Bank NPLs yet to peak. Underweight

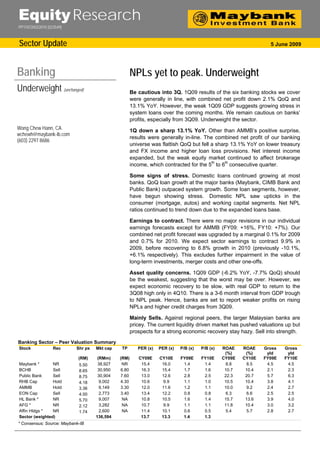

- 1. Equity Research PP11072/03/2010 (023549) Sector Update 5 June 2009 Banking NPLs yet to peak. Underweight Underweight (unchanged) Be cautious into 3Q. 1Q09 results of the six banking stocks we cover were generally in line, with combined net profit down 2.1% QoQ and 13.1% YoY. However, the weak 1Q09 GDP suggests growing stress in system loans over the coming months. We remain cautious on banks’ profits, especially from 3Q09. Underweight the sector. Wong Chew Hann, CA 1Q down a sharp 13.1% YoY. Other than AMMB’s positive surprise, wchewh@maybank-ib.com results were generally in-line. The combined net profit of our banking (603) 2297 8686 universe was flattish QoQ but fell a sharp 13.1% YoY on lower treasury and FX income and higher loan loss provisions. Net interest income expanded, but the weak equity market continued to affect brokerage income, which contracted for the 5th to 6th consecutive quarter. Some signs of stress. Domestic loans continued growing at most banks. QoQ loan growth at the major banks (Maybank, CIMB Bank and Public Bank) outpaced system growth. Some loan segments, however, have begun showing stress. Domestic NPL saw upticks in the consumer (mortgage, autos) and working capital segments. Net NPL ratios continued to trend down due to the expanded loans base. Earnings to contract. There were no major revisions in our individual earnings forecasts except for AMMB (FY09: +16%, FY10: +7%). Our combined net profit forecast was upgraded by a marginal 0.1% for 2009 and 0.7% for 2010. We expect sector earnings to contract 9.9% in 2009, before recovering to 6.8% growth in 2010 (previously -10.1%, +6.1% respectively). This excludes further impairment in the value of long-term investments, merger costs and other one-offs. Asset quality concerns. 1Q09 GDP (-6.2% YoY, -7.7% QoQ) should be the weakest, suggesting that the worst may be over. However, we expect economic recovery to be slow, with real GDP to return to the 3Q08 high only in 4Q10. There is a 3-6 month interval from GDP trough to NPL peak. Hence, banks are set to report weaker profits on rising NPLs and higher credit charges from 3Q09. Mainly Sells. Against regional peers, the larger Malaysian banks are pricey. The current liquidity driven market has pushed valuations up but prospects for a strong economic recovery stay hazy. Sell into strength. Banking Sector – Peer Valuation Summary Stock Rec Shr px Mkt cap TP PER (x) PER (x) P/B (x) P/B (x) ROAE ROAE Gross Gross (%) (%) yld yld (RM) (RMm) (RM) CY09E CY10E FY09E FY10E CY09E CY10E FY09E FY10E Maybank * NR 5.50 38,927 NR 15.4 16.0 1.4 1.4 8.8 8.5 4.5 4.5 BCHB Sell 8.65 30,950 6.80 16.3 15.4 1.7 1.6 10.7 10.4 2.1 2.3 Public Bank Sell 8.75 30,904 7.60 13.0 12.6 2.8 2.5 22.3 20.7 5.7 6.3 RHB Cap Hold 4.18 9,002 4.30 10.6 9.9 1.1 1.0 10.5 10.4 3.8 4.1 AMMB Hold 3.36 9,149 3.30 12.0 11.6 1.2 1.1 10.0 9.2 2.4 2.7 EON Cap Sell 4.00 2,773 3.40 13.4 12.2 0.8 0.8 6.3 6.6 2.5 2.5 HL Bank * NR 5.70 9,007 NA 10.8 10.5 1.6 1.4 15.7 13.6 3.9 4.0 AFG * NR 2.12 3,282 NA 10.7 9.9 1.1 1.1 11.8 10.4 3.0 3.2 Affin Hldgs * NR 1.74 2,600 NA 11.4 10.1 0.6 0.5 5.4 5.7 2.8 2.7 Sector (weighted) 136,594 13.7 13.3 1.4 1.3 * Consensus; Source: Maybank-IB

