Tresvista Monthly Me January 2009

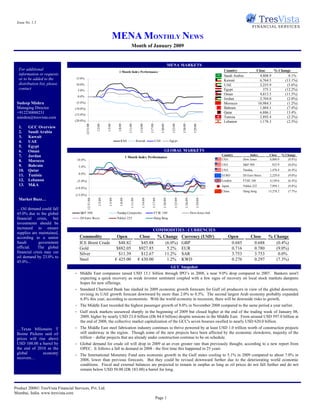

- 1. Issue No. 1.5 MENA MONTHLY NEWS Month of January 2009 MENA MARKETS For additional Country Close % Change 1 Month Index Performance information or requests Saudi Arabia 4,808.9 0.1% or to be added to the 15.0% Kuwait 6,764.5 (13.1%) distribution list, please 10.0% UAE 2,255.9 (5.6%) contact 5.0% Egypt 375.1 (12.2%) Oman 4,813.5 (11.5%) 0.0% Jordan 2,704.0 (2.0%) Sudeep Mishra (5.0%) Morocco 10,984.3 (1.2%) Managing Director (10.0%) Bahrain 1,804.1 (7.4%) +912230888231 (15.0%) Qatar 6,886.1 13.4% smishra@tresvista.com Tunisia 2,892.4 (2.2%) (20.0%) Lebanon 1,178.3 (2.5%) 12/31/08 1/2/09 1/5/09 1/8/09 1/11/09 1/14/09 1/17/09 1/20/09 1/23/09 1/26/09 1/29/09 1. GCC Overview 2. Saudi Arabia 3. Kuwait 4. UAE KSA Kuwait UAE Egypt 5. Egypt 6. Oman GLOBAL MARKETS 7. Jordan Country Index Close % Change 1 Month Index Performance 10.0% USA Dow Jones 8,000.9 (8.8%) 8. Morocco 9. Bahrain USA S&P 500 825.9 (8.6%) 5.0% 10. Qatar USA Nasdaq 1,476.4 (6.4%) 0.0% 11. Tunisia EURO DJ Euro Stoxx 2,229.0 (9.0%) 12. Lebanon (5.0%) London FTSE 100 4,149.6 (6.4%) 13. M&A Japan Nikkei 225 7,994.1 (9.8%) (10.0%) China Hang Seng 13,278.2 (7.7%) (15.0%) Market Buzz… 12/31/08 1/2/09 1/5/09 1/8/09 1/11/09 1/14/09 1/17/09 1/20/09 1/23/09 1/26/09 1/29/09 …Oil demand could fall 45.0% due to the global S&P 500 Nasdaq Composite FT SE 100 Dow Jones Indu financial crisis, but DJ Euro Stoxx Nikkei 225 Hang Seng investments should be increased to ensure COMMODITIES / CURRENCIES supplies are maintained, according to a senior Commodity Open Close % Change Currency (USD/) Open Close % Change Saudi government ICE Brent Crude $48.82 $45.88 (6.0%) GBP 0.685 0.688 (0.4%) official. The global Gold $882.05 $927.85 5.2% EUR 0.716 0.780 (9.0%) financial crisis may cut Silver $11.39 $12.67 11.2% SAR 3.753 3.753 0.0% oil demand by 23.0% to Steel € 425.00 € 430.00 1.2% KWD 0.276 0.297 (7.3%) 45.0%... GCC Snapshot - Middle East companies raised USD 13.1 billion through IPO’s in 2008, a near 9.0% drop compared to 2007. Bankers aren't expecting a quick recovery as weak investor sentiment coupled with a few signs of recovery on local stock markets dampens hopes for new offerings. - Standard Chartered Bank has slashed its 2009 economic growth forecasts for Gulf oil producers in view of the global downturn, revising its UAE growth forecast downward by more than 2.0% to 0.5%. The second largest Arab economy probably expanded 6.8% this year, according to economists. With the world economy in recession, there will be downside risks to growth. - The Middle East recorded the highest passenger growth of 8.0% in November 2008 compared to the same period a year earlier. - Gulf stock markets seesawed sharply in the beginning of 2009 but closed higher at the end of the trading week of January 08, 2009, higher by nearly USD 23.0 billion (Dh 84.0 billion) despite tensions in the Middle East. From around USD 597.0 billion at the end of 2008, the collective market capitalization of the GCC's seven bourses swelled to nearly USD 620.0 billion. …Texas billionaire T - The Middle East steel fabrication industry continues to thrive powered by at least USD 1.0 trillion worth of construction projects Boone Pickens said oil still underway in the region. Though some of the new projects have been affected by the economic slowdown, majority of the prices will rise above trillion – dollar projects that are already under construction continue to be on schedule. USD 100.00 a barrel by - Global demand for crude oil will drop in 2009 at an even greater rate than previously thought, according to a new report from the end of 2010 as the OPEC. It follows a fall in demand in 2008 - the first time this happened in 25 years global economy - The International Monetary Fund sees economic growth in the Gulf states cooling to 5.1% in 2009 compared to about 7.0% in recovers… 2008, lower than previous forecasts. But they could be revised downward further due to the deteriorating world economic conditions. Fiscal and external balances are projected to remain in surplus as long as oil prices do not fall further and do not remain below USD 50.00 (Dh 183.00) a barrel for long. Product 2008© TresVista Financial Services, Pvt. Ltd. Mumbai, India. www.tresvista.com Page 1

- 2. Issue No. 1.5 MENA MONTHLY NEWS Month of January 2009 Saudi Arabia …According to Airports Sectors % ▼▲ Company % Change 1 Month Index Performance CAGR 0.1% International Council Telecom 0.9% Top 5 Gainers: SASEIDX Index SCCI 108.3% (ACI), the Middle East Banking (1.6%) Shams 105.2% will be the fastest – 5,300.0 Cement 1.8% Saudi British Bank Takaful 85.4% 5,150.0 Insurance 13.0% growing region in the Al Baha Investment and Development Co 54.6% 5,000.0 Wafra Food Products Company 48.0% world for passenger 4,850.0 Top 5 Losers: traffic in 2009, driven 4,700.0 UCA (30.1%) by aggressive 4,550.0 Malath Insurance (21.8%) development of some of 4,400.0 Savola Group (21.1%) Saudi Paper Group (18.9%) 12/31/08 1/3/09 1/6/09 1/9/09 1/12/09 1/15/09 1/18/09 1/21/09 