Saral Gyan Hidden Gem - May 2014

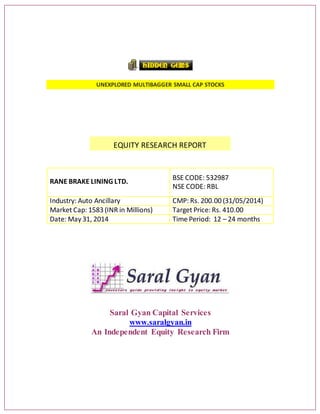

- 1. UNEXPLORED MULTIBAGGER SMALL CAP STOCKS EQUITY RESEARCH REPORT RANE BRAKE LINING LTD. BSE CODE: 532987 NSE CODE: RBL Industry: Auto Ancillary CMP: Rs. 200.00 (31/05/2014) Market Cap: 1583 (INR in Millions) Target Price: Rs. 410.00 Date: May 31, 2014 Time Period: 12 – 24 months Saral Gyan Capital Services www.saralgyan.in An Independent Equity Research Firm

- 2. HIDDEN GEMS – MAY 2014 - 2 - SARAL GYAN CAPITAL SERVICES TABLE OF CONTENT S.No Content Page No. 1. Company Background 03 2. Recent Developments 07 3. Financial Performance 10 4. Peer GroupComparison 12 5. Key Concerns / Risks 12 6. Investment Rationale 13 7. Saral GyanRecommendation 14 8. Disclaimer 15

- 3. HIDDEN GEMS – MAY 2014 - 3 - SARAL GYAN CAPITAL SERVICES 1. Company Background The Rane group was established in 1929, comprising of seven companies with twenty five plants dedicated to automobile component manufacturing. It symbolizes the successful integration of global quality with indigenous expertise. It employs over 5200 highly trained personnel. Headquartered in Chennai, the company has pan-India presence with 25 manufacturing facilities across states including Pantnagar (Uttrakhand). Rane group manufactures a comprehensive range of automobile components like hydraulic power steering systems, manual steering & suspension systems, valve train components,friction material products, steering columns & electricpower steering,seat belt systems and die casting products. It is the leading OE supplier of various auto components. The group exports to 31 countries around the world. Rane Brake Lining Limited (RBL) RBL was established in 1964 and has achieved the distinction of being domestic leader among friction material manufacturers. RBL manufactures friction material products like brake linings, disc pads, clutch facings, clutch buttons for automotive applications and composite brake blocks for Railways. It supplies friction products for all surface transport applications from motorcycles to trains. RBL had an annual sales turnover of INR 38355 Million in 2013 - 2014. Manufacturing Facilities RBL has four plants located in the major Indian cities of Chennai, Hyderabad, Puducherry and Trichy. These were established in 1964, 1991, 1997 and 2008 respectively. RBL is equipped with state-of- the-art facilities. During the year 2008-09, the company completed the expansion project in Trichy in the state of Tamilnadu with the active participation and technical inputs from the company's collaborator, Nisshinbo Brake Inc, of Japan. The state of the art plant

- 4. HIDDEN GEMS – MAY 2014 - 4 - SARAL GYAN CAPITAL SERVICES commenced commercial production during the year. They increased the production capacity of Asbestos by 4,645 MT to 18,892 MT. During the year 2009-10, the company further increased the production capacity of Asbestos by 96 MT to 18,988 MT. Chennai Plant: Automotive Products : Brake linings, disc pads and clutch facings Railway products : Composite brake blocks Aerospace : Organic pads for trainer aircraft Hyderabad Plant: Automotive Products : Brake linings, clutch facings & sintered clutch buttons Railway Products : Compositive brake blocks Puducherry Plant: Automotive Products : Disc pads, clutch facings & CV Brake Pads Railway Products : Composite Brake Blocks Trichy Plant: Automotive Products : Disc Pads & Brake linings RBL is having collaboration with Nisshinbo Industries Inc., Japan and this helps RBL in bringing out truly world-class products for our customers. R&D is given high priority and it is equipped with latest testing facilities. R&D centre is approved by Department of Science & Technology, Government of India. All four plants are equipped with production facilities to manufacture different types of products. 9 depots are situated across the country with concentration on south, north and west in India to cater to aftermarket requirements. RBL manufactures Brake Linings, Disc Pads, Clutch Facings, Composite Brake Blocks and Clutch Buttons. RBL products are used in brake system between wheel and brake shoe to decelerate & stop the vehicle and in clutch system between flywheel and clutch plate to transmit rotary motion.

