In class lease examples with ifrs f08

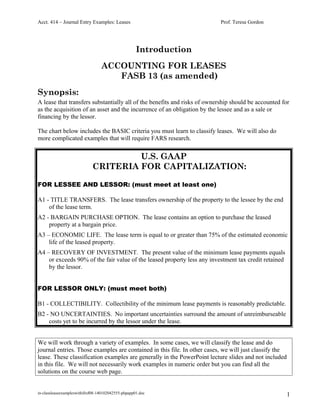

- 1. Acct. 414 – Journal Entry Examples: Leases Prof. Teresa Gordon Introduction ACCOUNTING FOR LEASES FASB 13 (as amended) Synopsis: A lease that transfers substantially all of the benefits and risks of ownership should be accounted for as the acquisition of an asset and the incurrence of an obligation by the lessee and as a sale or financing by the lessor. The chart below includes the BASIC criteria you must learn to classify leases. We will also do more complicated examples that will require FARS research. U.S. GAAP CRITERIA FOR CAPITALIZATION: FOR LESSEE AND LESSOR: (must meet at least one) A1 - TITLE TRANSFERS. The lease transfers ownership of the property to the lessee by the end of the lease term. A2 - BARGAIN PURCHASE OPTION. The lease contains an option to purchase the leased property at a bargain price. A3 – ECONOMIC LIFE. The lease term is equal to or greater than 75% of the estimated economic life of the leased property. A4 – RECOVERY OF INVESTMENT. The present value of the minimum lease payments equals or exceeds 90% of the fair value of the leased property less any investment tax credit retained by the lessor. FOR LESSOR ONLY: (must meet both) B1 - COLLECTIBILITY. Collectibility of the minimum lease payments is reasonably predictable. B2 - NO UNCERTAINTIES. No important uncertainties surround the amount of unreimburseable costs yet to be incurred by the lessor under the lease. We will work through a variety of examples. In some cases, we will classify the lease and do journal entries. Those examples are contained in this file. In other cases, we will just classify the lease. These classification examples are generally in the PowerPoint lecture slides and not included in this file. We will not necessarily work examples in numeric order but you can find all the solutions on the course web page. in-classleaseexampleswithifrsf08-140102042555-phpapp01.doc 1

- 2. Acct. 414 – Journal Entry Examples: Leases Prof. Teresa Gordon Introductory Examples – Lease 1A – Operating Lease To illustrate accounting for lease transactions, we will use a simple case involving three parties: 1. 2. 3. Farview Farms needs a small tractor (Model SX). These tractors have an expected useful life of six years with no salvage value. Idaho First Bank & Trust which is currently charging 12% interest on long-term equipment loans. Troy Tractors, Inc., which manufactures the Model SX tractor at a cost of $40,000 and then sells them for $50,000. It also has a few units for trial use which rent for $500 per week. If Farview Farms rents a tractor for one week from Troy Tractors, the journal entries would follow the usual pattern for a rental: Farview Farms Debit Credit Troy Tractors Debit Credit Rent expense Cash Cash Rental Income Depreciation expense Accumulated depreciation Comments --An operating lease is, in essence, a rental agreement. The lessor retains the risks and benefits of ownership. in-classleaseexampleswithifrsf08-140102042555-phpapp01.doc 2

- 3. Acct. 414 – Journal Entry Examples: Leases Prof. Teresa Gordon Installment Purchase Arrangement SITUATION 1B: PURCHASE WITH LONG-TERM BANK FINANCING Assume Farview Farms decides to purchase the tractor and borrows the full purchase price of $50,000 from Idaho First Bank & Trust at 12% interest on the unpaid balance of the loan. The borrower agrees to make annual payments of $10,000 for five years. Again, the journal entries follow the normal pattern: Farview Farms Debit Credit Troy Tractors Debit Credit Idaho First Bank & Trust Debit Credit Cash Note Payable to Bank Equipment Cash (to Troy Tractors) At year end: Depreciation expense Accumulated depreciation Interest expense Interest payable Cash Sales Cost of goods sold Inventory Note Receivable Cash At year end Interest receivable Interest revenue in-classleaseexampleswithifrsf08-140102042555-phpapp01.doc 3

