Second part

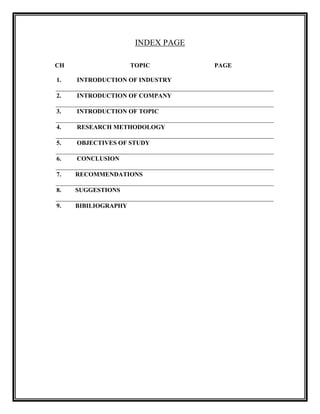

- 1. INDEX PAGE CH TOPIC PAGE 1. INTRODUCTION OF INDUSTRY 2. INTRODUCTION OF COMPANY 3. INTRODUCTION OF TOPIC 4. RESEARCH METHODOLOGY 5. OBJECTIVES OF STUDY 6. CONCLUSION 7. RECOMMENDATIONS 8. SUGGESTIONS 9. BIBILIOGRAPHY

- 2. ACKNOWLEDGEMENT A project report is never the sole product of the person who‟s name appears on the cover. There are always some people whose guidance proves to be an immense help in giving its final shape, so it becomes m y first dut y to express m y gratitude towards all of them who help me in finalizing this project report. In continuous to this i am thankful to prof. H.L.Chhatwal (Dean,SGI) of MBA department who help me to complete m y project report. And special thank to Miss Priti Dhingra (Facult y Guide,SGI) for giving his valuable time and guidance to complete this study. I am extremel y thankful to god who is the ultimate guide providing with valuable, insight, courage and determination at every doorstep with deep regard always.

- 3. EXECVTIVE SUMMARY In m y project report my main objective was to study the various products of different life insurance companies and compare the HDFC standard life production code with other major competitor in the market. To complete this study i used the secondary data f or collecting the different features of products from their website and literature. While doing the training i also visit the office of different life insurance companies to collect the data. In m y study i find that the life insurance products used for di fferent purpose like saving, protection and investment and all contracts are the long term products. After studied HDFC standard life insurance protection product with different life insurance companies product. I found that the product of hdfc standard life is the best product prevailing in the market.

- 4. CHAPTER-I INTRODUCTION TO INDUSTRY

- 5. INSURANCE SECTOR IN INDIA The insurance sector in India has come a full circle from being an open competitive market to nationalization and back to a liberalized market again. Tracing the developments in the Indian insurance sector reveals the 360-degree turn witnessed over a period of almost two centuries. A BRIEF HISTORY OF THE INSURANCE SECTOR: The business of life insurance in India in its existing form started in India in the year 1818 with the establishment of the Oriental Life Insurance Company in Calcutta. Some of the important milestones in the life insurance business in India are: 1912: The Indian Life Assurance Companies Act enacted as the first statute to regulate the life insurance business. 1928: The Indian Insurance Companies Act enacted to enable the government to collect statistical information about both life and non-life insurance businesses. 1938: Earlier legislation consolidated and amended to by the Insurance Act with the objective of protecting the interests of the insuring public. 1956: 245 Indian and foreign insurers and provident societies taken over by the central government and nationalized. LIC formed by an Act of Parliament, viz. LIC Act, 1956, with a capital contribution of Rs. 5 crore from the Government of India.

- 6. The General insurance business in India, on the other hand, can trace its roots to the Triton Insurance Company Ltd., the first general insurance company established in the year 1850 in Calcutta by the British.

- 7. INSURANCE SECTOR REFORMS In 1993, Malhotra Committee headed by former Finance Secretary and RBI Governor R.N. Malhotra was formed to evaluate the Indian insurance industry and recommend its future direction. The Malhotra committee was set up with the objective of complementing the reforms initiated in the financial sector. The reforms were aimed at “creating a more efficient and competitive financial system suitable for the requirements of the economy keeping in mind the structural changes currently underway and recognizing that insurance is an important part of the overall financial system where it was necessary to address the need for similar reforms…” In 1994, the committee submitted the report and some of the key recommendations included: i) STRUCTURE: Government stake in the insurance Companies to be brought down to 50% Government should take over the holdings of GIC and its subsidiaries so that These subsidiaries can act as independent corporations . All the insurance companies should be given greater freedom to operate

- 8. ii) COMPETITION: Private Companies with a minimum paid up capital of Rs.1bn should be allowed to enter the industry. No Company should deal in both Life and General Insurance through a single Entity. Foreign companies may be allowed to enter the industry in collaboration with the domestic companies. Postal Life Insurance should be allowed to operate in the rural market. Only one State Level Life Insurance Company should be allowed to operate in Each state iii) REGULATORY BODY: The Insurance Act should be changed An Insurance Regulatory body should be set up Controller of Insurance (Currently a part from the Finance Ministry) should Be made independent iv) INVESTMENT: Mandatory Investments of LIC Life Fund in government securities to be Reduced from 75% to 50% GIC and its subsidiaries are not to hold more than 5% in any company (There Current holdings to be brought down to this level over a period of time)

- 9. v) CUSTOMER SERVICE: LIC should pay interest on delays in payments beyond 30 days Insurance companies must be encouraged to set up unit linked pension plans Computerization of operations and updating of technology to be carried out in the Insurance industry The committee emphasized that in order to improve the customer services and increase the coverage of the insurance industry should be opened up to competition. But at the same time, the committee felt the need to exercise caution as any failure on the part of new players could ruin the public confidence in the industry. Hence, it was decided to allow competition in a limited way by stipulating the minimum capital requirement of Rs.100 crores. The committee felt the need to provide greater autonomy to insurance companies in order to improve their performance and enable them to act as independent companies with economic motives. For this purpose, it had proposed setting up an independent regulatory body.

- 10. THE INSURANCE REGULATORY AND DEVELOPMENT AUTHORITY (IRDA) Reforms in the Insurance sector were initiated with the passage of the IRDA Bill in Parliament in December 1999. The IRDA since its incorporation as a statutory body in April 2000 has fastidiously stuck to its schedule of framing regulations and registering the private sector insurance companies. The other decisions taken simultaneously to provide the supporting systems to the insurance sector and in particular the life insurance companies was the launch of the IRDA‟s online service for issue and renewal of licenses to agents. The approval of institutions for imparting training to agents has also ensured that the insurance companies would have a trained workforce of insurance agents in place to sell their products, which are expected to be introduced by early next year. Since being set up as an independent statutory body the IRDA has put in a framework of globally compatible regulations. In the private sector 12 life insurance and 6 general insurance companies have been registered.

- 11. INSURANCE COMPANIES IN INDIA Aviva Bajaj Allianz Birla Sun Life HDFC Standard Life ICICI Pru ING Vysya Life Insurance Corporation Max New York Life Metlife India Om Kodak Mahindra Reliance Life Insurance SBI Life Insurance Tata AIG AVIVA INDIA The Life Insurance joint venture company between Dabur India and the Aviva UK. Dabur is one of India's oldest and largest groups of companies with consolidated annual turnover in excess of Rs 1,350 crores, country's leading producer of traditional healthcare products. Aviva Plc is UK‟s largest and the world‟s fifth largest insurance Group. It is one of the leading providers of life and pensions products to Europe and has substantial businesses elsewhere around the world.

- 12. BAJAJ ALLIANZ Bajaj Allianz Life Insurance Co. Ltd. is a joint venture between Allianz AG, and Bajaj Auto, one of the biggest 2 and 3 wheeler manufacturers in the world. Bajaj Auto Ltd, the flagship company of the Rs. 8000 crore Bajaj group is the largest manufacturer of two- wheelers and three-wheelers in India and one of the largest in the world. Allianz: Allianz Group is insurers and financial service providers. Founded in 1890 in Berlin, Allianz is now present in over 70 countries with almost 174,000 employees. At the top of the international group is the holding company, Allianz AG, with its head office in Munich. Allianz Group provides its more than 60 million customers worldwide with a comprehensive range of services in the areas of: Property and Casualty Insurance, Life and Health Insurance, Asset Management and Banking Characterized by global presence with a local focus and driven by customer orientation to establish high earnings potential and financial strength, Bajaj Allianz Life Insurance Co. Ltd. was incorporated on 12th March 2001. The company received the Insurance Regulatory and Development Authority (IRDA) certificate of Registration (R3) No 116 on 3rd August 2001 to conduct Life Insurance business in India.