- 5. HIDDEN GEMS – MAY 2014 - 5 - SARAL GYAN CAPITAL SERVICES Domestic Market Leadership: Leader in Commercial Vehicle /PassengerCar / UtilityVehicle & Two Wheeler applications Leading supplierof composite brake blocks to Indian Railways Most preferredbrand in independentreplacementmarkets SignificantsuppliertoState Transport Undertakings Exports: Products suppliedto 15 countries Supplyexperience toSri Lankan Railwaysfor composite brake blocks Range & technologyfor Indian/ European Commercial Vehicle references CV disc brake pads to Europe The products are supplied in Asbestos (A) and Asbestos Free (AF) grades to OEMs through brake assembly manufacturers (Tier-1), aftermarkets and export markets. RBL supplies friction material to all leading OEMs in India through brake / clutch assembly manufacturers, aftermarket, export market for Heavy Commercial Vehicle (HCV), Light Commercial Vehicle (LCV), Utility Vehicle (UV), Passenger Car (PC), Two Wheelers (2W), Tractor segments and Indian Railways. i) OE Segment: Brake Assembly Manufacturers Vehicle OEMs Railways • Amalgamations Repco Ltd, • Ashok Leyland Ltd, • Delhi Metro Rail Corporation Ltd, • Automotive Axles Ltd, • Asia Motor Works Ltd, • Indian Railways, • Brakes India Ltd, • Bajaj Auto Ltd, • Malaysian Railways, • Brembo Brake India Private Ltd, • Caterpillar India Private Ltd, • Sri Lankan Railways • Endurance Technologies Private Ltd, • Force Motors Ltd, • Exedy India Ltd, • Ford India Ltd, • Foundation Brake ManufacturingLtd • General Motors, (Formerly Robert Bosch Chassis Ltd), • Honda Siel Cars India Ltd, • Luk India Private Ltd, • Hyundai Motor India Ltd, • Mando India Ltd, • Mahindra & Mahindra Ltd, • Mahindra Navi Star Automobiles Ltd, • Maruti Suzuki India Ltd, • Nissan Motors India Private Ltd, • Renault Nissan Automotive Private Ltd, • Royal Enfield Motors Ltd, • Tata Motors Ltd, • Tractors and Farm Equipment Ltd, • Toyota Kirloskar Motor Private Ltd, • Ve Commercial Vehicles Ltd, • Volkswagen • Yamaha Motor Private Ltd

- 6. HIDDEN GEMS – MAY 2014 - 6 - SARAL GYAN CAPITAL SERVICES ii) Aftermarket segment: There are more than 10,000 dealers serviced by 7 Whole Sale Distributors (WSD) across the country. RBL has 9 depots spread across the country with location choice specific to business density for servicing the market requirements. iii) Export segment: RBL exports to Australia, Sri Lanka, Bangladesh, United Kingdom and Middle East countries for independent aftermarket products. Management System Certification All the manufacturing plants of RBL are certified by TUV Nord, Germany for the following management systems: ISO 9001:2008 – Quality Management System, ISO/TS 16949:2009 - International Automotive Quality System, ISO 14001:2004 : Environmental Management System, BS OHSAS 18001:2007 - Occupational Health & Safety Management System.