1/24/09 1/27/09 1/30/09 its carriers. The SFG (17.9%) passenger traffic in the Middle East is expected to increase annually by 6.0% until 2012, Macro Economic News compared to the global ▲ The Saudi Organization for Industrial Estates & Technology Zones allocated land worth SAR 24.0 billion (USD 6.4 billion) average of 4.3%. for industrial projects in 2008. Middle East has fared ▲ The Saudi Industrial Development Fund confirmed it extended loans worth SAR 24.3 billion to the construction industries much better than other sector since 2001, equivalent to 32.0% of total loans for the industrial sector. regions as it still grew by over 10.0% in ▲ The annual inflation rate in Saudi Arabia eased to 9.0% in December 2008, down from 9.5% in November 2008. The rents 2008… index, which includes fuel and water, surged 17.7% and food costs rose 11.3%. ▲ Saudi Arabia's Public Investment Fund raised the ceiling of loans to 40.0% of a project's investment cost from 30.0% previously. Sector News ▲ Saudi King Abdullah approved plans to create 204,056 new jobs in the education sector. ▲ Issuance of sukuk fell by more than 50.0% in 2008, due to the credit crisis and the debate over their compliance to Islamic laws, according to rating agency Moody's. ▼ Growing demand and a dwindling inventory forced SABIC to raise construction steel prices by SAR 155.00 (USD 41.40) per ton. Company News ▲ Al Zakari Group plans to launch a SAR 4.0 billion real estate project in Riyadh. The project consists of a high – rise building with an area exceeding 500,000.0 sqm. ▲ Fitch Rating Agency has affirmed the rating of SABIC’s long – term Issuer Default rating as A+ with a stable outlook and its Short-term Issuer Default rating as F1. ▲ Gulf Merger, the leading Mergers & Acquisitions advisory firm in Kuwait, announced the sale of a controlling interest in Jassim Transport and Stevedoring Company WLL (JTC) by Al - Masar United WLL to Global Private Equity, in a deal representing the largest private equity transaction to date in Kuwait's history. …According to Gulf ▼ Saudi Basic Industries Corporation permanently shut down its aromatics plant in the United Kingdom and its plastic plant Finance House, the in Spain. The company has also temporarily shut down other steel plants. global financial turmoil has ended the boom ▼ Saudi Basic Industries Corp. intends to lay off employees in 2009 as part of its plan to cut cost, according to Mohamed Al cycle in most GCC Mady, the company's CEO. Sabic Innovative Plastics has already laid off approximately 1,000 workers and Sabic Europe states. The steep fall in has laid off about 300 workers. oil prices from their ▼ State – owned Saudi Arabian Airlines lost SAR 1.8 billion (USD 479.8 million) in 2008 due to cases of passengers failing to peak last summer, travel after reservation. output contraction across other key Liquidity / Capital raising economic sectors, tight - Saudi Kayan signed a SAR 2.0 billion loan agreement with the Saudi Industrial Development Fund to finance a portion of its liquidity conditions, and new petrochemical complex in the Jubail industrial city. the fall in asset prices - Saudi based Jubail Energy Services Company and PIF signed a long term SAR 720.0 million financing agreement, to finance will make 2009 a part of the seamless pipe manufacturing facility being built in Jubail. challenging year for the GCC. However, the - A SAMA report showed that the annual growth in the Kingdom's money supply slowed to its lowest level in at least a year. The current environment is annual growth of M3, the broadest measure of money circulating in the economy, slowed to 19.2% in November 2008 from also creating attractive 20.2% in October 2008. buy opportunities for - 24.0% of Saudi borrowers have fallen behind on loan repayments, affecting some two hundred financial institutions, cash – rich investors according to the head of a credit bureau. The volume of consumer credit fell to SAR 178.9 billion (USD 47.7 billion) by mid – looking for gains over 2008 from SAR 185.4 billion in mid – 2007. the medium to long - SAMA lowered its repo rate by 50 bps to 2.00% from 2.50%, in an effort to ease liquidity and boost economic growth. It term… also reduced its reverse repo rate to 0.75% from 1.50%. Product 2008© TresVista Financial Services, Pvt. Ltd. Mumbai, India. www.tresvista.com Page 2

