RMPG Learning Series CRM Workshop Day 5

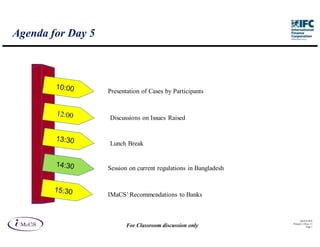

- 1. Agenda for Day 5 Presentation of Cases by Participants Discussions on Issues Raised Lunch Break Session on current regulations in Bangladesh IMaCS’ Recommendations to Banks IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 1

- 2. Regulatory framework: Banks Minimum Capital • Tk. 200 crore • 10% Capital adequacy ratio • 5% Core Capital • Not more than % of capital in a bank may be acquired Ownership without the approval of the Bangladesh Bank. Foreign ownership • Up to xx% • 365 days (in case of asset financing) , 180 days (in Provisioning case of loans and other exposures) Availability of deposit insurance facility for • Yes depositors IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 2

- 3. Categories of Loans Continuous Loan If any uncertainty or doubt arises in respect of recovery of any Continuous Loan, Demand Loan or Fixed Short-term Agricultural Categories Demand Term Loan, the same and Micro of Loans Loan will have to be Credit classified on the basis of qualitative judgment be it classifiable or not on the basis of Fixed Term Loan objective criteria IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 3

- 4. Loan Classification Past due/overdue • If not repaid/renewed within the fixed expiry date for repayment will be treated as past due/overdue from the following day of the expiry date Special Mention • A Continuous Loan/Demand loan/Term Loan which will remain overdue for a period of 90 days or more, will be put into the "Special Account Mention Account(SMA)" • Sub-standard if it remains past due/overdue for 6 months or beyond but Sub-standard less than 9 months. Doubtful • `Doubtful' if for 9 months or beyond but less than 12 months Bad-Debt • Bad-Debt' if for 12months or beyond IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 4

- 5. Provisioning Norms …1 Classified Continuous, Demand and Fixed Term Loans Sub-standard 20% Doubtful 50% Bad/Loss 100% Provision in respect of Short-term Agricultural and Micro-Credits is to be maintained at the following rates All credits except 'Bad/Loss'(i.e. 'Doubtful', 'Sub-standard', irregular and 5% regular credit accounts) 'Bad/Loss' 100% IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 5

- 6. Provisioning Norms…2 Banks will be required to maintain General Provision All unclassified loans (other than loans under Consumer 1% Financing and Special Mention Account Unclassified amount for Consumer Financing whereas it has to 5% be maintained @ 2% on the unclassified amount for (i) Housing Finance and (ii) Loans for Professionals to set up business under Consumer Financing Scheme. Outstanding amount of loans kept in the 'Special Mention 5% Account' (SMA) after netting off the amount of Interest Suspense. IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 6

- 7. Agenda for Day 5 Presentation of Cases by Participants Discussions on Issues Raised Lunch Break Session on current regulations in Bangladesh IMaCS’ Recommendations to Banks IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 7

- 8. Governance framework for Risk Management Organization structure with well defined roles and responsibilities Review of existing policies, processes and Formulation of policies, processes and formation systems and of different committees modifications if required Robust reporting and Monitor execution analysis infrastructure for through periodic reviews early warnings or done by these committees monitoring trends IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 8

- 9. Risk Management Process and Tools Post Sanction Pre Pre Sanction Post disbursement Default disbursement DP report and stock Appraisal audits Execution of all Special Mention documents Monitoring report Accounts report Assessment through Branch Compliance rating models Certificate Meeting pre Loan Review disbursement Mechanism NPA reporting Prudential exposure conditions limits Re-rating of large accounts annually Evaluate decoupling of Evaluate possibility of Sector wise, product wise Sector wise, product wise origination and assessment / setting up a centralized legal NPA and SMA rating rating migrations credit rating cell IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 9

