Check Today's Report - 23.11.2015

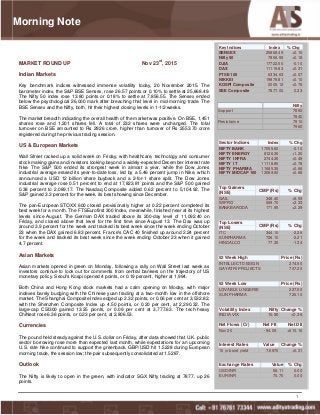

- 1. 1 Key Indices Index % Chg SENSEX 25868.49 +0.10 Nifty 50 7856.55 +0.18 DJIA 17722.50 -0.10 DAX 11119.83 +0.31 FTSE 100 6334.63 +0.07 NIKKEI 19879.81 +0.10 KOSPI Composite 2005.12 +0.76 SSE Composite 7877.00 0.33 Nifty Support 7860 7840 Resistance 7910 7960 Sector Indices Index % Chg NIFTY BANK 17055.60 -0.10 NIFTY ENERGY 8126.35 +1.20 NIFTY INFRA 2744.35 +0.49 NIFTY IT 11118.85 +0.78 NIFTY PHARMA 11685.35 +0.66 NIFTY MIDCAP 100 13089.90 +0.66 Top Gainers (NSE) CMP (Rs) % Chg GAIL 348.40 +9.59 WIPRO 569.70 +2.33 BANKBARODA 171.95 +2.29 Top Losers (NSE) CMP (Rs) % Chg ITC 344.10 -2.26 SUNPHARMA 726.10 -2.21 HINDALCO 77.35 -1.34 52 Week High Price (Rs) INTELLECT DESIGN 274.50 GAYATRI PROJECTS 707.20 52 Week Low Price (Rs) LOVABLE LINGERIE 227.50 SUN PHARMA 726.10 Volatility Index Nifty Change % INDIA VIX 15.90 +0.36 Net Flows (Cr) Net FII Net DII Nov 20 -94.09 +610.16 Interest Rates Value Change % 10 yr bond yield 7.6970 +0.31 Exchange Rates Value % Chg USD/INR 66.11 0.00 EUR/INR 70.70 0.00 MARKET ROUND UP Nov 23rd , 2015 Indian Markets Key benchmark indices witnessed immense volatility today, 20 November 2015. The barometer index, the S&P BSE Sensex, rose 26.57 points or 0.10% to settle at 25,868.49. The Nifty 50 index rose 13.80 points or 0.18% to settle at 7,856.55. The Sensex ended below the psychological 26,000 mark after breaching that level in mid-morning trade. The BSE Sensex and the Nifty, both, hit their highest closing levels in 1-1/2 weeks. The market breadth indicating the overall health of the market was positive. On BSE, 1,451 shares rose and 1,201 shares fell. A total of 232 shares were unchanged. The total turnover on BSE amounted to Rs 2926 crore, higher than turnover of Rs 2553.70 crore registered during the previous trading session. US & European Markets Wall Street racked up a solid week on Friday, with healthcare, technology and consumer stock making gains and investors looking beyond a widely-expected December interest rate hike. The S&P 500 ended its strongest week in almost a year, while the Dow Jones industrial average erased its year-to-date loss, led by a 5.46 percent jump in Nike, which announced a USD 12 billion share buyback and a 2-for-1 share split. The Dow Jones industrial average rose 0.51 percent to end at 17,823.81 points and the S&P 500 gained 0.38 percent to 2,089.17. The Nasdaq Composite added 0.62 percent to 5,104.92. The S&P gained 3.3 percent for the week, its best showing since December. The pan-European STOXX 600 closed provisionally higher at 0.22 percent completed its best week for a month. The FTSEurofirst 300 Index, meanwhile, finished near at its highest levels since August. The German DAX traded above its 200-day level of 11,092.40 on Friday, and closed above that level for the first time since August 13. The Dax was up around 3.9 percent for the week and tracked its best week since the week ending October 23 when the DAX gained 6.83 percent. France's CAC 40 finished up around 2.24 percent for the week and tracked its best week since the week ending October 23 when it gained 4.7 percent. Asian Markets Asian markets opened in green on Monday, following a rally on Wall Street last week as investors continue to look out for comments from central bankers on the trajectory of US monetary policy. Seoul's Kospi opened 4 points, or 0.19 percent, higher at 1,994. Both China and Hong Kong stock markets had a calm opening on Moday, with major indexes barely budging with the Chinese yuan trading at a two-month low in the offshore market. The Shanghai Composite Index edged up 2.32 points, or 0.06 per cent at 3,532.82, with the Shenzhen Composite Index up 4.50 points, or 0.20 per cent, at 2,290.32. The large-cap CSI300 gained 13.25 pionts, or 0.09 per cent at 3,777.63. The tech-heavy ChiNext rose 6.36 points, or 0.23 per cent, at 2,806.53. Currencies The pound held steady against the U.S. dollar on Friday, after data showed that U.K. public sector borrowing rose more than expected last month, while expectations for an upcoming U.S. rate hike continued to support the greenback. GBP/USD hit 1.5228 during European morning trade, the session low; the pair subsequently consolidated at 1.5287. Outlook The Nifty is likely to open in the green, with indicator SGX Nifty trading at 7877, up 26 points. Morning Note

- 2. 2 For forthcoming Board Meeting, click on the following link http://www.bseindia.com/corporates/board_meeting.aspx? expandable=0 News Flash Economy News Islamists attack luxury hotel in Mali capital, TV says commandos free 80 hostages. Fitch Ratings said on Friday a proposed 23.6 percent hike in salaries and pensions for about 10 million current and former government employees in India could hurt the country's finances and underscore the weakness in its sovereign credit profile. State finance ministers called on Friday for a proposed Goods and Services Tax (GST) to be simplified but did not discuss what rate it should be set at, indicating scant progress on Prime Minister Narendra Modi's priority reform. Duerr buys Indian cleaning systems supplier Mhitraa Government Calls for Comments on Proposed Plan of Phasing-Out Exemptions and Deductions. It intends to bring down Rate of Corporate Tax from 30% to 25% Banks need to extract more from IT investments as Basel-III will create technological challenges: Study Corporate News Swaraj Automotives standalone net profit declines 18.31% in the September 2015 quarter. Sales rise 6.37% to Rs 25.90 crore Innovation Software Exports reports standalone net loss of Rs 0.01 crore in the September 2015 quarter. Reported sales nil. Indian Infotech and Software consolidated net profit declines 49.61% in the September 2015 quarter. Sales rise 1775.23% to Rs 40.13 crore. Vedanta may scale back expansion on soft aluminium prices. Earlier this month, LME aluminium prices softened to level below $1,500 a tonne on weak demand. Fast-food majors on the fast track online. With offline business weakening, quick- service brands change focus Two US law firms threaten class action law suit against Dr Reddy's. Company dismisses allegations about alleged misrepresentation of facts Bosch India inaugurates new facility in Chennai. This will be the 15th facility for Bosch in India Mesco Steel kicks off work on expansion. Company expanding its steel making capacity from 1 mtpa to 3.5 mtpa Dr Reddy's countersues AstraZeneca over purple pill. The company has alleged that AstraZeneca 'knew' about its plans to use the same colour in the capsules Intellect Design Arena announced the launch of its Digital Distribution Suite for the UK Life and Pension markets. New Delhi Television said its executives and NDTV Studios yesterday, 19 November 2015 received a show cause notice from the Directorate of Enforcement . Kolte Patil Developers announced that chief executive officer of the company has stepped down from his position to pursue other opportunities. Jubilant FoodWorks said that Domino's Pizza India has partnered with Zippr, a Hyderabad based startup that is solving the problem of complex addresses. Hindalco, Birla Carbon to raise $2.4-bn via bonds. Both companies looking to restructure loans RPP Infra Projects said that the order is for improving & widening road on NH-17 & NH-48 in identified stretches of New Mangalore Port Road Connectivity Project. The work is to be completed within 9 months.

- 3. 3 Commodities News U.S. crude futures closed moderately higher on Friday, as the count of domestic oil rigs fell slightly last week resuming their trend downward after a brief impasse a week earlier. On the New York Mercantile Exchange, WTI crude for January delivery traded in a range of $41.37 and $42.05 a barrel before settling at $41.88, up 0.15 or 0.35% on the session. After falling below $40 a barrel earlier this week for the first time in 10 weeks, U.S. crude futures rallied to close the week up by more than 2%. WTI crude is still near August lows when it fell to its lowest levels since the height of the Financial Crisis. Investors have kept a close eye on the total of domestic oil rigs online, amid forecasts for sharp declines in U.S. output in 2016. Last week, production held steady at approximately 9.18 million barrels per day. In June, U.S. output surged above 9.6 million bpd, its highest level in more than 40 years. Extending gains for the third straight day, gold prices advanced by 0.27 percent to Rs 25,530 per 10 grams in futures trade on Friday as speculators enlarged positions, taking positive cues from overseas markets. At the Multi Commodity Exchange, gold for delivery in far-month February next year gained Rs 68, or 0.27 percent, to Rs 25,530 per 10 grams in a business turnover of 23 lots. In a similar fashion, the metal for delivery in December traded higher by Rs 56, or 0.22 percent, to Rs 25,347 per 10 grams in 1,077 lots. Natural gas futures sank to the lowest level in almost four weeks on Friday, as warm weather and healthy stockpiles continued to weigh. On the New York Mercantile Exchange, natural gas for delivery in December plunged 13.1 cents, or 5.76%, to close the week at $2.145 per million British thermal units on Friday. It earlier fell to $2.123, the lowest since October 28. Meanwhile, the January contract slumped 12.1 cents, or 5.02%, to end at $2.291. Commodity Pivot Table for 23/11/2015 Scrip Pivot point R1 R2 R3 S1 S2 S3 ALUMINIUM 30-Nov-15 96.33 98.12 100.68 102.47 93.77 91.98 89.42 ALUMINIUM 31-Dec-15 97.95 99.65 102.25 103.95 95.35 93.65 91.05 CARDAMOM 15-Dec-15 704.70 720.90 730.30 746.50 695.30 679.10 669.70 COPPER 30-Nov-15 302.52 305.43 310.72 313.63 297.23 294.32 289.03 CRUDEOIL 19-Nov-15 2692.33 2735.67 2798.33 2841.67 2629.67 2586.33 2523.67 CRUDEOIL 18-Dec-15 2812.67 2867.33 2901.67 2956.33 2778.33 2723.67 2689.33 GOLD 4-Dec-15 25311.33 25422.67 25602.33 25713.67 25131.67 25020.33 24840.67 LEAD 30-Nov-15 105.90 107.20 109.45 110.75 103.65 102.35 100.10 LEAD 31-Dec-15 106.95 108.15 110.30 111.50 104.80 103.60 101.45 NATURALGAS 24-Nov-15 146.47 149.73 155.87 159.13 140.33 137.07 130.93 NATURALGAS 28-Dec-15 156.30 159.30 165.00 168.00 150.60 147.60 141.90 NICKEL 30-Nov-15 581.63 591.17 607.93 617.47 564.87 555.33 538.57 NICKEL 31-Dec-15 587.83 597.67 614.83 624.67 570.67 560.83 543.67 SILVER 4-Dec-15 33741.67 34009.33 34429.67 34697.33 33321.33 33053.67 32633.33 ZINC 30-Nov-15 102.95 105.20 108.70 110.95 99.45 97.20 93.70 ZINC 31-Dec-15 104.30 106.25 109.60 111.55 100.95 99.00 95.65

- 4. 4 Key Corporate Action Symbol Purpose Ex-Date Record Date DCM Interim Dividend - Rs 1.50/- Per Share 20-Nov-15 23-Nov-15 TAKE Interim Dividend - Re 0.30/- Per Share 23-Nov-15 25-Nov-15 CELESTIAL Annual General Meeting 23-Nov-15 - MANAPPURAM Interim Dividend-Re 0.45/- Per Share 24-Nov-15 26-Nov-15 Key Economic Events Time (IST) Region Event Forecast 2:00 US CFTC S&P Speculative Net (-127.8 K) Monday 13:30 France French Manufacturing PMI (Nov) 50.7 14:00 Germany Germany Manufacturing PMI (Nov) 54.3 20:30 US Manufacturing PMI (Nov) - 20:30 US Existing Home Sales (Oct) 5.4 Mil Options Strategy Exit from the short synthetic option strategy created on TATAMOTORS and long synthetic option strategy created on AXIS BANK. Weekly consolidated call tracker Segment – NSE Cash and F&O Date Stock Trade Entry Stoploss Target1 Target2 Booked Remark 16/Nov/15 PNB BUY 138.1 136.6 139.6 141 138.1 Exitted 16/Nov/15 TATASTEEL SELL 221.8 223.8 219.8 217.6 223.8 SL 16/Nov/15 PCJEWELLER SELL 408 412 404 400 400 Target 16/Nov/15 MASTEK SELL 162 163.5 160.3 158.5 163.5 SL 16/Nov/15 GODREJIND BUY 387 383 391 395 391 Target 16/Nov/15 IRB SELL 245 242.5 247.5 250 Avoided 16/Nov/15 RECLTD SELL 235 237.5 232.5 230 Not initiated 17/Nov/15 ICICIBANK BUY 268.4 266 271 274 Not considered 17/Nov/15 CAIRN BUY 133.5 132 135 136.5 136.5 Target 17/Nov/15 CUMMINSIND SELL 984.3 993 975 966 967.2 Target 17/Nov/15 POLARIS BUY 204 202 206 208 202 SL 17/Nov/15 SIEMENS SELL 1224 1236 1212 1200 1212 Target 17/Nov/15 DIVISLAB SELL 1108 1119 1097 1088 Not initiated 17/Nov/15 LICHSGFIN SELL 465.6 470 460.25 456 464 Near cost closed 18/Nov/15 ASHOKLEY BUY 92.45 91.45 93.45 94.5 91.45 SL 18/Nov/15 AMBUJACEM BUY 201 199 203 205 202.5 Target 18/Nov/15 VEDL SELL 90.5 91.5 89.5 88.5 89.1 Target 18/Nov/15 LT BUY 1368 1355 1381 1394 1355 SL 18/Nov/15 SUNTV SELL 375 379 371 367.5 373.8 Target 19/Nov/15 DABUR BUY 270.5 268 273 275 273.75 Target 19/Nov/15 IBULHSGFIN BUY 619.1 613.1 625 632 625 Target 19/Nov/15 GATI BUY 145.0 143.5 146.5 148 146.5 Target 19/Nov/15 ZEEL BUY 386 382 390 394 391.45 Target

- 5. 5 19/Nov/15 ASHOKLEY BUY 93 92 94 95 93.05 Near cost exit 19/Nov/15 BRITANIA BUY 2907 2878 2936 2920 Target 20/Nov/15 ADANIPORTS BUY 272.5 269.5 275.5 278.5 269.5 SL 20/Nov/15 CEATLTD SELL 1035 1045 1025 1015 1045 SL 20/Nov/15 CRISIL BUY 1950 1930 1970 1990 1974 Target 20/Nov/15 CAIRN BUY 137 135.5 138.5 140 135.5 SL 20/Nov/15 LT BUY 1372 1360 1384 1396 1368 Near cost exit 16/Nov/15 AUROPHARMA Nov Fut SELL 823.6 831 816 808 816 Target 16/Nov/15 DABUR Nov Fut SELL 261.70 263.8 259 257 262.15 Near cost closed 17/Nov/15 PFC Nov Fut SELL 220.6 222.5 218 216 218 Target 17/Nov/15 CANBK Nov Fut SELL 278.70 281.5 276.4 273.8 276.4 Target 18/Nov/15 PFC Nov Fut SELL 218.25 220.25 216 214 214 Target 18/Nov/15 IDBI Nov Fut SELL 85.80 86.8 84.8 83.5 83.5 Target 19/Nov/15 CAIRN Nov Fut SELL 137.30 138.5 135.9 134.6 138.5 SL 19/Nov/15 IOCL SELL 403.00 406 398 394 406 SL 19/Nov/15 PETRONET Nov Fut SELL 206.35 208.35 204.35 202 204.35 Target 20/Nov/15 CROMPGREAV NOV BUY 175.5 173.5 177.5 179 179 Target Segment – MCX Date Commodity Trade Entry Stoploss Target1 Target2 Booked Remark 16/Nov/15 ZINC Nov Fut SELL 106.70 107.7 105.7 104.7 104.7 Target 16/Nov/15 COPPER Nov Fut SELL 316.8 320 313.8 312 312 Target 16/Nov/15 SILVER Dec Fut BUY 34211 34111 34311 34418 34111 SL 17/Nov/15 ZINC Nov Fut SELL 102.60 103.6 101.6 100.6 102.1 Target 17/Nov/15 CRUDE Nov Fut BUY 2752 2728 2782 2805 2778 Target 17/Nov/15 COPPER Nov Fut SELL 307.9 310.5 304.5 302 310.5 SL 17/Nov/15 NATGAS Nov Fut SELL 152.7 154.1 151.2 149.6 151.3 Target 18/Nov/15 ZINC Nov Fut SELL 100.45 101.45 99.45 98.45 101.45 SL 18/Nov/15 CRUDE Dec Fut BUY 2825 2800 2850 2850 Target 18/Nov/15 SILVER Dec Fut SELL 33750 33850 33650 33550 33550 Target 19/Nov/15 COPPER Nov Fut SELL 304.00 306.5 300.5 297.2 303.6 Near cost closed 20/Nov/15 NICKEL NOV SELL 592 600 584 576 576 Target 20/Nov/15 NATURALGAS NOV SELL 148.7 150.7 146.7 144.7 144.7 Target Performance Report Equity + F&O (Rs) Commodity (Rs) Total Profit Made Consolidated 291331.61 218527.50 Total Profit Made this Week 59342.01 29000.00 Disclaimer: This report is only for the information of our customers. Recommendations, opinions or suggestions are given with the understanding that readers acting on this information assume all risks involved. The information provided herein is not to be constructed as an offer to buy or sell securities of any kind. ATS Wealth Managers Pvt Ltd and/or its group companies do not as assume any responsibility or liability resulting from the use of such information.