- 3. Issue No. 1.5 MENA MONTHLY NEWS Month of January 2009 Kuwait …According to Sectors % ▼▲ Company % Change Proleads data, upstream Insurance (5.7%) Top 5 Gainers: 1 Month Index Performance CAGR (13.1% ) Villa Moda 55.8% investments in the Oil Banks (16.6%) KGL Transport Company, KGL 34.0% 7,800.0 and Gas sector in the Food (11.4%) Wataniya Airways 25.0% Service (13.1%) KWSIIDX Index 7,500.0 GCC currently stand at AAYANRE 24.0% Real Estate (12.2%) GCC 20.0% USD 204.0 billion, a 7,200.0 Industries (12.9%) Top 5 Losers: 9.0% increase from 6,900.0 Investment (18.0%) HITS Telecom (57.3%) USD 188.0 billion in 6,600.0 TID (54.9%) ILIC (54.6%) June 2008. The number 6,300.0 Global (54.2%) 12/31/08 1/3/09 1/6/09 1/9/09 1/12/09 1/15/09 1/18/09 1/21/09 1/24/09 1/27/09 1/30/09 of projects has gone up Jeezan (47.9%) by 10.9% from 239 in June 2008 to 265 in January 2009. Investments in upstream Macro Economic News oil projects were up ▲ OPEC member Kuwait will cut oil supply by 10.0% from January 22, 2008 to buyers in the United States and Europe. The 6.7% from USD 118.0 billion to USD 125.0 cuts, along with a smaller percentage reduction to Kuwait's main customers in Asia, wil bring supply from Kuwait in line with billion, while gas its OPEC target. upstream projects were ▲ Kuwait’s new government, set up on Monday, January 12, 2009 as per Decree 1 for 2009, is the fifth Cabinet during His up 12.0% from USD Highness the Amir Sheikh Sabah Al – Ahmad Al – Sabah's tenure and also the fifth cabinet chaired by His Highness the Prime 70.0 billion to USD 78.0 Minister Sheikh Nasser Al – Mohammed Al – Sabah. billion… ▲ Kuwait Investment Authority will own 16.0% in troubled Gulf Bank after the lender completed its capital hike. ▲ The government has confirmed that is has approved a KWD 5.0 billion fund aimed at providing liquidity for local companies. ▼ The Kuwaiti stock market continued to slide in the month of December making 2008 one of the worst year’s in terms of Kuwait market performance by posting a decline of 45.4% for the entire year. The market capitalization reached KWD 33.4 billion at the end of 2008, registering a decline of 16.2% as compared to November 2008 and down 41.8% compared to 2007. ▼ Kuwait Investment Authority has so far injected KWD 275.0 million (USD 975.0 million) in the KWD 1.5 billion financial portfolio that was set up by the Council of Ministers to support the country's stock market. ▼ The work on Kuwait City’s USD 7.0 billion metro project is being postponed for at least eighteen months as the government undertakes a wide ranging study of the country’s land based transport requirements. Government Regulations ▲ Despite implementing cost – cutting measures across government departments, the government has approved a KWD 70.0 million budget for recruiting Kuwaiti staff in the public sector. The new budget will allow the appointment of 13,300 personnel in the various governmental and public sector bodies. ▲ The National Assembly enacted the long anticipated Labor Law which states that women will be barred from working at nights ...Almost USD 14.0 between 8 p.m. to 7 a.m., except in hospitals. Workers will also be prohibited from working for more than 48 hours a week, billion is being spent in while expatriate workers must be provided with accommodation. Penalties imposed against begging have also been Gulf countries on new toughened. hospital and healthcare Sector News facilities currently in various stages of ▼ The Central Bank of Kuwait has instructed local financing companies to stop providing personal loans, except for consumer construction in a series goods. This is done taking into the light the companies are facing considerable problems due to some defaulting customers. of major public, private, and jointly financed Company News initiatives. The figures ▼ Global Investment House, Kuwait’s biggest investment bank, defaulted on most of its debt, in the first of several expected show Saudi Arabia casualties among financial firms in the wealthy oil producing nation due to the credit crunch. leading the way with total healthcare projects currently being built valued at more than USD 6.6 billion. Current spending in the UAE and Qatar on new healthcare facilities is closely matched at USD 2.9 billion and USD 2.8 billion respectively… Product 2008© TresVista Financial Services, Pvt. Ltd. Mumbai, India. www.tresvista.com Page 3

- 4. Issue No. 1.5 MENA MONTHLY NEWS Month of January 2009 UAE …OPEC could decide Sectors % ▼▲ Company % Change to reduce oil output 1 Month Index Performance CAGR (5.6% ) Insurance Index (2.2%) Top 5 Gainers: ADA 38.7% again at its meeting in 2,600.0 Health Care Index (2.1%) RAKCC 35.8% Telecomm Index 1.7% March 2009 if crude 2,500.0 Methaq Lil Takaful 28.8% Construction Index 1.2% prices fall further. It has CBI 26.1% ADSMI Index Energy Index (3.0%) 2,400.0 ADSB 20.8% already cut 4.2 mbpd Real Estate Index (23.2%) Top 5 Losers: since September 2008, 2,300.0 Bank&Finance Index (10.9%) RAKBANK (47.4%) equivalent to 5.0% of its 2,200.0 Industrial Index 6.6% BoS (46.6%) Consumer Index 6.4% ALDAR (35.8%) global oil supply… 2,100.0 UCC (24.5%) 12/31/08 1/3/09 1/6/09 1/9/09 1/12/09 1/15/09 1/18/09 1/21/09 1/24/09 1/27/09 1/30/09 Qtel (23.5%) Macro Economic News ▲ The net profits of UAE companies listed on its two stock exchanges are projected to have jumped by nearly 33.0% in 2008 to turn the country into the second best stock performer in the region, according to a survey by NCB Capital. The full year 2008 estimates depict an average 16.4% growth in net incomes for companies in the GCC and Egypt. ▲ The Dubai government's 2009 budget which boosted the fiscal outlay by 42.0% to Dh 37.7 billion was widely welcomed by Dubai's business community. The budget estimates a 