Risks, Ratios and Yield Curves

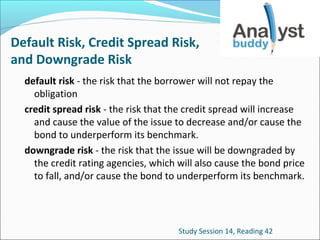

- 1. Default Risk, Credit Spread Risk, and Downgrade Risk default risk - the risk that the borrower will not repay the obligation credit spread risk - the risk that the credit spread will increase and cause the value of the issue to decrease and/or cause the bond to underperform its benchmark. downgrade risk - the risk that the issue will be downgraded by the credit rating agencies, which will also cause the bond price to fall, and/or cause the bond to underperform its benchmark. Study Session 14, Reading 42

- 2. Sources of information to asses the default risk of a bond 1. Credit Rating 2. Rating Watch 3. Rating Outlook Study Session 14, Reading 42

- 3. Four Cs of credit analysis 1. Character - management’s integrity and commitment to meet obligations 2. Covenants - the terms and conditions, the borrowing and lending parties have agreed to as part of the bond issue Two types of Covenants i. Affirmative covenants ii. Negative covenants 3. Collateral - the assets offered as security for the debt as well as other assets controlled by the issuer 4. Capacity - to the corporate borrower’s ability to generate cash flow or liquidate short-term assets to repay its debt obligations. Study Session 14, Reading 42

- 4. Factors to Evaluate the Capacity to Pay Industry trends Regulatory environment Operating and competitive position Financial position and sources of liquidity Company structure Parent company support agreements Special event risk Study Session 14, Reading 42

- 5. Factors to Evaluate the financial position and sources of liquidity Working capital position of the firm Dependable cash flow Back up facilities Securitized assets Third party guarantees Study Session 14, Reading 42

- 6. Credit Analysis with Ratios Solvency Ratios Current Ratio = Current Assets / Current Liabilities Acid Test Ratio = (Current Assets – Inventories) / Current Liabilities Capitalization or Financial Leverage Ratios Long term debt to capitalization ratios = Long term debt / (Long term debt + Minority Interest + Shareholders common and preferred equity ) Total debt to capitalization ratios = (Current Liabilities + Long term debt) / (Current Liabilities + Long term debt + Minority Interest + Shareholders common and preferred equity) Study Session 14, Reading 42

- 7. Credit Analysis with Ratios (cont.) Coverage Ratios EBIT Coverage Ratio = EBIT / Annual Interest Expense EBITDA Coverage Ratio = EBITDA / Annual Interest Expense Du Pont Analysis ROE = Net Income / Shareholders equity = ( Net Income / Sales) * (Sales/Total Assets) * (Total assets / Shareholders equity) Study Session 14, Reading 42

- 8. Cash Flow Measures Used by S&P Funds from operations = Net Income + Depreciation +/- other non cash items Operating cash flow = Funds from operations + decrease (increase) in non current assets – increase (decrease) in non current liabilities Free operating cash flows = Operating cash flow – capital expenditures Discretionary cash flows = Free operating cash flow – cash dividends Pre-financing cash flows = Discretionary cash flows – acquisitions + asset disposals + other sources Study Session 14, Reading 42

- 9. Ratios Used by S&P Coverage Ratios (the higher the ratio, the stronger the issuer’s capacity to pay): Funds from operations / total debt Funds from operations / capital spending requirement (Free operating cash flow + Interest) / Interest (Free operating cash flow + Interest) / ( Interest + Annual Principal Repayment) Leverage Ratio ( the lower the ratio, the stronger is the issuer’s capacity to pay) Debt Payback Period = Total debt / Discretionary cash flows Study Session 14, Reading 42

- 10. Two Areas to Analyse High-Yield Issuers Debt Structure Analysis - includes the following types of issues: bank debt, reset notes, and senior and subordinated debt (which may be zero coupon bonds). Corporate Structure Analysis - Debt is borrowed at the parent level, and funds to pay the obligation in the future are obtained from operating subsidiaries Study Session 14, Reading 42

