2nd Pension Plan De Risking Summit Agenda

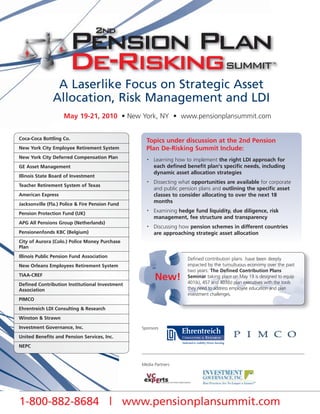

- 1. A Laserlike Focus on Strategic Asset Allocation, Risk Management and LDI May 19-21, 2010 • New York, NY • www.pensionplansummit.com Coca-Coca Bottling Co. Topics under discussion at the 2nd Pension New York City Employee Retirement System Plan De-Risking Summit Include: New York City Deferred Compensation Plan • Learning how to implement the right LDI approach for GE Asset Management each defined benefit plan's specific needs, including dynamic asset allocation strategies Illinois State Board of Investment • Dissecting what opportunities are available for corporate Teacher Retirement System of Texas and public pension plans and outlining the specific asset American Express classes to consider allocating to over the next 18 Jacksonville (Fla.) Police & Fire Pension Fund months Pension Protection Fund (UK) • Examining hedge fund liquidity, due diligence, risk management, fee structure and transparency APG All Pensions Group (Netherlands) • Discussing how pension schemes in different countries Pensionenfonds KBC (Belgium) are approaching strategic asset allocation City of Aurora (Colo.) Police Money Purchase Plan Illinois Public Pension Fund Association Defined contribution plans have been deeply New Orleans Employees Retirement System impacted by the tumultuous economy over the past two years. The Defined Contribution Plans TIAA-CREF New! Seminar taking place on May 19 is designed to equip 401(k), 457 and 403(b) plan executives with the tools Defined Contribution Institutional Investment Association they need to address employee education and plan investment challenges. PIMCO Ehrentreich LDI Consulting & Research Winston & Strawn Investment Governance, Inc. Sponsors United Benefits and Pension Services, Inc. NEPC Media Partners 1-800-882-8684 | www.pensionplansummit.com

- 2. A Laserlike Focus on Strategic Asset Allocation, Risk Management and LDI May 19-21, 2010, New York, NY • www.pensionplansummit.com Dear Colleague, Attend and Network with: The environment for pension plan s has changed substantially and the • CIOs at Corporate and Public strategic asset allocation, enterpris need for e risk management, and advanced Pension Funds diversifying portfolios certainly rem strategies for ain strong. The 2nd Pension Plan De-R • Executive Directors Summit is the premier conference isking designed to inform corporate and • Heads of Alternative Investments plan executives on the latest in strat public pension egic asset allocation and risk man Directors of Investment agement. • Taking place in New York from May • Managing Directors at Mutual Fund 19-21, 2010, the 2nd Pension Plan Companies Risking Summit is the perfect plat De- form for corporate and public DB from their plan sponsor peers, lead plans to hear • Senior Vice Presidents at Insurance ing policymakers and top investme Companies Attendees will share ideas through nt executives. tailored interactive roundtables, ben their DB plans through case studies, chmark • Portfolio Managers at ETF Providers and network with fellow plan spon investment professionals. sors and • Senior Investment Consultants • Benefits Managers at 401(k) Plans In addition to our two-day conferen • Executive Directors at 457 Plans ce, we are holding a pre-conferen Contribution Plans Seminar. We ce Defined are gathering experts to discuss and • Senior Portfolio Managers guidance on the latest in participa provide nt education programs, target-date and investment challenges. fund options, Please take a few minutes to read through the agenda, and visit the www.pensionplansummit.com-for website- the latest information on addition al speakers. Sponsorship and I look forward to meeting you in New Exhibition Opportunities York this May! Sponsoring or exhibiting at the 2nd Kind regards, Pension Plan De-Risking Summit and Defined Contribution Plans Seminar , our is an excellent opportunity for your P.S. Don t miss dtables company to showcase its products and services to an audience of Jenna Gottlieb interactive roun nce institutional investors. For more 2nd Pension Plan De-Risking Sum mit and pre-confereage 6 for information on sponsoring or exhibiting at this or upcoming Program Director seminar! See p offers events, please call Mario Matulich on special pricing T : 212-885-2754 212-885-2719 or e-mail jenna.gottlieb@iqpc.com mario.matulich@iqpc.com. 2 1-800-882-8684 | www.pensionplansummit.com