- 4. Acct. 414 – Journal Entry Examples: Leases Prof. Teresa Gordon SITUATION 1C - DIRECT FINANCING LEASE For various reasons either (or both) Farview Farms and Idaho First Bank & Trust might prefer a lease arrangement to an outright purchase/long-term loan. Assume that the bank agrees to purchase the tractor from Troy Tractors for $50,000. It then computes the payment on the lease required for it to earn its desired rate of 12% interest if the lease is written for five years with the first payment coming at the end of the first year (after harvest). [PVA = 50,000, n = 5, i = 12%, pymt = 13,871]. The lease agreement specifies that Farview Farms gets to keep the tractor at the end of the lease. 0 1 2 3 4 5 ----------------------------------------------------------------DATE LEASE INTEREST REDUCTION LEASE PAYMENT LEASE RECBL/LIAB 50,001.85 RECBL/LIAB BALANCE ----------------------------------------------------------------01/01/12 0.00 0.00 0.00 50,000.00 12/31/12 13,871.00 6,000.00 7,871.00 42,129.00 12/31/13 13,871.00 5,055.48 8,815.52 33,313.48 12/31/14 13,871.00 3,997.62 9,873.38 23,440.10 12/31/15 13,871.00 2,812.81 11,058.19 12,381.91 12/31/16 13,871.00 1,489.09 12,381.91 0.00 Farview Farms Debit Credit Troy Tractors Debit Credit Idaho First Bank & Trust Debit Credit Farm Equipment Lease obligation At year end: Depreciation expense Accumulated depreciation Interest expense Lease obligation Cash Cash Sales Cost of goods sold Inventory Equipment held for lease Cash Net investment in lease Equipment held for lease Cash Interest revenue Net investment in lease in-classleaseexampleswithifrsf08-140102042555-phpapp01.doc 4

- 5. Acct. 414 – Journal Entry Examples: Leases Prof. Teresa Gordon SITUATION 1D - SALES TYPE LEASE Farview Farms may also be able to arrange a similar or better lease arrangement with the manufacturer of the Model SX tractor. We will assume that the lease terms are the same for purposes of illustration. NOTE: The first step in doing lease accounting involves finding the present value of the cash flows that are transferred between the lessee and lessor. This "present value of the minimum lease payments" [PVMLP] will give you the SALES amount for the lessor (assuming a sales-type lease) and the ASSET amount for the lessee. COMPUTE PVMLP: [n = 5, i = 12%, pymt = 13,871] Farview Farms Debit Credit Debit Credit Farm Equipment Lease obligation At year end: Depreciation expense Accumulated depreciation Interest expense Lease obligation Cash Troy Tractors Net investment in lease Sales Cost of goods sold Inventory At year end: Cash Interest revenue Net investment in lease in-classleaseexampleswithifrsf08-140102042555-phpapp01.doc 5

- 6. Acct. 414 – Journal Entry Examples: Leases Prof. Teresa Gordon Introductory Example – Lease 1E - BARGAIN PURCHASE OPTION 1. 2. Inception date: 1/1/12 Lessor: Troy Tractors Inc. 3. Fair value of tractor at 1/1/12: $50,000 4. Cost to manufacture tractor: $40,000 5. Estimated fair value at end of lease is $10,000 6. Fixed non-cancelable lease term: 5 years. 7. First payment due on 12/31/12 8. Lessee: Farview Farms 9. Incremental borrowing rate (lessee): 12% 10. Implicit interest rate (known to lessee): 12% 11. Option to buy at end of lease term for $5,000 12. Estimated useful life of tractor: 8 years To earn its desired return of 12%, at what amount should Troy Tractors set the annual payments? Construct an amortization table and prepare the journal entries for both parties: Date Payment Interest "Principal" Farview Farms Balance Debit Credit Debit Credit At inception: Farm Equipment Lease liability At year end: Interest expense Lease liability Cash Depreciation expense Accumulated depreciation Troy Tractors At inception: in-classleaseexampleswithifrsf08-140102042555-phpapp01.doc 6

- 7. Acct. 414 – Journal Entry Examples: Leases Prof. Teresa Gordon Lease Receivable Sales Cost of Goods Sold Inventory At year end: Cash Lease Receivable Interest revenue in-classleaseexampleswithifrsf08-140102042555-phpapp01.doc 7

- 8. Acct. 414 – Journal Entry Examples: Leases Prof. Teresa Gordon Introductory Example – Lease 1F - ANNUITY DUE Assume that Troy Tractors and Farview Farms sign a lease agreement on a SX Tractor with the following terms: 1. 2. Inception date: 1/1/12 Lessor: Troy Tractors Inc. 6. 7. Lessee: Farview Farms Fixed non-cancelable lease term: 6 years. 3. Fair value of tractor at 1/1/12: $50,000 8. Option to buy at end of lease term for $2,000 4. Estimated fair value at end of lease is $10,000 9. Estimated useful life of tractor: 8 years 5. First payment due on 1/1/12 10. Desired rate of return for lessor and incremental borrowing rate for lessee: 12% With these lease terms, how much should Troy Tractors ask for the annual payments? Construct an amortization table and prepare the journal entries for both parties: Date Payment Interest "Principal" Farview Farms Debit Balance Credit At inception: Farm Equipment Lease liability Cash At year end: Interest expense Lease liability Depreciation expense Accumulated depreciation in-classleaseexampleswithifrsf08-140102042555-phpapp01.doc 8

