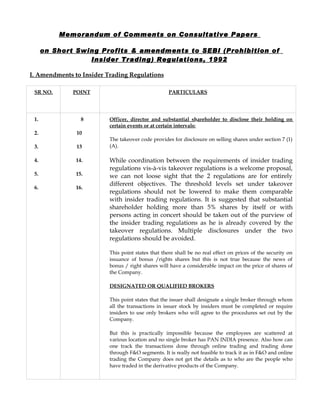

Insider Trading Regulations

- 1. Memorandum of Comments on Consultative Papers on Short Swing Profits & amendments to SEBI (Prohibition of Insider Trading) Regulations, 1992 I. Amendments to Insider Trading Regulations SR NO. POINT PARTICULARS 1. 8 Officer, director and substantial shareholder to disclose their holding on certain events or at certain intervals: 2. 10 The takeover code provides for disclosure on selling shares under section 7 (1) 3. 13 (A). 4. 14. While coordination between the requirements of insider trading regulations vis-à-vis takeover regulations is a welcome proposal, 5. 15. we can not loose sight that the 2 regulations are for entirely different objectives. The threshold levels set under takeover 6. 16. regulations should not be lowered to make them comparable with insider trading regulations. It is suggested that substantial shareholder holding more than 5% shares by itself or with persons acting in concert should be taken out of the purview of the insider trading regulations as he is already covered by the takeover regulations. Multiple disclosures under the two regulations should be avoided. This point states that there shall be no real effect on prices of the security on issuance of bonus /rights shares but this is not true because the news of bonus / right shares will have a considerable impact on the price of shares of the Company. DESIGNATED OR QUALIFIED BROKERS This point states that the issuer shall designate a single broker through whom all the transactions in issuer stock by insiders must be completed or require insiders to use only brokers who will agree to the procedures set out by the Company. But this is practically impossible because the employees are scattered at various location and no single broker has PAN INDIA presence. Also how can one track the transactions done through online trading and trading done through F&O segments. It is really not feasible to track it as in F&O and online trading the Company does not get the details as to who are the people who have traded in the derivative products of the Company.

- 2. This proposal negates the overall scheme of ‘principle based approach to regulate rather than a rule based approach’. It can be considered that an Insider is supposed to trade in the shares of the company, after observing the trading window freeze, only after pre-clearance of trade and give event based/periodical disclosures. After these regulatory provisions, a third party confirmation is not required. A company as such is not expected to facilitate trading in its shares by the insiders. Empanelment of designated brokers may amount to facilitating such trading. It is also a common knowledge that both the Brokers as well as investors are discreet in selecting each other and therefore imposing a broker over the employees may not be a good idea. The existing provisions are self balancing and an additional requirement of a confirmation from a broker is not required. DERIVATIVES AMENDMENT It is difficult to monitor the derivative products as there is daily variation of premium in F&O transactions. Unlike Beneficial Position (BENPOS) in the case of trading in shares, there is no means to cross check the information given by insiders. In the case of dealing through brokers, information can be taken from them. However a lot of transactions also take place through on-line trading. SEBI should prescribe specific formats for disclosure of dealing in derivative products. SEBI should provide a transparent mechanism to handle this. It is also important to clarify as to how and to what extent other provisions like pre-clearance of trade, minimum holding period of 30 days, event based reporting at every 2% change etc. will be applicable for trading in derivatives by insider. TIPPEE LIABILITY At the Company level it is difficult to monitor Tippee Liability. THE PENAL CLAUSE Substantial shareholder if not an employee need not be governed in insider trading. II. Short Swing Profits

- 3. Clause Brief Comments & Suggestions 4 ………the same securities were bought Comments: the definition of ‘securities’ and sold within six months of each include derivatives as per Securities other……. Contract Regulation Act. In the present scenario, the derivative contracts have a maximum tenure of 3 months. Hence this clause cannot be enforced in the case of derivatives. Suggestion: Please consider whether the regulation can be modified to include a lesser holding period for derivative contracts or the same be exempted from the requirement of minimum holding period. 5 ……..all officers of the company who Comments: companies form various trusts are beneficial owners, directly or for the benefit of its employees (including indirectly, of ten percent or more of any class of securities…… ESOP trust) which hold shares in the said company. Such trust may hold more than 10% stake in the company. Since all the employees would be beneficiaries of such trust, it would amount to covering all the employees of the company within the definition of ‘designated persons’. Suggestion: The word beneficiaries may be substituted by “Persons” holding more than 10%. The definition of ‘key management personnel’ should also be given. 6 …….employee benefit plan…… Comments: Please specifically clarify whether the shares allotted under Employee Stock Option schemes (ESOP) can be sold within 6 months of allotment. A demat account can have both, shares on conversion of stock option as well as through purchase of shares. In this situation, if shares under ESOP are not to be held for 6 months since allotment, SEBI needs to prescribe a method to identify shares purchased for holding for 6 months. We suggest LIFO method.