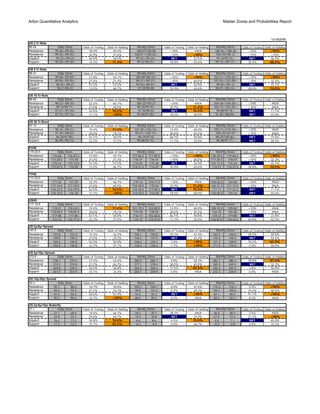

Arbor Quantitative Analytics Master Zones and Probabilities Report

- 1. Arbor Quantitative Analytics Master Zones and Probabilities Report 12/16/2009 US 2 Yr Note 99-24 Daily Zones Odds of Testing Odds of Holding Weekly Zones Odds of Testing Odds of Holding Monthly Zones Odds of Testing Odds of Holding Resistance 99-26+/99-26+ 18.4% 44.4% 100-07/100-08 <10% #N/A 100-26+/100-28 <10% >90% Resistance 99-25+/99-25+ 42.9% 47.6% 100-01+/100-02+ <10% >90% 100-10/100-12 <10% <10% Support 99-22+/99-23 44.9% 50.0% 99-25+/99-26+ MET 37.5% 99-24/99-25+ MET 56.3% Support 99-20+/99-20+ 14.3% 71.4% 99-21/99-21+ 18.8% 55.6% 99-15+/99-17+ 35.4% 88.2% US 5 Yr Note 98-31 Daily Zones Odds of Testing Odds of Holding Weekly Zones Odds of Testing Odds of Holding Monthly Zones Odds of Testing Odds of Holding Resistance 99-08+/99-09+ 21.8% 44.1% 100-08/100-10+ <10% >90% 102-27+/103-02+ <10% >90% Resistance 99-04+/99-05+ 47.4% 51.4% 99-27+/99-31+ <10% 60.0% 101-03+/101-09+ <10% 33.3% Support 98-25+/98-27 51.3% 57.5% 99-03+/99-07+ MET 32.0% 99-05+/99-12 MET 43.1% Support 98-21/98-22 13.5% 66.7% 97-29/98-00 35.9% 63.6% 98-07+/98-14+ 28.8% 70.5% US 10 Yr Note 98-04 Daily Zones Odds of Testing Odds of Holding Weekly Zones Odds of Testing Odds of Holding Monthly Zones Odds of Testing Odds of Holding Resistance 98-22+/98-24+ 22.2% 66.7% 100-22/100-27 <10% #N/A 104-18+/104-30+ <10% #N/A Resistance 98-15/98-17+ 37.0% 40.0% 99-20/99-29+ 25.9% 71.4% 102-15+/102-26+ <10% #N/A Support 97-27+/97-29+ 63.0% 76.5% 97-30/98-03 MET 70.4% 99-08/99-18+ MET 11.1% Support 97-15+/97-16+ 11.1% >90% 97-04/97-09+ 18.5% 60.0% 97-30+/98-09+ MET 55.6% US 30 Yr Bond 97-13 Daily Zones Odds of Testing Odds of Holding Weekly Zones Odds of Testing Odds of Holding Monthly Zones Odds of Testing Odds of Holding Resistance 98-16+/98-21+ 19.4% 71.4% 101-30+/102-10+ 13.9% 60.0% 109-17+/110-10+ <10% #N/A Resistance 97-29+/98-02+ 30.6% 18.2% 99-27+/100-13+ 30.6% 45.5% 105-29/107-07 <10% #N/A Support 96-29/97-00+ 61.1% 50.0% 96-19/97-02 66.7% 45.8% 98-29/100-00+ MET 19.4% Support 96-09+/96-13+ 22.2% 37.5% 95-06/95-14+ 11.1% 25.0% 96-28/97-17+ MET 58.3% FVH0 115-20.5 Daily Zones Odds of Testing Odds of Holding Weekly Zones Odds of Testing Odds of Holding Monthly Zones Odds of Testing Odds of Holding Resistance 116-06 116-07.5 21.8% 44.1% 117-06.5 117-09.5 <10% >90% 118-29.5 119-04.5 <10% >90% Resistance 115-28.5 115-30 47.4% 51.4% 116-27 116-31 <10% 60.0% 117-28.5 118-07 <10% 33.3% Support 115-14 115-15.5 51.3% 57.5% 115-25 115-30 MET 32.0% 115-11.5 115-24 MET 43.1% Support 115-07.5 115-09 13.5% 