- 9. Acct. 414 – Journal Entry Examples: Leases Troy Tractors At inception: Cash Lease Receivable Sales Cost of Goods Sold Inventory At year end: Lease Receivable Interest revenue in-classleaseexampleswithifrsf08-140102042555-phpapp01.doc Prof. Teresa Gordon Debit Credit 9

- 10. Acct. 414 – Journal Entry Examples: Leases Prof. Teresa Gordon International Financial Reporting Standards (IFRS) Leases (IAS17) A lease is classified as a finance lease if it transfers substantially all the risks and rewards incidental to ownership. A lease is classified as an operating lease if it does not transfer substantially all the risks and rewards incidental to ownership. Classification depends on the substance of the transaction rather than the form of the contract. Examples of situations that individually or in combination would normally lead to a lease being classified as a finance lease are: a) the lease transfers ownership of the asset to the lessee by the end of the lease term. b) the lessee has the option to purchase the asset at a price that is expected to be sufficiently lower than the fair value at the date the option becomes exercisable for it to be reasonably certain, at the inception of the lease, that the option will be exercised. c) the lease term is for the major part of the economic life of the asset even if title is not transferred. d) at the inception of the lease the present value of the minimum lease payments amounts to at least substantially all of the fair value of the leased asset. e) the leased assets are of such a specialized nature that only the lessee can use them without major modifications. Other indications that it is a finance lease include: a) if the lessee can cancel the lease, the lessor’s losses associated with the cancellation are borne by the lessee. b) gains or losses from the fluctuation in the fair value of the residual accrue to the lessee (for example, in the form of a rent rebate equalling most of the sales proceeds at the end of the lease) c) the lessee has the ability to continue the lease for a secondary period at a rent that is substantially lower than market rent. The examples and indicators (above) are not always conclusive. If it is clear from other features that the lease does not transfer substantially all risks and rewards incidental to ownership, the lease is classified as an operating lease. in-classleaseexampleswithifrsf08-140102042555-phpapp01.doc 10

- 11. Acct. 414 – Journal Entry Examples: Leases Prof. Teresa Gordon Lease Example #3 On January 1, 2012, Andrewson Consulting and Sun Computers sign a lease with the following terms: 1. 3. 5. 7. 9. Term: 3 years Implicit interest rate (known to lessee) 10% Fair value of asset $130,000 Incremental borrowing rate: 15% Estimated useful life of asset: 4 years 2. Payments of $47,523 4. Lessor retains ownership of asset at end of lease 6. Cost of asset $100,000 8. First payment due 1/1/12 10. No collection or cost uncertainties for lessor FIND PRESENT VALUE OF MINIMUM LEASE PAYMENTS: Type of lease for Lessor Lessee US GAAP IFRS 0 1 2 Date 1/01/12 1/01/12 1/01/13 1/01/14 Lessee Lease Payment Interest 0 8,248 4,320 12,568 47,523 47,523 47,523 142,569 Debit Credit in-classleaseexampleswithifrsf08-140102042555-phpapp01.doc Principal 47,523 39,275 43,203 130,001 Balance 130,000 82,477 43,202 0 0 Lessor Debit Credit 11

- 12. Acct. 414 – Journal Entry Examples: Leases Prof. Teresa Gordon Lease Example #5 On March 30, 2012, Genessee Engineering, Inc. and Idaho First Bank sign a lease with the following terms: 1. 2. 3. 4. 5. 6. 7. Inception of lease: March 30, 2012 Term: 3 years Implicit interest rate (not known to lessee) 10% Fair value of asset $100,000 Incremental borrowing rate: 12% Estimated useful life of asset: 5 years Purchase option at end of lease: $2,500 8. 9. 10. 11. 12. 13. Payments of ______________ Est. fair value of asset at end of lease $5,000 Cost of asset $100,000 First payment due 3/30/12 No collection or cost uncertainties for lessor Both parties have calendar-year fiscal years. FIND THE PAYMENT WHICH IDAHO FIRST BANK SHOULD ASK TO EARN THE IMPLICIT INTEREST RATE LISTED ABOVE: PVMLP for Lessee: PVMLP for Lessor: Type of lease for Lessor Lessee US GAAP IFRS Explain: in-classleaseexampleswithifrsf08-140102042555-phpapp01.doc 12

