New York Minimum Wage Hike May Cost Jobs

- 1. Michael J. Chow NFIB Research Foundation Washington, DC November 1, 2012 Economic Effects of a New York Minimum Wage Increase: An Econometric Scoring of S6413 This report analyzes the potential economic impact of implementing the changes to New York minimum wage laws contained in S6413 on private sector employment and production. S6413, originally introduced on February 6, 2012 by Senator Jeffrey D. Klein would (a) raise the minimum wage in New York to $8.50 beginning in 2013 and (b) provide for future increases in the minimum wage dependent upon cost of living adjustments. Billed as a measure that would help reduce income inequality, the long-run effect of the legislation would be the destruction of jobs and economic production in the state of New York. Depending upon the rate of inflation in future years, enacting legislation containing the essence of S6413 could result in nearly 22,000 lost jobs in New York over a ten-year period and a reduction in real output of $2.5 billion. More than 70 percent of the lost jobs would be jobs from the small business sector of the economy. 1

- 2. Introduction Employers in all fifty states are required to offer workers a minimum wage in exchange for their labor. The primary federal statute in the area of minimum wages is the Fair Labor Standards Act (FLSA) of 1938 which, as amended, establishes a basic minimum wage that must be paid to covered workers. The current federal minimum wage is $7.25 per hour. States are permitted to establish their own minimum wages which have the potential to replace the federal rate as the basic minimum wage, provided that the state minimum wage established exceeds the federal rate. The effective minimum wage in the state of New York is currently $7.25, equal to the federal rate (Table 1). Table 1: Historical Effective Minimum Wage Rates for New York Year Minimum Wage Year Minimum Wage 1972 $1.85 1993 $4.25 1973 $1.85 1994 $4.25 1974 $1.85 1995 $4.25 1975 $1.85 1996 $4.25 1976 $2.30 1997 $4.25 1977 $2.30 1998 $4.25 1978 $2.30 1999 $4.25 1979 $2.90 2000 $4.25 1980 $3.10 2001 $5.15 1981 $3.35 2002 $5.15 1982 $3.35 2003 $5.15 1983 $3.35 2004 $5.15 1984 $3.35 2005 $6.00 1985 $3.35 2006 $6.75 1986 $3.35 2007 $7.15 1987 $3.35 2008 $7.15 1988 $3.35 2009 $7.15 1989 $3.35 2010 $7.25 1990 $3.35 2011 $7.25 1991 $3.80 2012 $7.25 1992 $4.25 ---- ----- Source: Department of Labor Despite multiple recent increases in the state minimum wage (the state minimum wage has increased 40.8 percent over the past decade), state legislators continue to push for additional increases. The most recent attempt takes the form of S6413, a bill originally introduced on February 6, 2012 by Senator Jeffrey D. Klein. If passed, the bill would raise the minimum wage to $8.50 in 2013. Future increases to the state minimum wage rate would be guaranteed vis-à-vis indexation to cost of living increases on an annual basis. 2

- 3. This brief report attempts to quantify the potential economic impact implementation of S6413 might have on New York small businesses and their employees by using the Business Size Insight Module (BSIM). The BSIM is a dynamic, multi-region model based on the Regional Economic Models, Inc. (REMI) structural economic forecasting and policy analysis model which integrates input-output, computable general equilibrium, econometric, and economic geography methodologies. It has the unique ability to forecast the economic impact of public policy and proposed legislation on different categories of U.S. businesses differentiated by size of firm. Forecast variables include levels of private sector employment and real output. By comparing simulation results for scenarios which include proposed or yet-to-be-implemented policy changes with the model’s baseline forecast, the BSIM is able to obtain estimates of how these policy changes might impact employer firms and their workers. Description of New Employer Costs Under S6413 Minimum wage increases raise the cost of labor for employers.1 S6413 is no exception to this rule. Increases to the New York minimum wage law constitute a direct increase in employer costs. Intended to take effect on January 1, 2013, the bill would increase the minimum wage to $8.50 with annual adjustments in future years linked to increases in the cost of living as measured by the Consumer Price Index for all urban consumers. The precise amount of additional wages employers must pay under S6413 is uncertain since future wage increases depend upon future (unknown) cost of living adjustments (COLA). Due to this uncertainty, the analysis in this report relies on a set of three different COLA paths which, with the assistance of the BSIM, provide a range of potential employment and production effects resulting from S6413’s implementation. The three paths chosen for this analysis were a path with no increases in the cost of living in future years, a path with two percent annual increases in the cost of living, and a path with four percent annual increases in the cost of living. With historical rates of increases in the cost of living in mind, these three paths can reasonably be expected to include within their range the actual, realized path of future cost of living adjustments. Table 2 presents the hypothetical paths the New York minimum wage would take under these three scenarios assuming that S6413 is implemented in 2013. Larger increases in cost of living adjustments translate to larger increases from the status quo minimum wage, leading to larger additional employer costs in future years. The additional per-employee wage burdens shouldered by employers in future years is presented in Table 3 in percentage terms. Assuming zero percentage changes to the cost of living in future years, the increase of the minimum wage to $8.50 per hour still represents a 17.2 percent increase in the 1 Good overviews of the literature on the minimum wage can be found in: Brown, Charles, Curtis Gilroy, and Andrew Cohen, “The Effect of the Minimum Wage on Employment and Unemployment: A Survey,” NBER Working Paper No. 846, January 1982; Neumark, David and William Wascher, “Minimum Wages, Labor Market Institutions, and Youth Employment: A Cross-National Analysis,” Industrial and Labor Relations Review, Vol. 57, No. 2, January 2004. 3

