Investment

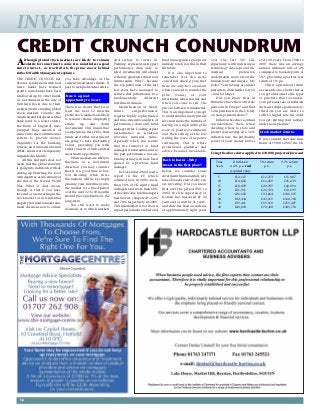

- 1. 16 THE CREDIT CRUNCH has become synonymous with bad news: banks have reduced profits; some banks have been swallowed up by other banks (or Government in the case of Northern Rock) due to their reckless practice making global stock markets volatile; the American and European central bank (and, to a lesser extent, the Bank of England) have pumped huge amounts of money into the world financial system to provide money (liquidity) for the banking system; and rumours abound (HSBC shares were temporarily suspended in March). All this bad news does not mean that the global economy is going into meltdown with us ending up bartering for food with cigarettes, as in Germany at the end of the Second World War. What it does mean, though, is that if you have invested or are investing in the stock market or in residential property you need to make some smart decisions now to ensure you take advantage of the current investment climate. It pays to seek professional advice. Now is a great opportunity to invest There is no doubt that for at least the next 12 months global stock markets are likely to remain volatile (displaying erratic up and down movements). This means that your pensions, ISAs, PEPs, trust funds and other investments are going to have fluctuating values, providing you with either concern or with an ideal investment opportunity. When markets are likely to fluctuate in a downward direction you may consider that it is a good time to buy. Not knowing when these fluctuations will be by simply phasing your investment into the market for a fixed period over the next 12 to 18 months should prove profitable in the long-term. You still need to make decisions as to which markets and sectors to invest in. Warning: at present, using past performance data only to select investments will almost certainly guarantee disastrous future results. Why? – because the top performers of the last few years have managed to achieve that performance in a fundamentally different investment climate. Identification of likely future out-performance requires highly sophisticated and time-intensive analysis of performance data and fund manager styles. Looking at past performance in isolation provides minimal value, especially when you realise that the turnover of fund managers is substantial, and so the past performance you are looking at may well have been gained by a previous fund manager. In November 2006 I read a report in the FT which outlined how, in 2006, more than 50% of UK equity fund managers and more than 60% of fixed income fund managers had moved, compared to 62% and 70% respectively in 2005. This information is not shown in past performance tables and fund management groups are unlikely to tell you this in their literature. It is also important to remember (for the more concerned among you) that there are only two occasions when you need to consider the price (value) of your investment; when you buy and when you come to sell. The price in between is immaterial. This is an important concept to understand as many private investors make the mistake of buying on a high (riding the wave of positive sentiment) and then selling at the low (riding the wave of negative sentiment). This is where professional guidance and advice becomes invaluable. Back to basics – Why invest in the first place? Before we consider some investment fundamentals, let’s take a broader view of why you are investing. Did you know that over the period 1901 to 2002, the life expectancy of women has increased by 32 years and of men by 31 years¹; and there has been an increase of approximately eight years over the last 30? Life expectancy is still increasing as technology develops and the medical profession understands more about the human body and disease. My point? Your savings are under pressure to work harder for you – and for longer. Did you know that in Britain we have the worst state pensions in Europe² and that 1.2m pensioners in the UK rely on state pensions alone³? Inflation becomes a critical consideration, then, when deciding where to store and protect your savings. At a 3.6% inflation rate, the purchasing power of your money halves every 20 years. From 1900 to 2007 there was an average annual inflation rate of 4% compared to bank deposits of 5%4, providing a positive real return of 1% p.a. This is a precarious return as research also shows that as you get older (due to the types of purchase that you make), your personal rate of inflation increases disproportionately; therefore you are likely to suffer a higher rate the older you get, putting your savings under more pressure5. Stock market returns If you consider the same time frame of 1900 to 2007, the UK CREDIT CRUNCH CONUNDRUM Although global stock markets are likely to remain volatile for some time to come it is nonetheless a good time to invest – as Ivor Kellock, the prime mover behind Kellock Wealth Management explains. INVESTMENT NEWS Time If Inflation 5% return 9.7% return Years is 4% p.a. real p.a. p.a. required value 5 £12,167 £12,763 £15,887 10 £14,802 £16,289 £25,239 15 £18,009 £20,789 £40,096 20 £21,911 £26,533 £63,699 25 £26,658 £33,864 £101,197 30 £32,434 £43,219 £160,768 35 £39,461 £55,160 £255,407 40 £48,010 £70,400 £405,756 Using the above data applied to £10,000 projected forward