26.0% increase in government revenue from Dh 26.5 billion in 2008 to Dh 33.5 billion in 2009 without the addition of any new taxes or fees. ▲ Preliminary official figures show that the GDP of Dubai in 2008 rose between 13.0% and 16.0% in nominal terms and 6.0% to 8.0% in real terms. At 37.0% of the GDP, wholesale and retail sectors were the biggest contributors to the UAE's economy, …MSCI Barra, the contrary to the perception that real estate was the biggest contributor. global market index ▼ The Abu Dhabi Investment Authority may have lost USD 125.0 billion in 2008. The Emirate's fund was managing USD 328.0 provider, indicated that billion at the end of 2008 compared with USD 453.0 billion at the end of 2007. it would not include - The Central Bank has instructed UAE banks not to liquidate mortgaged shares and collateral assets. These instructions were three large Gulf stock recently issued to create stability in stock markets. markets, UAE, Qatar, and Kuwait in its main Government Regulations emerging markets index, mainly due to ▲ UAE's market regulator Securities and Commodities Authority (SCA) has asked listed companies to furnish more details in quot;stringentquot; foreign their financial statements, calling for more transparency. ownership restrictions… Sector News ▲ Cement prices in the UAE have fallen by almost 10.0% since the last week of December 2008 due to declining demand. Currently, cement prices in the UAE range between Dh 340.0 and Dh 400.0 depending on the urgency and payment method. According to experts, prices could witness a further correction in the forthcoming months. ▲ Total land sales in Dubai soared 109.0% to reach Dh 234.5 billion in 2008 compared to Dh 112.4 billion in 2007. In 2008, there were 5,806 cash sales worth Dh 69.6 billion, 3,547 mortgage transactions worth Dh 114.0 billion, and 303 donations of land and property worth Dh 9.0 billion. The transactions registered as sales were spread across 109 districts with a total of 106.9 million square feet of land sold. ▲ The UAE has recorded strong growth in the industrial sector with total volume of investments reaching Dh 77.0 billion in 2008. Compared to 2004, the industrial units in the country grew by 40.0% to 4,219 units in 2008, with investment volume more than doubling in four years. The number of people employed in industries also grew by 40.0%. ▼ UAE's banks have the highest exposure to the real estate sector among its regional peers and it has cast doubts on the asset quality of many banks. Credit Suisse estimates that the true exposure for UAE may lie around 35.0% of total loans. …Gulf States are poised Company News to witness an abrupt slowdown in economic ▲ Gulftainer said volumes at its terminals in the UAE, the Khorfakkan Container Terminal, and the Sharjah Container growth this year and Terminal grew by over 15.0% in 2008, compared with 2007 volumes, to reach 2,501,829 TEU, reflecting increasing customer could face recession if confidence in the company in these difficult times. average crude prices fall ▲ Emaar Properties, the Arab world’s largest real estate developer by market value, set up a USD 4.0 billion borrowing program toward USD 25.00 a but is unlikely to draw on the debt until market conditions improve barrel, according to HSBC… Liquidity / Capital raising - Bourse Dubai has launched syndication of a USD 2.5 billion loan that will refinance the company's USD 3.8 billion loan agreed in March 2008 to back its acquisition of Nordic exchanges group OMX. The margin is 325 bps over Libor, with an additional fee of 75 bps if the borrower opts to extend. - The UAE Central Bank reduced its benchmark repurchase rate by 50 basis points to 1.00% to boost lending and shore up the economy. This 50 basis point cut should further reduce the cost of liquidity supporting facilities implemented by the central bank. Product 2008© TresVista Financial Services, Pvt. Ltd. Mumbai, India. www.tresvista.com Page 4

- 5. Issue No. 1.5 MENA MONTHLY NEWS Month of January 2009 Egypt Company % Change Top 5 Gainers: 1 Month Index Performance CAGR (12.2% ) HCSI 371.7% …Fitch Ratings 450.0 Egyptian Real Estate Group 99.8% assigned a stable credit PBE 78.8% 430.0 NCH 69.0% outlook to construction Hermes Index 410.0 Alexandria Flour Mills 68.0% and property corporates Top 5 Losers: in the GCC and expects 390.0 CIIC (60.8%) SHEENI (34.4%) them to continue 370.0 El Sewedy Cables (29.3%) generating sufficient 350.0 Olympic Group (25.0%) operational cash flow to 12/31/08 1/3/09 1/6/09 1/9/09 1/12/09 1/15/09 1/18/09 1/21/09 1/24/09 1/27/09 1/30/09 Mohandes Insurance Company (25.0%) support upcoming debt maturities in the short to Macro Economic News medium term… ▲ S&P’s affirmed its BB+/B foreign currency and BBB-/A-3 local currency sovereign credit ratings on Egypt. The outlook on the ratings is stable. ▲ Urban consumer inflation in Egypt eased to 18.3% in the year to December 2008, according to CAPMAS. ▲ Public enterprises realized profits estimated at EGP 5.5 billion in 2008. Revenues of public enterprises companies rose from EGP 