- 4. minimum wage. In contrast, constant cost of living adjustments of two percent annually will result in a 40.1 percent increase in the minimum wage in 2022, ten years from 2013, the assumed year of implementation. Constant cost of living adjustments of four percent annually will result in a minimum wage that is 66.9 percent higher than it is today. Table 2: Future New York Minimum Wage Trajectories Under Different Cost of Living Adjustment Paths Hypothetical Hypothetical Hypothetical Minimum Wage Minimum Wage Minimum Wage Schedule, Schedule, Schedule, Year 0 Percent COLA Path 2 Percent COLA Path 4 Percent COLA Path 2012 $7.25 $7.25 $7.25 2013 $8.50 $8.50 $8.50 2014 $8.50 $8.67 $8.84 2015 $8.50 $8.84 $9.19 2016 $8.50 $9.02 $9.56 2017 $8.50 $9.20 $9.94 2018 $8.50 $9.38 $10.34 2019 $8.50 $9.57 $10.76 2020 $8.50 $9.76 $11.19 2021 $8.50 $9.96 $11.63 2022 $8.50 $10.16 $12.10 Table 3: Per-Employee Percentage Increase in Minimum Wage (Compared to Status Quo) Under Different Cost of Living Adjustment Paths Hypothetical Hypothetical Hypothetical Minimum Wage Minimum Wage Minimum Wage Schedule, Schedule, Schedule, Year 0 Percent COLA Path 2 Percent COLA Path 4 Percent COLA Path 2013 17.2% 17.2% 17.2% 2014 17.2% 19.6% 21.9% 2015 17.2% 22.0% 26.8% 2016 17.2% 24.4% 31.9% 2017 17.2% 26.9% 37.2% 2018 17.2% 29.4% 42.6% 2019 17.2% 32.0% 48.3% 2020 17.2% 34.7% 54.3% 2021 17.2% 37.4% 60.5% 2022 17.2% 40.1% 66.9% An important aspect of modeling minimum wage increases is “tipped” employees. According to the U.S. Department of Labor (DOL), tipped employees are employees who “customarily and regularly receive more than $30 per month in tips.”2 Employers may use tips received by such employees as a credit against their minimum wage obligations to the employees, 2 For detailed information on tipped employees, a useful resource is the DOL fact sheet available here: http://www.dol.gov/whd/regs/compliance/whdfs15.pdf. 4

