Epam stock analytics 2 april 2012

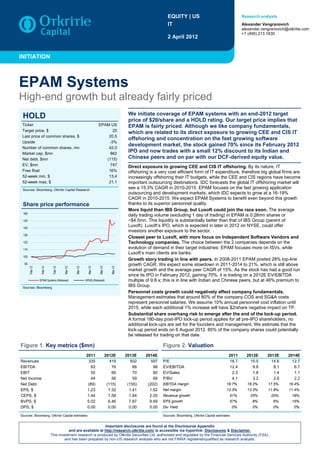

- 1. EQUITY | US Research analysts IT Alexander Vengranovich alexander.vengranovich@otkritie.com +7 (495) 213 1830 2 April 2012 INITIATION EPAM Systems High-end growth but already fairly priced We initiate coverage of EPAM systems with an end-2012 target HOLD price of $20/share and a HOLD rating. Our target price implies that Ticker EPAM US EPAM is fairly priced. Although we like company fundamentals, Target price, $ 20 which are related to its direct exposure to growing CEE and CIS IT Last price of common shares, $ 20.5 offshoring and concentration on the fast growing software Upside -3% Number of common shares, mn 42.0 development market, the stock gained 70% since its February 2012 Market cap, $mn 862 IPO and now trades with a small 12% discount to its Indian and Net debt, $mn (115) Chinese peers and on par with our DCF-derived equity value. EV, $mn 747 Direct exposure to growing CEE and CIS IT offshoring. By its nature, IT Free float 16% offshoring is a very cost efficient form of IT expenditure, therefore big global firms are 52-week min, $ 13.4 increasingly offshoring their IT budgets, while the CEE and CIS regions have become 52-week max, $ 21.1 important outsourcing destinations. IDC forecasts the global IT offshoring market will Sources: Bloomberg, Otkritie Capital Research see a 15.3% CAGR in 2010-2015. EPAM focuses on the fast growing application outsourcing and development markets, which IDC expects to grow at a 16-19% CAGR in 2010-2015. We expect EPAM Systems to benefit even beyond this growth Share price performance thanks to its superior personnel quality. More liquid than IBS Group, but Luxoft could join the race soon. The average 160 daily trading volume (excluding 1 day of trading) in EPAM is 0.26mn shares or 150 ~$4.5mn. This liquidity is substantially better than that of IBS Group (parent of 140 Luxoft). Luxoft‟s IPO, which is expected in later in 2012 on NYSE, could offer investors another exposure to the sector. 130 Closest peer to Luxoft, with more focus on Independent Software Vendors and 120 Technology companies. The choice between the 2 companies depends on the 110 evolution of demand in their target industries: EPAM focuses more on ISVs, while Luxoft‟s main clients are banks. 100 Growth story trading in line with peers. In 2008-2011 EPAM posted 28% top-line 90 growth CAGR. We expect some slowdown in 2011-2014 to 21%, which is still above Feb-12 Feb-12 Feb-12 Mar-12 Mar-12 Mar-12 Mar-12 Mar-12 market growth and the average peer CAGR of 15%. As the stock has had a good run since its IPO in February 2012, gaining 70%, it is trading on a 2012E EV/EBITDA EPAM Systems (Rebased) SP500 (Rebased) multiple of 9.8.x; this is in line with Indian and Chinese peers, but at 46% premium to Sources: Bloomberg IBS Group. Personnel costs growth could negatively affect company fundamentals. Management estimates that around 80% of the company COS and SG&A costs represent personnel salaries. We assume 10% annual personnel cost inflation until 2015, while each additional 1% increase will have $2/share negative impact on TP. Substantial share overhang risk to emerge after the end of the lock-up period. A formal 180-day post-IPO lock-up period applies for all pre-IPO shareholders; no additional lock-ups are set for the founders and management. We estimate that the lock-up period ends on 6 August 2012. 85% of the company shares could potentially be released for trading on that date. Figure 1. Key metrics ($mn) Figure 2. Valuation 2011 2012E 2013E 2014E 2011 2012E 2013E 2014E Revenues 335 419 502 597 P/E 16.7 15.5 14.6 12.7 EBITDA 62 76 88 98 EV/EBITDA 12.4 9.8 8.1 6.7 EBIT 55 66 70 80 EV/Sales 2.3 1.8 1.4 1.1 Net Income 44 56 59 68 P/BV 4.1 3.2 2.6 2.2 Net Debt (89) (115) (155) (202) EBITDA margin 18.7% 18.2% 17.5% 16.4% EPS, $ 1.23 1.32 1.41 1.62 Net margin 13.3% 13.3% 11.8% 11.4% CEPS, $ 1.44 1.58 1.84 2.05 Revenue growth 51% 25% 20% 19% BVPS, $ 5.02 6.46 7.87 9.49 EPS growth 57% 8% 6% 15% DPS, $ 0.00 0.00 0.00 0.00 Div Yield 0% 0% 0% 0% Sources: Bloomberg, Otkritie Capital estimates Sources: Bloomberg, Otkritie Capital estimates Important disclosures are found at the Disclosures Appendix and are available at http://research.otkritie.com/ is accessible via hyperlink: Disclosures & Disclaimer. This investment research is produced by Otkritie Securities Ltd, authorised and regulated by the Financial Services Authority (FSA), and has been prepared by non-US research analysts who are not FINRA registered/qualified as research analysts.