- 13. Acct. 414 – Journal Entry Examples: Leases Prof. Teresa Gordon Example 5 – Lessee Accounting (Capital Lease with BPO) On March 30, 2012, Genessee Engineering, Inc. and Idaho First Bank sign a lease with the following terms: 1. Term: 3 years 2. Payments of 35,869 3. Implicit interest rate (not known to lessee) 10% 4. Est. fair value of asset at end of lease $5,000 5. Fair value of asset $100,000 6. Cost of asset $100,000 7. Incremental borrowing rate: 12% 8. First payment due 3/30/12 9. Estimated useful life of asset: 5 years 10. No collection or cost uncertainties for lessor 11. Purchase option at end of lease: $2,500 12. Both parties have calendar-year fiscal years. Date 0 1 2 3 03/30/12 03/30/12 03/30/13 03/30/14 03/30/15 Lease Payment Interest 35,869 35,869 35,869 2,500 0 7,488 4,082 266 Principal 35,869 28,381 31,787 2,234 Genessee Engineering Inc. 3/30/12 Balance 98,270 62,401 34,020 2,234 0 Debit Credit Leased Asset Lease obligation Cash 12/31/12 35,869 Depreciation expense Accumulated depreciation Interest expense Interest payable 3/30/13 Interest expense Interest payable Lease obligation Cash 12/31/13 35,869 Depreciation expense Accumulated depreciation Interest expense Interest payable in-classleaseexampleswithifrsf08-140102042555-phpapp01.doc 13

- 14. Acct. 414 – Journal Entry Examples: Leases Lease #5 3/30/14 Genessee Engineering Inc. Prof. Teresa Gordon Debit Credit Interest expense Interest payable Lease obligation Cash 12/31/14 35,869 Depreciation expense Accumulated depreciation Interest expense Interest payable 3/30/15 Interest expense Interest payable Lease obligation Cash 12/31/15 2,500 Depreciation expense Accumulated depreciation 12/31/15 Depreciation expense Accumulated depreciation 3/30/17 Depreciation expense Accumulated depreciation Acc'd Depreciation in-classleaseexampleswithifrsf08-140102042555-phpapp01.doc Lease Liability 14

- 15. Acct. 414 – Journal Entry Examples: Leases Prof. Teresa Gordon Example 5 – Lessor Accounting (Direct Financing Lease with BPO) Date 0 1 2 3 03/30/12 03/30/12 03/30/13 03/30/14 03/30/15 Lease Payment Interest 35,869 35,869 35,869 2,500 110,107 0 6,413 3,468 226 10,107 Idaho First Bank & Trust 03/30/12 Cash Principal 35,869 29,456 32,401 2,274 100,000 Balance 100,000 64,131 34,675 2,274 0 Debit Credit 35,869 Net investment in lease Equipment purchased for lease 12/31/12 Interest receivable Interest revenue 3/30/13 Cash 35,869 Interest receivable Interest revenue Net investment in lease 12/31/13 Interest receivable Interest revenue 3/30/14 Cash 35,869 Interest receivable Interest revenue Net investment in lease 12/31/14 Interest receivable Interest revenue 12/31/15 Cash 2,500 Interest receivable Interest revenue Net investment in lease in-classleaseexampleswithifrsf08-140102042555-phpapp01.doc 15

- 16. Acct. 414 – Journal Entry Examples: Leases Prof. Teresa Gordon Example 5 – FASB Style J E s - Lessor Date 0 1 2 3 Lease Payment 03/30/12 03/30/12 03/30/13 03/30/14 03/30/15 Interest 35,869 35,869 35,869 2,500 110,107 0 6,413 3,468 226 10,107 Principal 35,869 29,456 32,401 2,274 100,000 Idaho First Bank & Trust 3/30/12 Lease Payments Receivable (or Gross investment in lease) Balance 100,000 64,131 34,675 2,274 0 Debit Credit 110,107 Equipment purchased for lease Unearned interest revenue Cash 35,869 Lease Payments Receivable (or Gross investment in lease) 12/31/12 Unearned interest revenue Interest revenue 3/30/13 Cash 35,869 Unearned interest revenue Interest revenue Lease Payments Receivable (or Gross investment in lease) Continue as above for the following dates 12/31/13 3/30/14 12/31/14 3/30/15 in-classleaseexampleswithifrsf08-140102042555-phpapp01.doc 16

- 17. Acct. 414 – Journal Entry Examples: Leases Prof. Teresa Gordon COMMENTS ON APPLYING CRITERIA (US GAAP) LEASE TERM: Always ends at a bargain purchase option (including ordinary renewal periods up to BPO). Includes renewal periods under bargain renewal options if there is a penalty large enough to assure renewal if renewal or extensions is at option of lessor during which lessee guarantees lessor's debt related to property during which there is a loan from lessee to the lessor Lease must be cancelable only under remote contingency, with permission of lessor, or if lessee enters into new lease with lessor, or with there is a large penalty for cancellation that makes cancellation unlikely. MINIMUM LEASE PAYMENTS: Excludes contingent rentals Excludes executory costs paid by lessor: maintenance property taxes insurance Excludes all rental payments past date of bargain purchase option Includes all rental payments up to date of bargain purchase option Includes bargain purchase option Includes renewal penalties not large enough to assure continuation of lease Includes rents during renewal periods covered by: bargain renewal options nonrenewal penalty large enough to assure continuation of lease Includes guaranteed residual value of property If guaranteed by lessee If guaranteed by third party, only lessor includes as part of minimum lease payments Note: Never record the leased asset at more than its fair value! The asset should be recorded at the lower of the PVMLP or the FMV. in-classleaseexampleswithifrsf08-140102042555-phpapp01.doc 17