- 10. Policy for Internal Capital Adequacy Assessment Process : Objectives Enunciate Bank’s overall risk philosophy Define acceptable risk measurement methodologies including risk mitigation mechanisms Ability to assess capital adequacy to ensure Compliance with Bangladesh Bank guidelines Adequate capital as buffer to ensure business stability simultaneously with rapid growth Provide better internal governance environment and facilitate proactive Capital Budgeting Define organization structure and responsibilities for effective internal assessment process including reporting mechanisms Ensure continued validity and relevance of risk assessment methodologies through periodical internal audit IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 10

- 11. ICAAP framework Identification of RMD, CRMC, ORMC & ALM Cell all material risks Based on materiality Oversight Reporting of risks Measurement and Measurement methodology aligned with RBI assessed process and reporting of all guidelines Reporting of CRAR structure the material risks Scenarios sensitized to bank’s profile Actions Additional Capital for Capital cushion Strategy for Required to manage unexpected scenarios normal growth based on ensuring capital Additional capital for understanding Stress testing framework to provide a measure of adequacy capital cushion increased risks of implicit risks Linking capital requirements to Additional Capital for normal growth the level of Risks Additional capital for increased risks IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 11

- 12. Capital Planning Stress test results indicate a breach in tolerance levels Expected asset Planned growth with the same portfolio mix investments Notional capital Strategy to acquire Additional cushion for risks riskier assets for not mentioned in higher target Capital Pillar I and could be profitability or entry Requirement based on the stress into new areas test results IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 12

- 13. Importance of Risk Based Pricing Aligns the incentive for a bank to balance risk with return Pricing is a tool to maintain proactive provisioning Necessary for value creation and preservation Building block for credit risk management IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 13

- 14. Pre-requisites for “Risk Pricing” credit - A Bank must have the capability to generate... History of risk score of borrowers Information on defaults associated with the risk score of borrowers Loss given default Variance in loss given default IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 14

- 15. Computing Risk Premia - Expected Loss Probability of Loss Given Default (PD) Default (LGD) Borrower PD Collateral LGD Risk Score Type 1 .05% 1 5% 2 - 2 - Exposure Expected 3 - 3 - at Loss x x (EL) = Default (EAD) 4 - 4 - 5 10% 5 20% 6 - 6 - 7 - 7 - 8 - 8 - 9 - 9 - 10 100% 10 75% IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 15

- 16. Present status in many banks - How mis-pricing of risk is harmful. Risk-based The cross-subsidy pricing • Good credit risks subsidising the poor Interest rate % credit risk accounts Subsidy “Bad risks” • Threat of under-priced Bank pricing disintermediation leaves banks with poor credit risk accounts Good credits overpriced AAA • Already beginning to BBB Risk happen in most markets IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 16

- 17. Risk Based Pricing - An example Client: XYZ Risk Grading B+ I Loan Size (Tk. Crore) 100 II Tenor (Years) 5 III Probability of Default 2% IV Loss Given Default 50% V Hurdle Rate on Equity (Share holder Expectation) 16% VI Capital as % of funded assets 8% VII Cost of Funds for 5 Yr Tenor (From FTP) 5.50% 1 Cost of Funds 5.50% Risk Adjusted 2 Cost of Operation 1.00% Pricing (1+2+3+4) 3 Return on Capital (I*V*VI) (Loan Size %) 1.28% = 4 Expected Loss (III*IV) 1.00% 8.78 % IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 17

- 18. RAROC is gaining popularity as it links investor aspirations to Management goals Shareholders demand optimum risk-adjusted return on their risk capital Banks’ activities are increasingly arranged along business unit lines to improve focus Bank Management is able to allocate scarce capital among business units based on their potential risk-adjusted performance Performance Measurement Capital Allocation Performance Budgeting Lending decision IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 18

- 19. 5 steps to RAROC of a loan/ business line/ portfolio STEP 1: Calculate Net Interest Earned STEP 2: Calculate Expected Loss STEP 3: Calculate the Risk-Adjusted Spread STEP 4: Calculate the Risk Capital to be allocated for that activity STEP 5: Calculate RAROC from inputs of Step 3 and 4 IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 19