- 11. Credit Analysis of Asset Backed Securities Collateral Credit Quality - Rating agencies evaluate whether the collateral is of sufficient quality to be able to provide cash flows to pay principal and interest over the life of the issue Seller/ Servicer Quality - Rating agency looks at the servicer’s performance history, experience, underwriting standards adopted for loan originations, servicing capabilities (including databases, systems, and personnel), financial strength, and growth relative to its competitive and business environment. Study Session 14, Reading 42

- 12. Credit Analysis of Asset Backed Securities (cont.) Cash Flow Stress and Payment Structure - Rating agencies analyses cash flow projections under different scenarios related to losses, delinquencies, and economic conditions to assess how these cash flows are distributed to the various tranches (bonds) in the asset-backed security structure. Legal Structure - A firm that securitizes assets, , in the event of bankruptcy, the courts will not apply the cash flow from the collateral toward satisfaction of general corporate liabilities Study Session 14, Reading 42

- 13. Risk Considerations for Tax Backed Debt Issuer’s debt structure Budgetary policy Local tax and intergovernmental revenue availability Issuer’s socioeconomic environment Study Session 14, Reading 42

- 14. Risk Considerations for Revenue Bonds Limits of the basic security Flow of funds structure Rate, or user charge, covenant Priority-of-revenue claims Additional Bonds Test Study Session 14, Reading 42

- 15. Economic risk factors in evaluation of Sovereign Ratings Economic and income structure Prospects for economic growth Degree of fiscal flexibility Public debt burden Monetary policy and price stability Balance of payments flexibility External debt and liquidity Study Session 14, Reading 42

- 16. Political risk factors in evaluating Sovereign Ratings Form of government and degree of citizen participation in the political process. Political stability and orderliness of leadership or political party succession. Degree of national agreement on economic policy goals. Integration of its economy in global trade and financial systems. Internal and external security risks. Study Session 14, Reading 42

- 17. Local Currency Ratings and Foreign Currency Debt Ratings Factors used in analysis of local currency debt ratings: political stability and the extent of participation by the populace in the political process income base and growth along with economic infrastructure tax discipline and budgetary record monetary policy and the rate of inflation the government debt burden and debt service experience Factors used in the analysis of foreign currency debt ratings: country’s balance of payments the composition of external balance sheet relative to its external debt (foreign currency) obligations. Study Session 14, Reading 42

- 18. Multiple Discriminate Analysis (MDA) Multiple Discriminate Analysis (MDA) - a statistical technique used to predict default. Z Score Model - one type of MDA Z =1.2X1 + 1.4X2 + 3.3X3 + 0.6X4 + 1.0X5 Where: X1 = Working capital/Total assets (in decimal) X2 = Retained earnings/Total assets (in decimal) X3 = Earnings before interest and taxes/Total assets (in decimal) X4 = Market value of equity/Total liabilities (in decimal) X5 = Sales/Total assets (number of times) Z = Z-score Study Session 14, Reading 42

- 19. Credit Risk Models Structural Models - based on option pricing theory((Brian Scholes Option Pricing Model) Reduced Form Models - do not look “inside the firm,” but instead model directly the probability of default or downgrade Popular Models: Jarrow and Turnbull Model Duffie and Singleton Model Study Session 14, Reading 42

- 20. Three Types of Yield Curves 1. normal or positively sloped yield curve –the most common relationship are yields in which the longer the maturity, the higher the yield 2. flat yield curve - the yield for all maturities is approximately equal. 3. inverted or a negatively sloped yield curve - the relationship between maturities and yields was such that the longer the maturity the lower the yield steepness or slope of the yield curve - The difference between long-term Treasury yields and short-term Treasury yields Study Session 14, Reading 43

- 21. Parallel and Non Parallel Shifts in the Yield Curve shift in the yield curve - the relative change in the yield for each Treasury maturity parallel shift in the yield curve - a shift in which the change in the yield for all maturities is the same nonparallel shift in the yield curve - the yield for different maturities does not change by the same number of basis points Study Session 14, Reading 43

