Earnings Release Report 4Q10

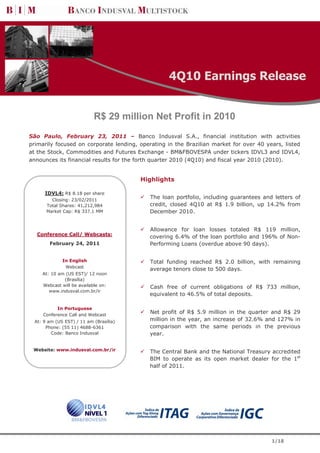

- 1. 4Q10 Earnings Release R$ 29 million Net Profit in 2010 São Paulo, February 23, 2011 – Banco Indusval S.A., financial institution with activities primarily focused on corporate lending, operating in the Brazilian market for over 40 years, listed at the Stock, Commodities and Futures Exchange - BM&FBOVESPA under tickers IDVL3 and IDVL4, announces its financial results for the forth quarter 2010 (4Q10) and fiscal year 2010 (2010). Highlights IDVL4: R$ 8.18 per share Closing: 23/02/2011 The loan portfolio, including guarantees and letters of Total Shares: 41,212,984 credit, closed 4Q10 at R$ 1.9 billion, up 14.2% from Market Cap: R$ 337.1 MM December 2010. Allowance for loan losses totaled R$ 119 million, Conference Call/ Webcasts: covering 6.4% of the loan portfolio and 196% of Non- February 24, 2011 Performing Loans (overdue above 90 days). In English Total funding reached R$ 2.0 billion, with remaining Webcast average tenors close to 500 days. At: 10 am (US EST)/ 12 noon (Brasília) Webcast will be available on: Cash free of current obligations of R$ 733 million, www.indusval.com.br/ir equivalent to 46.5% of total deposits. In Portuguese Conference Call and Webcast Net profit of R$ 5.9 million in the quarter and R$ 29 At: 9 am (US EST) / 11 am (Brasília) million in the year, an increase of 32.6% and 127% in Phone: (55 11) 4688-6361 comparison with the same periods in the previous Code: Banco Indusval year. Website: www.indusval.com.br/ir The Central Bank and the National Treasury accredited BIM to operate as its open market dealer for the 1st half of 2011. 1/18

- 2. The financial and operating information presented in this report are based on consolidated financials prepared in local currency (Real), according to Brazilian GAAP (BRGAAP). Key Indicators – R$ MM Results 4Q10 3Q10 4Q09 4Q10/ 3Q10 4Q10/ 4Q09 2010 2009 2010/2009 Income from Financial Intermediation 34.5 39.1 27.4 -11.6% 26.2% 141.9 94.3 50.5% Operating Results 6.1 12.6 4.2 -51.2% 45.9% 41.6 1.1 3666.2% Net Profit 5.9 7.5 4.4 -21.5% 32.6% 29.0 12.8 127.0% Balance Sheet Resultados Trimestrais 4Q10 3Q10 4Q09 4Q10/ 3Q10 4Q10/ 4Q09 Loan Portfolio 1,876.9 1,707.3 1,635.9 9.9% 14.7% Loan Portfolio + Guarantees and L/Cs 1,941.2 1,769.1 1,698.7 9.7% 14.3% Cash & Short Term Investments 51.7 54.0 357.2 -4.3% -85.5% Securities and Derivatives 1,261.3 1,404.5 725.0 -10.2% 74.0% Total Assets 3,276.1 3,230.2 2,730.2 1.4% 20.0% Total Deposits 1,577.6 1,471.2 1,273.2 7.2% 23.9% Open Market 538.6 739.0 365.8 -27.1% 47.2% Foreign Borrowings 325.3 323.5 377.4 0.6% -13.8% Domestic On-lending 127.7 108.0 142.6 18.2% -10.5% Shareholders’ Equity 426.4 432.4 432.7 -1.4% -1.4% Performance 4Q10 3Q10 4Q09 4Q10/ 3Q10 4Q10/ 4Q09 Free Cash 732.8 679.7 695.9 7.8% 5.3% NPL 60 days/ Loan portfolio 3.8% 3.7% 5.9% 0.2 p.p. -2.1 p.p. NPL 90 days/ Loan portfolio 3.3% 2.5% 5.4% 0.7 p.p. -2.2 p.p. Basel Index 17.6% 19.9% 22.5% -2.3 p.p. -4.9 p.p. 4Q10 3Q10 4Q09 4Q10/ 3Q10 4Q10/ 4Q09 2010 2009 2010/2009 ROAE 5.6% 7.2% 4.1% -1.5 p.p. 1.5 p.p. 6.8% 2.9% 3.9 p.p. Net Interest Margin (NIM) 6.5% 7.0% 6.7% -0.5 p.p. -0.2 p.p. 6.7% 7.9% -1.3 p.p. Net Interest Margin (NIMa) 7.9% 8.5% 8.0% -0.6 p.p. -0.1 p.p. 8.2% 9.3% -1.2 p.p. Efficiency Ratio 65.7% 61.6% 63.2% 4.1 p.p. 2.5 p.p. 60.9% 52.3% 8.6 p.p. Other Information 4Q10 3Q10 4Q09 Number of Clients - Corporate Borrowers 709 703 660 Number of Employees 362 354 333 Banco Indusval Multistock (BIM) is a commercial bank with 43 years of experience in the financial markets, focusing on local and foreign currency corporate loan products. Operating with agility and quality in its services, BIM has a wide range of products designed to meet the specific needs of this market, including structured deals. To guarantee such a level of service, the Bank relies on a network of 11 branches strategically located in economically relevant Brazilian regions, including an offshore branch, and its subsidiary Indusval Multistock Corretora de Valores, the brokerage arm that operates at the São Paulo Stock, Commodities and Futures Exchange - BM&FBOVESPA. The Bank is a publicly-held financial institution listed at Level 1 Corporate Governance of the BM&FBOVESPA since July 2007 and voluntarily adopts additional practices specific to companies listed in the Novo Mercado special trading segment. 2/18