- 20. RAROC: Step 1 of 5 STEP 1 Calculate Net Interest Earned Net Interest earned = (Interest Rate – STEP 2 Calculate Expected Loss Interest Expenses) x Amount of Loan STEP 3 Calculate the Risk-Adjusted Spread 1.Interest rate is market determined on which STEP 4 Calculate the Risk Capital to be allocated for that acti vity the banker has limited control STEP 5 Calculate RAROC from inputs of Step 3 and 4 2.Interest expense depends on bank’s cost of funds and is given by ALM IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 20

- 21. RAROC: Step 2 of 5 Expected Loss = Probability of Default x Loss Given Default x Amount of loan STEP 1 Calculate Net Interest Earned 1.Probability of Default can be derived from STEP 2 Calculate Expected Loss transition matrix STEP 3 Calculate the Risk-Adjusted Spread 2. Loss given default is the proportion of STEP 4 Calculate the Risk Capital to be allocated for that acti vity money lost after recoveries on a defaulted account STEP 5 Calculate RAROC from inputs of Step 3 and 4 - STEP 5 Calculate RAROC from inputs of Step 3 and 4 IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 21

- 22. RAROC: Step 3 of 5 Risk Adjusted Spread *= Net Interest Earned (Step 1) STEP 1 Calculate Net Interest Earned Less: Expected Loss (Step 2) STEP 2 Calculate Expected Loss Less: Administrative Expenses STEP 3 Calculate the Risk-Adjusted Spread Add: Non-interest income STEP 4 Calculate the Risk Capital to be allocated for that acti vity This is similar to risk-based pricing , but RAROC goes a step further STEP 5 Calculate RAROC from inputs of Step 3 and 4 * The spread is in absolute amount IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 22

- 23. RAROC: Step 4 of 5 STEP 1 Calculate Net Interest Earned Capital Allocated *= Standard Risk Weight (of an asset) x Minimum STEP 2 Calculate Expected Loss Regulatory capital x Loan amount STEP 3 Calculate the Risk-Adjusted Spread *Capital allocated may be Regulatory Capital STEP 4 Calculate the Risk Capital to be allocated for that acti vity STEP 5 Calculate RAROC from inputs of Step 3 and 4 IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 23

- 24. RAROC: Step 5 of 5 RAROC = Risk-Adjusted Spread (Step 3) STEP 1 Calculate Net Interest Earned Risk Capital (Step 4) STEP 2 Calculate Expected Loss STEP 3 Calculate the Risk-Adjusted Spread If the RAROC is higher than the “Hurdle STEP 4 Calculate the Risk Capital to be allocated for that acti vity activity rate” a loan is acceptable in terms of risk/return STEP 5 Calculate RAROC from inputs of Step 3 and 4 IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 24

- 25. Credit Risk framework under Basel II Align regulatory capital Credit Risk more closely with economic capital Measurement Standardised IRB Method Method Regulatory Supervisory Risk Foundation weights and Credit Risk Mitigation Advanced Economic Capital IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 25

- 26. Ownership and policy review The policy would be reviewed regularly to incorporate Additional material risks as and when they arise and are measurable Changes in risk measurement methodology based on regulatory directives or implementation of various tools Reporting by different functions and levels Risk Management Department would review and maintain the policy IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 26

- 27. Recommendations for Systems supporting credit process Risk Management Solution to be used for capturing origination data Sanction process workflow to be automated based on defined rules Credit rating to be automated and centralized User profiles to avoid conflicts of interest and decouple rating from origination Capture data for rejected loan application and make it available in a centralized manner Collateral management can be done using Risk Management Solution IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 27

- 28. DISCUSSIONS IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 28

- 29. All the contents of the presentation are confidential and should not be published, reproduced or circulated without the written consent of IFC, Bangladesh Bank and IMaCS. IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 29