QE Index Rises 1.0% Led by Telecom, Insurance Gains

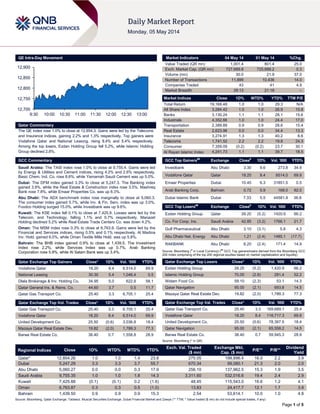

- 1. Page 1 of 5 QE Intra-Day Movement Qatar Commentary The QE index rose 1.0% to close at 12,854.3. Gains were led by the Telecoms and Insurance indices, gaining 2.2% and 1.3% respectively. Top gainers were Vodafone Qatar and National Leasing, rising 8.4% and 5.4% respectively. Among the top losers, Ezdan Holding Group fell 5.2%, while Islamic Holding Group declined 2.8%. GCC Commentary Saudi Arabia: The TASI index rose 1.0% to close at 9,755.4. Gains were led by Energy & Utilities and Cement indices, rising 4.2% and 2.6% respectively. Basic Chem. Ind. Co. rose 8.6%, while Yamamah Saudi Cement was up 5.0%. Dubai: The DFM index gained 3.3% to close at 5,247.3. The Banking index gained 3.9%, while the Real Estate & Construction index rose 3.5%. Mashreq Bank rose 7.8%, while Emaar Properties Co. was up 6.3%. Abu Dhabi: The ADX benchmark index rose marginally to close at 5,060.3. The consumer index gained 5.7%, while Inv. & Fin. Serv. index was up 3.0%. Foodco Holding surged 15.0%, while Investbank was up 9.6%. Kuwait: The KSE index fell 0.1% to close at 7,425.9. Losses were led by the Telecom. and Technology, falling 1.1% and 0.7% respectively. Manazel Holding declined 5.2% while Real Estate Trade Centers Co. was down 4.2%. Oman: The MSM index rose 0.3% to close at 6,763.9. Gains were led by the Financial and Services indices, rising 0.5% and 0.1% respectively. Al Madina Inv. Hold. gained 6.0%, while Oman Textile Mills Hold. was up 5.8%. Bahrain: The BHB index gained 0.9% to close at 1,439.5. The Investment Index rose 2.2%, while Services Index was up 0.7%. Arab Banking Corporation rose 5.9%, while Al Salam Bank was up 3.4%. Qatar Exchange Top Gainers Close* 1D% Vol. ‘000 YTD% Vodafone Qatar 18.20 8.4 6,514.0 69.9 National Leasing 30.30 5.4 1,046.4 0.5 Dlala Brokerage & Inv. Holding Co. 34.95 5.0 622.9 58.1 Qatar General Ins. & Reins. Co. 44.60 3.7 0.5 11.7 Qatar Gas Transport Co. 25.40 3.3 6,705.1 25.4 Qatar Exchange Top Vol. Trades Close* 1D% Vol. ‘000 YTD% Qatar Gas Transport Co. 25.40 3.3 6,705.1 25.4 Vodafone Qatar 18.20 8.4 6,514.0 69.9 United Development Co. 25.50 (0.6) 3,036.8 18.4 Mazaya Qatar Real Estate Dev. 19.82 (2.0) 1,789.3 77.3 Barwa Real Estate Co. 38.40 0.7 1,558.8 28.9 Market Indicators 04 May 14 01 May 14 %Chg. Value Traded (QR mn) 1,001.4 801.4 25.0 Exch. Market Cap. (QR mn) 727,689.8 725,688.2 0.3 Volume (mn) 30.0 21.9 37.0 Number of Transactions 11,899 10,436 14.0 Companies Traded 43 41 4.9 Market Breadth 29:13 21:18 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 19,168.48 1.0 1.0 29.3 N/A All Share Index 3,284.42 1.0 1.0 26.9 15.8 Banks 3,130.24 1.1 1.1 28.1 15.6 Industrials 4,352.66 1.0 1.0 24.4 17.0 Transportation 2,389.89 0.9 0.9 28.6 15.4 Real Estate 2,623.96 0.0 0.0 34.4 13.3 Insurance 3,274.91 1.3 1.3 40.2 8.6 Telecoms 1,741.52 2.2 2.2 19.8 24.3 Consumer 7,359.09 (0.2) (0.2) 23.7 30.1 Al Rayan Islamic Index 4,241.73 1.1 1.1 39.7 18.5 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Investbank Abu Dhabi 3.30 9.6 273.8 34.9 Vodafone Qatar Qatar 18.20 8.4 6514.0 69.9 Emaar Properties Dubai 10.45 6.3 31851.5 0.5 Arab Banking Corp. Bahrain 0.72 5.9 168.0 92.0 Dubai Islamic Bank Dubai 7.33 5.5 44581.9 36.8 GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Ezdan Holding Group Qatar 28.25 (5.2) 1420.9 66.2 Co. For Coop. Ins. Saudi Arabia 42.85 (3.2) 1766.1 21.7 Gulf Pharmaceutical Abu Dhabi 3.10 (3.1) 5.8 4.3 Abu Dhabi Nat. Energy Abu Dhabi 1.21 (2.4) 1485.1 (17.7) RAKBANK Abu Dhabi 8.20 (2.4) 171.4 14.9 Source: Bloomberg ( # in Local Currency) ( ## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) Qatar Exchange Top Losers Close* 1D% Vol. ‘000 YTD% Ezdan Holding Group 28.25 (5.2) 1,420.9 66.2 Islamic Holding Group 70.00 (2.8) 281.4 52.2 Widam Food Co. 59.10 (2.3) 53.1 14.3 Qatar Navigation 95.00 (2.1) 693.8 14.5 Mazaya Qatar Real Estate Dev. 19.82 (2.0) 1,789.3 77.3 Qatar Exchange Top Val. Trades Close* 1D% Val. ‘000 YTD% Qatar Gas Transport Co. 25.40 3.3 169,689.1 25.4 Vodafone Qatar 18.20 8.4 116,717.3 69.9 United Development Co. 25.50 (0.6) 78,397.5 18.4 Qatar Navigation 95.00 (2.1) 65,558.2 14.5 Barwa Real Estate Co. 38.40 0.7 59,945.3 28.9 Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 12,854.26 1.0 1.0 1.4 23.8 275.05 199,896.4 16.0 2.2 3.9 Dubai 5,247.29 3.3 3.3 3.7 55.7 670.34 99,080.1 21.3 2.0 2.0 Abu Dhabi 5,060.27 0.0 0.0 0.3 17.9 256.10 137,962.5 15.3 1.9 3.5 Saudi Arabia 9,755.35 1.0 1.0 1.8 14.3 3,311.60 532,016.6 19.4 2.4 2.9 Kuwait 7,425.88 (0.1) (0.1) 0.2 (1.6) 48.45 115,543.0 16.6 1.2 4.1 Oman 6,763.87 0.3 0.3 0.5 (1.0) 13.83 24,417.7 12.1 1.7 3.9 Bahrain 1,439.50 0.9 0.9 0.9 15.3 2.54 53,614.1 10.0 1.0 4.8 Source: Bloomberg, Qatar Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 12,700 12,750 12,800 12,850 12,900 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 5 Qatar Market Commentary The QE index rose 1.0% to close at 12,854.3. The Telecoms and Insurance indices led the gains. The index rose on the back of buying support from non-Qatari shareholders despite selling pressure from Qatari shareholders. Vodafone Qatar and National Leasing were the top gainers, rising 8.4% and 5.4% respectively. Among the top losers, Ezdan Holding Group fell 5.2%, while Islamic Holding Group declined 2.8%. Volume of shares traded on Sunday rose by 37.0% to 30.0mn from 21.9mn on Thursday. Further, as compared to the 30-day moving average of 28.8mn, volume for the day was 4.2% higher. Qatar Gas Transport Co. and Vodafone Qatar were the most active stocks, contributing 22.3% and 21.7% to the total volume respectively. Source: Qatar Exchange (* as a % of traded value) Earnings Earnings Releases Company Market Currency Revenue (mn)1Q2014 % Change YoY Operating Profit (mn) 1Q2014 % Change YoY Net Profit (mn) 1Q2014 % Change YoY Dubai Investments (DI) Dubai AED 277.9 1.7% – – 265.0 25.6% Ras Al Khaimah Ceramics Abu Dhabi AED 792.7 -1.6% – – 58.0 14.0% Credit Rating & Collection Co. (Tahssilat) Kuwait KD – – – – -0.1 NA Tijara & Real Estate Investment Co. Kuwait KD – – – – -0.1 NA Dhofar International Development & Investment Holding Co. (DIDIC) Oman OMR 2.1 -0.3% – – 4.7 -59.1% Al Anwar Holdings Oman OMR 6.0 54.0% – – 3.1 90.8% Source: Company data, DFM, ADX, MSM News Qatar QE-listed firms see 1Q2014 profit slowdown – The companies listed on the Qatar Exchange (QE) saw a slowdown in profitability in 1Q2014, mainly due to slippages in the earnings of the industrials, insurance and transport sectors. According to the QE data, the cumulative net profits of listed companies grew 8.6% during 1Q2014 vs. 11.36% during the same period last year. The cumulative net profits of QE-listed companies stood at QR11.06bn in 1Q2014 as compared to QR10.19bn in 1Q2013 period. The largest contribution to the overall net profits came from banks, followed by industrials, real estate, telecom, transport, consumer goods and insurance. (Gulf-Times.com) QE and QNBFS hold roadshow to highlight Qatar growth – The Qatar Exchange (QE) in collaboration with QNB Financial Services has commenced a week-long roadshow across the globe that aims to support the further development and practice of the QE-listed companies’ investor relations. The roadshow will be hosted by Bank of America Merrill Lynch in New York and Deutsche Bank in London. It is designed to complement the companies’ ongoing investor relations activities through which senior management of listed companies can meet key decision makers from a number of leading international fund managers. Qatar’s forthcoming inclusion in the MSCI Emerging Market Index has provided a unique opportunity to showcase its market- leading listed companies. (Gulf-Base.com) All MPHC products become regulated – Mesaieed Petrochemical Holding Company (MPHC) has stated that all its products have now come under the "regulated" category and Qatar Chemical & Petrochemical Marketing & Distribution Company (Muntajat) has been entrusted with the marketing of those products to international markets. MPHC said that as per a ministerial directive, high density polyethylene, medium density polyethylene, normal alpha olefins, 1-Hexene, 1-Octane, 1-Butane, ethylene and pygas have now been designated as regulated products. Earlier, the company’s other products namely caustic soda solution, ethylene dichloride, vinyl chloride monomer and hydrochloric acid were designated as regulated products prior to its incorporation on May 29, 2013. (QE) Barwa Al Baraha construction enters new phase – Barwa Real Estate Company (BRES) announced that the construction work for package two of the second phase of Barwa Al Baraha project will begin in May 2014. Barwa Al Baraha – which is Barwa’s largest development – is being constructed in two phases over 1.8mn square meters with a capacity of 53,000 workers. Package two of the second phase involves the construction of 32 buildings built at a cost of QR691mn, which will be completed within 17 months. These buildings will also have four dining halls, two playgrounds, two mosques, as well as restaurants and utility shops. The already completed phase one provides the largest truck and vehicle parking space in Qatar, with 4,200 parking spaces for trucks of different sizes. (Gulf-Times.com) Retail market to be on focus at Cityscape Qatar – The Qatari retail market is set to take center stage at the 2014 edition of Cityscape Qatar, which will host a dedicated conference “The Retail Forum” on June 4. Cityscape Qatar’s Group Director Deep Marwaha said that in order to capitalize on opportunities in this sector, investors from Qatar and abroad have registered in record number for the Retail Forum. The forum will explore the Qatari retail scene, focusing on opportunities for mall developers, mall operators and retailers alike. According to Al Asmakh Real Estate Development Company, the current mall Overall Activity Buy %* Sell %* Net (QR) Qatari 70.84% 72.35% (15,028,075.57) Non-Qatari 29.15% 27.65% 15,028,075.57

- 3. Page 3 of 5 space will double to reach to almost 1mn square meters of net leasable area over the next two to three years. (Gulf-Times.com) CGC wins HMC deal for surveillance, access control systems – The Consolidated Gulf Company (CGC) has been awarded a multimillion dollar contract by Hamad Medical Corporation to provide state-of-the-art CCTV surveillance cameras and access control systems that are linked to a centralized control & command center. CGC’s CCTV technology will help HMC in safeguarding public, personnel and building premises, which