- 3. Management Comments Since the end of 2009, we have been looking for opportunities arising from the paradigm shift in the global economy for a bank focused on midsized companies. We analyzed our strengths and weaknesses and, in the first half of 2010, decided to diversify our revenue sources by creating a client platform targeted at the specific needs of our corporate clients with revenue of over R$ 400 million (‘Upper Middle’ companies), whom we refer to internally as ‘Large Companies’. We also strengthened our Structured Finance Operations department to increase revenues from operations in the debt market and provide customized solutions for loan operations of large companies and debt restructuring for midsized companies. These initiatives were concluded in the second half of the year and have already started contributing to volumes and results. The year 2010 was more positive than 2009. However, the recovery and growth of midsized companies were slower than expected and corporate loan default rates, which seemed to start declining at the end of 2009 following the trend in individual loans, stagnated during the year. One of the positive aspects was the continuation of medium- and long-term funding sources, which enabled an increasing volume of funding at stable costs throughout the year. However, since the beginning of 2011, these costs were pressured by both macroprudential measures to curb consumer credit and the consequent inflation, as well as the greater competition for funding due to the lower availability of loan assignments for banks operating in the consumer financing segment. Thanks to the characteristics intrinsic to our business, Banco Indusval Multistock’s capital structure was not impacted by the increase in reserve requirements and capital allocation to long-term consumer financing. We consider competition from large banks in the middle market segment healthy, particularly after the credit contraction period, given that midsized companies borrow from several banks in view of the limited volume of credit lines granted. The presence of strong partners may guarantee higher liquidity in this segment. Macroeconomic Environment 4Q10 3Q10 4Q09 4Q10/3Q10 4Q10 4Q09 2010 2009 2010/ 2009 2011 *1 2012*1 GDP Variation (IBGE- Q on Q) n.a. *3 0.5% 2.1% 2,30 p.p. 0,70 p.p. 7.8% *3 -0.2% 8.00 p.p. 4.6% 4.5% Inflation Rate (IPCA – IBGE) 2.2% *2 0.5% 1.6% -0,50 p.p. -1,60 p.p. 5.9% *2 4.3% 1,65 p.p. 5.5% 4.6% - FX Rate Variation (US$/ R$) -0.89% -5.96% 2.15% 5,07 p.p. 1,25 p.p. -3.30% -25.30% 21,95 p.p. 4.79% 2.85% Interest Base Rate Var.(Selic) 2.56% 2.62% 2.10% -0,06 p.p. 0,46 p.p. 9.78% 9.90% -0,12 p.p. 13.95% -11.36% Individuals Default Rate (BACEN) 5.7% *3 6.0% 7.7% -0,30 p.p. -2,00 p.p. 5.7% *3 7.7% -2,00 p.p. - - Corporate Default Rate (BACEN) 3.6% *3 3.5% 3.8% 0,10 p.p. -0,20 p.p. 3.6% *3 3.8% -0,20 p.p. - - Deafult Rate (BACEN) 4.6% *3 4.7% 5.5% -0.10 p.p. -0.90 p.p. 4.6% *3 5.5% -0.90 p.p. 4.5% 4.5% *1 Estimated at FEBRABAN Research – 07 to 11/02/2011 *2 Source: IBGE *3 Central Bank of Brazil estimates or preliminary figures 3/18

- 4. Credit in Brazil Credit Operations in the Financial System Individuals Corporates Resources Resources Total Credit/GDP Balances in R$ Million Non Total Non Total R$ million % Earmarked Earmarked earmarked earmarked 2008 Dec 394 287 138 019 532 306 476 890 218 098 694 988 1 227 294 40.5 Mar 410 968 142 109 553 077 465 180 224 634 689 814 1 242 891 40.7 Jun 434 331 147 255 581 587 464 467 230 787 695 254 1 276 841 41.5 2009 Sep 451 453 158 623 610 076 470 422 267 578 738 000 1 348 076 43.6 Dec 469 863 166 076 635 939 484 661 293 704 778 365 1 414 304 44.4 Mar 486 526 176 239 662 765 483 722 305 459 789 181 1 451 946 44.0 Jun 505 906 186 393 692 299 510 186 326 402 836 588 1 528 887 44.6 2010 Sep 528 885 201 437 730 322 532 676 350 776 883 452 1 613 774 45.4 Dec* 558 267 217 035 775 302 559 306 369 144 928 450 1 703 752 46.6 Variation % In the month 1.8 2.7 2.1 1.1 1.1 1.1 1.6 0.3 p.p. In the quarter 5.6 7.7 6.2 5.0 5.2 5.1 5.6 1.2 p.p. In the year 18.8 30.7 21.9 15.4 25.7 19.3 20.5 2.2 p.p. In 12 months 18.8 30.7 21.9 15.4 25.7 19.3 20.5 2.2 p.p. * BACEN estimates Source: BACEN Preliminary data from the Brazilian Central Bank for December 2010 show the total loan operations in the country’s financial system at R$ 1.7 trillion, with a 5.6% growth in the quarter and 20.5% in the year, with a credit/GDP ratio estimated at 46.6%. This growth was driven by earmarked credit both in loans to individuals via housing loans, as well as for corporates, through the Brazilian National Economic and Social Development Bank (BNDES) lending. Operations contracted with free credit accounted for 65.6% of the total credit. Free Credit loans amounted to R$ 1.1 trillion, increasing by 5.3% in the quarter (4.7% in 3Q10) and 17.1% in 12 months. Meanwhile, earmarked loans totaled R$ 0.6 trillion, increasing by 6.1% and 27.5%, respectively. The earmarked credit grew by 0.2 percentage points over September and 1.9 percentage points on December 2009, reaching 34.4% of total credit in the financial system in December 2010. Government-controlled banks maintained their 42% share of total loans. BIM focuses on corporate lending, primarily with the utilization of free resources, with credit agreements mainly in the R$10,000 to R$100 million range. The Central Bank estimates point to a 7.7% growth (including earmarked loans) in the three months through November and by 20.5% in the 11 months of 2010 (24% in 12 months). 9.0 Default Central Bank data depict stability 7.0 in default rates in corporate loans in the last 4 quarters. In the same % 5.7 5.0 period, individual loan default 4.6 dropped by 200 bps. The Central 3.6 3.0 Bank’s percentages refer to the Corporates Individuals Total total balance of loans overdue 1.0 more than 90 days. Dec Dec Dec Sep Oct No v Dec Jan Feb M ar A pr M ay Jun Jul A ug Sep Oct Nov Dec 2006 2007 2008 2009 2010 S o urce : B A C E N 4/18