- 3. Pre-Summit Seminar Wednesday May 19, 2010 Defined Contribution Plans--Navigating Participant Education and Investment Strategies 10:30 Registration For the Seminar and Networking 1:50 Communicating to Participants and Managing With Sponsors And Delegates Expectations • Reviewing the methods of communication plan sponsors use to relay plan investment information, without stepping over the 11:10 Avoiding Common Investing Pitfalls for DC Plan line into investment advice Participants • Learn how to tailor your company’s education efforts when • Examining the critical mistakes that prevent employees from times are tough, through targeted programs like Dave Ramsey’s achieving a secure retirement and the solutions to overcome Financial Peace University those • Taking a holistic view of savings to provide plan participants • Catching when participants invest in multiple target-date funds with the tools they need to achieve their retirement goals • Avoiding the risks of inflation, market volatility, and an Kurt Hollar extended lifespan Director-Benefits Georgette Gestely Coca-Coca Bottling Co. Director New York City Deferred Compensation Plan 2:40 Networking Break 12:00 Networking Luncheon 3:10 Fee Disclosure and Transparency for DC Plans • Detailing new investment products that do not engage in 1:00 Next Generation Target-Date Strategies revenue sharing practices • Outlining the advantages of implementing customized target • Comparing active and passive fee structures in DC plans date fund strategies including investment manager flexibility • Discussing the legislative and regulatory developments that are and fiduciary oversight affecting DC plan sponsors, and the growing interest in the • Designing optimal glide paths to reach retirement income and transparency of fees and expenses risk management targets Lew Minsky • Selecting asset classes beyond stocks and bonds to heighten Executive Director diversification within strategies Defined Contribution Institutional Investment Association • Hearing case studies of large plan sponsors that continue to evolve their customized solutions Stacy Schaus 4:00 “Inconvenient Truths” About 401(k) Plans Senior Vice President, Defined Contribution Practice • Considering tripling the employer contribution to equal 9% of PIMCO pay as is the case in Australia • Discussing how plan sponsors could best help employees reach Barbara Kontje the their retirement goals including communicating how much Director of Retirement Plan Investments employees need to contribute based on when they started saving American Express • Addressing that few investment managers incorporate Marla Kreindler international equities into passively-managed target-date funds Partner despite the high returns achieved during the past decade Winston & Strawn Jane White Ross Bremen Author Partner “America, Welcome to the Poorhouse” NEPC 4:45 Chairman’s Closing Remarks and End of Seminar For speaking and sponsorship opportunities, please contact Jenna Gottlieb at 212-885-2754 or jenna.gottlieb@iqpc.com 3 Sponsors:

- 4. Main Summit Day 1 Thursday May 20, 2010 Strategic Asset Allocation: Discussing Diversification, Alternatives, and LDI 7:30 Registration & Coffee 11:45 Re-evaluating Strategic Asset Allocation and Portfolio Construction 8:00-10:00 Breakfast Workshop: The Asset Return– • Analyzing portfolio construction and investment themes, and Funding Cost Paradox: The Case for LDI determining where costly mistakes/significant gains were made • Dissecting what opportunities are available for corporate and In spite of their risk-reducing aspects, plan sponsors often hesitate to public pension plans and outlining the specific asset classes to adopt LDI strategies because of perceived higher funding costs. In this consider allocating to such as private equity and real estate workshop, Dr. Norman Ehrentreich will address these concerns by • Hearing about a portfolio that recently shifted to a liability- introducing the Asset Return–Funding Cost Paradox. He will show that driven investment model and how the investment staff the link between higher average returns and lower funding costs tends weighed the pros and cons to break down in the US and Canada. Lower returning LDI strategies are likely to result in lower funding costs in the long run. Susan Mangiero President and