comprise around 30 sites including hospitals, emergency units, medical supply rooms and accommodations, making them more connected and secured. (Gulf-Base.com) 47 countries to participate in Project Qatar expo – Around 2,100 exhibitors from 47 countries will participate in the 11th edition of Project Qatar 2014 — an annual trade expo that brings together stakeholders of construction & building material sector. To be held from May 12 to 15, Project Qatar will feature 24 international pavilions spread across 41,500sqm of indoor and outdoor exhibition space at the Qatar National Convention Centre. IFP Qatar’s General Manager and Organizer of Project Qatar George Ayache announced that three countries – Indonesia, Palestine, and Romania will make their debut at the expo. Ayache added that Qatar’s construction boom has attracted many countries to take part in the country’s multibillion dollar infrastructure projects. (Peninsula Qatar) International Reuters: RBA to hold rates – Australia's central bank is almost certain to maintain a neutral policy bias this week with a batch of data likely to point to an economy that is picking up speed, just before a tough federal budget. All 25 economists polled by Reuters expect the Reserve Bank of Australia (RBA) to hold its cash rate steady at a record low 2.5% and reiterate its vow to keep interest rates unchanged over the months ahead. Nomura Analyst Martin Whetton stated that although recent economic indicators have been mixed and inflation was weaker than expected, the RBA's policy stance is likely to be firmly neutral and it is expected to leave its monetary policy unchanged. The RBA will get another chance to reiterate it this week when it releases its quarterly statement on monetary policy. Data this week including retail sales and employment, which should underpin the RBA's relatively sanguine outlook on the Australian economy. (Reuters) Portugal to emulate Ireland in exit from bailout program – Portugal will follow Ireland in exiting its three-year bailout program without seeking a precautionary credit line, when the program ends on May 17. Prime Minister Pedro Passos Coelho stated that the government has decided to exit the financial aid program without resorting to any precautionary program. Meanwhile, Eurozone finance ministers are scheduled to discuss Portugal when they meet in Brussels shortly. The decision was taken after Portugal last month held its first bond auction since the €78bn ($108 billion) rescue from the European Union and the International Monetary Fund in 2011. Portugal’s exit leaves Greece as the sole Eurozone country still in a bailout regime four years after it sought aid at the onset of the debt crisis. Ireland became the first nation to end its rescue program in December, while Spain exited its bank bailout in January 2014. (Bloomberg) Yen climbs on China data as BoJ touts recovery – The Japanese yen climbed against all major currency after data on China’s manufacturing fell short of analyst estimates, spurring demand for safer assets. The yen strengthened against the dollar for a second day after the Bank of Japan (BoJ) Governor Haruhiko Kuroda said that the nation’s economic recovery is on track, dampening expectations the BoJ will add to monetary stimulus. The dollar remained lower following weekly declines against peers, with the Federal Reserve Chair Janet Yellen due to testify to US lawmakers this week, amid speculation that the Fed will keep its rates near zero. The yen climbed 0.3% to 101.90 per