34.0 billion in June 2003 to EGP 60.0 billion in June 2008. ▲ Egypt and Libya will invest USD 6.0 billion in a new refinery, expanding another, and building five hundred gas stations. ▲ The Minister of Transport said that a network of roads and bridges are currently being expanded to accommodate five times their capacity, a project that will cost EGP 10.0 billion. A five – year plan is set to construct 4,500.0 kilometers of road, of …A report presented to which 2,200.0 kilometers have been laid out so far. the Islamic insurance ▼ Egypt’s net foreign reserves were USD 34.1 billion in December 2008, declining for the second straight month by 0.9% from conference in Saudi USD 34.4 billion in November 2008 and increasing 7.7% y – o – y from USD 31.7 billion in December 2007. Arabia said that the GCC's Islamic Government Regulations insurance (Takaful) market will grow five - The Central Bank announced new banking regulations for M&A financing. Under the new regulations, banks will have a fold over the next 10.0 5.0% ceiling on their total lending to acquisition financing and the maximum amount a bank can lend to any investor is years while the market 20.0% of the 5.0% ceiling. Banks will also be required to set a higher default risk to M&A financing. for Shariah – compliant Sector News insurance will be worth USD 14.0 billion by ▲ The Trade Minister unveiled new incentives to support the country’s automobile and textile industries, two major employers of 2015… Egypt’s labor force. These incentives included removing fees on car exports of 2.0% as well as exempting imported car components from customs. The government is also looking into reducing or canceling sales taxes on cars. As for textiles, the government would support the local industry by offering a cash subsidy of EGP 150.00 per quintal of cotton. ▲ Egypt received 12.8 million tourists in 2008, with a 15.3% percent increase in tourist arrivals. Over 2008, the industry grew at a rate of 25.0% until the global economic crisis hit in September 2008. Since then, the number of tourists visiting Egypt has declined. Global tourism grew by only 2.0% in 2008. In FY 2008, tourism contributed around 7.0% percent to Egypt’s GDP with revenues rising 16.0% to reach USD 11.0 billion. ▲ Egypt will establish its first real estate index, which will be the benchmark for real estate prices in Egypt. The new index will gather information and data related to the actual production and large companies in the real estate sector. ▲ The Industrial Development Authority approved an offer by the Kuwaiti Al – Kharafi Group to build Egypt’s second steel billet plant at an estimated investment cost of USD 800.0 million. The plant will have an annual capacity of 6.0 million tons. ▲ The Industrial Development Authority approved the establishment of two sugar factories with total investments of EGP 2.0 billion by Saudi Arabia’s Savola Group and Egypt’s Nile Sugar Company, a unit of the Sawiris Group. Construction work has begun in the second factory, which is expected to start operations in 2010. ▲ The tourism minister agreed to exempt tourism transportation companies from tourism promotion fees to the government. …GCC health ministers He also agreed to set up a fund to support tourism. could soon approve increasing tax on ▲ The Chairman of the Mortgage Finance Authority said that the authority is targeting to raise the value of mortgage finance cigarettes and other from EGP 3.0 billion to EGP 5.0 billion by the end of 2009. The aim for increasing the size of mortgage finance is to tobacco products by penetrate lower and middle income classes. 200.0%, according to a ▼ Egypt's petrochemicals exports decreased by 30.0% y – o – y in the last two months of 2008, reported Bloomberg. top Bahrain health - The Egyptian government imposed a duty of EGP 500.00 (USD 90.00) per ton on imports of white sugar to protect the local ministry official... sugar industry. Liquidity - The Arab Trade Financing Program (ATFP) and the Central Bank of Egypt signed a credit line deal worth USD 40.0 million. Egypt will use the credit in the financing of foreign trade. The ATFP has now extended a total of 79 credit lines worth USD 1.2 billion to all national agencies in Egypt. - Centamin Egypt, a gold mining company, entered into a new CAD 60.0 million agreement with a syndicate of underwriters. Product 2008© TresVista Financial Services, Pvt. Ltd. Mumbai, India. www.tresvista.com Page 5