CEO What you will learn: Investment Governance, Inc. • Understanding how current pension regulations induce plan sponsors to violate the requirements to convert an equity risk 12:30 Networking Luncheon premium into lower funding costs • Learning which plans are more likely to experience this Asset 1:30 Asset Class Spotlight: Interactive Roundtable Return–Funding Cost Paradox and discussing why geometric Discussions average asset returns are an inappropriate measure of past The Pension Plan De-Risking Summit’s Asset Class Spotlight is a investment success great opportunity for you—the plan sponsor—to get a better • Hearing how funding costs are path-dependent on the specific handle on some of the alternative asset classes that may be of return sequences and learning about reverse dollar cost averaging interest to you. Each roundtable discussion lasts 50 minutes, and How you will benefit: is led by an expert in that particular field. The uniquely informal, • A better appreciation of the risk and cost implications of LDI offline format of the spotlight session enables you to brainstorm strategies will ease common concerns against them with your peers regarding the suitability of that particular asset • Why equity heavy strategies are to be considered short term class for your investment portfolio. Alternative asset classes under strategies and LDI strategies not the spotlight include: • Understand how the well-known risk-return relationship can turn • Private Equity into a risk-penalty relationship and why pension plans in the U.S. • Emerging Markets are likely to increase their long-term funding costs by investing in • Commodities equities. • TIPS • Timberland Investments Norman Ehrentreich • Corporate Bonds Owner • Infrastructure Ehrentreich LDI Consulting & Research 2:20 International Pension Funds on Strategic Asset 9:00 Registration & Coffee Allocation • Reviewing the latest on strategic asset allocation trends from 10:15 Chairperson’s Opening Remarks large public and corporate European funds • Hearing case studies from European pension funds that have 10:30 Lessons Learned: How the 2008-2009 Economic implemented an LDI strategy and dissecting what lessons can Landscape Impacted Pension Plan Investment be learned for U.S. plans contemplating a similar strategy Strategies • Discussing how pension schemes in different countries are • Pinpointing the asset classes that suffered the biggest losses responding to investment issues over the past two years • Learning how to shift portfolios from outdated investment Martin Clarke strategies to asset allocations that will better meet set Executive Director-Financial Risk investment objectives Pension Protection Fund (UK) • Weighing how the need for liquidity impacts alternative investment decisions Onno Steenbeek Director Corporate ALM and Risk Policy Jerry Davis APG All Pensions Group (Netherlands) Trustee and Board Chairman New Orleans Employees Retirement System Edwin Meysmans Director 11:20 Networking Break Pensioenfonds KBC (Belgium) 4 1-800-882-8684 | www.pensionplansummit.com

- 5. Main Summit Day 1 ...continued 3:10 Afternoon Networking and Refreshment Break 4:30 Best Practices: Investment Manager Selection featuring The Brilliance Bar • Addressing how search and hire activity has changed in light of the financial crisis and rebounding economy Have questions? We’ve got answers. Providing you with • Examining popular mandates defined benefit plans have out on two new tools to solve today’s most critical challenges… the market including managers for TIPS and active domestic Step up to our Brilliance Bar! growth equity funds • Learning how to affordably replace an investment manager There’s no question too big or small. The Brilliance Bar without losing assets if expectations are not met will be staffed with members of our speaker faculty and who will make themselves available during specific breaks to offer advice to John Sopranuk your most pressing concerns. The Brilliance Bar provides you with President, Board of Trustees an additional opportunity to ask the questions that are left City of Aurora (Colo.) Police Money Purchase Plan outstanding after the sessions have concluded. 