Aproximación de Valor- Valor de Mercado de una empresa

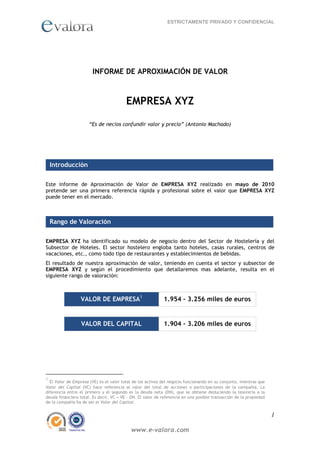

- 1. STRICTLY PRIVATE AND CONFIDENTIAL VALUE ESTIMATION REPORT XYZ COMPANY Price is what you pay. Value is what you get (Warren Buffett) Introduction Introduction XYZ COMPANY Value Estimation Report is expected to be a first, quick and professional reference about the value that XYZ COMPANY could have in the market. Valuation Range XYZ COMPANY has identified its business model inside the Automotive, components and transportation material Industry and the Subsector of Railway material manufacturing. The automotive, transport components and material Industry includes the manufacturers and suppliers of every type of motor vehicles, motorbikes and bicycles, aeronautic and naval, as well as fuel and repair services sale. The result of our instant valuation, taking into account XYZ COMPANY’s industry and subsector, and according to the procedure we will later explain in detail, results in the following valuation range: ENTERPRISE VALUE1 770 – 1,283 thousand euros EQUITY VALUE 670 – 1,183 thousand euros 1 The Enterprise Value (EV) is the total value of the running company’s assets, while Equity Value (E QV) refers to the total value of the company’s shares or participations. The difference between the former and the latter is the net debt (ND), which is obtained subtracting the cash from the total financial debt. Therefore, E QV = EV – ND. The reference value in a potential propriety transaction of the company has to be the Equity Value. www.e-valuation.us

- 2. STRICTLY PRIVATE AND CONFIDENTIAL Valuation Methodology Valuation Methodology To obtain the value of XYZ COMPANY, e-Valuation has applied a valuation procedure which is widely known by professionals in the financial industry: “Comparable Publicly Traded Companies Multiples”. This method provides a relative measure of XYZ COMPANY’s value by using companies that quote in the Stock Market as a reference of price, which is public and known. Although there are no two exact companies and traded ones are generally larger than XYZ COMPANY, their comparison offers a realist reference about the price buyers and investors are paying for the companies in this particular industry. In order to obtain XYZ COMPANY’s value, we have used four financial parameters that reflect the current situation of XYZ COMPANY, comparing them to those of the chosen quoted companies and establishing a relationship between them and the price of the listed companies. The process begins by choosing potential companies that are comparable to XYZ COMPANY from a large list of carefully chosen companies that quote in official and international stock markets. We currently obtain information and financial data of more than 1,400 enterprises on a daily basis. We group those companies under 36 different industrial activities. Each of these industrial sectors is then divided into subsectors, according to the degree of specialization of each of the traded companies. As a result, we work with more than 240 different subsectors. This exhaustive division of the different economic activities into industry sectors and subsectors allows evaluation to increase the accuracy of the valuation of the company, in this case of XYZ COMPANY. Once the comparable companies from the subsector of XYZ COMPANY have been chosen, we gather their most significant financial data, particularly: ● Sales ● EBITDA: Earnings Before Interest, Taxes and Amortization. ● EBIT: Earnings Before Interest and Taxes or Operating Profit ● Net Income www.e-valuation.us