dollar and advanced 0.3% to 141.33 per euro. Europe’s common currency remained unchanged at $1.3871. (Bloomberg) China factory activity shrinks in April, new export orders contract – Activity in China's manufacturing sector contracted for a fourth consecutive month in April, fuelling speculation that the world's second-largest economy is still losing momentum. The final reading of the HSBC/Markit purchasing managers' index (PMI) for April came in at 48.1, lower than a preliminary reading of 48.3 but up slightly from an eight-month low of 48.0 in March. The HSBC/Markit PMI has been below the 50 level that separates growth from contraction since the start of 2014. Further, output and new orders contracted in April, and new export orders slipped back into contraction after a recovery the previous month. (Reuters) Regional Saudi Aramco awards $1.7bn Jazan IGCC contract to Tecnicas – The Saudi Arabian Oil Company (Saudi Aramco) has awarded the Spanish energy contractor Tecnicas Reunidas a $1.7bn contract to build a large power complex in Saudi Arabia's Jazan Province. Tecnicas Reunidas will build the Jazan IGCC (Integrated Gasification Combined Cycle) complex in the south western region of Saudi Arabia and the facility will be operational by 2017. The Jazan IGCC complex will convert the vacuum residue produced in the adjacent Jazan refinery into synthesis gas. (Bloomberg) APC secures SR46mn pipe contract from Saudi Aramco – Arabian Pipes Company (APC) has been awarded a SR46mn contract for supplying 258km of welded steel pipes to Saudi Aramco. The production and supply of the pipes will start during 3Q2014 at APC’s Riyadh factory and the financial impact will be visible in 3Q2014. (Tadawul) Kingdom issues tender to buy 550,000 tons of wheat – According to European traders, Grain Silos & Flour Mills Organization (GSFMO), the state grains authority in the Kingdom of Saudi Arabia has issued an international tender to buy 50,000 tons of hard and soft wheat. The wheat is expected to be sourced from Europe, North and South America and Australia, at the sellers' option. Shipment is sought between the second half of June and first half of August, with arrival in July and August 2014. (GulfBase.com) SEC signs 10 contracts worth SR4.06bn – The Saudi Electricity Company (SEC) has signed 10 contracts worth SR4.06bn for setting up six power transformer stations, two overhead link-up lines and purchasing steam condensers. SEC’s CEO Ziyad Muhammad Al-Sheeha said six contracts include the construction of electricity transformer stations located in Wa'd Al-Shimal, Al-Gurayyat, Al-Jouf and Ar'ar in the Northern Frontier Region, Al-Khafji in the Eastern Province and Al-Madhaya in Jazan province. These stations are expected to help increase SEC's power capacity and boost economic development in these regions. The plants are projected to be ready in 29 months from the date of signing the contracts. (Gulf- Base.com) Nielsen: UAE's 1Q2014 consumer confidence surges – According to a survey by Nielsen, consumer confidence in the UAE gained four points to 114 during 1Q2014 over 4Q2013. The survey showed that consumer intentions to buy new clothes and

