More Related Content Similar to Financial Model Manufacturing And Retail Businesses (20) 1. ABU CAPITAL LTD

Projection Projection Projection

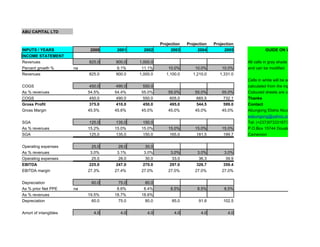

INPUTS / YEARS 2000 2001 2002 2003 2004 2005 GUIDE ON USAGE

INCOME STATEMENT

Revenues 825.0 900.0 1,000.0 All cells in gray shade are input cells

Percent growth % na 9.1% 11.1% 10.0% 10.0% 10.0% and can be modified

Revenues 825.0 900.0 1,000.0 1,100.0 1,210.0 1,331.0

Cells in white will be automatically

COGS 450.0 490.0 550.0 calculated from the input data you enter

As % revenues 54.5% 54.4% 55.0% 55.0% 55.0% 55.0% Coloured sheets are calculated automati

COGS 450.0 490.0 550.0 605.0 665.5 732.1 Thanks

Gross Profit 375.0 410.0 450.0 495.0 544.5 599.0 Contact

Gross Margin 45.5% 45.6% 45.0% 45.0% 45.0% 45.0% Abungong Elisha Abungong(Financial M