- 2. EPAM Systems | INITIATION | Russia | 2 April 2012 Table of contents Investment summary.................................................................................... 3 Valuation ........................................................................................................ 5 Financial assumptions ................................................................................. 7 Sensitivity analysis..................................................................................... 11 Business description ................................................................................. 12 High-end software developer ........................................................................ 12 Diversified revenue streams ......................................................................... 13 M&A activity has supported growth .............................................................. 17 Professional staff located in CEE and CIS is a key success factor.............. 18 Market .......................................................................................................... 23 Rising importance of offshore IT services .................................................... 23 CEE and CIS is a top growing offshore delivery region ............................... 24 IPO, liquidity and shareholding structure ................................................ 25 Key management and board members .................................................... 27 Financial forecasts ..................................................................................... 29 Disclosures appendix ................................................................................ 30 Otkritie Capital 2

- 3. EPAM Systems | INITIATION | Russia | 2 April 2012 Investment summary We initiate coverage of EPAM Systems with an end-2012 target price of $20/share and a HOLD rating. Our target price, which we base on a combination of DCF and target 2012E EV/EBITDA valuation methodologies, implies no upside potential from the current share price. EPAM is currently trading at 12% discount to Indian and Chinese peers on 2012E EV/EBITDA. Positives Direct exposure to growth in CEE and CIS IT offshoring. In an increasingly competitive environment, companies from all industries are seeking new ways to grow and protect their market positions while sustaining profitability levels. Investment into IT is one way to achieve this. By its nature IT offshoring is a very cost efficient form of IT spending, hence big global firms are increasingly offshoring their IT budgets, with the CEE and CIS regions becoming important outsourcing destinations. IDC forecasts that the global IT offshoring market will see a 5-year 15.3% CAGR in 2010-2015, while the application outsourcing and application development markets, on which EPAM is focused, are expected to grow at 16-19% over this period. As a CEE offshore software developer, EPAM provides direct exposure to these growth markets. Superior CEE and CIS IT specialists‟ skills are EPAM‟s main differentiating factor. We think that personnel quality is a key point of differentiation in the company‟s value proposition to clients. EPAM Systems‟ specialists have an average 6 years of industry experience, with more than 90% having Masters or above degrees in science, math and engineering, and more than 90% speaking English. IT specialists from Eastern Europe and CIS are also known for being very creative and capable of solving the most difficult problems that occur in customized software development. This, in our view, gives the company a qualitative advantage over its Indian and Chinese peers. This view is confirmed by the results of an ACM programming contest in which Russia has been the leader over the last 5 years, while Poland and Ukraine, despite being smaller countries, are also among the prize winners every year. Moreover, Russian programmers are rated #1 by TopCoder rating, followed by Japan and China. Ukrainian, Polish and Belarusian programmers are also in the top-10. Proven historical growth track record with optimistic outlook. In 2008- 2011, EPAM posted a 28% top-line CAGR. We expect some slowdown over 2011-2014 to 21%, which is still above market growth and the peer average CAGR of 15%. Good revenue visibility with high proportion of recurring revenue. Thanks to the project type services provided, EPAM estimates that 80-85% of its revenue is visible at the beginning of each year and 95% of revenue is visible before each quarter starts. EPAM expects that 85-90% revenue will be generated by existing clients in 2012. The management sees significant potential to increase revenue from 7-8 of top-10 clients, and most of the revenue growth in 2012 is expected to be generated by top-30 accounts. Business model is not sensitive to exchange rate volatility. 50% of UK and Europe revenues are derived in local currencies, while the rest revenues are denominated in US dollars. Most of the costs in Belarus and Ukraine are USD denominated, while Russian Ruble costs are offset by Russian Ruble revenues, which tend to be equal. Therefore EPAM is slightly exposed to Euro and British pound volatility. Stable high profitability and strong balance sheet. EPAM posted a healthy 19% EBITDA margin in 2011, which gained 1ppts YoY. We forecast flat EBITDA margins of 18% in 2012-2015, which corresponds to the average profitability of its peers. The company has no debt on its balance sheet and positive net cash. EPAM has an open $30mn revolver credit line, which it can use anytime when needed. Otkritie Capital 3