- 5. Operating Performance Profitability Results from Financial Intermediation – R$ MM 4Q10 3Q10 4Q09 4Q10/ 3Q10 4Q10/ 4Q09 2010 2009 2010/2009 Income from Financial Intermediation 115.9 123.4 93.3 -6.1% 24.3% 454.5 407.5 11.5% Loan Operations 68.8 72.0 60.7 -4.5% 13.3% 267.5 264.4 1.2% Loans & Discounts Receivables 61.3 63.1 51.0 -2.8% 20.2% 236.3 224.3 5.4% Financing 4.5 7.9 6.0 -42.2% -24.5% 23.3 35.4 -34.2% Other 2.9 1.1 3.7 175.0% -21.4% 7.9 4.7 67.6% Securities 24.2 44.9 24.9 -46.1% -2.9% 112.3 101.4 10.7% Derivative Financial Instruments 14.2 0.0 0.0 n.m. n.m. 13.0 0.0 n.m. FX Operations Result 8.7 6.6 7.6 33.3% 14.6% 61.7 41.7 47.8% Financial Intermediation Expenses 81.4 84.4 65.9 -3.5% 23.5% 312.6 313.2 -0.2% Money Market Funding 60.1 55.2 37.8 8.8% 58.8% 200.0 142.6 40.2% Time Deposits 41.7 37.9 27.4 10.3% 52.6% 143.3 95.4 50.2% Repurchase Transactions 16.1 15.8 9.2 1.3% 74.6% 50.8 35.7 42.2% Interbank Deposits 2.3 1.5 1.3 48.7% 77.7% 5.9 11.5 -48.4% Loans, Assign. & Onlending 7.8 8.1 6.4 -3.4% 22.1% 63.5 23.0 175.7% Foreign Borrowings 5.8 1.6 2.2 262.8% 166.1% 50.4 6.7 657.8% Dom. Borrowings + Onlending 2.1 6.5 4.2 -68.3% -51.4% 13.1 16.4 -20.0% Derivative Financial Instruments 0.0 9.7 5.3 -100.0% -100.0% 0.0 36.3 -100.0% Allowance for Loan Losses 13.5 11.4 16.4 18.7% -17.7% 49.0 111.3 -56.0% Result from Financial Intermediation 34.5 39.1 27.4 -11.6% 26.2% 141.9 94.3 50.5% Income from Financial Intermediation, detailed in note 15(a) to the annual financial statements and summarized above, decreased by 6.1% in the quarter but grew 24.3% over 4Q09. Income from loan operations accounted for 59% of total income from financial intermediation, followed by income from securities (21%), derivative financial instruments (12%) and foreign exchange operations (8%). Income from loan operations fell 4.5% in the quarter, mainly due to the drop in income from financings, in particular import financing and BNDES-Exim onlendings, both for the lower average outstanding balances and the lesser impact of exchange rate fluctuations, compared to the previous quarter. In case of average financing outstanding balances, it is worth to mention that around R$ 10 million were paid during the quarter with the final balance being recovered only by the end of December. Regarding foreign exchange variation, the Brazilian real appreciated by approximately 6% against the U.S. dollar in 3Q10, but only 0.9% in 4Q10, which is also reflected in the expenses with loans and onlendings in the country. The decline in Income from Securities Operations in the quarter was due to fluctuations in the market interest rates compared with the fixed rates of government bonds. However, a part of the revenues from derivative financial instruments is related to swaps and interbank rate futures (DI Futuro) to hedge against interest rate risks both on securities and funding in indicators other than the CDI rate and hence it also compounds the result for such deals. The growth in income from foreign exchange operations comes from the increase in average balances of export financing operations in the quarter, offset by the increase in expenses with foreign borrowings. 5/18

- 6. Income from financial intermediation totaled R$ 454.5 million in the year, up 11.5% from 2009, and consisted of income from loan operations (58.9%), income from securities (24.7%), income from derivative financial instruments (2.8%) and income from foreign exchange operations (13.6%). Expenses from Financial Intermediation, detailed in note 15(b) to the financial statements, were equivalent to 70% of the income from financial intermediation in 4Q10 (68% in 3Q10 and 71% in 4Q09), down 3.5% from 3Q10 and up 23.5% over 4Q09, as detailed below. Money Market Funding Expenses increased, primarily due to the growth in the average funding volume and also because a portion of the time deposits was raised based on indicators other than the CDI overnight rate. Note that these indicators were hedged and hence these expenses are partly offset by the income from derivative financial instruments, as explained above. Expenses with Loans, Assignments and Onlending dropped 3.4% in the quarter, but were 22.1% higher than in 4Q09, reflecting the 31.3% decrease in onlending expenses, the reduction in average balances of BNDES onlendings and the foreign exchange effect on the BNDES-Exim operations mentioned above. This drop was partially offset by the increase in expenses with foreign borrowings for the higher average balances contracted from correspondent banks to meet the 8% growth of the Trade Finance portfolio. The Allowance for Loan Losses of R$ 13.5 million in the quarter (equivalent to 11.6% of income from financial intermediation) raised the total allowance to R$ 119.6 million on December 31, 2010, providing a coverage deemed adequate by Management. Comparing the years ended December 31, the expenses with financial intermediation remained stable with an 11.5% growth in income from intermediation, that increased gross income from financial intermediation by 50.5% to R$ 141.9 million, as against R$ 94.3 million in 2009. Net Interest Margin Income from Financial Intermediation was R$ 34.5 million in the quarter, 11.6% lower than in 3Q10 but 26.2% higher than the R$ 27.4 million in 4Q09. Net Interest Margin (NIM) stood at 6.5%, versus 6.7% in 7.9% 4Q09. However, adjusting gross income from financial 6.5% intermediation for the foreign exchange effects on 4.6% securities (booked under other operating income and expenses), and the average interest-bearing assets by the balances of repurchase operations of equal amount, interest rate and tenor both in assets and 1Q09 2Q09 3Q09 4Q09 1 0 Q1 2Q10 3Q10 4Q10 liabilities (null result), the adjusted net interest margin is 7.9% in 4Q10 (8.0% in 4Q09). N IM N IM ( a) GIM (Gross Income from Financial Intermediation + ALL expenses NIM(a): + Net Foreign Exchange Variation on Securities) ( Average interest-bearing assets - Repo operations) Income from financial intermediation came to R$ 141.9 million in the year (R$ 94.3 million in 2009), for NIM of 6.7% (7.9% in 2009) and adjusted NIM of 8.1% (9.3% in 2009). 6/18