- 3. STRICTLY PRIVATE AND CONFIDENTIAL The process continues by linking those financial magnitudes to a calculation of the value of the company, obtained throughout the price of the comparable companies’ shares. Therefore, we obtain the following valuation multiples, from which an industry average is calculated: 2 ● Enterprise Value / Sales ● Enterprise Value / EBITDA ● Enterprise Value / EBIT 3 ● Equity Value / Net Income (valuation multiple known as “PER”) The next step of the process implies applying those sector valuation multiples to the parameters of the company under valuation (Sales, EBIT, EBITDA and PER), making the following assumptions: ● On the one hand, we must take into consideration that the companies compared to XYZ COMPANY normally have a much larger size. On the other, as they are companies that trade in international stock markets, their shares are very liquid (easy to sell) in comparison to those of non-quoted and smaller sized companies. For these reasons an adjustment must be made which consists in applying a discount of 20% to the valuation. ● When we apply the valuation multiples based on Sales, EBIT, EBITDA and Net Income we obtain the Enterprise Value of XYZ COMPANY. When we apply “PER” we obtain the Equity Value. Therefore, in order to calculate the Enterprise Value throughout PER, it is necessary to add the net debt of the company to the result obtained. In euros XYZ Multiple Equity Cash Debt Enterprise COMPANY (PER) Value (-) (+) Value Net Income 100,000 15.0x 1,500,000 50,000 150,000 1,600,000 Hereafter, we will explain in detail XYZ COMPANY Instant Valuation, making this calculation again but without showing the company’s cash and net debt figures. 2 The Enterprise Value (EV) is the total value of the running company’s assets, while Equity Value (E QV) refers to the total value of the company’s shares or participations. The difference between the former and the latter is net debt (ND), which is obtained subtracting the cash from the total financial debt. Therefore, E QV = EV – ND. The reference value in a potential propriety transaction of the company has to be the Equity Value. 3 PER are the English acronyms for “Price to Earnings Ratio”. It can be calculated as price per share divided by profit per share, or as the total market cap of the company (Equity Value) divided by the total Net Income. www.e-valuation.us

- 4. STRICTLY PRIVATE AND CONFIDENTIAL XYZ COMPANY VALUATION XYZ COMPANY VALUATION A summary of the valuation throughout the multiples of comparable quoted companies process is detailed in the table below: ● The first column shows the financial data of XYZ COMPANY. ● The second one reflects the average multiples obtained from quoted companies from the sector of XYZ COMPANY. ● The third column expresses the result obtained from multiplying the two previous columns. ● The fourth and fifth columns reflect the discount applied to the result previously obtained: firstly the discount, and secondly the result of its application. ● Next, the relative weights of each magnitude used to obtain the Enterprise Value of XYZ COMPANY are reflected, and then applied to the results previously obtained. Finally, we reach a Final Enterprise Value that is equal to the addition of each of the results previously weighted. In euros XYZ Discounted Discounted % Enterprise Multiples Results COMPANY Tax Results Weight Value Sales 1,000,000 0.5x 500,000 20% 400,000 15% 60,000 EBITDA 300,000 6.0x 1,800,000 20% 1,440,000 30% 432,000 EBIT 200,000 8.0x 1,600,000 20% 1,280,000 30% 384,000 PER 50,000 15.0x 750,000 20% 600,000 25% 150,000 XYZ COMPANY VALUE 1,026,000 0 We must recall that, in the case of Net Income, we must adjust it according to its net debt to be able to compare it with the rest of the financial parameters, as detailed in the previous page. The Enterprise Value obtained for each of the multiples (last column) can be different depending on which one we choose. This is the reason why, in order to obtain the Final Enterprise Value, a weighted average is calculated for each of the values obtained. In this way, some multiples are given more relevance than others, depending on how influenced by accounting policies, extra operating activities, etc. Weighting the results obtained according to the table chart and applying a specific reliability range to this weighted average, we can conclude that the Valuation Range of XYZ COMPANY is between 770 y 1,283 thousand euros. www.e-valuation.us