- 4. EPAM Systems | INITIATION | Russia | 2 April 2012 Risks and negatives Shareholder structure implies substantial overhang risk after the end of the lock-up period. 56.2% of the company is controlled by private equity funds, which sold part of their shares at the IPO in February 2012; therefore we see a high risk of potential share overhang. Altogether, 34.872mn shares (83% of total shares) could enter the market at various dates after the end of the lock-up period on 6 August 2012, we estimate. The founders control 18.2% of the company, with the rest being owned by management and floated on the market. Major revenue loss risk lies in deterioration of general economic environment. Clients may decide to reduce spending on technology services or sourcing due to a challenging economic environment, or other internal and external factors relating to their businesses, such as corporate restructuring, pricing pressure, changes to its outsourcing strategy, switching to another IT services provider or returning work in-house. High reliability on qualified personnel. As EPAM Systems is heavily exposed to the quality of its personnel, we point out the risk of financials deterioration in case of higher attrition rate. In 2011 EPAM had lower attrition rate in comparison to its Indian and Chinese peers. Personnel costs growth could negatively affect company fundamentals. Management estimates that around 80% of the company COS and SG&A costs represent personnel salaries. Based on the management guidance we estimate that the headcount will increase by 20% in 2012 (vs 25% revenue growth), while going forward we expect the headcount to increase at 7ppts lower than annual revenue growth. We assume 10% annual personnel cost inflation until 2015, while each additional 1ppt increase will have $2/share negative impact on TP. High exposure to Belarus political risk, as almost half of EPAM staff is located there. Belarus has been governed since 1994 by President Alexander Lukashenko, who was most recently re-elected in December 2010. The president has a wide (and excessive) range of powers including: call elections; make appointments to the executive arms of the government, judiciary, the local executive and administrative bodies; issue edicts, orders and decrees that have the force of law. Progress on structural reform and a reduction in the extent of direct state support in the economy has been slow in Belarus, and reforms of this nature are likely to be politically unpopular. Belarus has a bad political image and poor relations with the EU and US, therefore we see a risk that this situation could adversely affect EPAM‟s ability to service it western clients. Political and governmental instability in CIS and CEE countries could badly affect operations in these countries. Since the early 1990s, Belarus, Russia, Ukraine, Hungary and other CIS and CEE countries have sought to transform from one-party states with centrally planned economies to democracies with market economies of various degrees. The sweeping nature of these reforms, and the failure of some of them, has left the political systems of many CIS and CEE countries vulnerable to popular dissatisfaction, including demands for autonomy from particular regional and ethnic groups. More liquid than IBS Group, but Luxoft could join the race later in 2012. The average daily trading volume (excluding 1 day of trading) in EPAM is 0.26mn shares or ~$4.5mn. This is substantially higher than for IBS Group (parent of Luxoft), which is listed on the Frankfurt stock exchange with average trading volumes of only $100,000/day. Luxoft‟s IPO, which is expected in later this year on NYSE, could offer investors further exposure to the sector. No dividends to be paid in foreseeable future. EPAM systems currently anticipates retaining all available funds for use in the operation and expansion of the business, and does not envisage paying any cash dividends in the foreseeable future. Otkritie Capital 4

- 5. EPAM Systems | INITIATION | Russia | 2 April 2012 Valuation Our $20/share target price is calculated as an average between our DCF valuation and target 2012E EV/EBITDA multiple. Both methods generate relatively close valuations: our DCF methodology generates a $19.7/fully diluted share valuation, while from our target 2012E EV/EBITDA multiple of 11.1x, we derive $20.2/fully diluted share target equity value. DCF valuation is based on 13.5% WACC and 4% terminal growth rate. This is a 0.5% higher discount rate than for IBS Group: this accounts for the higher country/political risk in Belarus (where the bulk of EPAM‟s production personnel is located), than Russia (where most of IBS Group personnel is located). We use 46.3mn as a number of shares, which is an estimate of fully diluted amount of shares for end-2012. Figure 3. EPAM Systems DCF valuation 2011 2012E 2013E 2014E 2015E 2016E 2017E 2018E 2019E 2020E Revenue, $mn 335 419 502 597 705 811 908 990 1,069 1,133 EBITDA, $mn 62 76 88 98 106 131 156 179 202 215 Capex and acquisitions, $mn (16) (36) (18) (18) (18) (18) (18) (18) (18) (18) Change in working capital, $mn (3) (39) (19) (21) (24) (25) (23) (20) (19) (15) Taxes on EBIT, $mn (9) (11) (12) (14) (15) (19) (23) (27) (31) (33) Free cash flow, $mn 35 (10) 39 45 49 69 91 114 134 149 Discount Factor, % 88% 78% 68% 60% 53% 47% 41% 36% 32% Years from now, # 1 2 3 4 5 6 7 8 9 PV of FCF, $mn (9) 30 31 30 36 43 47 49 48 WACC 13.5% Terminal growth 4% Value of period 2012-2020, $mn 304 Terminal value, $mn 520 Enterprise value, $mn 824 Net debt, $mn -89 Equity value, $mn 912.8 Fully diluted # shares (mn) 46.3 Equity per share, $ 19.7 Sources: Otkritie Capital Research Otkritie Capital 5