- 7. Efficiency Ratio Efficiency Ratio – R$ MM 4Q10 3Q10 4Q09 4Q10/ 3Q10 4Q10/ 4Q09 2010 2009 2010/2009 Personnel Expenses 15.7 14.0 13.8 12.0% 14.1% 56.5 51.2 10.2% Contributions and Profit-sharing 1.2 2.6 1.8 -55.9% -36.6% 8.1 5.7 43.7% Administrative Expenses 11.3 9.9 9.4 14.2% 20.2% 39.4 41.9 -6.0% Taxes 4.2 5.3 2.4 -20.4% 75.8% 15.3 11.2 37.1% Other Operating Expenses 3.0 2.3 4.9 30.5% -37.8% 9.4 7.0 33.8% A- Operating Expenses Total 35.4 34.2 32.2 3.6% 9.7% 128.7 117.0 10.0% Gross Income Fin. Interm. (w/o ALL) 48.0 50.5 43.8 -4.8% 9.8% 190.9 205.6 -7.1% Income from Services Rendered 4.0 3.2 2.8 24.9% 43.8% 12.8 11.5 10.9% Income from Banking Tariffs 0.3 0.3 0.2 -2.6% 22.7% 1.0 0.7 33.2% Other Operating Income 1.5 1.5 4.2 1.7% -64.1% 6.6 5.9 10.6% B- Operating Income Total 53.9 55.5 51.0 -2.9% 5.6% 211.2 223.7 -5.6% Efficiency Ratio (A/B) 65.7% 61.6% 63.2% 4.1 p.p. 2.5 p.p. 60.9% 52.3% 8.6 p.p. The efficiency ratio in 4Q10 was impacted by a combination of lower income from financial intermediation, explained above, and the increase in operating expenses, mainly relating to: − personnel expenses, due to the slight increase in the headcount, and the retrospective effect from Sepetember of the wage increases from the union agreement signed in October thus 4Q10 expenses include wage increases related to 4 months; − administrative expenses, especially third-party services, which represented 45.7% of total administrative expenses in the quarter. Net Profit Banco Indusval Multistock registered net profit of R$ 5.9 million in 4Q10, Improved down 21.5% from 3Q10 but 32.6% higher than in 4Q09. Recurring Net profit in the year was R$ 29.0 million, up 127.0% from the R$ 12.8 Results million recorded in the previous year, led by recurring revenues. Net profit in 2009 included non-operating revenue, net of taxes, from the sale of BM&FBovespa and CETIP stock amounting to R$ 5.0 million. 7/18

- 8. Loan Portfolio The Loan Portfolio, as detailed in Explanatory Note 6 to the Financial Statements, grew 9.9% in the quarter and 14.7% in the year, led by working capital loans and discount of receivables operations to corporate borrowers. The trade finance transactions (Financing in Foreign Currency – Import Financing and Advances on FX Contracts – Export Financing) maintained their 20% share of the total loan portfolio. Additionally, the credit portfolio also bears BNDES onlendings and FINAME operations; the remaining outstanding balance of the car loan portfolio discontinued in October 2008; and the portion of middle market loans and car financings assigned to other financial institutions under our credit risk coverage (co-obligation). Loan Portfolio by Product– R$ MM 4Q10 3Q10 4Q09 4Q10/ 3Q10 4Q10/ 4Q09 Loan Operations 1,550.9 1,401.4 1,365.6 10.7% 13.6% Loans & Discounted Receivables 1,353.5 1,227.6 1,141.3 10.3% 18.6% BNDES/ Finame 112.6 91.1 116.2 23.7% -3.0% Direct Consumer Credit – used vehicles 6.2 7.8 16.2 -20.2% -61.7% Financing in Foreign Currency 51.9 42.1 23.1 23.4% 124.9% Other Financing 14.2 17.3 25.5 -18.1% -44.2% Assignment with Co-obligation 12.4 15.5 43.4 -20.1% -71.5% Advances on Foreign Exchange Contracts 316.2 297.7 270.2 6.2% 17.0% Other Loans 9.8 8.2 0.0 19.2% n.m. DISBURSED CREDIT OPERATIONS 1,876.9 1,707.3 1,635.9 9.9% 14.7% Guarantees Issued (Guarantees. L/Gs and L/Cs) 64.3 61.8 62.9 4.0% 2.2% TOTAL 1,941.2 1,769.1 1,698.7 9.7% 14.3% Allowance for Loan Losses (119.6) (112.2) (133.4) 6.6% -10.3% Loan Portfolio by Currency – R$ MM 4Q10 3Q10 4Q09 4Q10/ 3Q10 4Q10/ 4Q09 Local Currency - Real 1,508.7 1,367.5 1,342.5 10.3% 12.4% Foreign Currency 368.2 339.8 293.3 8.4% 25.5% TOTAL 1,876.9 1,707.3 1,635.9 9.9% 14.7% Loan operations in reais, which correspond to 80% of the total loan volume, grew 10.3%, while foreign currency (Trade Finance) operations grew 8.4%. The trade finance portfolio in U.S. dollars expanded by 10% in the period, from US$ 200.8 million in September to US$ 221.0 million in December, up 31% on the US$ 168.3 million on December 31, 2009. Middle market operations accounted for 82% of the loan portfolio. The so called “Large Companies” platform, which began its activities in July 2010 and serves companies with annual revenue of over R$ 400 million, represented 14% of the loan portfolio. Other loans, including the remaining balance of the ‘Consumer Credit – Used Vehicles’ account, which was discontinued in October 2008, corresponded to 4% of the portfolio. 8/18