- 13. BIRLA SUN LIFE INSURANCE COMPANY LIMITED Birla Sun Life Insurance is the coming together of the Aditya Birla group and Sun Life Financial of Canada to enter the Indian insurance sector. The Aditya Birla Group, a multinational conglomerate has over 75 business units in India and overseas with operations in Canada, USA, UK, Thailand, Indonesia, Philippines, Malaysia and Egypt to name a few. FOREIGN PARTNER: Sun Life Assurance, Sun Life Financials primary insurance business, has excellent ratings with the world's top rating agencies. With assets under management as on September 30, 2000 totaling more than CDN billion, it ranks amongst the largest international financial service organizations in the world. Today, the Sun Life Financial Group of companies and partners are represented globally in Canada, the United States, the Philippines, Japan, Indonesia, India and Bermuda. HDFC - STANDARD LIFE HDFC Standard Life Insurance HDFC Standard Life Insurance Company is a joint venture between India's largest housing finance provider, HDFC and Europe's largest mutual life assurance company - The Standard Life Assurance Company (U. K). HDFC Standard Life Insurance Company Limited is the First Private Sector Life Insurance Company to be granted a license. FOREIGN PARTNER: Standard Life, UK, founded in 1825, has been at the forefront of the UK insurance industry for 175 years by combining sound financial judgment with integrity and reliability. It is the Largest Mutual Life company in Europe and has total assets of Rs. 5,50,000 crore. It is one of the very few insurance companies in the world to have received 'AAA' rating from two of the leading international credit rating agencies, Moody's and Standard &

- 14. Poor's. Standard Life was recently voted 'Company of the Decade' in U.K. by the Independent Brokers called IFAs. ICICI PRUDENTIAL LIFE INSURANCE ICICI Prudential Life Insurance is a joint venture between the ICICI Group and Prudential plc, of the UK. ICICI started off its operations in 1955 with providing finance for industrial development, and since then it has diversified into housing finance, consumer finance, mutual funds to being a Virtual Universal Bank and its latest venture Life Insurance. FOREIGN PARTNER: Established in 1848, Prudential plc. Of U.K. has grown to be the largest life insurance and mutual fund Company in U.K. Prudential plc. Has had its presence in Asia for the past 75 years catering to over 1 million customers across 11 Asian countries. Prudential is the largest life insurance company in the United Kingdom (Source: S&P's UK Life Financial Digest, 1998). ICICI and Prudential came together in 1993 to provide mutual fund products in India and today are the largest private sector mutual fund company in India. Their latest venture ICICI Prudential Life plans to take care of the insurance needs at various stages of life.

- 15. ING VYSYA ING Vysya Life Insurance Company Private Limited (the Company) entered the private life insurance industry in India in September 2001, and in a short span of 3 years has established itself as a distinctive life insurance brand with an innovative, attractive and customer friendly product portfolio and a professional advisor force. It also distributes products in close cooperation with the ING Vysya Bank network. The Company is headquartered at Bangalore. MAX NEW YORK LIFE MAX INDIA: Max India Limited is a multi-business corporation that has business interests in telecom services, bulk pharmaceuticals, electronic components and specialty products. It is also the service-oriented businesses of healthcare, life insurance and information technology. NEW YORK LIFE: New York Life has grown to be a Fortune 100 company and an expert in life insurance. It was the first insurance company to offer cash dividends to policy owners. In 1894, New York Life pioneered the then unheard-of concept of insuring women at the same rate as men. Thereafter, it continued to introduce a series of firsts - a disability benefit clause in 1920, unemployment insurance in 1992, and complete customer care on the Web in 1998. Today New York Life has over US billion in assets under management and over 30,000 agents and employees worldwide. The October 2000 Fortune Survey named New York Life amongst the top three most admired life and health insurance companies worldwide. With over 3 million policyholders, New York Life is a leading provider of insurance in a host of countries worldwide.

- 16. METLIFE INDIA MetLife India was incorporated as a joint venture between MetLife International Holdings, Inc., Jammu & Kashmir Bank, M Pallonji & Co. and other private investors. MetLife India is headquartered in Bangalore with offices and presence in major Indian cities, and an additional 1000-outreach point through its channel partners. MET LIFE: Ranked 38 on the Fortune 500 list (April 2003), MetLife, Inc. (MetLife) is one of the world's largest financial organizations. MetLife, through its affiliates, is the number 1 life insurer in the U.S. with approximately $2.4 trillion of life insurance in force (as of December 2002) and has been delivering reliable, high quality service to customers since 1868. LIFE INSURANCE CORPORATION OF INDIA (LIC) The Life Insurance Corporation (LIC) was established about 44 years ago with a view to provide an insurance cover against various risks in life. A monolith then, the corporation, enjoyed a monopoly status and became synonymous with life insurance. Its main asset is its staff strength of 1.24 lakh employees and 2,048 branches and over six-lakh agency force. LIC has hundred divisional offices and has established extensive training facilities at all levels. At the apex, are the Management Development Institute, seven Zonal Training Centers and 35 Sales Training Centers? At the industry level, along with the Government and the GIC, it has helped establish the National Insurance Academy. It presently transacts individual life insurance businesses, group insurance businesses, social security schemes and pensions, grants housing loans through its subsidiary; and markets savings and investment products through its mutual fund. It pays off about Rs 6,000 crore annually to 5.6 million policyholders.

- 17. OM KOTAK MAHINDRA LIFE INSURANCE Established in 1985 as Kotak Capital Management Finance promoted by Uday Kotak the company has come a long way since its entry into corporate finance. It has dabbled in leasing, auto finance, hire purchase, investment banking, consumer finance, broking etc. The company got its name Kotak Mahindra as industrialists Harish Mahindra and Anand Mahindra picked a stake in the company. Kotak Mahindra is today one of India's leading Financial Institutions. OLD MUTUAL: Old Mutual plc is an international financial services group based in London with expanding operations in life assurance, asset management, banking and general insurance. Old Mutual is listed on the London Stock Exchange (where it is included on the FTSE 100 Index) and also on the South African, Namibian, Malawi and Zimbabwe stock exchanges. It has 156 years of experience in the life insurance business. OM KOTAK MAHINDRA: OM Kotak Mahindra is the coming together of Kotak Mahindra Finance Ltd., and Old Mutual plc to enter the Indian insurance arena to offer a wide range of innovative life insurance products. RELIANCE LIFE INSURANCE Reliance Life Insurance Company Limited is a part of Reliance Capital Ltd. of the Reliance - Anil Dhirubhai Ambani Group. Reliance Capital is one of India‟s leading private sector financial services companies, and ranks among the top 3 private sector financial services and banking companies, in terms of net worth. Reliance Capital has interests in asset management and mutual funds, stock broking, life and general insurance, proprietary investments, private equity and other activities in financial services.

- 18. Reliance Capital Limited (RCL) is a Non-Banking Financial Company (NBFC) registered with the Reserve Bank of India under section 45-IA of the Reserve Bank of India Act, 1934. Reliance Capital sees immense potential in the rapidly growing financial services sector in India and aims to become a dominant player in this industry and offer fully integrated financial services. Reliance Life Insurance is another step forward for Reliance Capital Limited to offer need based Life Insurance solutions to individuals and Corporate. TATA AIG The Tata AIG joint venture is a tie up between the established Tata Group and American International Group Inc. The Tata Group is one of the largest and most respected industrial houses in the country, while AIG is a leading US based insurance and financial services company with a presence in over 130 countries and jurisdictions around the world. SBI LIFE INSURANCE SBI Life Insurance Company Ltd. is a joint venture between India's largest bank, State Bank of India and Cardif S.A., a leading life insurance company in France. State Bank of India (SBI) is a household name, and it stands as the last word for financial strength and security in the country. SBI's illustrious background dates back to the year 1806 when it started business, as a presidency bank, known as Bank of Bengal. Over the long journey, it has learnt to combine the best of banking practices handed down from the imperial management with the more dynamic ways of doing banking in the modern India. It has grown as a responsible giant in the banking field over the years. Today, it has a branch network of over 9000 branches, an aggregate deposit base of nearly Rs196821 crore (US$45,121mm) and a total balance sheet size of Rs.261504 crore (US59, 950 mm). Together with its 7 Associate Banks, SBI commands about 30% of the

- 19. market share in banking. SBI is the strongest and most profitable bank in the country. It has a tangible net worth of Rs.12146 crore (US$2,784mm) as at March 2000, and it earned a pre-tax profit of Rs.2051 crore (US$470 mm) for the fiscal ending that date. Cardif is a wholly owned subsidiary of BNP Paribas, which is one of the top 10 banks in the world, and the third largest in Europe. BNP is one of the oldest foreign banks with a presence in India dating back to 1860. It has 9 branches in major metros across the country. Cardif came into being in the year 1973. Since then it has grown into a vibrant insurance company specializing in personal lines such as long-term savings, protection products and creditor insurance. Cardif had a premium income of over US$ 4 billion in 1999, and more than US$ 23 billion of funds under its management. Cardif has been specializing in the art of selling insurance products through commercial banks in France and 23 other countries. France is the mother of banc assurance in the world. Over 65% of life insurance business is done through banks and financial institutions' counters in France, and the trend is rapidly catching up in other countries. It operates joint ventures in developed as well as developing countries, such as Brazil, Chile and the Czech Republic. SBI Life Insurance Company Ltd is registered as a life insurance company with the Insurance Regulatory & Development Authority of India (IRDA) and has been issued License number 111 on 29th March 2001. The Company's authorized capital is Rs.250 crore, and the paid-up capital at present is Rs.125 crore. SBI owns 74% of the total equity, and Cardif the balance 26%.

- 20. CHAPTER-II INTRODUCTION TO COMPANY

- 21. INTRODUCTION TO HDFC STANDERD LIFE INSURANCE HDFC Standard Life Insurance Company Ltd. is one of India's leading private insurance companies, which offers a range of individual and group insurance solutions. It is a joint venture between Housing Development Finance Corporation Limited (HDFC Ltd.), India's leading housing finance institution and a Group Company of the Standard Life, UK. HDFC as on March 31, 2007 holds 81.9 per cent of equity in the joint venture. Financial Expertise. As a joint venture of leading financial services groups, HDFC Standard Life has the financial expertise required to manage your long-term investments safely and efficiently. RANGE OF SOLUTIONS: We have a range of individual and group solutions, which can be easily customized to specific needs. Our group solutions have been designed to offer you complete flexibility combined with a low charging structure. TRACK RECORD SO FAR: Our cumulative premium income, including the first year premiums and renewal premiums is Rs. 1532.21 Crores Apr-Mar 2005 - 06. We have covered over 1.6 million individuals out of which over 5, 00,000 lives have been covered through our group business tie-ups.

- 22. HDFC LIMITED HDFC is India‟s leading housing finance institution and has helped build more than 23, 00,000 houses since its incorporation in 1977. In Financial Year 2003-04 its assets under management crossed Rs. 36,000 Cr. As at March 31, 2004, outstanding deposits stood at Rs. 7,840 crores. The depositor base now stands at around 1 million depositors. Rated „AAA‟ by CRISIL and ICRA for the 10th consecutive year. Stable and experienced management. High service standards. Awarded The Economic Times Corporate Citizen of the year Award for its long- standing commitment to community development. Presented the „Dream Home‟ award for the best housing finance provider in 2004 at the third Annual Outlook Money Awards. Standard Life Group (Standard Life plc and its subsidiaries).The Standard Life group has been looking after the financial needs of customers for over 180 years. It currently has a customer base of around 7 million people who rely on the company for their insurance, pension, investment, banking and health-care needs. Its investment manager currently administers £125 billion in assets. It is a leading pensions provider in the UK, and is rated by Standard & Poor's as 'strong' with a rating of A+ and as 'good' with a rating of A1 by Moody's. Standard Life was awarded the 'Best Pension Provider' in 2004, 2005 and 2006 at the Money Marketing Awards, and it was voted a 5 star life and pension‟s provider at the Financial Adviser Service Awards for the last 10 years running. The '5 Star' accolade has also been awarded to Standard Life Investments for the last 10 years, and to Standard Life Bank since its inception in 1998. Standard Life Bank was awarded the 'Best Flexible Mortgage Lender' at the Mortgage Magazine Awards in 2006.

- 23. VISION 'The most successful and admired life insurance company, which means that we are the most trusted company, the easiest to deal with, offer the best value for money, and set the standards in the industry'. “THE MOST OBVIOUS CHOICE FOR ALL” VALUES VALUES that will be observed while we work with HDFCSL: INTEGRITY: WHAT IS IT? Honest and Truthful in every Action. Transparency. Stick to principles irrespective of outcome. Be just and fair to everyone. WHY? Integrity is the bedrock on which the company and the expectations of the customers and employees are built. Integrity establishes the credibility of the person defines the character and empowers one to do justice to the job. Enables building confidence and trust, achieving transparency and laying a strong foundation for a binding relationship. Guiding principle for all walks of life.

- 24. INNOVATIONS: WHAT IS IT? Building a storehouse of treasures through experiences. Looking at every product and process through fresh eyes everyday WHY? To exceed customer expectation and maximize customer retention. To achieve competitive advantage. To promote a growth and upgrade standards in the industry. To foster creativity amongst employees and partners To open a world of new possibilities. CUSTOMER CENTRIC: WHAT IS IT? Understanding his expectation by keeping him as the center point Listen actively. Understand customer need and deliver solutions. Customer interest always supreme.

- 25. WHY? Reinforce brand loyalty by complete transparency. Customer is the source of revenue for the company. Customer is the reason for our existence. Ensure that customer choose our company to do business with. Will contribute to customer retention Customer goodwill alone can bring more business and more customers. PEOPLE CARE: WHAT IS IT? Genuinely understanding the people we work with. Guiding their development through training and support. Helping them develop requisite skills to reach their true potential. Know them on a personal front. Create an environment of trust and openness. Respect for time of others. WHY? People are the most valuable asset of the company. Motivate to individual to give his/ her best. Job satisfaction.

- 26. TEAM WORK: WHAT IS IT? Whole team makes the ownership of the deliverable. Consult all involved, understand and arrive at a common objective. Co-operate and support across departmental boundaries. Identify strength and weaknesses accordingly allocate responsibility to achieve common objective. WHY? Together every one achieves more. It adds joy at work place. Teamwork generates synergy and provides a focused approach. One for all and all for one.

- 27. ORGANIZATIONAL SET UP AT HDFC STANDARD LIFE MANAGING DIRECTOR GENERAL MANAGER HEAD RETAIL (SALES) BUSINESS DEVELOPMENT MANAGER/ CORPORATE AGENCY MANAGER SALES DEVELOPMENT MANAGER CERTIFIED FINANCIAL CONSULTANT

- 28. BOARD OF DIRECTORS Management People Mr. Deepak S Parekh Chairman Mr. Keki M Mistry Managing Director Mr. Alexander M Crombie Group Chief Executive of Standard Life Group Ms. Marcia D Campbell Group Operation Director Mr. Keith II Skeoch Chief Executive Standard Life Investment Mr. Gautam R divan Chartered Accountant Mr. Ranjan Pant Global Management Consultant Mr. Ravi Narain Managing Director & CEO of NSE of India Mr. Deepak M Satwalekar Managing Director & CEO of Company Ms. Renu S Karnad Executive Director

- 29. CHAPTER-III INTRODUCTION TO TOPIC

- 30. PROTECTION PLANS Protect your income and family “The most successful and admired life insurance company, which means that we the most trusted company, the easiest to deal with, offer the best value for money, and set standards in the industry. In short, “the most obvious choice for all”. INTRODUCTION We spend our lives in earning income and giving a good life to our family. We give our time and work hard to give them all the luxuries. We also take loans to purchase a house /car for our family. However, if we died, how would our family manage. It is important to secure our income and thus the future of our family. This will ensure that, even if something were to happen to us, their lifestyle would be protected and our dreams for them realized. PROTECTION Our Protection category products offer solutions for the above. They are designed in a manner to provide a high protection at a low cost, over a pre-determined period. Once the period is over, this protection ceases and nothing is payable at the expiry. Our offerings in this category are; 1. Term assurance plans. 2. Loan cover term assurance plan. 3. Rider that can be offered along with, endowment, money back, term and loan cover term policies.

- 31. TERM ASSURANCE PLAN Uncertainly is a part of life. In the event of the breadwinner the dependents are put to a lot of financial difficulty as they lose the source of income. The problem is compounded in case the family does not have savings to rely on. In case a person has dependents and also does not have savings on which the family can rely on in the event of his death, he needs to protect his income for the benefit of the family. Term assurance plan is designed to offer the protection of the income at the least possible cost. The term assurance plan can be opted for in a single premium / regular premium mode. The policyholder opts for a term and sum assured at the start. Once, the policy issued, this the level of protection he has over the life of the policy. No value is payable on the date of maturity. Premiums are low. The product is subject to financial and important to protect the income to sell this plan. The number of dependents of the client and their capacity to earn a living in the event of his death would be valuable information that can help you position this plan.

- 32. FEATURES OF TERM ASSURANCE PLAN DEATH BENEFIT: Amount paid in case of death during the plan. Provided the policy is in fore in the event of death of the assured during of the contract the sum assured is paid. EXPIRY OF THE COVER: On expiry of the cover nothing is payable as term assurance is a desired for protection only. PAID UP BENEFIT: There are no paid up benefits under the plan. SURRENDER BENEFITS: There are no surrender benefits under the plan. FREQUENCY OF PREMIUM PAYMENT: The policyholder can choose to pay by single premium or yearly or quarterly mode. The frequency of premium payment can be altered during the term of the contract. DAYS OF GRACE: The premium is payable in advance and should be paid within the days of grace allowed under the plan are 15 days form the due date of premium. In case the days of grace end on a holiday them the premium has to be paid on the next working day.

- 33. LAPSATION: In the event the premium is not paid within the days of grace the policy lapsed policy can be reinstated within one year form the date of lapse only. MINIMUM PREMIUM: The following are the minimum premium conditions under the term assurance plan. Single premium Rs 2000 Annual premium Rs 1500 Half-yearly mode Rs 800 Quarterly mode Rs 450 LIFE COVER BASIS: The plan can be sold on a single life or joint first death basis. OTHER CONDITIONS: Regular premium Single premium Minimum term 5 years 2 years Maximum term 30 years 15 years Minimum age at entry 18 years 18 years Minimum age at entry 60 years 60 years Minimum age at entry 65 years 65 years The policyholder has the choice to choose any term between the minimum and maximum terms available subject to the maximum age and term to expiry.

- 34. POLICY LOANS: Policy loans would not be available under the plan. TAX BENEFITS: The premium paid under the plan qualifies for tax rebate under section 80C of the income tax 1961 (deduction up to Rs 1 lakh under section 80C of the February 2005 beget). The claim benefits would also taxable as per section 10(10D) of the income tax act 1961. SPECIAL RATES FOR WOMENS: Since women have a lesser mortality rate than men for the same age. The premium rate charged for women would rate applicable to men three years younger. OPTIONAL BENEFITS: The client can choose any combination of the following rider benefits along with the plan 1. Accidental death benefit (ADB) 2. Critical illness benefits (CI) 3. Accelerated sum assured (ASA)

- 35. HDFC STD LIFE INSURANCE TERM ASSURANCE PLAN INTRODUCTION Uncertainty is apart of life. In case a person has dependents and also does not have savings on which the family can rely on in the event of his death, he needs to protect his income for the benefit of the family. Term assurance plan is designed to offer the protection of the income at the least possible cost. The term assurance plan helps to protect the lifestyle in the absence of the breadwinner and helps realize the dreams of the family. It is a plan designed to help an individual protect his/ Her family income earning capacity and help the family maintain their standard of living, in case of his / her untimely demise. This plan is a pure risk cover of by nature which means that the sum assured would be payable only in case of the death of the life assured during the term of the policy. The above implies that the plan does not have any maturity benefits. FEATURES PREMIUM OPTIONS: Single Premium Regular Premium Minimum age at entry 18 years last birthday 18 years last birthday Maximum age at entry 60 years last birthday 60 years last birthday Minimum Term 2 years 2 years Maximum Term 15 years 15 years Maximum age at expiry 65 years 65 years

- 36. The term assurance plan can be opted in a single premium and regular premium mode Under the regular premium modes one can pay premiums on an annual, half yearly or quarterly basis. The frequency of premium payment can be altered during the term of the contract. Please note that a regular premium policy cannot be changed to a single mode during the term of the contract. CONDITIONS: Minimum premium: Single Rs 2000 Yearly Rs 1500 Half yearly Rs 800 Quarterly Rs 450 PREMIUM PAYMENT CONDITION: The days of grace allowed under this plan are 15 days form the due date of premium under all modes. For payment of premium only cash, cheques, demand drafts or standing instructions are allowed. Post-dated cheques are also accepted. Back dating of this policy is not permitted.

- 37. WORKING OF TERM ASSURANCE PLAN The policyholder opts for a term and sum assured at the start. Once, the policy is issued, this is the level of protection he has over the life of the policy. In case of death during the term, the sum assured is payable to the family. No value is payable on the date expiry of the term. Premiums are low compared to the amount of risk cover. The product is subject to financial and medical underwriting. You need to convince the client that it is important to protect the income to sell this plan. The number of dependents of the client and their capacity to earn a living in the event of his death would be valuable information that can help you position this plan. STRUCTURE OF TERM ASSURANCE PLAN: 1. Start. 2. In case of death during the term SA is payable to the family. 3. Maturity nothing is payable.

- 38. This plan is allowed to singe life as well as joint lives on a first claim basis. DEATH BENEFIT: Provided the policy is in force in the event of death of the life assured during the term of the contract, sum assured is paid. BENEFIT ON EXPIRY OF COVER: On expiry of the cover nothing is payable as term assurance is a designed for protection only. OPTIONAL BENEFITS (RIDERS): The client can choose any combination of the following rider benefits along with the plan. 1. ACCIDENTAL DEATH BENEFIT (ADB): - An additional sum assured is payable is case of death due to accident and the policy terminates. 2. CRITICAL ILLNESS BENEFIT (CIB): -An additional sum assured is payable is case of critical illness and the policy continues with other benefits. 3. ACCELRATED SUM ASSURED (ASA): -Policy sum assured is payable is case of critical illness and the policy terminates.

- 39. SURRENDER BENEFIT: There are no surrender benefits under the plan. PAID UP BENEFITS: There are no paid up benefits under the plan. LAPSATION: In the event the premium is not paid within the days of grace the policy lapsed policy can be reinstated within one year form the date of lapse only. POLICY LOANS: Policy loans would not be available under the plan. TAX BENRFITS: The premium paid under the plan qualifies for tax rebate under section 80C of the income tax 1961 (deduction up to Rs 1 lakh under section 80C of the February 2005 budget). The claim benefits would also taxable as per section 10(10D) of the income tax act 1961. SPECIAL RATES FOR WOMEN: Since women have a lesser mortality rate than men for the same age. The premium rate charged for women would rate applicable to men three years younger.

- 40. COMPETITORS PLAN ICICI PRUDENTIAL LIFE GUARD Under this plan, in case of death of the life assured during the term, the Sum Assured will be paid to the beneficiary. There are no maturity benefits. Hence on survival till maturity, the policy will terminate. You will need to pay the regular annual premium, for the term chosen. You will be provided with life cover equal to the Sum Assured. Happiness and security for our family is what all of us want. However, the uncertainties of life often worry us. The thought of unfortunate events befalling us may cause anxiety about our ability to provide for our loved ones. This is especially the case if we are no longer there to provide for them. Insurance can help ease worries. It ensures that your loved ones are adequately provided for and that their lives are not affected, even if you are not around. ICICI Prudential Life Insurance, India's No. 1 private life insurance company presents LifeGuard. Choose from three term plans to insure your life and provide total security to your family, at a very affordable cost. LEVEL TERM ASSURANCE WITH RETURN ON PREMIUM: SINGLE PREMIUM The table below provides indicative premiums for various age-term combinations for a Sum Assured of Rs. 10 lakhs. Should you select this plan, you will need to pay a regular annual premium for the term chosen. You will be provided with life cover equal to the Sum Assured. In case of death of the life assured during the term, the Sum Assured under the plan will be paid to the beneficiary. On survival till maturity, all the premiums paid,

- 41. will be returned. The plan also offers the unique feature of an additional extended cover for 5 years after maturity of the policy, for 50% of the Sum Assured. This provides additional protection, even after the Premium Paying Term. The table below provides indicative premiums for various age-term combinations for a Sum Assured of Rs. 10 lakhs. TERM OF THE POLICY: Age 5 years 10 years 15 years 20 years 30 years Rs.2, 751 Rs.2, 751 Rs.2, 751 Rs.2, 751 35 years Rs.2, 878 Rs.2, 878 Rs.2, 878 Rs.2, 878 40 years Rs.3, 917 Rs.3, 917 Rs.3, 917 Rs.3, 917 Each premium indicated has been calculated on an annual premium basis for a healthy adult male. The exact premium to be paid may vary as a result of underwriting. LEVEL TERM ASSURANCE WITH RETURN ON PEMIUM: EXTENDED LIFE COVER Each premium indicated has been calculated on an annual premium basis for a healthy adult male. The exact premium to be paid may vary as a result of underwriting.

- 42. TERM OF PREMIUM: Age 5-years 10 years 15 years 20 years 30 years Rs.32, 195 Rs.15, 642 Rs.10, 860 Rs.9, 047 35 years Rs.37, 193 Rs.19, 170 Rs.13, 927 Rs.11, 928 40 years Rs.46, 130 Rs.24, 952 Rs. 18, 631 Rs.16, 230 FEATURES For added protection of your family against any unfortunate eventualities, LifeGuard offers you he following: ACCIDENT AND DISABILITY RIDER: On death of the life assured due to an accident, the beneficiary gets the additional sum assured under the rider. In case an accident related death occurs while traveling by mass surface public transport, the beneficiary gets twice the sum assured under the rider. In the event of total and permanent disability, 10% the rider. Sum assured is paid out every year, for 10 years.

- 43. PLAN SUMMARY: Name of the Product Life Guard Category Protection Plan (Traditional) Company ICICI Prudential Insurance Plan Summary In this plan, in case of death of the life assured during the term, the Sum Assured will be paid to the beneficiary. There are no maturity benefits. Hence on survival till maturity, the policy will terminate. In case of term assurance with return of premium, all premiums paid will be returned. Features: Eligibility Between 18 and 55 years. Risk Cover Death and Accidental Death. Loan The loan is not available in this plan. Benefits: Maturity Benefit In case of term assurance with return of premium, all premiums paid will be returned. Death Benefit Sum assured. Tax Benefit Tax benefits under section 80C and section 10(10D) as per the prevailing Income Tax laws. Additional Benefit Accident and Disability Rider, Waiver of premium. Premium: Minimum Rs. 2400 p.a. Discontinuance In case you wish to surrender LifeGuard Level Term Assurance and Single Premium Plans, no surrender value is

- 44. available. However, on surrender of LifeGuard Level Term Assurance with Return of Premium, a guaranteed surrender value is payable to you. This is only applicable once three years' of premium are paid. Funds: Composition There is no composition of funds under this plan. Charges: The charges are not applicable under this plan. Premium Allocation Rate No premium allocation rate is there in this plan. FMC No fund management charges are applicable in this plan. PAC There is no policy administration charge in this plan. Surrender Charge There is no surrender charge in this plan. Exclusions Suicide: If the Life assured commits suicide whether sane or insane, within one year from the date of commencement of this policy, the policy shall be void and the premiums paid will be refunded after deducting the expenses incurred by the Company for the issue of the policy.

- 45. AVIVA LIFE INSURANCE LIFE SHIELD Life Shield is a low cost life insurance plan which guarantees to pay a lump sum amount in case of your death during the term of the policy. Life is full of uncertainties and you need to secure the future of your loved ones. Life Shield is an ideal life insurance plan that helps you protect your family's future. While there can be no compensation for the loss of life, Life Shield ensures that your family's financial needs are met should something unfortunate happen to you. Its aims to pay out guaranteed cash amount in the unfortunate event of your death during the term of the policy. Life Shield is a low cost life insurance plan which guarantees to pay a lump sum amount in case of your death during the term of the policy. CONDITIONS TERM ALLOWED: Minimum term – 5 years Maximum term – 40 years Age limits - 18 – 55 years Maximum expiry age – 65 years Minimum Premium – Rs. 2000 Minimum sum assured – Rs. 500000

- 46. SUM ASSURED: The sum insured of the policy can be increased (only up to 40 years of age) once by 50% (subject to maximum increase of Rs.1,000,000) during the term of the policy, without submitting any evidence of good health, If: - You decide to increase the sum insured within three months of your marriage. - You decide to increase the sum insured within three months of the birth of your child. This option to increase the sum insured is available if the policy has been accepted on standard rates. It can be exercised only when outstanding term of the policy is at least 5 years and the policy is inforce for full sum insured. Payment of specified regular premiums up to the stipulated age. You can pay the premiums in cash, cheque, draft or direct debit at yearly, half- yearly, quarterly or at monthly (direct debit only) intervals. BENEFITS DEATH BENEFIT: The plan pays out a sum insured in the unfortunate event of your death before the maturity date. TAX BENEFIT: Premiums paid by you are eligible for tax deductions under Section 80C of the Income Tax Act, 1961.

- 47. ADDITIONAL BENEFIT: We offer preferred rates to customers opting for higher sum insured and to Pension Plus policyholders of Aviva. - You will receive a discount of Rs. 0.50 per thousand of sum insured on standard premium rates if you are opting for a sum insured of Rs. 1,000,000 and above. - If you are a Pension Plus policyholder, you will get an additional discount of 7.5% on the premium rate stated in the Premium Rate Table of Life Shield, provided your Life Shield policy has been accepted on standard rates. GRACE PERIOD: You will be given a 30 day grace period from the due date (15 days for monthly mode of premium payment) to pay the premium. If the premium is not paid within the grace period, then the policy will lapse without any value. REVIVAL: A lapsed policy can be reinstated within two years from the date of first unpaid premium subject to underwriting requirements of the company and payment of all the unpaid premiums with interest. EXCLUSION: No benefit amount will be payable if the death of life insured is caused directly or indirectly by actual or attempted suicide within one year from the date of commencement of the policy.

- 48. FREE LOOK PERIOD: You have the right to review the policy terms and conditions and cancel your policy within a period of 15 days from the date of receipt of the policy document. If you cancel your policy, the premium you have paid will be refunded after adjusting for stamp duty and medical expenses. ACCEPTANCE: Aviva will not be liable for any claim until acceptance of risk and receipt of premium. QUERIES AND COMPLAINTS: If you would like further information, or have any queries or complaints, please contact us at the numbers given overleaf.

- 49. PLAN SUMMARY: Name of the Product Life Shield Category Protection Plan Company AVIVA Life Insurance Plan Summary Life Shield is a low cost life insurance plan which guarantees to pay a lump sum amount in case of your death during the term of the policy. Life Shield is an ideal life insurance plan that helps you protect your family's future. While there can be no compensation for the loss of life, it ensures that your family's financial needs are met should something unfortunate happen to you. Features: Eligibility 18 – 55 years Risk Cover Death only. Loan The loan is not provided in this policy. Benefits: Maturity Benefit There is no maturity benefit in this plan. Death Benefit The plan pays out a sum insured in the unfortunate event of your death before the maturity date. Tax Benefit Premiums paid by you are eligible for tax deductions under Section 80C of the Income Tax Act, 1961. Additional Benefit We offer preferred rates to customers opting for higher sum insured and to Pension Plus policyholders of Aviva.

- 50. - You will receive a discount of Rs. 0.50 per thousand of sum insured on standard premium rates if you are opting for a sum insured of Rs. 1,000,000 and above. - If you are a Pension Plus policyholder, you will get an additional discount of 7.5% on the premium rate stated in the Premium Rate Table of Life Shield, provided your Life Shield policy has been accepted on standard rates. Premium: Minimum Rs. 2000 Discontinuance NA Funds: Composition In this plan, there is no composition of funds. Charges: No charges are applicable in this plan. Premium Allocation Rate There is no premium allocation rate in this policy. FMC No fund management charges are applicable in this policy. PAC There is no policy administration charge in this plan. Surrender Charge Surrender charge is not applicable in this plan. Exclusions No benefit amount will be payable if the death of life insured is caused directly or indirectly by actual or attempted suicide within one year from the date of commencement of the policy.

- 51. OM KOTAK TERM ASSURANCE PLAN The premiums under the plan are payable quarterly, half-yearly, yearly or by single premium. If there are more than 5 years before the benefit ceases, the plan can be converted into any other products (except a term product) available at that time, without proof of health (other than a simple AIDS test). The premium and the Sum Assured would be subject to the conditions then applicable. The Plan has no maturity values and is a pure risk plan. In the event of death the sum assured is payable. A single premium policy can be surrendered. 75 % of the single premium, adjusted for the proportion of the benefit term that has passed would be paid back. A healthy male 30-year old who buys a Kotak Term Assurance Plan for a Sum Assured of Rs 10,00,000 for a 20-year term, would have to pay an annual premium of Rs 3500/- only. In the event of death the beneficiary would receive the sum assured of Rs 10,00,000 CONDITIONS: Term allowed: 10-20 years for annual premium 5-20 years for single premium Minimum age at entry: 18 years Maximum age at entry: 60 years Maximum expiry age: 70 years

- 52. Minimum Premium: Quarterly - Rs 540 Half yearly- Rs 1,035 Yearly- Rs 2,000 Single Premium- Rs 10,000 Policy Fees: Quarterly: Rs 20 Half yearly: Rs 15 Yearly: Rs 0 Single: Rs 0 Grace period: 30 days from the date of unpaid premium. The policy lapses without any value if the premiums are not paid within the grace period. Revival: If the outstanding premiums are paid with handling charges within six months, the policy can be revived without proof of good health. Handling charges will be 6% of the outstanding premiums. Thereafter proof of good health will be required. UNDERWRITING REQUIREMETS: No medical: Rs 5 lacs for ages less than or equal to 35 years. Rs 3 lacs for age between 36 to 45 years.

- 53. RIDERS The following riders can be added to the plan: 1) ACCIDENT DEATH BENEFIT: In case of Death as a result of Accident the beneficiary will receive the additional sum assured. The maximum sum assured for this benefit cannot be more than the death benefit on the basic policy (subject to a maximum of Rs 10 lacs) Exclusions for the Accident Benefit: 1) Self inflicted injuries, suicide, insanity, immorality, committing of breach of law or being under the influence of drugs, liquor etc. 2) When the life assured is engaged in aviation or aeronautics other than as a passenger on a licensed commercial aircraft operating on a scheduled route. 3) Due to injuries from war (whether war is declared or not), invasion, hunting, mountaineering, motor racing of any kind, other dangerous hobbies or activities, or having been on duty in military, Para-military, security or police organization. 2) PERMANENT DISABILITY BENEFIT: An additional amount, payable as an annuity, over and above the basic policy sum assured in event of permanent disability of the life assured. The annuity is payable during the term of the basic policy. Permanent disability is defined as the permanent loss of use of any two limbs, or permanent and complete loss of sight in both eyes or injuries that render the insured incapable of earning an income from the date of accident onwards from any work,

- 54. occupation or profession (commensurate with his educational qualifications, training and experience) The permanent disability benefit can be availed for the term of the basic policy. The maximum permissible age at maturity is 70 years. The Sum Assured payable under the Permanent Disability benefit would be paid out in the following manner. 12% of the benefit sum assured each year for the first five years of the accident. Terminal payment of 60% of the benefit sum assured at the end of the fifth year. The maximum sum assured allowed is equal to double the sum assured on the basic policy subject to a maximum of Rs 10 lacs. The permanent disability benefit is subject to the following: The benefit is in full force at the time of the accident. The life assured has sustained the bodily injury directly and solely from the accident, which has been caused by outward, violent and visible means. The life assured becomes totally and permanently disabled from the date of accident due to such injury as stated above solely, directly an independently of all other causes of becoming disabled. The disability is such that the life assured is totally and permanently. Unable to earn an income from the date of the accident onwards from any work, occupation or profession (commensurate with his educational qualifications, training and experience).

- 55. Unable to use both hands at or above the wrist. Unable to use both feet at or above the ankle. Unable to use one hand at or above the wrist and one foot at or above the ankle, or blind in both eyes. The policyholder writes to the company, within 30 days from the day of the accident, giving the following details: o Date, time and place of the accident. o Nature of the accident and details thereof. o The life insured address. Within 120 days after the happening of the disability, the policyholder writes to the company giving the details of permanent and total disability, in the manner required by the company along with proof of disability and the life assured is willing to be examined by a Medical Examiner nominated by the company. The life assured should inform the Company of any changes in his occupation or activities as this could effect the terms an conditions of this rider. On such disclosure, the Company shall have the right to amend the benefits payable under this rider.

- 56. Exclusions to the permanent disability rider: Self inflicted injuries, suicide, insanity, immorality, committing any breach of law or being under the influence of drugs, liquor etc. When the life assured is engaged in aviation or aeronautics other than as a passenger on a licensed commercial aircraft operating on a scheduled route. Due to injuries from war (whether war is declared or not), invasion, hunting mountaineering, motor racing of any kind, other dangerous hobbies or activities, or having been on duty in military, par military, security or police organizations. 3) CRITICAL ILLNESS BENEFIT RIDER: Under the rider an immediate payment is made to the life assured in case he contracts any specified critical illness. The benefit is an advance payment of a part of the basic sum assured. Therefore after payment of the benefit amount the sum assured and benefits dependent on the basic sum assured will reduce proportionately. Future premiums will also be reduced after the benefit is paid. Critical illness benefit is available with certain conditions as follows: o It can be taken only at the time of purchase of an insurance policy and not subsequently. o The benefit is applicable only for the first critical illness diagnosed. Once paid, the benefit will cease. o Claims under critical illness will not be valid unless the policy along with the rider has been in force for at least six months.

- 57. o The policyholder has to comply with the requirements of On Kodak Marinara to furnish details of the critical illness, etc. o The rider is available between the age limit of 18 and 60 years. o The maximum vesting age cannot exceed 70 years. o The rider is available for the term of the basic plan (maximum term 20 years). o The rider benefit cannot exceed 50% of the basic sum assured subject to an overall limit currently 20 lacs. Exclusions: 1) Self inflicted injuries, suicide, insanity, immorality, and breach of law. 2) Unreasonable failure to seek medical advice. 3) Non disclosure of pre-existing medical illness or medical history. 4) Alcohol or solvent are used or drug consumption other than medical advice. 5) Infection with Human Immune Deficiency Virus (HIV) or condition due to Acquired Immune Deficiency Syndrome (AIDS). 6) Aviation or aeronautics activity except as a passenger traveling on a licensed commercial aircraft operating on a scheduled route. 7) Activities like invasion, hunting and mountaineering, motor racing of any kind and any dangerous hobbies or activities.

- 58. 8) Critical illness during duty in military, Para military, security or police organization or due to injuries from war (whether war be declared or not) FOLLOWING ARE THE CRITICAL ILLNESS THAT IS COVERED UNDER THE RIDER: Heart Attack Cancer Stroke Coronary Artery Bypass Graft Surgery Kidney Failure Major Organ Transplant Paralysis Loss of Limbs Aorta surgery Major burns Heart Valve Surgery Blindness The Kodak Preferred Term Plan is designed to provide you with reduced premium rates for a sum assured of Rs.10 lakhs and above. ELIGIBILTY: Males over the age of 25 years, who do not use tobacco in any form. Females over the age of 25 years. EXCLUSIONS: In case the life insured commits suicide within 1 (one) year of the plan, no benefits outlined in the plan would be payable.

- 59. Exclusions for Accidental Death Benefit, Permanent Disability Benefit & Critical Illness Benefit: The Accidental Death Benefit, Permanent Disability Benefit & Critical Illness Benefit would not be paid out in the following circumstances: a) Self inflicted injuries, suicide, insanity, immorality, committing any breach of law or being under the influence of drugs, liquor etc. b) When the life insured is engaged in aviation or aeronautics other than as a passenger on a licensed commercial aircraft operating on a scheduled route. c) Due to injuries from war (whether war is declared or not), invasion, hunting, other dangerous hobbies or activities, or having been on duty in military, para-military, security or police organization. Additional Exclusions for Critical Illness: a) Unreasonable failure to seek or follow medical advice. b) Any pre-existing medical conditions not disclosed at inception. c) Infection with Human Immunodeficiency Virus (HIV) or conditions due to acquired Immune Deficiency Syndrome (AIDS). In addition, no benefit would be paid in respect of the exclusions specific to each critical illness. Prohibition of Rebates:

- 60. Section 41 of the Insurance Act, 1938 states: - (1) No person shall allow or offer to allow, either directly or indirectly, as an inducement to any person to take out or renew or continue an insurance in respect of any kind of risk relating to lives or property in India, any rebate of the whole or part of the commission payable or any rebate of the premium shown on the policy, nor shall any person taking out or renewing or continuing a policy accept any rebate, except such rebate as may be allowed in accordance with the published prospectuses or tables of the insurer. (2) Any person making default in complying with the provision of this section shall be punishable with fine, which may extend to five hundred rupees. The product leaflet gives only the salient features of the plan. The policy document is the conclusive document, and provides in detail all the conditions relating to the Kotak Term Plan. PLAN SUMMARY: Name of the Product OmKotak-Kotak Term Assurance Plan Category Protection Plan Company Kotak Insurance Features: Eligibility Minimum age at entry: 18 years Risk Cover Life cover Loan Loans are also available under this plan. Benefits:

- 61. Maturity Benefit The Plan has no maturity values and is a pure risk plan. Death Benefit In the event of death the sum assured is payable Tax Benefit Sec 80C, 10(10D) of income tax act would apply. Additional Benefit Accidental Death Benefit, Permanent Disability Benefit, Critical Illness Benefit Rider Premium: Minimum Yearly - Rs 2,000 Single Premium - Rs 10,000 Discontinuance In case of a financial emergency, you have the option to surrender the policy provided you have taken the single premium payment payout option. Funds: Composition There is no composition of funds in this plan. Charges: No charges are applicable in this plan. Premium Allocation Rate There is no premium allocation rate this plan. FMC No fund management charges are applicable. PAC There is no policy administration charge under this plan. Surrender Charge There is no surrender charge under this policy. Exclusions In case the life insured commits suicide within 1 (one) year of the plan, no benefits outlined in the plan would be payable.

- 62. BRILA SUN LIFE TERM PLAN The plan has been designed for people who want to avail of the benefits or low cost. It is a low cost premium. Pure Risk coverage plans which takes care commitments toward your family or dependants, should anything uniform you. Dreams of a life full of cheerful and happy moments. However life has its so risks. To take care of these uncertainties, you need to plan ahead. We are insurance look at life insurance form your needs point of view, create solutions. It is this commitment which enables us to find way to adapt adjusts. It is this philosophy that has brought the adyta birla group and sun insurance. Together to form birla sun life insurance Company limited. UNIQUE FEATURES: RIDERS - Accidental death and dismemberment rider, critical illness rider and premium rider available along with plan, you can avail of riders even single premium policy. FAVORABLE TERM - Favorable premium rates for female clients. AGE BENEFITS - Maximum age for maturity is 70 years. FACE VALUE REBATE - Attractive rebate for face amounts equal to or greater than lakh for regular pay and for face amount greater than or equal to7 lakh for single pay. FREE LOOK PERIOD - Review your decision for 15 days form the date policy document.

- 63. CONDITIONS: Entry age 18-55 years. Minimum face amount (sum assured) Rs 250000 in case of single premium in case of regular premium for a per eligibility criteria. Benefits period As per policy terms 5, 10, 15, 20, or 25 years. Premium payment period Single pay or over the duration of the plan. Single payment frequency Annually, semi-annually, quarterly, monthly (ECS) or one-time payment. Grace period Pay your premium within 30 days after due dates. Amount due to nominee in event of death Face amount. of the life insured Maturity benefits Nil. Riders Accidental death and dismember critical illness rider, waiver of premium rider, but only of the time of purchase of policy. Tax under Under Sec 80C and Sec 10(10D) of the income tax act 1961.

- 64. RIDERS Riders are the additional benefits that you may buy at a nominal extra cost and add to yours policy. The addition of rider helps you to customize the birla sun life term to match your present and future needs. You may avail of these riders along with your base plan. ACCIDENT DEATH AND DISMEMBERMENT BENEFIT RIDER: It provides additional amount of cover in case of death due to accident or loss of more than one limb or sight in both the eyes and partial coverage in case of loss one limb or sight one eye. CRITICAL ILLNESS RIDER: It provides a cover in the event of life insured being diagnosed as suffering form any of the specified critical illnesses WAIVER OF PREMIUM: This rider waives payment of future premiums on the happening of any of the unforeseen events as covered under this rider. PLAN SUMMARY: Name of the Product Term Plan Category Protection plan Company BSL Insurance Plan Summary The plan is a low premium, pure risk coverage plan, which takes care of financial commitments. Features:

- 65. Eligibility 18 years or above Risk Cover Death, Critical Illness and Accidental Death Loan Loans are not available in this plan. Benefits: Maturity Benefit There is no maturity benefit under this plan. Death Benefit Sum Assured. Tax Benefit As per the current laws, the benefit paid under the policy are entirely tax free under section 10 (10 D) and the premium paid by you also enjoy the tax benefit under section 80 C of the Income Tax Act, 1961 Additional Benefit Accidental Death & Dismemberment Rider, Critical Illness Rider, Waiver Of Premium Riders Premium Single pay or over the duration of the plan Minimum Rs 2, 50,000 in case of single premium Rs 2, 00,000 in case of regular premium. Discontinuance NA Funds: Composition There is no composition of funds in this plan. Charges: Charges are not applicable in this plan. Premium Allocation Rate There is no premium allocation rate in this policy. FMC Fund management charges are not applicable in this plan. PAC There is no policy administration charge in this policy. Surrender Charge No surrender charge is applicable in this policy. Exclusions In case the life insured commits suicide within 1 (one) year of the plan, no benefits outlined in the plan would be payable.

- 66. COMPARISION HDFC ICICI AVIVA OM BIRLA SUN STD LIFE PRUDEN- KOTAK LIFE -TIAL RISK COVER Death, Death and Death only. Life cover. Death, Critical Accidental Accidental Illness and death, Death. Accidental Critical Death. illness & Accelerated Sum Assured. LOAN Loans are The loan is The loan is Loans are Loans are not not not not also available in this available in available in provided in available plan. this plan. this plan. this policy. under this plan. MATURITY There is no In case of There is no The Plan There is no BENEFIT maturity term maturity has no maturity benefit benefit assurance benefit in maturity under this plan. under this with return this plan. values and plan of premium, is a pure all risk plan. premiums paid will be returned. DEATH In the event Sum The plan In the event Sum Assured. BENEFIT of death of Assured. pays out a of death the the life sum insured sum assured

- 67. assured in the is payable. during the unfortunate term of the event of contract, your death sum assured before the is paid. maturity date. ADDITIONAL Accidental Accident We offer Accidental Accidental BENEFIT death and preferred Death Death & benefit, Disability rates to Benefit, Dismemberment Critical Rider, customers Permanent Rider, Critical illness Waiver of opting for Disability Illness Rider, benefit & premium. higher sum Benefit, Waiver Of Accelerated insured and Critical Premium Sum to Pension Illness Riders. Assured Plus policy Benefit benefit. holders of Rider. Aviva. FUND There is no In this plan, There is no In this plan, There is no COMPOSITION composition there is no composition there is no composition of of funds in composition of funds in composition funds in this this plan. of funds. this plan. of funds. plan. CHARGES There are No charges Charges are No charges Any kind of no charges are not are charges are not applicable applicable applicable applicable applicable in in this plan. in this plan. in this plan. in this plan. this plan.

- 68. In the above Plans, there are no Maturity Benefits and there is also no Composition of Funds. And the Charges are also not applicable in these Plans i.e. Fund Management Charges, Policy Administration Charges and Surrender Charges. Premium Allocation Rate is also not there in the above Plans. Loan is not available in any of the Plan And at the time of Death, the Sum Assured is given to the Life Assured. In case of RISK COVER: HDFC STANDARD LIFE It covers 4 risks as compared to other Plans i.e. Death, Accidental death, Critical illness & Accelerated Sum Assured. ICICI PRUDENTIAL LIFE It covers 2 risks Death and Accidental Death. AVIVA It covers only one risk i.e. Death OM KOTAK It covers only one risk i.e. Death BIRLA SUN LIFE It covers 3 risks i.e. Death, Accidental death & Critical illness. In case of ADDITIONAL BENEFITS: HDFC STANDARD LIFE It has Accidental death benefit, Critical illness benefit & Accelerated Sum Assured benefit.

- 69. ICICI PRUDENTIAL It has Accident and Disability Rider, Waiver of premium. AVIVA It offers preferred rates to customers opting for higher sum insured and to Pension Plus policy holders of Aviva. OM KOTAK It has Accidental Death Benefit, Permanent Disability Benefit and Critical Illness Benefit Rider. BIRLA SUN LIFE It has Accidental Death & Dismemberment Rider, Critical Illness Rider and Waiver of Premium Riders The advantage of HDFC STANDARD LIFE Plan over other Companies Plans is that HDFC STANDARD LIFE covers 4 risks i.e. Death, Accidental death, Critical illness & Accelerated Sum Assured as compared to others and it has Accelerated Sum Assured (ASA) Benefit, in this benefit Sum Assured is payable on diagnosis of anyone of the insured Critical Illness.

- 71. INTRODUCTION OF RESEARCH No project is completed without a research framework. So I have also gone through a procedure of research methodology. Research methodology is a way to systematically solve the problem. One can define research as a scientific search for pertinent information on a specific topic in it. The various steps that are generally adopted by a researcher in studying us research problems along with the logic behind him are studied. RESERACH METHODOLOGY PROCEDURE: Defining research procedure Reviewing the literature For mutating hypothesis Research designing Sample designing Data collection Analyzing data Interpreting and reporting

- 72. DEFINING THE RESEARCH PROBLEM: Defining research problems- there are two types of research problems, that is those which relates to state of nature and those which relate to relationship between variables. Our research is the former one and the problem in the precise way is . REVIEWING THE LITERATURE: I undertook extensive literature study from the library of HDFC standard life insurance, journals, newspapers and previous research. Finding about insurance, I consider internet, reference and advertisements. FORMULATION OF HYPOTHESIS: Hypothesis is a tentative assumption made in order to draw out and test its logical and empirical consequences. OUR CONSEQUENSES IS People have at least basic knowledge of insurance I have assumed certain priorities as per annexure Tax consideration is the market Saving venture Insurance awareness in terms of risk coverage

- 73. RESEARCH DESIGN: Decision regarding what, where, when, how much, by what concerning an inquiry, or a research study constitute a research design. A Research design is the arrangement and analysis of data in a manner that aims to combine. Relevance to the research purpose with economy in procedure. In fact research design is the conceptual structure within which the research is conducted. The research design used for the present study is description in nature. The major purpose of descriptive study is description of the state of affairs. As it exists at present. The main characteristics of the design are that is used where researcher has no control over the variables. Research design is a conceptual structure within which research is conducted. Research design can be various types Descriptive- Detail (Project Sheet) Explanatory- Profile of F.C Experimental- Body mass test Analytical- Need analysis (past record of F.C.) Sample design- Sample is a part of population which represent the whole population various types of sample design are-

- 74. Deliberate sampling it includes:- Convenience sampling Judgment sampling Simple random sampling Systematic sampling Filled activity Stratified sampling House wife Student Cluster sampling Group meeting DATA COLLECTION: Secondary data- Which someone else has already collected? The data collected for the study is primary and secondary in nature. Data collection technique:- The study will largely use primary data gathered.

- 75. ANALYSIS AND INTERPRETETION OF DATA:- After doing operations like coding, editing & tabulation, I analyzed the data by making various graphs which are depicted in the last of this project report. The findings are also mentioned along with graphs. Types of universe:- Sample design is to clearly define the set of objects technically called the universe. The universe can be finite or infinite. In finite universe the number of items is certain, but in case of infinite universe the number of items is infinite i.e. we cannot have any about the total numbers of items in my research. I use the finite universe.

- 76. CHAPTER-V OBJECTIVES OF STUDY

- 77. OBJECTIVES OF THE STUDY Why this project was chosen. The main objective of m y study is “Comparative studies of HDFC Standard Life Protection Products with competitor‟s products.” For the purpose of this I also decided some other objectives of m y study, which are as follows. Objectives of study More and more advertising should be used to tap the customers. Company should do personal selling. More awareness campaign should be undertaken so the people can rel y on the company. Services should be improved procedure to set Life Insurance policy should be made easily assessable.

- 78. CHAPTER-VI CONCLUSION 1. Insurance products are long term contract. 2. HDFC Standard Life is very good brand image in the market. 3. The ULIP‟s of HDFC Standard life are the best plans as compare with other product prevailing in the market. 4. Availabilit y of wide range of product according to the need of customer. 5. The promotion tools used by HDFC Standard Life are very effective. 6. The environment of HDFC Standard Life is full of joy & the way of doing work is also very simple & step by step.

- 79. CHAPTER -VII RECOMMENDATIONS 1. Benefits from the investment in Insurance should be increased as compare to Provident fund. 2. More & More advertising should be used to tap the customers. 3. Company should do personal selling. 4. More awareness campaign should be undertaken so that people can rel y on the company. 5. Services should be improved procedure to get Life Insurance Policy should be made easily assessable. 6. More & More of bonuses & extra benefit should be given. 7. Investment plans should be made to a suitable to individual need. 8. The people in rural areas should be taped & brought under the Life Insured policies. 9. Investment plans suitable to the female population (female child) should be brought in the market with premium & additional benefit. 10.More & More benefits should be added to children segment since they are the most untapped segment. Suddenl y policy should be in such a way that they cover both major as well as the minor in a single policy.

- 80. CHAPTER-VIII SUGGESTIONS 1. Insurance is a product with no feel of buying so to interact with people one should have patience because it takes too long to sell an insurance product. 2. As far as the company is concerned HDFC STANDARD LIFE should open more branches in each and every city so as to create awareness about the company. 3. The rural people should also be approached. 4. New innovative plan should be made for children, old people & couples. 5. Every effort should be made in the interest of the policy holders to provide them protection as well as return on investment. 6. Since it‟s a Life Insurance product the premium charges should be least.

- 81. CHAPTER-IX BIBLIOGRAPHY www.hdfcinsurance.com www.google.com www.iciciprudential.com www.omkotak.com www.birlasunlife.com www.avivalifeinsurance.com Research Methodology by C.R. Kothari