- 7. HIDDEN GEMS – MAY 2014 - 7 - SARAL GYAN CAPITAL SERVICES 2. Recent Development i) Rane Brake Lining Board recommends Dividend – May’14 Rane Brake Lining Ltd has informed BSE that the Board of Directors of the Company at its meeting held on May 21, 2014, inter alia, has recommended to the shareholders a dividend of Rs. 7.50/- per equity share on the paid up equity capital of Rs. 7,91,49,800 comprising of 79,14,980 equity shares of Rs. 10/- each fully paid up. The Register of Members & Share Transfer Books of the Company will remain closed from July 12, 2014 to July 22, 2014 (both days inclusive) for the purpose of Payment of Dividend & Annual General Meeting (AGM) of the Company to be held on July 22, 2014 The dividend will be paid to the eligible shareholders on July 28, 2014. ii) Rane Brake Lining Bags Deming Grand Prize 2013 – Nov’13 Rane Brake Lining Ltd. (RBL) was awarded the prestigious Deming Grand Prize 2013 at a special ceremony held in Tokyo on 14th Nov’13. Mr. P.S. Rao, RBL President, received the DGP Award from Mr. Masahiko Sakane, Vice- Chairman, Deming Prize Committee, on behalf of Mr. L. Ganesh, Chairman, Rane Group. The DGP win marked a glorious new chapter in RBL’s Excellence Journey towards achievingits vision of being the global supplier of choice in friction material. RBL now joins the elite group of 26 other companies the world over and seven other firms from India which have previously won this prestigious Award in Total Quality Management (TQM). It also gets the distinction of being the first friction material company in the world to have won the Award. With this prize, RBL becomes the third company from the Rane Group to have won DGP, making it the first group in the world to have three DGP Awards consecutively outside Japan and also the distinction of being the second group in the world to have won more than two DGP Awards. Mr. P. S. Rao, President, RBL, receiving the DGP Award from Mr. Masahiko Sakane, Vice Chairman, Deming Prize Committee, JUSE

- 8. HIDDEN GEMS – MAY 2014 - 8 - SARAL GYAN CAPITAL SERVICES On RBL winning the prestigious DGP, Mr. Ganesh said: “This distinction of being the 1st Group outside Japan to have won 3 consecutive DGP Awards is a great moment of pride and joy for each and every one in the Rane Group. This DGP reiterates our commitment to Total Quality Management and further propels us with greater momentum for the future.” Acknowledging the Award, Mr. Rao informed: “This great milestone for RBL was made possible by the total involvement and commitment of each and every employee of RBL towards TQM. RBL had the distinction of being the first company from the Rane Group to have won the DemingApplicationPrize,and today it holdsthe distinctionof being the first friction material company in the world to have won the DGP. This catapults RBL to a new league altogether and marks another step in its journey towards Excellence.” iii) Research & Development is carried in Specific Areas RBL has been actively engaging in developing new friction materials to meet emerging OEM customer requirementsonQuality, NVH (Noise, Vibration and Harshness) and also ensuring cost effectiveness. Significant progress has been made by the company towards improving the available range of applications in quick time to market by enhancing “Formulation Library” and using it effectively. Development of new grades pro-actively for un-served segments as a new approach has been taken. Focus areas are development of cost effective Asbestos free grades for Brake Linings and Disc Pads for PC, UV, HCV and LCV markets for improving market share in both OE and Aftermarket. Joint development with Nisshinbo, Japan is an important initiative for serving OEMs and also ensuring maximum localisation of raw materials. RBL’s own efforts for development of low cost formulations is also continuing at a fast pace. In order to combat stiff competition including overseas players, the Company is also focusing on development of alternate and green materials for performance and cost factors in collaboration with global suppliers. Specific R&D efforts to meet field performance requirements in passenger cars and utility vehicle segment helped the Company to add new product platforms of the customers and offer competitive technical alternatives to our competitor products including imports. The Company could gain new business based on competitive performance proposals from major OEMs. RBL has developednewasbestos-free frictionmaterialsfordomesticcommercial vehicle and global OEM customers with high-life linersfor stringent city bus applications as well as for global OEMs in India to whom full LCV / M&HCV range of products were offered.