- 9. Loan Portfolio by Client Segment – R$ MM 4Q10 3Q10 4Q09 4Q10/ 3Q10 4Q10/ 4Q09 Middle Market 1,538.5 1,524.2 1,529.7 0.9% 0.6% Local Currency - Real 1,253.5 1,240.8 1,236.4 1.0% 1.4% Loans & Discounted Receivables 1,139.3 1,150.6 1,120.2 -1.0% 1.7% Financing 14.2 1.4 0.0 935.6% n.m. BNDES / FINAME 99.9 88.9 116.2 12.5% -14.0% Foreign Currency 285.1 283.4 293.3 0.6% -2.8% Large Companies 256.5 110.0 - 133.1% - Local Currency - Real 173.4 53.6 - 223.5% - Loans & Discounted Receivables 160.7 51.4 - 212.7% - BNDES / FINAME 12.7 2.2 - 472.7% - Foreign Currency 83.1 56.4 - 47.3% - Other 81.9 73.1 106.2 12.0% -22.9% Consumer Credit – used vehicles 15.2 18.9 33.8 -19.8% -55.0% Acquired Loans & Financing 56.9 46.0 72.4 23.8% -21.4% Other Loans 9.8 8.2 0.0 19.2% 57464.7% Disbursed Credit Operations 1,876.9 1,707.3 1,635.9 9.9% 14.7% Guarantees Issued 64.3 61.8 62.9 4.0% 2.2% TOTAL 1,941.2 1,769.1 1,698.7 9.7% 14.3% Allowance for Loan Losses (119.6) (112.2) (133.4) 6.6% -10.3% Loan Portfolio by Industry Industry Participation Food & Beverage 18.3% Agribusiness 16.6% Civil Construction 9.4% Financial Institutions 5.6% Chemical & Pharmaceutical 5.3% Transportation & Logistics 4.6% Automotive 4.5% Textile, Apparel and Leather 4.0% Education 3.3% Energy Generation & Distribution 3.2% Metal Industry 2.9% Oil and Biofuel 2.6% Financial Services 2.3% Wholesale and retail trade 2.3% Individuals 2.2% Paper and Pulp 1.8% Other industries (*) 11.0% TOTAL 100.0% (*) Individual participation of less than 1.2% of credit portfolio 9/18

- 10. By Economic Activity By Segment Individuals Other 7% Services Upper 23% Middle 14% Financial Middle Interm. 3% Retail and Market 82% Other 4% Commerce Industry 11% 56% By Product By Client Concentration Trade Guarantees Other 25% Finance Issued BNDES 19% 3% Onlendings 6% Other 2% 61 - 160 10 largest 24% 20% Loans & Discounts 70% 11 - 60 31% By Maturity By Guarantee above 360 Vehicles 29% 3% Aval PN 23% Real State 181 to 360 9% Other 4% 13% Pledge/ Lien 4% Receivables Monitored 46% Pledge 8% 91 to 180 up to 90 Securities 18% days 3% 40% Quality of Loan Portfolio – R$ MM 4Q10 3Q10 4Q09 % Required Loan Allowance for Loan Allowance for Loan Allowance for Rating Provision Portfolio Loan Losses Portfolio Loan Losses Portfolio Loan Losses AA 0.0% 47.8 0.0 0.0 0.0 0.0 0.0 A 0.5% 664.4 3.3 584.9 2.9 488.8 2.4 B 1.0% 480.7 4.8 460.6 4.6 471.2 4.7 C 3.0% 417.1 12.5 408.5 12.3 494.3 14.8 D 10.0% 107.9 10.8 116.3 11.6 63.6 6.4 E 30.0% 65.5 19.6 75.9 22.8 26.3 7.9 F 50.0% 37.8 18.9 20.1 10.0 20.2 10.1 G 70.0% 20.2 14.1 5.0 3.5 6.2 4.4 H 100.0% 35.5 35.5 36.0 36.0 65.4 65.4 Compl. Allowance - - 0.0 - 8.5 - 17.3 TOTAL - 1,876.9 119.6 1,707.3 112.2 1,635.9 133.4 10/18

- 11. The Loan Portfolio balance includes loans negotiated with clients in the amount of R$ 241.3 million (R$ 165.2 million on December 31, 2009), which are mostly classified between D and H credit ratings, even when they are not overdue. Ratings are usually reclassified based on a credit review, after an analysis of the economic and financial fundamentals of the debtor or an increase in the collaterals that justifies such reclassification. In September, loans classified between D and H totaled R$ 266.9 million, equivalent to 14.2% of the loan portfolio, of which 73% were performing loans. The balance of agreements with installments overdue more than 60 days totaled R$ 72.2 million on December 31, 2010, corresponding to 3.8% of the loan portfolio making up the default ratio (NPL 60 days). The balance of agreements with installments overdue more than 90 days (Central Bank of Brazil standard) totaled R$ 61.2 million, equivalent to 3.3% of the loan portfolio (NPL 90 days), compared to the Central Bank’s estimate of 3.6% for corporate loans. Default by Segment – R$ MM Overdue Contracts Outstanding (NPL) Outstanding > 60 days > 60 days 4Q10 3Q10 4Q10 3Q10 4Q10 3Q10 Middle Market 1,538.5 1,524.2 67.2 4.4% 56.1 3.7% 56.6 3.7% 37.1 2.4% Large Companies 256.5 110.02 - - - 0.0% - - - 0.0% Other 81.9 73.1 5.1 6.2% 6.4 8.8% 4.5 5.5% 5.8 7.9% TOTAL 1,876.9 1,707.3 72.2 3.8% 62.6 3.7% 61.2 3.3% 42.9 2.5% Allowance for Loan Losses (ALL) 119.6 112.2 - - - - Allowance for Loan Losses / NPL - - 165.6% 179.2% 195.6% 261.8% ALL/ Loan Portfolio 6.4% 6.6% - - - - Note that the above table shows that allowance for loan losses on December 31, 2010 corresponded to 6.4% of the loan portfolio, covering 165% of the agreements with any installment overdue more than 60 days. The Management believes that the allowances constituted provide sufficient cover for the overdue loans. In 4Q10, loans amounting to R$ 6.1 million were written off, bringing the total write-offs in 2010 to R$ 62.8 million (R$ 48.2 million in 2009). These loans were classified as H for over 180 days and hence were fully provisioned. Recovery of overdue loans totaled R$ 3.0 million in the quarter and R$ 7.9 million in the year (R$ 4.2 million in 2009). Funding Funding volume increased 6.7% from the previous quarter to R$ 2.0 billion, with funding in reais accounting for 84% of the total volume. Total Funding – R$ MM 4Q10 3Q10 4Q09 4Q10/ 3Q10 4Q10/ 4Q09 Total Deposits 1,577.6 1,471.2 1,273.2 7.2% 23.9% Time Deposits (CDs) 739.9 753.1 666.0 -1.7% 11.1% Time Deposits with Special Guarantee (DPGE)* 591.0 543.1 505.8 8.8% 16.9% Agribusiness Letters of Credit (ALC) & Bank Notes 82.0 69.6 10.6 17.8% 676.5% Interbank Deposits 116.5 67.7 51.1 72.0% 127.9% Demand Deposits and Other 48.2 37.7 39.7 27.8% 21.2% Domestic Onlending 127.7 108.0 142.6 18.2% -10.5% Foreign Borrowings 325.3 323.5 377.4 0.6% -13.8% Trade Finance 307.0 286.0 267.9 7.3% 14.6% IFC A/B Loan 18.3 37.5 109.5 -51.1% -83.3% TOTAL 2,030.6 1,902.7 1,793.2 6.7% 13.2% * Time Deposits bearing the Guarantee of the Credit Insurance Fund 11/18

