Investment Idea - POLYPLEX CORPORATION LTD - "BUY"

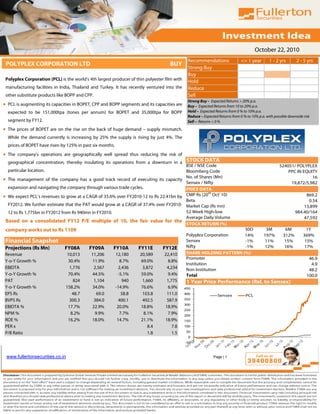

- 1. October 22, 2010 Recommendations <= 1 year 1 - 2 yrs 2 - 5 yrs POLYPLEX CORPORATION LTD BUY Strong Buy Buy Polyplex Corporation (PCL) is the world’s 4th largest producer of thin polyester film with Hold manufacturing facilities in India, Thailand and Turkey. It has recently ventured into the Reduce other substitute products like BOPP and CPP. Sell Strong Buy – Expected Returns > 20% p.a. • PCL is augmenting its capacities in BOPET, CPP and BOPP segments and its capacities are Buy – Expected Returns from 10 to 20% p.a. expected to be 151,000tpa (tones per annum) for BOPET and 35,000tpa for BOPP Hold – Expected Returns from 0 % to 10% p.a. Reduce – Expected Returns from 0 % to 10% p.a. with possible downside risk segment by FY12. Sell – Returns < 0 % • The prices of BOPET are on the rise on the back of huge demand – supply mismatch. While the demand currently is increasing by 25% the supply is rising by just 4%. The prices of BOPET have risen by 125% in past six months. • The company’s operations are geographically well spread thus reducing the risk of geographical concentration, thereby insulating its operations from a downturn in a STOCK DATA BSE / NSE Code 524051/ POLYPLEX particular location. Bloomberg Code PPC IN EQUITY • The management of the company has a good track record of executing its capacity No. of Shares (Mn) 16 Sensex / Nifty 19,872/5,982 expansion and navigating the company through various trade cycles. PRICE DATA th • We expect PCL’s revenues to grow at a CAGR of 35.6% over FY2010-12 to Rs 22.41bn by CMP Rs (20 Oct' 10) 869.2 Beta 0.54 FY2012. We further estimate that the PAT would grow at a CAGR of 37.4% over FY2010- Market Cap (Rs mn) 13,899 12 to Rs 1,775bn in FY2012 from Rs 940mn in FY2010. 52 Week High-low 984.40/164 Average Daily Volume 47,592 Based on a consolidated FY12 P/E multiple of 10, the fair value for the STOCK RETURN (%) company works out to Rs 1109 30D 3M 6M 1Y Polyplex Corporation 14% 197% 312% 369% Financial Snapshot Sensex -1% 11% 15% 15% Projections (Rs Mn) FY08A FY09A FY10A FY11E FY12E Nifty -1% 12% 16% 17% Revenue 10,013 11,206 12,180 20,589 22,410 SHARE HOLDING PATTERN (%) Promoter 46.9 Y-o-Y Growth % 30.4% 11.9% 8.7% 69.0% 8.8% Institution 4.9 EBIDTA 1,776 2,567 2,436 3,872 4,234 Non Institution 48.2 Y-o-Y Growth % 70.4% 44.5% -5.1% 59.0% 9.4% Total 100.0 PAT 824 1,104 940 1,660 1,775 1 Year Price Performance (Rel. to Sensex) Y-o-Y Growth % 158.2% 34.0% -14.9% 76.6% 6.9% 450 EPS Rs 48.7 69.0 58.8 103.8 111.0 400 Sensex PCL BVPS Rs 300.3 384.0 400.1 492.5 587.9 350 300 EBIDTA % 17.7% 22.9% 20.0% 18.8% 18.9% 250 NPM % 8.2% 9.9% 7.7% 8.1% 7.9% 200 ROE % 16.2% 18.0% 14.7% 21.1% 18.9% 150 PER x 8.4 7.8 100 P/B Ratio 1.8 1.5 50 0 -50 www.fullertonsecurities.co.in Page | 1