- 6. EPAM Systems | INITIATION | Russia | 2 April 2012 The figure below indicates that EPAM Systems is trading with only 12% discount to Indian and Chinese software developers on 2012E EV/EBITDA, but at a premium to Eastern European and Russian IT companies. We attribute the latter to the greater focus of public companies such as IBS Group and Armada on low-margin IT systems integration, which also offers lower growth. Figure 4. Peers‟ valuation comparison PE EV/EBITDA EV/Sales EBITDA margin 2011E 2012E 2013E 2011E 2012E 2013E 2011E 2012E 2013E 2011E 2012E 2013E Off-shore software developers 21.4 15.4 13.3 15.6 11.1 9.1 2.9 2.3 1.9 18% 19% 20% Indian software developers 23.9 17.4 15.2 16.1 11.8 10.2 3.5 2.8 2.4 21% 22% 22% TCS IN TATA CONSULTANCY SVCS LTD 26.1 21.3 17.8 19.8 15.1 12.9 5.9 4.5 3.8 30% 30% 29% INFY US INFOSYS TECHNOLOGIES-SP ADR 24.7 19.3 17.4 16.5 13.0 11.6 5.3 4.0 3.6 32% 31% 31% WPRO WIPRO LTD 20.1 18.8 16.1 15.4 13.7 11.6 3.3 2.7 2.3 21% 20% 20% HCLT IN HCL TECHNOLOGIES LTD 19.6 14.5 12.4 11.9 8.8 7.9 2.0 1.6 1.3 17% 18% 17% SCS IN SATYAM COMPUTER SERVICES LTD 28.3 9.6 9.9 16.7 6.8 6.0 1.3 1.1 0.9 8% 16% 16% ctsh us equity COGNIZANT TECH SOLUTIONS-A 24.5 21.0 17.4 16.5 13.5 11.3 3.4 2.8 2.3 21% 20% 20% Chinese software developers 17.4 13.2 10.8 14.8 10.6 7.6 1.8 1.4 1.1 12% 13% 15% SAPE US SAPIENT CORPORATION 21.2 16.3 13.6 10.6 9 7.4 1.4 1.2 1 13% 13% 14% iss us equity ISOFTSTONE HOLDINGS LTD-ADS 14.1 10.7 8.6 15.4 9.9 6.3 1.7 1.3 1 11% 13% 16% hsft us equity HISOFT TECHNOLOGY INT-ADR 17 12.6 10.3 18.5 13.1 9 2.2 1.6 1.3 12% 13% 15% Eastern European and Russian IT companies 23.2 13.8 11.1 7.2 5.7 4.7 0.7 0.6 0.5 10% 11% 12% ACP PW ASSECO POLAND SA 10.5 10.2 10.0 3.8 3.6 3.5 0.6 0.6 0.6 17% 17% 17% CMR PW COMARCH SA 29.5 18.0 14.1 7.3 6.3 4.8 0.6 0.6 0.5 8% 9% 10% CMP PW COMP SA 24.7 18.5 16.8 9.3 8.1 7.4 1.0 0.9 0.9 11% 11% 12% ARMD RX ARMADA 9.5 7.5 5.7 4.2 3.5 2.6 0.5 0.4 0.3 12% 12% 13% SGN PW SYGNITY SA 42.9 13.1 9.1 9.2 6.2 5.2 0.5 0.4 0.4 5% 7% 7% IBSG GR IBS GROUP-REGS GDR 22.2 15.6 10.8 9.5 6.7 4.7 0.8 0.6 0.5 8% 9% 10% EPAM US Equity EPAM Systems 19 15.2 14.3 12.1 9.6 7.9 2.3 1.7 1.4 19% 18% 17% vs Off-shore software developers -9% 1% 10% -21% -12% -11% -20% -21% -27% 0.7 p.p. -0.9 p.p. -2.3 p.p. vs India software developers -19% -11% -4% -23% -17% -21% -34% -36% -41% -2.7 p.p. -4.1 p.p. -4.8 p.p. vs China Software developers 12% 17% 35% -17% -8% 6% 32% 29% 24% 6.7 p.p. 5.2 p.p. 2.4 p.p. vs EE and Russia IT companies -16% 12% 31% 72% 70% 72% 244% 201% 163% 82% 68% 49% Sources: Otkritie Capital Research, Bloomberg We think that EPAM valuation in line with Indian and Chinese peers is justified as the company offers even faster growth profile in 2011-2014. While EPAM was growing in line with the average of its peers in 2007-2010, we expect it to grow faster than the market and its Chinese and Indian peers in 2011-2014. EPAM and Luxoft (CEE software development subsidiary of IBS Group) offer similar growth profiles. Figure 5. EPAM Systems historical revenue Figure 6. EPAM Systems forecast revenue CAGR CAGR 2007-2010 vs peers 2011-2014 vs peers ORACLE FS MPHASIS WIPRO ORACLE FS SAPIENT SAPIENT INFOSYS SATYAM TATA CONSULTANCY WIPRO LUXOFT INFOSYS EPAM SYSTEMS HCL TECH MINDTREE MINDTREE HCL TECHNOLOGIES COGNIZANT MPHASIS TATA CONSULTANCY COGNIZANT EPAM SYSTEMS HISOFT LUXOFT ISOFTSTONE HISOFT CAMELOT ISOFTSTONE 0% 10% 20% 30% 40% 50% 60% 0% 5% 10% 15% 20% 25% 30% 35% Sources: Otkritie Capital Research, Bloomberg, company data Sources: Otkritie Capital Research, Bloomberg, company data Otkritie Capital 6

