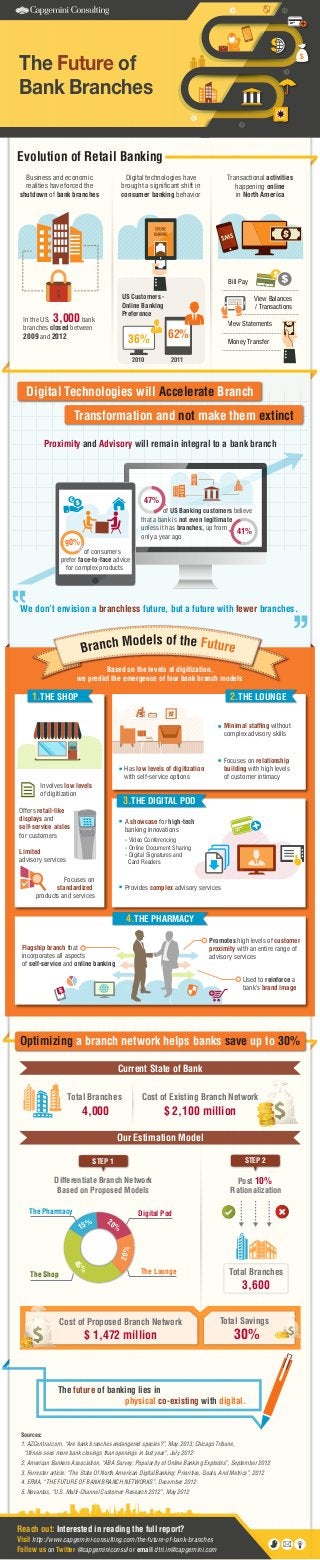

The Future of Bank Branches

- 1. The Future of Bank Branches Evolution of Retail Banking Business and economic realities have forced the shutdown of bank branches Digital technologies have brought a significant shift in consumer banking behavior Transactional activities happening online in North America Bill Pay US Customers Online Banking Preference 3,000 In the US, bank branches closed between 2009 and 2012 36% 2010 View Balances / Transactions View Statements 62% Money Transfer 2011 Digital Technologies will Accelerate Branch Transformation and not make them extinct Proximity and Advisory will remain integral to a bank branch 47% of US Banking customers believe that a bank is not even legitimate unless it has branches, up from 41% only a year ago 90% of consumers prefer face-to-face advice for complex products We don’t envision a branchless future, but a future with fewer branches. Based on the levels of digitization, we predict the emergence of four bank branch models 1.THE SHOP 2.THE LOUNGE Minimal staffing without complex advisory skills Focuses on relationship building with high levels of customer intimacy Has low levels of digitization with self-service options Involves low levels of digitization 3.THE DIGITAL POD Offers retail-like displays and self-service aisles for customers A showcase for high-tech banking innovations - Video Conferencing - Online Document Sharing - Digital Signatures and Card Readers Limited advisory services Focuses on standardized products and services Provides complex advisory services 4.THE PHARMACY Promotes high levels of customer proximity with an entire range of advisory services Flagship branch that incorporates all aspects of self-service and online banking Used to reinforce a bank’s brand image Optimizing a branch network helps banks save up to 30% Current State of Bank Total Branches Cost of Existing Branch Network 4,000 $ 2,100 million Our Estimation Model STEP 1 STEP 2 Differentiate Branch Network Based on Proposed Models Post 10% Rationalization The Pharmacy 45 The Shop 20 % 20% 15% Digital Pod % The Lounge Total Branches 3,600 Cost of Proposed Branch Network Total Savings $ 1,472 million 30% The future of banking lies in physical co-existing with digital. Sources: 1. AZCentral.com, “Are bank branches endangered species?”, May 2013; Chicago Tribune, “Illinois sees more bank closings than openings in last year”, July 2012 2. American Bankers Association, “ABA Survey: Popularity of Online Banking Explodes”, September 2012 3. Forrester article: “The State Of North American Digital Banking: Priorities, Goals, And Metrics”, 2012 4. EFMA, “THE FUTURE OF BANK BRANCH NETWORKS”, December 2012 5. Novantas, “U.S. Multi-Channel Customer Research 2012”, May 2012 Reach out: Interested in reading the full report? Visit http://www.capgemini-consulting.com/the-future-of-bank-branches Follow us on Twitter @capgeminiconsul or email dtri.in@capgemini.com