- 2. October 22, 2010 BUSINESS PROFILE Polyplex Corporation is the 4th largest producer of thin BOPET films in the world. The company currently has presence in PET films, BOPP films, CPP, Metalized Films and Extrusion Coating.It has manufacturing facilities in India, Thailand and Turkey, and has distribution setups in the United States and China. The plants in India are located at Khatima and Bajpur in 85% of its revenues come from overseas markets Uttarakand. It also has a captive production of BOPET chips used in the production of BOPET films, which helps the company to have a better cost control over the entire value chain. The PET chips are produced using Purified Terephthalic Acid and Mono- Ethylene Glycol which are by products of crude oil processing and therefore are subjected to price fluctuations. BOPET (Bi-axially Oriented polyethylene terephthalate Films) – BOPET films are high electrical resistance, high printability plastic films used in the FMCG, food packaging, electrical insulation, magnetic applications. It is also used in Touch Screen Panels, Solar Power Cells, Flat Screen TVs and Computers and LEDs which is driving the demand. The demand for BOPET films is growing at 25-30% worldwide while the growth in supply is meager 4% leading to increase in prices which have been beneficial for the company. The prices of PET films have increased by 125% in the past six months. The BOPET film market in India is estimated at 228,000 tpa for 2010 with the total capacity of 360,000 tpa, BOPP (Bi-axially Oriented polypropylene) – BOPP films have the high moisture resistant, higher tensile strength and are puncture resistant and is used in FMCG, food packaging and medical packaging. BOPET has better quality and is preferred Three- fourth of Polyplex over BOPP as a packaging product. The BOPP market in India is estimated at about 162,000 tons for the 2010 with a capacity products are used in the FMCG segment. base of 350,000 tons. Demand is expected to grow at more than 15%. In India the penetration of BOPP in packaging was low which has improved over a period of time resulting in higher growth in BOPP. CPP (Cast polypropylene) – PCL has recently entered the CPP segment. CPP is polypropylene based, and offers impressive transparency and external glossy qualities and used in FMCG and food packaging. Segment wise capacity Capacity (In tpa) Geographical Segmentation Segment FY2010 FY2012E PET 122,900 151,000 Europe BOPP - 35000 South America Metallised Film 22,000 22,000 32% 2% SE Asia CPP 2000 10000 19% India 17% Extrusion Coating (in mn sqm) 19,000 19,000 North America Segment wise Revenue (Rs crores) 21% Segment FY2010 Other Asia Middle East PET 74% 6% 3% Extrusion Coating 4% CPP 7% Capacity expansion to drive robust growth … Metalized Films 15% Total 100% The company is in the process of augmenting its capacities and is setting up a new PET line in India. The company is also in the process of setting a 35,000 TPA BOPP line in Thailand which is expected to commence operations in FY11. Recently, the company has added a new CPP line to its Thailand facility. These capacities would drive the growth for the company. www.fullertonsecurities.co.in Page | 2

- 3. October 22, 2010 BUSINESS PERFORMANCE Better than expected performance... The Net sales grew 41.7% Y-o-Y to Rs4.27bn as against Rs3.01bn in the previous corresponding quarter on the back of higher capacity utilization, commencement of new BOPP and PET plants in India and higher selling price due to The manufacturing units of company in all countries are favourable market conditions and strong demand. The company reported a 247 bps expansion in OPM to 20.8% from located strategically in Tax free 18.4% in Q1FY10 on the back of strong demand for polyester films and increase in selling price, which was much zones and hence tax out go is minimum. higher than the increase in the raw material cost. Net profit surged 461%Y-o-Y to Rs390mn from Rs70mn in Q1FY10 on strong demand. We expect the FY11 revenues to jump by 69% to Rs 20.5bn on higher capacities. Annual Revenues & Margins Quarterly Performance 25000 25% 4500 30% 4000 25% 20000 20% Revenues (Rs mn) 3500 Revenues (Rs mn) 3000 20% Margins(%) Margins(%) 15000 15% 2500 15% 2000 10000 10% 1500 10% 1000 5000 5% 5% 500 0 0% 0 0% Revenue (Rs mn) PAT Margins EBITDA Margins Net Revenue (Rs mn) EBITDA Margins Peer Group Comparison EBIDTA PAT Revenue ROE P/E P/B CMP FV Companies Margin Margin (Rs. mn) (%) (x) (x) (Rs.) (Rs.) (%) (%) Polyplex Corporation 12180 20% 8% 14% 15.3 2.2 869 10 Jindal Poly 17036 24% 12% 19% 13.0 2.5 1134 10 Uflex 22910 21% 8% 18% 10.1 1.8 286 10 Cosmo films 9590 15% 7% 23% 4.7 1.1 161 10 * FY10 consolidated figures Peer Comparison PCL operates at comparable margins. The company currently trades at a P/E of 15.3 and commands a premium compared to its peers on the back of strong capacity expansion initiatives as well as a geographically diversified Strong revenue visibility business model. Going forward we expect the company to post better results on the back of strong growth in expected in FY11 revenues. www.fullertonsecurities.co.in Page | 3