5:20 End of Summit Day 1 3:40 ESG Investing Thriving in Rebounding Economy • Reviewing how corporate governance and climate-based issues affect long-term portfolio performance • Analyzing how manager skill, investment style and time period, is integral to how ESG factors translate into investment performance • Hearing a case study of how a pension fund recently incorporated an integrated ESG strategy Mike Musuraca Former Trustee New York City Employees Retirement System Main Summit Day 2 Friday May 21, 2010 Strategic Asset Allocation: Discussing Diversification, Alternatives, and LDI 8:00 Registration & Coffee 9:50 The Future of LDI and What it Means for Your DB Plan Today 8:45 Chairperson’s Opening Remarks • Reviewing what regulatory changes are on the horizon • Discussing what new products and services are needed to help 9:00 Sustainable Pension Fund Investing Through LDI pension plans implement LDI strategies • Learning how to implement the right LDI approach for each • Hearing the way that US pension plans have changed their defined benefit plan's specific needs, including dynamic asset views on LDI and their plans for implementation in the wake of allocation strategies market developments over the past two years • Comparing the various LDI implementation choices and Emily Reid addressing the challenges of diversification, volatility, and the Chief Compliance Officer role of physical securities versus synthetics Illinois State Board of Investment • Weighing the risks associated with implementing an LDI strategy, and learning how those risks could be mitigated 10:40 Networking Break • Explaining how an LDI program should be monitored, and how its performance could be measured A Laserlike Focus on Risk Management, Corporate Norman Ehrentreich Governance and Volatility Owner Ehrentreich LDI Consulting & Research 11:10 Keynote Address: “The Good Pensions Have Gone Away: Must Americans Change Their Expectations?” Thomas J. Mackell, Jr. Chairman, United Benefits and Pension Services, Inc.; Former Chairman, Federal Reserve Bank of Richmond 5 Sponsors:

- 6. 11:40 Using Alternatives to Manage Volatility: 2:20 Public Pension Fund Perspectives on De-Risking Opportunities and Challenges Ahead and Diversification • Discussing how institutional investors view alternatives now • Addressing the unique liability challenges faced by public and how they are integrating these investments into their defined benefit plans portfolios • Taking a look at popular assets classes for 2010, including • Examining hedge fund liquidity, due diligence, risk emerging markets, active TIPS and international small-cap management, fee structure and transparency funds • Hearing about where some of the top fund of funds are • Understanding, monitoring and managing the risks associated investing, what types of strategies are hot and which are with portfolio diversifiers like infrastructure and timberland unlikely to recover investments Sheryl Schwartz James McNamee Managing Director, Alternative Investments President TIAA-CREF Illinois Public Pension Fund Association Dory Wiley John Keane Chairman of the Alternative Assets Committee Executive Director Teacher Retirement System of Texas Jacksonville (Fla.) Police & Fire Pension Fund 12:30 Networking Luncheon 3:10 Networking Break 1:30 Pension Plan Asset Allocation: The GE Perspective 3:40 Creating an Effective Risk Modeling Framework • The Strategic and Tactical Asset Allocation Process • Identifying appropriate hedging products for DB plans including • Keys to an Effective Tactical Asset Allocation Effort corporate bonds • Lessons Learned from the Recent Market Crisis • Navigating the most effective risk assessment methodologies such as scenario analysis Jay Ireland • Creating a comprehensive risk management strategy for your President and CEO pension fund GE Asset Management Jimmy Yan General Counsel at Manhattan Borough President's Office and trustee at New York City Employee Retirement System 4:30 Close of Conference About Our Sponsors Norman Ehrentreich, Ehrentreich LDI Consulting & Research Dr. Norman Ehrentreich is a leading industry expert and thinker on liability driven investment strategies. His research on LDI has led him to propose the existence of an Asset Return – Funding Cost Paradox for DB pension plans. Contrary to conventional wisdom, this paradox posits that pension plans in the US with LDI strategies are likely to experience lower funding costs than those that have higher returning, but more volatile equity strategies. In 2009 he founded Ehrentreich LDI Consulting & Research in an attempt to foster