- 22. Types of Non Parallel Shifts 1. A downward shift in the yield curve combined with a steepening of the yield curve. 2. An upward shift in the yield curve combined with a flattening of the yield curve. twist in the slope of the yield curve - a flattening or steepening of the yield curve butterfly shifts - nonparallel shifts in the yield curve that change its curvature Study Session 14, Reading 43

- 23. Construction of Spot Rate Curve shift in the yield curve - the relative change in the yield for each Treasury maturity Selection of Securities Determine the methodology for constructing the curve bootstrapping is used as a repetitive technique Study Session 14, Reading 43

- 24. Selection of Securities Yields should not be biased on the following: 1. Default 2. Embedded options 3. Liquidity 4. Pricing errors Treasury issues that are candidates for inclusion 1. Treasury coupon strips 2. On the run Treasury issues 3. On the run Treasury issues and selected off the run issues 4. All Treasury coupon securities and bills Study Session 14, Reading 43

- 25. Elements of Swaps and Swap Curve Two parties “swapping” payments One party is paying a floating rate and receiving a fixed rate, and The other party is paying a fixed rate and receiving a floating rate. Swap is described in terms of a “rate”. The most common reference rate used in swaps is the 3- month LIBOR. When LIBOR is the reference rate, the swap is referred to as a “LIBOR- based swap”. Study Session 14, Reading 43

- 26. Swap Spread Swap spread reflects the risk of the counterparty to the swap failing to satisfy its obligation. Swap spread primarily reflects credit risk. Value: Swap spread = Swap rate - Government yield on a bond with the same maturity as the swap Study Session 14, Reading 43

- 27. Pure Expectations Theory pure expectations theory - forward rates exclusively represent expected future spot rates The theory neglects the risks inherent in investing in bonds. Two types of risks in bond investments: 1. interest rate risk 2. reinvestment risk Study Session 14, Reading 43

- 28. Liquidity Preference Theory, Preferred Habitat Theory Liquidity Preference Theory - the investors will hold longer-term maturities if they are offered a long-term rate higher than the average of expected future rates by a risk premium that is positively related to the term to maturity Preferred Habitat Theory - rejects the assertion that the risk premium must rise uniformly with maturity Study Session 14, Reading 43

- 29. Measuring Yield Curve Risk yield curve risk - the exposure of a portfolio or position to a change in the term structure Yield curve risk can be measured by changing the spot rate for a particular key maturity and determining the sensitivity of a security or portfolio to this change, holding the spot rate for the other key maturities constant. Study Session 14, Reading 43

- 30. Measuring Historical Yield Volatility yield volatility – Parameter measured the exposure of a portfolio to rate changes depends on how likely and how much interest rates may change Formula: Xt = 100[Ln(yt/yt- 1)] Study Session 14, Reading 43

- 31. Annualizing the Standard Deviation Formula: Daily standard deviation * sqrt (number of days in a year) Some investors and traders use the number of days in the year, 365 days, to annualize the daily standard deviation. Some investors and traders use only either 250 days or 260 days to annualize. Study Session 14, Reading 43

- 32. ARCH Model autoregressive conditional heteroskedasticity (ARCH) model The statistical model used to estimate this time series property of volatility conditional - the value of the variance depends on or is conditional on the value of the random variable heteroskedasticity - the variance is not equal for all values of the random variable Study Session 14, Reading 43

- 33. Determination of benchmark interest rates The Treasury market A sector of the bond market The market for issuers securities Study Session 14, Reading 44

- 34. Generation of Interest Rate Trees The interest rates on the tree are used to generate the cash flows taking into account the embedded option. The interest rates on the tree are used to compute the present value of the cash flows. Study Session 14, Reading 44

- 35. Binomial Model, Trinomial Model, Discrete Time Option Pricing Model interest rate model - a probabilistic description of how interest rates can change over the life of the bond Interest Rate Tree Models: binomial model - valuation model that assume that interest rates can realize one of two possible rates in the next period trinomial models - valuation model that assume that interest rates can take on three possible rates in the next period discrete time option pricing model – a more complex model that assume in creating an interest rate tree that more than three possible rates in the next period can be realized Study Session 14, Reading 44