- 4. October 22, 2010 Key Risks and Concerns PCL operates in the packaging industry which has low entry barriers. The cost of setting up a 30,000 tpa capacity plant is roughly around USD 45-55mn and takes around 12-18 months. The current realization of Rs 225/kg is 125% The company has a Debt to Equity ratio of 1.28 higher than the long term average of Rs 100/kg due to the demand and supply scenario. Any incremental capacity addition might hurt realizations. New PET lines with incremental capacities in the range of 250,000 tpa are expected to commission by FY12 with India and China having the major share. The Exports by PCL are subjected to Countervailing and Anti Dumping duties and any increase in the same would pressurize the margins. Any increase in raw material prices would also hurt the margins. VALUATION We expect PCL’s revenues to grow at a CAGR of 35.6% over FY2010-12 to Rs 22.41bn by FY2012. We further Based on a consolidated estimate that the PAT would grow at a CAGR of 37.4% over FY2010-12 to Rs 1,775bn in FY2012 from Rs 940mn FY12 P/E multiple of 10, the fair value for the company in FY2010. works out to Rs 1109 Based on a consolidated FY12 P/E multiple of 10, the fair value for the company works out to Rs 1109 We recommend a ‘BUY’ rating on the stock. Financial Analysis and Projections Particulars (Rs Mn) FY08A FY09A FY10A FY11E FY12E Net Revenue 10,013 11,206 12,180 20,589 22,410 Other Income 117 221 249 371 434 Total Income 10,130 11,427 12,429 20,960 22,844 Operating Expenditure 8,354 8,860 9,993 17,087 18,610 Depreciation 387 540 599 781 846 EBIT 1,390 2,027 1,837 3,091 3,388 EBIT Margin (%) 13.9% 18.1% 15.1% 15.0% 15.1% Interest 211 368 274 326 347 Profit Before Tax 1,178 1,659 1,563 2,765 3,042 Less: Tax 51 119 190 361 404 PAT 824 1,104 940 1,660 1,775 PAT Margin (%) 8.2% 9.9% 7.7% 8.1% 7.9% ROE (%) 16.2% 18.0% 14.7% 21.1% 18.9% EPS (Rs) 48.7 69.0 58.8 103.8 111.0 BVPS (Rs) 300.3 384.0 400.1 492.5 587.9 Valuation Ratios (x) FY11E FY12E P/E 8.4 7.8 P/B 1.8 1.5 www.fullertonsecurities.co.in Page | 4

- 5. October 22, 2010 Board of Directors Director Name Current Position Description Shri. Sanjiv Saraf is Non Independent Non-Executive Chairman of the Board of Polyplex Corporation Ltd. He is promoter Director of the Company and is associated with the Company since its inception. Shri Sanjiv Saraf is B.Tech from Indian Institute of Technology (IIT), Shri. Sanjiv Saraf Chairman Kharagpur. Shri Saraf has guided the Company from the time of the setting up of Company's first Polyester Film project in 1988 to the subsequent expansions and diversifications in India as well as through its subsidiaries abroad. He was the Managing Director of the Company for over sixteen years. He is currently non-executive director and the Chairman of the Company. Shri. Pranay Kothari is Chief Executive Officer, Non-Independent Whole Time Director of Polyplex Corporation Ltd. He is a qualified Chartered Accountant and Company Secretary and has been associated with the Company since 1985. During his tenure with the Shri. Pranay Kothari Chief Executive Officer Company he has held the positions of Company Secretary, Director (Operations) (Whole Time Director). He was last appointed as Whole Time Director designated as Executive Director for a term of three years w.e.f. September 7, 2006. Shri Pranay Kothari is a professional director of the Company. Independent Non- Subrahmanyan S. Executive Vice Subrahmanyan S. is currently serving as an Independent Non-Executive Vice Chairman on the Board of Polyplex Corporation. Chairman Shri. Ranjit Singh is Chief Operating Officer, Non Independent Whole Time Director of Polyplex Corporation Ltd. He is COO, joined Polyplex in 1996 and currently has overall charge of the Film Business. Mr. Singh has been instrumental in enhancement in productivity Chief Operating Shri. Ranjit Singh and quality levels at plant, besides institutionalizing cost cutting measures and a process driven approach in the Company. He is a Officer qualified Mechanical Engineer and an MBA from the Indian Institute of Management, Ahmedabad. Shri. Jitender Balakrishnan was appointed as an Additional Director of Polyplex Corporation Limited., with effect from July 20, 2010. He Shri. Jitender Balakrishnan Additional Director has done his B.E. (Mech.) from National Institute of Technology (NIT), Madras University. He has served on the Board of IDBI Bank Limited as Executive Director and thereafter as Deputy Managing Director and Group Head - Corporate Banking. Shri. Sanjiv Chadha is Non Independent Non-Executive Director of Polyplex Corporation Ltd. He is a Non Resident Indian and practicing Non-Executive as an Architect in the United States of America. Shri Sanjiv Chadha is B. Arch from Indian Institute of Technology (IIT) and has done M.S. Shri. Sanjiv Chadha Independent Director Architecture from Illinois Institute of Technology, U.S.A. He is member of American Institute of Architecture, Association of Licensed Architect, International Council of Shopping Centers and International Facilities Management Association. Non-Executive O. Mehra O. Mehra currently serves as an Independent Non-Executive Director on the Board of Polyplex Corporation. Independent Director Non-Executive Brij Soni Brij Soni currently serves as an Independent Non-Executive Director on the Board of Polyplex Corporation. Independent Director Non-Executive Suresh Surana Suresh Surana currently serves as an Independent Non-Executive Director on the Board of Polyplex Corporation. Independent Director Non-Executive Ravi Kumar Ravi Kumar currently serves as an Independent Non-Executive Director on the Board of Polyplex Corporation. Independent Director www.fullertonsecurities.co.in Page | 5