- 2. 17 INVESTMENT NEWS WHAT INVESTMENT DECISIONS DO YOU NEED TO MAKE? St Albans 01727 870613 www.kwm.cc ivor@kwm.cc Kellock Wealth Management is a trading style of Trinity House Financial Planning Limited – Highland Suite, Great Hollanden Business Centre, Mill Lane, Underriver, Sevenoaks, Kent TN15 0SQ – which is authorised and regulated by the Financial Services Authority. Registered in England No: 4740530 Registered Address as above stock market provided an average annual return of 9.7% p.a.4; this was 5.7% pa more than inflation and 4.7% p.a. more than bank deposits. You can see in the table (to the right) the significant difference this would make to your savings over the longer term: You can also deduce from this that to create a sum of money in the future, you will need to invest less if you are achieving a higher rate of return; and also that investing in the real economy is likely to provide superior returns over bank deposits. Planning for school fees is a perfect example of this due to school fee inflation historically running ahead of RPI. What is the longer term? If you accept the premise that over the longer term you are likely to get better returns from the stock market, how do you define the long term? Fidelity (one of the world’s largest investment fund houses) has conducted some research on this. They examined cumulative returns for the FTSE – A All share index and MSCI World Index, taken over all eligible periods of one, five and 10 years at one month start intervals, from 1.12.82 to 3.12.07. The table below shows that while all time periods showed a good level of profit, it was only over the 10 year time periods that a profit was made 100% of the time. Source: Fidelity Investments. Sterling (with dividends re- invested, net of basic rate income tax). Returns do not take into account dealing costs It is important to remember that past performance is not a guide to the future, but this is a compelling argument suggesting that you would expect to make a gain over 10 years. Comparing stock market and bank deposit returns, Barclays Capital has compared five and 10 year returns since 1945. Up to the end of 2006 there were 52 discrete periods. Of all the five-year periods, investments in the UK stock market provided superior returns for 39 out of 52 periods; and over 10 years for 50 out of 52 periods. The reason for this is simple. You are investing in businesses in the real economy that primarily aim to make a profit, but most importantly also aim to share some of that profit with you in the form of dividends. This provides you with two separate profit opportunities; the opportunity of capital appreciation, and the actual money received (assuming a dividend is paid). Deposits only provide one profit result – interest. This point can also be illustrated by taking another look at the period from 1945 to 20066. Approximately one- third of the overall return from this period of investing in the stock market came from dividends received and reinvested. £100 invested in 1945 was worth £107,609 at the end of 2006, compared to £7,367 without dividends received and reinvested. This also compares favourably to inflation (£2,647) and deposits (£1,709). So investing in the real economy with income and capital growth over the longer term is likely to provide you with more savings and protect you from inflation. Some investors try to be clever; by coming out of the market when it’s going down, and get back in just as it starts going up again. Surely this makes sense? This is called market timing and, yes, if you get it right it can significantly add to your portfolio returns. However, the problem is that because markets are unpredictable, it’s just as easy to get the timing wrong. Just as the sharp falls in stock markets tend to be concentrated in short periods of time, the best gains are similarly concentrated. Because these gains often occur just before or after a market fall, you are likely to miss the best gains if you follow the herd. This suggests that now is a good time to invest for the long-term. Time in the market – and not timing – is the critical point here. Fidelity has done some research on this too, looking at five major world stock markets: see table above. Timing the market is difficult to get right, aptly illustrated by some high profile hedge funds going into administration recently, completely misreading the market. Consider further research that shows that as a species we have the ability to ignore relevant facts, to overestimate our own ability, to have bias in our judgment and decision-making and to have difficulty assessing our own interests and true wishes. This has been sometimes described as cognitive illusions7. If you have difficulty believing this we have a questionnaire that will highlight this for you – please email me for copy. Like visual