Check Today's Report 13/11/2015

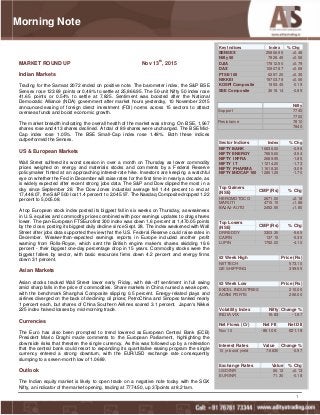

- 1. 1 Key Indices Index % Chg SENSEX 25866.95 +0.48 Nifty 50 7828.45 +0.58 DJIA 17812.50 +0.79 DAX 10907.87 +0.69 FTSE 100 6297.20 +0.35 NIKKEI 19703.78 +0.06 KOSPI Composite 1993.45 -0.19 SSE Composite 3618.14 -0.89 Nifty Support 7740 7700 Resistance 7810 7840 Sector Indices Index % Chg NIFTY BANK 16836.00 -0.98 NIFTY ENERGY 7885.60 -3.54 NIFTY INFRA 2689.95 -1.85 NIFTY IT 11214.20 -1.73 NIFTY PHARMA 11618.30 -3.09 NIFTY MIDCAP 100 12851.25 -1.70 Top Gainers (NSE) CMP (Rs) % Chg HEROMOTOCO 2671.00 +2.18 MARUTI 4715.15 +1.88 BAJAJ-AUTO 2452.55 +1.80 Top Losers (NSE) CMP (Rs) % Chg DRREDDY 3303.35 -5.65 CAIRN 137.15 -5.35 LUPIN 1792.00 -4.10 52 Week High Price (Rs) NIITTECH 573.10 GE SHIPPING 399.55 52 Week Low Price (Rs) EXCEL INDUSTRIES 210.00 ADANI PORTS 266.00 Volatility Index Nifty Change % INDIA VIX 16.83 -1.67 Net Flows (Cr) Net FII Net DII Nov 10 -861.06 621.18 Interest Rates Value Change % 10 yr bond yield 7.6830 -0.57 Exchange Rates Value % Chg USD/INR 66.12 +0.13 EUR/INR 71.30 -0.18 MARKET ROUND UP Nov 13th , 2015 Indian Markets Trading for the Samvat 2072 ended on positive note. The barometer index, the S&P BSE Sensex rose 123.69 points or 0.48% to settle at 25,866.95. The 50-unit Nifty 50 index rose 41.65 points or 0.54% to settle at 7,825. Sentiment was boosted after the National Democratic Alliance (NDA) government after market hours yesterday, 10 November 2015 announced easing of foreign direct investment (FDI) norms across 15 sectors to attract overseas funds and boost economic growth. The market breadth indicating the overall health of the market was strong. On BSE, 1,967 shares rose and 413 shares declined. A total of 89 shares were unchanged. The BSE Mid- Cap index rose 1.05%. The BSE Small-Cap index rose 1.48%. Both these indices outperformed the Sensex. US & European Markets Wall Street suffered its worst session in over a month on Thursday as lower commodity prices weighed on energy and materials stocks and comments by a Federal Reserve policymaker hinted at an approaching interest-rate hike. Investors are keeping a watchful eye on whether the Fed in December will raise rates for the first time in nearly a decade, as is widely expected after recent strong jobs data. The S&P and Dow dipped the most in a day since September 28. The Dow Jones industrial average fell 1.44 percent to end at 17,448.07, the S&P 500 lost 1.4 percent to 2,045.97. The Nasdaq Composite dropped 1.22 percent to 5,005.08. A top European stock index posted its biggest fall in six weeks on Thursday, as weakness in U.S. equities and commodity prices combined with poor earnings updates to drag shares lower. The pan-European FTSEurofirst 300 index was down 1.6 percent at 1,470.05 points by the close, posting its biggest daily decline since Sept. 28. The index weakened with Wall Street after jobs data supported the view that the U.S. Federal Reserve could raise rates in December. Weaker-than-expected earnings reports in Europe included another profit warning from Rolls-Royce, which sent the British engine maker's shares skidding 19.6 percent - their biggest one-day percentage drop in 15 years. Commodity stocks were the biggest fallers by sector, with basic resources firms down 4.2 percent and energy firms down 3.1 percent. Asian Markets Asian stocks tracked Wall Street lower early Friday, with risk-off sentiment in full swing amid sharp falls in the price of commodities. Share markets in China nursed a weak open, with the benchmark Shanghai Composite slipping 0.5 percent. Energy-related plays and airlines diverged on the back of declining oil prices; PetroChina and Sinopec tanked nearly 1 percent each, but shares of China Southern Airlines soared 3.1 percent. Japan's Nikkei 225 index