- 5. STRICTLY PRIVATE AND CONFIDENTIAL Graphical Representation of the Valuation Graphical Representation of the Valuation 770 1,283 VE Final PER 563 938 1,200 2,000 VE / EBIT VE / EBITDA 1,350 VE / Ventas 375 625 0 0 0 0 0 0 50 00 50 00 50 1. 1. 2. 2. Enterprise Empresa (Miles de Euros) Valor de Value (Thousand Euros) e-Valuation, Expert in Business Valuations Founded in the year 2000, e-Valuation is the leading company valuation services firm. Since it was set up in November 2000, by a team of experts sourced from international investment banks, e-Valuation has lent its services to a wide range of clients: from companies with a turnover of less than $ 1 million, to corporations with Turnover over $ 500 million; from start-up companies to firms which have been in the market for over a century. e-Valuation is staffed by a team of professionals with extensive experience in investment banking, who have been involved in corporate transactions (acquisitions, sales and mergers), from all sectors of the economy, for an aggregate value of over $ 2 billion. Furthermore, e-Valuation’s operations are entirely independent from banks, investment funds and public organizations. This enables us to provide independent financial advice, uninfluenced by external interests. e-Valuation has ISO 9001 Certification in Company Valuation Consultancy Services, Devising Valuation Multiples, and Corporate Finance. www.e-valuation.us

- 6. STRICTLY PRIVATE AND CONFIDENTIAL Legal Notice / Disclaimer Legal e-Valuation Financial Services S.L., herein after “e-Valuation” declares that this document is produced solely for the specified recipient and its internal use. The information contained in this document is proprietary and confidential to e-Valuation’s client and may not be transmitted, reproduced or made available to any other person neither be used for any purpose other than the purpose for which it has been provided without the express written consent of e-Valuation. The information in this document is based upon any management forecasts supplied to e-Valuation and reflects prevailing conditions and our views as of this date, all of which are accordingly subject to change. The information set forth herein is current only for any time period. E-Valuation’s opinions and estimates constitute e-Valuation’s judgement and should be regarded as indicative. The conclusions reached in this presentation may be contrary to the conclusions or views expressed in another valuation on the same company. This may be the result of differing time horizons, methodologies, market events or other factors. The information in this document was obtained from various sources which e-Valuation does not guarantee to be accurate and which it has not independently verified. No representation or warranty, express or implied, is made and no reliance should be placed on the fairness, validity, accuracy or completeness or correctness of the information, assumptions, results or opinions contained herein. E-Valuation is not acting in the capacity of financial adviser or fiduciary of any recipient of this Presentation with respect to the information included herein. The appropriateness of a particular investment or strategy will depend on the company’s individual circumstances and objectives. The user agrees that it will make its own independent determination in entering into any transaction. There can be no assurance that the Company will achieve the results herein presented. This document is not, and should not be construed as, in any jurisdiction, an offer to sell, or the solicitations of an offer to buy any shares of the company valued or to enter into any other transaction relating thereto or the provision of investment advice. This Report is not a proposal to invest or disinvest in the valued business, and does not take into account the specific interests, financial situation or the individual needs of the person or entity that demands the valuation. The information contained in this Report is an only informative. E-Valuation will neither accept any liability arising from the different views of other experts nor take responsibility for notifying any change derived from its opinion. E-valuation has not audited or verified any of the information provided by the company for the elaboration of this document. The information related to the sector, the multiples of quoted companies, weights and, in general, all technical information used, is the result of internal analysis of evaluation, using information from sources which are considered reliable. E-valuation does not make itself responsible or accepts liability for possible errors in those sources. Neither evaluation nor any of the companies from its group (including any subsidiary or holding company), directors, managers and employees will be responsible (either directly or indirectly) of any costs, claims, damages, liabilities, and other expenses, including any loss that arises from the use of this document. Contact Details www.e-valuation.us

- 7. STRICTLY PRIVATE AND CONFIDENTIAL e-Valuation Financial Services e-Valuation Financial Services North America Nothern Europe www.e-valuation.us www.e-valuation.us info@e-valuation.us info@evaluation.us 14 Wall Street, 20th floor One Canada Square, 29th Floor New York City, 10005 Canary Wharf London E14 5DY United States of America United Kingdom e-Valuation Financial Services e-Valuation Financial Services Sourth America Southern Europe www.e-valuation.us www.e-valuation.us info@e-valuation.us info@e-valuation.us 111 Brickell Avenue, 11th Floor c/José Ortega y Gasset 42 Miami 33131 Madrid ,28006 United States of America Sapin www.e-valuation.us