66.7% 114-21.5 114-25 35.9% 63.6% 114-21 114-27.5 28.8% 70.5% TYH0 117-05.5 Daily Zones Odds of Testing Odds of Holding Weekly Zones Odds of Testing Odds of Holding Monthly Zones Odds of Testing Odds of Holding Resistance 117-26 117-29 22.2% 66.7% 119-12 119-17.5 <10% #N/A 123-26.5 124-05 <10% #N/A Resistance 117-16.5 117-18.5 37.0% 40.0% 118-18.5 118-24 25.9% 71.4% 120-31.5 121-15.5 <10% #N/A Support 116-27.5 116-29.5 63.0% 76.5% 116-30.5 117-08.5 MET 70.4% 117-11 117-21.5 MET 11.1% Support 116-15.5 116-18 11.1% >90% 114-23.5 114-29 18.5% 60.0% 116-05.5 116-16 MET 55.6% USH0 117-16.5 Daily Zones Odds of Testing Odds of Holding Weekly Zones Odds of Testing Odds of Holding Monthly Zones Odds of Testing Odds of Holding Resistance 118-21 118-24.5 19.4% 71.4% 121-19.5 122-00.5 13.9% 60.0% 128-15.5 129-02 <10% #N/A Resistance 118-00.5 118-05.5 30.6% 18.2% 119-20 120-02 30.6% 45.5% 124-15 125-02 <10% #N/A Support 117-00 117-06 61.1% 50.0% 116-17 116-26.5 66.7% 45.8% 118-13 119-00 MET 22.8% Support 116-14 116-17.5 22.2% 37.5% 114-12 114-21.5 11.1% 25.0% 116-07.5 116-26.5 64.8% 52.5% US 2yr5yr Spread 147.4 Daily Zones Odds of Testing Odds of Holding Weekly Zones Odds of Testing Odds of Holding Monthly Zones Odds of Testing Odds of Holding Resistance 151.0 151.4 15.3% 22.2% 154.1 155.0 32.2% 47.4% 162.7 164.6 30.5% 44.4% Resistance 149.0 149.3 47.5% 39.3% 146.6 147.5 MET 42.4% 144.6 148.3 MET 54.2% Support 145.5 145.9 42.4% 56.0% 138.3 139.7 3.4% >90% 127.3 129.9 10.2% 83.3% Support 144.4 144.8 23.7% 57.1% 134.6 135.4 1.7% >90% 117.4 119.2 3.4% 50.0% US 2yr10yr Spread 272.8 Daily Zones Odds of Testing Odds of Holding Weekly Zones Odds of Testing Odds of Holding Monthly Zones Odds of Testing Odds of Holding Resistance 278.7 279.3 21.2% 63.6% 283.5 284.7 5.8% 33.3% 282.7 285.3 30.8% 81.3% Resistance 274.3 274.8 57.7% 46.7% 277.1 278.4 38.5% 45.0% 265.9 269.3 MET 32.7% Support 269.8 270.3 36.5% 36.8% 264.2 265.4 11.5% 83.3% 242.0 245.5 3.8% 50.0% Support 267.5 267.9 23.1% 33.3% 258.7 259.9 0.0% #N/A 232.3 234.9 0.0% #N/A US 10yr30yr Spread 93.3 Daily Zones Odds of Testing Odds of Holding Weekly Zones Odds of Testing Odds of Holding Monthly Zones Odds of Testing Odds of Holding Resistance 95.7 96.0 16.7% 30.8% 103.3 104.1 0.0% 67.6% 115.2 116.7 0.0% >90% Resistance 94.0 94.3 47.2% 54.7% 99.9 101.0 8.3% 39.3% 104.1 105.6 19.4% 68.4% Support 91.4 92.0 55.6% 61.3% 91.5 92.3 MET >90% 87.1 89.4 41.7% >90% Support 90.2 90.6 16.7% >90% 88.4 89.2 8.3% #N/A 80.4 82.3 8.3% #N/A US 2yr5yr10yr Butterfly 21.1 Daily Zones Odds of Testing Odds of Holding Weekly Zones Odds of Testing Odds of Holding Monthly Zones Odds of Testing Odds of Holding Resistance 27.7 28.4 14.6% 66.7% 24.3 25.7 38.2% #N/A 36.4 38.7 3.4% #N/A Resistance 23.9 24.7 59.6% 64.7% 19.4 20.8 MET 33.3% 27.9 31.6 21.3% >90% Support 16.2 17.2 34.8% 70.0% 6.6 8.6 4.5% 75.0% 4.8 7.1 MET 60.0% Support 11.3 12.3 15.7% 83.3% -6.3 -4.9 0.0% 66.7% -5.2 -2.8 0.0% 33.3%

