Depreciation

•Télécharger en tant que PPT, PDF•

2 j'aime•5,674 vues

Signaler

Partager

Signaler

Partager

Recommandé

Recommandé

Contenu connexe

Tendances

Tendances (19)

Chapter 12 & 14 depreciation of non current assets clc

Chapter 12 & 14 depreciation of non current assets clc

En vedette (6)

Mrf tyres-Analysis of balance sheet and Ratio statement

Mrf tyres-Analysis of balance sheet and Ratio statement

Similaire à Depreciation

Similaire à Depreciation (20)

Adjustments to the final accounts of business organisations 12

Adjustments to the final accounts of business organisations 12

Basic Accounting Principles session 1 by Dino Leonandri

Basic Accounting Principles session 1 by Dino Leonandri

PROCESS ENGINEERING & ECONOMICS - COST ACCOUNTING & ESTIMATION

PROCESS ENGINEERING & ECONOMICS - COST ACCOUNTING & ESTIMATION

Financial accounting AC-23-Adjusting Journal Entries

Financial accounting AC-23-Adjusting Journal Entries

Dernier

Falcon stands out as a top-tier P2P Invoice Discounting platform in India, bridging esteemed blue-chip companies and eager investors. Our goal is to transform the investment landscape in India by establishing a comprehensive destination for borrowers and investors with diverse profiles and needs, all while minimizing risk. What sets Falcon apart is the elimination of intermediaries such as commercial banks and depository institutions, allowing investors to enjoy higher yields.Falcon Invoice Discounting: The best investment platform in india for investors

Falcon Invoice Discounting: The best investment platform in india for investorsFalcon Invoice Discounting

+971581248768>> SAFE AND ORIGINAL ABORTION PILLS FOR SALE IN DUBAI AND ABUDHABI}}+971581248768in dubai+971581248768_)whatsapp*abortion pills in dubai/buy cytotec misoprostol and mifepristone in dubai

More arrow_drop_down

WHATSAPP +971581248768 ABORTION PILLS IN DUBAI,MISOPROSTOL IN DUBAI,@CYTOTEC TABLETS IN DUBAI/cytotec in abu dhabi/abortion pills in sharjah/MIFEPRISTONE IN DUBAI/misoprostol in ajman/@abortion pills in ras al khaimah@mifepristone in sharjah>mifepristone in abu dhabi>ABORTION PILLS FOR SALE IN ABU DHABI,KUWAIT,AJMAN,SHARJAH,RAS AL KHAIMAHSALMIYA,AL WAKRAH,JOHANNESBURG,AL AIN,CYTOTEC IN DUBAI+971581248768 cytotec price in dubai,abu dhabi.al ain,ajman,sharjah,,OTTAWA,ALBERTA,CALGARY,TORONTO,IDAHO,OHIO, Midrand ,Sandton,Hyde Park,Johannesburg,New Hampshire,South Dakota,North Dakota,how how can i get abortion pills in dubai ,abu dhabi,,riyadh.oman.muscat,Arkansas ,Kansas,West Virginia, abortion pills in for sale in dubai.abu dhabi+971581248768 Oklahoma,Nebraska,Vermont,Idaho,South Carolina,Wisconsin ~ misoprostol price in dubai.ajman.al ain.kuwaitcity,Alabama,Maine,New Mexico, soweto+971581248768,cytotec pills in kuwait,sharjah,ajman,ras al khaimahMissouri,, un wanted kit in dubai, Victoria, Sydney, ajman, Botswana ,misoprostol in abu dhabi.sharjah.dubai Alabama,get abortion pills in ras al khaimah,al ain,ajman,abu dhabi.sharjah,kuwaitcity,al satwa,deira. Charlotte,Austin,San Francisco,New York,Seattle,farwaniyah,cytotec pills for sale in al ain ,ajman,dubai,Washington,misoprostol tablets available +971581248768 in dubai,abu dhabi,sharjah,al ain,deira,ajman) abortion pills in abu dhabi,sharjah,dubai,fujairah,jumeirah,ras al khaimah,Rockhampton,Toowoomba,Coffs Harbour,J!~+971581248768>> SAFE AND ORIGINAL ABORTION PILLS FOR SALE IN DUBAI AND ABUD...

!~+971581248768>> SAFE AND ORIGINAL ABORTION PILLS FOR SALE IN DUBAI AND ABUD...DUBAI (+971)581248768 BUY ABORTION PILLS IN ABU dhabi...Qatar

Dernier (20)

Falcon Invoice Discounting: The best investment platform in india for investors

Falcon Invoice Discounting: The best investment platform in india for investors

Power point presentation on enterprise performance management

Power point presentation on enterprise performance management

!~+971581248768>> SAFE AND ORIGINAL ABORTION PILLS FOR SALE IN DUBAI AND ABUD...

!~+971581248768>> SAFE AND ORIGINAL ABORTION PILLS FOR SALE IN DUBAI AND ABUD...