- 18. Acct. 414 – Journal Entry Examples: Leases Prof. Teresa Gordon Lease Example #7 On January 1, 2012, Harris Manufacturing (lessee) and Accel Engines sign a lease with the following terms: 1. 3. 5. 7. 9. 10. Term: 4 years Implicit interest rate (known to lessee) 10% Fair value of asset $300,000 Incremental borrowing rate: 12% Estimated useful life of asset: 6 years Est. fair value of asset at end of lease: $10,000 2. 4. 6. 8. 10. 11. PVMLP for Lessee: Payments of $84,079 Lessor retains ownership of asset at end of lease Cost of asset $250,000 First payment due 1/1/12 No collection or cost uncertainties for lessor The residual value is NOT guaranteed by lessee PVMLP for Lessor: Type of lease for Lessor Lessee US GAAP IFRS Explain: Lessee Date 0 1 2 3 01/01/12 01/01/12 01/01/13 01/01/14 01/01/15 Lease Payment 84,079 84,079 84,079 84,079 Interest 0 20,909 14,592 7,644 Lessor Principal Balance 84,079 63,170 69,487 76,435 Lessee – Harris Manufacturing in-classleaseexampleswithifrsf08-140102042555-phpapp01.doc 293,171 209,092 145,922 76,435 0 Lease Payment Interest 84,079 84,079 84,079 84,079 10,000 0 21,593 15,344 8,470 909 Debit Principal 84,079 62,486 68,735 75,609 9,091 Balance 300,000 215,921 153,435 84,700 9,091 0 Credit 18

- 19. Acct. 414 – Journal Entry Examples: Leases in-classleaseexampleswithifrsf08-140102042555-phpapp01.doc Prof. Teresa Gordon 19

- 20. Acct. 414 – Journal Entry Examples: Leases Prof. Teresa Gordon Lease # 7 - Lessor Accounting for Sales-Type Lease when there is an Unguaranteed Residual Value Date 0 1 2 3 4 Lease Payment 01/01/12 01/01/12 01/01/13 01/01/14 01/01/15 01/01/16 Totals 84,079 84,079 84,079 84,079 10,000 346,316 Lessor – Accel Engines Interest Principal 0 21,593 15,344 8,470 909 46,316 Debit 84,079 62,486 68,735 75,609 9,091 300,000 Balance 300,000 215,921 153,435 84,700 9,091 0 0 Credit 1/1/12 Net Investment in Lease (PVMLP + PV of Unguaranteed RV) Cost of Sales (Cost of asset - PV of Unguaranteed RV) Inventory/Equipment (Cost of asset) Sales Revenue (PVMLP) Cash Net Investment in Lease 12/31/12 Interest receivable Interest Revenue 1/1/13 Cash Interest Receivable Net Investment in Lease in-classleaseexampleswithifrsf08-140102042555-phpapp01.doc 20

- 21. Acct. 414 – Journal Entry Examples: Leases Prof. Teresa Gordon UNGUARANTEED RESIDUAL VALUES JOURNAL ENTRY FORMAT FOR LESSOR (As illustrated by FASB -- use of Gross rather than Net investment in lease is optional. Net investment in lease = GIIL - unearned income) DIRECT FINANCING LEASE: Gross Investment in Lease (MLP + Unguaranteed Residual Value + initial direct costs) Equipment (Cost or carrying amount) Unearned Income (GIIL - cost or carrying amount) SALES TYPE LEASE: Gross Investment in Lease (MLP + Unguaranteed Residual Value) Cost of Sales (Cost of asset - PV of Unguaranteed Residual Value) Inventory/Equipment (Cost of asset) Unearned Income (GIIL -PVMLP) Sales Revenue (PVMLP) Where MLP = minimum lease payments exclusive of executory costs paid by the lessor GIIL = gross investment in lease PVMLP = present value of MLP The “easier” method: DIRECT FINANCING LEASE: Net Investment in Lease (PVMLP + PV of Unguaranteed Residual Value + initial direct costs) Equipment (Cost or carrying amount) SALES TYPE LEASE: Net Investment in Lease (PVMLP + PV of Unguaranteed Residual Value) Cost of Sales (Cost of asset - PV of Unguaranteed Residual Value) Inventory/Equipment (Cost of asset) Sales Revenue (PVMLP) in-classleaseexampleswithifrsf08-140102042555-phpapp01.doc 21