- 6. Issue No. 1.5 MENA MONTHLY NEWS Month of January 2009 Other Countries …The lucrative beauty and cosmetics industry Oman is set to get even bigger ▲ An investment fund that aims at restoring investors' confidence in Oman's bourse will be operational soon. The OMR 150.0 in the region, with some million (USD 389.7 million) funds will be 60.0% owned by the government while the remaining stake will be held by banks, industry experts investment and securities firms. expecting beauty sales ▲ Oman is reaping the rewards of a significant tourist interest in the country and has called upon the private sector to invest more to exceed Dh 11.0 in infrastructure projects. Government sources estimate that tourism’s contribution to the GDP will be 3.0% before 2010. billion by 2010. Almost ▲ The Executive President of the Central Bank of Oman said that the current global financial crisis has so far not impacted the 60.0% of the GCC Omani banking sector. population is under 25 years old, ensuring a ▲ Non – OPEC producer Oman is targeting crude oil production of 800,000.00 bpd in 2009, up from the current production of high growth rate in the 750,000.00 bpd. beauty market. The ▲ Octal Petrochemicals has started operations of its second PET plant in the port city of Salalah. The new facility has a beauty products and capacity of 300,000.0 metric tonnes per annum, making it the largest PET resin plant of its type in the Middle East and the services market is worth largest clear rigid PET sheet plant in the world. more than Dh 7.3 billion ▼ Oman will slash public spending and cut projects this year if the average oil price slips below the USD 45.00 per barrel, which in Saudi Arabia. Beauty was originally budgeted for 2009 according to the Economy Minister. sales for the UAE are forecasted to exceed Dh Jordan 3.3 billion by 2010; Dubai accounts for ▲ The Jordan Securities Commission (JSC) will implement a two – year program to further develop and strengthen capital almost 70.0% of it, market’s regulations in the Kingdom and to fine – tune the trading products and practices in the market. amounting to Dh 2.3 ▲ Jordan and Qatar agreed to create a USD 2.0 billion Qatari investment fund in Jordan. billion. According to ▲ The budget deficit was around JOD 692.0 million in 2008 or 5.0% of the GDP compared to an estimated JOD 826.0 million, Chaloub Group, the according to an initial review of the budget’s actual figures. In the budget letter for 2009, the government projected a JOD 695.0 market is expected to million deficit. grow at 5.0% to 10.0% growth for 2009… ▲ A new legislation imposes stringent regulations on foreign exchange companies, requiring them to obtain a license from the recently established Foreign Exchange Regulatory Commission. License requirements include JOD 10.0 million in capital for privately owned firms and JOD 15.0 million for public firms, as well as JOD 500,000.0 in license fees. ▲ A new legislation imposes stringent regulations on foreign exchange companies, requiring them to obtain a license from the recently established Foreign Exchange Regulatory Commission. License requirements include JOD 10.0 million in capital for privately owned firms and JOD 15.0 million for public firms, as well as JOD 500,000.0 in license fees. ▼ Net investment of non Jordanians at the Amman Stock Exchange amounted to JOD 309.8 million at the end of 2008, less than the JOD 466.2 million in 2007. ▼ Prices of residential apartments in the Kingdom dropped by 10.0% during the Q4 2008, but investors in the housing sector say that despite the decreasing prices, demand is still low. Morocco ▲ Morocco is devising an export development strategy destined for eighteen international markets to increase its exports. The Moroccan Centre for Promoting Exports (CMPE) has approved an ambitious action plan for 2009 which provides for sixty promotional activities directed towards eighteen markets in partnership with professional federations and associations. ▲ At the end of November 2008, the trade deficit y – o – y growth slowed down from 44.7% at the end of November 2007 to 24.2% at the end of November 2008. Exports increased by 28.8% at the end of November 2008 compared to a growth of 12.9% at the end of November 2007. Imports (excluding oil) grew from MAD 214.0 billion at end of November 2007 to …Business confidence MAD 269.3 billion at the end of November 2008. Oil purchases recorded a strong rise standing at MAD 30.0 billion at the end in the Gulf has fallen of November 2008 against MAD 22.9 billion at the end of November 2007, a growth of 31.6%. Therefore, the cover rate rose sharply in the last three slightly to 48.6% against 47.6% at the end of November 2008. months in the wake of the global economic ▲ According to the High Commissioner of Planning, Morocco's economy is expected to achieve a 6.6% growth in Q1 2009 up crisis, according to from 4.8% in Q4 2008. The domestic demand would decline in Q1 2009 by 0.4% after a 0.9% decline in Q1 2008. The HSBC’s Middle East foreign demand would moderately slow down in 2009 compared to the 9.0% in 2008. This trend could continue in Q1 2009 banking division. with a growth rate not exceeding 2.0% due to a low economic growth outlook and the slowdown of international trade. Overall business ▲ According to Bank Al Maghrib, the global budgetary surplus amounted to MAD 3.2 million at the end of November 2008 as confidence fell from against MAD 3.8 million in November 2007. The current revenue settled at MAD 183.2 million recording a 21.3% rise. 99.8 in August 2007 to Current expenditure stood at MAD 139.6 million, growing at 17.4%. 