- 9. HIDDEN GEMS – MAY 2014 - 9 - SARAL GYAN CAPITAL SERVICES iv) Rane Group plans Rs 5580 million Capex, eyes Rs 43,000 million topline – Jun’13 Despite sluggish automobile market conditions, Rane Group has chalked out an expansion strategy with a budget of Rs 558 crore for the next three years as the Chennai-based leading auto component house expects the market to improve from the second half of the fiscal and report strong growth in the following two years. The group’s capex has also been necessitated as part of its strategy to maintain leadership in its business segments and achieve sales turnover of Rs 4,300 crore by 2015-16. The investmentswill be made across sevenentities,includingthree listed companies, of the group. “The capex of Rs 558 crore is for the total group during the next three years ending 2016. It will be funded through internal generations and debt,” said L Ganesh, chairman, Rane group. Most of the capex is intended towards expansion of capacity of steering gear, EPS (electric power steering), friction materials, including brake linings and disc pads, while part of it is towards productivity improvement and research and development. In an attempt to be technologically self-sufficient, the group has been steadily boosting R&D investments — from 0.5 per cent of sales in the past to 1.5 per cent going forward. Of the seven companies, Rane Madras and Rane NSK Steering Systems will spend Rs 160 crore and Rs 150 crore, respectively, on expansion of capacity in various areas on the back of new customers. Rane Brake Linings will spend about Rs 110 crore over the next three years on R&D as also to improve export business.Rane Engine, Rane TRW Steering Systems, Rane Diecast and Kar Mobiles will account for the rest of the spend. “Our capex plan is based on the assumption that markets will start improving towards the end of this year (although current signs are not encouraging) and the next two years will be seeing healthy growth. Besides the domestic market, we are also focusing on increasing exports, which is expected to be 15 per cent of sales by 2015-16,” Ganesh said. Despite a slowdown in the auto sector, the group managed to post a decent growth in FY13, with total revenues of Rs 2,923 crore ($538 million) against Rs 2,650 crore ($520 million) in FY12.

- 10. HIDDEN GEMS – MAY 2014 - 10 - SARAL GYAN CAPITAL SERVICES 3. Financial Performance Rane Brake Lining net profit rises 141.62% in the March 2014 quarter Net profit of Rane Brake Lining rose 141.62% to Rs 95.2 million in the quarter ended March 2014 as against Rs 39.4 million during the previous quarter ended March 2013. Sales rose 7.74% to Rs 1085.9 million in the quarter ended March 2014 as against Rs 1007.9 million during the previous quarter ended March 2013. For the full year, net profit rose 89.12% to Rs 172.1 million in the year ended March 2014 as against Rs 91.0 million during the previous year ended March 2013. Sales rose 2.03% to Rs 3835.1 million in the year ended March 2014 as against Rs 3758.8 million during the previous year ended March 2013. Rane Brake Lining net profit rises 142.57% in the December 2013 quarter Net profit of Rane Brake Lining rose 142.57% to Rs 24.5 million in the quarter ended December 2013 as against Rs 10.1 million during the previous quarter ended December 2012. Sales declined 0.71% to Rs 929.0 million in the quarter ended December 2013 as against Rs 935.3 million during the previous quarter ended December 2012 1 2 3 4 5 6 Net Sales 935.34 1007.87 935.23 890.93 929.05 1085.93 Net Profit 10.12 39.44 24.43 28.01 24.54 95.16 935.34 1007.87 935.23 890.93 929.05 1085.93 10.12 39.44 24.43 28.01 24.54 95.16 0 200 400 600 800 1000 1200 RsinMillions Dec 12 Mar 13 Jun 13 Sep 13 Dec 13 Mar 14 Last 6 Quarters Net Sales & Profit

