Analyst report on Oroco Resource Corp

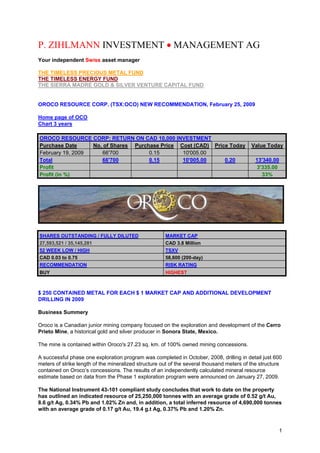

- 1. P. ZIHLMANN INVESTMENT • MANAGEMENT AG Your independent Swiss asset manager THE TIMELESS PRECIOUS METAL FUND THE TIMELESS ENERGY FUND THE SIERRA MADRE GOLD & SILVER VENTURE CAPITAL FUND OROCO RESOURCE CORP. (TSX:OCO) NEW RECOMMENDATION, February 25, 2009 Home page of OCO Chart 3 years OROCO RESOURCE CORP: RETURN ON CAD 10,000 INVESTMENT Purchase Date No. of Shares Purchase Price Cost (CAD) Price Today Value Today February 19, 2009 66'700 0.15 10'005.00 Total 66'700 0.15 10'005.00 0.20 13'340.00 Profit 3'335.00 Profit (in %) 33% SHARES OUTSTANDING / FULLY DILUTED MARKET CAP 27,593,521 / 35,145,281 CAD 3.8 Million 52 WEEK LOW / HIGH TSXV CAD 0.03 to 0.75 58,600 (200-day) RECOMMENDATION RISK RATING BUY HIGHEST $ 250 CONTAINED METAL FOR EACH $ 1 MARKET CAP AND ADDITIONAL DEVELOPMENT DRILLING IN 2009 Business Summery Oroco is a Canadian junior mining company focused on the exploration and development of the Cerro Prieto Mine, a historical gold and silver producer in Sonora State, Mexico. The mine is contained within Oroco's 27.23 sq. km. of 100% owned mining concessions. A successful phase one exploration program was completed in October, 2008, drilling in detail just 600 meters of strike length of the mineralized structure out of the several thousand meters of the structure contained on Oroco’s concessions. The results of an independently calculated mineral resource estimate based on data from the Phase 1 exploration program were announced on January 27, 2009. The National Instrument 43-101 compliant study concludes that work to date on the property has outlined an indicated resource of 25,250,000 tonnes with an average grade of 0.52 g/t Au, 8.6 g/t Ag, 0.34% Pb and 1.02% Zn and, in addition, a total inferred resource of 4,690,000 tonnes with an average grade of 0.17 g/t Au, 19.4 g.t Ag, 0.37% Pb and 1.20% Zn. 1

- 2. Project Location OROCO's principal assets are: • A 100% ownership interest in the 215 hectare San Francisco and San Felix mining concessions hosting the past producing Cerro Prieto Mine, as well as a 100% interest in the 2,508 hectare, Cerro Prieto North mining concession containing additional strike length of the mineralized structure which hosts the Cerro Prieto Mine. • 100% ownership of 3 mining concessions within the original Morelos National Mining Reserve. The Celia Gene and Celia Generosa mining concessions lie within 2 kilometres of Goldcorp’s Los Filos-El Bermejal open pit gold mine and contain mineralization similar in style to that mine as well as the mineralization hosting several other gold mines in the area. High grade underground zones within the concessions hosted historic gold production. History The Cerro Prieto Mine operated from 1906 with production reportedly between 500 and 720 tpd of gold and silver ore grading 3 to 15 g/ton Au and 50 to 60 g/ton Ag. Mining operations ceased in 1912 at the time of the Mexican Revolution and were never resumed. A number of factors, including the 1966 mining law requiring 51% Mexican ownership, prevented further mining in the 20th century. Companies conducting exploration programs from 1969 to 1999 issued consistent reports of mineralization at Cerro Prieto. In 1998 Morgain Minerals Inc. conducted a reverse circulation drill program of 23 holes on a limited portion of the structure and based on this drill program Morgain management estimated that within the area of drilling and detailed work there is a bulk underground resource* of 7,061,129 tons at an average gold equivalent grade of 4.40 g/ton and an open pit resource* of 1,391,000 with an average gold equivalent grade of 2.47 g/ton. 2