eabungong@yahoo.com

SGA 125.0 135.0 150.0 Tel: (+237)97333187/77238818

As % revenues 15.2% 15.0% 15.0% 15.0% 15.0% 15.0% P.O.Box 15744 Douala,

SGA 125.0 135.0 150.0 165.0 181.5 199.7 Cameroon

Operating expenses 25.0 28.0 30.0

As % revenues 3.0% 3.1% 3.0% 3.0% 3.0% 3.0%

Operating expenses 25.0 28.0 30.0 33.0 36.3 39.9

EBITDA 225.0 247.0 270.0 297.0 326.7 359.4

EBITDA margin 27.3% 27.4% 27.0% 27.0% 27.0% 27.0%

Depreciation 60.0 75.0 80.0

As % prior Net PPE na 8.6% 8.4% 8.5% 8.5% 8.5%

As % revenues 19.5% 18.7% 18.6%

Depreciation 60.0 75.0 80.0 85.0 91.8 102.5

Amort of intangibles 4.0 4.0 4.0 4.0 4.0 4.0

2. Amort of intangibles 4.0 4.0 4.0 4.0 4.0 4.0

EBIT 161.0 168.0 186.0 208.0 230.9 252.9

EBIT margin 19.5% 18.7% 18.6% 18.9% 19.1% 19.0%

Non-oper expenses 10.0 10.0 8.0 10.0 11.0 12.0

As % revenues 1.2% 1.1% 0.8%

Non-oper expenses 10.0 10.0 8.0 10.0 11.0 12.0

Interest income 3.0 5.0 6.0

Surplus fund 0.8 0.8 0.0

Cash 4.0 4.0 4.0

ST investments 1.7 1.7 1.8

Interest income 3.0 5.0 6.0 6.4 6.5 5.8

Interest Expense 50.0 50.0 50.0

Necessary to Finance 0.0 0.7 5.4

ST Notes 1.4 1.4 1.4

Debt 1 15.0 15.0 15.0

Debt 2 22.5 22.5 22.5

Debt 3 8.8 8.8 8.8

Interest Expense 50.0 50.0 50.0 47.7 47.7 47.7

EBT 104.0 113.0 134.0 156.7 178.7 198.9

EBT Margin 12.6% 12.6% 13.4% 14.2% 14.8% 14.9%

Provision for Taxes 36.0 40.0 47.0

Tax Rate % 34.6% 35.4% 35.1% 35.0% 35.0% 35.0%

Provision for Taxes 36.0 40.0 47.0 54.9 62.5 69.6

Net Income 68.0 73.0 87.0 101.9 116.2 129.3

Net Margin 8.2% 8.1% 8.7% 9.3% 9.6% 9.7%

Dividends 10.0 12.0 11.0

3. Payout Ratio% 14.7% 16.4% 12.6% 10.0% 10.0% 10.0%

Dividends 10.0 12.0 11.0 10.2 11.6 12.9

Net to Retained Earnings 58.0 61.0 76.0 91.7 104.5 116.4

BALANCE SHEET

CURRENT ASSET INPUT

BALANCE SHEET 2000 2001 2002 2003 2004 2005

ASSETS

Surplus fund 0.0 0.0 0.0 30.8 0.0 0.0

Interest rate % 5.000% 5.000% 5.000%

Interest Income 0.8 0.8 0.0

Cash 60.0 75.0 80.0 80.0 80.0 80.0

% of Revenue 7.3% 8.3% 8.0%

Cash 60.0 75.0 80.0 80.0 80.0 80.0

Interest rate 5.000% 5.000% 5.000%

Interest income 4 4 4

ST investments 30.0 32.0 33.0 34.0 35.0 36.1

% growth 3.6% 3.6% 3.3%

ST investments 30.0 32.0 33.0 34.0 35.0 36.1

Interest rate 5.000% 5.000% 5.000%

Interest Income 1.7 1.7 1.8

Account Receivable 60.0 75.0 90.0

% of revenues 7.3% 8.3% 9.0%

Days of revenues 26.5 30.4 32.9 30.0 30.0 30.0

Account Receivable 60.0 75.0 90.0 49.7 54.7 60.2

Inventory 120.0 135.0 150.0

4. % of revenues 14.5% 15.0% 15.0%

Days of COGS 53.1 54.8 54.8 98.0 95.0 95.0

Inventory 120.0 135.0 150.0 162.4 173.2 190.5

Other Current Assets 10.0 10.0 12.0