halved losses by mid-morning trade. Currencies The Euro has also been prompted to trend lowered as European Central Bank (ECB) President Mario Draghi made comments to the European Parliament, highlighting the downside risks that threaten the single currency. As this was followed up by a reiteration that the central bank could resort to expanding its quantitative easing program the single currency entered a strong downturn, with the EUR/USD exchange rate consequently slumping to a seven-month low of 1.0689. Outlook The Indian equity market is likely to open trade on a negative note today with the SGX Nifty, an indicator of the market opening, trading at 7774.50, up 37points at 8.21am. Morning Note

- 2. 2 For forthcoming Board Meeting, click on the following link http://www.bseindia.com/corporates/board_meeting.aspx? expandable=0 News Flash Economy News Big reforms push: Govt opens up 15 sectors for FDI including construction, defence, retail and plantation with an aim to ease foreign direct investment in the country. The road map for the phasing out of corporate tax exemptions and reduction in the tax rate to 25% is being drawn up. Raghuram Rajan Appointed as Vice Chairman of Bank for International Settlements Festival Season Brings in Cheer; Car Sales Rise 22% in October Piyush Goyal has asserted that the newly unveiled debt restructuring plan for DISCOMs, will eventually lead to a saving of Rs 1,80,000 crore annually General Electric and Alstom have won contracts worth a combined $5.6 billion (~ 37,100Cr) to supply India's railways with new locomotives, as the vast but dilapidated state-owned network looks to foreign companies to help it modernise. US expects India to contribute more to tackle climate change Corporate News Hindalco Industries net profit rose 31.10% to Rs 103.27 crore on 6.43% increase in total income to Rs 9342.14 crore in Q2 September 2015 over Q2 September 2014. PTC India Financial Services (PFS) posted 454% surge in net profit to Rs 211.25 crore on 121.8% growth in total income to Rs 442.29 crore in Q2 September 2015 over Q2 September 2014. Profit from sale of investments stood at Rs 206.93 crore in Q2 September 2015, PFS said. Maxwell Industries reported net loss of Rs 6.27 crore in Q2 September 2015 compared with net profit of Rs 1.13 crore in Q2 September 2014. Dr Reddy's Laboratories extending its intraday slide after the US drug regulator ordered a third-party audit across the manufacturing network of the company. Financial Technologies said it entered into two different agreements for sale of additional 3.63% stake in Indian Energy Exchange for nearly Rs 100 crore. State Trading Corporation of India reported net profit of Rs 1.02 crore in Q2 September 2015 as compared to net loss of Rs 2.33 crore in Q2 September 2014. The stock debuted at Rs 856 on BSE, a premium of 11.90% compared with its initial public offer (IPO) price. The company intends to use the proceeds of the fresh issue of shares primarily to retire its aircraft lease obligations. It will utilize Rs 1165.66 crore to retire some of the exiting aircraft lease obligations. NHPC net profit surged 72.6% to Rs 1180.87 crore on 21% rise in total income to Rs 2813.71 crore in Q2 September 2015 over Q2 September 2014. Novelis Inc. reported a net loss of $13 million for Q2 September 2015 against net profit of $38 million in Q2 September 2014. Net sales declined 12.32% to $2482 million in Q2 September 2015 over Q2 September 2014. HPCL reported net loss of Rs 320.50 crore in Q2 September 2015 compared with net profit of Rs 850.21 crore in Q2 September 2014. Pfizer net profit surged 3402.3% to Rs 61.64 crore on 6.4% increase in net sales to Rs 506.45 crore in Q2 September 2015 over Q2 September 2014. Vodafone India profit up 17.3% in H1 FY16; gets ready for IPO