- 7. EPAM Systems | INITIATION | Russia | 2 April 2012 Financial assumptions Revenue growth to slow from 50% in 2011 to 25% in 2012. The slowdown in 2012 is explained by the higher base in 2011 and a mature client portfolio. The management conservatively expects revenue to go up by 23-25% in 2012. We regard this guidance as conservative but for now project 25% top line growth in 2012. This estimate could be revised after the publication of 1Q12 results. Going forward we conservatively expect a 21% 3-year revenue CAGR in 2011- 2014. Figure 7. EPAM Systems revenue forecast, $mn 1,200 1,133 60% 1,069 990 1,000 50% 908 811 40% 800 705 597 30% 600 502 419 20% 400 335 10% 222 161 150 200 0% 0 -10% 2019E 2012E 2013E 2014E 2015E 2016E 2017E 2018E 2020E 2008 2009 2010 2011 Revenue, $mn Revenue growth, % (rhs) Sources: Otkritie Capital Research, company data We expect most of the new revenue to be generated by existing clients, EPAM expects that 85-90% revenue will be generated by existing clients in 2012. The management sees significant potential to increase revenue from 7-8 of top-10 clients, and most of the revenue growth in 2012 is expected to be generated by top-30 accounts. On-boarding of new clients could become tougher if economic turbulence persists. We forecast generally declining EBITDA margin until 2015 on the back of persistently higher than average market top-line growth. In 2012-2015 we forecast an adjusted EBITDA margin of 20%, flat vs 2011. The company expects to increase headcount by 20-22% in 2012, which should be the main cost inflation factor for 2012. EBITDA margin adjusted for non-recurring is expected to bottom at 17% in 2015. Figure 8. EPAM Systems adjusted EBITDA forecast, $mn 250 235 25% 221 196 200 20% 172 145 150 15% 118 108 97 100 84 10% 68 44 50 5% 20 25 0 0% 2013E 2012E 2014E 2015E 2016E 2017E 2018E 2019E 2020E 2008 2009 2010 2011 EBITDA, $mn EBITDA margin, % (rhs) Sources: Otkritie Capital Research, company data Otkritie Capital 7

- 8. EPAM Systems | INITIATION | Russia | 2 April 2012 EPAM systems EBITDA margin corresponds to the average level of profitability for its peers. Generally bigger players like Oracle FS and Infosys enjoy higher margins on the back of scalability of the business. Figure 9. EPAM systems‟ profitability vs peers (EBITDA margin, 2011) 40% 37% 35% 33% 30% 30% 25% 21% 21% 19% 20% 18% 18% 18% 17% 15% 13% 12% 12% 10% 6% 5% 0% Cognizant Luxoft Infosys EPAM Sapient Hisoft Isoftstone Oracle FS Camelot HCL Technologies Mphasis Minftree TATA Consultancy WIPRO Sources: Otkritie Capital Research, Bloomberg, company data We assume a flat 17% tax rate going forward. Our forecast corresponds with the management 2012 guidance of 17%, which is based on the assumption that EPAM continues to benefit from tax exemptions in Belarus and Hungary. EPAM‟s subsidiary in Belarus is a member of the Belarus Hi-Tech Park, in which member technology companies are 100% exempt from the current Belarusian income tax rate of 24%. This exemption is expected to last until July 2021, when the “On High-Technologies Park” Decree expires. EPAM‟s subsidiary in Hungary benefits from a tax credit of 10% of annual qualified salaries, taken over a four-year period, for up to 70% of the total tax due for that period. The company has been able to take the full 70% credit for 2007, 2008, 2009 and 2010 and expects to continue to do so in the foreseeable future. Otkritie Capital 8

- 9. EPAM Systems | INITIATION | Russia | 2 April 2012 We estimate annual capex to stay at the level of $18mn, which is in the middle of management‟s guidance range of $17-22mn. Our assumption implies that the capex/revenue ratio gradually falls from 6% in 2011 to 3% in 2015. On December 7, 2011, EPAM entered into an agreement with IDEAB Project Eesti AS of approximately for the construction of a 14,071m2 office building within the High Technology Zone in Minsk, Belarus. The building is expected to be operational in the second half of 2012. In 2011 the company already spend $1.5mn as the CAPEX for the construction, the total cost of the project is expected to reach $19mn. The rest $17.5mn should be spend in 2012. Figure 10. CAPEX/Revenue forecast, % 40 14% 35 12% 30 10% 25 8% 20 6% 15 4% 10 5 2% 0 0% 2012E 2013E 2014E 2015E 2016E 2017E 2018E 2019E 2020E 2008 2009 2010 2011 CAPEX, $mn Capex/revenue, % (rhs) Sources: Otkritie Capital Research, company data We assume that no dividends will be paid in foreseeable future. EPAM currently anticipates that it will retain all available funds for use in the operation and expansion of the business, and does not envisage paying any cash dividends in the foreseeable future. Otkritie Capital 9