HomeRoots Pitch Deck | Investor Insights | April 2024

HomeRoots Pitch Deck | Investor Insights | April 2024

SEO Case Study: How I Increased SEO Traffic & Ranking by 50-60% in 6 Months

SEO Case Study: How I Increased SEO Traffic & Ranking by 50-60% in 6 Months

Falcon Invoice Discounting: Aviate Your Cash Flow Challenges

Falcon Invoice Discounting: Aviate Your Cash Flow Challenges

Pre Engineered Building Manufacturers Hyderabad.pptx

Pre Engineered Building Manufacturers Hyderabad.pptx

Escorts in Nungambakkam Phone 8250092165 Enjoy 24/7 Escort Service Enjoy Your...

Escorts in Nungambakkam Phone 8250092165 Enjoy 24/7 Escort Service Enjoy Your...

Falcon's Invoice Discounting: Your Path to Prosperity

Falcon's Invoice Discounting: Your Path to Prosperity

Falcon Invoice Discounting: Unlock Your Business Potential

Falcon Invoice Discounting: Unlock Your Business Potential

Paradip CALL GIRL❤7091819311❤CALL GIRLS IN ESCORT SERVICE WE ARE PROVIDING

Paradip CALL GIRL❤7091819311❤CALL GIRLS IN ESCORT SERVICE WE ARE PROVIDING

Rice Manufacturers in India | Shree Krishna Exports

Rice Manufacturers in India | Shree Krishna Exports

The Abortion pills for sale in Qatar@Doha [+27737758557] []Deira Dubai Kuwait![The Abortion pills for sale in Qatar@Doha [+27737758557] []Deira Dubai Kuwait](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![The Abortion pills for sale in Qatar@Doha [+27737758557] []Deira Dubai Kuwait](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

The Abortion pills for sale in Qatar@Doha [+27737758557] []Deira Dubai Kuwait

Uneak White's Personal Brand Exploration Presentation

Uneak White's Personal Brand Exploration Presentation

Marel Q1 2024 Investor Presentation from May 8, 2024

Marel Q1 2024 Investor Presentation from May 8, 2024

Depreciation

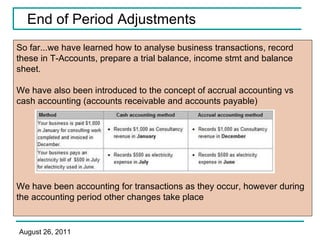

- 1. So far...we have learned how to analyse business transactions, record these in T-Accounts, prepare a trial balance, income stmt and balance sheet. We have also been introduced to the concept of accrual accounting vs cash accounting (accounts receivable and accounts payable) We have been accounting for transactions as they occur, however during the accounting period other changes take place End of Period Adjustments

- 3. The income stmt reports earnings for a specific time period (1qtr, 1yr etc) The balance sheet reports the assets, liabilities and owners equity on a specific date (as at 31 Dec 20xx) Therefore to follow the matching principle, accounts in the trial balance must be adjusted before financial statements are prepared. The matching principle

- 5. Current vs Non Current Assets Balance Sheet Current Assets: Within the financial year: Cash - Expected to produce revenue Accounts receivable - Can be used to meet short term / day to day obligations Prepaid Insurance - Generally can be liquidated (converted to cash within 1 yr) Inventories Non Current Assets: (Fixed Assets) Office Furniture - Tend to remain in the business for a longer period of time Motor Vehicles - Indirectly generate income Buildings - Can not be liquidated instantly for cash Land - Suject to depreciation Total Assets = Current + Non Current Assets

- 9. Non-current assets such as vehicles, equipment etc cannot be included as expenses in an income statement because they are not used up in one reporting period. A delivery van for example will be useful to a company for a number of years, during which time it helps the company earn revenues by delivering goods. Under accrual accounting, revenue for a reporting period must be Matched with the relevant expenses for that period. Depreciation is the process of allocating (or writing off) the cost of a non-current asset over its useful life . What is Depreciation?

- 10. An assets useful life is the period of time that asset is expected to help produce revenues. Depreciation is the recognition of a decline in value of an asset due to wear and tear. Depreciation is an expense account. When depreciation is recognized as an adjusting entry at the end of the accounting period, an expense is charged – a debit entry is made to depreciation expense. Where does the credit entry go? Adjusting Entries - Depreciation

- 11. Under the ‘historical cost’ principle, assets are recorded at their actual cost. (regardless of whether the firm got a good buy or over paid for them.) When we made an adjustment for pre-paid insurance, the asset accounts were credited to show that they had been consumed. However assets that are expected to provide future benefits for more than 1 yr require a different approach. The business must maintain a record of the actual cost of an asset. The credit side of the adjusting entry therefore goes to an asset – contra account called ‘Accumulated Depreciation’ Accumulated Depreciation

- 12. The depreciation adjusting entry is: DR Depreciation Expense (P/L) CR Accumulated Depreciation (B/S – contra asset account) Accumulated depreciation is also known as Provision for depreciation Accumulated Depreciation cont.. Balance Sheet Income Statement Assets: Expenses: Delivery Equipment 3,600 Depreciation Expense 100 less: Accumulated depreciation (100) Net Book Value 3,500

- 13. Balance Sheet with accumulated depreciation

- 15. If a company's accounting year ends on December 31, but the purchase of the asset was 1 July, what will the depreciation schedule look like? What is the cash outlay? How will the company report the depreciation expense on the company's income statement? Why is depreciation expense regarded as a non-cash expense? Depreciation Example cont.