- 22. Acct. 414 – Journal Entry Examples: Leases Prof. Teresa Gordon Lease Example #9 On January 1, 2012, Hamford Ritz Inc. and Cisco Leasing sign a lease with the following terms: 1. 3. 5. 7. 9. 11. 13. Term: 4 years Implicit interest rate (not known to lessee) 10% Fair value of asset $300,000 Incremental borrowing rate: 12% Estimated useful life of asset: 5 years Est. fair value of asset at end of lease: $25,000 The lessor incurred initial direct costs of $1,848 related to the lease 2. 4. 6. 8. 10. 12. Payments of $81,140 Lessor retains ownership of asset at end of lease Cost of asset $300,000 First payment due 1/1/12 No collection or cost uncertainties for lessor The residual value is NOT guaranteed by lessee FIND PRESENT VALUE OF MINIMUM LEASE PAYMENTS: Type of lease for Lessor Lessee US GAAP IFRS Explain: Lessee 0 1 2 3 Date 01/01/12 01/01/12 01/01/13 01/01/14 01/01/15 Lease Payment 81,140 81,140 81,140 81,140 Hamford Ritz Inc. (Lessee) in-classleaseexampleswithifrsf08-140102042555-phpapp01.doc Interest Principal 12% 0 23,386 16,456 8,694 Debit 81,140 57,754 64,685 72,447 Balance 276,026 194,886 137,131 72,447 0 Credit 22

- 23. Acct. 414 – Journal Entry Examples: Leases in-classleaseexampleswithifrsf08-140102042555-phpapp01.doc Prof. Teresa Gordon 23

- 24. Acct. 414 – Journal Entry Examples: Leases Prof. Teresa Gordon Lease Example #9 – Lessor Accounting for Initial Direct Costs with a Direct Financing Lease How to arrive at adjusted interest rate: 0 1 2 3 4 Date 01/01/12 01/01/12 01/01/13 01/01/14 01/01/15 01/01/16 Lease Payment 81,140 81,140 81,140 81,140 25,000 Interest 9.56% 0 21,100 15,360 9,072 2,182 Cisco Leasing Co. (Lessor) 1/1/12 Initial Direct Costs – Leases Principal Balance 301,848 220,708 160,667 94,887 22,818 0 81,140 60,040 65,780 72,069 22,818 Debit Credit 1,848 Cash Equipment held for lease 1,848 300,000 Cash 1/1/12 300,00 Net investment in lease Equipment purchased for lease 300,000 Initial direct costs - leases Cash 1,848 81,140 Net investment in lease 12/31/12 Net investment in lease Interest revenue 1/1/13 Cash in-classleaseexampleswithifrsf08-140102042555-phpapp01.doc 81,140 24

- 25. Acct. 414 – Journal Entry Examples: Leases Prof. Teresa Gordon Net investment in lease 12/31/15 Net investment in lease Interest revenue 1/1/16 Used Equipment Net investment in lease Loss on Leased Asset The last “payment” the lessor will receive is the returned equipment. It should be recorded at the lower of fair value or original estimated residual value. In other words, it may be necessary to record a loss. Lessors are supposed to evaluate the residual values at each balance sheet date and recognize any losses in anticipated value. in-classleaseexampleswithifrsf08-140102042555-phpapp01.doc 25

- 26. Acct. 414 – Journal Entry Examples: Leases Prof. Teresa Gordon Lease Example #10 On May 1, 2012, SlumberJay, Inc. and Omaha Oscillators, Inc. sign a lease with the following terms: 1. 3. 5. 7. 9. 10. 12. Term: 4 years Implicit interest rate (NOT known to lessee) 10% Fair value of asset $270,000 Incremental borrowing rate: 12% Estimated useful life of asset: 4 years Est. fair value of asset at end of lease: $0 Initial direct costs incurred by lessor $1,000 2. 4. 6. 8. 10. 11. Payments of $82,434 Lessor retains ownership of asset at end of lease Cost of asset $250,000 First payment due 5/1/12 There are collection uncertainties for lessor The payments include $5,000 for insurance to be paid by the lessor FIND PRESENT VALUE OF MINIMUM LEASE PAYMENTS: Type of lease for Lessor Lessee US GAAP IFRS 0 1 2 3 Date 05/01/12 05/01/12 05/01/13 05/01/14 05/01/15 Lease Payment Interest 77,434 77,434 77,434 77,434 0 19,257 13,439 7,040 Lessor – Omaha Oscillators, Inc. Principal 77,434 58,177 63,995 70,394 Balance 270,000 192,566 134,389 70,394 0 Debit Credit 05/01/12 Initial direct costs – deferred Cash 05/01/12 Cash Unearned rental income Prepaid Insurance 82,434 12/31/12 Rental costs Initial direct costs - deferred Insurance expense Prepaid insurance Unearned rental income Rental income Depreciation expense in-classleaseexampleswithifrsf08-140102042555-phpapp01.doc 26