- 10. EPAM Systems | INITIATION | Russia | 2 April 2012 Figure 11. EPAM Systems selected financials 2011 2012E 2013E 2014E 2015E 2016E 2017E 2018E 2019E 2020E P&L Revenue 334.5 419 502 597 705 811 908 990 1,069 1,133 Cost of revenues (exclusive of depreciation and amortization) 205.3 260.0 314.8 379.6 455.4 516.6 571.6 616.3 658.7 697.6 Selling, general and administrative expenses 64.9 82.2 99.5 120.0 144.0 163.3 180.8 194.9 208.3 220.6 Depreciation and amortization expense 7.5 10.6 18.1 18.1 18.0 18.0 18.0 18.0 18.0 18.0 Goodwill impairment loss 1.7 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Other operating expenses, net (0.0) 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Income from operations 55.0 65.7 69.6 79.8 87.6 112.8 137.6 160.5 184.0 196.9 EBITDA 62.5 76.4 87.7 97.8 105.6 130.8 155.6 178.5 202.0 214.9 EBITDA margin 19% 18% 17% 16% 15% 16% 17% 18% 19% 19% Adjusted EBITDA 68.3 84 97 108 118 145 172 196 221 235 Adjusted EBITDA margin 20% 20% 19% 18% 17% 18% 19% 20% 21% 21% Interest income 1.3 1.3 1.7 2.3 3.0 3.8 4.8 6.2 8.0 10.1 Interest (expense) (0.0) 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Other income 0.1 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Foreign exchange (loss) (3.6) 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Income before provision for income taxes 52.7 67.0 71.3 82.1 90.6 116.6 142.4 166.7 192.0 207.0 Provision for income taxes 8.4 11.4 12.1 13.9 15.4 19.8 24.2 28.3 32.6 35.2 Net income 44 55.6 59.2 68.1 75.2 96.7 118.2 138.4 159.4 171.8 Net income margin 13% 13% 12% 11% 11% 12% 13% 14% 15% 15% Adjusted net income 53.9 63.0 68.0 78.6 87.5 111.0 134.1 155.7 178.1 191.7 Adjusted net income margin 16% 15% 14% 13% 12% 14% 15% 16% 17% 17% Balance Sheet Cash and cash equivalents 88.8 115.0 155.4 202.2 253.7 325.5 420.6 539.4 679.6 836.5 Accounts receivable, net 59.5 78.3 93.9 111.7 131.9 151.6 169.8 185.1 199.9 211.9 Unbilled revenues, net 24.5 45.1 54.1 64.3 75.9 87.3 97.8 106.6 115.1 122.0 Prepaid and Other current assets 6.4 10.8 13.0 15.7 18.9 21.4 23.7 25.5 27.3 28.9 Deferred tax assets, current 4.4 5.9 7.1 8.4 9.9 11.4 12.8 13.9 15.0 15.9 Total current assets 183.6 255.0 323.4 402.4 490.2 597.2 724.6 870.5 1036.9 1215.2 Property and equipment, net 35.5 60.3 60.2 60.2 60.1 60.1 60.1 60.0 60.0 60.0 Restricted cash 2.6 2.6 2.6 2.6 2.6 2.6 2.6 2.6 2.6 2.6 Intangible assets 1.3 1.3 1.3 1.3 1.3 1.3 1.3 1.3 1.3 1.3 Goodwill 8.2 8.2 8.2 8.2 8.2 8.2 8.2 8.2 8.2 8.2 Deferred tax assets, long-term 1.9 1.9 1.9 1.9 1.9 1.9 1.9 1.9 1.9 1.9 Other long-term assets 2.7 2.7 2.7 2.7 2.7 2.7 2.7 2.7 2.7 2.7 Total non-current assets 52.1 76.9 76.8 76.7 76.7 76.6 76.6 76.6 76.6 76.6 Total assets 235.6 331.9 400.2 479.1 566.9 673.8 801.3 947.1 1,113.5 1,291.8 Accounts payable 2.7 3.7 4.5 5.5 6.6 7.4 8.2 8.9 9.5 10.1 Accrued expenses 24.8 28.1 34.1 41.1 49.3 55.9 61.9 66.7 71.3 75.5 Deferred revenue 6.9 6.9 6.9 6.9 6.9 6.9 6.9 6.9 6.9 6.9 Due to employees 8.2 10.8 13.1 15.8 18.9 21.5 23.7 25.6 27.4 29.0 Taxes payable current 8.7 8.7 8.7 8.7 8.7 8.7 8.7 8.7 8.7 8.7 Deferred tax liabilities 1.7 0.6 0.7 0.9 1.1 1.2 1.4 1.5 1.6 1.7 Other liabilities 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Revolving line of credit 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Total current liabilities 53.1 59.0 68.1 78.9 91.5 101.7 110.9 118.3 125.4 131.9 Deferred taxes 0.3 0.3 0.3 0.3 0.3 0.3 0.3 0.3 0.3 0.3 Taxes payable, long-term 1.2 1.2 1.2 1.2 1.2 1.2 1.2 1.2 1.2 1.2 Total long-term liabilities 1.5 1.5 1.5 1.5 1.5 1.5 1.5 1.5 1.5 1.5 Total liabilities 54.6 60.5 69.6 80.4 93.0 103.2 112.3 119.8 126.9 133.4 Total stockholders‟ equity 181.0 271.4 330.6 398.7 473.9 570.7 688.9 827.3 986.7 1,158.5 Cash Flow Net income 44.4 55.6 59.2 68.1 75.2 96.7 118.2 138.4 159.4 171.8 D&A 7.5 10.6 18.1 18.1 18.0 18.0 18.0 18.0 18.0 18.0 Change in WC (2.7) (39.4) (18.9) (21.4) (23.7) (25.0) (23.1) (19.6) (19.1) (14.9) Net cash provided by (used in) operating activities 49.2 26.9 58.4 64.8 69.5 89.8 113.1 136.8 158.2 174.9 Net cash used in investing activities -16 (35.5) (18.0) (18.0) (18.0) (18.0) (18.0) (18.0) (18.0) (18.0) Net cash (used in) provided by financing activities 1.6 34.8 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Effect of exchange-rate changes on cash and cash equivalents 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Net increase (decrease) in cash and cash equivalents 34.8 26.2 40.4 46.8 51.5 71.8 95.1 118.8 140.2 156.9 Cash and cash equivalents, beginning of period 54.0 88.8 115.0 155.4 202.2 253.7 325.5 420.6 539.4 679.6 Cash and cash equivalents, end of period 88.8 115.0 155.4 202.2 253.7 325.5 420.6 539.4 679.6 836.5 Sources: Otkritie Capital Research, company data Otkritie Capital 10

