09 02 24 Web 2.0 Weekly

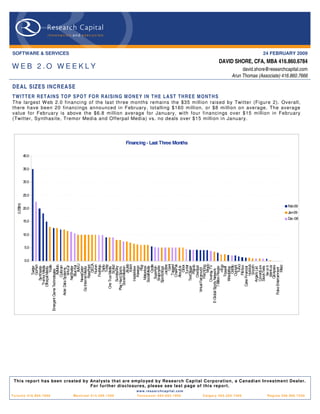

- 1. SOFTWARE & SERVICES 24 FEBRUARY 2009 DAVID SHORE, CFA, MBA 416.860.6784 WEB 2.O WEEKLY david.shore@researchcapital.com Arun Thomas (Associate) 416.860.7666 DEAL SIZES INCREASE T WIT T E R R ET AI N S T O P S PO T F O R R AI SI N G M ON E Y IN T H E L A ST T H R E E M ONT H S The largest W eb 2.0 financing of the last three months remains the $35 million raised by Twitter (Figure 2). Overall, there have been 20 financings announced in February, totalling $160 million, or $8 million on average. The average value for February is above the $6.8 million average for January, with four financings over $15 million in February (Twitter, Synthasite, Tremor Media and Offerpal Media) vs. no deals over $15 million in January. Financing - Last Three Months 40.0 35.0 30.0 25.0 (US$m) Feb-09 20.0 Jan-09 Dec-08 15.0 10.0 5.0 0.0 DECA IMVU Mixpo JibJab Geni Tvinci ChakPak Oodle Tagged Hubdub GoFish Nurien Taptu Tvtrip Jackbe Ego Xobni Fliqz Gbox Meez RatePoint Yodle AdMob FooMojo Playdo FetchDog Snooth Scribd DotBlu blr Filtrbox Clickpass Overlay.TV Outright Outbrain CoveritLive Identi.ca Blue Kai VirtuOz fav.or.it OneSpot Tremor Media Kewego Snapmylife Twitter TextDigger NetShelter SundaySky Motionbox AboutUs StockTwits Synthasite Social Median SocialMedia Superfish 7 Billion People NewsGator InsideView Cake Financial Sportsblogs histleBox Tripwolf Angie's List Offerpal Media Go Internet Media One True Media Play Hard Sports Pulse Entertainment Virtual Fairground Tum Aster Data Systems E-Global Sports Network Emergent Game Technologies m W This report has been created b y Anal ysts that are emplo yed b y Research Capital Corporation, a Canadian Investment Dealer. For further disclosures, please see last page of this report. www.researchcapital.com T o ro n t o 4 1 6 . 8 6 0 . 7 6 0 0 Montreal 514.399.1500 Vancouver 604.662.1800 Calgary 403.265.7400 Regina 306.566.7550

- 2. Page 2 THE WEB 2.0 UNIVERSE 85 public Web 2.0 companies identified: W e have identified 85 public companies for our W eb 2.0 universe, with a combined market cap of $30 billion. These include a wide variety of companies, including MMOG (Massive Multi-Player Online Gaming) companies, social networking software companies, media sharing companies, and social lending companies. See below for a summary of the full universe (Figure 1). The average market cap for the group is ~$330 million (but a median of only $28.6 million), with average trailing revenue of $134 million (median $36 million). The companies are also highly profitable, with an average EBITDA margin of 17.8%. On a valuation basis, the overall average is 3.6x trailing revenue (median 1.1x) and 8.2x trailing EBITDA (median 5.4x). Fifteen of the companies have more than 500 employees. Comparable C ompany Analys is > Web 2.0 T rading C urrent US D Mark et US D L T M T otal US D L TM T otal E B IT DA TE V /L T M T E V /L T M C ompany Na me L T M as of Ti c ker E xc hange C urr enc y HQ Pric e C ap ($m) R ev ($m ) E B IT DA ($m ) % R evenue E B ITDA E mployees Acce lerize N ew Media, Inc. 9 /30/20 08 AC LZ OTCB B US D United S tates 0. 31 8. 3 3. 2 ( 4. 7) NM 4. 0 x - 20 Actoz S oft C o. , Ltd. 9 /30/20 08 A05 2790 K OS E KR W S outh Korea 11 ,0 50 6 5. 2 4 8. 9 8. 9 18 .3 % 0. 9 x 4.7 x NA AQ Inte ractive, Inc. 1 2/31 /2008 3838 TS E JP Y J a pan 31 ,8 00 1 8. 3 6 3. 7 5. 1 8. 0% - - NA As s ociated Media Holdings Inc. 6 /30/20 07 AS MH OTCP K US D United S tates 0. 01 0. 2 0. 1 ( 2. 3) NM 1 0. 2x - 3 B igs tring C orp. 9 /30/20 08 BSGC OTCB B US D United S tates 0. 01 0. 7 0. 1 ( 2. 1) NM 2 8. 9x - 8 B r ight T hings plc 9 /30/20 08 AIM: B GT AIM G BP United K ingdom 0. 02 3. 3 0. 2 ( 1. 6) NM 1 3. 4x - 9 B r oadW ebA s ia Inc. 9 /30/20 08 B W BA OTCP K US D United S tates 1. 01 8 5. 7 0. 0 ( 4. 6) NM - - 46 C DC C orp. 9 /30/20 08 C HIN. A Na s daqG S US D Hong K ong 0. 79 8 5. 2 428. 1 18 .8 4. 4% 0. 3 x 7.5 x 3 ,125 C hina G ateway C orpora tion 9 /30/20 08 CG W Y OTCB B US D United S tates 0. 00 0. 0 6. 7 ( 6. 6) -9 8. 9% 0. 0 x - 37 C hines e G amer International 9 /30/20 08 G T S M: 3083 GTS M TW D T a iwan 11 1. 00 271 . 8 3 7. 1 17 .5 47 .1 % 5. 9 x 12. 4x NA C ornerW orld C orporation 1 0/31 /2008 CW R L OTCB B US D United S tates 0. 15 7. 0 0. 6 3. 1 506. 8 % 1 3. 8x 2.7 x NA DAD A S pA 9 /30/20 08 C M: DA CM E UR Italy 5. 70 117 . 7 216. 0 34 .5 16 .0 % 0. 7 x 4.6 x 5 74 DXN Holdings B hd 1 1/30 /2008 DX N K LS E MY R Ma lays ia 0. 32 2 0. 0 7 6. 0 10 .1 13 .3 % 0. 5 x 3.9 x NA Digita lP os t Inter active, Inc. 9 /30/20 08 DG LP OTCB B US D United S tates 0. 01 0. 5 0. 4 ( 3. 3) NM 3. 6 x - 11 Digita lT own, Inc. 1 1/30 /2008 DG T W OTCB B US D United S tates 2. 40 6 5. 2 NM ( 2. 5) NM - - 3 Dolphin Digita l Me dia , Inc. NA DP DM OTCB B US D United S tates 0. 50 2 4. 2 NA NM NM - - 6 E olith C o. Ltd. 1 2/31 /2007 A04 1060 K OS E KR W S outh Korea 5 85 1 8. 3 1 6. 7 ( 0. 0) -0 .3 % 1. 1 x - NA E xtensions, Inc. 9 /30/20 08 E XT I OTCP K US D United S tates 0. 15 1 4. 2 NM NM NM - - 2 F ina ncia l Me dia Group, Inc. 1 1/30 /2008 F NG P OTCB B US D United S tates 0. 03 2. 1 6. 8 1. 2 18 .3 % 0. 2 x 1.0 x 22 F luid Mus ic C anada , Inc. 9 /30/20 08 T S X: F MN TS X CAD United S tates 0. 50 2 1. 0 4. 2 ( 8. 6) NM 1. 9 x - 29 F rogs te r Inte ractive P ictures A G 6 /30/20 08 FR G XT R A E UR G er many 4. 03 1 2. 1 5. 1 ( 3. 1) -6 0. 6% 2. 3 x - NA Ga mania Digital E nterta inme nt C o. , L td. 9 /30/20 08 6180 GTS M TW D T a iwan 2 1. 55 9 4. 3 107. 2 18 .1 16 .9 % 0. 6 x 3.8 x NA Ga meO n C o L td. 1 2/31 /2008 3812 TS E JP Y J a pan 91 ,0 00 9 2. 9 7 8. 8 20 .8 26 .4 % 0. 4 x 1.6 x NA GeoS entric O yj 9 /30/20 08 G E O 1V HL S E E UR F inland 0. 04 4 5. 6 5. 2 (12 .0) NM 7. 7 x - 92 Giant Interactive G roup, Inc. 9 /30/20 08 GA NY S E US D C hina 6. 05 1, 438. 1 245. 2 1 55. 7 63 .5 % - - 1 ,016 GigaMe dia L td. 9 /30/20 08 G IG M Na s daqG S US D T a iwan 6. 03 325 . 8 200. 5 48 .0 23 .9 % 1. 3 x 5.4 x 9 75 GoF is h C or poration 9 /30/20 08 G OF H OTCB B US D United S tates 0. 11 3. 2 6. 3 (11 .0) NM 2. 2 x - 41 Gravity C o., Ltd 9 /30/20 08 GRVY Na s daqG M US D S outh Korea 0. 70 1 9. 5 3 2. 7 6. 3 19 .2 % - - 6 36 Gree, Inc. 6 /30/20 08 T S E : 3 632 TS E JP Y J a pan 4 ,7 40 1, 116. 5 3 1. 0 11 .2 36 .0 % 3 3. 9x - NA GungHo Online E ntertainme nt, Inc. 9 /30/20 08 3765 OSE JP Y J a pan 112 ,4 00 135 . 7 107. 9 15 .8 14 .7 % 1. 0 x 6.9 x NA HanbitS oft, Inc. 9 /30/20 08 A04 7080 K OS E KR W S outh Korea 3 ,3 70 4 9. 4 4 6. 4 (11 .9) -2 5. 6% 0. 7 x - NA IA C /Inte rA ctiveC orp. 1 2/31 /2008 IAC I Na s daqG S US D United S tates 1 4. 92 2, 102. 2 1 , 445 . 1 64 .6 4. 5% 0. 2 x 5.4 x NA IA S E ne rgy, Inc. 1 0/31 /2008 IAS C . A OTCB B US D C a na da 0. 02 1. 5 0. 0 ( 0. 9) NM - - NA IdeaE dge, Inc. 1 2/31 /2008 O T C B B: ID AE OTCB B US D United S tates 0. 40 1 6. 9 0. 0 ( 4. 6) NM - - NA is ee media Inc. 9 /30/20 08 IE E T S XV CAD C a na da 0. 08 3. 3 1. 1 ( 4. 4) NM 0. 6 x - NA J umbuck E ntertainme nt P ty Ltd. 6 /30/20 08 AS X :J MB AS X A UD Aus tra lia 0. 40 1 2. 8 1 0. 1 4. 7 46 .0 % 0. 8 x 1.8 x 72 J umpT V Inc. 6 /30/20 08 T S X: J T V TS X CAD C a na da 0. 40 3 6. 4 1 1. 5 ( 1. 8) -1 5. 3% 3. 9 x - NA K a boos e Inc. 9 /30/20 08 T S X: K AB TS X CAD C a na da 0. 38 4 2. 6 5 9. 4 4. 5 7. 6% 0. 8 x 11. 0x NA K ings oft C o. Ltd. 9 /30/20 08 3888 S EHK HK D C hina 2. 77 383 . 5 106. 8 36 .1 33 .8 % 2. 8 x 8.2 x 1 ,660 Lingo Media C orpora tion 9 /30/20 08 T S XV :L M T S XV CAD C a na da 0. 90 9. 3 3. 3 ( 1. 4) -4 2. 5% 3. 1 x - NA Live World Inc. 9 /30/20 08 L VW D OTCP K US D United S tates 0. 04 1. 2 1 1. 7 ( 1. 2) -1 0. 1% 0. 0 x - 73 LookS mar t, Ltd. 9 /30/20 08 L OO K Na s daqG M US D United S tates 1. 27 2 1. 6 6 9. 5 ( 2. 6) -3 .7 % - - 93 Magnitude Informa tion S ys tems Inc. 9 /30/20 08 MA GY OTCB B US D United S tates 0. 02 7. 9 0. 1 ( 3. 2) NM - - 13 Mixi, Inc. 1 2/31 /2008 2121 TS E JP Y J a pan 368 ,0 00 594 . 8 123. 9 47 .1 38 .0 % 3. 9 x 10. 3x NA Mode rn T imes Gr oup Mtg AB 1 2/31 /2008 MT G B OM SE K S weden 11 2. 00 840 . 3 1 , 499 . 2 2 39. 7 16 .0 % 0. 9 x 5.4 x NA Moggle , Inc 1 2/31 /2008 MMO G OTCB B US D United S tates 2. 00 7 2. 6 NM ( 1. 1) NM - - 3 MOK O. mobi L imited 6 /30/20 08 MK B AS X A UD Aus tra lia 0. 04 2. 1 1. 3 ( 2. 0) NM 0. 7 x - NA NE O W IZ G ame s C orpora tion 1 2/31 /2007 A09 5660 K OS E KR W S outh Korea 33 ,7 50 217 . 0 120. 6 32 .4 26 .9 % 1. 7 x 6.4 x NA NetDra gon WebS oft, Inc. 9 /30/20 08 777 S EHK HK D C hina 2. 80 190 . 9 9 5. 3 46 .3 48 .6 % 0. 1 x 0.3 x 1 ,482 Netea s e. com Inc. 9 /30/20 08 NT E S Na s daqG S US D C hina 1 8. 63 2, 292. 5 422. 7 2 74. 4 64 .9 % - - 2 ,413 NeXplore C or por ation 9 /30/20 07 NX P C OTCP K US D United S tates 0. 50 2 7. 9 NM ( 4. 9) NM - - 19 Ngi G roup Inc. 1 2/31 /2008 2497 TS E JP Y J a pan 17 ,1 80 2 2. 4 103. 8 32 .0 30 .8 % - - NA Northgate T e chnologies L imited 1 2/31 /2008 5900 57 BSE INR India 3 8. 45 2 7. 0 135. 5 23 .8 17 .6 % 0. 2 x 1.1 x 2 86 Open T ext C orp. 1 2/31 /2008 OTE X Na s daqG S US D C a na da 3 1. 94 1, 657. 7 769. 3 1 95. 0 25 .3 % 2. 3 x 9.2 x 3 ,400 Openwa ve S ys tems Inc. 1 2/31 /2008 OPW V Na s daqG S US D United S tates 0. 82 6 8. 3 199. 6 (10 .2) -5 .1 % - - 6 27 P erfect W orld C o., Ltd. 9 /30/20 08 PWRD Na s daqG S US D C hina 1 2. 20 696 . 0 186. 9 99 .9 53 .5 % - - 1 ,401 P hotoC hannel Ne tworks Inc. 9 /30/20 08 T S XV :P N T S XV CAD C a na da 1. 96 5 2. 5 1 3. 6 ( 2. 4) -1 7. 7% 3. 8 x - NA Quepas a C orp. 9 /30/20 08 QPS A Na s daqC M US D United S tates 1. 40 1 7. 7 0. 1 (11 .8) NM - - 63 OAO R B C Informa tion S ys tems 1 2/31 /2007 RB CI RTS US D R us s ia 0. 30 4 1. 6 131. 7 17 .2 13 .1 % 0. 0 x 0.1 x NA S handa Intera ctive E nte rtainment L td. 9 /30/20 08 S NDA Na s daqG S US D C hina 3 1. 98 2, 218. 9 478. 0 2 28. 3 47 .8 % - - 2 ,564 S hutterfly, Inc. 1 2/31 /2008 S F LY Na s daqG S US D United S tates 7. 48 188 . 0 213. 5 29 .8 13 .9 % 0. 5 x 3.4 x NA S K C ommunications C o. , Ltd. 1 2/31 /2007 A06 6270 K OS E KR W S outh Korea 6 ,7 30 185 . 1 138. 7 13 .1 9. 4% 1. 3 x 14. 2x NA S NA P Inter active, Inc. 9 /30/20 08 S T VI OTCB B US D United S tates 1. 00 1 0. 7 2. 3 0. 2 10 .1 % 4. 2 x 41. 2x 5 S NM G lobal Holdings 9 /30/20 08 S NMN OTCP K US D United S tates 0. 00 0. 0 2. 0 ( 0. 7) -3 4. 8% 1. 1 x - 33 S ocial Me dia V enures , Inc. 1 2/31 /2008 S MVI OTCP K US D United S tates 1. 25 0. 0 0. 1 ( 0. 1) -6 0. 5% 0. 1 x - NA S park Networks , Inc. 9 /30/20 08 L OV AME X US D United S tates 2. 50 5 3. 6 6 0. 1 11 .7 19 .5 % 0. 8 x 4.2 x 1 76 S pectrumDNA, Inc. 9 /30/20 08 S PX A OTCB B US D United S tates 0. 10 4. 9 0. 1 ( 2. 7) NM - - 7 T encent Holdings Ltd. 9 /30/20 08 700 S EHK HK D C hina 4 6. 65 10 ,8 14.3 903. 8 4 47. 8 49 .5 % 1 2. 9x 26. 1x 6 ,039 T he P ar ent C ompany 8/2/2 008 K IDS . Q OTCP K US D United S tates 0. 02 0. 6 112. 0 (13 .5) -1 2. 0% 0. 2 x - 3 47 T he 9 Limited 9 /30/20 08 NC T Y Na s daqG S US D C hina 1 3. 22 365 . 0 252. 5 95 .1 37 .7 % - - 1 ,361 T he S tre et.com, Inc. 1 2/31 /2008 TS CM Na s daqG M US D United S tates 2. 23 6 7. 7 7 1. 9 7. 7 10 .8 % - - NA T ree . C om, Inc. 1 2/31 /2008 TR E E Na s daqG M US D United S tates 3. 98 3 7. 3 228. 6 (27 .0) -1 1. 8% 0. 2 x - NA Unis e rve C ommunications C or p. 1 1/30 /2008 T S XV :U S S T S XV CAD C a na da 0. 05 1. 0 2 3. 9 0. 1 0. 4% 0. 1 x 31. 3x NA Unite d Online Inc. 1 2/31 /2008 UNT D Na s daqG S US D United S tates 4. 76 390 . 8 669. 4 1 53. 9 23 .0 % 1. 0 x 4.5 x NA UOMO Media, Inc 1 0/31 /2008 UO MO OTCB B US D C a na da 0. 08 6. 8 0. 5 ( 0. 4) -9 1. 6% 1 5. 1x - NA VO IS , Inc. 9 /30/20 08 V OIS OTCB B US D United S tates 0. 75 5. 4 0. 0 ( 4. 0) NM - - 4 W ebz en Inc. 1 2/31 /2008 W ZE N Na s daqG M US D S outh Korea 1. 13 1 3. 4 1 9. 1 ( 1. 9) -1 0. 1% - - 3 30 W izz a rd S oftwa re C orporation 9 /30/20 08 W ZE AME X US D United S tates 0. 65 2 9. 3 6. 2 ( 6. 5) NM 4. 7 x - 1 10 W ooz yF ly, Inc. 9 /30/20 08 W ZY F OTCB B US D United S tates 0. 15 2. 6 0. 0 NM NM - - 14 W orlds .com Inc. 9 /30/20 08 W DDD OTCB B US D United S tates 0. 18 9. 4 0. 1 NM NM - - 1 W ynds torm C orporation NA W YN D OTCB B US D United S tates 0. 12 2. 2 NA NM NM - - NA XING A G 9 /30/20 08 O 1B C XT R A E UR G er many 3 1. 00 205 . 5 3 9. 9 15 .5 38 .8 % 3. 8 x 9.8 x 1 61 Y edangO nline C orp. 1 2/31 /2007 A05 2770 K OS E KR W S outh Korea 6 ,6 30 6 9. 4 4 5. 9 10 .3 22 .4 % 1. 5 x 6.7 x NA Y nk K or ea Inc. 1 2/31 /2007 A02 3770 K OS E KR W S outh Korea 4 ,1 00 6. 7 1 3. 0 ( 1. 0) -7 .6 % 0. 5 x - NA ZipL ocal Inc. 9 /30/20 08 T S XV :ZIP T S XV CAD C a na da 0. 01 0. 3 2. 8 ( 3. 8) NM 0. 3 x - NA High 10 ,8 14.3 1 ,4 99 .2 44 7. 8 506. 8 % 3 3. 9x 41. 2x 6, 039 Low 0. 0 0. 0 -2 7. 0 -9 8. 9% 0. 0 x 0.1 x 1 Average 333.1 133.9 29.0 17.8% 3.6x 8.2x 626 Median 2 8. 6 36.3 0 .1 15 .3 % 1. 0 x 5.4 x 92 Figure 1. Web 2.0 Universe Summary Source. Capital IQ

- 3. (U S$m ) 0.0 5.0 10.0 15.0 20.0 25.0 30.0 35.0 40.0 T w itter G oF is h Sy nthas ite Source. Company reports Tremor M edia O fferpal M edia Yodle Em ergent G am e T ec hnologies AdM ob O utbrain Figure 2. Financings, Last Three Months As ter D ata Sy s tems VirtuO z N etShelter Blue Kai IM VU N ew s G ator G o Internet M edia R atePoint D EC A N urien F ooM ojo T aptu T v trip O ne True M edia Sc ribd Sunday Sk y Play H ard Sports Soc ial M edian additional details, see Figure 30 (at end of note). J ibJ ab C A P I T A L M A R K E T S A C T I V I T Y (M & A A N D F I N A N C I N G ) Xobni Ins ideView Kew ego F liqz M otionbox Soc ialM edia O odle Superfis h Snapm y life Sports blogs J ac k be G eni T agged C hak Pak AboutU s G box Financing - Last Three Months T um blr Tex tD igger Play do O neSpot Virtual F airground Fetc hD og M ix po O v erlay .T V E-G lobal Sports N etw ork 7 Billion People m Ego T ripw olf Whis tleBox D otBlu O utright T v inc i Filtrbox C ak e F inanc ial H ubdub Snooth Angie's Lis t C ov eritLiv e Stoc k T w its fav .or.it Identi.c a C lic k pas s Puls e Entertainm ent M eez Jan-09 Feb-09 Dec-08 Page 3 average. The average value for February is above the $6.8 million average for January, with four financings over $15 Twitter (Figure 2). Overall, there have been 20 financings announced in February, totalling $160 million, or $8 million on Twitter raises $35 million: The largest W eb 2.0 financing of the last three months remains the $35 million raised by million in February (Twitter, Synthasite, Tremor Media and Offerpal Media) vs. no deals over $15 million in January. For

- 4. Page 4 Four video companies raise $25.9 million (total): Activity in February has been busiest among video companies (Figure 3), with Tremor Media, WhistleBox, Tvinci, and Mixpo raising a total of $25.9 million There have also been four financings of aggregation companies - Outbrain, Oodle, OneSpot and fav.or.it - raising a total of $22.5 million. Financing by Sector - February 2009 40.0 35.0 30.0 25.0 (US$m) 20.0 35.0 15.0 25.9 22.5 10.0 20.0 15.0 12.5 5.0 9.0 5.3 4.3 4.0 3.0 2.0 1.4 0.0 Comment/Reputation Gaming Wiki Travel Microblog Financial Services Search Virtual Goods Social Networks Video Aggregation Virtual World Analytics 1 4 4 1 1 1 1 2 1 1 1 1 1 Figure 3. Financings, by Sector, February 2009 Source. Company reports Average round size increases slightly: On a trailing 12-month basis, total financing dollars inched up as of February 2009, with average round sizes increasing slightly as well (Figure 4).

- 5. Page 5 LTM Financing 4,000.0 20.0 18.0 3,500.0 16.0 3,000.0 14.0 2,500.0 12.0 (US$m) (US$m) 2,000.0 10.0 8.0 1,500.0 6.0 1,000.0 4.0 500.0 2.0 0.0 0.0 May-06 May-07 May-08 Nov-05 Mar-06 Nov-06 Mar-07 Nov-07 Mar-08 Nov-08 Jul-05 Sep-05 Jan-06 Jul-06 Sep-06 Jan-07 Jul-07 Sep-07 Jan-08 Jul-08 Sep-08 Jan-09 Total Average Figure 4. Financings, Last 12 Months Source. Company reports Cumulative total nears $5.6 billion: Overall, on a cumulative basis, W eb 2.0 financings have totalled nearly $5.6 billion, with the majority of the financing coming in late 2007 and the first three quarters of 2008 (Figure 5).Financing for the first quarter of 2009 has now passed that raised in the fourth quarter of 2008 – reversing the downtrend since the second quarter last year.

- 6. Page 6 Web 2.0 Financing (cumulative) 1,400.0 6,000.0 1,313.3 1,200.0 5,000.0 1,000.0 944.7 4,000.0 800.0 712.7 (US$m) (US$m) 3,000.0 600.0 524.9 2,000.0 370.9 400.0 338.5 313.8 1,000.0 200.0 145.7151.5 135.6 101.6 87.2 82.8 57.8 77.4 37.5 33.5 18.2 41.9 35.5 38.8 20.1 0.0 0.0 Qtr4 Qtr1 Qtr2 Qtr3 Qtr4 Qtr1 Qtr2 Qtr3 Qtr4 Qtr1 Qtr2 Qtr3 Qtr4 Qtr1 Qtr2 Qtr3 Qtr4 Qtr1 Qtr2 Qtr3 Qtr4 Qtr1 2003 2004 2005 2006 2007 2008 2009 Figure 5. Financing, Cumulative Source. Company reports U.S. remains dominant: U.S. companies continue to dominate capital market activity – with almost 73% of financings/M&A involving U.S. companies (based on dollars) (Figure 6). Canadian companies generated under 1% of capital market activity based on dollar volume (Figure 6). Based on number of transactions, the U.S. leads with 73.5% of deals, while Canada is third in number of financings at 5.1% (Figure 7). Financing/M&A by Country - LTM (#) Financing/M&A by Country - LTM ($) Canada UK UK 5.1% Israel 5.1% 12.9% 4.0% France 2.8% China 7.9% ROW Russia 1.7% 9.5% Israel 1.0% Canada 0.7% France 0.7% ROW 2.3% USA USA 73.5% 72.8%

- 7. Page 7 Figures 6 & 7. Financing/M&A, by Country (LTM, $, #) Source. Company reports Larger volume of early-stage funding (by count): Almost half of financings in the last 12 months are for early-stage companies (Angel/Seed or Series A) (Figure 8). Series B rounds are 28.5% of the total, with later-stage (Series D, E and PIPE) deals accounting for just 7.0%. Financing by Type - LTM Series B Series C 28.5% 14.0% Series D 4.3% Angel/Seed 10.2% Debt financing 2.6% Series A PIPE 38.3% 2.1% Figure 8. Financing, by Type (LTM, #) Source. Company reports Equity financings smaller over last twelve months: In the last 12 months, the average size of Series A, B, C and D rounds have all been lower than the overall average (Figure 9). Note though that Angel/Seed rounds have been larger.

- 8. Page 8 Average financing round size 45.0 41.9 40.0 38.1 34.9 35.0 29.3 30.0 25.0 23.8 (US$m) 20.0 18.4 15.0 12.0 11.4 11.3 11.3 10.0 8.8 7.5 6.8 5.8 5.0 3.5 2.6 0.0 Angel/Seed Debt financing PIPE Series A Series B Series C Series D Series E LTM Average Size Overall Average Figure 9. Average Size per Round Source. Company reports C A P I T A L M A R K E T S A C T I V I T Y (P R I C E P E R F O R M A N C E ) Price Performance: Our W eb 2.0 index (market-cap weighted) has closely tracked the performance of the NASDAQ composite index, although it has outperformed the index from mid 2008 until recently (Figure 10).

- 9. Page 9 Web 2.0 Index Price Performance 140 120 100 80 60 40 20 0 2/25/2008 3/10/2008 3/24/2008 4/7/2008 4/21/2008 5/5/2008 5/19/2008 6/2/2008 6/16/2008 6/30/2008 7/14/2008 7/28/2008 8/11/2008 8/25/2008 9/8/2008 9/22/2008 10/6/2008 10/20/2008 11/3/2008 11/17/2008 12/1/2008 12/15/2008 12/29/2008 1/12/2009 1/26/2009 2/9/2009 2/23/2009 NASDAQ COMP Web 2.0 (Market Cap Weighted) Figure 10. Web 2.0 Price Performance Source. Capital IQ DigitalTown continues to lead; Webzen falls: DigitalTown Inc. (DGTW -OTCBB) again had the best performance in the group (for stocks with prices greater than $1) (Figure 11), increasing 20.0% on the week. W ebzen Inc. (W ZEN-NasdaqGM) fell the most, -24.8%.

- 10. Page 10 1 Week P rice P erformance DigitalTow n, Inc. 20.0% G ungHo Online Entertainment, Inc. 11.5% PhotoChannel Netw orks Inc. 10.7% S handa Intera ctive Entertainment Ltd. 4.7% X ING A G 4.2% Tree.Com, Inc. 1.8% NEOWIZ G ames Corporation 0.3% Moggle, Inc 0.0% Eolith Co. Ltd. -0.8% IA C/InterA ctiveCorp. -0.9% S park Netw orks , Inc. -2.0% Quepas a Corp. -2.1% A Q Interactive, Inc. -2.6% Chines e G amer International -2.6% G iant Interactive Group, Inc. -2.7% Neteas e.com Inc. -3.2% Tencent Holdings Ltd. -3.4% K ings oft Co. Ltd. -4.5% NetDragon WebS oft, Inc. -5.1% Frogs ter Interactive Pictures A G -6.7% LookS mart, Ltd. -7.3% G amania Digital Entertainment Co., Ltd. -7.9% United Online Inc. -8.3% The9 Limited -8.8% DA DA S pA -8.9% Y edangOnline Corp. -9.2% Open Tex t Corp. -10.2% Mix i, Inc. -10.9% Y nk K orea Inc. -11.4% G ree, Inc. -11.6% S hutterfly , Inc. -11.9% A ctoz S oft Co., Ltd. -13.0% TheS treet.com, Inc. -14.2% Perfect World Co., Ltd. -14.7% Modern Times Group Mtg A B -15.2% HanbitS oft, Inc. -17.0% S K Communications Co., Ltd. -17.2% GigaMedia Ltd. -18.3% G ameOn Co Ltd. -20.2% Webz en Inc. -24.8% -30.0% -25.0% -20.0% -15.0% -10.0% -5.0% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% Figure 11. 1-Week Price Performance Source. Capital IQ

- 11. Page 11 INDUSTRY NEWS (PARTNERSHIPS, FINANCIAL RESULTS, NEW PRODUCTS) K ey Developments Company Headline Notes O pe nwave S ys te ms A nno unces A bout O penwa ve O pen wave S ys tems Inc. anno unc ed Openwave(R ) E ma il Mx 8. 0 . O pen wa ve E mail Mx is an extens ible , O penwave S ys te ms Inc . E mail Mx 8. 0 c arrier-s ca le ema il s olution that wa s ra nk ed the mark et leader and top playe r in R adicati's ann ual 200 8 (Nas da qGS : O PW V ) Me ss aging P latforms for Hos ted E mail P roviders Mark et Q ua drant. T he late st ve rs ion, E mail M x 8 .0, now s upports mo bile e ma il us in g th e IM AP IDL E standa rd, and high capac ity mailboxes . T he I MAP ID LE feature en ables s ervice providers to offer mobile email directly to th eir s ubscribers with any compatible ha nds et, an d high ca pac ity mailboxe s offe r n early limitle ss s to rage to han dle the in crea sing amount of ric h c onte nt. O pen wave E mail Mx 8.0 addres s es the s ervic e provider's requirement to offer high ca pacity mailboxe s as well as network -bas ed mobile email th at e liminates the re quire me nt for us ers to download a ha nds et clie nt. O pen wave E mail Mx 8.0 sc ales to s uppo rt any nu mber of s ubsc ribers with fas t, re liable performa nce. T he dis tribu ted, multi-threaded a rc hitec tu re allows inde pendent sc alin g of all c ompo nents to fit a n operator's s pec ific gro wth patterns , while reducing the ope ra tor's T C O . T e ls tra S elects O penwa ve's Openwave I ntegra Nex t O pen wave S ys tems Inc. has an noun ce d th at T els tra ha s se lecte d O pen wave Integra, nex t ge neration O penwave S ys te ms Inc . G en S e rvice Man agemen t S olu tio n mobile in ternet se rv ice ma nage me nt s olution des igned to provide o pen , s ec ure multimedia and multi- (Nas da qGS : O PW V ) protoc ol se rv ic e ma nage ment s upport. O pe nwav e In tegra offe rs T els tra a ra nge of be nefits , inc lu ding the ability to rapidly s cale to me et c ha nging c us to me r needs, as well a s su pport new pro toc ols, co nten t types an d applications . O pe nwav e In tegra provide s T e ls tra a n evolutiona ry roadmap with innovative s ervic es and be nefits inc luding: C o st efficient evolutiona ry roadma p from W A P gate way to n ext-ge neration data arc hitec ture, ena bling T els tra to lev erage its inv es tme nt in O pe nwav e's M obile Acc es s Ga teway fo r W AP s upport R apid deploy me nt of ne w s ervice s and ability to c os t efficiently add c apa city an d ne w co re prox ies fo r new traffic , including o pen internet ac ce ss a nd R T S P s uppo rt C ommo n s ervic es framework for a ll protoc ols -W A P , HT T P , R T S P etc. with en hanc ed ope ra tio ns , adminis tration and monitorin g (O AM ) c apa bilitie s a cros s all traffic s and se rvic es that enables e as e of prov is ioning, mainte nance, billin g, an alytic s an d operations . I ntegra als o gives o perato rs th e ability to ex pand the c apabilities o f the ir ex is ting mo bile gate G eo S e ntric O yj A nno unc es the La unc h o f G y P S ii G eoS en tric O yj's G yP S ii bus ines s unit a nnounced the lau nc h of the Gy P S ii OpenE xpe rienc e AP I, the G eoS entric Oyj (HL S E : G E O 1V) O pe nex perie nc e A pi premier all-in clus iv e pla tform for incorporating loca tio n-bas ed so cial netwo rk ing func tiona lity into embe dded mobile c lients a nd a pplic ations . T he c ompan y will be de mon stra ting s elec t s ervic es of OE x on the s oo n to be rele as ed G y P S ii n ative applic ation s uppo rt for the iP h one. G yP S ii will be in H a ll 7 B 59 at M obile W orld C on gres s, B arce lon a. O E x s upports a wh ole new us er experie nc e on mo bile devic es , a s se en o n the iP h one a nd o ther n ew us er e xperience bas ed mobile platforms . O E x allows G yP S ii partn ers to e nhan ce th eir o wn produ cts and se rv ice s with the rich loc ation-s pec ific fe atures , co nten t and commu nity o f the G yP S ii mobile so cial ne twork. In us ing the AP I, partne rs c an le verage G y P S ii's vas t interna tio nal infras truc ture a nd imme dia tely o ffer n ew s ervices to their cu stomer bas e. G eo S e ntric O yj's T W I G B us ines s Unit L aunche s G eoS en tric O yj's T W IG bus ine ss unit, an nounce d th e launch of its ne xt generation , G P S /G S M personal G eoS entric Oyj (HL S E : G E O 1V) T W I G P rote ctor protec tio n de vice --T he T W IG P ro tec tor. C re ated to protec t lon e work ers, the vu lne ra ble and tho se nee din g ac ces s to eme rgenc y ca re , th e T W IG P rotecto r is s hock an d water re sis tant, ligh t an d ex tremely e as y to us e. In a ddition it c an co mmun ic ate with all TW IG (T M ) devices an d s upport s ys te ms us ing both S M S a nd G P R S M obile P hone T ele ma tics P ro toc ol. W hen o perated in c onjunc tion with the T W IG W ebF inder, th e T W IG P rotec to r provide s a fully inte grated, mobile co mmun ications a nd pro tec tio n s olution, that can be us ed any where in the world. L G E lectronic s I nc. an d G eoS en tric O yj A nno unc es L G E lectro nics In c. and G eoS entric O yj ann ounc ed a partners hip to embed G yP S ii's loc ation -e nabled G eoS entric Oyj (HL S E : G E O 1V); L G P artne rs hip to E mbed G y P S ii's Lo ca tio n-E n abled mobile digital lifes ty le applica tio n on a ran ge of new mo bile devices . Un der the terms of the deal, LG E lec troni c s Inc . (K O S E : A0665 70) M obile Digita l L ife style A pplic ation on a R ange o f E le ctron ic s mobile cu stomers will h ave ac ces s to G y P S ii's broa d range of lo ca tio n-aware fu nc tio ns and Ne w Mobile De vice s mobile lifes ty le s ervices in cluding us er gen erated c onte nt s haring, frien d finding and so cial ne tworking application, as well a s the ability to view it all o n a ma p within a s ingle, e as y to n avigate us er inte rfac e. T he s ervice will be prov ide d in pa rtn ersh ip with Intrins yc, L G 's nav igation so lution prov ide r. W ithin the pa rtners hip agree men t, L G E lectronic s and Gy P S ii will s hare adv ertis ing a nd s po ns orsh ip re ve nues ge nerate d by us ers of G yP S ii on the n ew L G devices . T he range will firs t launch ac ro ss the W indows Mo bile o perating sy s tem, c los ely fo llowed by An droid and ja va -e nabled devices . B eta wave C orpo ra tio n A nnou nc es A d-S upported B etawa ve C orporation (Go F is h C o rporation) an nounce d th e premie re of B etawav e T V , an ad-s upported G oF is h C orporation (O T C B B : G OF H ) V ideo P latfo rm v ide o platform. B e tawav e T V ha s lau nc hed on s ev eral publis hers with in the B e tawav e portfolio , an d will als o be available to s elect pa rtners not in the B e tawav e publis he r n etwork . T he produ ct fea tures advertis er- s afe , family -friendly progra mmin g includin g quality animation, youth-orie nted news , a ction s ports , mov ie an d v ide o ga me in forma tio n, s pe cial ev ents, ce le brity interv iews , fas hion, and health and beau ty se gments . B etawa ve T V o ffers marke ters a s c alable video a dve rtis in g an d dis tribu tio n s olution a nd e nables th em to ex tend the ir relations hip beyo nd dis play me dia and immersiv e integra tio ns . T he unive rs al play er is c us tomized for ea c h publis her's look an d fee l a nd is inc orporated in to the n aviga tio n of eac h s ite e ns uring a high lev el of co ns umer ado ption. S pons orship opportunitie s in clude the ability to feature mes sa ges be fore an d after profe ss iona lly pro duc ed video programming, as well as throu gh o verlay s at appropriate points in P hotoC ha nnel Networks I nc . A nnounc es the P hotoC han nel N etwo rk s In c. ann ounced the la unc h o f its new P NI Open A c ce ss P rojec t. T he P N I O pen P hotoC ha nne l Network s Inc . L aunc h of th e P NI O pe n A cce ss P roje ct A cces s P roje ct has been created for non -P NI c ustome rs to be able to tak e adv anta ge o f an d utiliz e the (T S X V: P N) po wer of the P NI P latfo rm's 'R o uting Tier' that cu rren tly de livers millions o f ima ges an d orde rs from P NI ho sted we bs ite s to its c us tomer's s tores and production fa cilities . T he P N I O pen Acc es s P rojec t will be ins trume ntal in prov idin g an output so lution for th e billions of digital image s cu rrently s tored on the we b or in de sk top s oftwa re produ cts whic h cu rren tly ha ve no direc t pro fes s ion al printing option . T he P N I O pen A cces s P roje ct also in clude s an o ption for la rger entities to sh are rev enue with P N I. T h is s y mbiotic relations hip will be a k ey driv er fo r thos e organiza tions tha t would like to work direc tly with P N I to provide A lfa B ank F ile s S uit A gains t O A O R B C Informa tio n A lfa B ank ha s filed a s uit again st O AO R B C In formation S ys te ms dema nding the repaymen t of a $ 41. 7 81 O AO R B C Informa ti on S ys tems S y ste ms for $41 . 8 M illion D ebt million debt, plus th e interes t wo rth $2 5, 06 9. T he ban k se ek s the re co very of a de bt wh ich formed as a (R T S : R B C I) c ons equenc e of the partie s' fix ed-te rm de als with se curities and foreign cu rren cy, ' unde r a n agre ement s igned on M arch 24, 200 8. T he Moscow A rbitration C o urt ha s re gis te re d a s uit, filed by the R oy al B a nk of S co tla nd a gains t A O R B C Information S ys tems , O O O R B C -C enter a nd ZA O R B C -TV protes ting th eir faerfect Whon or a cL td. reported sa les he sults is esthe n ted month s 5 . 17 millio n. mber 200 8. F or the period, P ilure to orld C o. redit agre ement. T res uit fo r tima in e at R UB ende d S epte P erfect W orld C o. L td. R epo rts Ov ers eas S ales P erfec t W orld C o., L td. R e su lts for the Nine Mo nths E nded S eptember th e c ompany 's ov ers eas s ales revenue s amounted to US D 19 million, s welling mo re tha n two times fro m (Nas da qGS : PW R D) 2 008 U S D 6 millio n in th e s ame period ended S eptember 200 7. T he growth was attributed to the compan y's B oomJ Inc. R epo rts R eve nue R es ults for th e M onth de votion to. techno logy res ea rc h and devthe mon th o f J anu ary 2 009. T he co mpa ny re ported $2. 3 million in B oomJ Inc reported re ven ue res ults fo r elopment. B oomJ Inc (O T C B B : B O MJ ) o f J anuary 2 009; P rov ides E arnin gs G uidance for rev enue s for th e month of J a nuary and $1. 07 million for th e month of Dec ember. T h e c ompan y a nnou nc ed the M onth of F e bruary 2009 th at it is on tra ck for c ontinue d s trong growth in the mon th o f F ebru ary. Figure 12. Key Developments Source. Capital IQ

- 12. Page 12 VALUATION MMOG companies lead market cap charts: Seven companies in our W eb 2.0 universe top US$1 billion in market capitalization (Figure 13). Sixty-three of the 85 (down from 64 last week) companies have market caps under US$100 million, with 27 (vs. 27 last week) under $10 million. Online gaming companies dominate the top of the list with four of the top seven by market cap. Market C ap (US D m) Tencent Holdings L td. Netea s e.com Inc. 2292.5 S handa Interac tiv e Entertainment L td. 2218.9 2102.2 IA C/InterA ctiveCorp. Open Tex t Corp. 1657.7 G iant Intera ctive G roup, Inc. 1438.1 G ree, Inc. 1116.5 Modern Times G roup Mtg A B 840.3 Perf ect World Co., L td. 696.0 Mix i, Inc. 594.8 United Online Inc. 390.8 383.5 K ings oft Co. L td. The9 Limited 365.0 G igaMedia L td. 325.8 Chines e G a mer International 271.8 NEOWIZ G a mes Corporation 217.0 XING A G 205.5 NetDragon WebS oft, Inc. 190.9 S hutterf ly , Inc. 188.0 S K Communica tions Co., L td. 185. 1 G ungHo Online Entertainment, Inc. 135.7 DA DA S pA 117.7 G a mania Digital Enterta inment Co., L td. 94. 3 G ameOn Co L td. 92. 9 B roadWebA s ia Inc. 85.7 CDC Corp. 85.2 Moggle, Inc 72.6 Y eda ngOnline Corp. 69.4 Openw av e S y s tems Inc. 68.3 TheS treet.com, Inc. 67.7 DigitalTow n, Inc. 65.2 A ctoz S of t Co., L td. 65.2 S pa rk Netw orks , Inc. 53.6 PhotoCha nnel Netw orks Inc. 52.5 49.4 HanbitS oft, Inc. G eoS entric Oy j 45.6 K aboos e Inc. 42. 6 OA O R B C Information S y s tems 41. 6 Tree.Com, Inc. 37. 3 J umpTV Inc. 36.4 Wiz z ard S oftw are Corporation 29.3 NeXplore Corporation 27.9 Northgate Tec hnologies Limited 27.0 Dolphin Digital Media , Inc. 24.2 Ngi G roup Inc. 22.4 LookS ma rt, L td. 21.6 Fluid Mus ic Ca nada , Inc. 21.0 DXN Holdings B hd 20.0 G ravity Co., Ltd 19.5 A Q Interactive, Inc. 18.3 Eolith Co. L td. 18.3 Quepas a Corp. 17.7 Idea Edge, Inc. 16.9 Ex tens ions , Inc. 14.2 Webz en Inc. 13.4 J umbuck Entertainment Pty L td. 12.8 Frogs ter Interactive Pic tures A G 12.1 10.7 S NA P Interactive, Inc. Worlds .com Inc. 9.4 Lingo Media Corporation 9.3 A cceleriz e New Media , Inc. 8.3 Magnitude Inf ormation S y s tems Inc. 7.9 CornerWorld Corporation 7.0 UOMO Media , Inc 6.8 Y nk K orea Inc. 6.7 5.4 V OIS , Inc. S pec trumDNA , Inc. 4.9 B right Things plc 3.3 is eemedia Inc. 3.3 G oFis h Corporation 3.2 Wooz y Fly , Inc. 2.6 Wy nds torm Corporation 2.2 Financial Media G roup, Inc. 2.1 MOK O.mobi Limited 2.1 IA S Energy , Inc. 1.5 LiveWorld Inc. 1.2 Unis erve Communica tions Corp. 1.0 B igs tring Corp. 0.7 The Parent Compa ny 0.6 DigitalPos t Interactive, Inc. 0.5 Z ipLoc al Inc. 0.3 A s s ociated Media Holdings Inc. 0.2 China G a tew ay Corporation 0.0 S ocial Media V enures , Inc. 0.0 S NM Global Holdings 0.0 0 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 Figure 13. Market Cap Ranking Source. Capital IQ TEV/Revenue (LTM) averages 3.6x: The overall average TEV/Revenue (LTM) multiple for our group is 3.6x – down from 4.4x last week (Figure 14). However, this is skewed by Gree (3633-TSE) at 33.9x and Bigstring (BSGC-OTCBB) at 28.9x. The median is only 1.1x. Note that we exclude multiples greater than 50x. Thirty-four of the companies have multiples under 1.5x.