- 3. NI 43-101 COMPLIANT RESOURCE At the completion of Oroco's Phase 1 exploration program at Cerro Prieto, Giroux Consultants Ltd. of Vancouver, an independent consulting firm specializing in resource and reserve calculations, completed a resource calculation using information from 23 of the 24 holes completed by Oroco in 2008. Drilling consisted of 24 holes in 6,000 meters diamond drilling at 100 meter centers over a strike length of 6000 meters and to a maximum depth of 400 meters as well as a single step out drill hole. CP023, drilled on strike 300 meters north of the area of detailed drilling. Drill hole CP023, considered a step out hole, intercepted a broad zone of well mineralized rock but data from this hole was not included in the resource calculation. On January 27, 2009 the results of this independent resource calculation were announced. 3

- 4. A Phase 2 drill program is planned which will include detailed drilling at 100 meter centers over an additional 650 of strike length and to a depth of 400 meters. Mineralization over this strike length has been confirmed by trenching and sampling on the outcropping structure at 50 meter intervals returning grades and widths comparable to those in the area of the existing resource, as well as the step out hole at approximately the mid point of this 650 meters of strike. Phase 2 exploration will also include preliminary testing of the additional several kilometres of length of the geological structure which hosts the mineralization. The Xochipala project 4

- 5. Oroco holds a 100% interest in two contiguous mineral concessions in Guerrero, Mexico; Celia Generosa and Celia Gene, totaling 193 hectares and together called the Xochipala Project. The Xochipala claims cover ground in the Guerrero Gold Belt sufficient to potentially generate reserves greater than 1 million ounces gold in ore bodies similar to the productive high-grade ore bodies that have been discovered in the past within the region.” (Report on the Xochipala Property “Morelos” National Reserve District, Guerrero, Mexico, Prepared by Tawn Albinson F., M.Sc., for Britannia Gold Corporation, 1997, the “Albinson Report”) Oroco’s Xochipala Project is located in the southeast extreme of the original Morelos National Mining Reserve, a 49,400 ha federal mineral reserve which includes the most promising and expanding gold reserves in Mexico. This region encompasses a northwest trend of intrusions with associated gold bearing iron skarn deposits and is part of a wider area which has come to be known as the Guerrero Gold Belt (the “GGB”). The GGB is currently the focus of aggressive exploration, delineation, development, and mining by Canadian and Mexican majors. Teck Cominco, Goldcorp and Grupo Mexico are exploring and delineating gold reserves in the GGB and to date have discovered in excess of 12 million ounces of gold. Regionally, several multi million ounce gold deposits related to skarns along the peripheries of felsic to intermediate intrusions have recently been identified. These include the El Limon deposit as well as the Nukay and Todos Santos deposits, and approximately two kilometres from the Xochipala Project boundary, Goldcorp’s Los Filos-El Bermejal mine, forecast to produce 280,000 ounces of gold in 2008. Oroco’s Celia Generosa and Celia Gene concessions contain mineralization in very well defined structures that outcrop for over one kilometre and were the site of some of the earliest gold mining in the region from a number of small underground workings. These concessions host intrusives of similar age and composition and several areas of skarn mineralization with significant associated gold assays. Past work, including exploration and artisanal mining, has focused on the high grade showings on the properties. The exploration program at Xochipala will focus on the high grade showings on the properties and potential for medium to lower grade deposits amenable to open pit mining. The project area is well served by a network of local roads and the principal centers of population are Xochipala just one kilometre from the property boundary, and the State capital of Chilpancingo approximately 30 kilometres away by good paved road. The district is served by hydroelectric power from the Caracol dam and water is locally available. A large trained labour pool is locally available. Recent Developments: OROCO REPORTS A 25.3 MILLION TONNE INDICATED RESOURCE AND 4.69 MILLION TONNE INFERRED RESOURCE AT CERRO PRIETO Oroco Resource Corp. reports the results of an independently calculated mineral resource estimate based on data from the recently completed Phase 1 exploration program at the 100% owned Cerro Prieto project in Sonora State, Mexico. The National Instrument 43-101 compliant study concludes that work to date on the property has outlined an indicated resource of 25,250,000 tonnes with an average grade of 0.52 g/t Au, 8.6 g/t Ag, 0.34% Pb and 1.02% Zn and, in addition, a total inferred resource of 4,690,000 tonnes with an average grade of 0.17 g/t Au, 19.4 g.t Ag, 0.37% Pb and 1.20% Zn. Ken Thorsen, President and CEO of Oroco, stated: quot;We are extremely excited to be releasing this initial National Instrument 43-101 Resource Estimate on the Cerro Prieto project. It is based on a diamond drill program of 23 holes, all of which successfully intercepted the mineralized zone (with the exception of two which failed to reach the zone because of bad ground conditions) and included mineralization that contributed to the resource. Also noteworthy is that the Phase 1 exploration 5