% of revenues 1.2% 1.1% 1.2% 10% 10% 10%

Other Current Assets 10.0 10.0 12.0 110.0 121.0 133.1

Current Assets 280.0 327.0 365.0 467.0 463.9 499.9

Net PPE 870.0 950.0 1,000.0

CapEx 130.0 155.0 130.0

% of revenues 15.8% 17.2% 13.0% 15.0% 18.0% 20.0%

CapEx 130.0 155.0 130.0 165.0 217.8 266.2

Depreciation 60.0 75.0 80.0 85.0 91.8 102.5

Net PPE 870.0 950.0 1,000.0 1,080.0 1,206.0 1,369.7

Intangibles 58.0 54.0 50.0

Amortization 4.0 4.0 4.0

Intangibles 58.0 54.0 50.0 46.0 42.0 38.0

Long-term Assets 92.0 116.0 150.0

% of revenues 11.2% 12.9% 15.0% 14.0% 14.0% 14.0%

% growth na 26.1% 29.3%

Long-term Assets 92.0 116.0 150.0 154.0 169.4 186.3

Total Assets 1,300.0 1,447.0 1,565.0 1,747.0 1,881.3 2,093.9

LIABILITIES

Short-term notes 10.0 12.0 14.0 14.0 14.0 14.0

Short-term notes 10.0 12.0 14.0 14.0 14.0 14.0

Interest rate 10.0% 10.0% 10.0%

interest expense 1.4 1.4 1.4

5. Account payable 60.0 70.0 80.0

% of revenues 7.3% 7.8% 8.0%

days of COGS 48.7 52.1 53.1 55.0 55.0 55.0

Account payable 60.0 70.0 80.0 91.2 100.3 110.3

Other Current liabilities 10.0 20.0 20.0

% of revenues 1.2% 2.2% 2.0% 2.0% 2.0% 2.0%

Other Current liabilities 10.0 20.0 20.0 22.0 24.2 26.6

Current Liabilities 80.0 102.0 114.0 127.2 138.5 150.9

Necessary to Finance 0.0 14.1 93.2

Interest rate 10.0% 10.0% 10.0%

Interest Expense 0.0 0.7 5.4

Debt 1 200.0 225.0 150.0

Debt 1 200.0 225.0 150.0 150.0 150.0 150.0

Interest Rate 10.0% 10.0% 10.0%

Interest expense 15.0 15.0 15.0

Debt 2 200.0 200.0 225.0

Debt 2 200.0 200.0 225.0 225.0 225.0 225.0

Interest rate 10.0% 10.0% 10.0%

Interest expense 22.5 22.5 22.5

Debt 3 110.0 110.0 110.0

Debt 3 110.0 110.0 110.0 110.0 110.0 110.0

Interest Rate 8.0% 8.0% 8.0%

Interest expense 8.8 8.8 8.8

Long-term Liabilities 40 38 37

6. % of Revenues 4.8% 4.2% 3.7% 4.0% 4.0% 4.0%

% growth N/A -5.0% -2.6%

Long-term Liabilities 40.0 38.0 37.0 44.0 48.4 53.2

Total Liabilities 630.0 675.0 636.0 656.2 686.0 782.3

SHAREHOLDERS EQUITY

Common stock 460.0 500.0 580.0 650.0 650.0 650.0

Common stock 460.0 500.0 580.0 650.0 650.0 650.0

Retained Earnings 200.0 261.0 337.0

Net to Retained earnings 91.7 104.5 116.4

Retained Earnings 200.0 261.0 337.0 428.7 533.2 649.6

Other Equity account 10.0 11.0 12.0

% of revenues 1.2% 1.2% 1.2% 1.1% 1.0% 0.9%

Other Equity account 10.0 11.0 12.0 12.1 12.1 12.0

Total SH Equity 670.0 772.0 929.0 1,090.8 1,195.3 1,311.6

Total Liab & SH Equity 1,300.0 1,447.0 1,565.0 1,747.0 1,881.3 2,093.9

N.B Do not Change the Formulas in this Section. If you Alter your Balance sheet will not Balance