illusions, the mistakes of intuitive reasoning are not easily eliminated from the mind, to the extent that you may not even see them happening. Decisions made on this basis can end up becoming costly and painful, thus putting professional investment advice further up the hierarchy of must-haves as part of your plan for future prosperity. Consider, too, that in the UK alone there are over 2,500 publicly quoted companies8 and nearly 3,000 funds available from 133 different companies9. The fund universe expands to over 10,000 from 4,000 managers10 if you look further afield to European funds. Residential property The credit crunch seems to be affecting the residential property market too. The great British press, always quick to paint a negative picture, have done a marvellous job so far. True, many of the UK sub prime lenders have pulled out of the lending market (due to the impossibility of raising funds), making it more difficult for non-standard mortgage applicants to find a mortgage. True, the house price indices over the past two quarters have shown nil or negative growth. Indebtedness in the UK is at record levels and repossessions are on the up. Should this make you worry about the UK housing market as a home owner or investor? Are we heading for an early 90s type of property slump? The simple advice here is to proceed with caution and not to purchase without very careful consideration. The key factor to consider for the next 18 months or so will be interest rates. Before the credit crunch emerged last summer, research showed that base rates needed to rise to 8.5%11 to put enough homeowners under enough pressure to struggle to keep up their monthly mortgage payments. Indeed, interest rates since August 2005 had been creeping up due to general economic inflationary pressures. Since last summer, though, interest rates have been reducing and the money markets are currently predicting interest rates to be 1% lower12 than they are now by this time next year. Be wary of making decisions on this information alone, as these predictions are based on information today and are vulnerable to the slightest change in economic data and sentiment. In fact, interest rates should still be going up as inflation is running outside the target set for the Bank of England. Interestingly, mortgage borrowing rates haven’t necessarily followed suit, so there is already growing pressure on household debt affordability. The two most likely outcomes for the housing market over the next couple of years of either negligible growth or of a downturn are fairly evenly balanced. The worst case scenario of a significant downturn fuelled by repossessions could happen but may be a couple of years away. Fixed rates for existing sub prime borrowers may not come to an end for a year or two, but they may then find that their variable rate is beyond their means - and with fewer sub prime lenders in the market to switch to, they could end up in financial difficulty. If you are looking to buy your main residence, then affordability is crucial; factor in a 2% rate rise and see how affordable it is then. If it’s a buy-to-let property, careful consideration of rental yield, interest rates, costs, occupancy rate, the local micro economy and your appetite for being a landlord all need to be thoroughly thought through. How we can assist you In conclusion, then, there is no one right place to invest. The right investment strategy for you is unlikely to be right for someone else. Your individual circumstances (both financial and family) will differ, as well as your personal tolerance for risk and reward. We have access to a Nobel Prize winning formula and award winning investment managers, whilst regularly monitoring and reviewing your portfolio to ensure it continues to match your objectives. Sources: 1 Office of National Statistics 2 Daily Mail 12/11/07 3 DWP 06/07 4 Global Investment Returns Yearbook 2008 5 Prudential, Newcastle Building Society, Alliance Trust Research (independently) 6 Barclays Capital 7 Journal Of Portfolio Management, Vol. 24 No. 4, Summer 1998 8 FTSE 9 Investment Management Association 02/08 10 Citywire 11 Alliance & Leicester 12 Barclays Commercial Time UK Global Years 1 81.7% 76.8% 5 85.5% 82.6% 10 100% 100% Average Annualised Returns over 15 years – effect of missing best days Ivor Kellock, the prime mover behind Kellock Wealth Management Market Index Stayed Best 10 Best 20 Best 30 Best 40 Fully Days Days Days Days Invested Missed Missed Missed Missed UK FTSE All Share £ 9.84% 6.89% 4.71% 2.78% 1.06% USA S&P 500 $ 10.63% 7.20% 4.57% 2.28% 0.32% Germany DAX 30 € 11.46% 6.65% 3.06% 0.21% -2.28% France CAC 40 € 11.02% 6.65% 3.56% 0.90% -1.43% Hong Kong Hang Seng HK$ 15.04% 8.44% 4.41% 1.01% -1.90% All figures show annualised, total returns, taken from 15-year periods, starting each consecutive month, from 30.11.92 to 30.11.07, in local currency terms. Source: Datastream as at 3.12.07. Basis: bid-bid with net income reinvested. These returns do not take into account initial fees. Percentage of Time Periods Showing Increase in Investment