70.3 in January 2009, ▲ According to the Exchange Office, in the first eleven months of 2008, the imports increased by 26.2% compared to the first across the GCC region, eleven months of 2007 whereas the exports rose by 15.9%. Trade deficit stood at MAD 88.6 million at the end of November according to a survey of 2008 as against MAD 53.4 million in November 2007 and the coverage rate (exports as a % of imports) fell to 72.7% in 1,317 individuals November 2008 after 79.3% in November 2007. representing their companies… ▲ According to the Exchange Office, the revenue of foreign investments and private loans amounted to MAD 27.1 million at the end of November 2008 as against MAD 34.0 million by November 2007. The foreign direct investments represented 80.8% of the overall amount. Product 2008© TresVista Financial Services, Pvt. Ltd. Mumbai, India. www.tresvista.com Page 6

- 7. Issue No. 1.5 MENA MONTHLY NEWS Month of January 2009 ▲ The High Commissioner for Planning (HCP) forecasts a 6.6% growth in Q1 2009 mainly driven by the agricultural added value which is expected to record a 22.2% rise. In Q3 2008, the economic growth reached 5.4% after 6.4% in Q2 2008 and 7.0% in Q1 2008. Bank Al Maghrib forecasts the annual growth rate in 2008 at 6.8%. ▲ Over the past two years (2007 and 2008), the overall tourist related investments amounted to MAD 39.0 million. ▲ Compared to November 2007, the nationwide sales of cement increased by 9.9% in November 2008. The Greater Casablanca still recorded the strongest rise with a growth of 13.1%. During December 2008, the cement sales dropped by 6.3%. ▼ According to the High Commissioner for Planning (HCP), the cost of living index increased by 0.3% in December 2008 compared to November 2008. Thereby, the inflation rate stands at 3.9% in 2008 after 2.1% in 2007. The HCP forecasts an inflation of 3.4% in Q1 2009. ▼ Inflation increased by 0.3% in December 2008 compared to November 2008. The rise is mainly due to a 0.5% growth in food prices, and a 0.2% rise in non – food prices. Following this change, the annual inflation rate in 2008 stood at 3.9% compared to 2007 and the core inflation increased by 4.5%. ▼ Cement sales decreased by 6.3% in December 2008 compared to December 2007. Total cement sales in 2008 increased by 9.9% compared to 2007. ▼ According to Morocco’s Central Bank, the growth rate of money supply, at the end of November 2008, recorded a fall to stand …Family businesses at 11.3% against 17.0% at the end of November 2007. The growth rate of the net foreign assets is negative, falling from 8.9% constitute the backbone at the end of November 2007 to -4.6% by the end of November 2008. Treasury debts declined to stand at MAD 82.0 billion at of Gulf economies and the end of November 2008 against MAD 83.3 billion at the end of November 2007. Finally, the y – o – y growth rate of play an important role in commercial banks loans recorded a fall to stand at 25.0% at the end of November 2008 against a rise of 27.0 % at the end of supporting and November 2007. promoting local Bahrain economic and social ▲ Inflation in Bahrain will drop to 1.5% in 2009, according to Standard Chartered Bank. development, says a study released by the ▲ BBK announced the launch of Capinnova Investment Bank, its new Sharia – compliant investment banking arm. A Capital Market wholesale Islamic investment bank, Capinnova is licensed by the Central Bank of Bahrain and capitalized at USD 500.0 million. Authority of Oman. In ▲ The new 114.0 km oil pipeline between Saudi Arabia and Bahrain is expected to be completed by 2011. It is expected to cost 2007, there were 30,000 USD 350.0 million. The new pipeline will increase the flow of crude oil to Bapco. family business ▲ Bintel plans to invest USD 250.0 million to increase its presence in Africa and at least three new markets over the next two companies with an years as part of the telecommunications service provider’s strategic expansion into emerging markets. investment of USD 500.0 billion and a ▲ S&P's downgraded investment bank Investcorp Bank and related entity Investcorp to 'BB+/B' from 'BBB/A-2'. Investcorp combined turnover of has already taken a hit from the credit crunch and laid off 90 people, 20.0% of its entire workforce, including 28 employees in USD 2.0 trillion. They Bahrain at the end of last year. account for 75.0% of ▼ Bahrain's sovereign wealth fund Mumtalakat lost around BD 267.0 million (USD 708.4 million) on its holdings of the the nongovernmental country's stock exchange’s shares in 2008 due to lower valuations. It holds 929.600 million shares in the exchange and its value contribution to the Gulf fell to BD 589.6 million at the end of 2008 from BD 857.0 million at beginning of 2008. economies and employ ▼ Moody's changed the outlook on Bahrain's sovereign ratings to negative from stable. The ratings given were: A2 for local and more than 15.0 million foreign currency government bonds, the A2 country ceiling for foreign currency bank deposits and the Aa3 country ceiling foreign workers and a for foreign currency bonds. The country ceiling for local currency bank deposits and local