- 36. Benchmark interest rates Benchmark interest rates can be one of the following: The Treasury market A specific bond sector with a given credit rating A specific issuer Benchmark interest rates can be based on either: An estimated yield curve An estimated spot rate curve Thus there are six potential benchmark interest rates (2*3). Study Session 14, Reading 44

- 37. Spread Measures nominal spread – a spread measured relative to the Treasury yield curve and reflects compensation for credit risk, liquidity risk and option risk zero volatility spread – a spread relative to the Treasury spot rate curve and reflects compensation for credit risk, liquidity risk and option risk option adjusted spread - a spread relative to the Treasury spot rate curve and reflects compensation for credit risk and liquidity risk. Study Session 14, Reading 44

- 38. OAS, Benchmark and Relative Value When the benchmark is the Treasury spot rate curve: the security is expensive if the security OAS is greater than required OAS the security is cheap if the security OAS is less than required OAS if the security OAS is equal to the required OAS, the security is fairly priced When a sector of the bond market with the same credit rating is the benchmark: if the security OAS is greater than the required OAS, the security is cheap if the security OAS is less than the required OAS, the security is expensive if the security OAS is equal to the required OAS, the security is fairly priced Study Session 14, Reading 44

- 39. Backward Induction Methodology It is a discounting process for valuing bonds with a binomial interest rate tree. It refers to the process of discounting distant values in a binomial tree, one node at a time, backwards through time to generate a current value. Study Session 14, Reading 44

- 40. Valuation of Callable Bonds and Putable Bonds using Binomial Model Callable bonds can be valued by modifying the cash flows at each node in the interest rate tree to reflect the cash flow prescribed by the embedded call option according to the call rule. Putable bonds are valued using the same procedure as for a callable bond, except that the relevant cash flows are dictated by the rules governing the exercise of the embedded put option. Study Session 14, Reading 44

- 41. Valuation of Bond with Embedded Options and Floating Rate Notes using Binomial Model bond with an embedded option or options - can be valued by requiring that the value at each node of the tree be adjusted based on whether or not the option will be exercised floating-rate note - the binomial method must be adjusted to account for the fact that a floater pays in arrears. That is, the coupon payment is determined in a period but not paid until the next period. Study Session 14, Reading 44

- 42. Convertible Securities The owner can exchange the bond for the common shares of the issuer. Gives the bondholder the right to buy the common stock of the issuer. Almost all convertible bonds are callable, and some convertible issues are putable. Study Session 14, Reading 44

- 43. Conversion Price, Conversion Ratio and Straight Value conversion ratio - number of common shares for which a convertible bond can be exchanged. conversion price - issue price divided by the conversion ratio. conversion value - value of the stock into which the bond can be converted. conversion value = market price of stock × conversion ratio straight value - value of the bond if it were not convertible market conversion price - price that a convertible bondholder would effectively pay if the bond were purchased and immediately converted. market conversion price = market price of convertible bond/conversion ratio Study Session 14, Reading 44

- 44. Fixed Income, Common Stock and Hybrid Equivalents fixed income equivalent (or a busted convertible) - the straight value is considerably higher than the conversion value so that the security will trade much like a straight security. common stock equivalent - the conversion value is considerably higher than the straight value so that the convertible security trades as if it were an equity instrument. hybrid equivalent - the convertible security trades with characteristics of both a fixed income security and a common stock instrument. Study Session 14, Reading 44

- 45. Advantages and Disadvantages of Convertibles Advantages: reduction in downside risk the price appreciation resulting from an increase in the value of the common stock Disadvantages: the upside potential given-up because a premium per share must be paid when the stock price rises, the bond will underperform because of the conversion premium of the bond Study Session 14, Reading 44

- 46. Mortgages mortgage - a loan secured by the collateral of some specified real estate property which obliges the borrower to make a predetermined series of payments the mortgage rate or contract rate - interest rate on the mortgage loan Study Session 14, Reading 45