Assets Without SF 1300 1447 1565 1,716.2 1,881.3 2,093.9

Liab, Equity without NTF 1300 1447 1565 1,747.0 1,867.2 2,000.8

Surplus Funds 0.0 0.0 0.0 30.8 0.0 0.0

Necessary to Finance 0.0 0.0 0.0 0.0 14.1 93.2

7. GUIDE ON USAGE

gray shade are input cells

hite will be automatically

from the input data you enter

sheets are calculated automatically

g Elisha Abungong(Financial Modeler)

g@yahoo.com

)97333187/77238818

15744 Douala,

13. ABU CAPITAL LTD

Projection Projection Projection

INPUTS / YEARS 2000 2001 2002 2003 2004 2005

INCOME STATEMENT

Revenues 825.0 900.0 1,000.0 1,100.0 1,210.0 1,331.0

COGS 450.0 490.0 550.0 605.0 665.5 732.1

Gross Profit 375.0 410.0 450.0 495.0 544.5 599.0

Gross Margin 45.5% 45.6% 45.0% 45.0% 45.0% 45.0%

SGA 125.0 135.0 150.0 165.0 181.5 199.7

Operating expenses 25.0 28.0 30.0 33.0 36.3 39.9

EBITDA 225.0 247.0 270.0 297.0 326.7 359.4

EBITDA margin 27.3% 27.4% 27.0% 27.0% 27.0% 27.0%

Depreciation 60.0 75.0 80.0 85.0 91.8 102.5

Amort of intangibles 4.0 4.0 4.0 4.0 4.0 4.0

EBIT 161.0 168.0 186.0 208.0 230.9 252.9

EBIT margin 19.5% 18.7% 18.6% 18.9% 19.1% 19.0%

Non-oper expenses 10.0 10.0 8.0 10.0 11.0 12.0

Interest income 3.0 5.0 6.0 6.4 6.5 5.8

Interest Expense 50.0 50.0 50.0 47.7 47.7 47.7

EBT 104.0 113.0 134.0 156.7 178.7 198.9

EBT Margin 12.6% 12.6% 13.4% 14.2% 14.8% 14.9%

Provision for Taxes 36.0 40.0 47.0 54.9 62.5 69.6

Net Income 68.0 73.0 87.0 101.9 116.2 129.3

Net Margin 8.2% 8.1% 8.7% 9.3% 9.6% 9.7%

Dividends 10.0 12.0 11.0 10.2 11.6 12.9

Net to Retained Earnings 58.0 61.0 76.0 91.7 104.5 116.4

14. ABU CAPITAL LTD

BALANCE SHEET 2000 2001 2002 2003 2004 2005

ASSETS

Surplus fund 0.0 0.0 0.0 30.8 0.0 0.0

Cash 60.0 75.0 80.0 80.0 80.0 80.0

ST investments 30.0 32.0 33.0 34.0 35.0 36.1

Account Receivable 60.0 75.0 90.0 49.7 54.7 60.2

Inventory 120.0 135.0 150.0 162.4 173.2 190.5

Other Current Assets 10.0 10.0 12.0 110.0 121.0 133.1

Current Assets 280.0 327.0 365.0 467.0 463.9 499.9

Net PPE 870.0 950.0 1,000.0 1,080.0 1,206.0 1,369.7

Intangibles 58.0 54.0 50.0 46.0 42.0 38.0

Long-term Assets 92.0 116.0 150.0 154.0 169.4 186.3

Total Assets 1,300.0 1,447.0 1,565.0 1,747.0 1,881.3 2,093.9

LIABILITIES

Short-term notes 10.0 12.0 14.0 14.0 14.0 14.0

Account payable 60.0 70.0 80.0 91.2 100.3 110.3

Other Current liabilities 10.0 20.0 20.0 22.0 24.2 26.6

Current Liabilities 80.0 102.0 114.0 127.2 138.5 150.9

Necessary to Finance 0.0 0.0 0.0 0.0 14.1 93.2

Debt 1 200.0 225.0 150.0 150.0 150.0 150.0

Debt 2 200.0 200.0 225.0 225.0 225.0 225.0

Debt 3 110.0 110.0 110.0 110.0 110.0 110.0

Long-term Liabilities 40.0 38.0 37.0 44.0 48.4 53.2

Total Liabilities 630.0 675.0 636.0 656.2 686.0 782.3

SHAREHOLDERS EQUITY

Common stock 460.0 500.0 580.0 650.0 650.0 650.0

Retained Earnings 200.0 261.0 337.0 428.7 533.2 649.6

Other Equity account 10.0 11.0 12.0 12.1 12.1 12.0

Total SH Equity 670.0 772.0 929.0 1,090.8 1,195.3 1,311.6

Total Liab & SH Equity 1,300.0 1,447.0 1,565.0 1,747.0 1,881.3 2,093.9

15. ABU CAPITAL LTD

CASH FLOW STATEMENT 2000 2001 2002 2003 2004 2005

Net Income 73.0 87.0 101.9 116.2 129.3

Add Back:

Depreciation 75.0 80.0 85.0 91.8 102.5

Amort. of Intangibles 4.0 4.0 4.0 4.0 4.0

Operating Cash Flow 152.0 171.0 190.9 212.0 235.8

(Inc) in Acct Receivable (15.0) (15.0) 40.3 (5.0) (5.5)

(Inc) in Inventory (15.0) (15.0) (12.4) (10.8) (17.3)

(Inc) other Current Assets 0.0 (2.0) (98.0) (11.0) (12.1)

Inc in Account Payable 10.0 10.0 11.2 9.1 10.0

Inc in Other Current Liabs 10.0 0.0 2.0 2.2 2.4

(Inc) in Oper. Working Capital (10.0) (22.0) (57.0) (15.4) (22.4)

Cash from Operations 142.0 149.0 133.9 196.5 213.4

CapEx (155.0) (130.0) (165.0) (217.8) (266.2)

Other (Inc) dec in net PPE 0.0 0.0 0.0 0.0 0.0

Other (Inc) dec in intangibles 0.0 0.0 0.0 0.0 0.0

(Inc) dec in long-term Assets (24.0) (34.0) (4.0) (15.4) (16.9)

Cash from Investments (179.0) (164.0) (169.0) (233.2) (283.1)

Inc (dec) in ST Notes 2.0 2.0 0.0 0.0 0.0

Inc (dec) in Nec. To finance 0.0 0.0 0.0 14.1 79.1

Inc (dec) in Debt 1 25.0 (75.0) 0.0 0.0 0.0

Inc (dec) in Debt 2 0.0 25.0 0.0 0.0 0.0

Inc (dec) in Debt 3 0.0 0.0 0.0 0.0 0.0

Dividends (12.0) (11.0) (10.2) (11.6) (12.9)

Inc (dec) in Long Term Liabs. (2.0) (1.0) 7.0 4.4 4.8

Inc (dec) in Common Stock 40.0 80.0 70.0 0.0 0.0

Other inc (dec) retained earnings 0.0 0.0 0.0 0.0 0.0

Inc (dec) in other equity accounts 1.0 1.0 0.1 0.0 (0.1)