- 2. Arbor Quantitative Analytics Master Zones and Probabilities Report Schatz December Futures 108.1 Daily Zones Odds of Testing Odds of Holding Weekly Zones Odds of Testing Odds of Holding Monthly Zones Odds of Testing Odds of Holding Resistance 108.23 108.24 12.9% 75.0% 108.38 108.41 3.3% >90% 108.70 108.76 0.0% #N/A Resistance 108.17 108.18 61.3% 84.2% 108.21 108.27 33.3% 60.0% 108.29 108.37 31.0% 88.9% Support 108.07 108.08 61.3% 36.8% 107.85 107.90 60.0% 50.0% 107.59 107.69 34.5% 70.0% Support 108.03 108.04 22.6% 42.9% 107.74 107.77 26.7% 75.0% 107.29 107.35 6.9% 50.0% Bobl December Futures 116.4 Daily Zones Odds of Testing Odds of Holding Weekly Zones Odds of Testing Odds of Holding Monthly Zones Odds of Testing Odds of Holding Resistance 116.73 116.76 17.2% 63.6% 117.23 117.31 13.1% 37.5% 118.64 118.80 10.0% 50.0% Resistance 116.60 116.64 39.1% 60.0% 116.87 116.95 26.2% 31.3% 117.32 117.48 35.0% 33.3% Support 116.21 116.26 56.3% 41.7% 115.96 116.04 70.5% 53.5% 115.29 115.50 43.3% 30.8% Support 115.92 115.96 25.0% 31.3% 115.69 115.77 23.0% 78.6% 114.62 114.85 15.0% 44.4% Bund December Futures 122.5 Daily Zones Odds of Testing Odds of Holding Weekly Zones Odds of Testing Odds of Holding Monthly Zones Odds of Testing Odds of Holding Resistance 123.05 123.11 16.2% 54.5% 123.90 124.04 18.2% 58.3% 125.50 125.78 7.8% 60.0% Resistance 122.75 122.81 41.2% 57.1% 123.26 123.48 31.8% 23.8% 124.19 124.70 35.9% 52.2% Support 122.20 122.29 52.9% 36.1% 122.07 122.25 62.1% 56.1% 121.45 121.73 40.6% 42.3% Support 121.86 121.92 26.5% 33.3% 121.52 121.66 16.7% 72.7% 120.13 120.52 14.1% 55.6% Bund 2Yr 10Yr Spread 197.9 Daily Zones Odds of Testing Odds of Holding Weekly Zones Odds of Testing Odds of Holding Monthly Zones Odds of Testing Odds of Holding Resistance 200.5 200.8 20.5% 12.5% 204.2 205.4 17.9% 57.1% 223.1 225.3 15.4% 50.0% Resistance 198.8 199.1 53.8% 42.9% 198.9 200.9 66.7% 50.0% 202.3 206.1 61.5% 54.2% Support 195.6 196.2 35.9% 21.4% 186.1 187.6 30.8% 41.7% 178.3 180.5 20.5% 50.0% Support 194.5 194.8 17.9% 42.9% 181.9 183.0 10.3% 75.0% 169.6 172.2 7.7% 66.7% Bund 10Yr 30Yr Spread 75.6 Daily Zones Odds of Testing Odds of Holding Weekly Zones Odds of Testing Odds of Holding Monthly Zones Odds of Testing Odds of Holding Resistance 77.6 77.8 12.9% 62.5% 84.4 85.2 4.8% >90% 87.3 88.7 9.7% 66.7% Resistance 76.6 77.0 43.5% 63.0% 79.8 81.2 17.7% 45.5% 77.9 79.3 100.0% 67.7% Support 74.8 75.0 59.7% 51.4% 73.3 74.9 77.4% 60.4% 65.4 66.7 4.8% >90% Support 73.1 73.3 19.4% 75.0% 69.8 70.5 25.8% 81.3% 58.5 59.8 0.0% #N/A EUR/USD 1.4533 Daily Zones Odds of Testing Odds of Holding Weekly Zones Odds of Testing Odds of Holding Monthly Zones Odds of Testing Odds of Holding Resistance 1.4655 1.4668 21.8% 50.0% 1.4972 1.4999 3.6% >90% 1.5777 1.5830 1.9% >90% Resistance 1.4603 1.4628 47.3% 50.0% 1.4802 1.4844 10.9% 83.3% 1.5221 1.5302 5.7% >90% Support 1.4469 1.4489 47.3% 30.8% 1.4499 1.4526 MET 60.0% 1.4702 1.4769 MET 30.2% Support 1.4400 1.4413 14.5% 37.5% 1.4334 1.4361 30.9% 58.8% 1.4411 1.4463 50.9% 55.6% GBP/USD 1.6258 Daily Zones Odds of Testing Odds of Holding Weekly Zones Odds of Testing Odds of Holding Monthly Zones Odds of Testing Odds of Holding Resistance 1.6409 1.6424 13.3% 75.0% 1.6635 1.6673 3.3% <10% 1.7201 1.7285 0.0% #N/A Resistance 1.6310 1.6330 56.7% 64.7% 1.6435 1.6473 30.0% 88.9% 1.6770 1.6888 10.0% >90% Support 1.6184 1.6203 50.0% 33.3% 1.6071 1.6109 60.0% 66.7% 1.6047 1.6176 MET 70.0% Support 1.6077 1.6091 30.0% 44.4% 1.5936 1.5974 20.0% 50.0% 1.5758 1.5843 10.0% 66.7% USD/JPY 89.70 Daily Zones Odds of Testing Odds of Holding Weekly Zones Odds of Testing Odds of Holding Monthly Zones Odds of Testing Odds of Holding Resistance 90.52 90.64 1.9% <10% 92.12 92.42 9.6% 60.0% 92.02 92.55 19.2% 40.0% Resistance 90.13 90.25 40.4% 76.2% 90.37 90.72 48.1% 68.0% 89.36 90.14 MET 73.1% Support 88.94 89.08 46.2% 45.8% 87.35 87.65 38.5% 60.0% 83.65 84.36 15.4% 75.0% Support 88.43 88.58 25.0% 69.2% 85.92 86.22 17.3% 66.7% 81.38 81.91 1.9% >90% AUD/USD 0.9068 Daily Zones Odds of Testing Odds of Holding Weekly Zones Odds of Testing Odds of Holding Monthly Zones Odds of Testing Odds of Holding Resistance 0.9174 0.9185 16.7% 72.7% 0.9310 0.9337 9.1% 16.7% 1.0212 1.0269 7.7% 60.0% Resistance 0.9136 0.9149 40.9% 55.6% 0.9197 0.9244 31.8% 57.1% 0.9357 0.9435 32.3% 81.0% Support 0.9009 0.9023 34.8% 43.5% 0.8965 0.9019 50.0% 54.5% 0.8867 0.8923 53.8% 74.3% Support 0.8885 0.8896 13.6% 22.2% 0.8699 0.8727 16.7% 27.3% 0.8557 0.8613 4.6% 66.7% USD/CAD 1.0612 Daily Zones Odds of Testing Odds of Holding Weekly Zones Odds of Testing Odds of Holding Monthly Zones Odds of Testing Odds of Holding Resistance 1.0728 1.0739 16.9% 60.0% 1.0827 1.0854 11.2% 60.0% 1.1070 1.1133 9.4% 50.0% Resistance 1.0645 1.0665 44.9% 62.5% 1.0691 1.0736 65.2% 67.2% 1.0813 1.0894 48.2% 63.4% Support 1.0548 1.0560 49.4% 54.5% 1.0450 1.0502 37.1% 63.6% 1.0258 1.0362 27.1% 65.2% Support 1.0436 1.0447 23.6% 47.6% 1.0324 1.0351 10.1% 66.7% 0.9845 0.9908 7.1% >90% USD/CHF 1.0404 Daily Zones Odds of Testing Odds of Holding Weekly Zones Odds of Testing Odds of Holding Monthly Zones Odds of Testing Odds of Holding Resistance 1.0489 1.0498 14.8% 50.0% 1.0530 1.0551 22.2% <10% 1.0458 1.0498 51.9% 57.1% Resistance 1.0434 1.0451 40.7% 36.4% 1.0411 1.0432 MET 48.1% 1.0225 1.0284 MET 25.9% Support 1.0331 1.0342 63.0% 47.1% 1.0168 1.0202 7.4% 50.0% 0.9864 0.9918 0.0% #N/A Support 1.0303 1.0312 33.3% 44.4% 1.0070 1.0091 0.0% #N/A 0.9664 0.9705 0.0% #N/A

- 3. Arbor Quantitative Analytics Master Zones and Probabilities Report Crude Oil (CLF0) 70.7 Daily Zones Odds of Testing Odds of Holding Weekly Zones Odds of Testing Odds of Holding Monthly Zones Odds of Testing Odds of Holding Resistance 72.90 73.12 15.9% 45.5% 75.82 76.38 13.0% 44.4% 93.30 94.30 0.0% #N/A Resistance 71.46 71.67 49.3% 52.9% 73.50 74.36 37.7% 61.5% 81.06 82.15 2.9% >90% Support 69.48 69.69 46.4% 37.5% 67.40 68.10 21.7% 60.0% 71.41 72.79 MET 26.1% Support 68.67 68.88 23.2% 31.3% 63.79 64.35 1.4% >90% 67.51 68.75 MET 68.1% Gold Spot 1123.9 Daily Zones Odds of Testing Odds of Holding Weekly Zones Odds of Testing Odds of Holding Monthly Zones Odds of Testing Odds of Holding Resistance 1146.89 1149.15 24.1% 57.1% 1184.14 1189.32 6.9% >90% 1315.36 1323.56 0.0% #N/A Resistance 1131.16 1134.41 43.1% 40.0% 1148.68 1158.86 20.7% 66.7% 1231.04 1239.24 24.6% >90% Support 1110.67 1114.45 50.0% 55.2% 1094.31 1099.49 37.9% 54.5% 1135.64 1143.84 MET 28.1% Support 1094.19 1096.45 19.0% 72.7% 1067.61 1072.79 3.4% 50.0% 1096.74 1108.19 59.6% 52.9% Silver Spot 17.4 Daily Zones Odds of Testing Odds of Holding Weekly Zones Odds of Testing Odds of Holding Monthly Zones Odds of Testing Odds of Holding Resistance 17.87 17.92 14.9% 57.1% 18.48 18.61 6.4% <10% 20.49 20.72 0.0% #N/A Resistance 17.58 17.67 42.6% 50.0% 18.05 18.19 27.7% 69.2% 19.22 19.49 MET 90.0% Support 17.13 17.20 51.1% 62.5% 16.53 16.75 17.0% 50.0% 16.77 17.00 MET 74.5% Support 16.78 16.83 12.8% 50.0% 15.63 15.76 4.3% 50.0% 15.41 15.64 17.0% 87.5% SPX 1107.9 Daily Zones Odds of Testing Odds of Holding Weekly Zones Odds of Testing Odds of Holding Monthly Zones Odds of Testing Odds of Holding Resistance 1116.65 1117.57 8.9% 75.0% 1133.21 1136.19 4.4% <10% 1203.01 1211.85 6.7% 66.7% Resistance 1112.19 1113.46 40.0% 77.8% 1114.08 1119.19 MET 86.7% 1126.02 1138.35 40.0% 83.3% Support 1103.23 1104.37 71.1% 53.1% 1088.35 1091.33 31.1% 50.0% 1043.77 1058.38 42.2% 68.4% Support 1095.48 1096.40 24.4% 27.3% 1058.23 1061.22 11.1% 60.0% 1003.07 1015.85 15.6% 85.7% NDX 1798.2 Daily Zones Odds of Testing Odds of Holding Weekly Zones Odds of Testing Odds of Holding Monthly Zones Odds of Testing Odds of Holding Resistance 1817.50 1819.78 19.1% 77.8% 1869.18 1875.07 6.4% 33.3% 1963.95 1979.91 10.6% 80.0% Resistance 1807.35 1811.48 59.6% 67.9% 1810.31 1821.38 MET 85.1% 1833.71 1849.67 44.7% 61.9% Support 1787.57 1790.16 59.6% 75.0% 1756.66 1767.80 25.5% 66.7% 1652.44 1676.11 21.3% 70.0% Support 1780.46 1782.75 10.6% 40.0% 1718.65 1724.54 2.1% <10% 1599.49 1615.45 0.0% #N/A iTraxx Euro Xover 477.3 Daily Zones Odds of Testing Odds of Holding Weekly Zones Odds of Testing Odds of Holding Monthly Zones Odds of Testing Odds of Holding Support 491.0 492.7 33.3% 62.5% 527.6 532.0 2.1% >90% 627.0 639.3 2.1% <10% Support 482.2 485.2 58.3% 46.4% 506.6 515.1 6.4% 66.7% 582.6 599.5 10.6% 80.0% Resistance 469.5 472.5 39.6% 47.4% 469.7 477.5 MET 66.0% 476.6 495.4 MET 61.7% Resistance 463.7 465.3 10.4% 20.0% 415.8 420.2 8.5% 75.0% 371.1 383.4 21.3% 90.0% iTraxx Euro Main 80.9 Daily Zones Odds of Testing Odds of Holding Weekly Zones Odds of Testing Odds of Holding Monthly Zones Odds of Testing Odds of Holding Support 84.8 85.1 4.5% <10% 86.8 87.6 0.0% #N/A 110.0 112.4 0.0% #N/A Support 81.8 82.4 40.9% 66.7% 84.1 84.9 13.6% 66.7% 98.8 101.3 22.7% >90% Resistance 78.8 79.2 59.1% 76.9% 77.5 78.7 MET 81.8% 76.8 79.8 MET 81.8% Resistance 75.6 75.9 13.6% 66.7% 68.0 68.8 13.6% 33.3% 61.6 64.7 9.1% >90% North American Investment Grade 92.3 Daily Zones Odds of Testing Odds of Holding Weekly Zones Odds of Testing Odds of Holding Monthly Zones Odds of Testing Odds of Holding Support 93.7 93.9 14.3% 22.2% 100.0 100.8 4.8% 66.7% 135.3 137.7 1.6% >90% Support 92.8 93.0 68.3% 67.4% 97.3 98.1 14.3% 77.8% 115.0 118.2 4.8% >90% Resistance 91.3 91.6 47.6% 70.0% 91.3 92.0 MET 74.6% 94.3 98.8 MET 30.6% Resistance 90.3 90.5 6.3% 75.0% 87.9 88.6 9.5% 83.3% 80.4 82.8 38.7% 70.8% DAX 5811.3 Daily Zones Odds of Testing Odds of Holding Weekly Zones Odds of Testing Odds of Holding Monthly Zones Odds of Testing Odds of Holding Resistance 5895.76 5904.62 10.4% 50.0% 6010.25 6034.51 19.5% 46.7% 6263.62 6319.86 19.5% 80.0% Resistance 5834.24 5849.72 29.9% 60.9% 5817.65 5864.83 MET 76.6% 5798.33 5892.07 MET 68.8% Support 5759.04 5767.89 61.0% 61.7% 5622.19 5663.87 29.9% 69.6% 5298.00 5354.24 9.1% 85.7% Support 5730.88 5739.74 19.5% 40.0% 5351.52 5380.62 9.1% 57.1% 5120.20 5176.44 0.0% #N/A CAN 10 Yr Note 3.4 Daily Zones Odds of Testing Odds of Holding Weekly Zones Odds of Testing Odds of Holding Monthly Zones Odds of Testing Odds of Holding Support 3.452 3.456 15.0% <10% 3.519 3.534 30.0% 66.7% 3.521 3.552 40.0% 62.5% Support 3.428 3.436 30.0% 50.0% 3.439 3.456 65.0% 53.8% 3.419 3.449 MET 70.0% Resistance 3.391 3.399 45.0% 44.4% 3.276 3.298 25.0% >90% 3.088 3.121 5.0% <10% Resistance 3.374 3.378 20.0% 25.0% 3.214 3.231 0.0% #N/A 2.764 2.809 0.0% #N/A CAN 10 Yr USD 10Yr Spread -18.7 Daily Zones Odds of Testing Odds of Holding Weekly Zones Odds of Testing Odds of Holding Monthly Zones Odds of Testing Odds of Holding Resistance -12.9 -12.2 27.6% 37.5% -2.1 -0.9 1.7% >90% 18.1 20.3 0.0% #N/A Resistance -15.7 -14.9 46.6% 33.3% -9.0 -7.7 20.7% 75.0% 8.5 12.0 1.7% >90% Support -21.7 -21.2 50.0% 44.8% -19.7 -17.4 MET 63.8% -10.2 -6.2 MET 31.0% Support -24.6 -24.1 22.4% 46.2% -25.6 -24.5 17.2% 50.0% -32.7 -30.5 27.6% 56.3%

- 4. Arbor Quantitative Analytics Master Zones and Probabilities Report USD 2yr Swap Spread 36.4 Daily Zones Odds of Testing Odds of Holding Weekly Zones Odds of Testing Odds of Holding Monthly Zones Odds of Testing Odds of Holding Support 38.9 39.2 21.4% 41.7% 42.0 42.8 16.1% 77.8% 50.5 52.0 7.1% >90% Zones 37.3 37.6 62.5% 42.9% 38.6 39.8 57.1% 65.6% 39.6 42.3 MET 82.1% Resistance 34.6 35.0 33.9% 63.2% 31.3 32.1 30.4% 47.1% 26.0 27.5 10.7% 66.7% Zones 33.5 33.8 10.7% 66.7% 27.7 28.5 8.9% 60.0% 21.3 22.8 1.8% >90% USD 5yr Swap Spread 38.9 Daily Zones Odds of Testing Odds of Holding Weekly Zones Odds of Testing Odds of Holding Monthly Zones Odds of Testing Odds of Holding Support 41.6 41.8 24.3% 66.7% 42.4 43.0 5.4% >90% 41.8 43.0 24.3% 77.8% Zones 39.6 39.8 59.5% 45.5% 39.8 40.9 51.4% 47.4% 37.1 39.2 MET 56.8% Resistance 37.9 38.1 43.2% 25.0% 33.9 35.0 13.5% 60.0% 26.1 27.3 2.7% >90% Zones 36.6 36.9 18.9% 14.3% 31.3 32.0 2.7% <10% 21.6 22.9 0.0% #N/A USD 10yr Swap Spread 14.4 Daily Zones Odds of Testing Odds of Holding Weekly Zones Odds of Testing Odds of Holding Monthly Zones Odds of Testing Odds of Holding Support 16.4 16.6 9.1% >90% 16.6 17.3 9.1% 50.0% 19.9 21.0 9.1% <10% Zones 15.1 15.3 63.6% 64.3% 14.4 15.1 MET 59.1% 15.2 17.4 MET >90% Resistance 13.0 13.3 22.7% 60.0% 9.6 10.2 9.1% >90% 4.8 5.9 4.5% <10% Zones 11.9 12.2 13.6% >90% 7.2 7.9 0.0% #N/A -4.3 -2.6 4.5% <10% USD 30yr Swap Spread -16.1 Daily Zones Odds of Testing Odds of Holding Weekly Zones Odds of Testing Odds of Holding Monthly Zones Odds of Testing Odds of Holding Support -13.9 -13.7 21.6% 52.6% -9.8 -9.2 6.8% 33.3% -3.9 -2.5 8.0% 71.4% Zones -14.9 -14.5 61.4% 59.3% -13.4 -12.7 37.5% 48.5% -10.7 -9.0 28.7% 64.0% Resistance -17.4 -17.0 47.7% 64.3% -19.8 -18.9 27.3% 62.5% -23.0 -20.4 48.3% 85.7% Zones -18.3 -18.0 10.2% 55.6% -23.5 -22.8 5.7% 80.0% -32.3 -30.4 6.9% >90%