- 2. Banking An uninspiring 1Q No major surprises, flattish QoQ. There were no big surprises in the 1Q09 results of the Malaysian banks, with combined net profit being flattish QoQ, but down YoY. AMMB’s final result for FY09 was above expectations due to lower impairment loss on investments. Combined net profit of the six banking groups in our coverage universe was down 2.1% QoQ, and a sharper 13.1% YoY on lower treasury and FX income and higher loan loss provisions. Net interest income continued to expand. Combined core net profit was up 2.3% QoQ, but it was still down 7.9% YoY. Some loan segments were beginning to show stress. Combined Earnings (RM m) Flattish sequential 4,000 profits, but down YoY 3,500 3,000 2,500 2,000 1,500 1,000 500 0 2Q06 3Q06 4Q06 1Q07 2Q07 3Q07 4Q07 1Q08 2Q08 3Q08 4Q08 1Q09 Pre-tax profit Core net profit Net profit Note: Comprising Maybank, BCHB, Public Bank, RHB Cap, AMMB and EON Cap Sources: Companies, Maybank-IB 1Q08 Net Profit Net profit YoY QoQ vs. Maybk-IB’s Comments (1Q09 vs. 4Q08) (RM m) expectations Maybank 503 -33.7% -31.5% NA 1Q09 affected by: i) higher mark-to- market loss on securities and derivatives (interest rate swap), ii) lower net forex gain, iii) higher loan loss provisions, iv) impairment losses on investments. BCHB 614 +14.7% +92.7% Within Strong treasury income in 1Q09 (4Q08 affected by one-off M&A related charges). Public Bank 589 +2.9% -9.9% Within Combined net interest and Islamic banking income marginally down mainly due to lower NIM from loan- deposit repricing gap. RHB Cap 229 +2.8% +16.1% Within Stronger QoQ due to lower loan loss provisions and leaner opex. AMMB 180 -17.3% -27.5% Above Preceeding quarter included RM95.5m gain from sale of 19% stake in general insurance business. AMMB core 180 -17.3% +17.9% Investment income improved QoQ, while loan loss provisions were lower. EON Cap 80 +4.2% -10.6% Within Weaker QoQ due to lower NIM, and net forex loss. Total 2,194 -13.1% -2.1% - - Total core 2,194 -7.9% +2.3% - - Sources: Companies, Maybank-IB 5 June 2009 Page 2 of 12

- 3. Banking Combined Operating Income (RM m) 6,000 5,000 4,000 3,000 2,000 1,000 0 2Q06 3Q06 4Q06 1Q07 2Q07 3Q07 4Q07 1Q08 2Q08 3Q08 4Q08 1Q09 Net interest inc Non-interest inc Islamic banking inc Note: Comprising Maybank, BCHB, Public Bank, RHB Cap, AMMB and EON Cap Sources: Companies, Maybank-IB Net interest income expanded, mixed impact from OPR reduction. Combined net interest income grew 1.7% QoQ and 13% YoY, boosted by the consolidation of BII at Maybank from 4Q08 and BankThai at BCHB from 1Q09. The 150 bps cut in the central bank’s overnight policy rate (OPR) since Nov 08 had a mixed impact on 1Q09’s net interest margins (NIM) – negative at Public Bank, AMMB and EON Cap (due to the loan-deposit repricing gap), neutral at RHB Cap, but positive at Maybank and BCHB (higher spreads for loans). NIM expansion at the Indonesian subsidiaries also raised overall NIM at Maybank and BCHB. 1Q09 Net Interest Income (excluding Islamic banking income) Net Int Inc (RM m) YoY QoQ NIM (QoQ) Maybank * 1,543 14.4% -0.3% 2.79% (+8 bps) / 2.57% (+2 bps) ex-BII BCHB # 1,407 25.0% 9.4% 2.6% (+10 bps) Public Bank 959 7.2% 0.7% 2.4% (-10 bps) RHB Cap 574 8.2% 0.2% 2.7% (unchanged) AMMB 445 3.8% 0.6% 2.99% (-8 bps) EON Cap 224 -3.5% -16.1% 2.64% (-20 bps) Total 5,152 13.0% 1.7% - * Consolidation of BII effective 4Q08. Excluding BII, we estimate net interest income contracted 6.2% YoY and 3.1% QoQ due to higher interest cost for new acquisitions. # Consolidation of BankThai effective 1Q09. Excluding BankThai, we estimate net interest income expanded by 15.4% YoY, and 1% QoQ. Sources: Companies, Maybank-IB Brokerage and FX income down, mixed at treasury. Non-interest income continued on a sequential quarterly decline for most banking groups. Brokerage income declined for the 5th to 6th sequential quarter – 1Q09’s brokerage income for major banking groups plunged 51-63% YoY. FX income was also down for all banks. Treasury performance was mixed – strong at BCHB, while Maybank was affected by higher mark-to-market loss on securities and derivatives (interest rate swaps). Fee-based income for all banks either expanded or was flat QoQ. 5 June 2009 Page 3 of 12

- 4. Banking 1Q09 Non-Interest Income Non-Int Inc (RM YoY QoQ % Non-Int Inc / Op m) inc Maybank 630 1.9% -22.2% 25.2% BCHB 915 14.6% 96.5% 36.9% Public Bank 294 -47.2% -6.1% 21.0% RHB Cap 213 -12.4% -19.3% 25.2% AMMB 251 -3.6% -16.8% 29.5% EON Cap 70 4.4% -9.1% 20.6% Total 2,374 -6.7% 6.4% 28.2% Sources: Companies, Maybank-IB Loans growth at larger banks outpaced system growth. Domestic loans growth continued at most banks, with stronger QoQ loans growth at Maybank, CIMB Bank and Public Bank compared to the system growth. Loans expansion was mainly in the consumer segment (mortgage and autos), while loans to the SMEs were generally down, reflecting poor business sentiment. Major YoY loans growth at the group levels of Maybank and BCHB was aided by new subsidiaries: BII (Sep 08), BankThai (Jan 09), and M&A: Niaga-Lippo (Nov 08). 1Q09 Gross Loans Gross Loans at Vs. Mar ‘08 Vs. Dec ‘08 Mar ‘09 (RM m) (YoY) (QoQ) Maybank 192,877 21.9% 1.8% Maybank (domestic) 104,490 12.6% 2.1% BCHB 134,810 33.4% 10.0% CIMB Bank (domestic) 92,009 18.6% 3.0% Public Bank 125,431 17.7% 4.2% Public Bank (domestic) 98,780 2.3% 4.3% RHB Cap 62,771 8.2% -0.6% AMMB 58,769 6.9% 0.6% EON Cap 31,027 6.5% 0.6% System * 733,874 +10.9% +1.0% * BNM Monthly Statistical Bulletin (Mar ‘09); Sources: Companies, Maybank-IB Stress showing in some loans segments. Sequential loan loss provisions (LLP) were lower at the smaller banks, while specific provisionings (including pre-emptive provisioning) was stepped up. NPLs crept up at the overseas operations: BII and the Singapore operations for Maybank, and from the consolidation of BankThai at BCHB. Domestic NPL saw upticks in the consumer (mortgage, autos) and working capital segments. Net NPL ratios of all the banks continued to trend down due to the expanded loans base. 1Q09 Loan Loss Provision, NPLs, Loan Loss Coverage LLP YoY QoQ Net NPL @ LLC @ (RM m) Mar ’09 Mar ’09 Maybank 412 147.7% 32.0% 1.73% 101.1% BCHB 272 43.7% 3.4% 2.62% 83.5% Public Bank 156 8.3% 4.1% 0.83% 163.8% RHB Cap 175 15.0% -17.1% 2.57% 84.9% AMMB 123 224.8% -13.9% 2.56% 75.1% EON Cap 36 -58.0% -44.2% 3.08% 72.1% Total 1,173 51.5% 2.7% 2.24% * 88.3% * * BNM Monthly Statistical Bulletin (Mar ‘08); Sources: Companies, Maybank-IB 5 June 2009 Page 4 of 12

- 5. Banking Gross NPL RM m Jun ‘07 Sep ‘07 Dec ‘07 Mar ‘08 Jun ‘08 Sep ’08 Dec ‘08 Mar ‘09 Maybank 8,258 8,082 8,010 7,648 6,472 6,909 6,827 6,863 BCHB 8,125 8,009 7,325 7,234 7,066 6,901 6,056 * 7,540 Public Bk 1,560 1,516 1,404 1,318 1,219 1,167 1,210 1,232 RHB Cap 3,998 3,589 3,165 3,183 3,009 2,897 2,840 3,105 AMMB 5,472 4,595 4,218 3,602 3,469 3,336 3,125 2,426 EON Cap 1,749 1,778 1,847 1,884 1,775 1,717 1,546 1,682 % loans Maybank 5.60 5.35 5.16 4.83 3.78 3.61 3.60 3.56 BCHB 8.65 7.92 7.25 7.16 6.51 6.17 4.94 * 5.59 Public Bk 1.70 1.58 1.39 1.24 1.08 0.99 1.01 0.98 RHB Cap 6.99 6.21 5.57 5.49 5.07 4.63 4.50 4.95 AMMB 10.67 8.75 7.89 6.55 6.25 5.77 5.35 4.13 EON Cap 6.11 6.15 6.30 6.47 5.98 5.62 5.01 5.42 * Included consolidation of BankThai from 1Q09; Sources: Company, Maybank-IB Loans Book As at Mar ‘09 Maybank * BCHB Public RHB Cap AMMB Gross Loans (RM m) Residential properties 24,243 30,398 33,437 14,480 11,316 Non-residential properties 6,518 9,873 24,563 3,114 2,878 Transport vehicles 18,797 13,959 29,855 7,654 24,350 Purchase of securities 10,492 10,548 1,794 2,019 1,882 Personal use 3,529 4,183 7,644 1,990 2,324 Credit cards 3,571 2,988 994 2,106 1,844 Working capital 52,901 38,021 20,030 23,121 9,437 Others 9,327 25,020 7,314 8,287 5,642 Overseas 63,500 Total 192,877 134,989 125,631 62,771 58,769 Gross NPL (RM m) Residential properties 2,020 1,726 499 1,135 924 Non-residential properties 344 449 110 163 221 Transport vehicles 153 407 183 241 454 Purchase of securities 183 78 3 49 67 Personal use 209 340 121 103 19 Credit cards 50 92 17 67 70 Working capital 2,286 2,711 283 1,129 450 Others 476 1,737 16 217 222 Overseas 1,143 Total 6,863 7,540 1,232 3,105 2,426 Gross NPL ratio (%) Residential properties 8.33% 5.68% 1.49% 7.84% 8.17% Non-residential properties 5.28% 4.55% 0.45% 5.23% 7.67% Transport vehicles 0.81% 2.91% 0.61% 3.15% 1.86% Purchase of securities 1.75% 0.74% 0.16% 2.41% 3.55% Personal use 5.93% 8.12% 1.58% 5.19% 0.82% Credit cards 1.39% 3.09% 1.73% 3.19% 3.81% Working capital 4.32% 7.13% 1.41% 4.88% 4.77% Others 5.10% 6.94% 0.22% 2.62% 3.93% Overseas 1.80% Total 3.56% 5.59% 0.98% 4.95% 4.13% * Included consolidation of BankThai from 1Q09; Sources: Company, Maybank-IB 5 June 2009 Page 5 of 12

- 6. Banking Banking Sector Summary (Quarterly) (RM mil) Mar-08 Jun-08 Sep-08 Dec-08 Mar-09 Mar-08 Jun-08 Sep-08 Dec-08 Mar-09 PROFIT AND LOSS BALANCE SHEET Operating income Gross loans - Maybank 2,235 2,982 2,026 2,659 2,497 - Maybank 158,265 171,217 191,223 189,387 192,877 - BCHB 2,017 2,158 1,683 1,882 2,514 - BCHB 101,049 108,475 111,860 122,537 134,810 - Public Bank 1,576 1,363 1,370 1,431 1,398 - Public Bank 106,576 113,056 117,760 120,319 125,431 - RHB Cap 830 844 855 917 847 - RHB Cap 58,005 59,305 62,626 63,161 62,771 - AMMB 826 779 754 889 854 - AMMB 54,999 55,540 57,814 58,420 58,769 - EON Cap 341 367 320 397 340 - EON Cap 29,131 29,680 30,567 30,853 31,027 Pre-tax profit Deposits fr customers - Maybank 1,020 1,019 882 960 654 - Maybank 185,202 187,112 204,946 206,593 211,724 - BCHB 749 947 572 448 839 - BCHB 131,602 136,842 141,954 153,425 167,394 - Public Bank 971 792 804 813 745 - Public Bank 144,500 152,174 155,818 162,280 168,133 - RHB Cap 310 362 489 262 315 - RHB Cap 79,379 75,051 75,624 73,962 76,450 - AMMB 309 274 326 345 273 - AMMB 55,769 47,085 48,930 50,668 64,132 - EON Cap 104 -99 89 109 107 - EON Cap 28,005 28,123 29,094 30,118 30,036 Net profit Total assets - Maybank 759 703 572 735 503 - Maybank 258,876 269,101 304,398 301,706 308,769 - BCHB 535 650 448 319 614 - BCHB 206,736 190,907 195,475 206,745 226,918 - Public Bank 717 594 616 654 589 - Public Bank 178,099 185,236 190,730 196,163 199,227 - RHB Cap 222 271 358 197 229 - RHB Cap 109,668 104,355 104,708 104,533 103,469 - AMMB 217 203 230 248 180 - AMMB 83,192 83,067 82,876 86,540 89,893 - EON Cap 75 -79 65 89 80 - EON Cap 41,523 41,563 42,885 43,423 42,061 PROFITABILITY RATIOS Net interest margin Cost-to-income - Maybank 2.72 2.81 2.50 2.71 2.79 - Maybank 47.7 37.8 60.0 53.0 56.5 - BCHB 2.30 2.20 2.30 2.60 2.71 - BCHB 52.6 48.0 55.2 58.2 52.8 - Public Bank 2.42 2.42 2.45 2.42 2.33 - Public Bank 32.8 30.2 33.6 32.7 35.6 - RHB Cap 2.35 2.55 2.60 2.70 2.62 - RHB Cap 44.3 40.4 43.0 47.7 44.6 - AMMB 3.10 2.99 3.23 3.07 2.99 - AMMB 55.4 53.6 52.2 45.1 47.7 - EON Cap 2.82 2.82 2.79 3.14 2.64 - EON Cap 44.4 59.5 62.2 50.3 55.7 LIQUIDITY RATIOS Net loans/customer dep Net loans/total deposit - Maybank 81.9 88.1 89.9 88.4 87.8 - Maybank 73.4 78.4 77.5 77.4 76.6 - BCHB 76.5 75.4 75.1 76.5 76.9 - BCHB 73.1 69.9 69.7 73.1 71.8 - Public Bank 72.6 73.1 74.4 73.0 73.4 - Public Bank 68.2 69.9 71.0 70.5 70.5 - RHB Cap 70.1 75.8 79.5 81.9 78.7 - RHB Cap 63.3 68.3 72.3 73.3 73.2 - AMMB 94.3 112.6 113.1 110.5 88.8 - AMMB 83.6 83.9 86.1 82.6 81.0 - EON Cap 99.8 100.9 100.6 98.4 99.3 - EON Cap 80.7 81.6 81.3 80.9 82.3 CAPITAL RATIOS Tier 1 core capital RWCR - Maybank 9.9 10.4 9.5 8.1 8.3 - Maybank 14.0 14.1 13.2 13.5 12.1 - BCHB 9.7 9.7 9.5 10.9 10.9 - BCHB 14.4 14.4 14.2 14.1 13.3 - Public Bank 7.6 8.6 7.4 8.3 7.6 - Public Bank 12.2 14.3 13.2 13.7 13.3 - RHB Cap 8.2 8.6 7.8 8.7 9.4 - RHB Cap 12.3 12.6 11.7 12.6 13.3 - AMMB 8.2 8.7 9.1 9.4 9.7 - AMMB 13.5 14.3 14.1 14.3 15.2 - EON Cap 8.8 8.5 8.3 9.1 9.4 - EON Cap 12.3 12.0 12.0 12.5 11.9 ASSET QUALITY RATIOS Net NPL Loan loss coverage - Maybank 2.42 1.92 1.84 1.80 1.73 - Maybank 87.2 99.2 100.2 99.8 101.1 - BCHB 3.67 3.31 3.07 2.29 2.62 - BCHB 71.9 74.2 76.6 88.1 83.5 - Public Bank 1.10 0.93 0.87 0.86 0.83 - Public Bank 132.1 150.2 159.1 159.7 163.8 - RHB Cap 3.23 2.75 2.38 2.24 2.57 - RHB Cap 74.4 81.5 87.4 90.3 84.9 - AMMB 3.66 3.31 3.00 2.74 2.56 - AMMB 67.3 72.3 74.5 77.5 75.1 - EON Cap 4.00 3.08 2.92 2.51 3.08 - EON Cap 62.1 74.1 75.4 78.6 72.1 Sources: Companies, Maybank-IB 5 June 2009 Page 6 of 12

- 7. Banking Forecasts and valuations 2-3% 2009 loan growth forecast retained. Loan disbursements, applications and approvals in the system slowed in Apr 09, reflecting cautious sentiment. YTD loans growth was slower at 1.4% (4M2008: +3.4%), driven by household loans (+2.2%) while business loans’ growth was anemic (+0.4%). Household loan growth was mainly in the residential property segment, aided by sales campaigns as developers cleared inventories. We retain our 2-3% loan growth forecast for 2009. Expect rising NPL momentum. 1Q09 GDP (-6.2% YoY, -7.7% QoQ) should be the weakest, suggesting the worst may be over. We expect the economy to recover from 2Q09, but the recovery will be slow, with a return to 3Q08’s high only in 4Q10. The poor 1Q09 GDP suggests growing stress in system loans. We expect sector NPLs to accelerate in 3Q09, based on the historical 3-6 month interval from GDP trough to NPL peak. We retain our +50% NPL formation expectation for 2009, implying a gross NPL ratio of 7.2% by end-2009 (end-2008: 4.8%). Malaysian GDP: The Worst is Over? RM b We project sequential 140 10% quarterly growth from 2Q09 130 5% 120 0% 110 (5%) 100 (10%) 2Q09E 3Q09E 4Q09E 1Q10E 2Q10E 3Q10E 4Q10E 1Q08 2Q08 3Q08 4Q08 1Q09 Real GDP (LHS) YoY gwth (RHS) Sources: Bank Negara, Maybank-IB GDP trough vs. NPL peak: 3-6 months interval 15% 90,000 NPL peak NPL peak 10% 80,000 70,000 5% 60,000 0% GDP 50,000 GDP trough trough? -5% 40,000 NPL -10% peak? 30,000 GDP trough -15% 20,000 2Q09E 4Q09E 2Q10E 4Q10E 4Q97 2Q98 4Q98 2Q99 4Q99 2Q00 4Q00 2Q01 4Q01 2Q02 4Q02 2Q03 4Q03 2Q04 4Q04 2Q05 4Q05 2Q06 4Q06 2Q07 4Q07 2Q08 4Q08 RM m Real GDP YoY Growth (LHS) Gross NPL (RHS) Sources: Bank Negara, Maybank-IB 5 June 2009 Page 7 of 12

- 8. Banking Pricey against regional peers on P/BV and ROE. The current liquidity driven market has lifted valuations. Share prices of banking stocks have recovered 18-50% from their year-lows even though fundamentals remain weak. We continue to Underweight the sector. Asian Banks (ex-Japan) : P/BV vs. ROE Sources: Bloomberg (71 listed banks in Asia), Maybank-IB Banking Sector – Regional Comparisons Stock Currency Shr px PER (x) PER (x) P/B (x) P/B (x) ROAE (%)ROAE (%) 2009E 2010E 2009E 2010E 2009E 2010E Malaysia Maybank RM 5.50 15.4 16.0 1.4 1.4 8.8 8.5 BCHB RM 8.65 16.3 15.4 1.7 1.6 10.7 10.4 Public Bank RM 8.75 13.0 12.6 2.8 2.5 22.3 20.7 RHB Cap RM 4.18 10.6 9.9 1.1 1.0 10.5 10.4 AMMB RM 3.36 12.0 11.6 1.2 1.1 10.0 9.2 EON Cap RM 4.00 13.4 12.2 0.8 0.8 6.3 6.6 HL Bank RM 5.70 10.8 10.5 1.6 1.4 15.7 13.6 AFG RM 2.12 10.7 9.9 1.1 1.1 11.8 10.4 Affin RM 1.74 11.4 10.1 0.6 0.5 5.4 5.7 Average 13.7 13.3 1.4 1.3 11.3 10.6 Singapore DBS SGD 12.60 18.3 15.3 1.2 1.2 6.7 7.7 UOB SGD 14.94 14.2 12.4 1.5 1.4 11.2 11.5 OCBC SGD 7.20 16.4 15.0 1.5 1.4 9.4 9.4 Average 16.3 14.2 1.4 1.3 9.1 9.5 China ICBC HKD 4.83 12.4 10.8 2.2 2.0 18.3 19.1 CCB HKD 5.14 11.4 10.0 2.1 1.9 19.1 19.4 BOC HKD 3.46 11.6 10.0 1.6 1.4 13.6 14.9 BEA HKD 27.45 22.3 18.6 1.5 1.4 6.6 7.7 Hang Seng HKD 117.00 18.0 16.5 4.4 4.1 24.4 26.1 BoCom HKD 7.52 13.3 11.4 2.0 1.8 15.5 16.0 Average 14.8 12.9 2.3 2.1 16.2 17.2 Regional 14.9 13.5 1.7 1.6 12.2 12.5 Sources: Maybank-IB, Consensus (Bloomberg) 5 June 2009 Page 8 of 12

- 9. Banking Malaysian Banks: Relative Share Price Performance (Indexed) 120 110 100 90 80 70 60 50 40 Oct-08 Dec-08 Apr-08 Apr-09 Jan-08 Feb-08 Mar-08 Jun-08 Jul-08 Aug-08 Sep-08 Jan-09 Feb-09 Mar-09 Jun-09 May-08 Nov-08 May-09 May bank BCHB Public RHB AMMB EON Sources: Bloomberg, Maybank-IB Maybank: Trailing P/BV BCHB: Trailing P/BV 5 4 4 3 3 2 2 1 1 0 0 Jan-98 Jan-99 Jan-00 Jan-01 Jan-02 Jan-03 Jan-04 Jan-05 Jan-06 Jan-07 Jan-08 Jan-09 Jan-98 Jan-99 Jan-00 Jan-01 Jan-02 Jan-03 Jan-04 Jan-05 Jan-06 Jan-07 Jan-08 Jan-09 Sources: Bloomberg, Maybank-IB Sources: Bloomberg, Maybank-IB Public Bank: Trailing P/BV RHB Cap: Trailing P/BV 5 4 4 3 3 2 2 1 1 0 0 Jan-98 Jan-99 Jan-00 Jan-01 Jan-02 Jan-03 Jan-04 Jan-05 Jan-06 Jan-07 Jan-08 Jan-09 Jan-98 Jan-99 Jan-00 Jan-01 Jan-02 Jan-03 Jan-04 Jan-05 Jan-06 Jan-07 Jan-08 Jan-09 Sources: Bloomberg, Maybank-IB Sources: Bloomberg, Maybank-IB 5 June 2009 Page 9 of 12

- 10. Banking AMMB: Trailing P/BV EON Cap: Trailing P/BV 3 2.0 1.5 2 1.0 1 0.5 0 0.0 Jan-03 Jan-04 Jan-05 Jan-06 Jan-07 Jan-08 Jan-09 Apr-98 Apr-99 Apr-00 Apr-01 Apr-02 Apr-03 Apr-04 Apr-05 Apr-06 Apr-07 Apr-08 Apr-09 Sources: Bloomberg, Maybank-IB Sources: Bloomberg, Maybank-IB Banking Sector Summary (Yearly) (RM mil) FY07 FY08 FY09 FY10 FY11 FY07 FY08 FY09 FY10 FY11 PROFIT AND LOSS BALANCE SHEET Operating income Gross loans - Maybank 8,854 9,630 9,761 10,582 11,120 - Maybank 147,497 171,217 192,556 199,394 211,356 - BCHB 9,011 7,741 9,737 10,085 10,397 - BCHB 100,980 122,537 137,413 144,087 151,491 - Public Bank 5,111 5,739 5,661 5,882 6,325 - Public Bank 101,005 120,319 132,385 143,004 154,473 - RHB Cap 3,388 3,445 3,455 3,577 3,724 - RHB Cap 56,814 63,161 65,056 67,007 70,358 - AMMB 3,028 3,352 3,271 3,442 3,567 - AMMB 50,742 54,999 58,769 59,944 61,743 - EON Cap 1,334 1,404 1,399 1,435 1,505 - EON Cap 29,307 30,853 31,493 32,459 35,065 Pre-tax profit Deposits fr customers - Maybank 4,364 4,086 3,179 3,163 3,702 - Maybank 163,677 187,112 210,432 217,904 230,977 - BCHB 3,686 2,716 2,755 2,886 3,188 - BCHB 127,517 153,425 171,836 180,182 189,442 - Public Bank 3,004 3,379 3,066 3,215 3,637 - Public Bank 138,765 162,280 178,554 192,876 208,344 - RHB Cap 1,137 1,422 1,144 1,224 1,349 - RHB Cap 75,793 73,962 76,181 77,705 80,036 - AMMB -85 1,194 1,218 1,069 1,118 - AMMB 42,382 55,769 64,132 65,414 67,377 - EON Cap 279 208 296 325 351 - EON Cap 27,463 30,118 30,743 31,685 34,229 Net profit Total assets - Maybank 3,178 2,928 2,254 2,243 2,625 - Maybank 256,667 269,101 310,117 319,581 336,946 - BCHB 2,793 1,952 1,901 1,978 2,199 - BCHB 183,507 206,745 227,569 236,450 247,092 - Public Bank 2,124 2,581 2,284 2,395 2,709 - Public Bank 174,155 196,163 215,357 231,583 249,428 - RHB Cap 713 1,049 853 913 1,006 - RHB Cap 105,154 104,533 104,632 106,650 110,696 - AMMB -282 669 861 764 799 - AMMB 78,983 83,192 89,893 90,573 92,488 - EON Cap 217 134 207 227 246 - EON Cap 41,174 43,423 44,015 45,272 48,857 PROFITABILITY RATIOS Net interest margin Cost-to-income - Maybank 2.73 2.73 2.79 2.82 2.80 - Maybank 42.8 44.2 55.6 55.7 55.3 - BCHB 2.42 2.30 2.63 2.58 2.58 - BCHB 46.9 53.2 54.8 55.0 56.3 - Public Bank 2.45 2.50 2.38 2.32 2.32 - Public Bank 33.1 31.2 33.1 33.2 32.1 - RHB Cap 2.49 2.56 2.62 2.67 2.71 - RHB Cap 44.4 43.9 44.9 45.1 45.2 - AMMB 2.72 2.91 2.98 2.97 2.97 - AMMB 44.8 45.9 49.3 48.9 49.2 - EON Cap 2.66 2.82 2.70 2.70 2.69 - EON Cap 44.2 53.0 54.0 54.8 54.5 LIQUIDITY RATIOS Net loans/customer dep Net loans/total deposit - Maybank 86.1 88.1 87.9 87.4 87.3 - Maybank 72.9 77.9 77.5 77.0 77.0 - BCHB 75.2 76.5 75.9 75.3 75.1 - BCHB 68.3 73.1 72.8 72.4 72.4 - Public Bank 71.6 73.0 72.8 72.6 72.6 - Public Bank 66.6 70.5 70.5 70.5 70.7 - RHB Cap 72.0 81.9 81.2 81.3 82.7 - RHB Cap 64.6 73.3 75.5 75.8 77.2 - AMMB 112.3 94.3 88.8 86.7 85.6 - AMMB 79.6 83.6 81.0 79.3 78.4 - EON Cap 102.8 98.4 98.0 97.8 97.8 - EON Cap 81.7 80.9 80.6 80.4 80.4 Note: Maybank FYE June, BCHB FYE Dec, Public Bank FYE Dec, AMMB FYE Mar, RHB Cap FYE Dec, EON Cap FYE Dec Sources: Companies, Maybank-IB, Consensus estimates 5 June 2009 Page 10 of 12

- 11. Banking Banking Sector Summary (Yearly - continued) FY07 FY08 FY09 FY10 FY11 FY07 FY08 FY09 FY10 FY11 CAPITAL RATIOS (x) Tier 1 core capital RWCR - Maybank 10.1 11.0 11.7 11.8 11.8 - Maybank 15.1 15.2 15.4 15.5 15.3 - BCHB 9.3 10.9 12.0 12.5 13.1 - BCHB 12.5 14.1 15.5 16.1 16.9 - Public Bank 9.1 8.3 8.3 8.7 8.9 - Public Bank 13.6 13.7 14.0 14.1 14.0 - RHB Cap 7.1 5.3 6.7 7.5 8.3 - RHB Cap 12.2 10.0 11.4 12.2 12.8 - AMMB 8.7 8.4 9.7 10.6 11.3 - AMMB 12.6 13.9 15.2 16.0 16.6 - EON Cap 9.22 9.1 9.4 9.6 9.5 - EON Cap 13.0 12.5 11.9 12.2 11.9 ASSET QUALITY RATIOS Net NPL Loan loss coverage - Maybank 3.02 1.92 2.32 2.92 3.04 - Maybank 80.3 99.2 86.7 79.1 78.0 - BCHB 3.87 2.29 3.38 3.75 3.93 - BCHB 69.3 88.1 74.2 73.3 72.5 - Public Bank 1.24 0.86 0.97 0.93 0.95 - Public Bank 119.5 159.7 138.9 136.3 134.5 - RHB Cap 3.43 2.24 3.33 4.14 4.34 - RHB Cap 71.4 90.3 77.0 71.7 70.7 - AMMB 6.22 3.66 2.56 4.85 5.33 - AMMB 56.6 67.3 75.1 62.4 64.3 - EON Cap 4.14 2.51 2.72 2.82 2.82 - EON Cap 58.1 78.6 78.1 77.7 77.7 RETURN RATIOS ROAE ROAA - Maybank 17.6 15.2 9.6 8.0 9.0 - Maybank 1.3 1.1 0.8 0.7 0.8 - BCHB 20.3 11.9 10.7 10.4 10.8 - BCHB 1.6 1.0 0.9 0.9 0.9 - Public Bank 23.1 27.3 22.3 20.7 21.2 - Public Bank 1.3 1.4 1.1 1.1 1.1 - RHB Cap 11.9 14.1 10.5 10.4 10.6 - RHB Cap 0.7 1.0 0.8 0.9 0.9 - AMMB -5.7 11.2 11.6 9.5 9.1 - AMMB -0.4 0.8 1.0 0.8 0.9 - EON Cap 7.0 4.2 6.3 6.6 6.8 - EON Cap 0.5 0.3 0.5 0.5 0.5 Note: Maybank FYE June, BCHB FYE Dec, Public Bank FYE Dec, AMMB FYE Mar, RHB Cap FYE Dec, EON Cap FYE Dec Sources: Companies, Maybank-IB, Consensus estimates 5 June 2009 Page 11 of 12

- 12. Banking Definition of Ratings Maybank Investment Bank Research uses the following rating system: BUY Total return is expected to be above 10% in the next 12 months HOLD Total return is expected to be between -5% to 10% in the next 12 months SELL Total return is expected to be below -5% in the next 12 months Applicability of Ratings The respective analyst maintains a coverage universe of stocks, the list of which may be adjusted according to needs. Investment ratings are only applicable to the stocks which form part of the coverage universe. Reports on companies which are not part of the coverage do not carry investment ratings as we do not actively follow developments in these companies. Some common terms abbreviated in this report (where they appear): Adex = Advertising Expenditure FCF = Free Cashflow PE = Price Earnings BV = Book Value FV = Fair Value PEG = PE Ratio To Growth CAGR = Compounded Annual Growth Rate FY = Financial Year PER = PE Ratio Capex = Capital Expenditure FYE = Financial Year End QoQ = Quarter-On-Quarter CY = Calendar Year MoM = Month-On-Month ROA = Return On Asset DCF = Discounted Cashflow NAV = Net Asset Value ROE = Return On Equity DPS = Dividend Per Share NTA = Net Tangible Asset ROSF = Return On Shareholders’ Funds EBIT = Earnings Before Interest And Tax P = Price WACC = Weighted Average Cost Of Capital EBITDA = EBIT, Depreciation And Amortisation P.A. = Per Annum YoY = Year-On-Year EPS = Earnings Per Share PAT = Profit After Tax YTD = Year-To-Date EV = Enterprise Value PBT = Profit Before Tax Disclaimer This report is for information purposes only and under no circumstances is it to be considered or intended as an offer to sell or a solicitation of an offer to buy the securities referred to herein. Investors should note that income from such securities, if any, may fluctuate and that each security’s price or value may rise or fall. Opinions or recommendations contained herein are in form of technical ratings and fundamental ratings. Technical ratings may differ from fundamental ratings as technical valuations apply different methodologies and are purely based on price and volume-related information extracted from Bursa Malaysia Securities Berhad in the equity analysis. Accordingly, investors may receive back less than originally invested. Past performance is not necessarily a guide to future performance. This report is not intended to provide personal investment advice and does not take into account the specific investment objectives, the financial situation and the particular needs of persons who may receive or read this report. Investors should therefore seek financial, legal and other advice regarding the appropriateness of investing in any securities or the investment strategies discussed or recommended in this report. The information contained herein has been obtained from sources believed to be reliable but such sources have not been independently verified by Maybank Investment Bank Bhd and consequently no representation is made as to the accuracy or completeness of this report by Maybank Investment Bank Bhd and it should not be relied upon as such. Accordingly, no liability can be accepted for any direct, indirect or consequential losses or damages that may arise from the use or reliance of this report. Maybank Investment Bank Bhd, its affiliates and related companies and their officers, directors, associates, connected parties and/or employees may from time to time have positions or be materially interested in the securities referred to herein and may further act as market maker or may have assumed an underwriting commitment or deal with such securities and may also perform or seek to perform investment banking services, advisory and other services for or relating to those companies. Any information, opinions or recommendations contained herein are subject to change at any time, without prior notice. This report may contain forward looking statements which are often but not always identified by the use of words such as “anticipate”, “believe”, “estimate”, “intend”, “plan”, “expect”, “forecast”, “predict” and “project” and statements that an event or result “may”, “will”, “can”, “should”, “could” or “might” occur or be achieved and other similar expressions. Such forward looking statements are based on assumptions made and information currently available to us and are subject to certain risks and uncertainties that could cause the actual results to differ materially from those expressed in any forward looking statements. Readers are cautioned not to place undue relevance on these forward- looking statements. Maybank Investment Bank Bhd expressly disclaims any obligation to update or revise any such forward looking statements to reflect new information, events or circumstances after the date of this publication or to reflect the occurrence of unanticipated events. This report is prepared for the use of Maybank Investment Bank Bhd's clients and may not be reproduced, altered in any way, transmitted to, copied or distributed to any other party in whole or in part in any form or manner without the prior express written consent of Maybank Investment Bank Bhd and Maybank Investment Bank Bhd accepts no liability whatsoever for the actions of third parties in this respect. This report is not directed to or intended for distribution to or use by any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. Published / Printed by Maybank Investment Bank Berhad (15938-H) (Formerly known as Aseambankers Malaysia Berhad) (A Participating Organisation of Bursa Malaysia Securities Berhad) 33rd Floor, Menara Maybank, 100 Jalan Tun Perak, 50050 Kuala Lumpur Tel: (603) 2059 1888; Fax: (603) 2078 4194 Stockbroking Business: Level 8, MaybanLife Tower, Dataran Maybank, No.1, Jalan Maarof 59000 Kuala Lumpur Tel: (603) 2297 8888; Fax: (603) 2282 5136 http://www.maybank-ib.com 5 June 2009 Page 12 of 12