- 4. Page 4 of 5 spend on home improvement projects increased 2% each. Around 37% consumers put spare cash into savings and 10% invested in stocks, while 22% consumers in the region said they had no spare cash, a decline of 3% compared to 4Q2013. Consumer confidence in Saudi Arabia also improved. More than 68% of markets tracked by Nielsen reported an improved recessionary sentiment compared to 4Q2013, with the steepest improvements in the UAE (-11% points), Switzerland (-11% points) and Peru (-10% points). (GulfBase.com) Dubai FDI brings International Halal Integrity Alliance to Mid-east – Dubai Investment Development Agency (Dubai FDI), an agency of the Department of Economic Development is planning to boost Dubai's Islamic economy initiative by attracting the International Halal Integrity Alliance (IHI Alliance) to the region. Under the agreement, Dubai FDI will support IHI Alliance to open its regional office in Dubai. The IHI Alliance Middle East office will provide halal industry training for businesses, government agencies, auditors and certification companies with emphasis on professional and Islamic integrity. (GulfBase.com) DME appoints Philip Futures as clearing member – The Dubai Mercantile Exchange (DME) has approved Phillip Futures as a clearing member, which will guarantee the financial performance of trades carried out by its customers on the DME. Phillip Futures is a Chicago-based clearing futures commission merchant and a member of the Singapore-based Phillip Capital Group. (GulfBase.com) EEC to raise SR1bn for KAEC construction – Emaar Economic City (EEC) is planning to raise SR1bn to finance construction of the King Abdullah Economic City. EEC will spend SR13bn developing the Saudi Arabian project over the next four years. EEC’s CEO, Fahd Al Rasheed said that the company is expecting to arrange the loans from two or three banks by the end of 2016. (Bloomberg) Arabtec appoints Iyad Abdalrahim as CFO – Arabtec Holding has appointed Iyad Abdalrahim as its Chief Financial Officer. Iyad Abdalrahim first joined Arabtec in 2013 as the CFO of Arabtec Construction Group. (DFM) TAOI to start operation on May 5 – Takaful Oman Insurance (TAOI) is planning to commence operation on May 5, 2014. The company, which offered 40% of its shares to investors last year, has faced a delay in completing certain procedures and getting the final license from the insurance regulator for carrying out Islamic insurance business. (Gulf-Base.com) PDC launches DILC subsidiary to develop industrial clusters – The Port of Duqm Company (PDC) has launched a new subsidiary, ‘Duqm Industrial Land Company’ (DILC) to support the development of industrial clusters for investment within the adjoining Special Economic Zone (SEZ) at Duqm. PDC will hold a 51% stake in DILC, while the remaining 49% stake will be held by a number of shareholders. PDC has been allocated 2,000 hectares of land to develop petrochemicals and medium & heavy industries as part of its concession agreement with the Omani government, as well as the Usufruct Agreement with SEZ Authority of Duqm (SEZAD). (GulfBase.com) Al Hassan gets LoI for AED19.3mn construction project – Al Hassan Engineering Company Abu Dhabi has received a letter of intent from Al Ghurair Iron & Steel (AGIS) for AED19.3mn for main construction works of the phase II expansion project in ICAD–I Mussafah, Abu Dhabi. The work is expected to be completed by April 2015. (MSM) OAE achieves remittances worth $2bn – The Oman UAE Exchange (OAE) has achieved $2bn mark in remittances business from Oman in 2013 as compared to $1.9bn in 2012. (GulfBase.com) NCSI: Oman’s GDP grows 2.8% in 2013 – According to the National Centre for Statistics & Information (NCSI), Oman’s GDP based on market prices rose by an annual 2.8% at the end of 2013. Total GDP amounted to OMR30.63bn at the end of 2013 as compared to OMR29.8bn at the