- 47. Types of Mortgage Designs mortgage design - a specification of the interest rate, term of the mortgage, and the manner in which the borrowed funds are repaid Types of Mortgage Designs: fixed-rate, level-payment fully amortized mortgages adjustable-rate mortgages balloon mortgages growing equity mortgages reverse mortgages tiered payment mortgages Study Session 14, Reading 45

- 48. Types of Mortgage Backed Securities 1. residential mortgage-backed securities - backed by residential mortgage loans Sectors: agency mortgage backed securities - issued by federal agencies non agency mortgage-backed securities - issued by private entities Residential mortgage-backed securities include: mortgage passthrough securities collateralized mortgage obligations stripped mortgage-backed securities. 2. commercial mortgage-backed securities - backed by commercial loans Study Session 14, Reading 45

- 49. Residential Mortgage Design Most common mortgage design in the United States: fixed-rate mortgage level-payment mortgage fully amortized mortgage. Features: the mortgage rate is fixed for the life of the mortgage loan the dollar amount of each monthly payment is the same for the life of the mortgage loan when the last scheduled monthly mortgage payment is made, the remaining mortgage balance is zero Study Session 14, Reading 45

- 50. Residential Mortgage Servicing Fee servicing fee - a portion of the mortgage rate Servicing of a mortgage loan involves: collecting monthly payments and forwarding proceeds to owners of the loan sending payment notices to mortgagors reminding mortgagors when payments are overdue maintaining records of principal balances initiating foreclosure proceedings if necessary furnishing tax information to borrowers (i.e. mortgagors) when applicable. Study Session 14, Reading 45

- 51. Residential Mortgage Prepayment prepayment - a payment made in excess of the monthly mortgage payment curtailment - When a prepayment is not for the entire outstanding balance prepayment risk - the risk when amount and timing of the cash flow from a mortgage loan are not known with certainty lockout period or penalty period - a period of time over which if the loan is prepaid in full or in excess of a certain amount of the outstanding balance, there is a prepayment penalty Study Session 14, Reading 45

- 52. Types of Mortgage Passthrough Securities mortgage passthrough security - created when one or more holders of mortgages form a collection (pool) of mortgages and sell shares or participation certificates in the pool. Types: 1. agency mortgage pass through securities – backed by an agency security Underwriting Standards: conforming mortgage nonconforming mortgage 2. non agency mortgage pass through securities - are nonconforming mortgages used as collateral for mortgage pass-through securities and are privately issued Study Session 14, Reading 45

- 53. Weighted Average Coupon and Weighted Average Maturity of Mortgage Passthrough Securities weighted average coupon rate(WAC) - found by weighting the mortgage rate of each mortgage loan in the pool by the percentage of the mortgage outstanding relative to the outstanding amount of all the mortgages in the pool. weighted average maturity(WAM) - found by weighting the remaining number of months to maturity for each mortgage loan in the pool by the amount of the outstanding mortgage balance. Study Session 14, Reading 45

- 54. Measuring the Prepayment Rates of Mortgage Passthrough Securities single monthly mortality rate(SMM) - ratio of the prepayment in a month and the amount available to prepay that month Formula: SMM = (Prepayment in month) / (Beginning mortgage balance for month t – Scheduled Principal Payment in month t) Formula: Given an assumed SMM for month t: (Prepayment in month) = SMM * (Beginning mortgage balance for month t – Scheduled Principal Payment in month t) Study Session 14, Reading 45

- 55. Conditional Prepayment Rate (CPR) of Mortgage Passthrough Securities Formula: Given the SMM for a given month CPR = 1 - (1 - SMM)12 Formula: Given a CPR SMM = 1 – (CPR)1/12 Study Session 14, Reading 45

- 56. PSA Prepayment Benchmark Expressed as a monthly series of CPRs. It assumes that prepayment rates are low for newly originated mortgages and then will speed up as the mortgages become seasoned. It assumes the following prepayment rates for 30-year mortgages a CPR of 0.2% for the first month, increased by 0.2% per year per month for the next 30 months until it reaches 6% per year, and a 6% CPR for the remaining months. Mathematically, 100 PSA can be expressed as follows: if t < 30 then CPR = 6% (t/30) if t > 30 then CPR = 6% Study Session 14, Reading 45

