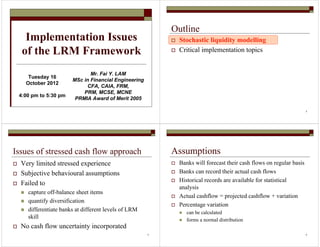

Implementation Issues of the LRM Framework

- 1. Implementation Issues of the LRM Framework Mr. Fai Y. LAM MSc in Financial Engineering CFA, CAIA, FRM, PRM, MCSE, MCNE PRMIA Award of Merit 2005 Tuesday 16 October 2012 4:00 pm to 5:30 pm 2 Outline Stochastic liquidity modelling Critical implementation topics 3 Issues of stressed cash flow approach Very limited stressed experience Subjective behavioural assumptions Failed to capture off-balance sheet items quantify diversification differentiate banks at different levels of LRM skill No cash flow uncertainty incorporated 4 Assumptions Banks will forecast their cash flows on regular basis Banks can record their actual cash flows Historical records are available for statistical analysis Actual cashflow = projected cashflow + variation Percentage variation can be calculated forms a normal distribution

- 2. 5 % of variation in cashflow forecast %1001% × −= cashflowProjected cashflowActual variation 6 Assumptions Banks with good LRM skills Experienced treasurers Stable businesses Lower risk investments More diversified funding sources More diversified lending counterparties More sophisticated IT systems Will result Lower average percentage variation Lower standard deviation of percentage variation 7 % of variation in cashflow forecast Average How conservative is the bank in making cashflow forecast? Standard deviation How consistent is the is the bank in making cashflow forecast? 8 Cash flow modelling Given a bank has made use of its best effort in forecasting the cash flows What is the worst situation of actual cash flows? Worst case at 99.9% confidence level Situation that happens once every thousand times

- 3. 9 Cash flow modelling Single month cash outflows Single month cash outflows and single month cash inflows Multiple month cash outflows and multiple month cash inflows 10 Potential application By tenor By funding source By counterparty By country By business 11 Quantitative risk measures Increasing uncertainty Higher standard deviation Market wide stress Lower correlation between cash inflows and cash outflows Increasing diversification Lower correlation among cash inflows among cash outflows 12 Outline Stochastic liquidity modelling Critical implementation topics

- 4. 13 Intragroup liquidity Local liquidity stress Cashflow projection from group members with high certainty and low correlation Global liquidity crisis Cashflow projection from group members with low certainty and high correlation 14 Intra-day liquidity Precautionary measure High certainty on intra-day cashflow projection Maintain sufficient liquidity cushion for the worst case at 99.99% confidence level (1 failure in 40 years) Intra-day monitoring Morning and afternoon on usual business days Step up to by hour during crisis 15 Collateral management To maintain sufficient and diversified high liquidity unencumbered assets Major issue: how much would be sufficient? Measured by haircut and liquidation horizon Tier 1 plan: Basel III collateral haircut table Tier 2 plan: LCR haircut table 16 Collateral haircut table, Basel III

- 5. 17 Contingency funding plan It is only a paper plan Support from interbank Support from parent company Support from central bank Fire sale of assets Public relationship with Media Regulator 18 Contingency funding plan Contingency funding measures / sources Central bank lending facilities Early warning signals / triggering events Roles and responsibilities Intraday liquidity considerations Managing customer / business relationships Retail / foreign banking operations Communication and public disclosure 19 Near term project plan Establish LRM committee LRM sub-committee under ALCO Design a 2-year plan Up to implementation of LCR Training and awareness Discuss with professional bodies, service providers and IT vendors Start with simple what you have on hand 20 Transfer pricing Asset investments are funded by liabilities, which consume liquidity Liabilities and liquidity => funding cost Liquidity costs to be calculated and charged to businesses To prevent the specific use of liquidity at the expenses of the entire

- 6. 21 Transfer pricing Still an active research topic Which discount rates to use Risk-free curve Treasury rates Interbank-swap rates Overnight index swap rates Risky curve