- 5. provided that a minimum cash wage, currently set to $2.13 per hour at the federal level, is also paid to the employees. States have the option of establishing their own cash wage. New York’s current cash wage is approximately $5.00 per hour.3 S6413 would raise this cash wage to $5.86 per hour. A second issue a modeler must concern himself with when modeling an increase in the state minimum wages is business size exemptions. Some states exempt businesses of a certain size from minimum wage requirements. The state of Illinois, for example, exempts employer firms with three or fewer employees from minimum wage laws. No such exemptions exist for the state of New York, and all employer firms in the state are therefore assumed to be affected by S6413. A third issue takes the form of potential “emulation effects” associated with individuals earning near (just above) the minimum wage. Some of these individuals will earn between $7.25 per hour and $8.50 and will see their wages raised automatically to $8.50 if the bill passes, although their wages may increase to even higher levels if employers attempt to maintain the pre-implementation wage structure. Other workers will earn just slightly above $8.50 and despite not being affected directly by the legislation, can be expected to pressure their employers for a raise in order to maintain the wage premium between them and the lowest-earning individuals in the economy. Failure to increase the wages of near-minimum-wage earners and allowing wage compression to occur may result in workers expressing their dissatisfaction by reducing work effort or leaving. Research suggests that “relative wages are important to workers,” and “firms may find it in their profit-maximizing interest to increase [near-minimum- wage] workers’ wages when minimum wages increase, in an attempt to restore work effort.”4 For the modeler, a key concern involves estimating how many workers can be expected to contribute to such emulation effects. Based upon state-level data from the Bureau of Labor Statistics, for this analysis it was adjudged that 15 percent of New York’s private sector employees less those individuals directly affected by S6413 would also see per capita raises equal to the dollar amount in wage increases experienced by workers earning at the minimum wage (equivalent to an initial raise of $1.25 per hour).5 Wage increases for these workers are assumed to occur simultaneously with the future scheduled increases in the minimum wage.6 3 A good source for information on mandated cash wages paid to tipped employees by state is the National Restaurant Association’s minimum wage map, available at http://restaurant.org/pdfs/advocacy/map_minwage.pdf. 4 Grossman, Jean Baldwin, “The Impact of the Minimum Wage on Other Wages,” The Journal of Human Resources, Vol. 18, No. 3 (Summer 1983). 5 According to the Bureau of Labor Statistics, New York wage earners at the 10 th percentile earn $8.85 per hour, while those at the 25th percentile earned $11.85 per hour. Emulation effects can be assumed to occur among workers who earn near (within a few dollars of) the minimum wage. Workers at the 15th percentile currently earn less than four dollars more than the proposed new minimum wage level and can reasonably be expected to press for the restoration of the original wage structure. It is assumed that emulation effects do not occur for workers earning above the 15th percentile. For workers earning at or below the 15 th percentile, it is assumed that earnings increase in 2013 by $1.25 (the wage differential between $7.25 and $8.50) unless the worker is a tipped employee. In a world 5

- 6. Besides the direct cost of higher wages in an increased minimum wage scenario, there are significant additional employer costs in the form additional payroll taxes that must be paid on wage differentials. In general, an employer’s share of payroll taxes equals 7.65 percent of employee wages and salary. Of this 7.65 percent, 6.2 percentage points are intended to help fund old age, survivors, and disability insurance, and 1.45 percentage points go toward helping to pay for Medicare hospital insurance. Employers in all three modeled scenarios can expect to pay more in payroll taxes as a consequence of a minimum wage increase. No Changes to Government Demand Given that a mandated minimum wage has been in effect for decades, it is assumed that government mechanisms to monitor compliance with the statute are established and well- developed. An increase in the minimum wage therefore should not require the development of new government mechanisms or materially increase government administrative costs. Therefore, there are no projected increases in government demand resulting from the implementation of S6413. Additional Private Spending in the Economy Consumers in an economy have two choices of what to do with their after-tax income. They can either choose to spend it, thereby increasing consumption within the economy, or they can elect to save it, and in doing so potentially increase investment in the economy. Government stimulus programs frequently focus on transferring wealth to lower-earning individuals because of the strong likelihood that these individuals will elect to spend the additional wealth in the short run, producing a temporary consumption-fueled boost to the economy, rather than to save. Consistent with expectations pertaining to increases in income for low-income workers, this analysis assumes that new additional income received by minimum wage earners is spent (and not saved), leading to a commensurate and immediate increase in consumption equal to the full value of the cumulative wage boosts received. Seventy-five percent of this new spending is assumed to occur in the retail trade industry. Twenty-five percent is assumed to occur in services. This assumption will have a countervailing effect on any negative employment and growth effects predicted by the model. with two percent inflation, that worker would see his wage raised by $1.25 from 2012 to 2013, by $0.17 from 2013 to 2014, and so on according to the wage differential schedule imputed from the figures contained in Table 2. 6 The assumption that wage changes due to emulation effects occur simultaneously with the minimum wage increase is supported by research suggesting that “any substantial emulation effects are not long delayed, which seems plausible because increases in the minimum are [typically] well-advertised in advance.” See Gramlich, Edward M., “Impact of Minimum Wages on Other Wages, Employment, and Family Incomes,” Brookings Papers on Economic Activity, The Brookings Institution, 1974, downloadable at: http://www.brookings.edu/~/media/projects/bpea/1976%202/1976b_bpea_gramlich_flanagan_wachter.pdf. 6