the adoption of LDI strategies among corporate and public pension plans. In doing so, his focus is on developing better research on the theory of liability driven investing and to lobby for structural pension reform to improve the regulatory framework in which pension plans are currently operating in. PIMCO is among the largest managers of fixed income assets in Defined Contribution plans with over $130 billion under management as of December 31, 2009. Based in Newport Beach, California, our DC Practice is dedicated to promoting effective DC Plan design and innovative retirement solutions. PIMCO manages fixed income, inflation protection, collective investment trust funds (CITs) and asset allocation strategies for our DC clients. We also provide custom target date glide path management and support. Our team is pleased to support our clients and broader community by sharing ideas and developments in DC plans in the hopes of fostering a more secure financial future for employees of corporations, not-for- profits, governments, and other organizations. If you have any questions about the PIMCO DC Practice, please contact your PIMCO representative or email us at pimcodcpractice@pimco.com. Media Partners 6 1-800-882-8684 | www.pensionplansummit.com

- 7. A Laserlike Focus on Strategic Asset Allocation, Risk 5 EASY WAYS TO Management and LDI REGISTER: 1 Web: www.pensionplansummit.com May 19-21, 2010, New York, NY 2 Call: 1-800-882-8684 3 Email: info@iqpc.com 4 Fax: 1-646-378-6025 (Email this form to info@iqpc.com or fax to 646-378-6025) 5 Mail: IQPC -535 5th Avenue, 8th Floor, New York, NY 10017 YES! Please register me ❑ Main Conference ❑ All Access (Main Conference + Seminar) ❑ Seminar Name ____________________________________________________________ Job Title _________________________________________________ Organization______________________________________________________ Approving Manager________________________________________ Address _____________________________________________ City________________________________________State__________Zip_________ Phone________________________________________________ E-mail_______________________________________________________________ ❑ Please keep me informed via email about this and other related events. ❑ Check enclosed for $_________ (Payable to IQPC) ❑ Charge my ❑ Amex ❑ Visa ❑Mastercard ❑ Diners Club Card #______________________________________Exp. Date___/___CVM code ______ ❑ I cannot attend, but please keep me informed of all future events. 18249.002/D/KD Registration Information MAKE CHECKS PAYABLE IN U.S. DOLLARS TO: IQPC Pension, Plans Register and Pay Register and Pay Standard Sponsors by 3/22/2010 by 4/19/2010 Price * CT residents or people employed in the state of CT must add 6% sales tax. Main Conference (save $200) (save $100) Team Discounts: For information on team discounts, please $299 $399 $499 contact IQPC Customer Service at 1-800-882-8684. Only one All Access (Main (save $200) (save $100) discount may be applied per registrant. Conference + Seminar) $299* $399* $499* Details for making payment via EFT or wire transfer: Seminar FREE (+Registration Fee) FREE (+Registration Fee) FREE (+Registration Fee) JPMorgan Chase - Penton Learning Systems LLC dba IQPC: 957-097239 ABA/Routing #: 021000021 * Pension & Plan Sponsors there is a $99 registration fee to attended the seminar. Reference: Please include the name of the attendee(s) and the event number: 18249.002 Register and Pay Register and Pay Standard Payment Policy: Payment is due in full at the time of All Others registration and includes lunches and refreshment. Your by 3/22/2010 by 4/19/2010 Price registration will not be confirmed until payment is received Main Conference (save $700) (save $400) and may be subject to cancellation. $1499 $1799 $2199 For IQPC’s Cancellation, Postponement and Substitution All Access (Main (save $949) (save $649) (save $349) Policy, please visit www.iqpc.com/cancellation Conference + Seminar) $1999 $2299 $2599 ©2010 IQPC. All Rights Reserved. The format, design, content Seminar $749 $749 $749 and arrangement of this brochure constitute a trademark of IQPC. Unauthorized reproduction will be actionable under the A $99 processing charge will be assessed to all registrations not accompanied by credit card payment at the time Lanham Act and common law principles. of registration. 7 Sponsors: