Changes in shareholding in listed companies by mf industry in september 2015 quarter

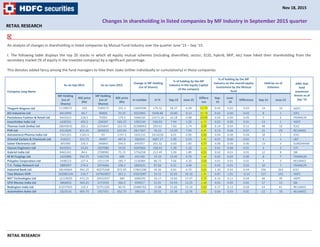

- 1. RETAIL RESEARCH An analysis of changes in shareholding in listed companies by Mutual Fund Industry over the quarter June ‘15 – Sep ’15: I. The following table displays the top 20 stocks in which all equity mutual schemes (including diversified, sector, ELSS, hybrid, MIP, etc) have hiked their shareholding from the secondary market (% of equity in the investee company) by a significant percentage. This denotes added fancy among the fund managers to hike their stake (either individually or cumulatively) in these companies. Company Long Name As on Sep 2015 As on June 2015 Change in MF Holding (no of Shares) % of holding by the MF industry in the Equity Capital of the company % of holding by the MF industry on the overall equity investment by the Mutual fund Held by no of Schemes AMC that held maximum shares as of Sep '15 MF Holding (no of Shares) BSE price (Rs) MF Holding (no of Shares) BSE price (Rs) In number In % Sep-15 June-15 Differe nce Sep- 15 June- 15 Difference Sep-15 June-15 Titagarh Wagons Ltd 21198573 103 7589273 101.3 13609300 179.32 18.37 6.58 11.79 0.05 0.02 0.03 14 10 HDFC KEI Industries Ltd 8413993 96.7 90000 70.25 8323993 9248.88 10.89 0.12 10.78 0.02 0.00 0.02 8 1 IDFC Pantaloons Fashion & Retail Ltd 9441623 218.5 75093 179.2 9366530 12473.24 10.18 0.08 10.09 0.05 0.00 0.05 7 2 FRANKLIN Insecticides India Ltd 1640331 403.2 248187 565.25 1392144 560.93 7.94 1.20 6.74 0.02 0.00 0.01 13 1 HDFC Thomas Cook (India) Ltd 28645810 202.2 6356847 222.55 22288963 350.63 7.83 1.74 6.09 0.14 0.04 0.11 48 16 ICICI PVR Ltd 6513020 815.45 3695653 633.05 2817367 76.23 13.99 7.94 6.05 0.13 0.06 0.07 35 29 RELIANCE Astrazeneca Pharma India Ltd 1501325 1165.4 93 1197.2 1501232 1614228 6.01 0.00 6.00 0.04 0.00 0.04 10 1 ICICI Oriental Carbon & Chemicals Ltd 616521 553.75 34497 487.8 582024 1687.17 5.99 0.33 5.65 0.01 0.00 0.01 5 1 L&T Salzer Electronics Ltd 891900 226.5 246843 246.5 645057 261.32 6.60 1.83 4.77 0.00 0.00 0.00 13 3 SUNDARAM Vascon Engineers Ltd 8425651 34.65 1837985 19.05 6587666 358.42 5.30 1.16 4.14 0.01 0.00 0.01 2 3 UTI Gabriel India Ltd 8465241 84.6 2708983 75.15 5756258 212.49 5.90 1.89 4.01 0.02 0.01 0.01 12 8 SBI M M Forgings Ltd 1622886 542.75 1181726 600 441160 37.33 13.45 9.79 3.66 0.02 0.02 0.00 8 7 FRANKLIN Polyplex Corporation Ltd 2448123 227.4 1311139 183.7 1136984 86.72 7.66 4.10 3.56 0.01 0.01 0.01 3 2 RELIANCE T.V. Today Network Ltd 3880097 274.6 2074466 196.2 1805631 87.04 6.51 3.48 3.03 0.03 0.01 0.02 10 7 FRANKLIN IndusInd Bank Ltd 58140664 942.25 40275266 872.05 17865398 44.36 9.81 6.79 3.01 1.36 0.92 0.44 296 263 ICICI Tata Motors-DVR 162985144 216.7 147963057 261.2 15022087 10.15 32.05 29.10 2.95 0.87 1.01 -0.14 137 143 HDFC NIIT Technologies Ltd 12119029 472.25 10432437 389 1686592 16.17 19.83 17.07 2.76 0.14 0.11 0.04 46 39 HDFC UFO Moviez India Ltd 3866833 569.25 3171916 566.5 694917 21.91 14.93 12.25 2.68 0.05 0.05 0.01 17 13 SBI Redington India Ltd 63237943 110.3 52751181 96.55 10486762 19.88 15.82 13.19 2.62 0.17 0.13 0.04 43 41 RELIANCE Automotive Axles Ltd 2323510 695.75 1927351 652.75 396159 20.55 15.38 12.76 2.62 0.04 0.03 0.01 22 18 RELIANCE RETAIL RESEARCH Nov 18, 2015 Changes in shareholding in listed companies by MF Industry in September 2015 quarter

- 2. RETAIL RESEARCH II. The following table displays the top 20 stocks in which all equity mutual schemes (including diversified, sectoral, ELSS, hybrid, MIP etc) have reduced their shareholding (% of equity in the investee company) by a significant percentage. This denotes that the fund managers are not too excited about these stocks and hence have cut their stake (either individually or cumulatively) in these companies. Company Long Name As on Sep 2015 As on June 2015 Change in MF Holding (no of Shares) % of holding by the MF industry in the Equity Capital of the company % of holding by the MF indusrty on the overall equity investment by the Mutual fund Held by no of Schemes MF Holding (no of Shares) BSE price (Rs) MF Holding (no of Shares) BSE price (Rs) In number In % Sep-15 June-15 Difference Sep-15 June-15 Difference Sep-15 June-15 Sasken Communication Technologie 75000 233.6 2141365 234.7 -2066365 -96.50 0.42 12.09 -11.67 0.00 0.01 -0.01 1 7 Tara Jewels Ltd 520189 33.85 2686383 60.4 -2166194 -80.64 2.11 10.91 -8.80 0.00 0.00 0.00 2 3 Omkar Speciality Chemicals Ltd 927200 192.5 2415955 157.7 -1488755 -61.62 4.51 11.74 -7.23 0.00 0.01 -0.01 5 6 Himatsingka Seide Ltd 7611437 207.9 14635025 93.15 -7023588 -47.99 7.73 14.86 -7.13 0.04 0.04 0.00 18 13 McDowell Holdings Ltd 588164 25.45 1288028 28.25 -699864 -54.34 4.20 9.21 -5.00 0.00 0.00 0.00 1 1 Zee Media Corporation Ltd 452 17.4 20375235 16.8 -20374783 -100 0.00 4.33 -4.33 0.00 0.01 -0.01 - 2 SML ISUZU Ltd 878731 1179.95 1431808 1130.7 -553077 -38.63 6.07 9.90 -3.82 0.03 0.04 -0.02 10 16 Chennai Petroleum Corporation Ltd 4333185 222.55 9459217 170.1 -5126032 -54.19 2.91 6.35 -3.44 0.02 0.04 -0.02 12 20 CCL Products (India) Ltd 7876838 234.85 12091408 181.05 -4214570 -34.86 5.92 9.09 -3.17 0.05 0.06 -0.01 17 18 Metalyst Forgings Ltd 2341825 63.7 3455086 125.85 -1113261 -32.22 6.37 9.40 -3.03 0.00 0.01 -0.01 5 5 IDFC Ltd 100216977 69.27 147806365 72.31 -47589388 -32.20 6.29 9.27 -2.99 0.17 0.28 -0.11 124 176 Merck Ltd 647362 783.25 1123764 800.75 -476402 -42.39 3.90 6.77 -2.87 0.01 0.02 -0.01 13 13 MEP Infrastructure Developers Ltd 8736323 52.85 13202745 61.6 -4466422 -33.83 5.37 8.12 -2.75 0.01 0.02 -0.01 3 8 Tamil Nadu Newsprint & Papers Ltd 4462294 182 6242749 155.2 -1780455 -28.52 6.45 9.02 -2.57 0.02 0.03 -0.01 9 4 Amtek Auto Ltd 1571 43.85 5501436 159.25 -5499865 -99.97 0.00 2.45 -2.45 0.00 0.02 -0.02 1 13 Strides Arcolab Ltd 6442188 1223.4 7847025 1111.15 -1404837 -17.90 10.80 13.16 -2.36 0.19 0.23 -0.03 69 67 KPIT Technologies Ltd 10683943 107.35 14798215 93.25 -4114272 -27.80 5.41 7.49 -2.08 0.03 0.04 -0.01 18 26 Jyoti Structures Ltd 22920995 13.76 25194490 24.4 -2273495 -9.02 20.92 23.00 -2.08 0.01 0.02 -0.01 11 14 Career Point Ltd 474912 127 845559 158 -370647 -43.83 2.62 4.66 -2.04 0.00 0.00 0.00 2 2 Dewan Housing Finance Corpor 4553249 220.05 10261164 210.48 -5707915 -55.63 1.56 3.52 -1.96 0.02 0.03 0.00 27 35

- 3. RETAIL RESEARCH III. The following table displays the top 20 stocks in which all equity mutual schemes (including diversified, sectoral, ELSS, hybrid, MIP etc) have hiked their shareholding (in terms of number of shares) by a significant percentage. This denotes added fancy among the fund managers to hike their stake (either individually or cumulatively) in these companies. Company Long Name As on Sep 2015 As on June 2015 Change in MF Holding (no of Shares) % of holding by the MF industry in the Equity Capital of the company % of holding by the MF indusrty on the overall equity investment by the Mutual fund Held by no of Schemes MF Holding (no of Shares) BSE price (Rs) MF Holding (no of Shares) BSE price (Rs) In number In % Sep-15 June-15 Difference Sep-15 June-15 Difference Sep-15 June-15 Astrazeneca Pharma India Ltd 1501325 1165.4 93 1197.2 1501232 1614228.00 6.01 0.00 6.00 0.04 0.00 0.04 10 1 Welspun Corp Ltd 3998971 114.95 2445 114.85 3996526 163457.10 1.52 0.00 1.52 0.01 0.00 0.01 3 1 Shipping Corporation of India Ltd 3066394 75.4 8700 50.05 3057694 35145.91 0.66 0.00 0.66 0.01 0.00 0.01 9 1 Jubilant Life Sciences Ltd 396880 379.75 1631 167 395249 24233.54 0.25 0.00 0.25 0.00 0.00 0.00 3 1 Mirza International Ltd 1117823 108.8 5500 78.95 1112323 20224.05 1.21 0.01 1.20 0.00 0.00 0.00 1 - Pantaloons Fashion & Retail Ltd 9441623 218.5 75093 179.2 9366530 12473.24 10.18 0.08 10.09 0.05 0.00 0.05 7 2 Network 18 Media & Investments 25063152 48.9 203152 59.35 24860000 12237.14 2.39 0.02 2.37 0.03 0.00 0.03 6 2 KEI Industries Ltd 8413993 96.7 90000 70.25 8323993 9248.88 10.89 0.12 10.78 0.02 0.00 0.02 8 1 Kitex Garments Ltd 27365 845.15 418 997.8 26947 6446.65 0.06 0.00 0.06 0.00 0.00 0.00 5 2 Housing Development & Infrastr 1900041 73.55 72152 92.05 1827889 2533.39 0.45 0.02 0.44 0.00 0.00 0.00 7 4 Oriental Carbon & Chemicals Ltd 616521 553.75 34497 487.8 582024 1687.17 5.99 0.33 5.65 0.01 0.00 0.01 5 1 High Ground Enterprise Ltd 1000 72.15 100 37.51 900 900.00 0.00 0.00 0.00 0.00 0.00 0.00 - - Srikalahasthi Pipes Ltd 32880 288.5 3625 196.7 29255 807.03 0.08 0.01 0.07 0.00 0.00 0.00 2 - Insecticides India Ltd 1640331 403.2 248187 565.25 1392144 560.93 7.94 1.20 6.74 0.02 0.00 0.01 13 1 Jayshree Chemicals Ltd 1200 8 200 8.05 1000 500.00 0.00 0.00 0.00 0.00 0.00 0.00 - - Sun TV Network Ltd 10349400 359.95 1786886 282.05 8562514 479.19 2.63 0.45 2.17 0.09 0.01 0.08 30 28 Vascon Engineers Ltd 8425651 34.65 1837985 19.05 6587666 358.42 5.30 1.16 4.14 0.01 0.00 0.01 2 3 Thomas Cook (India) Ltd 28645810 202.2 6356847 222.55 22288963 350.63 7.83 1.74 6.09 0.14 0.04 0.11 48 16 Ujaas Energy Ltd 2575887 15.88 695885 16.45 1880002 270.16 1.29 0.35 0.94 0.00 0.00 0.00 2 1 DCM Shriram Ltd 3239058 107.1 878159 111.15 2360899 268.85 1.99 0.54 1.45 0.01 0.00 0.01 5 4

- 4. RETAIL RESEARCH IV. The following table displays the top 20 stocks in which all equity mutual schemes (including diversified, sectoral, ELSS, hybrid, MIP etc) have reduced their shareholding (in terms of number of shares) by a significant percentage. This denotes that the fund managers are not too excited about these stocks and hence have cut their stake (either individually or cumulatively) in these companies. Company Long Name As on Sep 2015 As on June 2015 Change in MF Holding (no of Shares) % of holding by the MF industry in the Equity Capital of the company % of holding by the MF indusrty on the overall equity investment by the Mutual fund Held By no of Schemes MF Holding (no of Shares) BSE price (Rs) MF Holding (no of Shares) BSE price (Rs) In number In % Sep-15 June-15 Difference Sep-15 June-15 Difference Sep-15 June-15 Amtek Auto Ltd 1571 43.85 5501436 159.25 -5499865 -99.97 0.00 2.45 -2.45 0.00 0.02 -0.02 1 13 Anant Raj Ltd 1607 36 2081036 41.65 -2079429 -99.92 0.00 0.71 -0.70 0.00 0.00 0.00 1 2 IL&FS Engineering & Construction 586 67.4 120000 73.6 -119414 -99.51 0.00 0.10 -0.10 0.00 0.00 0.00 1 1 HCL Infosystems Ltd 17143 36.25 2790289 34.05 -2773146 -99.39 0.01 1.25 -1.24 0.00 0.00 0.00 1 3 Venkys (India) Ltd 1209 542.5 82514 334.3 -81305 -98.53 0.01 0.88 -0.87 0.00 0.00 0.00 - 1 BF Utilities Ltd 2078 468.25 136336 565.55 -134258 -98.48 0.01 0.36 -0.36 0.00 0.00 0.00 1 2 Saregama India Ltd 475 321.3 30475 194.1 -30000 -98.44 0.00 0.18 -0.17 0.00 0.00 0.00 - 1 Petron Engineering Construction 2600 189.9 125782 226.1 -123182 -97.93 0.03 1.67 -1.63 0.00 0.00 0.00 - 1 Prakash Industries Ltd 53904 27.4 2314725 32.15 -2260821 -97.67 0.04 1.72 -1.68 0.00 0.00 0.00 1 2 Sasken Communication Techno 75000 233.6 2141365 234.7 -2066365 -96.50 0.42 12.09 -11.67 0.00 0.01 -0.01 1 7 Talbros Engineering Ltd 293 256.9 4043 183.8 -3750 -92.75 0.01 0.16 -0.15 0.00 0.00 0.00 - - Reliance Infrastructure Ltd 167089 347.75 2264799 388.35 -2097710 -92.62 0.06 0.86 -0.80 0.00 0.02 -0.02 13 21 Den Networks Ltd 21159 121.55 259481 142.1 -238322 -91.85 0.01 0.15 -0.13 0.00 0.00 0.00 2 3 OnMobile Global Ltd 40000 86.45 486028 82.95 -446028 -91.77 0.03 0.42 -0.39 0.00 0.00 0.00 1 7 Religare Enterprises Ltd 996 295.6 11466 319.15 -10470 -91.31 0.00 0.01 -0.01 0.00 0.00 0.00 2 3 Godrej Properties Ltd 168378 329.1 1808915 246.8 -1640537 -90.69 0.08 0.91 -0.82 0.00 0.01 -0.01 3 5 EIH Associated Hotels Ltd 1600 199.1 14600 197.6 -13000 -89.04 0.01 0.05 -0.04 0.00 0.00 0.00 - 1 Gayatri Projects Ltd 62713 504 516128 288.5 -453415 -87.85 0.18 1.46 -1.28 0.00 0.00 0.00 - 4 JK Paper Ltd 3055 41.9 21147 31.95 -18092 -85.55 0.00 0.01 -0.01 0.00 0.00 0.00 - - Kesoram Industries Ltd 12440 82.8 79315 74.6 -66875 -84.32 0.01 0.07 -0.06 0.00 0.00 0.00 - 1

- 5. RETAIL RESEARCH V. The following table displays the top 20 stocks in which all equity mutual schemes (including diversified, sectoral, ELSS, hybrid, MIP etc) have held maximum assets (maximum % in overall equity AUM) in Sep ’15. This denotes the fancy among the fund managers to hold their stake maximum (either individually or cumulatively) in these companies. Company Long Name As on Sep 2015 As on June 2015 Change in MF Holding (no of Shares) % of holding by the MF industry in the Equity Capital of the company % of holding by the MF industry on the overall equity investment by the Mutual fund Held By no of Schemes MF Holding (no of Shares) BSE price (Rs) MF Holding (no of Shares) BSE price (Rs) In number In % Sep-15 June-15 Difference Sep-15 June-15 Difference Sep-15 June-15 ITC Ltd 1066706274 328.9 1052259133 315.05 14447141 1.37 13.29 13.11 0.18 8.68 8.67 0.01 362 358 HDFC Bank Ltd 204329590 1068.9 186955308 1067.45 17374282 9.29 8.11 7.42 0.69 5.40 5.22 0.19 555 523 Larsen & Toubro Ltd 146323995 1466.7 143456685 1782.75 2867310 2.00 15.71 15.41 0.31 5.31 6.68 -1.38 407 388 Infosys Ltd 149097726 1160.45 127561539 985.35 21536187 16.88 6.49 5.55 0.94 4.28 3.29 0.99 429 393 ICICI Bank Ltd 544445762 270.25 498375683 308 46070079 9.24 9.37 8.58 0.79 3.64 4.01 -0.37 528 510 Maruti Suzuki India Ltd 24149027 4689.3 23329868 4022.7 819159 3.51 7.99 7.72 0.27 2.80 2.45 0.35 410 394 Axis Bank Ltd 214484644 495.55 183598978 558.65 30885666 16.82 9.02 7.72 1.30 2.63 2.68 -0.05 450 425 State Bank of India 427454895 237.25 398229546 262.8 29225349 7.34 5.51 5.13 0.38 2.51 2.74 -0.23 363 365 Reliance Industries Ltd 93781633 860.5 79783300 1000.45 13998333 17.55 2.90 2.46 0.43 2.00 2.09 -0.09 334 311 Tata Consultancy Services Ltd 22182312 2587.7 19320579 2552.2 2861733 14.81 1.13 0.99 0.15 1.42 1.29 0.13 322 297 IndusInd Bank Ltd 58140664 942.25 40275266 872.05 17865398 44.36 9.81 6.79 3.01 1.36 0.92 0.44 296 263 Sun Pharmaceuticals Industries Ltd 61220410 868.45 61633630 874.2 -413220 -0.67 2.54 2.56 -0.02 1.32 1.41 -0.09 310 325 HCL Technologies Ltd 54128490 982.15 48799184 921.05 5329306 10.92 3.85 3.47 0.38 1.32 1.17 0.14 291 291 HDFC Ltd 41341299 1213.25 35042625 1296.45 6298674 17.97 2.62 2.22 0.40 1.24 1.19 0.05 282 270 Tata Motors Ltd 136948977 298.45 112216754 434.55 24732223 22.04 4.74 3.89 0.86 1.01 1.27 -0.26 319 304 Kotak Mahindra Bank Ltd 61797121 648.85 53669798 693.88 8127323 15.14 3.37 2.93 0.44 0.99 0.49 0.51 249 228 Divis Laboratories Ltd 35335506 1114.8 36917486 938 -1581980 -4.29 13.31 13.91 -0.60 0.97 0.45 0.52 172 161 Bank of Baroda 214737857 183.3 167976286 144.2 46761571 27.84 9.32 7.29 2.03 0.97 0.63 0.34 225 195 Cummins India Ltd 33143702 1095.9 32314036 894.85 829666 2.57 11.96 11.66 0.30 0.90 0.76 0.14 196 174 Bharat Petroleum Corporation Ltd 41847488 849.65 46536380 877.2 -4688892 -10.08 5.79 6.44 -0.65 0.88 1.07 -0.19 194 205

- 6. RETAIL RESEARCH VI. The following table displays the top 20 stocks in which all equity mutual schemes (whether diversified, sectoral, ELSS, hybrid, MIP etc) have increased their exposure significantly in terms of % of holding on overall equity AUM in Sep ‘15 from June ‘15. This denotes the fancy among the fund managers to increase their stake (either individually or cumulatively) in these companies. Company Long Name As on Sep 2015 As on June 2015 Change in MF Holding (no of Shares) % of holding by the MF industry in the Equity Capital of the company % of holding by the MF industry on the overall equity investment by the Mutual fund Held By no of Schemes MF Holding (no of Shares) BSE price (Rs) MF Holding (no of Shares) BSE price (Rs) In number In % Sep-15 June-15 Difference Sep-15 June-15 Difference Sep-15 June-15 Infosys Ltd 149097726 1160.45 127561539 985.35 21536187 16.88 6.49 5.55 0.94 4.28 3.29 0.99 429 393 Divis Laboratories Ltd 35335506 1114.8 36917486 938 -1581980 -4.29 13.31 13.91 -0.60 0.97 0.45 0.52 172 161 Kotak Mahindra Bank Ltd 61797121 648.85 53669798 693.88 8127323 15.14 3.37 2.93 0.44 0.99 0.49 0.51 249 228 IndusInd Bank Ltd 58140664 942.25 40275266 872.05 17865398 44.36 9.81 6.79 3.01 1.36 0.92 0.44 296 263 Maruti Suzuki India Ltd 24149027 4689.3 23329868 4022.7 819159 3.51 7.99 7.72 0.27 2.80 2.45 0.35 410 394 Bank of Baroda 214737857 183.3 167976286 144.2 46761571 27.84 9.32 7.29 2.03 0.97 0.63 0.34 225 195 Bharat Electronics Ltd 19027495 1137.05 20802588 1120.51 -1775093 -8.53 7.93 8.67 -0.74 0.54 0.20 0.33 128 138 Aurobindo Pharma Ltd 34738986 768.1 35938344 724.88 -1199358 -3.34 5.95 6.15 -0.21 0.66 0.34 0.32 79 76 Federal Bank Ltd 458666257 64.05 446256048 73.9 12410209 2.78 26.70 25.98 0.72 0.73 0.43 0.30 210 217 Cipla Ltd 47582355 637.8 34622335 616.3 12960020 37.43 5.92 4.31 1.61 0.75 0.56 0.19 285 237 HDFC Bank Ltd 204329590 1068.9 186955308 1067.45 17374282 9.29 8.11 7.42 0.69 5.40 5.22 0.19 555 523 NTPC Ltd 148453566 123.75 84309979 137.8 64143587 76.08 1.80 1.02 0.78 0.45 0.30 0.15 111 102 Cummins India Ltd 33143702 1095.9 32314036 894.85 829666 2.57 11.96 11.66 0.30 0.90 0.76 0.14 196 174 HCL Technologies Ltd 54128490 982.15 48799184 921.05 5329306 10.92 3.85 3.47 0.38 1.32 1.17 0.14 291 291 Tata Consultancy Services Ltd 22182312 2587.7 19320579 2552.2 2861733 14.81 1.13 0.99 0.15 1.42 1.29 0.13 322 297 Tech Mahindra Ltd 58578663 558.05 54441325 478.2 4137338 7.60 6.06 5.63 0.43 0.81 0.68 0.13 237 236 Mahindra & Mahindra Ltd 21319870 1260.7 16063222 1281.2 5256648 32.72 3.43 2.59 0.85 0.66 0.54 0.13 254 217 Thomas Cook (India) Ltd 28645810 202.2 6356847 222.55 22288963 350.63 7.83 1.74 6.09 0.14 0.04 0.11 48 16 Aditya Birla Nuvo Ltd 7608906 2139.45 6626357 1790.8 982549 14.83 5.85 5.09 0.75 0.40 0.31 0.09 125 111 Ambuja Cements Ltd 39716270 205.65 18845774 229.5 20870496 110.74 2.56 1.21 1.34 0.20 0.11 0.09 114 79

- 7. RETAIL RESEARCH VII. The following table displays the stocks in which all equity mutual schemes (whether diversified, sectoral, ELSS, hybrid, MIP etc) have reduced their shareholding to Nil in Sep ‘15. This denotes that the fund managers are not too excited about these stocks and hence have exited their stake (either individually or cumulatively) in these companies. Company Long Name As on Sep 2015 As on June 2015 Change in MF Holding (no of Shares) % of holding by the MF industry in the Equity Capital of the company % of holding by the MF indusrty on the overall equity investment by the Mutual fund Held By no of Schemes MF Holding (no of Shares) BSE price (Rs) MF Holding (no of Shares) BSE price (Rs) In number In % Sep-15 June-15 Difference Sep-15 June-15 Difference Sep-15 June-15 Astec Lifesciences Ltd - 239.3 715196 178.7 -715196 -100.00 - 3.68 -3.68 - 0.00 0.00 - 1 PC Jeweller Ltd - 350.85 355234 385.3 -355234 -100.00 - 0.20 -0.20 - 0.00 0.00 - 3 Radha Madhav Corporation Ltd - 29.05 216742 29.3 -216742 -100.00 - 0.34 -0.34 - 0.00 0.00 - 1 Simplex Projects Ltd - 22.3 141392 30.85 -141392 -100.00 - 1.12 -1.12 - 0.00 0.00 - 1 Meghmani Organics Ltd - 19.2 134569 17.05 -134569 -100.00 - 0.05 -0.05 - 0.00 0.00 - - Polaris Consulting & Services Ltd - 197.3 54013 157.75 -54013 -100.00 - 0.05 -0.05 - 0.00 0.00 - - CMI Ltd - 267.3 47918 112.65 -47918 -100.00 - 0.36 -0.36 - 0.00 0.00 - - AXISCADES Engineering Techn - 264.6 20636 224.2 -20636 -100.00 - 0.08 -0.08 - 0.00 0.00 - 1 Rasoya Proteins Ltd - 0.26 19434 0.27 -19434 -100.00 - 0.00 0.00 - 0.00 0.00 - 1 Gujarat NRE Coke Ltd - 3.17 5685 3.68 -5685 -100.00 - 0.00 0.00 - 0.00 0.00 - 1 Hinduja Ventures Ltd - 382.8 786 383.5 -786 -100.00 - 0.00 0.00 - 0.00 0.00 - 1 Asis Logistics Ltd - 10.21 500 18 -500 -100.00 - 0.01 -0.01 - 0.00 0.00 - - VIII. The following table displays the stocks in which all equity mutual schemes (whether diversified, sectoral, ELSS, hybrid, MIP etc) have raised shareholding in Sep ‘15 from Nil in June ‘15 by a significant percentage. This denotes added fancy among the fund managers to take fresh exposure (either individually or cumulatively) in these companies. Company Long Name As on Sep 2015 As on June 2015 Change in MF Holding (no of Shares) % of holding by the MF industry in the Equity Capital of the company % of holding by the MF indusrty on the overall equity investment by the Mutual fund Held By no of Schemes AMC that held maximum Share as of Sep '15MF Holding (no of Shares) BSE price (Rs) MF Holding (no of Shares) BSE price (Rs) In number In % Sep- 15 June- 15 Difference Sep- 15 June- 15 Difference Sep-15 June- 15 Minda Corporation Ltd 6653691 71.8 - 87.5 6653691 - 3.18 - 3.18 0.01 - 0.01 8 - UTI Granules India Ltd 1810597 140.6 - 84.65 1810597 - 0.87 - 0.87 0.01 - 0.01 8 2 BIRLA Adani Enterprises Ltd 1743500 80.75 - 91 1743500 - 0.16 - 0.16 0.00 - 0.00 6 - KOTAK PTL Enterprises Ltd 367097 63.95 - 36.05 367097 - 0.55 - 0.55 0.00 - 0.00 1 - SBI SMS Pharmaceuticals Ltd 31539 651 - 590.75 31539 - 0.37 - 0.37 0.00 - 0.00 1 - RELIANCE Vakrangee Ltd 29934 127.8 - 115.75 29934 - 0.01 - 0.01 0.00 - 0.00 3 1 MOTILAL OS Triveni Engineering and Indu 18112 25.9 - 15.65 18112 - 0.01 - 0.01 0.00 - 0.00 1 - ESCORTS

- 8. RETAIL RESEARCH Skipper Ltd 15474 144.3 - 168.1 15474 - 0.02 - 0.02 0.00 - 0.00 1 - INDIABULLS Hatsun Agro Product Ltd 9535 397.5 - 350.55 9535 - 0.01 - 0.01 0.00 - 0.00 1 - EDELWEISS Uniply Industries Ltd 5000 126.2 - 72.5 5000 - 0.03 - 0.03 0.00 - 0.00 1 - ESCORTS Omaxe Ltd 681 134.2 - 134.2 681 - 0.00 - 0.00 0.00 - 0.00 1 1 GOLDMAN Note: This report has been prepared based on the data provided by Capital Line database which in turn relies on the shareholding pattern filed by the respective companies with BSE from time to time. Mutual fund holdings as per disclosure norms mean shares held by SEBI-registered mutual funds, as a portfolio investment. Out of which, the equity AUM data shown in the above tables are taken from NAVIndia wherein the source data are compiled from the AMC factsheets. Analyst: Dhuraivel Gunasekaran (Dhuraivel.gunasekaran@hdfcsec.com) RETAIL RESEARCH Tel: (022) 3075 3400 Fax: (022) 2496 5066 Corporate Office HDFC securities Limited, I Think Techno Campus, Building - B, "Alpha", Office Floor 8, Near Kanjurmarg Station, Opp. Crompton Greaves, Kanjurmarg (East), Mumbai 400 042 Phone: (022) 3075 3400 Fax: (022) 2496 5066 Website: www.hdfcsec.com Email: hdfcsecretailresearch@hdfcsec.com Disclaimer: Mutual Funds investments are subject to risk. Past performance is no guarantee for future performance. This document has been prepared by HDFC Securities Limited and is meant for sole use by the recipient and not for circulation. This document is not to be reported or copied or made available to others. It should not be considered to be taken as an offer to sell or a solicitation to buy any security. The information contained herein is from sources believed reliable. We do not represent that it is accurate or complete and it should not be relied upon as such. We may have from time to time positions or options on, and buy and sell securities referred to herein. We may from time to time solicit from, or perform investment banking, or other services for, any company mentioned in this document. This report is intended for non- Institutional Clients This report has been prepared by the Retail Research team of HDFC Securities Ltd. The views, opinions, estimates, ratings, target price, entry prices and/or other parameters mentioned in this document may or may not match or may be contrary with those of the other Research teams (Institutional, PCG) of HDFC Securities Ltd.