- 3. 3 Commodities News Gold fell to a fresh five and a half year low, as investors continued to stake their bets on a December interest rate hike by the Federal Reserve following comments from a host of influential policymakers from the U.S. central bank on Thursday. Gold for December delivery traded in a broad range between $1,073.40 and $1,088.80 an ounce before settling at $1,080.50, down 4.40 or 0.41% on the session. Since peaking above $1,180 an ounce in late-October, gold futures have now closed lower in 10 of the last 12 sessions erasing all of their gains from the last three months. At one point in Thursday's session, the precious metal slumped to its lowest level since February 4, 2010, when it traded at $1,062.40. Gold has not dipped below $1,000 an ounce since 2009. Oil prices fell Thursday to their lowest levels since August as U.S. inventory data showed a seventh straight increase in U.S. supplies. U.S. crude inventories rose by 4.2 million barrels last week, the U.S. Energy Information Administration said Thursday. Analysts surveyed by The Wall Street Journal had expected an increase of 1.1 million barrels. Total supplies of crude oil and refined products rose 2.6 million barrels to 1.3 billion barrels, near all-time highs. December delivery settled down $1.18, or 2.7%, to $41.75 a barrel on the New York Mercantile Exchange. Brent, the global benchmark, fell $1.75, or 3.8%, to $44.06 a barrel on ICE Futures Europe. Natural gas prices swung between small gains and losses near an eight-day low on Thursday, as market participants looked ahead to fresh weekly information on U.S. gas inventories to gauge the strength of demand for the fuel. Natural gas for delivery in December on the New York Mercantile Exchange tacked on 1.1 cents, or 0.51%, to trade at $2.274 per million British thermal units during U.S. morning hours. It earlier fell to $2.234, the lowest since November 2. Commodity Pivot Table for 13/11/2015 Scrip Pivot point R1 R2 R3 S1 S2 S3 ALUMINIUM 30-Nov-15 98.97 99.43 100.22 100.68 98.18 97.72 96.93 ALUMINIUM 31-Dec-15 100.23 100.62 101.28 101.67 99.57 99.18 98.52 CARDAMOM 13-Nov-15 644.77 666.03 695.77 717.03 615.03 593.77 564.03 CARDAMOM 15-Dec-15 757.53 762.07 765.13 769.67 754.47 749.93 746.87 COPPER 30-Nov-15 319.28 321.97 325.68 328.37 315.57 312.88 309.17 CRUDEOIL 19-Nov-15 2808.33 2852.67 2934.33 2978.67 2726.67 2682.33 2600.67 CRUDEOIL 18-Dec-15 2904.00 2937.00 2998.00 3031.00 2843.00 2810.00 2749.00 GOLD 4-Dec-15 25357.00 25512.00 25695.00 25850.00 25174.00 25019.00 24836.00 LEAD 30-Nov-15 106.58 107.32 107.88 108.62 106.02 105.28 104.72 LEAD 31-Dec-15 107.60 108.20 108.70 109.30 107.10 106.50 106.00 NATURALGAS 24-Nov-15 150.83 153.07 155.63 157.87 148.27 146.03 143.47 NATURALGAS 28-Dec-15 164.23 165.87 168.33 169.97 161.77 160.13 157.67 NICKEL 30-Nov-15 626.90 631.70 640.30 645.10 618.30 613.50 604.90 NICKEL 31-Dec-15 632.87 637.83 646.57 651.53 624.13 619.17 610.43 SILVER 4-Dec-15 34030.00 34309.00 34729.00 35008.00 33610.00 33331.00 32911.00 ZINC 30-Nov-15 105.80 106.95 107.75 108.90 105.00 103.85 103.05 ZINC 31-Dec-15 106.95 108.05 108.85 109.95 106.15 105.05 104.25

- 4. 4 Key Corporate Action Symbol Purpose Ex-Date Record Date ATULAUTO Interim Dividend - Rs 2.75/- Per Share 10-Nov-15 13-Nov-15 TIDEWATER Interim Dividend - Rs 150 Per Share 10-Nov-15 13-Nov-15 SONATSOFTW Interim Dividend - Re 3.50/- Per Share (Purpose Revised) 10-Nov-15 13-Nov-15 AARTIDRUGS Interim Dividend - Rs 2.25/- Per Share (Purpose Revised) 10-Nov-15 14-Nov-15 HCL-INSYS Annual General Meeting 10-Nov-15 - LGBBROSLTD Interim Dividend - Rs 2.50/- Per Share (Purpose Revised) 10-Nov-15 13-Nov-15 MANAKSIA Interim Dividend - Rs 2/- Per Share (Purpose Revised) 10-Nov-15 14-Nov-15 ONGC Interim Dividend - Rs 4.50/- Per Share (Purpose Revised) 10-Nov-15 13-Nov-15 GULPOLY Interim Dividend - Rs 1.75 Per Share 10-Nov-15 13-Nov-15 MRF Interim Dividend - Rs 3/- Per Share 10-Nov-15 13-Nov-15 DCMSHRIRAM Interim Dividend-Rs 1.20/- Per Share 13-Nov-15 16-Nov-15 SUNDRMFAST Interim Dividend - Re 0.85/- Per Share 13-Nov-15 16-Nov-15 ACROPETAL Annual General Meeting 16-Nov-15 - L&TINFRA Interest Payment 16-Nov-15 17-Nov-15 HEXAWARE Interim Dividend Rs 2.25 Per Share 16-Nov-15 17-Nov-15 L&TINFRA Interest Payment 16-Nov-15 17-Nov-15 CARERATING Interim Dividend Rs 6/- Per Share 16-Nov-15 17-Nov-15 PAGEIND Interim Dividend 16-Nov-15 17-Nov-15 GABRIEL Interim Dividend Re 0.45 Per Share 16-Nov-15 17-Nov-15 MTEDUCARE Interim Dividend 16-Nov-15 17-Nov-15 PIIND Interim Dividend - Rs 1.20/- Per Share 17-Nov-15 18-Nov-15 IMPAL Interim Dividend Rs 2.50 Per Share 17-Nov-15 18-Nov-15 PPAP Interim Dividend Re 1/- Per Share 17-Nov-15 18-Nov-15 PRECWIRE Interim Dividend Rs 2.50 Per Share 18-Nov-15 19-Nov-15 INGERRAND Interim Dividend - Rs 3/- Per Share 18-Nov-15 19-Nov-15 Options Strategy The synthetic long stock is an options strategy used to simulate the payoff of a long stock position. It is entered by buying at-the-money calls and selling an equal number of at-the- money puts of the same underlying stock and expiration date. This is an unlimited profit, unlimited risk options trading strategy that is taken when the options trader is bullish on the underlying security but seeks a low cost alternative to purchasing the stock outright. Stock – AXISBANK Buy – 480CE – 12.75 CMP –481.71 Sell – 480PE – 12.25 -30000 -20000 -10000 0 10000 20000 30000 40000 460 470 480 490 500 510 AXISBANK @ Expiry Net Payoff

- 5. 5 Weekly consolidated call tracker Segment – NSE Cash and F&O Date Stock Trade Entry Stoploss Target1 Target2 Booked Remark 9/Nov/15 DISHTV BUY 96 95 97 98 98 Target 9/Nov/15 POLARIS BUY 205 203 207 209 207 Target 9/Nov/15 IPCALAB BUY 713 706 720 727 713 Exit at cost 9/Nov/15 NECLIFE BUY 51 50.5 51.5 52 Avoided 9/Nov/15 AMARAJABAT BUY 910 900 919 928 900 SL 9/Nov/15 PFC SELL 225.8 228 223.5 221 228 SL 10/Nov/15 BHARATFORG BUY 884 876 892 901 876 SL 10/Nov/15 NIITECH BUY 612 606 618 624 618 Target 10/Nov/15 STAR BUY 1269 1257 1280 1293 1257 SL 10/Nov/15 HINDZINC SELL 150.5 153 149 147.5 147.5 Target 10/Nov/15 IDEA SELL 131.8 133.1 130.5 129 129 Target 10/Nov/15 KEC SELL 136.4 137.7 135.1 134 137.5 SL 9/Nov/15 ICICIBANK Nov Fut SELL 262.35 264.9 260 257.5 260 Target 9/Nov/15 CAIRN Nov Fut SELL 145.95 147.6 144.5 143 144.5 Target 10/Nov/15 PFC Nov Fut SELL 226.9 230 224.5 221 230 SL 10/Nov/15 BHEL Nov Fut SELL 180.20 182.8 178.2 176.4 177.65 Target 10/Nov/15 ONGC Nov Fut SELL 240.35 243 237.5 235 238.1 Target 10/Nov/15 CAIRN Nov Fut SELL 140.8 142.25 139.1 137.5 138.1 Target Segment – MCX Date Commodity Trade Entry Stoploss Target1 Target2 Booked Remark 9/Nov/15 ZINC Nov Fut SELL 109.80 110.8 108.8 107.8 108.55 Target 9/Nov/15 CRUDE Nov Fut SELL 2977 3009 2950 2940 2940 Target 9/Nov/15 SILVER Dec Fut SELL 35020 34920 34820 35120 35120 SL 10/Nov/15 ZINC Nov Fut SELL 106.80 107.9 105.55 104.55 Open 10/Nov/15 CRUDE Nov Fut SELL 2940 2970 2910 2985 2927 Target 10/Nov/15 COPPER Nov Fut SELL 327 330 324 321 325.6 Target Performance Report Equity + F&O (Rs) Commodity (Rs) Total Profit Made Consolidated 222105.51 181377.50 Total Profit Made this Week 23267.30 9650.00 Disclaimer: This report is only for the information of our customers. Recommendations, opinions or suggestions are given with the understanding that readers acting on this information assume all risks involved. The information provided herein is not to be constructed as an offer to buy or sell securities of any kind. ATS Wealth Managers Pvt Ltd and/or its group companies do not as assume any responsibility or liability resulting from the use of such information