- 6. program included surface trenching confirming mineralization over a strike length 100% greater than that of the drill holes incorporated in this resource estimate, as well as a successful step out drill hole 300 meters north of the resource. The deposit remains open on strike to the north and south and to depth. We strongly feel that drilling in a Phase 2 exploration program, expected to be completed during 2009, has significant potential to add to the resource both on strike and down dip.” Fundamental Considerations A Phase 2 drill program is planned which will include detailed drilling at 100 meter centers over an additional 650 of strike length and to a depth of 400 meters. Mineralization over this strike length has been confirmed by trenching and sampling on the outcropping structure at 50 meter intervals returning grades and widths comparable to those in the area of the existing resource, as well as the step out hole at approximately the mid point of this 650 meters of strike. Phase 2 exploration will also include preliminary testing of the additional several kilometres of length of the geological structure which hosts the mineralization. The value of the contained metal in the resource is over $ 1 billion, approximately 1.25 million oz gold equivalent or 76 million oz silver equivalent. 85% is an indicated resource and will not require infill drilling. Oroco is confident that this resource can be substantially expanded as 20% of the drilled area remain to be included in the resource calculation. The phase 2 drill program will start in April for completion in October. 6

- 7. Some highlights: • At today’s metal prices, Oroco has $ 38 of contained metal per share in the current resource. • For each $ 1 market cap, Oroco has $ 250 of contained metal in the current resource. • For each $1 spent on exploration last year, Oroco created $ 1,000 of contained metal in the current resource and Phase 2 is projected to have similar results. • Mineralization is contained in a single contiguous ore body, averaging 40 meters wide, starting at surface, with topography favourable for low cost open pit mining. An economic assessment is under way and is expected to be completed in the next several weeks. The current resource is sufficient to support a 5,000 tpd mine with a 20 year mine life and management plans additional resource definition with the 2009 drill program sufficient to support a 10,000 tpd operation with a 20 year mine life. Mining and milling costs are estimated to be between $ 10 and $ 14 per tonne, and contained metal values are of $36 per tonne at current metal prices. Technical Considerations GOLD SHARES LIKELY TO OUTPERFORM THE PRICE OF GOLD! GOLD OUTPERFORMS THE SHARE PRICE OF GOLDCORP! THE SHARE PRICE OF GOLDCORP OUTPERFORMS THE PRICE OF GOLD! 7

- 8. TARGET $ 1,340 +70% GOLD OUTPERFORMING THE S&P 600 SMALL CAP 8

- 9. MAJORS PAID AT LEAST $ 50 PER OUNCE OF GOLD IN THE GROUND IN THE PAST AT A TIME WHEN THE GOLD PRICE WAS AT $ 650. THE GOLD EQUIVALENT RESOURCE OF 1.25 MILLION OUNCES HAS A MARKET CAP OF $ 3.30 PER SHARE. THE GOLD EQUIVALENT RESOURCE OF 1.25 MILLION OUNCES HAD A MARKET CAP OF $14 PER SHARE. THE GOLD EQUIVALENT RESOURCE OF 1.25 MILLION OUNCES HAD A MARKET CAP OF $0.58 PER SHARE. Peter Zihlmann www.pzim.ch invest@pzim.ch phone +41 44 268 51 10 mobile +41 79 379 51 57 9

- 10. www.timeless-funds.com is a shareholder in the company and will benefit from any increase in the company’s share price. ******************************************************************************************************************************* Disclosure: The author has not been paid to write this article, nor has he received any other inducement to do so. The author is a shareholder in the company and will benefit from any increase in the company’s share price. Disclaimer: The author’s objective in writing this article is to invoke an interest on the part of potential investors in this stock to the point where they are encouraged to conduct their own further diligent research. Neither the information nor the opinions expressed should be construed as a solicitation to buy or sell this stock. Investors are recommended to obtain the advice of a qualified investment advisor before entering into any transactions in the stock. ******************************************************************************************************************************* 10