salary increase ranges their organization/company is paying to current employees for the current fiscal year. Without exception, the greatest percentage was indicated for salary increases between 2.0% and 3.9% for current employees. 10

- 11. Candidate Sourcing Methods and Social Media Candidate Sourcing Methods Survey Identifies the Top Three Most Among staffing and recruiting managers, candidate sourcing methods remains a hot topic. The survey asked three Effective Methods for questions related to candidate sourcing. Recruiting and Survey respondents were asked to identify which of three Sourcing talent management systems (TMS) their companies/ organizations use in recruiting efforts. The results: What are the top three most effective recruiting/sourcing methods used by an 84.6 percent of respondents reported using Taleo organization/company? Survey data showed (totals 7.7 percent of respondents reported using Brass Ring equal more than 100 percent 7.7 percent of respondents reported using Kenexa because respondents could indicate more than one method) : As more and more companies encourage job applicants to file applications online, the use of electronic screening of candidate resumes, as opposed to an initial screening of 77.7 percent of the resume by a live company representative, has become a respondents cited much discussed issue. Employee Referrals The survey asked respondents if their company/organization 55.2 percent of use electronic screening for the resumes of job applicants. respondents cited Job seekers filing applications with Greater Cincinnati Commercial online companies have less than a 1 in 2 chance of having job boards (i.e., their resumes electronically screened. Monster, CareerBuilder, Sixty percent of respondents reported that their company/ etc.) organization does not electronically screen resumes. Nearly 36.8 percent of 38 percent of respondents indicated that electronic screening respondents cited the is used to screen resumes in their company/organization, while slightly more than two percent of respondents did not Organization/ know whether or not their company/organization uses Company website electronic screening of applicants’ resumes. In a recently published book, “Why Good People Can’t Find Less than 25 percent of Jobs,” by Peter Cappelli, the author cited the widespread use respondents cited social of electronic screening of job applicants’ resumes as one media, search firms, rehires of reason for the so-called “skills gap” (when companies can’t former employees, former find applicants with the right skills for a job). college interns or former Survey respondents were asked how satisfied they were CoOp students, referrals from that their electronic resume screening provides the best industry contacts, job possible candidates from the pool of applicants for a fairs/campus career services, position. The respondents reported the following results: college/university websites, military websites, professional 60.6 percent of respondents reported being satisfied associations/conferences, or advertising in traditional 21.2 percent of respondents reported being very satisfied media as effective recruiting/ 15.2 percent of respondents reported being unsatisfied sourcing methods. 3.0 percent of respondents reported being very unsatisfied 11

- 12. Social Media Cincinnati organizations/companies appear to be allocating more off the human resources or recruiting annual budget to social media recruiting than in the past two surveys. The Summer 2012 Survey data showed slight increases in the higher percentage levels of budgets devoted to social media than in the past surveys, while the data showed fewer responses in the lower budget percentage levels. The results from respondents to the Summer 2012 Survey: 54.0 percent of respondents reported less than 1.0 % of budget allocated to social media recruiting 20.7 percent of respondents reported between 1% - 4.9% of budget allocated to social me- dia recruiting 13.8 percent of respondents reported between 5% - 9.9% of budget allocated to social me- dia recruiting 5.7 percent of respondents reported 10% - 19.9% of budget allocated to social media re- cruiting 5.7 percent of respondents reported 20% or higher of budget allocated to social media re- cruiting LinkedIn remains the clear leader among the social media tools used by respondents in the recruiting and hiring process. Survey data showed the following usage of social media tools by respondents: 88.6 percent of respondents reported using LinkedIn 42.9 percent of respondents reported using Craigs List 41.4 percent of respondents reported using Facebook 32.9 percent of respondents reported using Twitter 15.7 percent of respondents reported using Google+ 10.0 percent of respondents reported using YouTube 2.9 percent of respondents reported using Flickr 2.9 percent of respondents reported using Google Social Media Analytics 1.4 percent of respondents reported using Klout 1.4 percent of respondents reported using Yammert 0.0 percent of respondents reported using Digg or SlideShare or Technorati or Yelp 12

- 13. Demographics This section of the survey asked questions about the companies and organizations represented by the survey participants. Industry Groups Survey participants were asked what industry group their company or organization belonged to based upon standard industry classification. Table C presents the industries reported by survey respondents. Table C Survey Participants by Industry Group Percentage of Industry Group Respondents Manufacturing 19.0 Healthcare 15.2 Non-profit 8.9 Financial – banking, insurance 6.3 Government – federal, state, local 6.3 Distribution 5.1 Employment and staffing services 5.1 Information technology 3.8 Legal 3.8 Retail 3.8 Architectural services 2.5 Internet Services 2.5 Transportation 2.5 Agribusiness 1.3 Biotechnology 1.3 Chemicals 1.3 Civil and Structural Engineering 1.3 CPA Firm 1.3 Education 1.3 Hotel 1.3 HVAC Service and Construction 1.3 Marketing and sales 1.3 Real estate and property management 1.3 Religious 1.3 Telecommunications 1.3 13

- 14. Location, Location, Location Data from the Summer 2012 Survey showed that the Greater Cincinnati area serves as an important location for the companies and organizations represented by the respon- dents: 56.3 percent of respondents reported that their national/global headquarters is located in the tri-state area 27.7 percent of respondents said their regional/divisional headquarters is located in the tri-state area 19.3 percent of respondents reported that their national/global headquarters is located outside the tri-state area Employees in Organizations or Companies The Summer 2012 Survey asked participants about the distribution of employees in their companies/ organizations. Table D shows the percentage of respondents who indicated their company or organization had employees or contract/temporary employees in specific locations. Table D Number of Employees in Organizations or Companies Represented by Summer 2012 Survey Participants (Reported as Percentage of Respondents; Grey Shading = No Response) Contract/Temporary Employees in the Number of Employees in the Employees in the Entire Employees Tri-State Tri-State Company/Corporation Less than 10 5.6% 69.8% 3.4% 11-50 10.1% 15.1% 3.4% 51-100 19.1% 7.0% 18.2% 101-250 30.3% 2.3% 29.5% 251 or more 5.8% 251-500 10.1% 8.0% 501-1,000 11.2% 4.5% 1,001-2,000 0.0% 6.8% 2,001 or more 13.5% 2,001-5,000 8.0% 5,001-10,000 5.7% 10,001-15,000 3.4% 15,001-20,000 1.1% 20,001 and above 8.0% 14