- 12. Deposits represented 78% of total funding in reais, mainly through the issue of Bank Deposit Certificates (CDBs) (36.4%) and Time Deposits with Special Guarantee (DPGE) (29.1%). The average term for deposits was 757 days from issue and 496 days from the close of the quarter until their maturity, as follows: Type of Deposit Average term from issuance Average term to maturity (*) CDB 560 347 Interbank 218 175 DPGE 1,181 795 ALC & Bank Notes 200 120 Portfolio of Deposits 757 526 (*) from Dec. 31, 2010 Deposits By Type By Investor By Maturity Interbank Demand Other 7% 3% Individuals 4% 181 to 360 Institutional 91 to 180 11% 15% ALC 51% 26% 5% +360 days Time 38% Deposits Financial Time (CDs) Inst. 9% Deposits 48% up to 90 (DPGEs) days 37% Enterprises 25% 22% Foreign borrowings increased slightly due to the expansion of the Trade Finance portfolio and the reduction in the IFC loan balance for the payment of the installment maturing in the quarter. Liquidity Free Cash – R$ MM Assets and Liabilities Management (GAPS) – R$ MM 696 733 791 680 734 Assets Liabilities 603 521 492 348 248 244 90 180 360 > 360 days 4Q09 3Q10 4Q10 On December 31, 2010, Cash totaled R$ 1,271.4 million and, excluding Money Market Funding (R$ 538.5 million), resulted in free cash of R$ 732.8 million, equivalent to 46.5% of total deposits and 171.9% of shareholders’ equity. Assets and liabilities are managed in order to guarantee both liquidity and sound health to the Bank, and this includes maintenance of a longer profile of liabilities, considering that 71% of the loan portfolio matures within 360 days. 12/18

- 13. Capital Adequacy The Basel Accord requires banks to maintain a minimum percentage of the capital weighted by the risk in their operations. In this context, the Central Bank of Brazil has stipulated that banks operating in the country should maintain a minimum percentage of 11.0%, calculated according to the Basel Accord regulations, which provides greater security to Brazil’s financial system against oscillations in economic conditions. The following table shows Banco Indusval Multistock’s position in relation to the minimum capital requirements of the Central Bank: Capital Adequacy– R$ MM 4Q10 3Q10 4Q09 4Q10/ 3Q10 4Q10/ 4Q09 Total Capital 426.4 432.4 451.0 -1.4% -5.4% Required Capital 266.6 238.6 220.2 11.7% 21.1% Margin over Required Capital 159.8 193.8 230.8 -17.5% -30.8% Basel Index 17.6% 19.9% 22.5% -2.3 p.p. -4.9 p.p. Risk Ratings Agency Classification Observation Last Report Financial Data B+/Positive/B Global Scale Standard & Poors Dec. 28, 2010 Sept. 30, 2010 brBBB+/Positive/brA-3 Local Scale - Brazil Financial Strength: D- Stable Moody's Ba3/Estable/Not Prime Global Scale Nov. 25, 2010 Sept. 30, 2010 A2.br/Estable/BR-2 Local Scale - Brazil 9,93 Riskbank Index RiskBank Jan. 13, 2011 Sept. 30, 2010 Ranking: 57 Low Risk Short Term FitchRatings BBB/Stable/F3 Local Scale - Brazil Jan. 21, 2011 Sept. 30, 2010 Capital Market Total Shares On December 31, 2010, Banco Indusval S.A. had a total of 41,212,984 shares, of which 27,000,000 were common shares (IDVL3) and 14,212,984 were preferred shares (IDVL4), with 746,797 preferred shares maintained in treasury. Share Buyback Program The 4th Share Buyback Program for the acquisition of up to 1,301.536 preferred shares, approved by the Board of Directors on August 10, 2010, is effective till August 9, 2011. Indusval S.A. CTVM is the intermediary for this program, through which a total of 772,397 preferred shares (IDVL4) had been acquired till December 31, 2010. Free Float Number of Shares as of Dec. 31, 2010 Type Paid-up Capital Controlling Group Management Treasury Free Float (%) Common 27,000,000 (17,116,173) (2,574,269) - 7,309,558 27.1% Preferred 14,212,984 (1,026,653) (159,570) (746,797) 12,279,964 86.4% Total 41,212,984 (18,142,826) (2,733,839) (746,797) 19,589,522 47.5% 13/18