- 57. Average Life of Mortgage Passthrough Securities weighted average life or average life - measure widely used by market participants Formula: Average Life = ∑ (t * Projected Principal received at time t) / (12 * Total Principal) Study Session 14, Reading 45

- 58. Factors affecting Prepayment Behaviour Prevailing mortgage rate Housing turnover Characteristics of the underlying residential mortgage loans Study Session 14, Reading 45

- 59. Contraction and Extension Risk of Mortgage Passthrough Securities contraction risk - undesirable consequences of declining interest rates: MBS exhibit negative convexity cash flows must be reinvested at a lower rate. extension risk - the drop in bond prices and the slowing of prepayments as interest rates increase Study Session 14, Reading 45

- 60. Collateralized Mortgage Obligations (CMOs) Collateralized mortgage obligations are bond classes created by redirecting the interest and principal from a pool of pass throughs or whole loans. CMOs are securities issued against a pool of mortgages for which the cash flows have been allocated to different classes called tranches. Study Session 14, Reading 45

- 61. Design of CMOs Sequential-pay tranches - a common arrangement for separating mortgage cash flows into classes to create CMOs where each class of bond is retired sequentially. Planned Amortization Class (PAC) tranches - the most common type of CMO, have a payment schedule that is established within a range of prepayment speeds called the initial PAC collar. Study Session 14, Reading 45

- 62. Stripped Mortgage Backed Security stripped mortgage-backed security - a derivative mortgagebacked security that is created by redistributing the interest and principal payments to two different classes. Classes: principal-only mortgage strip (PO) - a class of securities that receive only the principal payment portion of each mortgage payment. The PO exhibits some negative convexity at low rates. interest-only mortgage strip (IO) – a classes that receive only the interest component of each payment. The IO price is positively related to mortgage rates at low current rates. Study Session 14, Reading 45

- 63. Non Agency Residential Mortgage Backed Security non agency MBS (non agency securities) - issued by private entities and are usually backed with nonconforming mortgage loans nonconforming mortgage - loans that fail to meet the agency’s underwriting standards Non agency security cash flows are affected by mortgage default rates and thus require credit enhancement Study Session 14, Reading 45

- 64. Commercial Mortgage Backed Security commercial mortgage-backed securities - backed by a pool of commercial mortgage loans—loans on income-producing property. Features: structured as nonrecourse loans on two key ratios to assess the credit risk Debt-to-service coverage ratio Loan-to-value ratio. Study Session 14, Reading 45

- 65. Call Protection for CMBS Degree of call protection available investor: At the loan level From the actual CMBS structure. Methods of call protection at the loan level includes: Prepayment lock outs Defeasance Penalty fees Yield maintenance charges Study Session 14, Reading 45

- 66. Parties in a Securitization Process Seller - originates the loans and sells them to the issuer/trust. Issuer/trust - buys the loans from the seller and issues the ABS. Servicer - who services the original loans. Study Session 14, Reading 46

- 67. Home Equity Loans Closed-end Home Equity Loans (HELs) - secondary mortgages that are structured just like a standard fixed rate, fully amortizing mortgage. Distinctive Feature: credit traits of the borrowers Structure: non-accelerating senior tranches planned amortization class (PAC) tranches. Study Session 14, Reading 52

- 68. Manufactured Housing Backed Securities manufactured housing asset backed securities - backed by loans for manufactured homes. Distinctive feature: relatively stable prepayments Study Session 14, Reading 52

- 69. Auto Loan Backed Securities Auto loan-backed securities - backed by loans for automobiles Distinctive Features: Prepayments are caused by sales and tradeins, the repossession/resale process, insurance payoffs due to thefts and accidents, borrower payoffs, and refinancing. Auto loans have 36- to 72-month maturities and are issued by the financial subsidiaries of auto manufacturers, commercial banks, credit unions, etc. Study Session 14, Reading 52