- 11. HIDDEN GEMS – MAY 2014 - 11 - SARAL GYAN CAPITAL SERVICES Current & Expected Earnings Quarterly Ended Profit & Loss Account Expected Earnings for 1st and 2nd Qtr FY 2014-15: Rane Brake Lining Ltd has posted excellent bottom line in 4th quarter of FY 2013-14 with increase in operating margins. In last 5 years, RBL sales have been doubled and net profits have grown from 100.9 million to 172.1 million. We believe that company operating margins will continue to improve with increase is net profits considering new product launches, ease of inflation rates and hopes of interest rate cuts going forward, which will augur good demand for automobile as well as auto ancillary industry in domestic market during next 1 to 2 years. Particulars (Rs in Millions) Jun 2013 Sep 2013 Dec 2013 Mar 2014 Jun 2014 E Sep 2014 E Audited / UnAudited UA UA UA UA UA UA Net Sales 935.23 890.93 929.05 1085.93 1070.55 992.48 Total Expenditure 847.18 816.58 848.68 926.5 932.61 885.36 PBIDT(Excl OI) 88.05 74.35 80.37 159.43 137.94 107.12 Other Income 2.2 10.58 3.4 7.79 3.45 6.57 OperatingProfit 90.25 84.92 83.77 167.22 141.39 113.69 Interest 18.61 20.02 19.32 18.77 18.41 18.45 Exceptional Items 0 0 0 0 0 0 PBDT 71.64 64.9 64.45 148.45 122.98 95.24 Depreciation 44.91 44.91 46.33 46.02 46.86 47.14 ProfitBeforeTax 26.73 19.99 18.12 102.43 76.12 48.10 Tax 2.3 -8.02 -6.42 7.27 7.15 4.45 Provisions& contingencies 0 0 0 0 0 0 ProfitAfter Tax 24.43 28.01 24.54 95.16 68.97 43.65 Extraordinary Items 0 0 0 0 0 0 Prior Period Expenses 0 0 0 0 0 0 Other Adjustments 0 0 0 0 0 0 Net Profit 24.43 28.01 24.54 95.16 68.97 43.65 Equity Capital 79.15 79.15 79.15 79.15 79.15 79.15 FaceValue(INRS) 10 10 10 10 10 10 Reserves Calculated EPS 3.09 3.54 3.1 12.02 8.71 5.51 Calculated EPS (Annualised) 12.35 14.16 12.4 48.09 34.85 22.06 No of PublicShareHoldings 2913191 2861545 2846895 2722706 NA NA % of PublicShareHolding 36.81 36.15 35.97 34.4 NA NA

- 12. HIDDEN GEMS – MAY 2014 - 12 - SARAL GYAN CAPITAL SERVICES 4. Peer Group Comparison PEER GROUP Rane Brake Lining Sundaram Brake Lining Enkei Wheels Brakes Auto (India) CMP 200.00 190.00 53.15 7.23 52 W H/L 214.40/102.00 221.00/130.90 56.05/36.15 10.18/4.83 Market Cap 1583.00 747.57 677.95 151.58 Results (in Million) Mar-14 Mar-14 Mar-14 Mar-14 Sales 1085.93 650.04 819.48 3.50 PAT 95.16 -36.43 31.35 -0.60 Equity 79.15 39.35 63.78 209.66 EPS 21.75 -13.26 0.42 -0.03 P/E 9.20 0.00 127.91 0.00 5. Key Concerns / Risks India is becoming a preferred destination for many global automobile manufacturers to set up their manufacturing facilities. RBL is facing stiff competition in OEM business from both local players and global competitors. Entry of global auto majors is likely to encourage entry of new global competitors for RBL. In aftermarket, which is highly fragmented, RBL faces stiff competition from large number of organized and un-organized players. In terms of exports, foreign exchange fluctuations can adversely impact the operating margins and thereby affect the overall profitability of the company. Dumping from China is another risk factor for the company; commodity prices can also affect the input costs for the company impacting its margins.