Cash from Financing 54.0 21.0 66.9 6.9 70.9

Change in cash and Equity 17.0 6.0 31.8 (29.8) 1.1

Cash and Equivalents 90.0 107.0 113.0 144.8 115.0 116.1

Cash and Equiv in B/S 90.0 107.0 113.0 144.8 115.0 116.1

Parity Check 0.0 0.0 0.0 0.0 0.0 0.0

16. RECONCILIATION 2000 2001 2002 2003 2004 2005

Net PPE

Beginning Amount 870.0 950.0 1,000.0 1,080.0 1,206.0

CapEx 155.0 130.0 165.0 217.8 266.2

Depreciation 75.0 80.0 85.0 91.8 102.5

Expected ending Amount 950.0 1,000.0 1,080.0 1,206.0 1,369.7

B/S Amount 950.0 1,000.0 1,080.0 1,206.0 1,369.7

Other (Inc) dec Net PPE 0.0 0.0 0.0 0.0 0.0

Intangibles

Beginning Amount 58.0 54.0 50.0 46.0 42.0

Amortization 4.0 4.0 4.0 4.0 4.0

Expected ending Amount 54.0 50.0 46.0 42.0 38.0

B/S Amount 54.0 50.0 46.0 42.0 38.0

Other (Inc) dec intangibles 0.0 0.0 0.0 0.0 0.0

Retained Earnings

Beginning Amount 200.0 261.0 337.0 428.7 533.2

Net to Retained Earnings 61.0 76.0 91.7 104.5 116.4

Expected ending Amount 261.0 337.0 428.7 533.2 649.6

B/S Amount 261.0 337.0 428.7 533.2 649.6

Other inc(dec) Retained earnings 0.0 0.0 0.0 0.0 0.0

17. ABU CAPITAL LTD

Common Size Income Statement

Projection Projection Projection

INPUTS / YEARS 2000 2001 2002 2003 2004 2005

INCOME STATEMENT

Revenues 100.0% 100.0% 100.0% 100.0% 100.0% 100.0%

COGS 54.5% 54.4% 55.0% 55.0% 55.0% 55.0%

Gross Profit 45.5% 45.6% 45.0% 45.0% 45.0% 45.0%

SGA 15.2% 15.0% 15.0% 15.0% 15.0% 15.0%

Operating expenses 3.0% 3.1% 3.0% 3.0% 3.0% 3.0%

EBITDA 27.3% 27.4% 27.0% 27.0% 27.0% 27.0%

Depreciation 7.3% 8.3% 8.0% 7.7% 7.6% 7.7%

Amort of intangibles 0.5% 0.4% 0.4% 0.4% 0.3% 0.3%

EBIT 19.5% 18.7% 18.6% 18.9% 19.1% 19.0%

Non-oper expenses 1.2% 1.1% 0.8% 0.9% 0.9% 0.9%

Interest income 0.4% 0.6% 0.6% 0.6% 0.5% 0.4%

Interest Expense 6.1% 5.6% 5.0% 4.3% 3.9% 3.6%

EBT 12.6% 12.6% 13.4% 14.2% 14.8% 14.9%

Provision for Taxes 4.4% 4.4% 4.7% 5.0% 5.2% 5.2%

Net Income 8.2% 8.1% 8.7% 9.3% 9.6% 9.7%

Dividends 1.2% 1.3% 1.1% 0.9% 1.0% 1.0%

Net to Retained Earnings 7.0% 6.8% 7.6% 8.3% 8.6% 8.7%

18. ABU CAPITAL LTD

Common Size Statement

BALANCE SHEET 2000 2001 2002 2003 2004 2005

ASSETS

Surplus fund 0.0% 0.0% 0.0% 1.8% 0.0% 0.0%

Cash 4.6% 5.2% 5.1% 4.6% 4.3% 3.8%

ST investments 2.3% 2.2% 2.1% 1.9% 1.9% 1.7%

Account Receivable 4.6% 5.2% 5.8% 2.8% 2.9% 2.9%

Inventory 9.2% 9.3% 9.6% 9.3% 9.2% 9.1%

Other Current Assets 0.8% 0.7% 0.8% 6.3% 6.4% 6.4%

Current Assets 21.5% 22.6% 23.3% 26.7% 24.7% 23.9%

Net PPE 66.9% 65.7% 63.9% 61.8% 64.1% 65.4%

Intangibles 4.5% 3.7% 3.2% 2.6% 2.2% 1.8%

Long-term Assets 7.1% 8.0% 9.6% 8.8% 9.0% 8.9%

Total Assets 100.0% 100.0% 100.0% 100.0% 100.0% 100.0%

LIABILITIES

Short-term notes 0.8% 0.8% 0.9% 0.8% 0.7% 0.7%

Account payable 4.6% 4.8% 5.1% 5.2% 5.3% 5.3%

Other Current liabilities 0.8% 1.4% 1.3% 1.3% 1.3% 1.3%

Current Liabilities 6.2% 7.0% 7.3% 7.3% 7.4% 7.2%

Necessary to Finance 0.0% 0.0% 0.0% 0.0% 0.7% 4.4%

Debt 1 15.4% 15.5% 9.6% 8.6% 8.0% 7.2%

Debt 2 15.4% 13.8% 14.4% 12.9% 12.0% 10.7%

Debt 3 8.5% 7.6% 7.0% 6.3% 5.8% 5.3%

Long-term Liabilities 3.1% 2.6% 2.4% 2.5% 2.6% 2.5%

Total Liabilities 48.5% 46.6% 40.6% 37.6% 36.5% 37.4%

SHAREHOLDERS EQUITY

Common stock 35.4% 34.6% 37.1% 37.2% 34.6% 31.0%

Retained Earnings 15.4% 18.0% 21.5% 24.5% 28.3% 31.0%

Other Equity account 0.8% 0.8% 0.8% 0.7% 0.6% 0.6%

Total SH Equity 51.5% 53.4% 59.4% 62.4% 63.5% 62.6%

Total Liab & SH Equity 100.0% 100.0% 100.0% 100.0% 100.0% 100.0%