- 14. The 7,309,458 outstanding common shares are owned by members of the Ribeiro and Ciampolini families, who are not part of the Controlling Group. Thus, the preferred shares regularly traded on the stock exchange total 12,279,964, equivalent to 29.8% of the total capital. Stock Option Plan Following is the position of the Stock Option Plan of Banco Indusval S.A., created on March 26, 2008, with the aim of aligning the interests of executive officers and managers: Quantities Date Term for Strike Price Rights Grace Period Granted Exercised Not Exercised Granted Exercise R$ Expired 07.22.08 Three years Five years 10.07 161,869 - - 161,869 02.10.09 Three years Five years 5.06 229,067 25,600 10 203,457 02.22.10 Three years Five years 8.56 525,585 - 15,263 510,322 08.06.10 Three years Five years 7.72 261,960 - 2,524 259,436 1,178,481 25,600 17,797 1,135,111 In the quarter, 6,963 options expired for the resignation of its original holders. Shareholder Remuneration On December 29, 2010, the Bank paid Interest on Equity in the amount of R$ 6.2 million related to 4Q10, as advanced payment of the minimum mandatory dividend for 2010. This amount corresponds to R$ 0.15439 per share or R$ 0.13123 net of withholding tax. In 2010, total shareholder remuneration paid in advance under the minimum mandatory dividend for the fiscal year was R$ 25.1 million, corresponding to R$ 0.60983 per share (R$ 0.51836 net of withholding tax), resulting in a dividend yield of 7.36% and an 85% payout. 27,009 25,470 25,114 6,693 6,369 6,249 15,857 6,622 6,512 6,319 6,082 10,167 6,876 2,220 6,550 6,289 2,426 5,134 R$ 000’s 2,730 2,320 6,817 6,039 6,258 2,791 2,322 2006 2007 2008 2009 2010 1Q 2Q 3Q 4Q Shares Performance The shares of Banco Indusval Multistock (IDVL4) closed 4Q10 at R$ 7.95, for market cap of R$ 327.6 million and Shareholders’ Equity of R$ 426.4 million, resulting in a Market Value/ Book Value ratio of 0.77. The price of IDVL4 shares dropped by 0.62% in 4Q10 and 4.10% in the year. 14/18

- 15. However, prices adjusted to earnings show an appreciation of 3.52% in 2010. The Ibovespa index dropped by 0.18% in the quarter and appreciated 1.04% in the year. Base 100 em 31.12.2009 130 120 110 100 90 80 IBOVESPA IDVL4 IDVL4 adjusted to earnings 70 09 10 10 10 10 10 10 10 10 10 10 10 10 10 10 10 10 10 10 10 10 10 10 10 10 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 0 / 14 / 29 / 13 / 28 / 15 / 30 / 14 / 29 / 14 / 29 / 13 / 28 / 13 / 28 / 12 / 27 / 11 / 26 / 11 / 26 / 10 / 25 / 10 / 25 / /3 / / / / / / / / / / / / / / / / / / / / / / / / 12 01 01 02 02 03 03 04 04 05 05 06 06 07 07 08 08 09 09 10 10 11 11 12 12 At the closing of February 23, 2011, IDVL4 shares were traded at R$ 8.18, with an appreciation of 2.89% year to date. Liquidity and Trading Volume The preferred shares of Banco Indusval Multistock (IDVL4) were traded in 98% of the 247 sessions carried out at Bovespa in 2010. In 4Q10, a total of 2.9 million IDVL4 shares were traded over 1,016 transactions on the spot market, for total volume of R$ 22.8 million. In 2010, the volume traded on the spot market was R$ 78.8 million, representing approximately 9.7 million preferred shares over 5,029 trades. Shareholding Dispersion Distribution of Preferred Shares by type of investor: 12.31.2010 10.31.2010 # % # % TYPE OF INVESTOR Preferred % PN Preferred % PN Inv. Total Inv. Total Controlling Shareholders 4 1,026,653 7.2% 44.0% 4 1,026,653 7.2% 44.0% Management 10 159,570 1.1% 6.6% 10 159,570 1.1% 6.6% Family Members 12 515,931 3.6% 19.0% 12 515,931 3.6% 19.0% Brazilian Inst. Inv. 47 7,332,667 51.6% 17.9% 85 7,209,367 50.7% 17.6% Foreign Investors 12 2,842,625 20.0% 6.9% 12 3,047,225 21.5% 7.4% Brazilian Corporates 9 17,400 0.1% 0.0% 8 42,800 0.3% 0.1% Individuals 514 1,571,341 11.1% 3.8% 544 1,536,440 10.8% 3.7% Treasury - 746,797 5.2% 1.8% - 674,998 4.8% 1.6% TOTAL 608 14,212,984 100% 100% 675 14,212,984 100% 100% 15/18

- 16. BALANCE SHEET Consolidated R$ '000 Assets 12/31/2009 09/30/2010 12/31/2010 Current 2,243,031 2,683,574 2,672,676 Cash 4,051 9,518 7,081 Short-term interbank investments 353,143 44,526 44,648 Open market investments 292,897 17,500 22,507 Interbank deposits 60,246 27,026 22,141 Securities and derivative financial instruments 724,906 1,399,765 1,255,106 Own portfolio 553,778 532,614 586,517 Subject to repurchase agreements 108,200 726,223 540,385 Linked to guarantees 42,478 105,751 92,751 Derivative financial instruments 20,450 35,177 35,453 Interbank accounts 1,818 3,504 1,553 Payment and receipts pending settlement - 2,417 1,553 Restricted credits - Deposits with the Brazilian Central Bank 1,818 1,087 - Loans 809,685 833,693 920,861 Loans - private sector 817,661 844,624 933,827 Loans - public sector 24,559 13,660 9,137 (-) Allowance for loan losses (32,535) (24,591) (22,103) Other receivables 300,286 358,454 400,319 Foreign exchange portfolio 294,273 318,393 325,586 Income receivables 90 73 85 Negotiation and intermediation of securities 4,401 41,014 75,341 Sundry 14,741 6,065 4,756 (-) Allowance for loan losses (13,219) (7,091) (5,449) Other assets 49,142 34,114 43,108 Other assets 49,318 35,013 43,538 (-) Provision for losses (998) (1,908) (1,915) Prepaid expenses 822 1,009 1,485 Long term 473,952 533,553 590,638 Marketable securities and derivative financial instruments 69 4,697 6,151 Linked to guarantees 34 30 31 Derivative financial instruments 35 4,667 6,120 Interbank Accounts 11,207 8,557 7,352 Pledged Deposits - Caixa Economica Federal 11,207 8,557 7,352 Loans 396,617 447,191 503,536 Loans - private sector 472,449 527,627 595,564 Loans - public sector 7,538 - - (-) Allowance for loan losses (83,370) (80,436) (92,028) Other receivables 64,437 72,007 72,703 Trading and Intermediation of Securities 40 162 244 Sundry 68,667 71,910 72,503 (-) Allowance for loan losses (4,270) (65) (44) Other rights 1,622 1,101 896 Prepaid Expenses 1,622 1,101 896 Permanent 13,219 13,042 12,828 Investments 1,686 1,686 1,686 Other investments 1,686 1,686 1,686 Property and equipment 11,533 11,356 11,142 Property and equipment in use 2,173 2,192 2,192 Revaluation of property in use 3,538 3,538 3,538 Other property and equipment 12,290 12,073 12,515 (-) Accumulated depreciation (6,768) (6,729) (7,103) Leasehold Improvements - 300 282 - TOTAL ASSETS 2,730,202 3,230,169 3,276,142 16/18