end of 2012. Based on producer prices, the sultanate’s GDP grew by 3.4%, to OMR31.84bn in 2013 from OMR30.8bn in 2012. Financial intermediation services indirectly measured grew by 6% to OMR612.6mn. In addition, taxes minus subsidies on products grew to OMR1.21bn in 2013, from OMR1bn in 2012, representing a growth of 20.8%. NCSI’s statistics reveal a 1% drop in petroleum activity to OMR15.22bn in 2013, which is attributed to a 1.4% drop in the total value of crude oil production. On the other hand, the total value of natural-gas production rose by 4.3% to OMR1.17bn in 2013 as compared to OMR1.12bn in 2012. (GulfBase.com) Sohar oil refinery shut for repair – Sohar oil refinery in Oman has been shut after a cooling pipe burst and the repair work is expected to take another week. The refinery has a capacity to process 116,000 bpd of crude. (Bloomberg) IDC, Bin Faqeeh sign $45mn residential project at Dilmunia – Ithmaar Bank’s wholly-owned subsidiary, Ithmaar Development Company (IDC) announced the sale of key plots worth $45mn on the landmark ‘Dilmunia at Bahrain’ development to Bin Faqeeh Real Estate Investment Company. The $1.6bn Dilmunia at Bahrain development is a mixed-use project built on a man-made island off the coast of Muharraq. (Bahrain Bourse) Bahrain plans BHD15.6mn power grid expansion – According to a top official, Bahrain will spend BHD15.6mn to strengthen and expand the national power grid. The plan includes 60 medium-intensity projects costing BHD11.4mn and 430 low-intensity projects worth BHD4.2mn. This will be in addition to the construction and operation of 11 main stations and 180 substations. (GulfBase.com)

- 5. Contacts Saugata Sarkar Keith Whitney Sahbi Kasraoui Head of Research Head of Sales Manager - HNWI Tel: (+974) 4476 6534 Tel: (+974) 4476 6533 Tel: (+974) 4476 6544 saugata.sarkar@qnbfs.com.qa keith.whitney@qnbfs.com.qa sahbi.alkasraoui@qnbfs.com.qa QNB Financial Services SPC Contact Center: (+974) 4476 6666 PO Box 24025 Doha, Qatar DISCLAIMER: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange; QNB is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. While this publication has been prepared with the utmost degree of care by our analysts, QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 5 of 5 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg 80.0 90.0 100.0 110.0 120.0 130.0 140.0 150.0 160.0 170.0 180.0 190.0 200.0 Jun-10 Jan-11 Aug-11 Mar-12 Oct-12 May-13 Dec-13 QE Index S&P Pan Arab S&P GCC 1.0% 1.0% (0.1%) 0.9% 0.3% 0.0% 3.3% (0.8%) 0.0% 0.8% 1.6% 2.4% 3.2% 4.0% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D% WTD% YTD% Gold/Ounce 1,299.62 0.0 0.0 7.8 DJ Industrial 16,512.89 0.0 0.0 (0.4) Silver/Ounce 19.50 0.0 0.0 0.1 S&P 500 1,881.14 0.0 0.0 1.8 Crude Oil (Brent)/Barrel (FM Future) 108.59 0.0 0.0 (2.0) NASDAQ 100 4,123.90 0.0 0.0 (1.3) Natural Gas (Henry Hub)/MMBtu 4.71 0.0 0.0 8.5 STOXX 600 337.76 0.0 0.0 2.9 LPG Propane (Arab Gulf)/Ton 107.00 0.0 0.0 (15.2) DAX 9,556.02 0.0 0.0 0.0 LPG Butane (Arab Gulf)/Ton 120.37 0.0 0.0 (11.8) FTSE 100 6,822.42 0.0 0.0 1.1 Euro 1.39 0.0 0.0 0.9 CAC 40 4,458.17 0.0 0.0 3.8 Yen 102.20 0.0 0.0 (3.0) Nikkei 14,457.51 0.0 0.0 (11.3) GBP 1.69 0.0 0.0 1.9 MSCI EM 1,003.39 0.0 0.0 0.1 CHF 1.14 0.0 0.0 1.7 SHANGHAI SE Composite 2,026.36 0.0 0.0 (4.2) AUD 0.93 0.0 0.0 4.0 HANG SENG 22,260.67 0.0 0.0 (4.5) USD Index 79.52 0.0 0.0 (0.6) BSE SENSEX 22,403.89 0.0 0.0 5.8 RUB 35.84 0.0 0.0 9.0 Bovespa 52,980.31 0.0 0.0 2.9 BRL 0.45 0.0 0.0 6.4 RTS 1,148.96 0.0 0.0 (20.4) 184.7 154.6 140.7