- 27. Acct. 414 – Journal Entry Examples: Leases Prof. Teresa Gordon Accumulated Depreciation in-classleaseexampleswithifrsf08-140102042555-phpapp01.doc 27

- 28. Acct. 414 – Journal Entry Examples: Leases Lessor – Omaha Oscillators, Inc. 05/01/13 Cash Unearned rental income Prepaid Insurance Prof. Teresa Gordon Debit Credit 82,434 12/31/13 Rental costs Initial direct costs - deferred Insurance expense Prepaid insurance Unearned rental income Rental income Depreciation expense Accumulated Depreciation in-classleaseexampleswithifrsf08-140102042555-phpapp01.doc 28

- 29. Acct. 414 – Journal Entry Examples: Leases Prof. Teresa Gordon Lease Example #10 - Lessee 0 1 2 3 Date 05/01/12 05/01/12 05/01/13 05/01/14 05/01/15 Lease Payment Interest 77,434 77,434 77,434 77,434 SlumberJay, Inc. - Lessee 05/01/12 Leased Asset Prepaid Insurance Lease Obligation Cash 0 22,318 15,704 8,296 Principal 77,434 55,116 61,730 69,138 debit Balance 263,417 185,983 130,867 69,137 0 credit 82,434 12/31/12 Depreciation Expense Accumulated Depreciation Insurance expense Prepaid insurance Interest Expense Interest Payable 05/01/13 Lease Obligation Interest Payable Insurance expense Cash 82,434 12/31/13 Depreciation Expense Accumulated Depreciation Insurance expense Prepaid insurance Interest Expense Interest Payable 01/01/14 Lease Obligation Interest Payable Prepaid Insurance Cash in-classleaseexampleswithifrsf08-140102042555-phpapp01.doc 82,434 29

- 30. Acct. 414 – Journal Entry Examples: Leases Prof. Teresa Gordon Lease Example #11 On June 1, 2012, Fantasia Funnels, Inc. and Idaho First Bank sign a lease with the following terms: 1. 3. 5. 7. Term: 4 years Interest rate used to compute payments = 12% Fair value of asset $200,000 Incremental borrowing rate: 14% (Lessee does not know implicit interest rate) Estimated useful life of asset: 6 years Est. fair value of asset at end of lease: $10,000 Initial direct costs to arrange lease: $3,000 9. 11. 13. 2. 4. 6. 8. Payments of $61,924 Cost of asset $200,000 First payment due 6/1/12 The lessee can purchase asset for $10,000 at end of lease, otherwise, asset is returned to lessor. The payments include $5,000 for maintenance. No collection or cost uncertainties for lessor 10. 12. FIND PRESENT VALUE OF MINIMUM LEASE PAYMENTS: Type of lease for Lessor Lessee US GAAP IFRS Explain: Lessee’s Amortization Schedule 0 1 2 3 Date 06/01/12 06/01/12 06/01/13 06/01/14 06/01/15 Lease Payment 56,924 56,924 56,924 56,924 Fantasia Funnels Inc. (Lessee) in-classleaseexampleswithifrsf08-140102042555-phpapp01.doc Interest 14% 0 18,502 13,123 6,991 Debit Principal 56,924 38,422 43,801 49,933 Balance 189,081 132,157 93,735 49,933 0 Credit 30

- 31. Acct. 414 – Journal Entry Examples: Leases Prof. Teresa Gordon Lease Example #11 Date Lease Payment Interest Principal Balance 6/01/12 203,000 0 6/01/12 56,924 1 6/01/13 56,924 2 6/01/14 56,924 3 6/01/15 56,924 4 6/01/16 10,000 Note: This problem is similar to Lease #9. It requires you to compute a new interest rate for the lessor so that the initial direct costs are amortized over the life of the lease. Note that the residual value MUST be included because the asset’s value at the end of the lease is important to the lessor since there is no title transfer or bargain purchase option. Remember that the lessor’s amortization table includes residual values (whether or not they are guaranteed) if the lessor expects the leased asset to be returned at end of lease (in other words, no title transfer and no bargain purchase option). Idaho First Bank. (Lessor) in-classleaseexampleswithifrsf08-140102042555-phpapp01.doc Debit Credit 31

- 32. Acct. 414 – Journal Entry Examples: Leases in-classleaseexampleswithifrsf08-140102042555-phpapp01.doc Prof. Teresa Gordon 32

- 33. Acct. 414 – Journal Entry Examples: Leases Prof. Teresa Gordon LEASE Example #12 On August 1, 2012, Hells Gate Jet Boats and Washington Leasing Co. sign a lease with the following terms: 1. Term: 4 years with possible renewal (see #11) 2. Payments of $49,523 3. Implicit interest rate (NOT known to lessee) 10% 4. Lessor retains ownership of asset at end of lease 5. Fair value of asset $200,000 6. Cost of asset $200,000 7. Incremental borrowing rate: 14% 8. First payment due 8/1/12 9. Estimated useful life of asset: 6 years 10. No collection or cost uncertainties for lessor 11. At the end of the lease, HGJB can renew for one 12. The residual value is NOT guaranteed by lessee, more year at same annual amount of $49,523. This is asset is expected to be worth $25,000 at end of 4 certainly no bargain. There is a $15,000 penalty for years, and $15,000 at end of 5 years. non-renewal of the lease. However, this amount is probably not large enough to assure that HGJB will renew. WHAT ARE THE MINIMUM LEASE PAYMENTS? FIND PRESENT VALUE: LESSOR - Washington Leasing Co. Date Payment Interest Lessor - Washington Leasing Co. "Principal" Debit Balance Credit Lease Example 12 (continued) in-classleaseexampleswithifrsf08-140102042555-phpapp01.doc 33

- 34. Acct. 414 – Journal Entry Examples: Leases Prof. Teresa Gordon On August 1, 2012, Hells Gate Jet Boats and Washington Leasing Co. sign a lease with the following terms: 1. Term: 4 years with possible renewal (see #11) 2. Payments of $49,523 3. Implicit interest rate (NOT known to lessee) 10% 4. Lessor retains ownership of asset at end of lease 5. Fair value of asset $200,000 6. Cost of asset $200,000 7. Incremental borrowing rate: 14% 8. First payment due 8/1/12 9. Estimated useful life of asset: 6 years 10. No collection or cost uncertainties for lessor 11. At the end of the lease, HGJB can renew for one 12. The residual value is NOT guaranteed by lessee, more year at same annual amount of $49,523. This is asset is expected to be worth $25,000 at end of 4 certainly no bargain. There is a $15,000 penalty for years, and $15,000 at end of 5 years. non-renewal of the lease. However, this amount is probably not large enough to assure that HGJB will renew. WHAT ARE THE MINIMUM LEASE PAYMENTS? FIND PRESENT VALUE: LESSEE - Hells Gate Jet Boats Date Payment Interest Lessee - Hells Gate Jet Boats "Principal" Debit Balance Credit Lease #12 – continued in-classleaseexampleswithifrsf08-140102042555-phpapp01.doc 34

- 35. Acct. 414 – Journal Entry Examples: Leases Prof. Teresa Gordon What if the lessee decided that the penalty was large enough that they would renew the lease? How would you classify the lease in this situation? LESSEE - Hells Gate Jet Boats Date Payment Interest Lessee - Hells Gate Jet Boats "Principal" Debit Balance Credit Note that the implicit interest rate for the lessor would also have to be re-computed if the lessor also decided that the penalty was going to be large enough. A new table would be required. It would still be direct financing lease since lease term would exceed 75% of economic life. in-classleaseexampleswithifrsf08-140102042555-phpapp01.doc 35

- 36. Acct. 414 – Journal Entry Examples: Leases Prof. Teresa Gordon LEASE Example #13 On October 1, 2012, Knightco (lessee) and Jack Dear Corp. sign a lease with the following terms: 1. Term: 4 years, with possible renewal (see #11) 2. Payments of $68,565 3. Implicit interest rate (NOT known to lessee) 10% 4. Lessor retains title to the asset at end of lease 5. Fair value of asset $260,000 6. Cost of asset $200,000 7. Incremental borrowing rate: 12% 8. First payment due 10/1/12 9. Estimated useful life of asset: 6 years 10. No collection or cost uncertainties for lessor 11. Lease can be renewed for one more year at 12. Est. fair value of asset at end of original lease term is $17,000. The actual value is probably $25,000. $35,000. It should be worth $15,000 at the end of 5 13. There are no guarantees of residual value years. LESSOR AMORTIZATION TABLE Date Payment Interest "Principal" Balance LESSEE AMORTIZATION TABLE Date Payment Interest "Principal" Balance in-classleaseexampleswithifrsf08-140102042555-phpapp01.doc 36

- 37. Acct. 414 – Journal Entry Examples: Leases Prof. Teresa Gordon Lease #13 Lessee – Knightco Inc. Debit Credit Lessor – Jack Dear Corp. Debit Credit in-classleaseexampleswithifrsf08-140102042555-phpapp01.doc 37