- 11. EPAM Systems | INITIATION | Russia | 2 April 2012 Sensitivity analysis Our model is not sensitive to discount rate and terminal growth rate assumptions… Worst case scenario – which literally implies only 2.5% growth after the end of the forecast period and a 15% discount rate – implies 7% downside from the current share price. Figure 12. Target price sensitivity to discount and growth rates, $/share WACC 12.0% 12.5% 13.0% 13.5% 14.0% 14.5% 15.0% 2.5% 20.9 20.2 19.6 19.1 18.6 18.2 17.8 3.0% 21.2 20.5 19.9 19.4 18.9 18.4 18.0 Terminal 3.5% 21.7 20.9 20.2 19.6 19.1 18.6 18.2 growth rate 4.0% 22.1 21.3 20.6 20.0 19.4 18.9 18.4 4.5% 22.7 21.8 21.0 20.3 19.7 19.1 18.6 5.0% 23.3 22.3 21.4 20.7 20.0 19.4 18.9 5.5% 24.0 22.9 21.9 21.1 20.4 19.7 19.2 Sources: Otkritie Capital Research …but personnel costs growth could negatively affect company fundamentals. Management estimates that around 80% of the company COS and SG&A costs represent personnel salaries. Based on the management guidance we estimate that the headcount will increase by 20% in 2012 (vs 25% revenue growth), while going forward we expect the headcount to increase at 7ppts lower than annual revenue growth. We assume 10% annual personnel cost inflation until 2015, while each additional 1% increase will have $2/share negative impact on EPAM target price. Figure 13. Target price sensitivity to personnel costs, $/share Personnel growth vs revenue growth2012-2015 -10% -9% -8% -7% -6% -5% -4% Salary 8% 25.0 24.6 24.2 23.8 23.4 23.0 22.6 annual 9% 23.1 22.7 22.3 21.9 21.5 21.1 20.7 inflation, 2012- 10% 21.2 20.8 20.4 20.0 19.5 19.1 18.7 2015 11% 19.3 18.8 18.4 18.0 17.5 17.1 16.7 12% 17.3 16.8 16.4 15.9 15.5 15.0 14.6 Sources: Otkritie Capital Research Sensitivity to exchange rate volatility is low. 50% of UK and Europe revenues are derived in local currencies, while the rest revenues are denominated in US dollars. Most of the costs in Belarus and Ukraine are USD denominated, while Russian Ruble costs are offset by Russian Ruble revenues, which tend to be equal. Therefore EPAM is only slightly exposed to Euro and British pound volatility. Figure 14. Target price sensitivity to exchange rates volatility, $/share Euro appreciation to US Dollar -3% -2% -1% 0% 1% 2% 3% -3% 19.4 19.5 19.6 19.8 19.9 20.0 20.2 -2% 19.4 19.6 19.7 19.8 20.0 20.1 20.2 British pound -1% 19.5 19.6 19.8 19.9 20.0 20.2 20.3 appreciation 0% 19.5 19.7 19.8 20.0 20.1 20.2 20.4 to US Dollar 1% 19.6 19.7 19.9 20.0 20.2 20.3 20.4 2% 19.7 19.8 19.9 20.1 20.2 20.4 20.5 3% 19.7 19.9 20.0 20.1 20.3 20.4 20.6 Sources: Otkritie Capital Research Otkritie Capital 11

- 12. EPAM Systems | INITIATION | Russia | 2 April 2012 Business description High-end software developer EPAM Systems is an IT services provider focused on high-end software development. EPAM Systems is a global IT services provider, founded in 1993 and focused on software development services, software engineering and vertically-oriented custom development solutions. Since its inception EPAM Systems has been focused on software product development for Independent Software Vendors (ISV). Unlike custom application development, which is usually tailored to very specific business requirements, software products of ISVs must be designed with a high level of product configurability and operational performance to address the needs of a diverse set of end-users working in multiple industries and operating in a variety of deployment environments. This demands a strong focus on upfront design and architecture, strict software engineering practices, and extensive testing procedures. The company‟s focus on software product development services for ISVs and technology companies requires high-quality talent, advanced knowledge of up-to-date tools, and strong project management practices. As a result, EPAM Systems‟ work with ISVs and technology companies, exposes it to its customers‟ business and strategic challenges, allowing it to develop vertical-specific domain expertise. EPAM strategy rests on 5 pillars: Technical expertise. The company has spent over a decade working with industry-leading ISVs and technology companies to develop various key features of their product portfolios. The focus on complex software product development has shaped key aspects of the service offerings as well as the culture of software engineering excellence, enabling the company to accelerate expansion of its services into other key industry verticals. EPAM plans to continue focusing on software engineering services for industry-leading ISVs and emerging technology companies to further develop the technical expertise and advance the knowledge of new software engineering and technology trends. Deep vertical expertise. EPAM has traditionally focused on enterprises that are technology- and information-centric, where the deep software development expertise is highly valued. To further enhance client solutions in each of the verticals, the company has recruited IT professionals with significant industry expertise and understanding of vertical-specific business operations and issues. EPAM plans to continue enhancing the expertise in different verticals by recruiting IT professionals with industry expertise Highly-skilled employees. EPAM places a high priority on attracting, training and retaining employees, which is integral to the company‟s ability to meet the challenges of the complex software product development projects. Scalable proprietary processes, applications and tools. To streamline and accelerate the software development process, EPAM has created a full suite of proprietary software development lifecycle processes, applications and tools. From managing every aspect of a development project, to automated testing tools, to management and hosting options for delivered solutions, applications and tools help ensure that the clients achieve faster turn-around times, high- quality results and superior value Selective strategic acquisitions. EPAM has historically pursued strategic acquisitions focused on expanding vertical-specific domain expertise, geographic footprint, service portfolio, client base and management expertise. Furthermore, as part of the strategy to expand the geographic footprint with high-quality global resources, EPAM targets to pursue acquisitions of companies with significant presence in China, Latin America or elsewhere. Otkritie Capital 12