currency bonds remained at large number of Aa2. locals… - Al Salam Bank Bahrain and Tadhamon International Islamic Bank launched a BD 85.7 million (USD 227.4 million) sukuk. Qatar ▲ Qatar’s annual LNG production capacity will reach 62.0 million tons in 2010, double the existing level, the Minister of State for Energy and Industry said. ▲ The Deputy Prime Minister and Minister of Energy and Industry signed six contracts for water projects at a total cost of around QR 2.6 billion. ▲ Qatargas produced a total of 10.1 million tons of LNG in 2008, setting a new record for annual LNG production since it began producing LNG in late 1996. ▲ Cement production and sales in Qatar grew 24.0% y – o – y to 5.1 million tons in 2008, according to a top official of a domestic cement manufacturer. - Doha Bank has raised the interest rate on personal loans. The margin has been increased to 9.5% from a low of 6.0% three weeks ago. Tunisia ▲ Standard & Poor's Rating Services has rated the Arab Tunisian Bank’s long – term counterparty credit rating from BB to BB+ with a stable outlook, and its short – term rating as B. Product 2008© TresVista Financial Services, Pvt. Ltd. Mumbai, India. www.tresvista.com Page 7

- 8. Issue No. 1.5 MENA MONTHLY NEWS Month of January 2009 Lebanon …According to Kuwait Financial Centre ▲ In 2008, Lebanon saw the most solid tourism activity in over a decade. The number of tourists totaled 1,332,551 in 2008 up (Markaz), the 31.0% relative to 2007. The number of tourists in 2008 exceeded the number of tourists who visited the country in 2004 by profitability of the GCC 4.2%. 2004 was previously the most active year in tourist activity. banking sector is ▲ Net capital inflows into Lebanon amounted to USD 14.5 billion in the first eleven months of 2008, up by a significant 55.3% as expected to fall sharply compared to the first eleven months of 2007. This hefty influx of capital into the country managed to fully cover the growing in 2009 as the global trade deficit. economy sinks deeper ▲ Figures released by the High Customs Council show that the aggregate value of imports and exports totaled USD 18,229.0 into a recession. A million in the first eleven months of 2008, up by a major 36.8% in the first eleven months of 2007. Imports went up by 39.5% contraction in deposits while exports grew by 25.4%. With the growth in imports surpassing that in exports, the trade deficit widened by 44.0% to and loans, coupled with USD 11.8 billion. Furthermore, the increase in imports led to significant drop in the export – to – import coverage ratio to growing number of 21.5% in the first eleven months of 2008. defaults on loans, will - Figures released by Lebanon’s Kalafat Corporation indicated that loans extended to small and medium size companies under lead to deterioration in asset quality... the Kalafat guarantee totaled LBP 190.2 billion in 2008 up 35.8% from 2007. The number of guarantees amounted to 908 up 16.1% from 782 guarantees in 2007. Product 2008© TresVista Financial Services, Pvt. Ltd. Mumbai, India. www.tresvista.com Page 8

- 9. Issue No. 1.5 MENA MONTHLY NEWS Month of January 2009 Mergers & Acquisitions Announced Completion Offer Value (In USD Offer Value / Offer Value / S. No. Target Acquirer Industry Date Date mn) Net Income Book Value 1 Al Ahli Bank Qatar Investment Authority Banking 01-22-09 01-22-09 44.1 8.7x 2.0x 2 Qatar Islamic Bank Qatar Investment Authority Banking 01-22-09 01-22-09 5,248.0 11.6x 2.7x 3 S Tel Ltd Consortium of buyers Telecom 01-18-09 01-18-09 459.2 NA NA 4 M - Link Orascom Telecom Holding Telecom 01-13-09 01-13-09 77.0 NA NA About Us: Headquartered in Mumbai, India, TresVista Financial Services Pvt. Ltd provides research, analytics, advisory, investor relations, and other customized services for asset managers, private equity funds, investment banks, operating companies, and other institutions. This document is provided for assistance only and must not alone be taken as the basis for an investment decision. The user assumes the entire risk of any use made of this information. Each recipient of this document should make such investigation as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies referred to in this document (including the merits and risks involved), and should consult his own advisors to determine the merits and risks of such investment. This newsletter is provided for information purposes only. The information is believed to be reliable and is based on publicly available information, but TresVista does not warrant its completeness or accuracy. Opinions, estimates, and assumptions constitute our judgment as of the date hereof and are subject to change without notice. Past performance is not indicative of future results. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Additional information is available upon request. © 2008 TresVista Financial Services. TresVista Financial Services 303-B Floral Deck Plaza, MIDC Central Road, Andheri (East). Mumbai-400093 Product 2008© TresVista Financial Services, Pvt. Ltd. Mumbai, India. www.tresvista.com Page 9