- 17. Consolidated R$ '000 Liabilities 12/31/2009 09/30/2010 12/31/2010 Current 1,642,127 2,073,562 2,074,519 Deposits 709,240 775,912 820,679 Cash deposits 39,409 37,045 47,682 Interbank deposits 51,101 67,722 105,393 Time deposits 618,395 670,508 667,133 Other 335 637 471 Funds obtained in the open market 365,804 738,999 538,580 Own portfolio 107,885 722,696 538,580 Third party portfolio 257,919 16,303 Funds from securities issued or accepted 10,559 69,627 74,648 Agribusiness Letter of Credit & Bank Notes 10,559 69,627 74,648 Interbank accounts - 661 - Receipts and payment pending settlement - 661 - Interdepartamental accounts 15,906 9,715 5,898 Third party funds in transit 15,906 9,715 5,898 Borrowings 356,879 305,021 324,800 Domestic Borrowings - - - Foreign borrowings 356,879 305,021 324,800 Onlendings 65,248 34,599 43,297 BNDES 43,127 10,737 18,087 FINAME 22,121 23,862 25,210 Other liabilities 118,491 139,028 266,617 Social and statutory liabilities 391 2,501 571 Collection and payment of taxes and similar charges 25,671 902 22,002 Foreign exchange portfolio 19,174 35,255 4,474 Taxes and social security contributions 3,070 3,226 3,661 Negotiation and intermediation securities 29,073 56,587 195,316 Derivative financial instruments 34,946 32,667 34,184 Sundry 6,166 7,890 6,409 Long Term 655,097 723,485 774,736 Deposits 553,392 625,666 674,941 - - Interbank Deposits - - 11,088 Time deposits 553,392 625,666 663,853 Funds from securities issued or accepted - - 7,345 Agribusiness Letter of Credit & Bank Notes - - 7,345 Loan obligations 20,546 18,474 549 Foreign loans 20,546 18,474 549 Onlending operations - Governmental Bureaus 77,328 73,369 84,354 Federal Treasure - 15,032 - BNDES 6,911 18,800 28,154 FINAME 44,101 36,712 39,856 Other Institutions 26,316 2,825 16,344 Other liabilities 3,831 5,976 7,547 Taxes and social security contributions 2,904 5,794 5,647 Derivative financial instrument 745 - - Sundry 182 182 1,900 Future results 284 719 462 Shareholders' Equity 432,694 432,403 426,425 Capital 370,983 370,983 370,983 Capital Reserve 779 1,893 2,212 Revaluation reserve 1,995 1,945 1,928 Profit reserve 62,217 56,150 55,812 Asset valuation Adjustment 100 2,321 1,447 (-) Treasury stock (3,380) (889) (5,957) TOTAL LIABILITIES 2,730,202 3,230,169 3,276,142 17/18

- 18. INCOME STATEMENT Consolidated R$ '000 4T09 3T10 4T10 2009 2010 Income from Financial Intermediation 93,254 123,445 106,270 407,523 454,460 Loan operations 60,703 71,994 68,758 264,392 267,535 Income from securities 24,926 44,898 24,198 101,409 112,273 Income from derivative financial instruments - - 4,579 - 12,967 Income from foreign exchange transactions 7,625 6,553 8,735 41,722 61,685 Expenses from Financial Intermediaton 65,897 84,364 71,736 313,247 312,567 Money market funding 37,823 55,214 60,052 142,645 200,017 Loans, assignments and onlendings 6,414 8,107 7,833 23,045 63,542 Income from derivative financial instruments 5,251 9,660 (9,660) 36,280 - Allowance for loan losses 16,409 11,383 13,511 111,277 49,008 Gross Profit from Financial Instruments 27,357 39,081 34,534 94,276 141,893 Other Operating Income (Expense) (23,152) (26,523) (28,400) (93,171) (100,277) Income from services rendered 2,811 3,236 4,041 11,503 12,754 Income from tariffs 216 272 265 737 982 Personnel expenses (13,756) (14,023) (15,700) (51,245) (56,478) Other administrative expenses (9,369) (9,861) (11,258) (41,913) (39,399) Taxes (2,409) (5,317) (4,234) (11,171) (15,319) Other operating income 4,237 1,495 1,521 5,924 6,554 Other operating expense (4,882) (2,325) (3,035) (7,006) (9,371) Operating Profit 4,205 12,558 6,134 1,105 41,616 Non-Operating Profit 168 (9) 1,417 8,032 577 Earnings before taxes ad profit-sharing 4,373 12,549 7,551 9,137 42,193 Income tax and social contribution 1,901 (2,410) (499) 9,306 (5,041) Income tax 3,219 200 154 (11,835) 441 Social contribution 1,763 120 183 (7,267) 355 Deferred fiscal assets (3,081) (2,730) (836) 28,408 (5,837) Contributions and Equity (1,829) (2,631) (1,159) (5,665) (8,143) Net Profit for the Period 4,445 7,508 5,893 12,778 29,009 18/18