- 13. EPAM Systems | INITIATION | Russia | 2 April 2012 Diversified revenue streams EPAM service offerings cover the full software development lifecycle from complex software development services through maintenance and support, custom application development, application testing, enterprise application platforms and infrastructure management. The company provides the following services: Software Product Development Services. That includes product research, design and prototyping, product development, component design and integration, full lifecycle software testing, product deployment and end-user customization, performance tuning, product support and maintenance, as well as porting and cross-platform migration. EPAM focuses on development services for enterprise software products covering a wide range of business applications as well as product development for multiple mobile platforms and embedded software product services. Custom Application Development Services. EPAM provides business and technical requirements analysis, solution architecture creation and validation, development, component design and integration, quality assurance and testing, deployment, performance tuning, support and maintenance, legacy applications re-engineering/refactoring, porting and cross-platform migration and documentation. Enterprise Application Platforms. EPAM integrates the clients‟ chosen application platforms with their internal systems and processes and to create custom solutions filling the gaps in their platforms‟ functionality. As a proven provider of software product development services to major ISVs, EPAM participated in the development of industry standard technology and business application platforms and their components in such specific areas as customer relationship management and sales automation, enterprise resource planning, enterprise content management, business intelligence, e-commerce, mobile, Software-as-a-Service and cloud deployment. The experience in such areas allowed the company to offer services around Enterprise Application Platforms, which include requirements analysis and platform selection, deep and complex customization, cross-platform migration, implementation and integration, as well as support and maintenance. Application Testing Services. That includes software application testing, including test automation tools and frameworks; testing for enterprise IT, including test management, automation, functional and non-functional testing, as well as defect management and consulting services focused on helping clients improve their existing software testing and quality assurance practices. EPAM Quality Management System complies with global quality standards such as ISO 9001:2000. Application Maintenance and Support. That service includes incident management, fault investigation diagnosis, work-around provision, application bug fixes, release management, application enhancements and third-party maintenance. Infrastructure Management Services. EPAM has significant expertise in implementing large infrastructure monitoring solutions, providing real-time notification and control from the low-level infrastructure up to and including applications. The solutions cover the full lifecycle of infrastructure management including application, database, network, server, storage and systems operations management, as well as incident notification and resolution. EPAM Systems is highly concentrated on software development services, however the share of other offerings in the service mix is constantly increasing. In 2011 EPAM generated 66% of its revenue from software development services, which is down 7 ppts from 2008, indicating EPAM‟s transition from a software programming focused company to a full scope offshoring services provider that is diversified into many verticals. Otkritie Capital 13

- 14. EPAM Systems | INITIATION | Russia | 2 April 2012 Figure 15. EPAM Systems revenue breakdown by types of services provided, $mn 400 74% 350 18 72% 300 29 70% 250 68 8 68% 200 19 5 44 66% 4 150 11 12 27 28 64% 219 100 150 50 117 105 62% 0 60% 2008 2009 2010 2011 Other services Application maintenance and support Application testing services Software development Software development services share, % (rhs) Sources: Otkritie Capital Research, Company data Experience with ISV and technology clients made it possible for the company to develop business in multiple industries, including Banking and Financial Services, Business Information and Media, Travel and Hospitality and Retail and Consumer. Travel and Hospitality Group was fastest growing vertical in 2011 showing 114% YoY growth, it was followed Retail and Consumer and Banking and Finance verticals, which posted 79% and 78% growth correspondingly. Software Vendors and Technology vertical seems to be mature, but still showed 27% YoY growth in 2011. In future we expect EPAM to continue to develop other verticals, which should be the main growth driver. Figure 16. EPAM Systems client distribution by industry, $mn 350 32 300 40 250 31 18 200 19 76 12 24 10 150 5 10 43 37 25 62 100 17 22 46 22 29 50 87 59 58 69 0 2008 2009 2010 2011 Software Vendors and Technology Business Information and Media Banking and Financial Services Other verticals Travel and Hospitality Retail and Consumer Other verticals Sources: Otkritie Capital Research, company data Otkritie Capital 14