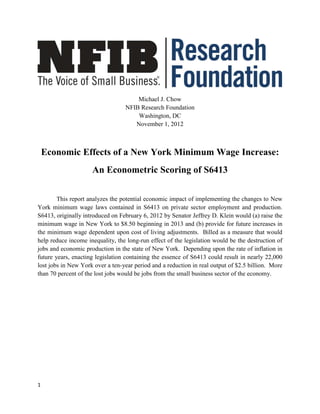

- 7. Simulation Results BSIM simulation results for the three modeled scenarios are provided below. All employment figures are in unit form, while output figures are presented in billions of dollars. Job losses forecast in year 2022 range from approximately 20,000 to 22,000. In all three scenarios, the small business sector is projected to shoulder at least 70 percent of the job losses. Estimates of the reduction in real output7 from its baseline in year 2022 range from approximately $2.2 billion to $2.5 billion. Simulation Results for a Minimum Wage Increase with a Zero Percent COLA Path For the scenario of a minimum wage increase with no assumed future cost of living adjustments, the BSIM forecasts that there will be 20,000 fewer jobs in 2022 due to the implementation of S6413 (Table 4). Seventy percent of the jobs lost are jobs in the small business sector. In addition, New York gross domestic product is forecast to be $2.2 billion less in 2022 compared to the baseline scenario (in which no minimum wage increase takes place) (Table 5). Table 4: Employment Difference from Baseline (Units), Zero Percent Cost of Living Increase Path Percent of Total Firm Size 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 (2022) 1-4 Employees 1,609 926 262 -340 -857 -1,276 -1,579 -1,813 -1,989 -2,110 10.5% 5-9 Employees 1,440 857 291 -223 -667 -1,017 -1,271 -1,469 -1,611 -1,715 8.6% 10-19 Employees 1,462 818 191 -380 -868 -1,260 -1,540 -1,750 -1,907 -2,018 10.1% 20-99 Employees 2,728 1,353 21 -1,167 -2,176 -2,972 -3,535 -3,968 -4,279 -4,487 22.4% 100-499 Employees 1,395 311 -686 -1,558 -2,279 -2,827 -3,198 -3,476 -3,658 -3,771 18.8% 500 + Employees 8,161 4,892 2,095 -247 -2,102 -3,492 -4,434 -5,134 -5,615 -5,927 29.6% < 20 Employees 4,511 2,601 744 -943 -2,392 -3,553 -4,390 -5,032 -5,507 -5,843 29.2% < 100 Employees 7,239 3,954 765 -2,110 -4,568 -6,525 -7,925 -9,000 -9,786 -10,330 51.6% < 500 Employees 8,634 4,265 79 -3,668 -6,847 -9,352 -11,123 -12,476 -13,444 -14,101 70.4% All Firms 16,795 9,157 2,174 -3,915 -8,949 -12,844 -15,557 -17,610 -19,059 -20,028 100.0% 7 The term “output” refers to the aggregate output of the New York economy (NY gross domestic product (GDP)). GDP has three possible definitions: (1) the value of final goods and services produced in an economy during a given period (as opposed to raw materials or intermediate goods which are produced or sourced earlier in the production process), (2) the sum of value added during a given period, or (3) the sum of incomes in the economy during a given period. It is a technical term whose significance may be better understood by the reader if she considers that because of the first definition, output serves as a rough proxy for sales. 7

- 8. Table 5: Real Output Difference from Baseline ($Billions), Zero Percent Cost of Living Increase Path Percent of Total Firm Size 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 (2022) 1-4 Employees 0.152 0.071 -0.006 -0.074 -0.130 -0.175 -0.205 -0.228 -0.243 -0.252 11.5% 5-9 Employees 0.139 0.078 0.019 -0.035 -0.079 -0.114 -0.138 -0.156 -0.168 -0.175 8.0% 10-19 Employees 0.146 0.081 0.016 -0.042 -0.090 -0.128 -0.154 -0.173 -0.187 -0.195 8.9% 20-99 Employees 0.280 0.137 -0.002 -0.125 -0.227 -0.306 -0.359 -0.400 -0.427 -0.442 20.2% 100-499 Employees 0.158 0.040 -0.069 -0.164 -0.240 -0.297 -0.333 -0.359 -0.375 -0.383 17.5% 500 + Employees 0.810 0.421 0.089 -0.186 -0.394 -0.543 -0.635 -0.698 -0.732 -0.745 34.0% < 20 Employees 0.437 0.230 0.029 -0.151 -0.299 -0.417 -0.497 -0.557 -0.598 -0.622 28.4% < 100 Employees 0.717 0.367 0.027 -0.276 -0.526 -0.723 -0.856 -0.957 -1.025 -1.064 48.5% < 500 Employees 0.875 0.407 -0.042 -0.440 -0.766 -1.020 -1.189 -1.316 -1.400 -1.447 66.0% All Firms 1.685 0.828 0.047 -0.626 -1.160 -1.563 -1.824 -2.014 -2.132 -2.192 100.0% Simulation Results for a Minimum Wage Increase with a Two Percent COLA Path For the scenario of a minimum wage increase with an assumed future cost of living adjustment path of two percent annually, the BSIM forecasts that there will be 21,000 fewer jobs in 2022 due to the implementation of S6413 (Table 6). Seventy-one percent of the jobs lost are jobs in the small business sector. In addition, New York gross domestic product is forecast to be $2.3 billion less in 2022 compared to the baseline scenario (in which no minimum wage increase takes place) (Table 7). Table 6: Employment Difference from Baseline (Units), Two Percent Cost of Living Increase Path Percent of Total Firm Size 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 (2022) 1-4 Employees 1,609 958 312 -289 -813 -1,250 -1,577 -1,839 -2,046 -2,207 10.5% 5-9 Employees 1,440 885 336 -175 -621 -988 -1,261 -1,483 -1,655 -1,789 8.5% 10-19 Employees 1,462 847 235 -334 -831 -1,239 -1,540 -1,786 -1,975 -2,121 10.1% 20-99 Employees 2,728 1,404 99 -1,092 -2,126 -2,964 -3,585 -4,082 -4,466 -4,754 22.6% 100-499 Employees 1,395 337 -658 -1,543 -2,292 -2,883 -3,311 -3,641 -3,891 -4,070 19.4% 500 + Employees 8,161 5,051 2,342 43 -1,827 -3,270 -4,275 -5,072 -5,660 -6,088 29.0% < 20 Employees 4,511 2,690 883 -798 -2,265 -3,477 -4,378 -5,108 -5,676 -6,117 29.1% < 100 Employees 7,239 4,094 982 -1,890 -4,391 -6,441 -7,963 -9,190 -10,142 -10,871 51.7% < 500 Employees 8,634 4,431 324 -3,433 -6,683 -9,324 -11,274 -12,831 -14,033 -14,941 71.0% All Firms 16,795 9,482 2,666 -3,390 -8,510 -12,594 -15,549 -17,903 -19,693 -21,029 100.0% 8