- 13. HIDDEN GEMS – MAY 2014 - 13 - SARAL GYAN CAPITAL SERVICES 6. Investment Rationale i) Management expansion strategy to maintain leadership position Despite sluggish automobile market conditions, Rane Group has chalked out an expansion strategy with a budget of Rs 558 crore in 2013 for the next three years as the Chennai-based leading auto component house expects the market to improve from and report strong growth in the following two years. Rane Brake Linings will spend about Rs 110 crore over the next two years on R&D as also to improve export business. Most of the capex is intended towards expansion of capacity of brake linings and disc pads, while part of it is towards productivity improvement and research and development.Inan attempt to be technologically self-sufficient, the company has been steadily boosting R&D investments — from 0.5 per cent of sales in the past to 1.5 per cent going forward. ii) Ease in Inflation and drop in Interest rates will drive growth The Company remains cautiously optimistic about the growth of the automotive industry. With easing of inflation rates and hopes of interest rate cuts, the economic growth is likely to build gradual momentum. The newer vehicle models introduced in the market are likely to spur the growth. With profitable growth continuing to remain the focus area, the Company plans to expand its horizons by adding new territories and new customers. iii) Significant Increase in promoters share holding Promoters have increased their stake in the company through continuous open market purchases. Share holdings of promoters in the company by end of Mar’14 quarter is 65.60%, increased by 2.65% during one year. In Mar’13, the same was 62.95%. iv) Dividend payout with attractive dividend yield RBL is paying regular dividend to the shareholders since past many years. Recently, company has declared dividend of Rs. 7.50 which will be paid on 28th July’14. With Rs. 7.50 dividend payout, dividend yield at CMP of Rs. 200 is 3.75%. v) Best in class technology in collaboration with the Nisshinbo Brakes Inc., Japan The Company wouldcontinue to take rigorous effortsto retain the market leadership by developing customized products for the customers. The Company in collaboration with the Nisshinbo Brakes Inc., Japan provides the state of- the-art technologies for applications in new generation vehicles. Moreover, RBL holds the distinction of being the first friction material company in the world to have won the most prestigious Deming Grand Prize 2013. This catapults RBL to a new league altogether and marks another step in its journey towards Excellence.

- 14. HIDDEN GEMS – MAY 2014 - 14 - SARAL GYAN CAPITAL SERVICES 7. Saral Gyan Recommendation Nisshinbo Brake Inc (NISB) who has been the technology partners of the company since 1996 have their shareholding of 20%. This will help the company in further advancement of research and development to meet the new technologyrequirementsof the future. Indian automotive industry is dominated by Japanese and Korean auto manufacturers. The increased co-operation with Nisshinbo Group will not only serve the Japanese and Korean manufacturers but also other European and domestic car companies in India. The technical inputs and greater co-operation from Nisshinbo Group would thus be beneficial to the Company in terms of business potential and customer relationship. The continuance of global majors in USA and Europe showing keen interest in sourcing auto components from India based on cost and quality, presents an opportunity for the company to grow its exports market further. The company believes to ride on the recovery in the domestic market while consolidating its operations. It has already taken a couple of initiatives to sharpen its cost competitiveness. The company hopes to do better in the following quarters due to expected less volatility in the commodity prices. As per our estimates, Rane Brake Lining Ltd can deliver bottom line of 242 million for full financial year 2014 – 15, annualized EPS of Rs. 30.6 with forward P/E ratio of 6.5 X for FY 2014-15, which makes stock an attractive bet at CMP. Management has rewarded shareholders by paying consistent dividends year after year. RBL has distributed 35% of its net profits in form of dividends. Dividend yield at current market price is 3.75, which offer good upside potential with limited downside risk. Dividend Payout Ratio Year Mar'09 Mar'10 Mar'11 Mar'12 Mar'13 Mar'14 Dividend Payout Ratio 54.67% 35.28% 25.92% 34.22% 34.73% 34.48% On equity of Rs. 79.2 million, the estimated annualized EPS for FY 14-15 works out to Rs. 30.6 and the Book Value per share is Rs. 141.8. At current market price of Rs. 200, stock price to book value is 1.41. Considering attractive valuations, and growth opportunities in domestic automobile industry, we find RBL a good investment opportunity. Saral Gyan Team recommends “BUY” on Rane Brake Lining Ltd. for a target of Rs. 410 over a period of 12-24 months. Buying Strategy: 70% at current market price of Rs. 200 30% at price range of Rs. 170 – 180 (in case of correction in stock price)

- 15. HIDDEN GEMS – MAY 2014 - 15 - SARAL GYAN CAPITAL SERVICES 8. Disclaimer Important Notice: Saral Gyan Capital Services is an Independent Equity Research Company. © SARAL GYAN CAPITAL SERVICES This document prepared by our research analysts does not constitute an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The information contained herein is from publicly available data or other sources believed to be reliable but we do not represent that it is accurate or complete and it should not be relied on as such. Saral Gyan Capital Services (www.saralgyan.in) or any of its affiliates shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. This document is provide for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision.