The Latvian Economy, 2010, May

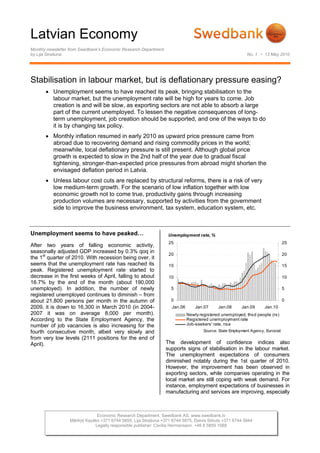

- 1. Latvian Economy Monthly newsletter from Swedbank’s Economic Research Department by Lija Strašuna No. 1 • 13 May 2010 Stabilisation in labour market, but is deflationary pressure easing? • Unemployment seems to have reached its peak, bringing stabilisation to the labour market, but the unemployment rate will be high for years to come. Job creation is and will be slow, as exporting sectors are not able to absorb a large part of the current unemployed. To lessen the negative consequences of long- term unemployment, job creation should be supported, and one of the ways to do it is by changing tax policy. • Monthly inflation resumed in early 2010 as upward price pressure came from abroad due to recovering demand and rising commodity prices in the world; meanwhile, local deflationary pressure is still present. Although global price growth is expected to slow in the 2nd half of the year due to gradual fiscal tightening, stronger-than-expected price pressures from abroad might shorten the envisaged deflation period in Latvia. • Unless labour cost cuts are replaced by structural reforms, there is a risk of very low medium-term growth. For the scenario of low inflation together with low economic growth not to come true, productivity gains through increasing production volumes are necessary, supported by activities from the government side to improve the business environment, tax system, education system, etc. Unemployment seems to have peaked… After two years of falling economic activity, seasonally adjusted GDP increased by 0.3% qoq in the 1st quarter of 2010. With recession being over, it seems that the unemployment rate has reached its peak. Registered unemployment rate started to decrease in the first weeks of April, falling to about 16.7% by the end of the month (about 190,000 unemployed). In addition, the number of newly registered unemployed continues to diminish – from about 21,800 persons per month in the autumn of 2009, it is down to 16,300 in March 2010 (in 2004- 2007 it was on average 8,000 per month). According to the State Employment Agency, the number of job vacancies is also increasing for the fourth consecutive month, albeit very slowly and from very low levels (2111 positions for the end of April). Unemployment rate, % 0 5 10 15 20 25 Jan.06 Jan.07 Jan.08 Jan.09 Jan.10 0 5 10 15 20 25 Newly registered unemployed, thsd people (rs) Registered unemployment rate Job-seekers' rate, nsa Source: State Employment Agency, Eurostat The development of confidence indices also supports signs of stabilisation in the labour market. The unemployment expectations of consumers diminished notably during the 1st quarter of 2010. However, the improvement has been observed in exporting sectors, while companies operating in the local market are still coping with weak demand. For instance, employment expectations of businesses in manufacturing and services are improving, especially Economic Research Department. Swedbank AS. www.swedbank.lv Mārtiņš Kazāks +371 6744 5859, Lija Strašuna +371 6744 5875, Dainis Stikuts +371 6744 5844 Legally responsible publisher: Cecilia Hermansson. +46 8 5859 1588

- 2. Latvian Economy Monthly newsletter from Swedbank’s Economic Research Department, continued No. 1 • 13 May 2010 2 (4) in such exporting sectors as wood, chemicals, machinery and equipment, and base metal industries, as well as in travel, tourism, computers, and research and development-related activities. Business confidence, employment expectations -80 -40 0 40 80 Jan.06 Jan.07 Jan.08 Jan.09 Jan.10 Retail trade Manufacturing Services Source: DG ECFIN Unemployment -40 0 40 80 120 160 200 Jan.06 Jan.07 Jan.08 Jan.09 Jan.10 -20 0 20 40 60 80 100 Unemployment expectations over next 12M (rs) Registered unemployment, thsd people Source: State Employment Agency, DG ECFIN Job-seekers’ data for the 1st quarter of 2010 will be available in late May, but currently it seems that our earlier forecast of this rate peaking at about 23% in the spring of 2010 holds. We will see the turning point in job-seekers’ rate only in August, when Labour Force Survey results for the 2nd quarter will be published. However, the dynamics of this rate will most likely be similar to registered unemploy- ment dynamics (although the latter might decrease faster due to weaker motivation to register when unemployment benefits end). Even with a possibility of unemployment rate to increase again in autumn due to seasonal factors, unless recovery in the euro zone is substantially slower than expected due to Greece problems, the unemployment rate reached this spring will still be the maximum. … but the labour market will remain weak in the upcoming years Overall, there is some stabilisation in the labour market, but, as historical experience shows, the unemployment rate will be high for years to come.1 With low employment, no wage growth, and conti- nuing fiscal consolidation, there is still little hope of the revival of consumer spending needed to sustain a meaningful recovery. We see that job creation is and will be slow, as exporting sectors are unable to absorb a large part of the current unemployed. There are about 230,000 job seekers in Latvia, which is nearly as many as the exporting sectors currently employ.2 With private consumption and investment starting to recover in 2011, job creation will pick up somewhat, but it is clear that part of the current unemployment is a long-term one, as domestic demand sectors will not need as many employees as in the boom years. This situation is encouraging people to emigrate, leading to structural problems in the long term by diminishing the size and quality of the labour force. To lessen the negative consequences of long-term unemployment, job creation should be supported. One of the ways to do this is by changing tax policy. For instance, targeted and temporary tax dedu- ctions might be considered to encourage first employment among younger people and long-term unemployed. 3 This initiative should be included already in the 2011 budget. Is the deflation story dead? Monthly consumer price inflation in the 1st quarter of 2010 was caused by more expensive imported goods and seasonal increases in food prices. At the same time, prices of local goods and services continued to decline. While the total consumer price index (CPI) fell by just 0.2% qoq, core CPI (i.e., excluding fuel, nonprocessed food, and admi- nistratively regulated prices) declined by 1.4% qoq in the 1st quarter of 2010. Monthly increases in producer prices at the beginning of the year were mostly driven by more expensive exported production. On a quarter-on-quarter basis, the 1 See, e.g., IMF, World Economic Outlook (April 2010), “Chapter 3, Unemployment dynamics during recessions and recoveries: Okun’s law and beyond”. 2 Swedbank estimations. For instance, there are about 130,000 employed in manufacturing, which is about 14% of total employment. In the service sectors, there might be up to 100,000 people working for exports (about 10% of total employment). 3 For more details, see IMF, World Economic Outlook (2010).

- 3. Latvian Economy Monthly newsletter from Swedbank’s Economic Research Department, continued No. 1 • 13 May 2010 3 (4) producer price index (PPI) of production realised in the local market declined by 0.2%, while that of exported production rose by 3.2% in the 1st quarter of 2010. Core inflation and total CPI, yoy, % -10 -5 0 5 10 15 20 Jan.06 Jan.07 Jan.08 Jan.09 Jan.10 -2 -1 0 1 2 3 4 Core inflation, mom Total inflation, mom Core inflation, yoy Total inflation, yoy Source: CSBL, LaB Overall, it can be seen that upward price pressure is coming from abroad, due to recovering demand and rising commodity prices in the world. In addition, the weakening euro exchange rate against US dollar is beneficial for Latvian exporters (outside the euro zone), although it makes imported energy resources more expensive. Producer price inflation, yoy -20 -15 -10 -5 0 5 10 15 20 25 Jan.06 Jan.07 Jan.08 Jan.09 Jan.10 Total Local market Exported Source: CSBL Although global price growth is expected to slow in the 2nd half of the year due to a gradual fiscal tightening, stronger-than-expected price pressures from abroad might shorten the envisaged deflation period in Latvia. Nevertheless, local deflationary pressure will still be present, as the labour market will be weak and deleveraging will proceed. This pressure, together with low global inflation, implies that, even if inflation in Latvia resumes, it will be subtle (excluding the effect of tax changes). Tax changes might influence price developments substantially, though (especially direct taxes, such as VAT or excise). Therefore, when planning tax changes, the authorities should consider not only the fiscal effect and the effect on incomes but also the influence on prices. Timing is particularly important, taking into account the euro adoption target in 2014. Although low inflation might make the further process of competitiveness adjustment slower than it would be in the deflation case, it would somewhat ease the deleveraging process, as well as increase budget revenues (e.g., tax revenues would rise due to growing turnover) and diminish the budget deficit. CPI growth (yoy), % -5 0 5 10 15 20 Jan.08 Jul.08 Jan.09 Jul.09 Jan.10 Eurozone SE UK RU EE LT LV Source: Reuters Competitiveness still improving It should be emphasized that deflation is not a necessary condition for improving competitiveness. What matters is Latvia’s development relative to its trading partners. In the 1st quarter of 2010, competitiveness continued to improve due to a bigger price growth in trading partner countries, as well as to favourable exchange rate developments. For instance, the CPI-based real effective exchange rate (REER) of the lats has already declined by 9% from its peak in February 2009 – an amount that is nearly 1/3 of its appreciation since 2006. A similar trend can also be observed in the PPI-based REER. So far, the competitiveness adjustment has been achieved through labour cost cuts, which cannot be continued forever, while productivity improvement has been weak. 4 Unit labour costs were also reduced in the 1st quarter of 2010 – unemployment 4 For more details see our recent Swedbank Analysis „Competitiveness adjustment in Latvia – no pain, no gain?”, available at http://www.swedbank.lv/eng/docs/materiali.php?nmid=0&naid =3

- 4. Latvian Economy Monthly newsletter from Swedbank’s Economic Research Department, continued No. 1 • 13 May 2010 4 (4) rose, and, according to our forecast, wage cuts continued. However, it seems that most of the potential to improve competitiveness through labour cost cuts and weak labour market driven deflation has been used by now. At the same time, with the labour market remaining weak, there are no strong inflationary pressures. Further adjustment through the labour market would be extremely painful, squeezing domestic demand further and undermining the recovery. The competitiveness adjustment is not yet over, but, in our opinion, further gains should be obtained via productivity- enhancing structural reforms. Effective exchange rates of the lats, 2005=100 90 100 110 120 130 140 Jan.06 Jan.07 Jan.08 Jan.09 Jan.10 NEER REER_CPI REER_PPI Source: Bank of Latvia Risks to future growth Unless labour cost cuts are replaced by structural reforms, there is a risk of very low medium-term growth. In our opinion, the risk of stagflation (i.e., high inflation and no growth) is very small, but the scenario of low inflation together with low economic growth is more likely. In case of low global inflation, this would make the process of improving competitiveness slower and longer than it could be with local deflation, and export-driven growth would also decelerate. For this scenario not to come true, productivity gains by increasing production volumes are necessary, supported by activities from the government side to improve the business environment, tax system, education system, etc. Lija Strašuna Swedbank Economic Research Department Balasta dambis 1a, Riga, LV 1048, Latvia www.swedbank.lv Martiņš Kazāks, +371 6744 5859 Dainis Stikuts, +371 6744 5844 Lija Strašuna, +371 6744 5875 Legally responsible publisher Cecilia Hermansson, +46 88 5859 1588 Swedbank’s monthly newsletter is published as a service to our customers. We believe that we have used reliable sources and methods in the preparation of the analyses reported in this publication. However, we cannot guarantee the accuracy or completeness of the report and cannot be held responsible for any error or omission in the underlying material or its use. Readers are encouraged to base any (investment) decisions on other material as well. Neither Swedbank nor its employees may be held responsible for losses or damages, direct or indirect, owing to any errors or omissions in Swedbank’s monthly newsletter.