- 9. Table 7: Real Output Difference from Baseline ($Billions), Two Percent Cost of Living Increase Path Percent of Total Firm Size 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 (2022) 1-4 Employees 0.152 0.074 -0.001 -0.070 -0.128 -0.174 -0.208 -0.234 -0.254 -0.268 11.5% 5-9 Employees 0.139 0.081 0.023 -0.030 -0.075 -0.111 -0.137 -0.158 -0.173 -0.184 7.9% 10-19 Employees 0.146 0.084 0.021 -0.037 -0.086 -0.125 -0.154 -0.177 -0.193 -0.205 8.8% 20-99 Employees 0.280 0.142 0.006 -0.117 -0.222 -0.304 -0.364 -0.411 -0.445 -0.469 20.2% 100-499 Employees 0.158 0.042 -0.066 -0.162 -0.241 -0.302 -0.345 -0.377 -0.400 -0.415 17.9% 500 + Employees 0.810 0.437 0.113 -0.158 -0.371 -0.529 -0.630 -0.706 -0.755 -0.783 33.7% < 20 Employees 0.437 0.239 0.043 -0.137 -0.289 -0.410 -0.499 -0.569 -0.620 -0.657 28.3% < 100 Employees 0.717 0.381 0.049 -0.254 -0.511 -0.714 -0.863 -0.980 -1.065 -1.126 48.5% < 500 Employees 0.875 0.423 -0.017 -0.416 -0.752 -1.016 -1.208 -1.357 -1.465 -1.541 66.3% All Firms 1.685 0.860 0.096 -0.574 -1.123 -1.545 -1.838 -2.063 -2.220 -2.324 100.0% Simulation Results for a Minimum Wage Increase with a Four Percent COLA Path For the scenario of a minimum wage increase with an assumed future cost of living adjustment path of four percent annually, the BSIM forecasts that there will be nearly 22,000 fewer jobs in 2022 due to the implementation of S6413 (Table 8). Seventy-two percent of the jobs lost are jobs in the small business sector. In addition, New York gross domestic product is forecast to be $2.5 billion less in 2022 compared to the baseline scenario (in which no minimum wage increase takes place) (Table 9). Table 8: Employment Difference from Baseline (Units), Four Percent Cost of Living Increase Path Percent of Total Firm Size 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 (2022) 1-4 Employees 1,609 989 361 -232 -764 -1,214 -1,561 -1,855 -2,098 -2,296 10.5% 5-9 Employees 1,440 913 380 -123 -576 -954 -1,245 -1,487 -1,688 -1,853 8.4% 10-19 Employees 1,462 876 280 -284 -788 -1,210 -1,534 -1,811 -2,034 -2,216 10.1% 20-99 Employees 2,728 1,457 181 -1,013 -2,063 -2,944 -3,618 -4,183 -4,644 -5,018 22.8% 100-499 Employees 1,395 361 -624 -1,519 -2,298 -2,938 -3,417 -3,815 -4,132 -4,388 20.0% 500 + Employees 8,161 5,206 2,595 341 -1,528 -3,003 -4,075 -4,950 -5,643 -6,190 28.2% < 20 Employees 4,511 2,778 1,021 -639 -2,128 -3,378 -4,340 -5,153 -5,820 -6,365 29.0% < 100 Employees 7,239 4,235 1,202 -1,652 -4,191 -6,322 -7,958 -9,336 -10,464 -11,383 51.8% < 500 Employees 8,634 4,596 578 -3,171 -6,489 -9,260 -11,375 -13,151 -14,596 -15,771 71.8% All Firms 16,795 9,802 3,173 -2,830 -8,017 -12,263 -15,450 -18,101 -20,239 -21,961 100.0% 9

- 10. Table 9: Real Output Difference from Baseline ($Billions), Four Percent Cost of Living Increase Path Percent of Total Firm Size 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 (2022) 1-4 Employees 0.152 0.077 0.003 -0.065 -0.124 -0.173 -0.210 -0.241 -0.265 -0.284 11.6% 5-9 Employees 0.139 0.083 0.027 -0.025 -0.071 -0.108 -0.136 -0.159 -0.177 -0.192 7.8% 10-19 Employees 0.146 0.087 0.026 -0.032 -0.081 -0.122 -0.153 -0.179 -0.198 -0.214 8.7% 20-99 Employees 0.280 0.148 0.015 -0.109 -0.215 -0.302 -0.367 -0.421 -0.463 -0.496 20.2% 100-499 Employees 0.158 0.045 -0.062 -0.159 -0.241 -0.308 -0.355 -0.395 -0.426 -0.450 18.3% 500 + Employees 0.810 0.453 0.137 -0.130 -0.346 -0.508 -0.619 -0.707 -0.772 -0.817 33.3% < 20 Employees 0.437 0.247 0.056 -0.122 -0.276 -0.403 -0.499 -0.579 -0.640 -0.690 28.1% < 100 Employees 0.717 0.395 0.071 -0.231 -0.491 -0.705 -0.866 -1.000 -1.103 -1.186 48.3% < 500 Employees 0.875 0.440 0.009 -0.390 -0.732 -1.013 -1.221 -1.395 -1.529 -1.636 66.7% All Firms 1.685 0.893 0.146 -0.520 -1.078 -1.521 -1.840 -2.102 -2.301 -2.453 100.0% 10

- 11. Small Business Share of Job Losses in Year 2022 100% 90% 80% 70.4% 71.0% 71.8% 70% 60% 50% 40% 30% 20% 10% 0% 0% COLA Path 2% COLA Path 4% COLA Path Figure 1 Small Business Share of Lost Production in Year 2022 100% 90% 80% 70% 66.0% 66.3% 66.7% 60% 50% 40% 30% 20% 10% 0% 0% COLA Path 2% COLA Path 4% COLA Path Figure 2 11